The 2021 Global IPO proceeds finished $278bn higher than 2020 at $608bn due to the surge in the global IPO activity, with the valuations pushed even higher by the strong investor appetite for equity.

2021 hence also marked the biggest IPO year ever, with America continuing to be the dominant region. EMEA saw the highest relative year-on-year growth (367%), while the Asia-Pacific growth was relatively modest.

While these statistics bring to light a glimpse of what an IPO can offer your company, you should first understand what an IPO is and how you can take your company public. Typically, going public refers to when a company undertakes its initial public offering, or IPO, by selling shares of stock to the public. Usually, this is done in order to raise additional capital.

Going public is a significant step for any company, which comes with lots of legal processes before, during, and after going public, along with added reporting requirements, once your company is public.

This article is aimed to be your guide through the basic understanding of IPOs and how to take your company public by covering the following topics:

- What is an Initial Public Offering (IPO)?

- Two Common Types of IPO

- Key terms of IPOs

- How to Take Your Company Public?

- How can Deskera Help with Taking your Company Public?

- Key Takeaways

- Related Articles

What is an Initial Public Offering (IPO)?

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. As a pre-IPO private company, your business is most likely to have grown with a relatively smaller number of shareholders, including early investors like the founders, family, and friends, along with professional investors like venture capitalists or angel investors.

Through an IPO, your company would get access to raising a lot of money from its public investors. This will increase your company’s ability to grow and expand, with a side advantage also being that the transparency and share listing credibility would also assist you in securing better terms when seeking borrowed funds.

Usually, when a company has reached unicorn status, i.e., when its private valuation is approximately $1 billion, it considers going public. However, this is not the sole qualifying feature for IPO, as depending on the market competition and your ability to meet listing requirements, private companies at various valuations but with strong fundamentals and proven profitability potential can also qualify for an IPO.

IPO shares of your company will have to be priced through underwriting due diligence. In fact, when your company goes public, the previously owned private share ownership converts into public ownership, making its worth equal to the public trading price.

This often brings higher returns on investment for your private investors as typically an IPO includes a share premium for the current private investors, giving them an opportunity to fully realize gains from their investment. Additionally, share underwriting can also include special provisions for private to public share ownership.

Talking about the public market, an IPO gives a huge opportunity to millions of investors to buy shares in your company and thereby contribute capital to your company’s shareholders’ equity. Here, the public is in reference to any individual or institutional investor who is interested in investing in your company.

The two main generating factors for the company’s new shareholders’ equity value are:

- The number of shares the company sells

- The price for which the shares are sold

While shareholders’ equity continues to represent the shares owned by the private and public investors, what cannot be denied is how through an IPO, the shareholders’ equity increases significantly due to cash from the primary issuance.

Two Common Types of IPO

The two common types of IPO are:

- Fixed Price Offering: Fixed Price IPO can be referred to as the issue price that some companies set for the initial sale of their shares.

- Book Building Offering: In this case, the company initiating an IPO offers a 20% price band on the stocks to the investors. The interested investors bid on the shares before the final price is decided.

However, what also needs to be noted is how IPOs can either have primary offerings or secondary offerings. An IPO in which your company sells new securities and receives proceeds in exchange is known as a primary offering.

In contrast, though, if your company decides to have an IPO where it re-sells securities held by the existing owners of the company, and all the proceeds are received by these existing owners, it is known as a secondary offering. Almost always, though, IPOs have primary offerings, but sometimes they can also include the secondary offering component.

Key Terms of IPOs

Just like everything in the investing world, the world of IPOs comes with its own set of jargon and key terms as well. They are:

- Common Stock- This refers to all the units of ownership in a public company that usually entitles its holders to have voting rights on company matters. These holders also receive company dividends. When going public, a company offers shares of common stock for sale.

- Issue Price- This is the price at which shares of common stock will be sold to the investors even before the IPO company starts trading on public exchanges. The issue price is commonly also known as offering price.

- Lot Size- Lot size refers to the smallest number of shares that you can bid for in an IPO. If, however, you want to bid for more shares, then you would be required to bid in multiples of the lot size.

- Preliminary Prospectus- This is the document created by an IPO company having detailed information about its business-like strategies, historical financial statements, financial KPIs, business metrics, recent financial results, and management. Sometimes, it is also called the “red herring” because of the red lettering down the left side of its front cover.

- Price Band- This is the price range in which the investors can bid for the IPO shares. These are set by the company and the underwriter. Generally, it varies for each category of investor. For example, qualified institutional investors will have a different price band than retail investors.

- Underwriter- Underwriter refers to the investment bank that is managing the offerings of the issuing company. Generally, it is the underwriter who determines the issue price, publicizes the IPO, and even assigns shares to the investors.

How to Take Your Company Public?

Considering that it is affected by the global political climate and interest rate environment, the landscape of IPOs is very dynamic, with windows of opportunity opening and closing quickly. This is also why it is essential for companies to use the right insights to identify the right times at which they should make their IPO-related moves like marketing, IPO launch date, and so on.

However, the steps for taking your company public are more detailed and as follows:

Making the Decision to go Public

Any private company going public is a momentous decision that often involves a change in the mindset of your company’s executives and employees because a public company would have to operate keeping in mind the benefit of the wider group of investors and stakeholders. However, first, you should identify your reasons for going public.

Some of the possible reasons why a company would want to go public are:

- To access public capital markets and raise money to expand operations and therefore secure more revenue avenues.

- To acquire other companies with publicly-traded stock as the currency.

- To attract and retain talented employees, thereby also reducing employee turnover ratio and all the expenses associated with it.

- To diversify and reduce investor holdings.

- To provide liquidity for the existing shareholders.

- To enhance your company’s brand while strengthening its brand positioning statement.

While you might have many other reasons except for these that are private and personal, what is important is for you to keep your specific goals in mind throughout the entire process of IPO.

However, what you should also consider is whether going public is the right decision for your company. Usually, a company considers going public when its funding requirements to meet the business demands start exceeding its ability to raise additional capital and working capital through other channels on favorable and attractive terms. In this scenario, too though, going public is not always the solution, and to access whether it is for your company or not, some of the questions you must be able to answer are as follows:

- Is your track record attractive?

A company with an attractive track record is one that is outpacing the industry average in its growth, which therefore increases its chances of attracting prospective investors. Such companies perform better in their IPOs rather than those companies that have marginal or inconsistent growth.

In fact, even investment bankers look for companies that will be able to fulfill several of their benchmark criteria, therefore boosting their chances for a successful offering and solid performance in the after-market. Some of the most important criteria that are often considered by these investment bankers are:

- A large addressable market

- A unique and differentiated business model

- An attractive product or service, preferably one with a competitive advantage or first-mover status

- A favorable environmental, social and corporate governance (ESG) profile

- A well-thought-out focused business plan

- An established track record

- Favorable financial prospects in a growth industry, including revenue growth, future earnings visibility like subscription or contract revenue, and strong cash flow generation

- An experienced, “public company ready” management team

- Strong financial, operational, and compliance controls

Though all companies may not meet each of these criteria, they might have other favorable characteristics like a product or service that is highly visible, unique, or of vast public interest or which would have a profound impact on the concerned industry. Such characteristics will highlight the company’s potential to grow and succeed in IPO and afterward.

Additionally, your sales prospects should be strong enough to help you maintain consistently strong sales and earnings with an upward trajectory. This can be assessed through monitoring of sales and various other metrics, thereby showing the market support for your company’s product or services.

This will also help in differentiating your company from other companies looking forward to going public but which has no evidence of predictability and lacks in forecasting sales and earning trends.

Particularly in the case of companies associated with technology, life sciences, and pharmaceutical industries, they can qualify for IPO early on due to the uniqueness of their products or services.

Additionally, nowadays, many investors also prefer to invest capital in those companies that are not only financially profitable, with strong financial KPIs, but also works towards mitigating climate change risk, reducing environmental impacts, promoting diversity, equity, and inclusion, promoting corporate social responsibility, increases positive impact on the community and is basically a positive inclusion in the society. Therefore, when considering an IPO, you would be required to understand these expectations of your investors as well.

- Are you prepared to file timely financial statements with the Securities and Exchange Commission (SEC)?

Public companies would be obligated to file their financial statements with the SEC on a quarterly and annual basis, with the prescribed data requirements and adherence to the rigorous SEC accounting and disclosure guidelines. Considering that these financial statements become due within a short duration after the end of every financial period, it brings with it increased time pressure on reporting compared to what a private company would be facing.

Thus, the building of appropriate systems, processes, and controls becomes vital for your company to be able to meet its public company reporting requirements. Additionally, you would also have to establish the necessary financial statement integrity through the implementation of an effective system of internal control that will support your management’s reporting obligations as a public company.

- On which exchange will your company execute its IPO?

When your company is looking to go public, it will also have to choose the market, geography, and exchange that is best suitable for its stock. Most of the companies executing their IPO in the United States get listed on either the New York Stock Exchange (NYSE) or on the Nasdaq Stock Market (Nasdaq).

Each of the exchanges has its own specific entry requirements in regards to earnings history, shareholders’ equity, market capitalization, number of expected shareholders, and corporate governance. However, the listing requirements tend to be similar.

Usually, a company seeking to go public speaks to both the exchanges in order to identify the potential benefits of each over the other. In such a scenario, the underwriters tend to indicate how there would be no meaningful marketing impact on your IPO by choosing either of these two exchanges.

However, in order to ensure the smoothest possible transaction, your company, along with its advisors, should approach the exchange in the beginning stages of the capital-raising process. Also, if your company is considering overseas or dual listings, it will also have to evaluate the impact of an International Financial Reporting Standards (IFRS) or other potential Generally Accepted Accounting Principles (GAAP) conversion on the offering process and internal control related requirements.

- Is the market right for your company to execute its IPO?

Depending on the overall market strength and the market’s recent experience with IPOs, as well as other factors like the technological changes, and industry economic conditions, the demand for IPOs can vary greatly. This highlights how one of the most unpredictable aspects of going public is stock market volatility, which is why getting the timing right of your IPO is essential to get the best possible results.

Usually, it is in the booming bull market that the market window for new corporate offerings tends to open and enjoy popularity. In contrast, in a declining market, the market window can effectively close, leading to IPO activities to slow down to stop entirely.

Determining Your Company’s Filer Status

Determining your company’s filer status is important as this will then determine your reporting requirements during the ongoing IPO process as well as throughout the life as a public company. However, what also needs to be remembered here is that your company’s filer status should be assessed continuously during the ongoing IPO process as well as each fiscal year thereafter as a public company.

- Does my company qualify as a foreign private issuer?

The majority of the companies in the USA registering with the SEC are domestic issuers. However, in order to qualify as foreign private issuers (FPI), several areas of potential relief are available to the companies.

The USA securities law defines a foreign issuer as a foreign government, a foreign national, or a company or other organization that is incorporated or organized under the laws of any foreign country. A foreign issuer can hence qualify as an FPI unless:

- More than 50% of the issuer’s outstanding voting securities are held of record directly or indirectly by the residents of the USA.

- The majority of the executive officers or directors are USA citizens or residents.

- More than 50% of the assets of the issuer are located in the USA.

- The business of the issuer is administered principally in the USA.

Additionally, foreign issuers can also choose to use the registration and reporting forms that are used by the domestic registrants. However, the requirements for an FPI can differ significantly from those of the domestic registrants of the USA. In contrast, though, a foreign issuer that qualifies as an FPI do get certain benefits like:

- Extended filing timelines as an FPI is allowed to file annual reports up to 4 months after the year-end.

- Being able to file using foreign accounting principles with the material differences being reconciled to USA GAAP. However, if as an FPI you prepare your financial statements like balance sheet, cash flow statement, income statement, and profit and loss statement in accordance with the IFRS as issued by the International Accounting Standards Boards (IASB), then there would be no reconciliation requirements to be taken care of by your company.

- An FPI will not be subject to SEC proxy rules or executive compensation disclosures under S-K Item 402.

- An FPI will not be subject to quarterly reporting on Form 10-Q or periodic reporting on Form 8-K.

- Does your company qualify as an emerging growth company (EGC)?

The 2012 JOBS Act was enacted with the principal purpose of encouraging private companies to raise capital through an IPO of their common equity by providing certain accommodations to the qualifying companies of the USA.

Though there were changes made to this act by the FAST Act of 2015 and further clarification made on this policy changes through the release of Compliance and Disclosure Interpretations (C&DIs) in 2017, the principal objective of the JOBS Act remains the same.

This act applies to the EGCs for a maximum period of five years. EGCs are those companies that meet the following criteria:

If your company meets these criteria, then you can choose to become an EGC filer, therefore getting the benefit of having less strict financial reporting rules. Irrespective of whether you are a domestic issuer or an FPI, you can qualify to be an EGC.

Some of the benefits of opting for EGC filer status are:

- Being able to omit financial statements (annual or interim, registrant or acquiree) from the confidentially submitted draft registration statements that are not reasonably believed to be required at the time of the contemplated offering.

- Being able to include one less year of audited financial statements in an effective registration statement.

- Not being a subject to the auditor attestation requirements of Sarbanes-Oxley 404 (b) for a period of up to 5 years.

- Not required to obtain an audit of internal control over your company’s financial reporting.

- The confidential submission and review process will allow your company as an EGC to keep its financial and business-related information confidential until it has decided to complete its IPO. If you decide not to go forward with the entire going public transition, then the information submitted by you to the SEC will continue to be confidential and not disclosed to the public, as it is exempted from the disclosure under the Freedom of Information Act. Additionally, you would also be able to explore alternate paths of funding like SPAC while concurrently preparing for the traditional IPO.

Such reliefs will allow you to save on extra time and expenses that would have been otherwise spent on meeting these obligatory requirements.

Note: A company that is an EGC as of the first day of its fiscal year will continue to be an EGC until the earliest of:

- The last day of the fiscal year during which its total annual gross revenue is $1.07 billion or more (an amount which is adjusted as per inflation every five years)

- The date on which the issuer has issued more than $1 billion in non-convertible debt securities during the trailing previous three-year period.

- The date on which you- the issuer become a large accelerated filer (which is generally a company with a worldwide public float of at least $700 million).

However, a grace period is offered by the FAST Act for companies that lose their EGC status during the registration process. If such a company has filed a registration statement for an IPO, then it would lose its EGC status either when it completes its IPO or one year from the date that the company ceases to be an EGC, whichever comes first.

Preparing to Become a Public Company

In order for your company’s IPO to succeed, you need to undertake careful planning, which should also involve preparing your management team and business units to begin functioning as a public company, both internally and externally. To do so, a cross-functional and holistic view is essential, rather than one that focuses solely on the accounting and financial reporting matters.

The three important elements that are must for having a successful IPO are:

- IPO readiness assessment: Here, the big picture issues are identified in their early stages, even while realistic timetables are established based on the offering’s strategic objectives, your company’s specific business issues, the time needed to prepare registration information, and the time required to prepare for operation as a public company. This involves-

- Accounting and reporting

- Finance effectiveness

- Financial planning and analysis

- Internal controls and internal audit

- Tax

- Compensation and HR

- Capital markets strategy

- Media and investor relations

- Governance

- Legal and compliance

- Enterprise risk management

- Treasury

- IT and cybersecurity

- Project management

- A working group that solely focused on the immediate process of taking your company public. This includes:

- Preparation of required financial, marketing, and business information.

- Determining the optimal tax and legal structure.

Note: The “going public” process ends when your offering is sold, and the proceeds are received by you or by your shareholders.

- A working group that is focused on the tasks that need to be attended to prepare your business for being public. Some of the tasks that this includes are:

- Upgrading, sustaining, or enhancing financial reporting capabilities.

- Creating an investor relations function.

- Meeting the governance, reporting, and internal controls standards and listing requirements of the SEC of the selected exchange.

Deciding the Structure of Your Company’s IPO

By choosing an appropriate structure for your IPO, you would be able to secure substantial benefits for your company while also driving value and efficiency. There are many corporate structures through which companies go public, whether it is the traditional C-corporation, an Up-C, a master limited partnership, a YieldCo, or a real estate investment trust (REIT).

In addition to the potential benefits and drawbacks of each of these corporate structures, you should also consider the advantages and disadvantages that are associated with different IPO processes like direct listings (DL) or SPACs.

- Traditional IPO: In this IPO structure, all the historical owners of your company will hold economic and voting shares in the registrant. The registrant, however, may sell shares to the public at the time of the desired exit. What remains constant with this IPO structure is how your company would be required to satisfy the relevant stock exchange’s listing requirements and governance standards.

Under this IPO structure, the transactions will be underwritten, with an underwriter-led book building process and a commitment on behalf of your company or the selling stockholders to sell a specific number of shares for a fixed initial public offering price as negotiated with the underwriters. The underwriters will be compensated by underwriting discounts or commissions arising from the sale of your shares.

- Alternative IPO Structure Up-C: The popularity for this structure of the IPO is ever increasing because, unlike the tax benefits that are lost by the originally pass-through entities who then convert or merge with a C Corporation to go public through the traditional IPO structure, in case of an Up-C structure of an IPO, it allows access to the capital markets while the pre-IPO investors continue to invest in the pass-through entities. The benefit of this is that it helps in maintaining the preferential tax treatment while forming a new, publicly-traded C-Corporation that consolidates with the original pass-through entities.

An Up-C structure of an IPO can be utilized by all the companies across all the industries and sectors. However, it is most preferred by the closely held private companies or those companies who have private equity portfolios.

An Up-C IPO can be structured in a number of ways depending upon the economic and tax results of your company and what all its owners were trying to achieve. However, what remains the trademark characteristic of all Up-C structure IPO is that there are two classes of common stock that are issued typically.

- Class A- These are the common stock issued to the public investors and carry the majority of the economic rights through PubCo’s ownership of a proportionate share of the operating pass-through entity’s units.

- Class B- These are the common stock issued to the pre-IPO investors and carried only voting rights in PubCo, with no economic rights. Usually, these shares are owned on a one-for-one basis with the pre-IPO investor’s ownership of units in the operating pass-through entity.

- Alternative IPO Process- SPAC: SPACs are “blank check” companies that are created with the sole purpose of raising capital through an IPO in order to merge with an existing private company. By merging with a SPAC sponsor, your company would be able to access the liquidity via the public market.

Usually, SPACs are formed by an experienced management team or a sponsor with nominal invested capital while continuing to provide a way to the public markets to your company, which would otherwise not be available through the traditional IPO path.

While there are periods of volatility in the US equity markets, risking the company’s money, the SPACs mergers ensure that there is lesser certainty because your company would be able to negotiate your share prices with your SPAC sponsor, and make it part of the merger agreement, thereby locking the price in.

Additionally, your company would also be able to negotiate other terms of the deal, like bringing in more funds through private investment in public equity (PIPE) or through additional debt or equity.

However, mergers with SPACs do not come without their own complexities like having to meet an accelerated public company readiness timeline, addressing complex accounting and financial reporting requirements that might differ based upon the lifecycle and filing status of the SPAC involved and your company’s eligibility for certain EGC and/or SRC accommodations.

- Alternative IPO Process- Direct Listing: In the case of a direct listing, there are no traditional underwriters, but you will need a financial advisor or a designated market maker (NYSE listings or NASDAQ listings).

Usually, the fees of advisors is lesser than that of the traditional underwriters as their roles are different. For instance, the advisor does not act as an intermediary between the investors and your company, but rather helps your company define the objectives of your listing, how to go about the registration statement and assists in preparing investor presentations and other communications related to investors and informing them about your company.

Additionally, in case of the direct listing, your company should consider facilitating the market for primary, secondary trades for 12-18 months prior to your direct listing as you will need to include the price range within which your company expects to sell its shares in the registration statement of your primary direct listing.

Also, in the case of the direct listing, it would be the responsibility of your company’s existing private investors to provide liquidity from day one and beyond, such that it facilitates trading and stability in your company’s direct listing.

In the case of the direct listing, you would also be required to organize an investor day weeks before your direct listing. Through this, you would be able to present your brand, equity story, and all the key performance indicators and business metrics to the investors so that they have all the information needed to make their investment decision. This would be followed by your company having a series of investor education meetings with your potential investors.

Lastly, in the case of a direct listing, the opening of the trade will involve a combination of pricing and listing into one simultaneous process. The direct listing opening trade will occur when the market makers determine that a sufficient number of shares from the supply side and demand side can be crossed in a sale. Post this, all the shareholders will get access to the liquidity instantly as usually there is no shareholder lock-up in direct listings.

- Dual Track Process: A common request from the shareholders evaluating the possibility of an IPO as a liquidity event is their desire for optionality. In fact, several IPOs are started as a part of a dual-track process, wherein a private sales process gets publicized openly, or there is a statement from a shareholder that they would be open to a sale if the opportunity presents itself.

However, in a dual-track process, your management would have to be protected from the demands and often competing work streams involved in this process through careful and rigorous planning.

The dual-track process does come with several key advantages like the setting of valuation expectations, increased market interest, and promotion of your company in the eyes of the investors. Also, the dual-track strategies are dependent on various market factors like market conditions, sponsor motivations, and available resources while also ensuring that the shareholders have placed themselves in a position that they can achieve the highest exit multiple possible.

Maximizing the Value of Your IPO

An IPO is not just an opportunity that involves access to the public capital but will also let your company define its positioning in the market along with its growth prospects. To take your company public, i.e., have an IPO, a high level of the disclosure along with a very clear focus on the future prospects and growth of your business would be required.

This is because it is these disclosures and approaches which will set the tone of all your public market interactions while also providing the criteria against which your company’s future performance would be measured. This is where the equity story comes into play, which is the basis of your company’s positioning in the marketplace.

Equity story is the foundation of any successful IPO. The purpose of the equity story is to create a clear vision for your company while also showing compelling rationale and evidence to your investors for why they should be interested in buying your company’s stock. In fact, the investment bankers would rely on your company’s equity story to determine the marketability of your company and its valuation.

The six key components that should be well-supported and ensure sustainable profit, growth, and returns and that are addressed by every successful equity story are:

- Addressable market- Investors tend to look for your company’s potential to grow revenues and market share within a growth industry to justify why they should invest in your company. While having a competitive position in the market at the time of your IPO is important, so are the plans of your company to grow its existing market share.

A company undergoing an IPO discloses lesser financial information than a public company does to its public investors, and through your equity story, you will need to bridge this gap and give your investors the confidence that your company is focused on the right growth verticals and channels in the marketplace.

- Growth opportunity and drivers- This component of your equity story should explain to your potential investors how your company’s competitive advantages will leverage the industry growth drivers, even after the IPO.

- Company strategy- Your equity story would be effective only when it also shares your company’s operating model and scales that differentiate your company from its peers. It should also include how your company is planning to scale its operations as it capitalizes on the industry growth channels.

To better understand your company’s capital management strategies, investors also seek to understand your business plans and whether you are planning to grow organically or through acquisitions. In this section, you should also be able to share how the proceedings from the IPO will be used to further the growth of your company.

- Company strengths- Here, you should cover all the key differentiating strategies, offerings, and processes that set your company apart from your competitors, thereby making it an attractive investment for your potential investors. While a company’s strengths grow over time, sharing those that you already have is a crucial component of your equity story.

- Financial projections- In order to value an IPO, your potential investors will have to understand the forward multiples and financial ratios like growth rates margins at which your company plans to price its IPO.

This will help them understand how your company is performing and valuing as against your competitors. These forward multiples and key performance indicators that will matter to your investors vary from each industry. However, usually, they revolve around profitability, sales, margins, customer metrics, marketing KPIs and so on.

Additionally, your equity story should also cover how you compare against your peers. Identifying an appropriate set of peers is challenging indeed, but yet a critical piece in achieving an optimal valuation.

- Deep talent breach- Another distinguishing quality for your potential investors would be a seasoned team of executives and directors driving your company. Thus, your equity story should cover the experience of your management team, thereby proving their credibility and gaining investors’ confidence in your favor.

Your company’s lawyers will have to review your equity story in order to ensure that there are no material misstatements or omissions. They would also ensure that your equity story is aligned with the disclosures throughout Form S-1.

However, do make sure that it is crisp, comprehensible, compelling, and aligned internally as well as externally. This will also help in giving a clear vision to your employees, recruiting and retaining top talent, and facilitating a clear and consistent articulation of the company’s value proposition to investors and potential acquirers.

Common Accounting and Financial Reporting Issues Your Company will have to Address with an IPO

With an IPO, there are several accounting and financial reporting disclosure issues that your company would have to address. This would include matters related to financial statements, compensation, taxation, and other complex technical accounting areas.

The key to having a successful IPO and not having these issues be an impediment for your company to become public is by getting in front of these issues before you begin with the IPO registration process.

Some of the most common accounting and reporting issues that your company will face as part of your IPO process and its related areas are:

- Segment reporting- Usually, this is a major change for companies undertaking an IPO as private companies in the USA are not required to report financial information about their segments. Generally, it is presumed that all the information is made available to the chief operating decision-maker (CODM) to assess the performance of your business and make decisions about the allocation of resources.

Through segment reporting, which is based on this internal information, it is ensured that the investors have the benefit of seeing your business with the same level of transparency and details that your management does. It is also important for companies to assess and finalize their segment conclusions early in the IPO readiness process so that there is a consistency of conclusions throughout Form S-1.

- Non-GAAP measures and KPIs- Often, it is only after a company’s IPO that a company’s KPIs are scrutinized by a variety of stakeholders. Hence, by effectively using non-GAAP measures and KPIs, your company would be able to determine how you are viewed by the investment community.

Effective communication with the investment community is vital for you to get the right valuation at the time of your IPO, and this hence often involves usage of various operating and financial KPIs to evidence the past performance and show future expectations.

Through these, you would also be able to represent your company’s management’s view of your business, objectives, goals, and strategy. Using these, you would also be able to ensure that you have a compelling and effective equity story.

What needs to be taken care of here is that with your disclosure here, you should also share a clear definition of the metric, how it is calculated, a statement explaining how it is useful to the investors, and a statement stating how your management uses the metric in managing and monitoring your company’s performance.

Additionally, there are three basic presentation and disclosure models that govern the use of non-GAAP measures that you would have to choose from, a choice that is often determined by the industry that you are a part of.

- Management’s discussion and analysis (MD&A)- Often, companies are unable to describe the effects of underlying factors on the company’s performance. A registration statement, as well as all future financial statement filings with the USA’s SEC, will require the inclusion of MD&A related to a company’s financial statements. This is to give the readers an insight into the quality of your company’s earnings and cash flows and the likelihood that the past performance is indicative of future performance.

Here, you would have to discuss your company’s sales volumes, cost structures, liquidity, and capital resources, sources and uses of cash flows, vendor relationships, unusually non-recurring charges, employee compensation, significant environmental exposures, and other such risks and uncertainties. It is advisable to write your MD&A after your quarterly and annual financial statements.

- Risk factors- These are included in the non-financial part of your IPO registration statement. It is regulation S-K which makes it mandatory for companies to disclose all the known significant factors that will make their offering risky or speculative in a clearly understandable language.

Some of the common categories of risks include industry risks, company risks, and investment risks. If in case your company’s risk factor exceeds 15 pages, then the same regulation also requires to give its summary in a maximum of 2 pages.

- Compensation discussion and analysis (CD&A)- This section will discuss the objectives and implementation of executive compensation programs by focusing on the most important factors underlying your company’s compensation policies and decisions.

It should also discuss why each element of a compensation program was chosen, how were the award levels determined, and how each of the chosen elements fits in your company’s overall compensation objectives. However, if your filer status is EGC, then you would have to follow the SRC rules, which provide relief about compliance with CD&A requirements.

Additionally, because your company is going public, you would also be required to analyze and discuss in the CD&A the risk attributes of your broader compensation policies for employees, including those of the non-executive officers. This disclosure, however, would only be required if your company’s compensation policies have a material impact on the company.

- Revenue Recognition- The Accounting Standards Codification (ASC) 606, “Revenue from Contracts with Customers,” provides a single, comprehensive model to be applied in all industries, and as a company that is contemplating an IPO should ensure that they have performed a thorough assessment of the application of the standard on the organization.

This is because, by doing so, they would be able to articulate the impact of the application of the standard on the results of your operations and future projections to your investors, investment bankers, and other stakeholders.

- Leasing- Here, the standard to be followed is “Leases,” ASC 842, which became effective for public companies as of January 1, 2019, and will be effective for all the calendar year companies beginning from January 1, 2022. This means that if your company has not adopted this standard, then it would be required as part of your going-public process or shortly after effectiveness, depending on whether the company qualifies as an EGC or not.

If, however, your company does qualify as an EGC, then you would be allowed to elect the Accounting Standards Transition Period Accommodation and adopt it on a private company timeline.

Now, according to this standard, you would be required to record most of your company’s leases- operating as well as financing on the balance sheet. Hence, depending on the nature and extent of your company’s lease portfolio, you might require significant efforts to meet this requirement.

- Cheap Stock- This refers to the issuance of equity instruments like options, warrants, common stock, or restricted stock typically during the 12 to 24 months preceding an IPO for a price or with a strike price that is below the expected IPO price.

Usually, this issue arises in connection with the granting of employee stock options and often results in recognition of additional stock-based compensation expenses. Also, in regards to the valuations performed, your company’s management should also include:

- Details of the valuation approaches like cost, market, and income approaches used for estimating the value of your enterprise.

- Various methodologies are used for allocating the value of an enterprise to its common stock.

- The weighting of the different models used and if there have been significant changes in the weighting over time.

- Earnings Per Share (EPS)- Private companies are not required to present earnings per share (EPS), and in the case of those companies who have complex capital structures with multiple types of equity, different types of potential common shares, and various classes of common stock, this calculation can be complex.

Your company might have participating securities that are required to be included in the calculation of the basic EPS using the 2-class method through which participating security is treated to have rights to earnings that otherwise would have been available to common shareholders. Also, a common share would also be participating security if, in their current form, they are entitled to receive dividends when declared on the common stock.

- Liability versus Equity Classification- The classification of the liabilities and equity in financial statements, as well as the calculation of the earnings per share, is scrutinized by the SEC as this can impact the security’s credit rating, regulatory capital requirements, and debt covenant requirements i.e., capital ratios or leverage.

Often, instruments that can classify as equity, as well as liabilities, are issued by the companies to raise capital from the investors who are seeking certain return profiles. As part of your IPO process, you will need to assess whether certain financial instruments that were classified as equity while being a non-public company now need to be classified as a mezzanine in your balance sheet or not as a public company.

- Pro forma financial information- This is applicable to all the companies who have significant business combinations or dispositions, previous history as part of another entity, material repayment of the debt, or changes in capitalization at the effectiveness or close of an IPO.

The main objective of this is to help your investors understand how certain specific transactions have affected your historical balance sheet and income statement. What needs to be taken care of here is that all the adjustments necessary to achieve a fair statement of the pro forma information presented should be included in the registration statement.

- Goodwill and intangible assets- Public companies that report goodwill on their balance sheet, cannot amortize it. Additionally, an annual impairment assessment is required before the end of a reporting period if there are any triggering events that may be indicating an impairment. A goodwill impairment loss is measured as the amount by which a reporting unit’s carrying amount exceeds its fair value, not exceeding the carrying amount of goodwill.

- Consolidation- Here, your company will have to ensure that it has carefully assessed variable interest entities (VIEs) as entities accounted for under the VIE accounting model. This is because they have the potential to significantly change your company’s accounting policies, financial statement disclosures, data-gathering processes, and internal controls.

- Related party transactions- The overall rule applicable here is that your company would be required to disclose and provide details for any transaction in the last three years that involved more than $120,000 in which your company was a participant and any director, executive officer, or 5% stockholder (or their immediate family members) had or has a direct or indirect material interest.

- Income taxes- One of the most complex accounting requirements before an IPO that also requires significant judgment, like, for example, whether net operating losses exist or not, is the accounting of income taxes and their related disclosures.

- Employee notes receivable- In regards to employee notes, there are some key factors that companies preparing for their IPO need to consider. For instance, Section 402 of Sarbanes-Oxley prohibits publicly traded companies from providing personal loans to directors and executive officers.

This hence means that if your company has such existing loans or is considering entering into new ones, they should first determine which of these are prohibited and take the appropriate corrective action prior to your IPO. Considering that these corrective actions might require executives to repay loans prior to the IPO and, therefore, the original contractual maturity, advance planning is a must.

Building a Going-Public Team

For your IPO to be successful, you will need advisors who are well versed with all that there is to IPO and take your company public. You would hence be required to identify all the key players and specialists in your going-public team who will help you prepare the registration statement and other sales documents.

Your company will get the opportunity to select many of the participants in its IPO process. For example,

- Auditors

- Lawyers

- Underwriters

- Underwriters counsel

- Accounting advisors

- Capital market advisors

- Project management team

- Securities counsel

Additionally, it is also your company’s duty to monitor the drafting of your IPO registration statement and to ensure that all the components of the document and the assumptions behind those documents are correctly understood.

While the extent of participation of your company’s personnel in preparing the registration document does get determined on the basis of their expertise, what remains constant is their role in providing all the necessary information to prepare the registration document. In fact, during this period, you might even need to hire additional staff to help you meet all the needs of your day-to-day functioning as well as of your IPO process.

Preparing the Registration Statement

When preparing your registration statement, make sure that it is not your underwriters or attorneys who perform significant amounts of drafting, but rather your management team, as only then would you be able to ensure that your registration statement is in line with the management’s view of your business.

However, which SEC form should be used for the registration purposes should be determined by your company in consultation with your counsel and underwriter.

It is form S-1 which is the basic registration form for IPOs, other than which your company might choose to submit other registration statements confidentially to the SEC for its review, while also choosing what interim and annual financial information of certain periods should be omitted from your filing of the registration statement. Here, your company’s filer status will also play a determining role.

The registration statement consists of two principal parts:

- Part I- This part contains essential facts regarding your company’s business operations, financial condition, and management of the company. These details would have to be included in the prospectus as well as in the company’s financial statements.

- Part II- This will include all the additional information and details that are not to be included in the prospectus.

Navigating the IPO Process

What you need to remember here is that the most successful IPOs are those that were launched by businesses who had started operating like public companies well before their actual IPO. This practice ensured that they had a smooth and efficient transition in becoming a public company.

Generally, a typical IPO process takes somewhere between 6 to 12 months. Having an experienced project management team will help ensure your company’s success in terms of navigating codependent parties and stages that are integral for executing a successful IPO.

Once your company reaches a preliminary understanding with its underwriters, the IPO process will start in full force, with the first period being a quiet period. In the quiet period, your company would be subjected to all the SEC guidelines regarding the publication of information outside the prospectus.

In this period, having any activities that enhance your company’s brand awareness, its names, products, and geographic markets would be limited. This is because any publicity that creates a favorable attitude towards your company’s securities might be considered illegal. However, continuing with already established, normal advertising and publicizing of the information is acceptable.

Additionally, your company is also allowed to have oral or written communication with certain potential investors during this period in order to gauge interest in its IPO. Potential investors are those that are either qualified institutional buyers (QIBs) or institutions that are designated as accredited investors.

Note: Any materials used to test the waters might be requested by the SEC and remain subject to federal securities laws.

When navigating the IPO process, your company will have to be able to manage the following tasks in parallel timelines while keeping your business running as usual:

- Preparation of the preliminary prospectus

- Investigation of your company’s affairs for underwriter due diligence

- Preparation of marketing materials for the roadshow

Also, once your company’s registration statement has been filed, the “waiting period” or “cooling-off period” begins and continues up to the effective date of the registration. During this period, there will be restrictions on the activities that your company, as well as your underwriter, can engage in.

Hence, during this period, a preliminary prospectus (or “red herring”) can be sent to interested institutions or persons that do share the expected offering price, and with its cover page captioned as “preliminary prospectus.” It is encouraged, though, that this is done only after the SEC comments have been received, reviewed, and incorporated into the draft prospectus.

Also, during this period, your underwriters cannot make actual sales but rather only accept “indications of interest” from potential purchasers for the securities that are covered by the registration statement. Actual sales can be made only after SEC declares the registration statement effective, a date which is known as the “effective date.”

Before this effective date, however, you would need to address and resolve in writing each of the comments in the staff’s letter, thereby submitting an amended registration statement. This letter is issued by the SEC staff after the review of your registration statement and sets forth questions, possible deficiencies, and suggested revisions. While differences of opinions might exist between your approach and that of the SEC staff, the comments shared by them tend to be constructive.

Note: If, in the period after filing the IPO registration statement and before the final SEC approval, there have been significant developments like, for example, material adversity which will affect your IPO’s attractiveness or a favorable settlement in a major lawsuit that will reduce uncertainty about your company and make its IPO more attractive. Any such developments must be reported through amendments to the IPO registration statement.

Also, your company’s underwriter will also help you with arranging meetings called roadshows with financial analysts, potential institutional investors, and brokers so that they can learn about your company. Generally, these meetings are attended by your company's key executives, who should be prepared to answer questions related to the specifics of your business.

This is crucial because the credibility projected by a management team during its presentation and its ability to respond to potential investors’ and brokers’ questions will have a major impact on the success of your IPO. The roadshows can last for as long as two weeks, with several physical and virtual presentations and meetings each day.

In addition to filing the registration statement with the SEC, your company will also need to make filings in the states in which it wants to offer the securities, as well as with FINRA. Additionally, your company is also required to publicly file the initial confidential submission and all amendments with the SEC no later than 15 calendar days before the date on which they conduct a roadshow.

After the completion of the roadshows and right before the effective date of your registration statement, an underwriting agreement is signed by the authorized representative of your company and the underwriter.

This agreement would outline the number of securities to be issued, their agreed-upon offering price, the underwriter’s discount or commission, and the net proceeds to the company. These details are to be also amended in your registration statement, which is to be then filed with the SEC.

However, to simplify filing requirements in regards to the final pricing amendment, the SEC now allows companies to omit the information concerning the public offering price, price-related information, and underwriting syndicate from a registration statement that is declared effective.

In such a scenario, the omitted information will have to be included either in the final prospectus and then incorporated by reference into the registration statement or in a post-effective amendment to the registration statement.

The actual time period from when your company initially files for an IPO till when it receives proceedings from an offering varies from each company. This is because the length of this time period depends on several factors including but not limited to-

- The readiness of your company to go public

- Availability of information that must be disclosed in the registration statement

- Market conditions

Your company’s stock will be ready to begin trading in the public market once your IPO is priced and the underwriting agreement is executed. The trading platform for your securities will be the stock exchange decided by you. The two major exchanges in the USA are the New York Stock Exchange (NYSE) and the Nasdaq Stock Market (NASDAQ).

Note: The exchange listing fees and requirements vary with the exchanges you have chosen, and these should be considered during the exchange selection process.

After the IPO, a date known as the “closing date,” which is usually specified in the underwriting agreement, is when your company will have to deliver the registered securities to the underwriter and receive payment for the issue. Various other documents like bring-down letters, which are prepared by the independent auditors, are also exchanged at the closing. Usually, the closing is three to five days after the pricing of your offering.

Also, if your offering trades well after its pricing, then your company along with its underwriters may choose the option of over-allotment, thereby selling more shares than what was originally planned. This option is known as the “greenshoe” option, and its upper limit is at 15% of the shares offered. The underwriters can choose to purchase these extra shares in whole or in part.

How can Deskera Help with Taking your Company Public?

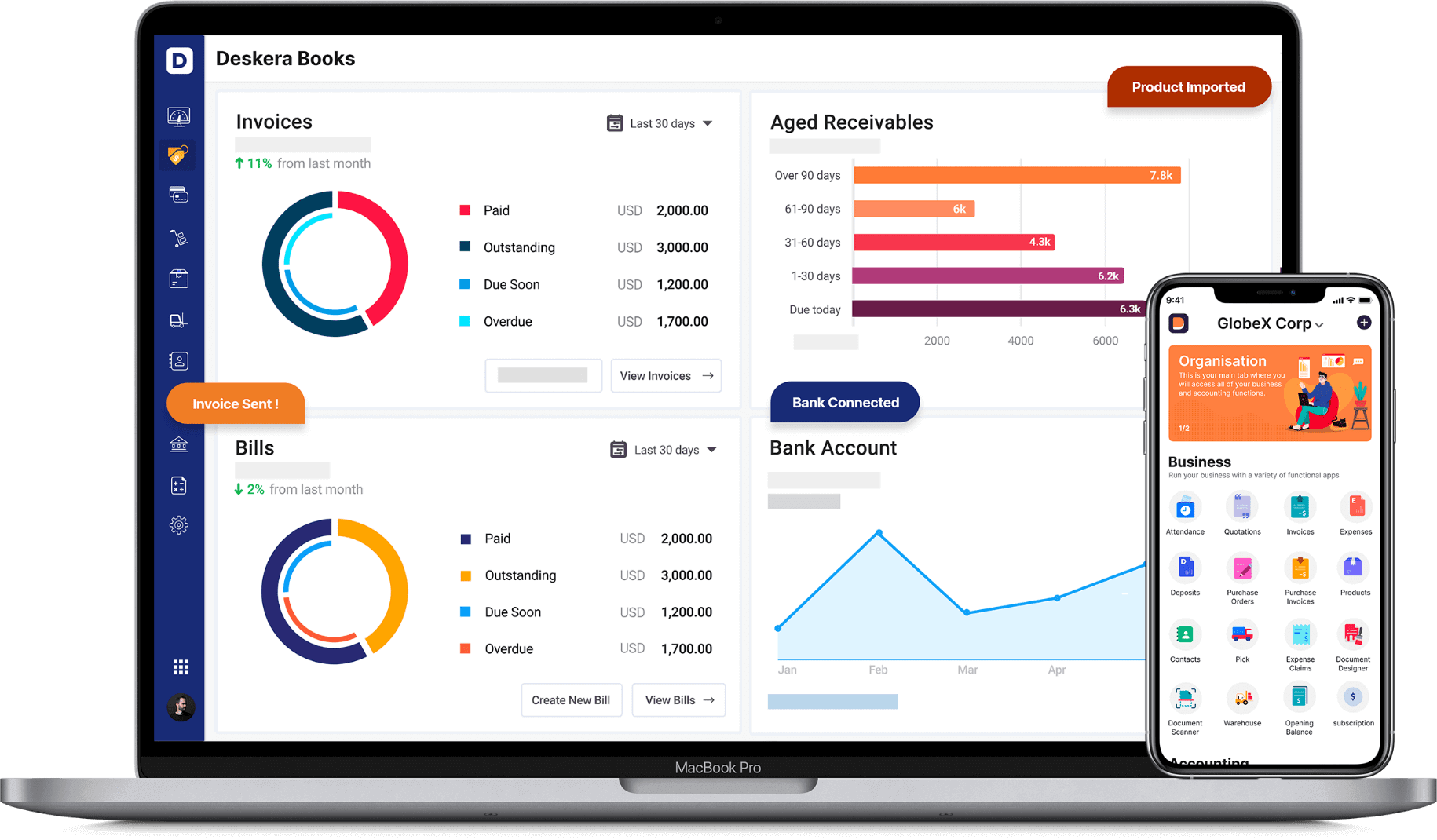

Deskera Books is cloud-based accounting software that has enterprise-level features at small business pricing.

With Deskera Books, you can meet all your accounting and financial obligations efficiently and faster. Additionally, you can also add your accountant to your Deskera Books account by adding their email address inviting them to use the system for free.

Key Takeaways

When your company is pursuing an IPO, having an advisor with the right experience and insight will help you achieve your objectives and therefore have a successful IPO.

What is also important for a successful IPO is to be ready when the capital market window opens, have your company and its management team prepared well-in advance to be a public company, and have accounting software like Deskera Books ready to help you with all your financial and accounting obligations, largely automating several processes involved therein.

The several steps involved in taking your company public are:

- Selecting an underwriter and investment bank

- Fulfilling the due diligence and regulatory filings

- Drafting the registration statement

- Preparing and auditing financial information

- Deciding the legal and tax structure of your company

- Developing a compelling and clear equity story

- Selecting research analysts and KPIs to measure the performance of your company and its IPO

- Preparing the red herring document and going on roadshows

- Final pricing of your securities after the effective date of your IPO

- Ensure after-market stabilization through the help of your underwriters

- Readying your company to scale and operate as a public company

After becoming a public company, your company will have to proactively manage its reputation by regularly communicating with analysts, investors, and financial media. This will help in ensuring that you are able to maintain a positive image of your company through an accurate telling of your story.

The public’s perception of your company will have a direct effect on the value of your stocks, and this is why maintaining a positive perception is so crucial for your company. Additionally, you would also have to strictly meet your quarterly and annual reporting requirements while also getting comfortable with its content and costs.

Related Articles