Have you ever wondered how businesses meticulously track their inventory and maintain accurate financial records?

Inventory accounting is the cornerstone of this intricate process, crucial for efficient resource management, operational optimization, and financial transparency.

Whether you’re a small business owner or a seasoned accountant, mastering the nuances of inventory accounting is essential for driving business success and profitability.

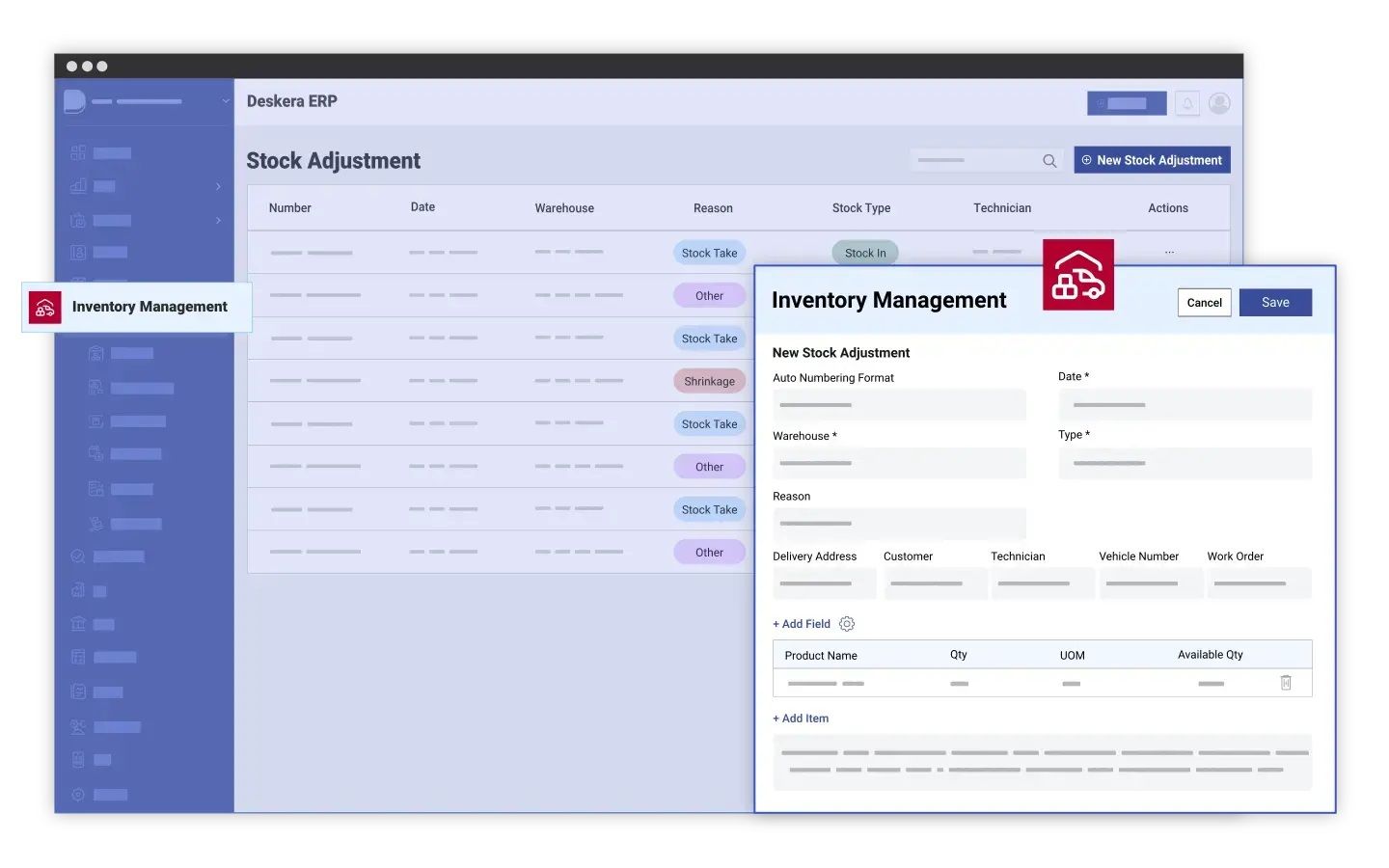

In the quest for effective inventory management, leveraging advanced tools like Deskera ERP can be a game-changer. Deskera ERP is an integrated business management software that offers comprehensive solutions for inventory accounting.

With features such as real-time tracking of inventory levels, automated updates, and seamless integration with accounting systems, Deskera ERP ensures precise inventory valuation and compliance with accounting standards.

In this comprehensive guide, we will demystify inventory accounting by exploring its definition, various types, and practical examples. We will also highlight the numerous benefits of accurate inventory accounting while addressing the common challenges faced by businesses.

What is Inventory?

Inventory is a crucial concept in business operations and accounting. In simple terms, inventory refers to the goods and materials a business holds for the purpose of resale or production. Understanding inventory in accounting is essential for effective management and financial reporting.

What is Inventory in Accounting?

In accounting, inventory is categorized as a current asset on the balance sheet. This is because it is expected to be sold, used, or converted into cash within a year.

Inventory in accounting encompasses all the items a business uses to produce goods or offers for sale. Proper accounting for inventory ensures accurate financial statements and efficient operational management.

Different Types of Inventory in Accounting

Understanding the different types of inventory in accounting is crucial for effective business management. Inventory in accounting refers to the goods and materials that a business holds for the purpose of resale. Proper accounting for inventory ensures accurate financial reporting and efficient operations.

Here are the main types of inventory in accounting:

1. Raw Materials

Raw materials are the basic components used in the production of goods. These items are yet to be processed or assembled into finished products.

For example, in a furniture manufacturing company, wood and fabric would be considered raw materials.

Proper inventory accounting for raw materials helps businesses manage their production processes efficiently.

2. Work-in-Progress (WIP)

Work-in-progress inventory includes items that are in the process of being manufactured but are not yet completed.

This type of inventory accounting is important for understanding the current state of production and for costing purposes.

For instance, partially assembled furniture in a factory would be classified as WIP.

3. Finished Goods

Finished goods are completed products that are ready for sale. Accounting inventory for finished goods involves tracking these items until they are sold to customers.

For example, chairs and tables that are fully assembled and ready for retail are considered finished goods.

4. Maintenance, Repair, and Operating (MRO) Supplies

MRO supplies include items that are used in the production process but are not part of the final product. These can include tools, machinery parts, and cleaning supplies.

Effective inventory and accounting software for small businesses can help track and manage MRO supplies efficiently.

5. Merchandise Inventory

Merchandise inventory consists of goods that are purchased by retailers and wholesalers for resale.

For example, a bookstore's inventory of books is merchandise inventory.

Accounting for inventory in this category ensures accurate financial records and inventory control.

6. Packing Materials

Packing materials are items used to protect goods during shipping and storage. These materials are essential for ensuring that products reach customers in good condition.

Inventory accounting for packing materials helps in cost management and operational efficiency.

How to Choose the Right Inventory Accounting Method

Choosing the right inventory accounting method is crucial for a business's financial health and operational efficiency.

The method selected can impact the cost of goods sold (COGS), net income, and tax liabilities.

Here are key factors to consider when choosing the right inventory accounting method:

1. Nature of the Business

- Type of Inventory: Businesses dealing with perishable goods (e.g., food, pharmaceuticals) may benefit from the First-In, First-Out (FIFO) method, which aligns with the physical flow of goods.

- Industry Practices: Some industries have standard practices for inventory accounting that businesses may need to follow for consistency and comparability.

2. Financial Objectives

- Tax Implications: During inflationary periods, the Last-In, First-Out (LIFO) method can reduce taxable income by matching higher recent costs with current revenues.

- However, this may not be suitable for businesses seeking to show higher net income.

- Profitability Reporting: FIFO often results in higher net income during inflation, which can be attractive to investors and stakeholders.

3. Regulatory Requirements

- Accounting Standards: Ensure compliance with applicable accounting standards. For example, LIFO is not permitted under International Financial Reporting Standards (IFRS), which can be a constraint for multinational companies.

4. Inventory Turnover

- Inventory Turnover Rate: Businesses with high inventory turnover may prefer methods that closely align with the actual flow of goods, such as FIFO, to reflect accurate inventory costs.

5. Price Volatility

- Stable vs. Fluctuating Prices: The Weighted Average Cost method smooths out price fluctuations, providing a consistent cost basis that can be beneficial for businesses with stable pricing environments.

- For businesses with significant price volatility, FIFO or LIFO might better reflect current cost structures.

6. Complexity and Administrative Burden

- Record-Keeping: Consider the complexity of maintaining records for each method. FIFO and the Weighted Average Cost method are generally simpler to administer than LIFO, which requires meticulous tracking of the most recent inventory purchases.

7. Financial Reporting

- Impact on Financial Statements: Evaluate how each method will impact the financial statements.

- FIFO typically results in higher inventory valuations on the balance sheet during inflation, while LIFO may lower inventory values.

Comparing the Inventory Accounting Methods

Understanding the differences and implications of various approaches to valuing inventory is crucial for making informed financial decisions.

Cost Method

This method values inventory at the cost of acquisition or production. It includes all expenses incurred to bring the inventory to its present condition and location.

Advantages

It is simple and straightforward and it reflects the actual cost incurred.

Disadvantages

It may not reflect current market conditions if there have been significant price changes.

Net Realizable Value (NRV)

NRV is the estimated selling price of inventory in the ordinary course of business, less any estimated costs of completion and selling expenses.

This method is often used when the inventory is expected to be sold at a lower price due to damage or obsolescence.

Advantages

It provides a realistic estimate of the inventory's worth, especially in cases of impairment.

Disadvantages

It can be subjective and requires frequent reassessment.

First-In, First-Out (FIFO)

First-In, First-Out (FIFO) is an inventory accounting method that assumes the earliest acquired inventory items are sold first.

This means that the cost of older inventory is matched against current revenue, reflecting the assumption that the first items purchased are the first to be sold.

Advantages

- Simplicity: FIFO is straightforward and easy to implement, making it a popular choice for many businesses.

- Relevance: The method aligns closely with the actual physical flow of goods, particularly for businesses dealing with perishable items.

- Inflation Advantage: During periods of inflation, FIFO can result in lower cost of goods sold (COGS) and higher net income since older, cheaper inventory costs are matched against current revenues.

Disadvantages

- Tax Implications: Higher net income can lead to higher tax liabilities compared to other methods like LIFO.

- Inventory Valuation: In times of rising prices, ending inventory values on the balance sheet will be higher, which may not always reflect current market conditions.

Last-In, First-Out (LIFO)

Last-In, First-Out (LIFO) is an inventory accounting method that assumes the most recently acquired inventory items are sold first.

This approach matches the latest inventory costs against current revenues, assuming that the newest items are sold before older stock.

Advantages

- Tax Benefits: LIFO can reduce tax liabilities during inflationary periods by matching higher recent costs against current revenues, resulting in a lower taxable income.

- Cost Matching: It better matches current costs with current revenues, which can provide a more accurate reflection of profitability in certain industries.

Disadvantages

- Complexity: LIFO can be more complex to implement and maintain, requiring detailed record-keeping and adjustments.

- Not Reflective of Physical Flow: The method may not accurately represent the physical flow of inventory, which can be confusing for management and investors.

- Regulatory Restrictions: LIFO is not permitted under International Financial Reporting Standards (IFRS), limiting its use for companies that operate internationally.

Weighted Average Cost

The Weighted Average Cost method calculates an average cost for all inventory items available during a period.

This average cost is then used to determine the cost of goods sold (COGS) and ending inventory values. It smooths out price fluctuations over time.

Advantages

- Simplicity: It is relatively simple to calculate and implement, especially with automated inventory systems.

- Stability: The method smooths out price fluctuations, providing a stable cost basis that can be useful for budgeting and planning.

- Consistency: It provides consistent inventory valuation and COGS calculations over time, which can simplify financial analysis.

Disadvantages

- Less Responsive to Market Conditions: The method may not reflect the most current market conditions, as it averages costs over a period.

- Potential Discrepancies: In cases of significant price volatility, the weighted average cost may not accurately reflect the true cost of specific inventory items.

Steps to Choose the Right Inventory Accounting Method

Selecting the right inventory accounting method requires a careful analysis of business needs, financial objectives, and regulatory requirements.

By considering factors such as the type of inventory, tax implications, and price volatility, businesses can make an informed decision that enhances financial reporting and operational efficiency.

- Assess Business Needs: Understand the nature of your inventory and industry practices.

- Consult Financial Advisors: Seek advice from accountants or financial consultants to understand the implications of each method.

- Analyze Financial Impact: Use financial modeling to project how each method affects your financial statements.

- Review Regulatory Requirements: Ensure compliance with local and international accounting standards.

- Consider Administrative Capacity: Evaluate your ability to maintain accurate records for the chosen method.

The Importance of Accurate Inventory Valuation

Accurate inventory valuation is a cornerstone of effective business management and financial reporting. It plays a vital role in ensuring that a company's financial statements are reliable, which is crucial for stakeholders making informed decisions.

Here are the key reasons why accurate inventory valuation is important:

1. Accurate Financial Statements

- Balance Sheet Accuracy: Inventory is a significant current asset on the balance sheet. Accurate valuation ensures that the reported value of inventory reflects its true worth, providing a clear picture of the company's assets.

- Income Statement Reliability: The cost of goods sold (COGS) is directly influenced by inventory valuation. Accurate COGS calculations lead to correct gross profit and net income figures, which are essential for assessing the company's profitability.

2. Compliance with Accounting Standards

- Regulatory Compliance: Businesses must adhere to accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Accurate inventory valuation is necessary to comply with these standards, avoiding legal and financial penalties.

- Audit Preparedness: Accurate inventory records simplify the auditing process, helping businesses pass audits without discrepancies or qualifications.

3. Informed Business Decisions

- Pricing Strategies: Accurate inventory costs help in setting appropriate prices for products. Overvaluation can lead to overpriced goods, reducing sales, while undervaluation can result in underpricing, and eroding profit margins.

- Inventory Management: Understanding the true value of inventory aids in managing stock levels. It helps prevent overstocking, which ties up capital, and understocking, which can lead to lost sales.

- Financial Planning and Forecasting: Accurate valuation provides a solid foundation for financial forecasting, budgeting, and planning. It ensures that projected profits and expenses are based on reliable data.

4. Impact on Cash Flow and Profitability

- Tax Implications: Inventory valuation affects taxable income. Overvalued inventory can lead to higher tax liabilities, while undervalued inventory might reduce tax burdens but could attract scrutiny from tax authorities.

- Profit Margin Analysis: Accurate inventory valuation helps in analyzing profit margins effectively. It ensures that the cost components of goods sold are correctly identified, leading to more accurate margin calculations.

5. Investor and Stakeholder Confidence

- Transparency: Accurate financial statements foster trust and confidence among investors, creditors, and other stakeholders. They rely on these statements to assess the company's financial health and make investment decisions.

- Attracting Investment: Companies with transparent and accurate financial reporting are more likely to attract investment. Investors look for reliability and accuracy in financial data to minimize risk.

6. Mitigating Risks and Avoiding Errors

- Operational Efficiency: By maintaining accurate inventory records, businesses can streamline their operations, reducing the risks associated with inventory mismanagement such as stockouts, overstocking, and obsolescence.

- Error Prevention: Accurate inventory valuation helps prevent errors in financial reporting that can lead to costly corrections and potential reputational damage.

Impact of Inventory Valuation Methods on Financial Statements and Business Decisions

Inventory valuation methods significantly influence a company's financial statements and strategic business decisions.

Each method—such as First-In, First-Out (FIFO), Last-In, First-Out (LIFO), Weighted Average Cost, and others—affects how inventory costs are calculated, which in turn impacts profitability, tax liabilities, and financial reporting.

Here’s a detailed discussion of their impact:

1. Balance Sheet

- Asset Valuation: Inventory valuation directly affects the value of current assets on the balance sheet. Different methods can lead to variations in inventory values reported. For instance, FIFO typically results in higher inventory values during inflationary periods due to older, lower-cost items being sold first.

- Accuracy and Transparency: Accurate valuation enhances the transparency of the balance sheet, providing stakeholders with a clear understanding of the company’s asset base.

2. Income Statement

- Cost of Goods Sold (COGS): Inventory valuation methods determine the cost assigned to goods sold during a specific period. FIFO assigns older, lower-cost inventory to COGS, resulting in higher gross margins and net income during rising prices. In contrast, LIFO assigns newer, higher-cost inventory to COGS, potentially reducing taxable income during inflation.

- Gross Profit Margin: Different methods can impact gross profit margins, influencing how investors perceive the company’s profitability and operational efficiency.

- Net Income: Variations in COGS affect net income directly. FIFO often leads to higher net income compared to LIFO during inflationary periods, due to lower COGS.

3. Tax Implications

- Taxable Income: Inventory valuation affects taxable income and, consequently, tax liabilities. LIFO can potentially reduce taxable income by matching higher current costs with revenue, whereas FIFO can result in higher taxable income during inflation.

- Tax Planning: Businesses may choose inventory valuation methods strategically to minimize tax liabilities or align with financial reporting goals.

4. Business Decisions

- Pricing Strategies: Accurate inventory valuation informs pricing decisions. Overvalued inventory under FIFO may lead to higher selling prices, while LIFO might suggest lower prices to maintain profitability.

- Inventory Management: Methods like FIFO and LIFO influence inventory management practices. FIFO encourages maintaining higher inventory levels to capitalize on lower costs, while LIFO may lead to leaner inventory practices to reduce tax liabilities.

- Financial Planning: Consistent and reliable inventory valuation supports effective financial forecasting, budgeting, and resource allocation.

5. Investor Perception and Stakeholder Confidence

- Financial Transparency: Transparent and consistent inventory valuation methods enhance investor confidence in financial statements. Stakeholders rely on accurate reporting to assess the company’s financial health and make investment decisions.

- Comparability: Standardized inventory valuation methods facilitate comparability across industry peers, aiding investors in evaluating performance and risk.

Importance of Effective Inventory Management

Effective inventory management is crucial for optimizing operations and maintaining financial health in businesses across various industries.

It involves overseeing the flow of goods from manufacturers to warehouses and ultimately to customers.

Here’s why effective inventory management is essential:

1. Cost Control and Efficiency

- Optimized Inventory Levels: Effective management ensures that inventory levels are neither excessive nor insufficient. This minimizes carrying costs associated with storage, handling, and obsolescence.

- Reduction of Holding Costs: By managing inventory efficiently, businesses can reduce costs related to storage space, insurance, and depreciation of goods.

- Improved Cash Flow: Proper inventory management prevents overstocking, freeing up capital that can be invested in other areas of the business.

2. Meeting Customer Demand

- Enhanced Customer Satisfaction: Maintaining optimal inventory levels ensures that products are available when customers demand them, reducing stockouts and backorders.

- Responsive Supply Chain: Effective management enables businesses to respond swiftly to changes in customer preferences and market demands, improving overall service levels.

3. Operational Efficiency and Productivity

- Streamlined Operations: Well-managed inventory streamlines workflows and reduces operational bottlenecks, enhancing overall efficiency.

- Inventory Accuracy: Accurate inventory tracking and management systems minimize errors, such as mis-shipments or lost inventory, which can disrupt operations.

4. Strategic Decision-Making

- Data-Driven Insights: Effective inventory management provides actionable data on sales trends, demand forecasting, and supplier performance. This data supports informed decision-making and strategic planning.

- Optimized Production Planning: By aligning inventory levels with production schedules, businesses can optimize manufacturing processes and reduce lead times.

5. Financial Management and Reporting

- Accurate Financial Reporting: Proper inventory management ensures accurate valuation of assets, which is critical for financial reporting and compliance with accounting standards.

- Cost of Goods Sold (COGS): Accurate inventory records enable precise calculation of COGS, influencing profitability metrics and tax liabilities.

6. Risk Mitigation

- Minimized Obsolescence: Effective inventory management reduces the risk of inventory obsolescence by rotating stock effectively and monitoring product shelf life.

- Supply Chain Resilience: By maintaining optimal inventory levels, businesses can mitigate risks associated with supplier delays, natural disasters, or economic fluctuations.

5 Techniques for Managing Inventory

Effective inventory management techniques are essential for optimizing supply chain operations and ensuring smooth business operations.

Here are some key techniques used to manage inventory:

1. Just-in-Time (JIT) Inventory Management

Just-in-time inventory management aims to reduce carrying costs by receiving goods only as they are needed in the production process or for customer orders. This method helps minimize excess inventory and associated storage costs.

Benefits:

- Cost Efficiency: Reduces storage costs and minimizes the risk of inventory obsolescence.

- Improved Cash Flow: Frees up capital that would otherwise be tied up in inventory.

- Lean Manufacturing: Supports lean production practices by reducing waste and improving efficiency.

Challenges:

- Supply Chain Reliability: Requires a dependable supply chain to ensure timely deliveries.

- Demand Variability: Vulnerable to fluctuations in customer demand and supply chain disruptions.

2. Safety Stock Inventory

Safety stock is a buffer inventory held to mitigate the risk of stockouts due to unexpected increases in demand, supply chain delays, or other disruptions. It acts as a cushion to ensure continuity in operations.

Benefits:

- Risk Mitigation: Provides protection against unexpected fluctuations in demand or supply.

- Customer Service: Ensures that products are available to meet customer demand, enhancing customer satisfaction.

- Operational Stability: Reduces the risk of disruptions that could impact production or sales.

Challenges:

- Cost Considerations: Adds to carrying costs and ties up capital that could be used elsewhere.

- Inventory Management: Requires careful monitoring and management to balance between excess and insufficient stock levels.

3. Economic Order Quantity (EOQ)

Economic Order Quantity is a calculation that determines the optimal order quantity that minimizes total inventory costs, including ordering costs and holding costs.

Benefits:

- Cost Optimization: Helps minimize total inventory costs by balancing ordering and holding costs.

- Efficiency: Ensures that inventory levels are maintained at optimal levels without excess or shortages.

- Simplicity: Provides a straightforward method for determining order quantities based on demand and cost factors.

Challenges:

- Assumptions: This relies on stable demand patterns and fixed costs, which may not always reflect dynamic market conditions.

- Implementation: Requires accurate data and ongoing adjustments to maintain effectiveness over time.

4. ABC Analysis

ABC Analysis categorizes inventory into three categories based on value and importance: A (high-value, low-volume items), B (moderate-value, moderate-volume items), and C (low-value, high-volume items). This classification helps prioritize inventory management efforts.

Benefits:

- Prioritization: Focuses resources on managing high-value items that contribute most to revenue and profit.

- Efficiency: Optimizes inventory control efforts by aligning management practices with item importance.

- Cost Efficiency: Helps reduce costs associated with carrying and managing inventory.

Challenges:

- Data Accuracy: Requires accurate data on item value, demand, and usage patterns for effective classification.

- Maintenance: Requires regular review and updates to ensure items are properly categorized as business conditions change.

5. Vendor Managed Inventory (VMI)

Vendor Managed Inventory shifts the responsibility for managing inventory levels and replenishments to the supplier rather than the buyer. The supplier monitors inventory levels and initiates replenishment based on agreed-upon criteria.

Benefits:

- Inventory Optimization: Reduces the buyer's carrying costs and stockouts by maintaining optimal inventory levels.

- Supply Chain Collaboration: Improves coordination between buyer and supplier, enhancing supply chain efficiency.

- Focus on Core Competencies: Allows the buyer to focus on core business activities rather than inventory management.

Challenges:

- Dependence on Suppliers: Relies on supplier reliability and communication for effective inventory management.

- Data Sharing: Requires sharing sensitive inventory and sales data with suppliers, necessitating trust and clear agreements.

Need for Tools and Software for Inventory Management

Effective inventory management is essential for businesses to optimize operations, reduce costs, and ensure accurate financial reporting.

Utilizing specialized tools and software tailored for inventory management offers several advantages:

1. Streamlined Accounting for Inventory

- Accuracy and Efficiency: Inventory management software automates the recording and tracking of inventory transactions, minimizing human errors associated with manual data entry.

- Real-Time Updates: Provides real-time visibility into inventory levels, allowing businesses to make informed decisions based on up-to-date information.

- Integration with Accounting Systems: Seamless integration with accounting software ensures that inventory transactions are accurately reflected in financial statements, facilitating efficient inventory accounting.

2. Enhanced Inventory Control and Monitoring

- Optimized Stock Levels: Tools help businesses maintain optimal inventory levels by tracking stock movements, identifying slow-moving or obsolete items, and facilitating timely replenishment.

- Forecasting and Demand Planning: Advanced software provides forecasting capabilities based on historical data and trends, enabling businesses to anticipate demand fluctuations and plan inventory accordingly.

3. Cost Reduction and Efficiency

- Reduction in Holding Costs: By minimizing excess inventory and preventing stockouts, businesses can reduce carrying costs associated with storage, insurance, and depreciation.

- Order Optimization: Inventory management tools use algorithms such as Economic Order Quantity (EOQ) to calculate optimal reorder points and quantities, optimizing ordering processes and reducing costs.

4. Compliance and Reporting

- Regulatory Compliance: Software solutions help businesses comply with accounting standards (e.g., GAAP, IFRS) by ensuring accurate inventory valuation and reporting.

- Auditing and Transparency: Facilitates audit readiness with detailed inventory records and transaction histories, improving transparency and accountability.

5. Scalability and Business Growth

- Support for Expansion: Inventory management software scales with business growth, accommodating increased inventory volumes and operational complexities.

- Multi-location Management: Enables centralized control and visibility over inventory across multiple locations or warehouses, streamlining logistics and supply chain management.

6. Integration with Other Business Systems

- ERP Integration: Many inventory management tools integrate with Enterprise Resource Planning (ERP) systems, providing a holistic view of business operations from inventory management to finance and beyond.

- CRM Integration: Integration with Customer Relationship Management (CRM) systems helps align inventory levels with customer demand and sales forecasts, improving customer service and satisfaction.

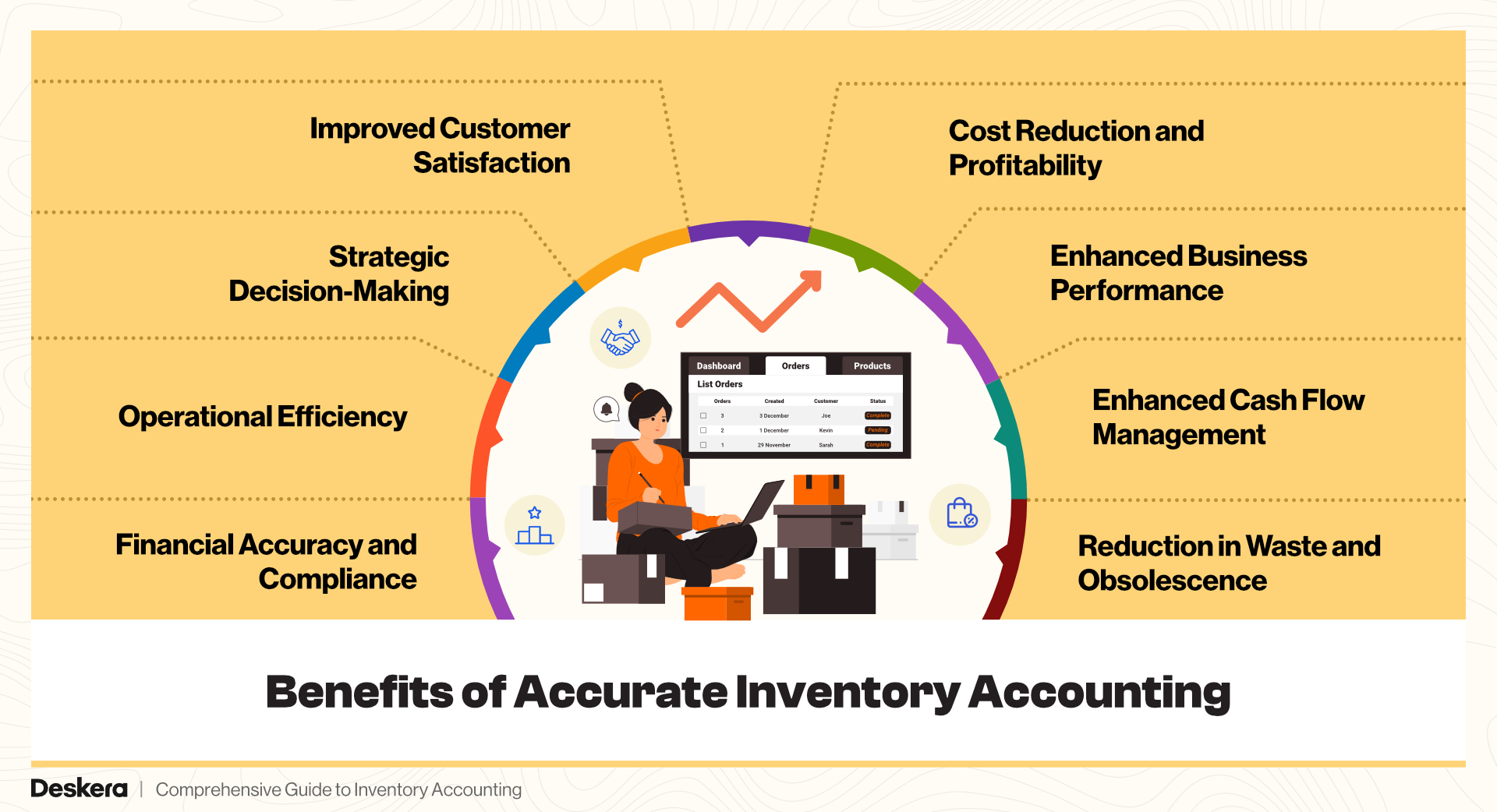

Benefits of Accurate Inventory Accounting

Accurate inventory accounting offers numerous advantages to businesses across various industries, ensuring financial stability, operational efficiency, and regulatory compliance.

Here are the key benefits:

1. Financial Accuracy and Compliance

- Compliance with Accounting Standards: Accurate inventory accounting ensures compliance with accounting principles such as GAAP or IFRS, maintaining transparency in financial reporting.

- Reduced Audit Risks: Detailed and precise inventory records mitigate audit risks by providing clear documentation of inventory transactions and valuations.

- Improved Financial Accuracy and Reporting: Accurate inventory data enhances financial accuracy and facilitates reliable financial reporting, supporting investor confidence and stakeholder trust.

2. Operational Efficiency

- Optimized Inventory Levels: Precise inventory accounting helps businesses maintain optimal stock levels, minimizing excess inventory and associated carrying costs.

- Effective Cost Management: Accurate tracking of inventory costs enables businesses to identify cost-saving opportunities and optimize operational expenses.

- Reduction in Waste and Obsolescence: Improved inventory visibility reduces the risk of overstocking obsolete or slow-moving items, minimizing waste and maximizing inventory turnover.

3. Strategic Decision-Making

- Better Decision-Making and Strategic Planning: Reliable inventory data supports informed decision-making, including pricing strategies, production planning, and supply chain management.

- Enhanced Cash Flow Management: Accurate inventory accounting facilitates efficient cash flow management by aligning inventory levels with sales forecasts and payment cycles.

4. Improved Customer Satisfaction

- Reliable Availability: Ensures products are consistently available to meet customer demand, reducing stockouts and enhancing customer satisfaction.

- Timely Order Fulfillment: Accurate inventory accounting enables businesses to fulfill orders promptly, improving overall service levels and customer retention.

- Increased Customer Satisfaction and Service Levels: Meeting customer expectations through reliable inventory management enhances customer loyalty and strengthens competitive advantage.

- Responsive Demand Management: Anticipates and adapts to customer preferences and fluctuations in demand, improving service reliability and customer experience.

5. Cost Reduction and Profitability

- Lower Holding Costs: Efficient inventory management based on accurate accounting minimizes storage costs, insurance premiums, and inventory obsolescence.

- Enhanced Profit Margins: Optimal inventory control contributes to higher profit margins by reducing costs and maximizing sales revenue.

6. Enhanced Business Performance

- Operational Transparency: Clear visibility into inventory levels and costs enhances operational transparency, facilitating performance monitoring and continuous improvement.

- Scalability: Enables businesses to scale operations effectively by managing inventory efficiently across multiple locations or warehouses.

7. Enhanced Cash Flow Management

- Strategic Inventory Management: Aligns inventory levels with sales forecasts and payment cycles to optimize cash flow.

- Capital Efficiency: Prevents overstocking, freeing up capital for other operational needs and growth initiatives.

- Liquidity Optimization: Maintains adequate liquidity by minimizing tied-up capital in excessive inventory.

8. Reduction in Waste and Obsolescence

- Proactive Inventory Control: Identifies slow-moving or obsolete items early through accurate tracking and demand analysis.

- Optimized Inventory Turnover: Adjusts pricing strategies or promotions promptly to clear excess inventory and reduce obsolescence.

- Cost Savings: Minimizes losses associated with unsellable inventory, improving overall profitability and resource allocation.

Accurate inventory accounting not only supports financial accuracy and compliance but also delivers tangible benefits across operational efficiency, customer satisfaction, and cost management.

By leveraging advanced inventory management practices, businesses can optimize their inventory operations, reduce operational risks, and sustain long-term growth in competitive markets.

How Inventory Accounting Influences Financial Reporting

Inventory accounting plays a pivotal role in financial reporting, impacting the balance sheet, income statement, and overall profitability.

Accurate and efficient accounting for inventory ensures that businesses can maintain financial transparency, comply with accounting standards, and make informed strategic decisions.

Leveraging inventory and accounting software, especially for small businesses, enhances accuracy and operational efficiency, driving better financial outcomes and business growth.

Here’s a closer look at how inventory affects financial reporting:

How Inventory Affects the Balance Sheet

- Asset Valuation: Inventory is recorded as a current asset on the balance sheet. Accurate valuation of inventory ensures that the balance sheet reflects the true value of a company’s assets.

- Types of Inventory: Inventory can include raw materials, work-in-progress, and finished goods. Proper classification and valuation of these categories are crucial for financial accuracy.

- Inventory Examples: For instance, a retailer’s balance sheet will list the value of its unsold merchandise, while a manufacturer’s balance sheet will include the cost of raw materials, partially completed products, and finished goods ready for sale.

Role of Inventory in Calculating the Cost of Goods Sold (COGS)

- Inventory Turnover: The movement of inventory in and out of stock plays a significant role in calculating COGS. Accurate tracking of inventory helps determine the actual cost of goods sold during a specific period.

- Accounting for Inventory: Methods like First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted Average Cost affect how inventory costs are assigned to COGS. Each method impacts the financial outcome differently.

- Accounting Inventory Examples: In FIFO, the oldest inventory costs are assigned to COGS, often resulting in lower COGS during inflationary periods. In contrast, LIFO assigns the most recent inventory costs to COGS, which can increase COGS and reduce taxable income.

Impact on Income Statements and Profitability

- Revenue Recognition: Accurate inventory accounting ensures that the cost of inventory sold is correctly matched with revenue, providing a clear picture of gross profit.

- Profit Margins: Variations in inventory accounting methods can impact reported profit margins. For example, using FIFO during periods of rising prices may result in higher gross profit compared to LIFO.

- Income Statement Accuracy: Inventory accounting influences key metrics on the income statement, such as gross profit, operating income, and net income. Accurate inventory valuation is crucial for representing the company’s financial performance accurately.

Importance of Inventory and Accounting Software for Small Businesses

- Automation and Efficiency: Inventory and accounting software for small businesses automates the tracking and management of inventory, reducing manual errors and enhancing efficiency.

- Real-Time Data: Provides real-time insights into inventory levels, helping businesses make informed decisions about purchasing, sales, and inventory management.

- Integration Capabilities: Modern inventory and accounting software solutions integrate seamlessly with other business systems, ensuring consistent and accurate financial reporting.

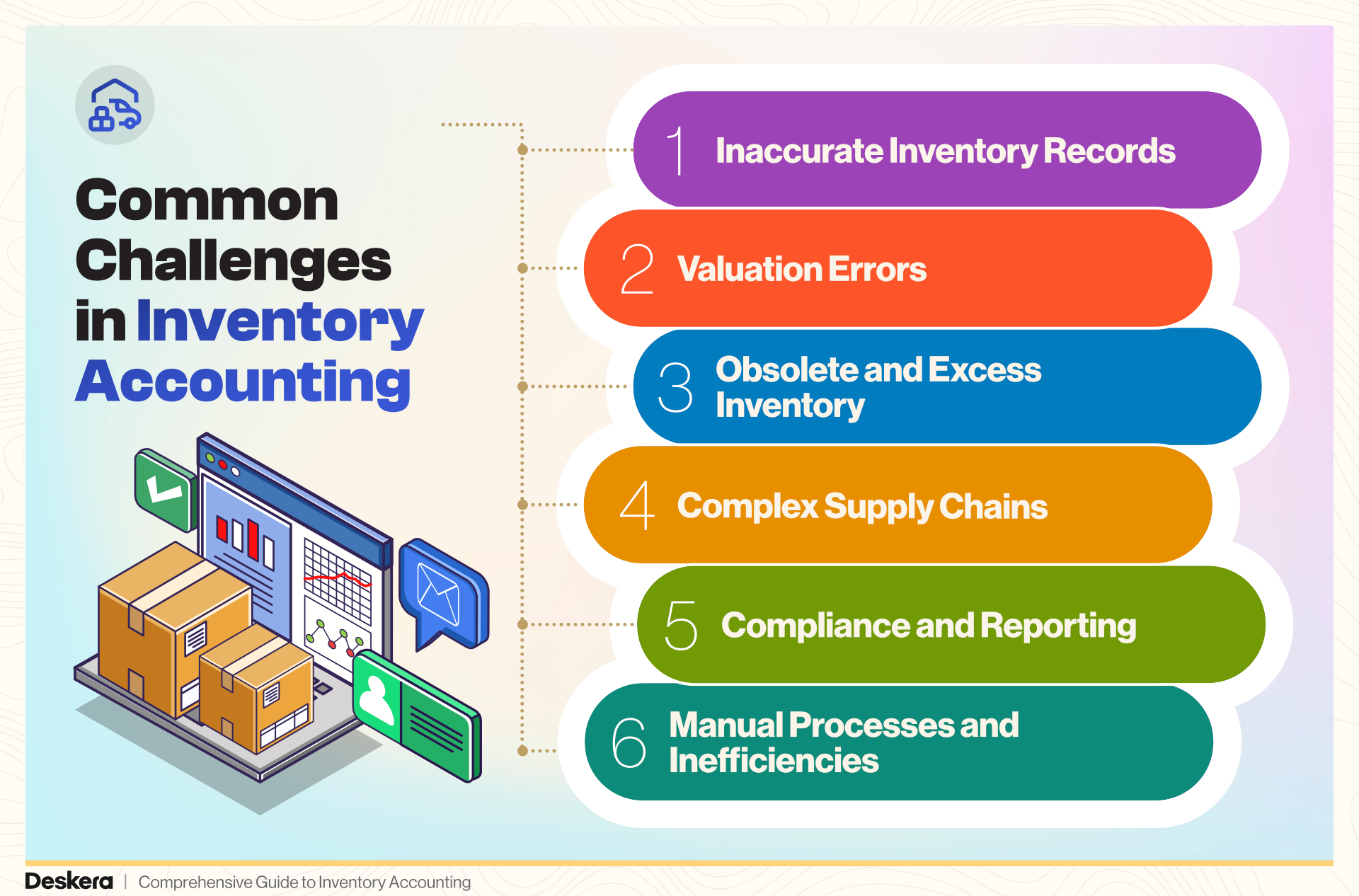

Common Challenges in Inventory Accounting and Strategies to Mitigate Them

Inventory accounting is a critical aspect of business operations that ensures accurate financial reporting and efficient inventory management. However, it comes with several challenges.

Here are some common challenges in inventory accounting and strategies to mitigate them:

1. Inaccurate Inventory Records

Challenge: Inaccurate inventory records can lead to discrepancies between actual stock levels and recorded amounts, affecting financial statements and decision-making.

Strategy:

- Regular Audits: Conduct regular physical inventory counts and reconcile them with inventory records to ensure accuracy.

- Inventory and Accounting Software: Utilize reliable inventory and accounting software for small businesses to automate tracking and minimize manual errors.

- Training: Train staff on proper inventory management practices to reduce errors in data entry and handling.

2. Valuation Errors

Challenge: Incorrect inventory valuation can distort the cost of goods sold (COGS) and overall financial performance.

Strategy:

- Standardized Methods: Apply consistent inventory valuation methods such as FIFO (First-In, First-Out), LIFO (Last-In, First-Out), or Weighted Average Cost across accounting periods.

- Software Solutions: Use inventory and accounting software that supports multiple valuation methods and ensures accurate calculation of inventory costs.

- Regular Review: Regularly review and adjust inventory valuation methods to align with current business conditions and accounting standards.

3. Obsolete and Excess Inventory

Challenge: Holding obsolete or excess inventory ties up capital and increases storage costs, impacting profitability.

Strategy:

- Demand Forecasting: Implement robust demand forecasting techniques to align inventory levels with anticipated sales.

- Inventory Example: Apply ABC analysis to categorize inventory based on importance and turnover rates, focusing on managing high-value items more closely.

- Clearance Strategies: Develop strategies for clearing out obsolete inventory, such as discounts, promotions, or write-offs.

4. Complex Supply Chains

Challenge: Managing inventory across complex supply chains can lead to challenges in coordination and timely reporting.

Strategy:

- Integration: Integrate inventory and accounting software with supply chain management systems to ensure real-time data flow and visibility.

- Collaboration: Foster strong relationships with suppliers and implement vendor-managed inventory (VMI) practices to streamline inventory management.

- Technology Utilization: Leverage technology such as RFID and barcoding for accurate tracking and management of inventory across the supply chain.

5. Compliance and Reporting

Challenge: Ensuring compliance with accounting standards and regulations can be challenging, especially for small businesses.

Strategy:

- Accounting for Inventory Examples: Study and apply industry-specific inventory accounting examples to understand best practices and regulatory requirements.

- Regular Updates: Stay updated on changes in accounting standards and regulations that affect inventory accounting.

- Professional Advice: Seek guidance from accounting professionals to ensure compliance and accurate financial reporting.

6. Manual Processes and Inefficiencies

Challenge: Relying on manual processes for inventory management can lead to inefficiencies and increased risk of errors.

Strategy:

- Automation: Automate inventory management processes using advanced inventory and accounting software tailored for small businesses.

- Streamlined Workflows: Implement streamlined workflows to enhance efficiency and reduce manual intervention.

- Continuous Improvement: Regularly evaluate and improve inventory management practices to leverage technology and best practices.

How Can Deskera Help You with Inventory Accounting?

Deskera ERP is an integrated business management software that provides comprehensive solutions for inventory accounting, helping businesses streamline operations and maintain financial accuracy.

Here are some key ways Deskera ERP can assist with inventory accounting:

1. Automated Inventory Management

- Real-Time Tracking: Deskera ERP offers real-time tracking of inventory levels, ensuring accurate and up-to-date information on stock availability.

- Automated Updates: Inventory records are automatically updated with each transaction, reducing the risk of manual errors and ensuring consistent data across the system.

- Inventory Example: Whether managing raw materials, work-in-progress, or finished goods, Deskera automates tracking and updates to maintain accurate records.

2. Comprehensive Inventory Accounting Features

- Multiple Valuation Methods: Deskera ERP supports various inventory valuation methods such as FIFO, LIFO, and Weighted Average Cost, allowing businesses to choose the most appropriate method for their accounting needs.

- Cost Tracking: Accurately tracks the cost of goods sold (COGS) and inventory costs, providing clear insights into profitability and cost management.

- Accounting for Inventory: Automatically calculates inventory valuation and adjusts financial statements accordingly, ensuring accurate financial reporting.

3. Integration with Accounting Software

- Seamless Integration: Deskera ERP integrates with its accounting module, allowing for seamless synchronization of inventory data with financial records.

- Inventory and Accounting Software: This integration ensures that inventory transactions are reflected in the general ledger, accounts payable, and accounts receivable, maintaining financial consistency.

- Inventory Accounting Examples: Deskera provides detailed examples and templates to help businesses understand and implement best practices in inventory accounting.

4. Enhanced Reporting and Analytics

- Detailed Reports: Generates comprehensive reports on inventory levels, valuation, and movements, providing valuable insights for decision-making.

- Analytics: Advanced analytics tools help identify trends, forecast demand, and optimize inventory levels to reduce costs and improve efficiency.

- Accounting Inventory Insights: Access to detailed inventory accounting insights helps businesses make informed strategic decisions based on accurate data.

5. Inventory Management for Small Businesses

- User-Friendly Interface: Deskera ERP is designed with small businesses in mind, offering an intuitive interface that simplifies inventory and accounting processes.

- Scalability: Scalable solutions that grow with your business, ensuring that inventory management remains efficient as your business expands.

- Inventory and Accounting Software for Small Business: Provides a cost-effective solution that combines inventory management with accounting, helping small businesses maintain control over their financial operations.

6. Improved Efficiency and Compliance

- Regulatory Compliance: Ensures compliance with accounting standards and regulations, reducing the risk of non-compliance and associated penalties.

- Workflow Automation: Automates routine tasks and workflows, freeing up time for staff to focus on strategic activities.

- Reduction in Errors: Minimizes manual data entry errors, ensuring the accuracy of financial statements and inventory records.

Key Takeaways

Effective inventory accounting is crucial for the financial health and operational efficiency of any business. This guide highlights the benefits of accurate inventory accounting, addresses common challenges, and provides insights on how modern solutions like Deskera can enhance inventory management.

Here are the key takeaways:

Benefits of Accurate Inventory Accounting

- Financial Accuracy and Compliance: Ensures compliance with accounting standards, reduces audit risks, and enhances financial reporting accuracy.

- Operational Efficiency: Optimizes inventory levels, manages costs effectively, and reduces waste and obsolescence.

- Strategic Decision-Making: Provides data-driven insights for better decision-making, forecasting, and planning.

- Customer Satisfaction: Improves product availability, timely order fulfillment, and overall service levels.

- Cost Reduction and Profitability: Lowers holding costs and enhances profit margins.

- Enhanced Business Performance: Improves operational transparency and scalability.

Common Challenges in Inventory Accounting

- Inaccurate Inventory Records: Mitigated through regular audits, using reliable inventory and accounting software, and staff training.

- Valuation Errors: Addressed by applying consistent valuation methods, using software solutions, and regular review.

- Obsolete and Excess Inventory: Manage it with demand forecasting, ABC analysis, and clearance strategies.

- Complex Supply Chains: Overcome it by integrating inventory and supply chain systems, strong supplier relationships, and technology utilization.

- Compliance and Reporting: Ensured through staying updated on regulations, using industry-specific examples, and seeking professional advice.

- Manual Processes and Inefficiencies: Reduced through automation, streamlined workflows, and continuous improvement.

Inventory and Financial Reporting

- Balance Sheet Impact: Inventory is a current asset, with accurate valuation critical for financial accuracy.

- Calculating COGS: Methods like FIFO, LIFO, and Weighted Average Cost affect how inventory costs are assigned to COGS.

- Income Statement Impact: Accurate inventory accounting ensures proper matching of inventory costs with revenue, affecting profit margins and financial performance.

- Software for Small Businesses: Inventory and accounting software for small businesses automates tracking, provides real-time data, and integrates with other systems for accurate financial reporting.

How Can Deskera Help with Inventory Accounting

- Automated Inventory Management: Real-time tracking and automated updates reduce manual errors.

- Comprehensive Features: Supports multiple valuation methods, tracks costs accurately, and ensures proper financial reporting.

- Integration: Seamlessly integrates inventory data with accounting records, enhancing financial consistency.

- Reporting and Analytics: Generate detailed reports and provide analytics for informed decision-making.

- Small Business Focus: Offers a user-friendly interface and scalable solutions tailored for small businesses.

- Efficiency and Compliance: Ensures regulatory compliance, automates workflows, and reduces errors.

By addressing common challenges and leveraging advanced tools like Deskera, businesses can enhance inventory accounting, maintain financial accuracy, and drive operational efficiency. Accurate inventory accounting is essential for sustaining growth, optimizing resources, and achieving long-term business success.

Related Articles