Central Government has set the GST Input Tax Credit (ITC) as one of the essential parts of the new indirect tax machinery. Input Tax Credit (ITC) is a kind of tax that businesses pay on a purchase. ITC can be used to reduce tax liability when businesses make a sale. It means that businesses can be able to reduce their tax by claiming credit to the extent of ITC paid on purchases.

This guide will help you to understand everything you want to know about Input Tax Credit (ITC) under GST.

What is Input Tax Credit (ITC)

ITC(Input Tax Credit) is the tax where a business pays on a purchase, and when it makes the sale, it can reduce its tax liability. In short, businesses can reduce their tax liability on purchases by claiming credit to the extent of GST.

How does the ITC work?

The buyer will get the credit for the input tax paid at each stage of the supply chain and can offset the GST that needs to be paid to the state and Central Governments.

To understand the concept in more, let us take the below example,

A Company sells Kitchen Knives, which a custom made kitchen knives,

- They purchase plastic and steel knives from a vendor for Rs.2000 at the GST rate of 12.5%. Here, the Input Tax Credit they pay is Rs.250.

- Now the company sells the manufactured knives for Rs.4000, plus an output tax of 12.5%, and makes the total selling price Rs.4500(Rs.4000 + Rs.500).

Finally the Tax that company pays to the Government = Output tax - Input tax credit = Rs.500 - Rs.250 = Rs.250

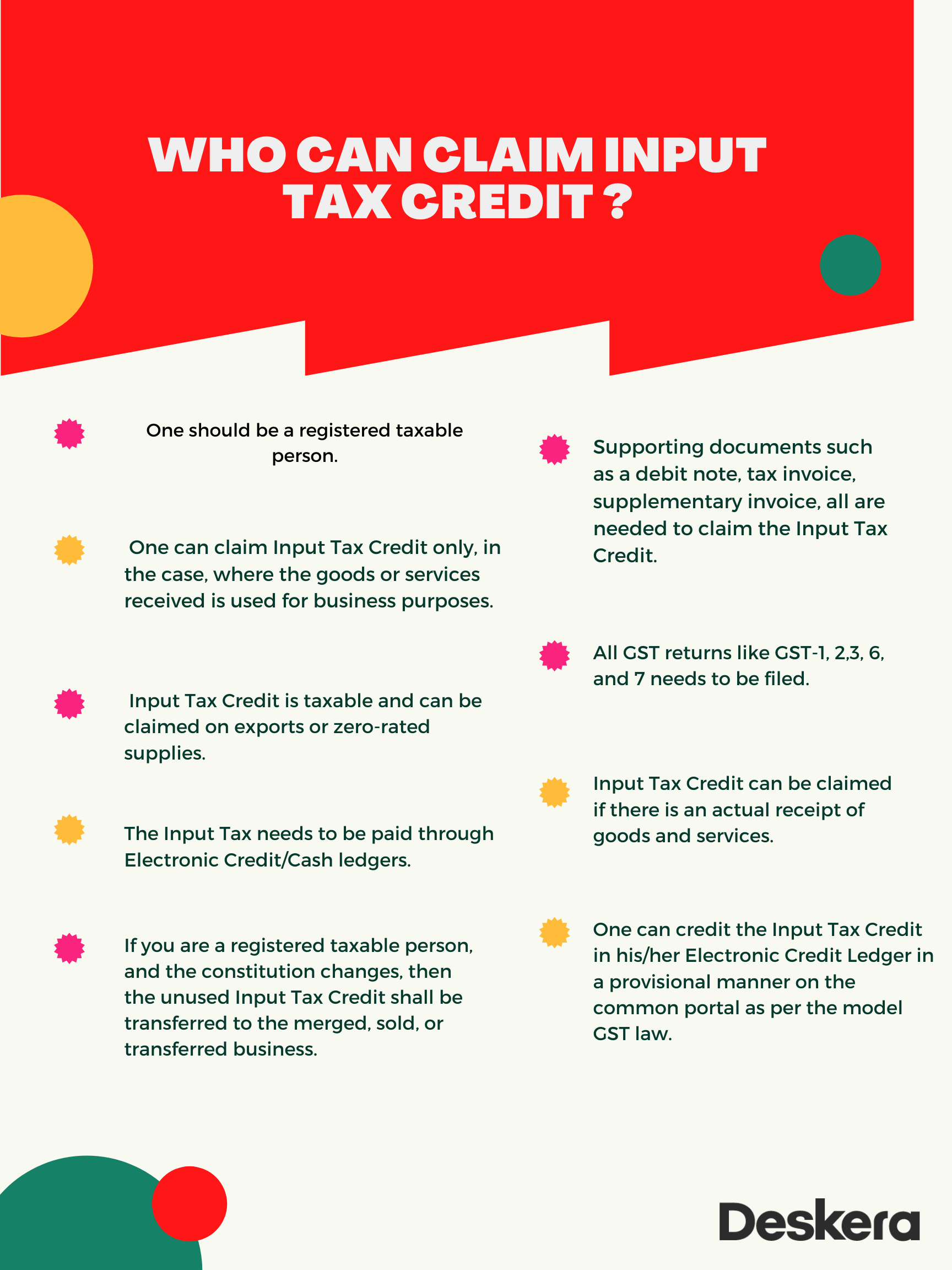

Who Can Claim Input Tax Credit?

As per the GST laws, if you want to claim and be entitled to your Input Tax Credit then you need to follow the below,

A business under a composition scheme cannot avail of the Input Tax Credit. ITC cannot be claimed for personal use or for goods that are exempt.

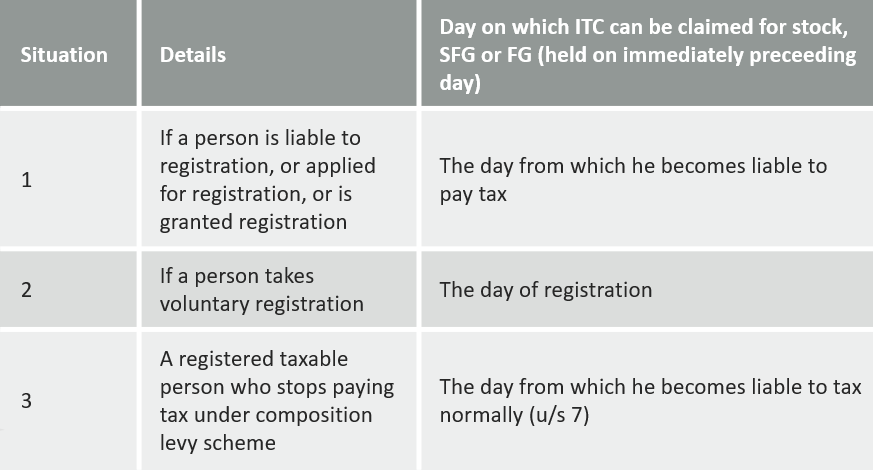

Time Limit for Availing GST Input Tax Credit in India

A taxable person who has registered can get ITC in the prescribed time and manner. In the table below, you can see different situations in which inputs can be claimed for stock, semi-finished goods, or finished goods.

Other conditions:

ITC mentioned in the above situations can be claimed within one year only, from the tax issue invoice relating to supply.

In remaining situations, the last date to claim ITC is earlier of the two,

- Under section 27, before filing a valid return for September month, following the F.Y ending to which such invoice is related, or,

- Before filing the annual return.

The last date for annual return filing is 31st December, following the end of the financial year.

How to Claim ITC in GST?

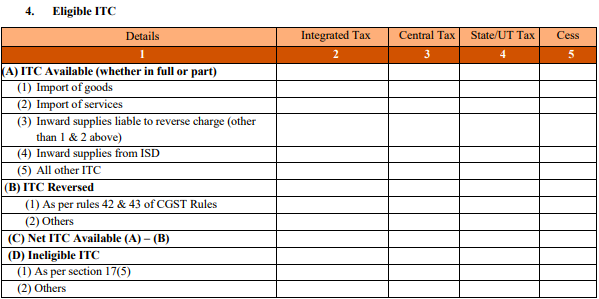

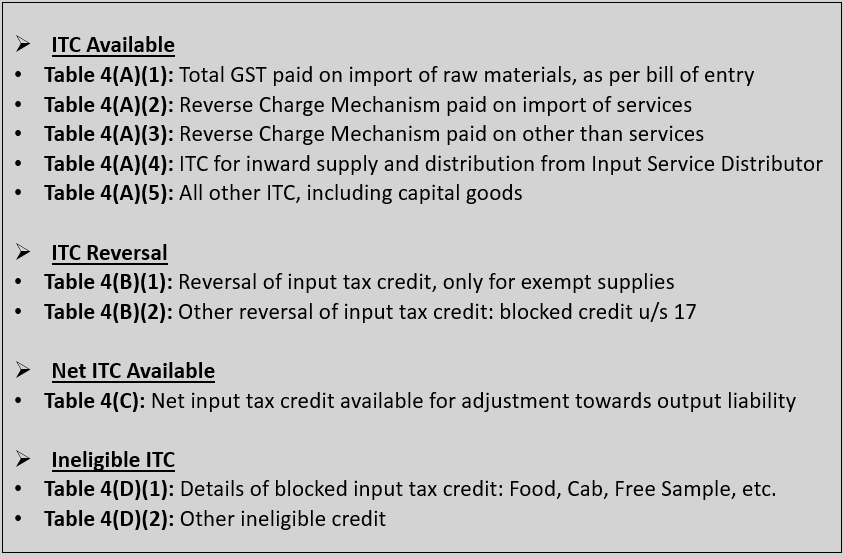

A taxpayer can claim the ITC while filing the monthly GST returns via Form GSTR - 3B. Table 4 within GSTR-3B is used exclusively for claiming the input tax credit.

You can file a summary of input tax credit claimed in Table 4:

- Eligible ITC

- Ineligible ITC

- Reversal of ITC in GST

Below given is a short brief on the contents of Table 4 under GSTR-3B Form:

Here is an important Note - A taxpayer on a provisional basis can claim up to 20% of the eligible ITC, as reported by the suppliers, using GSTR-2A return Form.

So, it is always suggested that the taxpayer must match the numbers with their supplier's data. In this way, the information mentioned in the GSTR-2A return form shall match with the details mentioned in the GSTR-3B return form.

Reversal of Input Tax Credit

For the business purposes, only on goods and services ITC can be availed. Thus ITC cannot be used if user for personal use or for making exempt supplies.

Apart from these, there are some other circumstances where ITC can be reversed.

1) In 180 days, non-payment of invoices– ITC will be reversed for invoices that were not paid within 180 days of issue.

2) Credit note issued to ISD by the seller– This is for ISD. If the seller issues a credit note to the HO, then subsequently, ITC reduced will be reversed.

3) Inputs partly for business purposes and partly for exempted supplies or personal use – For businesses that use inputs for personal and business purposes. For personal purposes, ITC used in the portion of input goods/services will be reversed proportionately.

4) Capital goods partly for business and partly for exempted supplies or personal use – This is similar to the mentioned above except for that it consists of capital goods.

5) ITC reversed is less than required- This is calculated after the annual return is furnished. If total ITC on inputs of exempted/non-business purpose is more than the ITC actually reversed during the year, then the difference amount will be added to output liability. Interest will be applicable.

The details of reversal of ITC will be furnished in GSTR-3B.

Type of Taxes under GST

GST will replace all existing taxes such as CST, VAT, Excise Duty, Service Tax, Entertainment Tax.

Following are the three types of taxes under GST

- State GST – SGST

- Centre GST – CGST

- Integrated GST – IGST

How is Input Tax Credit Used?

If ITC received on account of CGST

- First be used to pay CGST.

- After that for any amount remaining shall be used to pay IGST.

- Please Note, you cannot use ITC of CGST to pay SGST.

If ITC received on account of SGST

- First used to pay SGST first.

- After that for any remaining amount shall be used to pay IGST.

- Note that you cannot use the ITC of SGST to pay CGST.

If ITC received on account of IGST

- First used to pay IGST first.

- After that for any amount remaining shall be used to pay CGST.

- The last priority should be given to the payment of SGST.

Reconciliation of Input Tax Credit

In their respective GST returns, to vail the ITC, there must be a complete match between the details provided by you and your supplier.

If there is any mismatch between the two, you as a recipient and the supplier will be notified regarding any discrepancies after the filing of GSTR-3B. After this also there is any mismatch, you are not allowed to avail of the ITC.

.

Documents Required for Claiming GST Input tax Credit

If you are a registered taxable person, the ITC can be claimed based on below mentioned documents:

- An invoice that the supplier of goods or services issues

- Issues invoice by the recipient of the goods and services that an unregistered dealer supplies. These supplies come under the SCM(Reverse Charge Mechanism). This mechanism consists of the supplies made by an unregistered person to a registered person.

- A supplier who issues a debit note of tax charged is lesser than the tax paid on such supply.

- To document an integrated tax on imports, a bill of entry or similar documents is also required.

- As per the rules under GST, an input service distributor issues an invoice or a credit note.

- A supply bill by a dealer opting for a composition scheme or an exporter or a supplier of the exempted goods.

Special Cases of Input Tax Credit

Input tax credit for Capital goods

Capital goods that are exclusively used for making exempted goods and for personal use, ITC is not available.

Here, ITC will be applicable only of depreciation is claimed on the tax component of the capital goods.

Input tax credit on the Job work

The manufacturer can send goods for further processing to a job worker. In these cases, on the goods, ITC will be allowed that are sent to the job worker in the following circumstances:

- From a primary place of business

- Of such goods, directly from the place of supply of the supplier.

To enjoy the ITC, the principal must receive the goods back within 1 year.

The input tax credit that the Input Service Distributor provides

An input service distributor can be the registered office/branch office/the head office of the registered person under GST. The input service distributor collects the input tax credit made and distributed to all the recipients on all the purchases.

ITC on the transfer of business

In the case of mergers/amalgamations and the transfer of business, it is applicable. The transferor will have the available ITC, which will be passed to the transferee at business transfer.

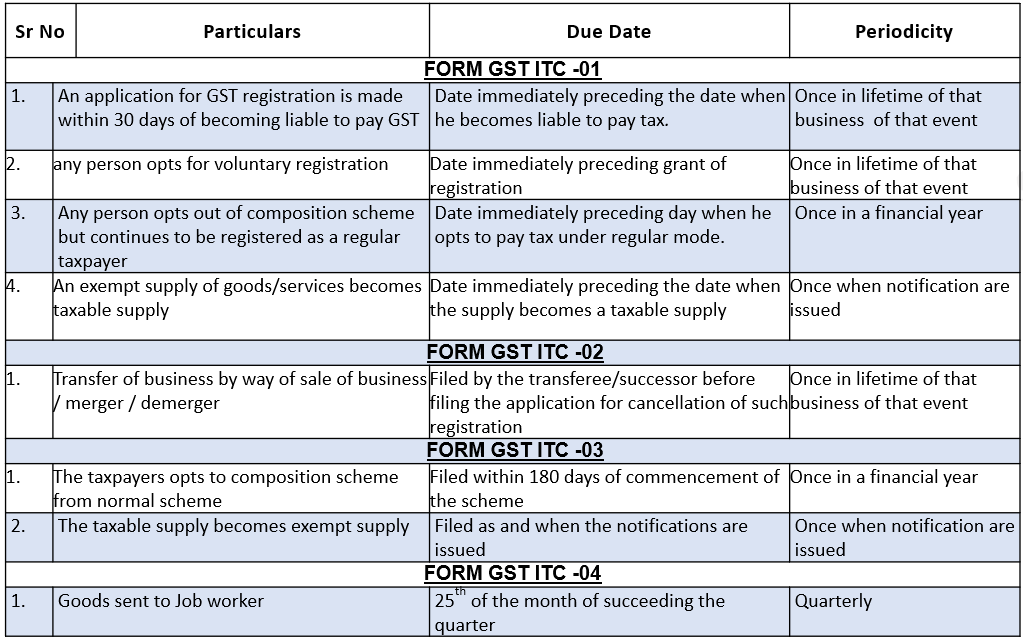

Forms for Input Tax Credit under GST

There are 4 types of ITC Forms, which are as follows

- ITC 01 – ITC for new GST Registration

- ITC 02 – Transfer of ITC in case of sale/merger etc.

- ITC 03 – Reversal of ITC

- ITC 04 – ITC on goods sent to Job Worker

Due Date of ITC forms

Refer the below article to know how does ITC Reversal apply in Deskera Books

Refer to the video tutorial for Ineligible ITC with India GST in Deskera Books

Conclusion

Finally, we have discussed everything about the input tax credit and the claim process under the India GST law. In the country, ITC is an innovative way of increasing the taxpayer's base. Also, it is beneficial for businesses as it can reduce their tax liability by claiming credit to the extent of GST payable on purchases.

Related Articles