Indian Accounting Standards Aka Ind As. were developed to harmonize standards related to international accounting and reporting. Accounting standards standardize the whole accounting procedure of the economy.

All companies after adopting these accounting standards follow the same manner of recording transactions. It is an attempt to help everyone in the business sector to easily understand the whole accounting system.

Moreover, considering how companies are prone to frauds and so is the government, the presence of certain norms & principles, accounting standards, scam-proves a company.

If you are an already established company but want to know more about the Indian Accounting Standards, or if you are a company just starting out, this article is all you need.

In this article we will discuss the objectives of accounting standards, its benefits, the applicability of Indian accounting standards, and the standards in depth.

By the end of this article you will have insights into:

- What are Indian accounting standards?

- Benefits of Indian accounting standards

- List of Indian accounting standards and their objectives

- Easy accounting with Deskera Books.

What are Indian Accounting Standards?

As per popular definitions, Indian accounting standards are nothing but guidelines to be followed in the accounting system. It means rules & regulations that are to be followed while recording accounting & financial transactions. It governs the manner in which financial statements are prepared & presented in a company.

In India, Institute of Chartered Accountants formulate & issue accounting standards. These standards are followed by accountants of all the companies registered in India. As we have mentioned before, these accounting standards help in preparation and presentation of financial statements.

While you may have understood the base objective of Indian accounting standards, let us get into the depth of these objectives and understand what kind of underlying objectives are there.

Core Objectives of the Indian Accounting Standards

There is always a reason for any mission. Similarly, there are certain objectives for having accounting standards. Let us take a look at the objectives of accounting standards so that we understand in depth the deeper aim of it.

- The main objective of Indian accounting standards is to bring in more transparency of annual financial statements in company accounts.

- Ensure companies in India adopt these standards to implement internationally recognized best practices.

- One systematic, single accounting system common for all the companies. Cutting out confusions and frauds.

- The Indian accounting standards are so simplified that they can be understood worldwide, globally.

- There are several global requirements and the Indian accounting standards are designed to match the global requirements.

- To increase the reliability of the financial statements.

These are some of the major objectives of Indian accounting standards

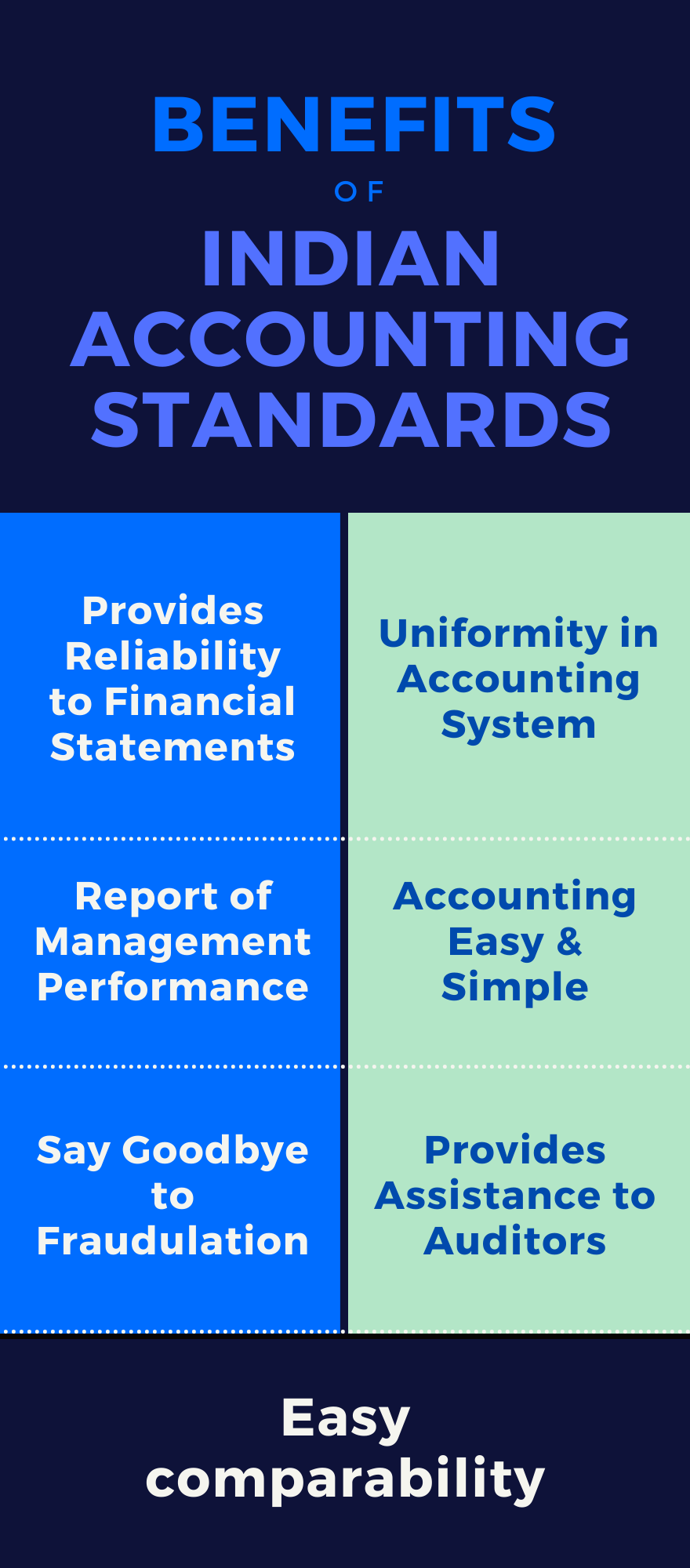

Benefits of Indian Accounting Standards

Provides Reliability to Financial Statements

The financial statements are a significant measure of gaining data with respect to organizations. Financial backers and various partners rely upon these assertions for getting data. These individuals take significant choices based on this information as it were.

It is in this way vital that these financial statements are valid and reasonable. Bookkeeping principles completely oversee these financial reports. It is guaranteed by accounting principles that these assertions are genuine and reliable.

Uniformity in Accounting System

Accounting standards are the one that aids in acquiring the consistency of entire accounting. It is one significant benefit of accounting guidelines. Accounting guidelines set similar standards and guidelines for the treatment of accounting exchanges.

It implies that all organizations record the exchanges in a similar way. For instance, Accounting Standard administers the entire deterioration of accounting. All organizations will be following AS-6 for issues worried about devaluation. This way it acquires consistency throughout the entire accounting system in the country, as well as globally.

Report of Management Performance

The accounting standards make it simple in deciding responsibility of the executives. It makes it simple to gauge the exhibition of supervisory crew and give any ideas.

It helps in breaking down administration capacity in keeping up with dissolvability of the firm, expanding the organization's benefit and different other significant jobs.

It guides the administration to take on specific accounting standards and its strategy. Same arrangement ought to be followed continually to keep away from any disarray.

Accounting Easy & Simple

Working in the general Indian accounting system, data is a significant benefit of accounting norms. It gives standard guidelines to each and every accounting exchange. It eliminates all intricacy in the accounting system.

Standard and uniform cycle is followed. It helps the clients in simple agreement and dodges any deludes from it.

Say Goodbye to Fraudulation

Accounting standards assume a proficient part in forestalling fakes in the accounting system. Fakes and any accounting information control may unfavorably influence the association.

Accounting norms set up various accounting rules and standards. These accounting standards administer the entire accounting system. These standards are not discretionary to be followed yet are obligatory to be followed.

It turns out to be practically difficult to distort and control any monetary information on a piece of the executives. Submitting any extortion additionally becomes more enthusiastic for them.

Provides Assistance to Auditors

The Indian accounting standards help the auditors in playing out their obligations, in their audits. It improves on their assignment and makes it simple for them to play out their jobs. Accounting Standards have set up various guidelines, rules and guidelines to be trailed by organizations in their accounting system.

These standards and guidelines are obligatory to be trailed by each organization. It oversees the entire way of planning and introducing monetary guidelines. So if the examiner guarantees that the organization has kept accounting guidelines, he can without much of a stretch confirm that all monetary norms are reasonable and valid.

Easy Comparability

Accounting standards have improved the correlation of various financial reports. Budget reports of two organizations can be effectively thought about. In the event that two organizations are following a distinctive accounting framework and configuration, examination between them turns out to be very troublesome.

Like on the off chance that one organization follows LIFO technique for stock keeping, accounting while others follows FIFO strategy. Here examination becomes troublesome as two are following various techniques. Accounting standards help in beating this issue.

List of Accounting Standards in India

We have collated a list of Indian accounting standards that as a blooming company you must know about. Take notes! For your in depth knowledge and understanding we have also mentioned the objective of each accounting standard.

Ind AS 1 Presentation of Financial Statements

Objective: This standard sets out generally speaking necessities for show of financial statements, rules for their construction and least prerequisites for their substance to guarantee likeness.

Ind AS 2 Inventories Accounting

Objective: Its arrangements with accounting of inventories like estimation of stock, incorporations and avoidances in its expense, divulgence necessities, and so forth.

Ind AS 7 Statement of Cash Flows

Objective: It manages cash got or paid during the period from working, financing and contributing exercises. It additionally shows any adjustment of the money and money counterparts of any element.

Ind AS 8 Accounting Policies, Changes in Accounting Estimates and Errors

Objective: It prescribes choosing and changing accounting strategies along with accounting medicines and exposures.

Ind AS 10 Events after Reporting Period

Objective: It manages any changing or unchanging occasion happening subsequent to reporting.

Ind AS 11 Construction Contracts

Objective: It manages any changing or unchanging occasion happening subsequent to reports.

Ind AS 12 Income Taxes

Objective: This standard recommends accounting for income tax. The chief issue in representing annual duties is the means by which to represent the current and future assessment.

Ind AS 16 Property, Plant and Equipment

Objective: This recommends accounting treatment for Property, Plant And Equipment (PPE) like acknowledgment of resources, assurance of their conveying sums and the devaluation charges and impedance misfortunes to be perceived comparable to them.

Ind AS 17 Leases

Objective: This standard recommends fitting accounting arrangements and guidelines for tenants and lessors.

Ind AS 19 Employee Benefits

Objective: This standard recommends bookkeeping and divulgence prerequisites identifying with representative advantages.

Ind AS 20 Accounting for Government Grants and Disclosure of Government Assistance

Objective: This Standard will be applied in representing and in exposure of, government awards and in revelation of different types of government help.

Ind AS 21 The Effects of Changes in Foreign Exchange Rates

Objective: This standard helps to understand how to incorporate unfamiliar cash exchanges and unfamiliar activities in the financial reports of a company and how to make an interpretation of budget reports into a presentation currency.

Ind AS 23 Borrowing Costs

Objective: It gives acquiring cost caused on qualifying asset should frame part of that asset, it additionally directs on which money cost ought to be promoted, conditions for capitalization, season of initiation and discontinuance of capitalization of getting cost.

Ind AS 24 Related Party Disclosures

Objective: This guarantees that any organization’s fiscal reports contain fundamental revelations to cause us to notice the likelihood that its monetary position and benefit or misfortune might have been influenced by the presence of related gatherings and by exchanges and exceptional equilibriums.

Ind AS 27 Separate Financial Statements

Objective: This recommends bookkeeping and revelation necessities for interests in auxiliaries, joint endeavors and partners when a company plans separate budget reports.

Ind AS 28 Investments in Associates and Joint Ventures

Objective: This standard endorses representing interests in partners and to set out necessities for the utilization of value technique when representing interests in partners and joint endeavors.

Ind AS 29 Financial Reporting in Hyperinflationary Economies

Objective: This standard will give a comprehensive rundown of qualities that will order an economy as hyper inflationary and detailing of working outcomes and monetary position.

Ind AS 32 Financial Instruments: Presentation

Objective: This Standard sets up standards for introducing monetary instruments as liabilities or value and for balancing monetary resources and monetary liabilities.

Ind AS 33 Earnings per Share

Objective: This Standard recommends standards for the assurance and presentation of per share.

Ind AS 34 Interim Financial Reporting

Objective: This helps with least minimum content of an interval financial report and standards for acknowledgment and estimation in complete or dense financial statements for a period.

Ind AS 36 Impairment of Assets

Objective: This Standard recommends techniques that a company applies to guarantee that a company's conveying sum isn't more than its recoverable sum.

Ind AS 37 Provisions, Contingent Liabilities and Contingent Assets

Objective: This guarantees that correct acknowledgment rules and estimation bases are applied to arrangements, unforeseen liabilities and unexpected resources and appropriate divulgences are made in the notes to empower clients to comprehend their tendency, timing and sum.

Ind AS 38 Intangible Assets

Objective: This Standard recommends bookkeeping treatment for intangible assets. It determines conditions for acknowledgment of intangible assets and how to quantify conveying sums at which elusive resources ought to be perceived.

Ind AS 40 Investment Property

Objective: This recommends accounting treatment for speculation property and related exposure prerequisites.

Ind AS 41 Agriculture

Objective: This prescribes accounting treatment and divulgences identified with agricultural movement.

Ind AS 101 First-time adoption of Ind AS

Objective: Its primary goal is to plan first financial reports according to Ind AS containing excellent data that is straightforward, tantamount and ready at prudent expense, appropriate beginning stage for bookkeeping as per Ind AS.

Ind AS 102 Share Based payments

Objective: It manages bookkeeping of offer based installment exchanges and reflects impact of such installment on benefit or misfortune and financial reports of elements.

Ind AS 103 Business Combination

Objective: It applies to exchanges or other occasions that meet the meaning of a business mix. This standard aids in working on the significance, unwavering quality and equivalence of the data that a revealing substance gives in its budget summaries about a business mix and its belongings.

Ind AS 104 Insurance Contracts

Objective: This standard determines financial reporting for protection decreases by a back up plan element.

Ind AS 105 Non-Current Assets Held for Sale and Discontinued Operations

Objective: This determines representing resources held available to be purchased, and sold and divulgence of uncompleted activities.

Ind AS 106 Exploration for and Evaluation of Mineral Resources

Objective: This standard indicates financial reporting for investigation and assessment of mineral resources.

Ind AS 107 Financial Instruments: Disclosures

Objective: This expect elements to give exposures identified with monetary instruments that will empower clients to assess meaning of monetary instruments for substance's monetary position and execution and nature and degree of dangers emerging from monetary instruments to which the element is uncovered during the period and toward the finish of the detailing time frame, and how the element deals with those dangers.

Ind AS 108 Operating Segments

Objective: This reveals data to empower clients of its fiscal reports to assess the nature and monetary impacts of the business exercises in which it draws in and the financial conditions where it works.

Ind AS 109 Financial Instruments

Objective: This builds up standards for financial reporting of financial assets and financial liabilities that will introduce important and helpful data to clients of financial reports for their evaluation of the sums, timing and vulnerability of an element's future cash flows.

Ind AS 110 Consolidated Financial Statements

Objective: This sets up standards for the presentation of the financial statements when a company controls at least one different.

Ind AS 111 Joint Arrangements

Objective: This sets up standards for financial reporting by companies that have an interest in game plans that are controlled jointly.

Ind AS 112 Disclosure of Interests in Other Entities

Objective: This standard requires a company to unveil data that empower clients of its fiscal reports nature hazard and impact of such interest.

Ind AS 113 Fair Value Measurement

Objective: This characterizes reasonable worth, set outs system for estimating fair value and divulgences about reasonable worth estimations. Such a value measurement estimation guideline will apply when one more Ind AS requires or allows utilization of reasonable worth.

Ind AS 114 Regulatory Deferral Accounts

Objective: This determines financial statements requirements for administrative deferral account adjustments that emerge when a company gives labor and products to customers at a cost or rate that is liable to rate guideline.

Ind AS 115 Revenue from Contracts with Customers

Objective: This sets up rules that an organization will apply to report helpful data to clients of financial statements about, sum, timing and vulnerability of income and incomes emerging from an agreement with a customer.

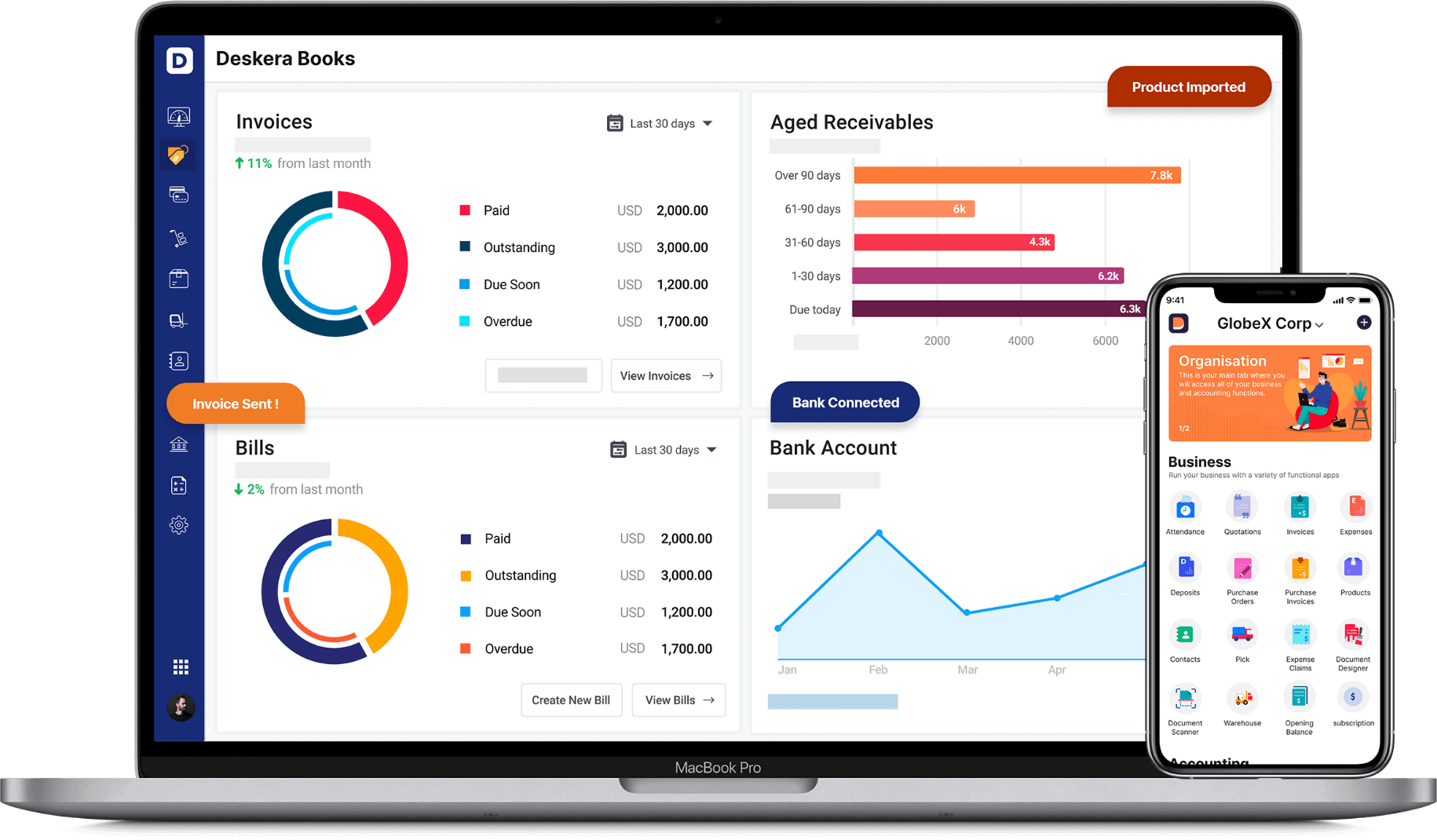

Easy Accounting With Deskera Books

Accounting is certainly not a one man's job, and that said it is not easy manage. Hence you need Deskera books. Deskera Books is a cloud-based accounting and inventory software that gives you the freedom to run your business while it takes care of all the accounting and financial details.

Under Financial Reports, the user can quickly view their cash flow statement based on the data available in the system. You can also toggle between the direct or indirect method seamlessly!

If you create additional accounts in Deskera Books, you can also customize the settings to map those accounts under a specific cash flow category. You can even determine the description written in the cash flow statement for that account!

Deskera Books also enables you to access other crucial financial reports at your fingertips, such as Balance Sheet and Income Statement.

Showcasing accurate financial reporting and various other features, Deskera Books is the ideal business accounting solution for small businesses with real time view of important reports like Cash Flow, Profit & Loss, Balance Sheet and Trial Balance.

The chart of accounts will help you systemize your process. It is the list of financial accounts used in the general ledger of an organization. The primary account types usually include Assets, Liabilities, Equity, Revenue, and Expense.

Choose from the list of default Chart of Accounts made available in Deskera Books accounting software. You can also create and customize new accounts that suit your business needs.

Here is a quick guide by Deskera on accounting and other products.

Looks like Deskera books is just exactly what you need, so get your 15 days free trial today.

Key Takeaways

Indian Accounting Standard provides principles for recognition, measurement, treatment, presentation and disclosures of accounting transactions in financial statements prepared by any company.

- The primary objective of accounting standards is to harmonize the different accounting policies. The policies are used in the preparation of financial reports.

- The objective of accounting standards is to bring a standard to the policies.

- The adoption of Indian Accounting Standards has improved the comparability of financial information of Indian companies worldwide.

- It is crucial to understand that these Indian Accounting Standards upscale the methodology of Indian Accounting.

- To maintain the accounting standards companies should closely evaluate the key areas of impact, and develop an appropriate strategy for communication to stakeholders to minimize any surprises or adverse reactions.

Related Articles