Running payroll in India can be overwhelming. There are so many components, like CTC, Basic, HRA, TA, DA, EPF, Income Tax, Form-16 and so on. It is easy to miss out on a fine detail and be non-compliant, a must-avoid situation. Which is why we bring you this complete guide to running payroll in India.

For any organization, calculating payroll manually is not an easy task. It is very time-consuming and tedious. That is where a payroll solution plays a vital role. In a vast country like India, and its various state-level rules and geography, it is crucial to have a payroll system that is scalable and robust.

When you say 'payroll,' it is not just paying salaries to employees but an entire process that takes place straight from the employee punching into the generation of his/her payslip. It will be a tedious process to work on a month-on-month basis and require dedicated resources. Still, a foolproof payroll system can handle all your salary-related operations with ease.

This guide will learn the basics of India payroll and statutory compliance, why it is essential, how it is done, how a successful payroll process looks, and more. Let's get started!

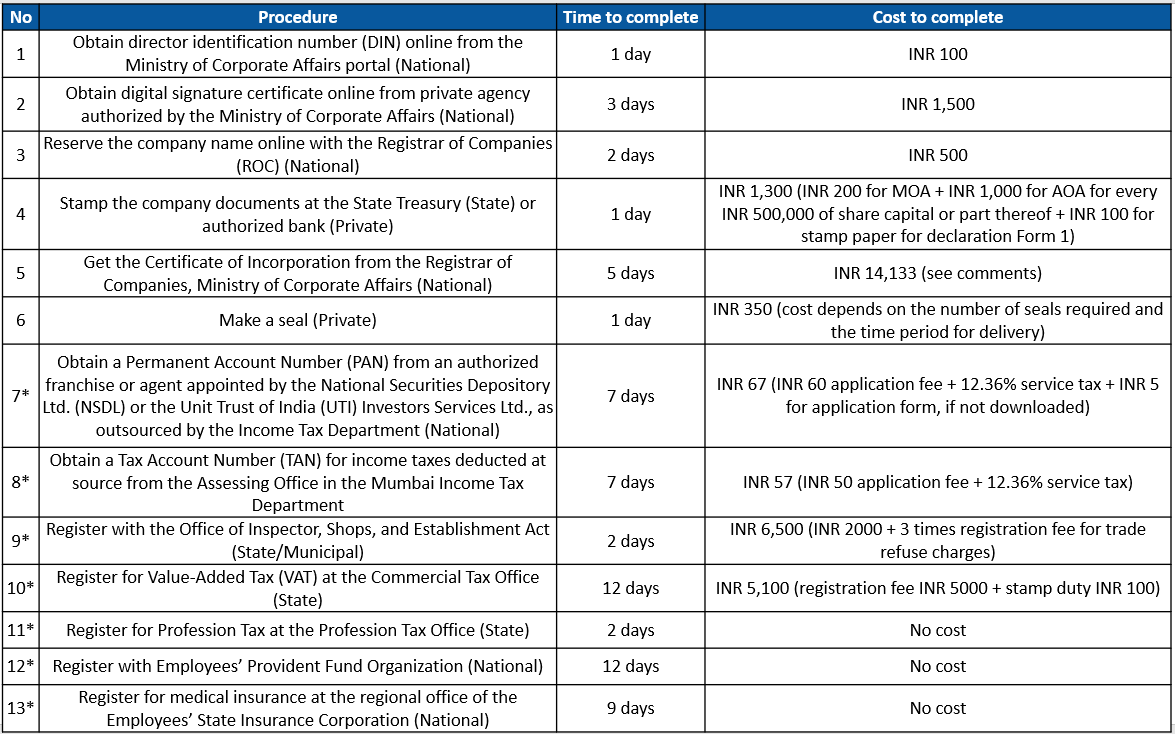

For a proper payroll setup in India, you should have a registered company. If you don't have a registered company at the moment, or want to start a new business with employees, then you can register a new company by following the steps below.

To know more about registration of a company please refer to the below site of ROC (Registrar of Companies):

www.mca.gov.in

What Is Payroll in India?

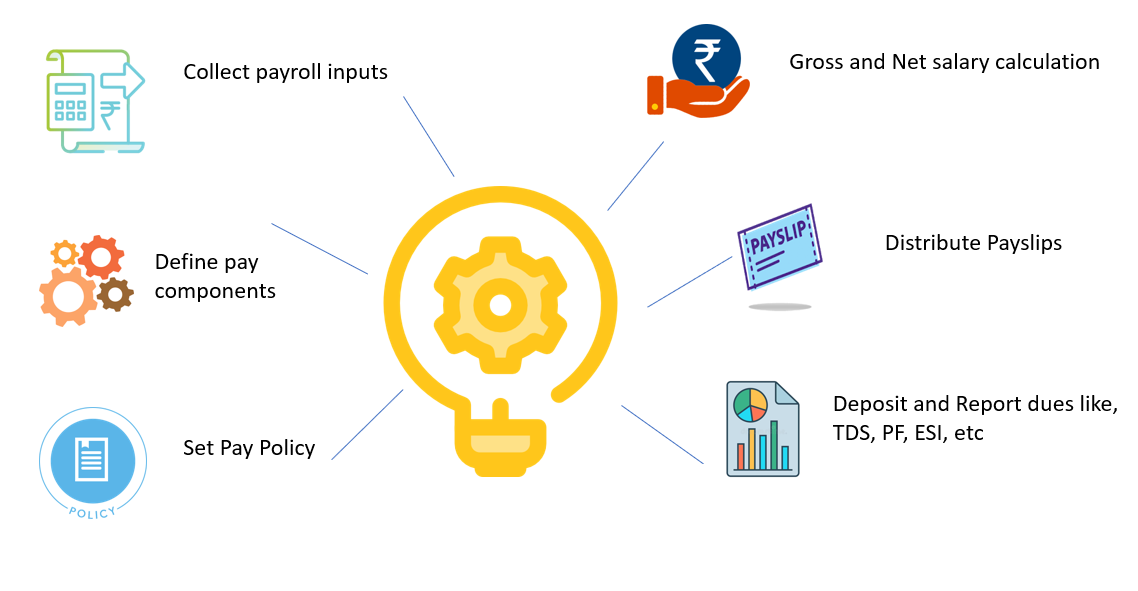

When a company pays its employees is known as payroll. It is also the total amount of money the employer pays to the employees. As a business function, it consists of,

- Developing organization policies like pay policy including leave encashment policy, flexible benefits, etc.

- Defining components in payslip like basic, variable pay, LTA, and HRA.

- Other payroll inputs such as meal allowances, etc

- The actual calculation of gross salary, statutory as well as non-statutory deductions, and arriving at the net pay

- Releasing employee salary

- Depositing dues like TDS, PF, etc. with appropriate authorities and filing returns

How Is Payroll Calculated in India?

The payroll process involves, at what is due to the employees, which is also called as 'net pay' arrived after adjusting the required taxes and other deductions,

The equation for calculating the net pay is,

Net pay = Gross Income- Gross Deduction

Where,

Gross Income or salary = All types of regular income + allowances + any one-time payment or benefit.

Gross Deduction = All types of regular deductions + statutory deductions + any one-time deductions.

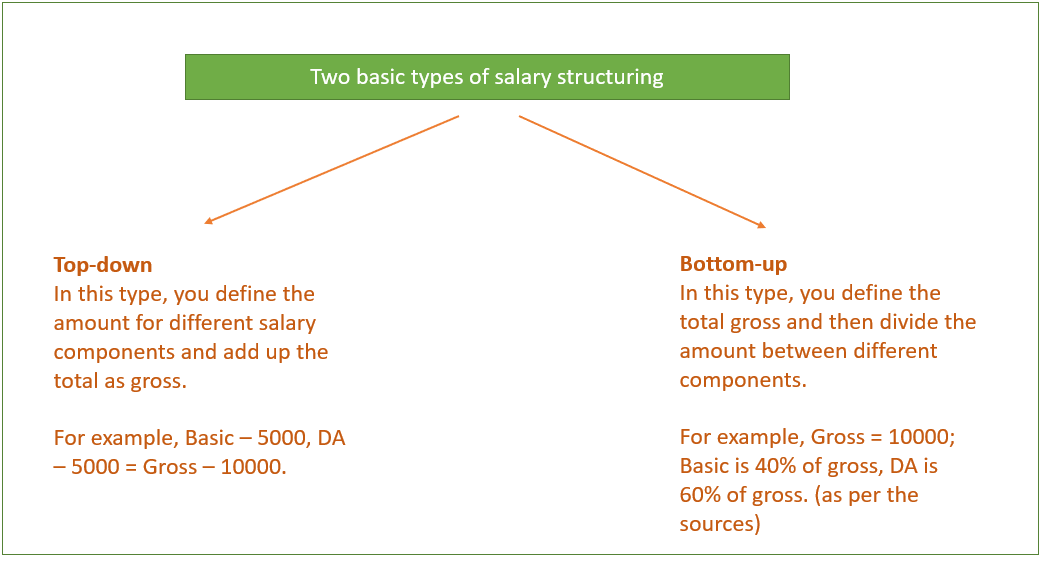

What Are the Important Elements of Salary Structure in India?

In every payroll in India, the monthly salary and wages disbursement has many vital components structured together that make a salary package. These elements are essential for both employers and employees to calculate taxes, PF, ESI, benefits, LTA, etc.

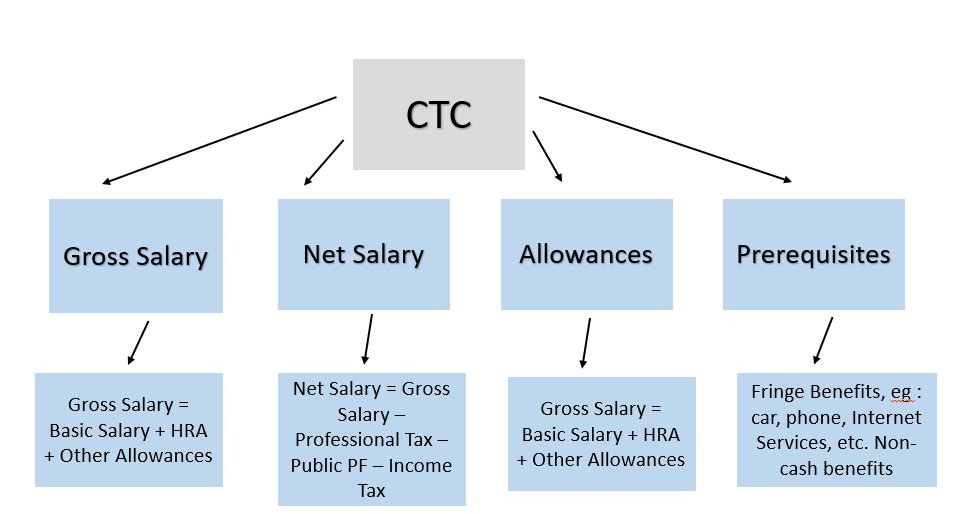

CTC

The total amount spent on the employees is known as the CTC or cost to the company. It is the full salary package of an employee. CTC includes all monthly components such as "Basic Salary," "Perquisites," "Allowances''. Please note CTC is never the take-home salary of an employee.

CTC=Gross Salary + Gratuity + PF

Gross Salary

The Gross salary calculation is done by adding employees, basic salary, allowances, before tax, and other deductions. It consists of overtime pay, bonuses, holiday pay, etc.

Gross Salary = Basic Salary + HRA + Other Allowances.

Net /Take Home Salary

As per the company's HR policy, the amount calculated after deducting income tax at source (TDS) and other deductions is a take-home salary or net salary.

Net salary = Gross Salary – Professional Tax – Public Provident Fund – Income Tax

Allowances

Over and above the basic salary, mandatory benefits are provided, which are either fully/partially taxable or completely exempt from tax. Common ones are mentioned below,

- House Rent Allowance (HRA)

To cover the cost of renting a home, HRA is offered to the employees. It provides tax benefits to employees for the sum that they pay towards their accommodation every year. - 40% of basic (non-metros)

- 50% of basic (metros

- Medical

To meet the employee's medical expenditure, the organizations pay a fixed amount for medical allowance. - Leave Travel Allowance (LTA)

To cover the employee's travel expense when he or she is out of work, LTA is offered to the employees. It is eligible for tax exemption.

- Conveyance

Employees are provided with the conveyance allowance by their employers to meet their travel expenses from home to the workplace and vice-versa. - Children education allowances

A certain amount is given to the employees to educate their children in India. Any amount spent more than the provided limit of INR 100pm per child for a max of two children is taxable. - Dearness Allowance (DA)

Aimed at the mitigation of the impact of inflation, a certain percentage of basic salary is paid to the employees is known as Dearness Allowance(DA). The government usually pays DA to employees of the public sector and pensioners.

Prerequisites

These are fringe benefits or non-cash benefits that some employees enjoy due to their official position. Some examples are permitted to use the official vehicle for personal use, rent-free accommodation, and a premium on personal accident policy. The monetary value of perquisites gets added to the salary, and the employee pays tax on them.

Deductions

In Indian Payroll Processing, deductions, when applied to the CTC, give you the actual take-home salary that an employee gets. Below mentioned are some of the most common deductions:

Provident Fund (PF)

Employee Provident Fund(EPF) is a benefit scheme to an employee, where the amount is deducted each month by both the employer and the employee.

- How is it calculated? – 12% of Basic Salary + DA + both employee and employer contribute special.

- To whom does it apply? - Companies with employee strength of 20 or more. It is mandatory for employees whose Basic, DA, and allowances amount is less than ₹15,000 pm.

Employees' State Insurance (ESI)

ESI is the amount paid fully during the medical leave (depending on the job profile and company policy). If a company has ten or more employees (20 in Maharashtra and Chandigarh) whose gross salary is below Rs. 21,000 per month, then the employer is required to avail ESIC scheme for such employees.

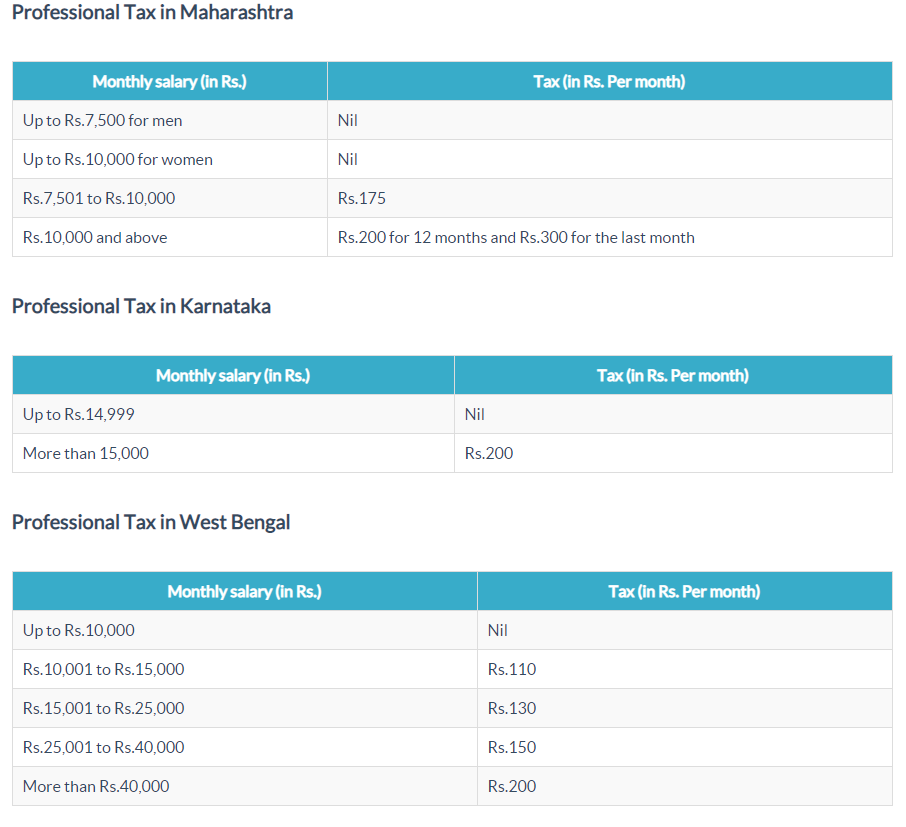

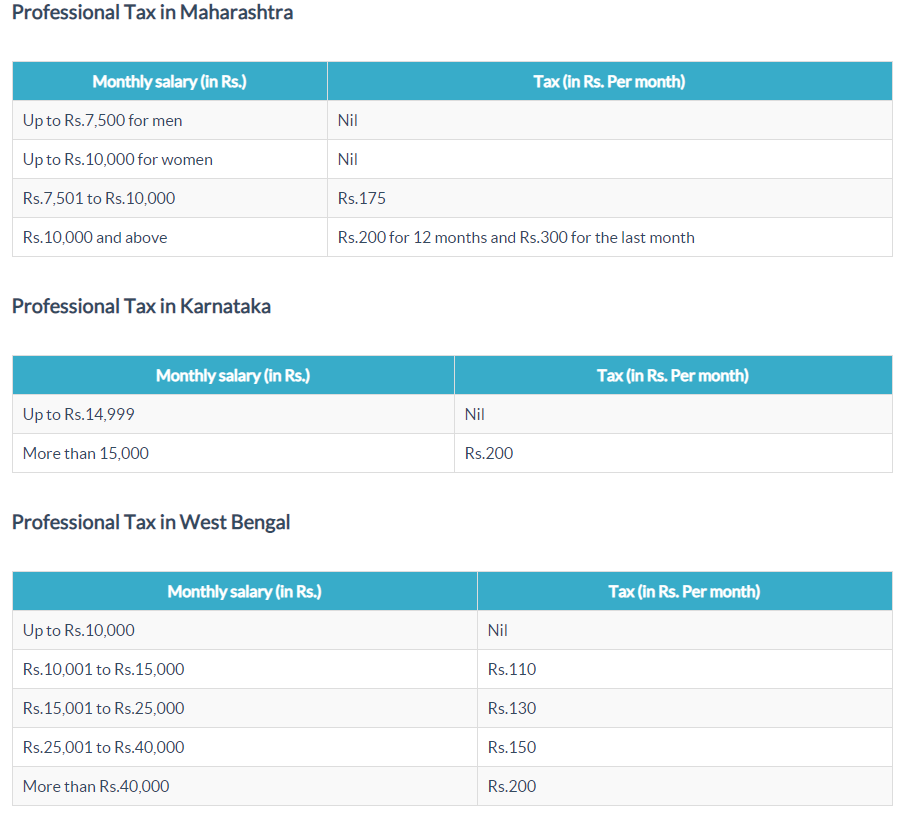

Professional Tax

The government imposes a professional tax on salaried employees and professionals.

Labour Welfare Fund

A Labour welfare fund is a statutory contribution managed by respective state authorities.

National Pension Scheme (NPS)

NPS is a scheme initiative of the government of India. It is a pension contribution scheme that allows a person to create a retirement corpus. Men and women can use it as a saving-investment or post-retirement tool.

Other Elements of Payroll in India

Payslip

A salary slip is a document issued to the employees by employers. It contains detailed information such as HRA, LTA, Bonus paid, etc., and also a deduction for that month.

Form 16

Form 16 is a document issued by the employer and contains the required information to prepare and file income tax returns. This document needs to be given every month on or before June 15 of next year.

Reimbursements

Reimbursement is the amount paid by the employer to an employee for the official expenses such as; official phone calls, taxi trips for travel to client locations, meals at a client location, or hotel stay for official trips. It is not taxable to the employee.

Incentive and Bonus

Incentives are paid for if an employee meets specific set goals, and bonuses are paid in the form of a reward.

Ad-hoc pay

Ad-hoc pay items include one-off or occasional pay such as annual bonus, incentives (based on performance), festival advance, etc. Companies further offer salary/wage-advance on a per request basis, which are also considered as ad-hoc pay.

Income Tax

Income tax is a tax imposed on employees' income. An employee receives his/her salary after the employer deducts the tax. It s is known as TDS(Tax Deduction at Source)

Employee Investment Declarations

At the beginning of the financial year, an investment declaration has to be made. Here the employer will ask you to declare the tax-savings investments for the year. It will deduct the tax accordingly from your monthly salary. It is essential as it can lead to a higher in-hand salary.

Gratuity

Gratuity is received by an employee from his/her employer upon the employee leaves the job. Only after five years, an employee can receive the gratuity amount. It is deducted every year by the employer, and so it will get deducted from your CTC.

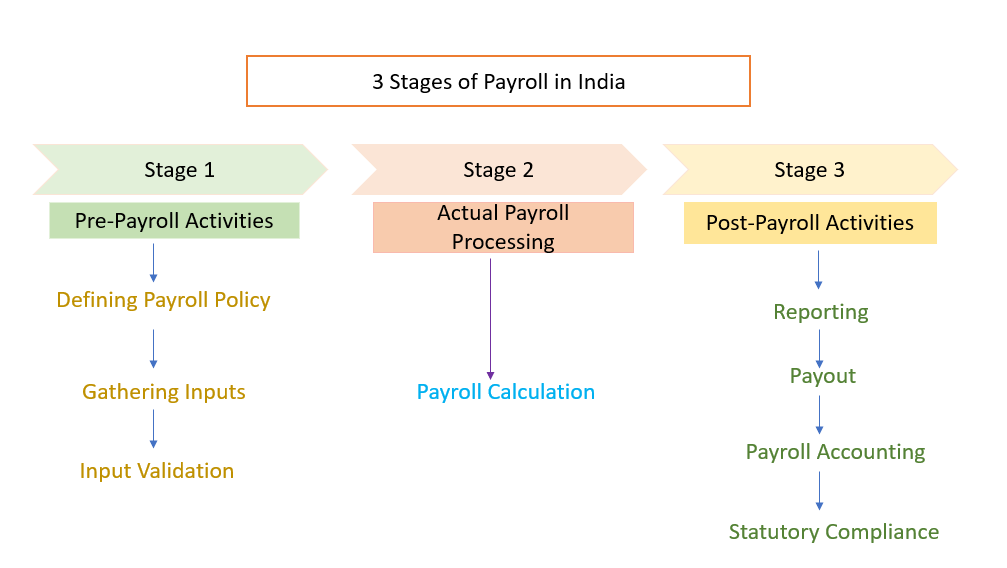

A Step-by-step Process of Payroll Processing in India

A company's payroll cycle consists of three stages

- Pre-payroll activities

- Actual Payroll process

- Post-payroll activities

Stage 1 - Pre-Payroll Activities

- Defining Payroll Policy

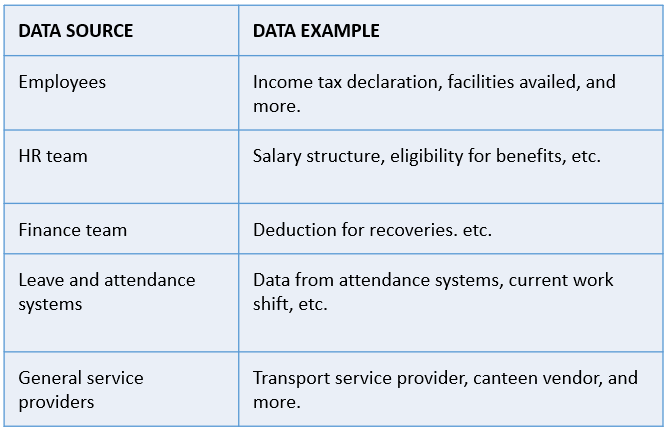

It is the first step where you need to set the policies in place to process the payroll. The management shall approve these policies. Examples of such policies are attendance policy, pay policy, leave and benefits policy, etc. To run the payroll department smoothly, an organization needs a set payroll policy and procedures and ensures all employees' payment is made accurately and on time. - Gathering inputs

In the next step you need to gather inputs from various departments to ensure accurate calculation of payroll.

At first, all this data collection can seem to be overwhelming. So to make it easy, you must incorporate payroll software, which will consist of features like attendance and leave management, Employee Self Service Portal(ESS), and many more to make it hassle-free.

- Input validation

After all, information is gathered, then you need to verify its validity because a small mistake can ruin the entire payroll process. - Ensure that the list contains all the active employees and no records of inactive employees.

- Check that data adheres to the company policy.

- Ensure the data present in the correct format.

Stage 2: Actual Payroll Process

Payroll calculation

After completing the pre-payroll activities, the actual work towards reaching the employees' net pay takes place in this stage. During the pre-payroll activities with the already gathered payroll data like attendance and leave data, shift-wise calculations, deductions, tax, incentives, expenses, etc., will have to run.

Once the data is verified, it is now time to feed it into the payroll system. After the adjustment of required taxes and deductions are made, you will get the net pay. To be double sure, you need to recheck the process to nullify the chances of errors.

Stage 3: Post Payroll Activities

- Statutory Compliance

During the payroll processing, the payroll administrator needs to adhere to the statutory compliances religiously. During payroll processing, various statutory deductions such as PF, ESI TDS are deducted. Later, these deductions are paid to the respective authorities and government bodies. - Payroll Accounting

Each organization has to maintain accurate books of accounts, and one of its significant entries is the salary paid. So, during the payroll process, salary data must be entered into the ERP or accounting system. - Payout

Once all these steps are completed, you can now pay the salaries via cash, cheques, or bank transfers. For hassle-free transfers, it is always good to have salary accounts of employees. For making the payments to the salary account, you will need to send salary bank account statements with details such as employee ID, account number, etc., to the branch. - Reporting

Reporting is the last step, where you need to prepare accurate reports that contain information such as department/ location-wise employee cost. For further analysis, these reports are sent to the financial department or the management team.

Once you complete the payroll run for a particular month, the finance and high management team may ask for reports such as department-wise employee cost, location-wise employee cost, etc. As a payroll officer, it becomes your responsibility to dig into the data, extract the required information, and share the reports.

These are what goes into the making of an efficient payroll process in India. Now that you know the procedure in detail, make sure to leverage the information and amplify your organization's efficiency.

What Are Leave, Attendance, and LOP data in Indian Payroll Processing?

To keep track of employee's leaves and attendance, gathering leave and attendance data are very important. The most significant challenge managers have to face is managing the time of employees successfully so that the resources in the company are productive. Employee attendance and leave management involve keeping records of sick leaves and holidays and ensuring that the payroll gets done in an error-free manner and on time.

Employee attendance and leave data collection to involve record-keeping of sanctioned leaves by managers and their daily attendance, including each employee's number of working hours and half days.

Below Listed Are The Most Common Type of Leaves in the Indian Payroll System

Sick leave

Sick leaves allow employees to recover from an illness and take care of their health. After a stipulated period of employment time, employees are entitled to take sick leave in an organization. This type of leave is mandatory in labor law.

Casual leave

Employees take casual leaves for various purposes, such as travel, vacation, rest, and family events. There are rules where an employee can take casual leaves, which will vary from three days to five days up to seven days. Some companies do not allow an employee to take all the casual leaves in one go, and few do.

Maternity leave

Depending on the company's policy, maternity leave is provided to new mothers for 12-26 weeks. During the initial period, many expected mothers avail themselves of other maternity leaves by giving overtime to the company as per the comfort zone. Proceeding the expected delivery date, as per the Maternity Benefit Act, 1961, the employers have to provide 12 weeks paid leave to any women who have worked for at least 80 days in the 12 months.

Paternity leave

It is a type of leave provided to the father-to-be. In the leave policy, it does not come in the mandatory category. Companies usually provide 1-2 weeks of leaves to take care of their child post-delivery.

Earned Leave or Privilege Leave

This leave type is commonly known as paid leave, where employees earn these leaves for a specified number of days as per company policy. These leaves are sanctioned to the employees without any salary deduction. Depending on the company leave policy, the number of earned leaves may vary.

Comp offs

Comp off leaves is offered to an employee who works on a non-working day.

Bereavement Leave

Bereavement leave is offered to an employee in case of emergency/ unfortunate death of a family member.

What Are The Types of Holidays in India?

Weekly Holidays

At the end of the week, there are one or two weekly holidays for the employees depending on the organizational policy.

National Holidays

National Holidays are the fixed holidays in India on January 26, August 15, and October 2 every year.

Religious holidays

Diwali, Christmas, Eid, Holi – your employee is sure to place importance on religious holidays that they celebrate and want the day off to spend time with their family and observe the festival.

What Is LOP (Loss of Pay)?

When an employee is out of leave balance and still avails leaves, then such leaves are beyond his/her paid leaves, and then he/she will not be paid salary for such excess leaves. These are known as Loss of Pay(LOP) or Leave Without Pay(LWOP).

The calculation of Loss of Pay is based on the calendar day logic. Also, in some organizations they may state that if any leave availed in violation of leave policy would become LOP.

LOP Calculation

When deducting salary for Loss of Pay(LOP) due to leave or other reasons, the number of days calculation for a given pay period significantly impacts.

Ex: Loss of pay when days = 30

-> INR 30,000/30 = INR 1,000

Loss of Pay when days are calculated excluding Weekends

let's say there are 8 Saturdays and Sundays in a month

Effective days = 30-8=22 days

Loss of Pay = INR 30,000/22=INR 1,364/-

While processing payroll, data plays an imperative role; leave and attendance data are significant payroll calculation elements. It is a tricky challenge to navigate the leave management minefield without a leave management system.

Navigating the leave management minefield without a leave management system is a tricky challenge. Even a slight fall can cause payroll processing errors, resource crunch, and legal complications. Considering this, every organization must implement leave and attendance management software to reduce efforts and smooth functioning.

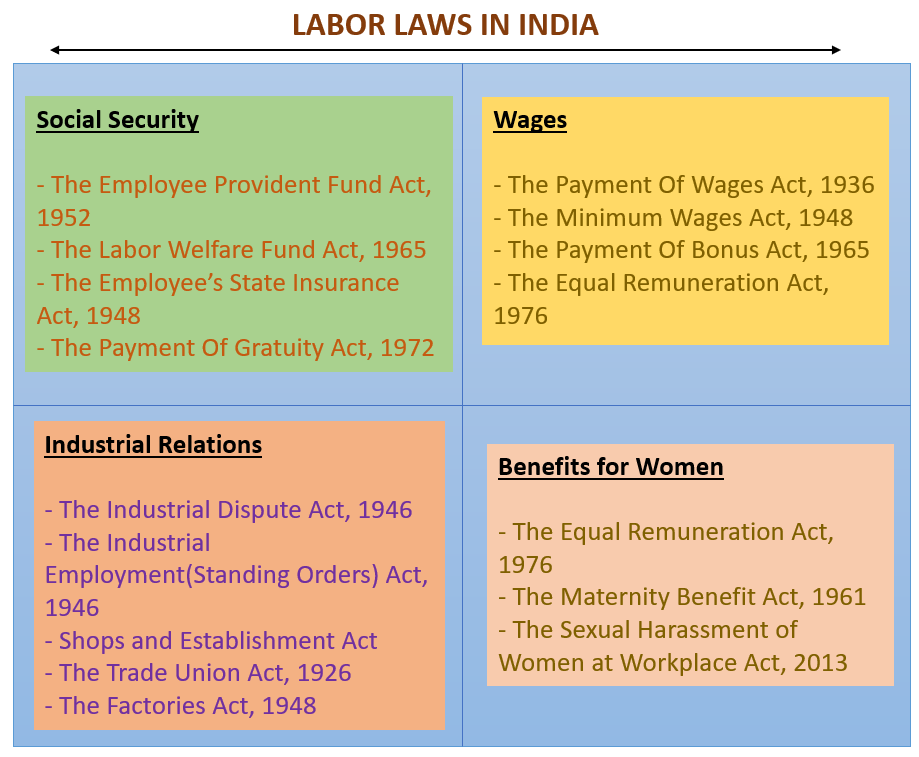

Payroll Statutory Compliance In India

In India, organizations have to ensure that the company's payroll is compliant with the required laws and regulations.

Company's worry a lot about facing legal issues associated with statutory compliances. With increasing non-compliance risks, it becomes necessary for the companies to have statutory compliance in HR in India.

What Is Statutory Compliance in India?

To adhere to rules & regulations of the state in which the business is established is known as Statutory Compliance. Under Statutory Compliance comes all the labor and taxation laws of the state. In India, every company has to endure both national and state-level laws mandatorily. Thus, all companies dealing with statutory compliance need to be well-versed with the various labor regulations in India.

Non-compliant with the regulations Amounts to Facing Legal Troubles like

- Heavy fines, penalties, or even complete shutdown in extreme cases.

- Civil or criminal liabilities.

- Loss of the company's integrity.

- Distrust amongst stakeholders.

- Loss of company's loyalty among employees, clients, etc.

To minimize the risk related to the non-compliance of statutory requirements requires a deep knowledge of statutory knowledge.

What Are Statutory Rules in India?

About Statutory compliance in the Indian Payroll Management system, there are several standard statutory requirements that companies should chase for their payroll management. Labor laws in India for private companies are the same throughout and don't change for a specific company.

Rules regarding HR compliance are distributed to specific sectors:

Click here to know more about Labor Welfare in India.

Major Statutory Requirements in India:

The Minimum Wages Act, 1948

- In Indian companies, the minimum wage rates are fixed under the Minimum wages Act,1948, and are determined by Provincial Governments and the Central Government.

- The minimum wage rate is declared at different levels, such as sectoral, occupational, state, and national levels.

- These wages will be established for any occupation, region, or sector.

- It ensures that the skilled and unskilled laborers get paid enough and is determined by considering the cost of living.

The Central & State Governments in India may notify the employments scheduled and fix/revise minimum wage rates for these scheduled employments under the Minimum Wage Act, 1948.

For fixing/revising minimum wages, there are two methods:

- Committee Method

Under this method, the government set the committees and subcommittees to hold recommendations and inquiries for changing and fixing minimum wages. - Notification Method

Under this method, the proposals get fixed by the government in the official Gazette for the persons who will be affected and will also specify the date two months prior. After this, the proposals are taken into consideration.

The fixes /revises for the minimum wage of the concerned scheduled employment come into force from the date of its issue after three months.

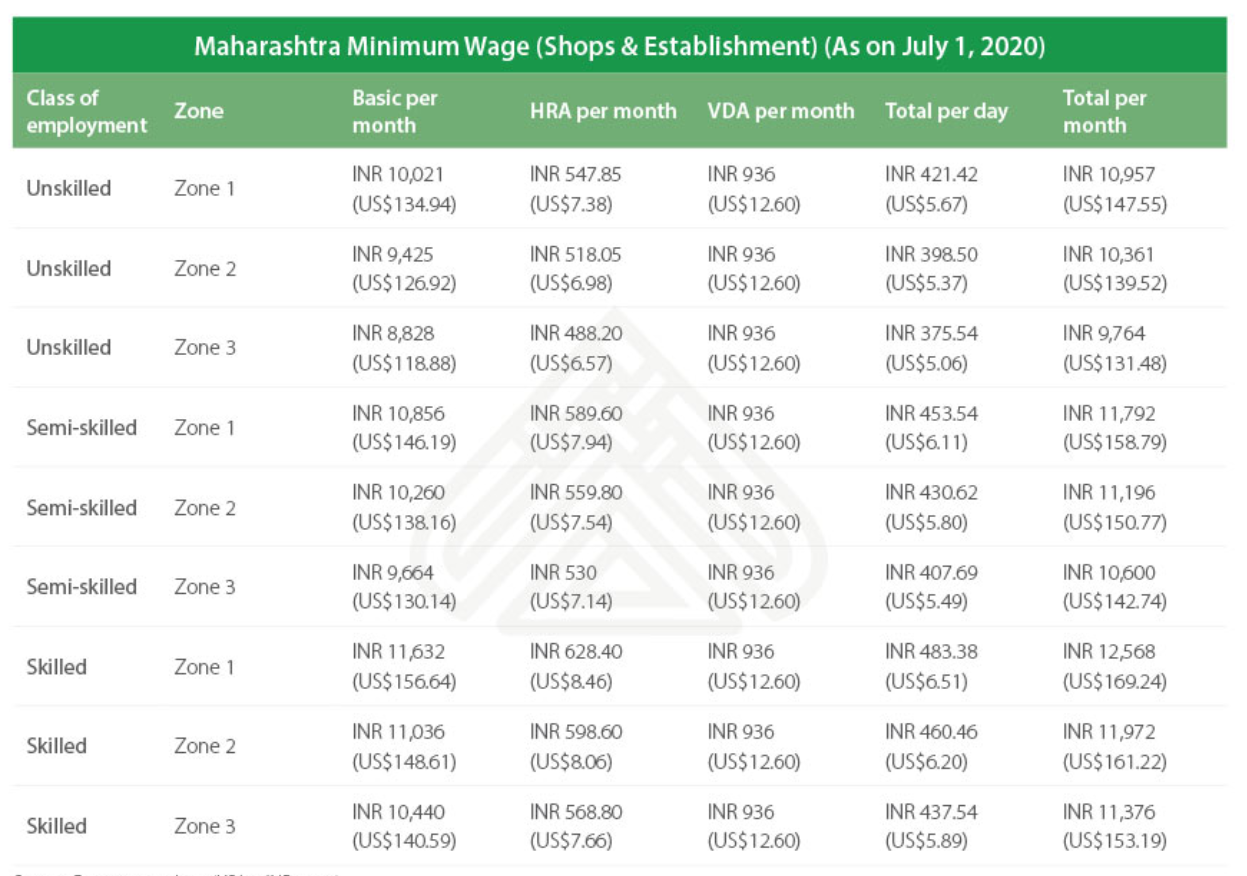

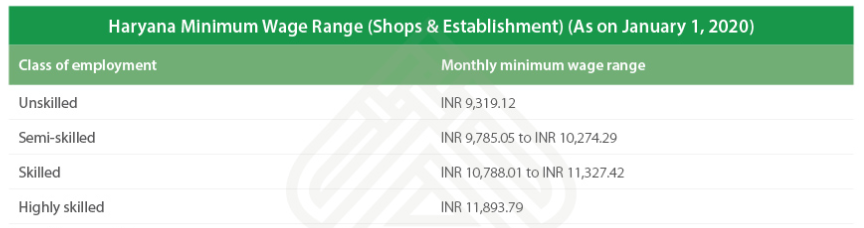

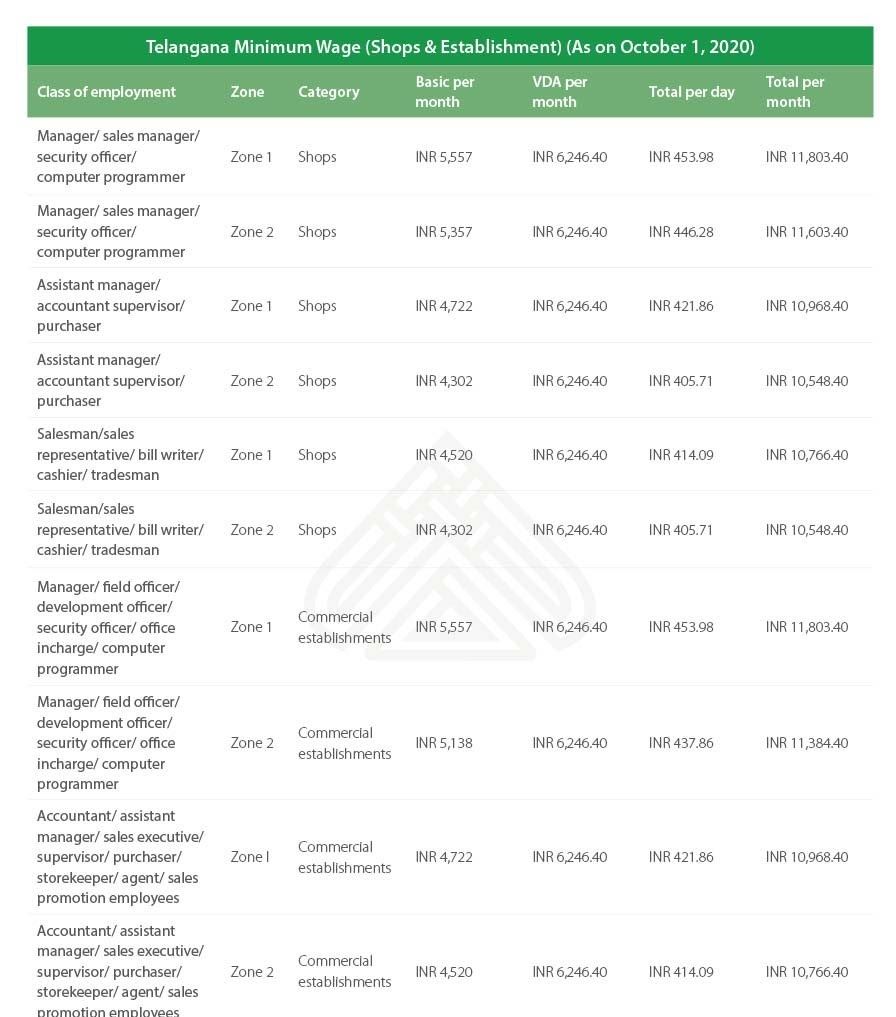

Minimum Wage Rates Across India

Listed below are the minimum wage rates across ten states/UT in India.

Examples of minimum wages across Indian states/UT

Click here to know more about the Minimum Wage Act, 1948

The Payment of Bonus Act, 1965

- The Payment of Bonus Act, 1965, catered to an annual bonus to the employees in specific organizations such as Factories and companies with more than 20 employees.

- Under this Act, the bonus calculation is made, considering employees' salaries and the profits made by the establishment.

- The eligibility for Bonus Payment Act are, Employees drawing a salary of ₹21,000 pm or less(basic+DA, excluding other allowance), have completed 30 working days in that financial year.

- The Bonus shall be paid at a minimum rate of 8.33% and a maximum of 20%.

- Bonus payment shall be made within eight months from the closing of the accounting year.

- In case if employees are dismissed by fraud, misconduct, or even absenteeism, they can be disqualified from paying the bonus.

Know more on The Payment of Bonus Act.

What Is an Employee Provident Scheme(EPF) in India?

EPF, also known as Employee Provident Scheme(EPF), is a retirement benefits scheme maintained by EPFO(Employee Provident Fund Organization). The employer and employee contributions towards the EPF scheme every month are equal to 12% of basic salary and Dearness Allowance(DA). Out of the employer contribution, 8.33% is contributed towards the Employee Pension Scheme.

How Does the EPF Scheme Work?

Under the EPF scheme, employers and employees both contribute to the EPF account every month. However, it is the responsibility of the employer to deposit the entire amount in the EPF account. Usually, the employee's EPF share is deducted from their monthly salary.

For all these EPF transfers, an employee must have a UAN(Universal Account Number), which the EPFO gives. The UAN is allotted to an individual by different employers, which acts as an umbrella for multiple Member IDs.

Applicability of the EPF Act

The EPF scheme is mandatory for all organizations that have employed a minimum of 20 employees. Within one month of attaining the employee strength, an employer must obtain EPF registration.

Even if the employee strength of a registered establishment falls below the requisite number, The rules or regulations of the EPF Act will continue, even if the employee strength of a registered organization falls below the required number.

Organizations with less than 20 employees can also avail of voluntary registration. All the employees from the beginning of their employment will be eligible for EPF.

EPF Contribution Rate and Breakup

For most employees, the EPF contribution rate is 12 % of basic salary, excluding HRA. The employer also needs to contribute equally to the EPF account.

Under certain circumstances, a 10% rate is applicable if the company meets the following criteria.

- Has employed less than 20 employees

- Losses suffered more than its entire net worth

- If it belongs to the beedi, brick, jute, or guar gum industry

- Is a sick industrial company and which has been declared as such by the Board for Industrial and Financial Reconstruction (BIFR)

The Breakup of EPF Contribution:

The whole 12% of an employee's salary goes to their EPF account, while the employer's contribution is divided among the following:

- 8.33% to the Pension Fund

- 3.67% to the EPF account

EPF calculation Example

An employee can contribute more than 12% of Rs 15,000 if they wish to do so. However, there is no obligation that the employer has to match the employee’s contribution.

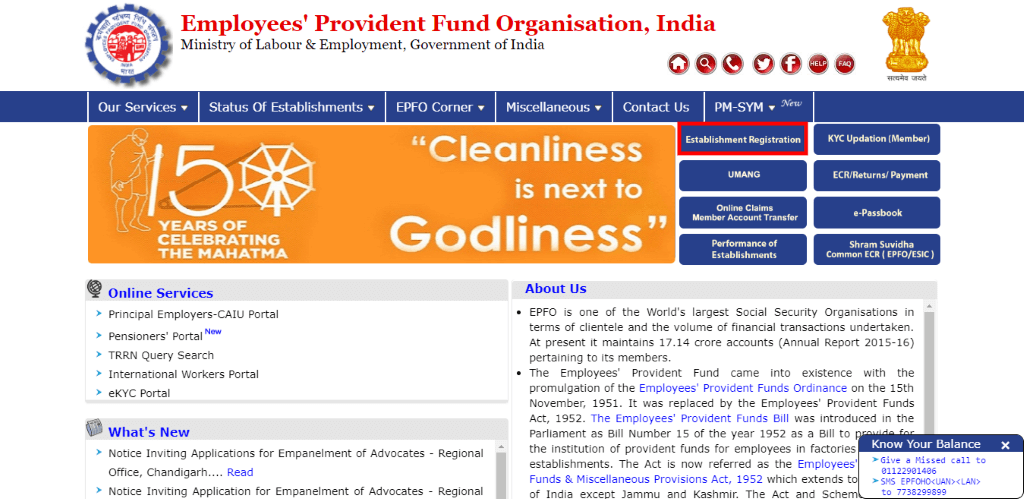

EPF Registration Process For Employers

Here are the steps that you need to follow for EPF registration:

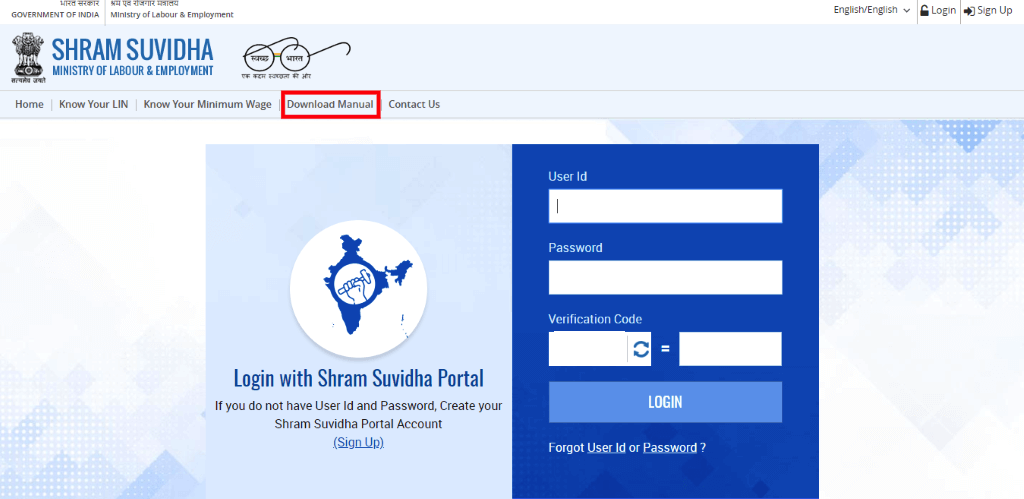

Step 1 - Visit the EPFO website and click on ‘Establishment Registration’ on the top-right side of the page.

Step 2 - A new window will open, then download and read the instruction manual before registering your establishment.

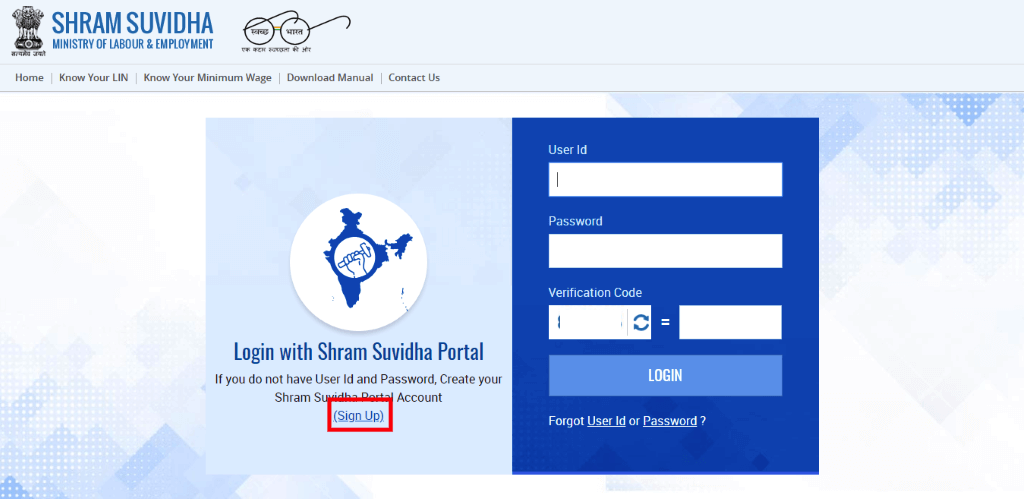

Step 3 - Then, Click on the sign up button.

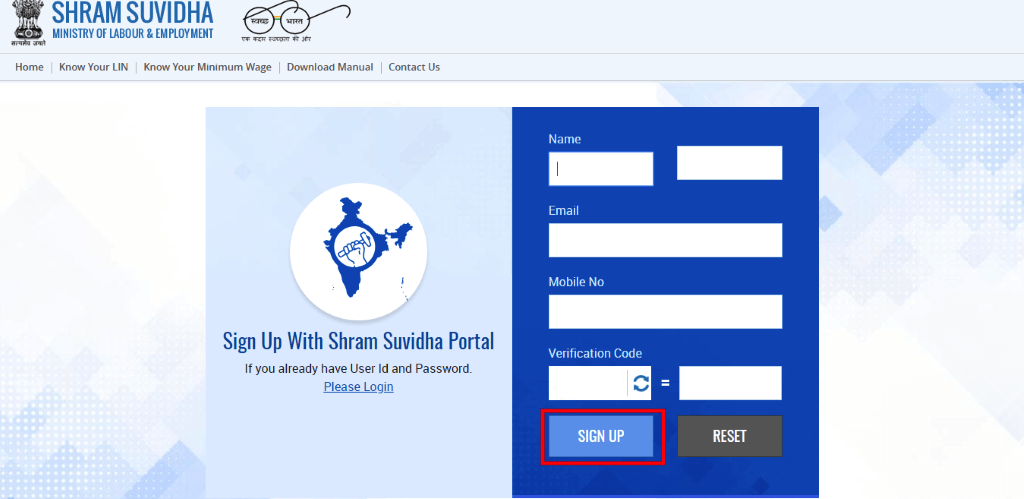

Step 4 - Now enter your name, email, mobile number, verification code>> click on ‘SIGN UP’ to create your account.

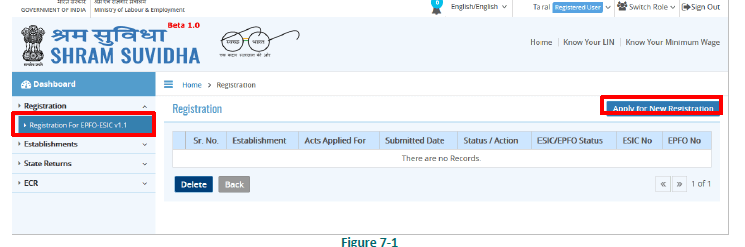

Step 5 - In the next screen, select ‘Registration For EPFO-ESIC’ and then click on ‘Apply for New Registration’.

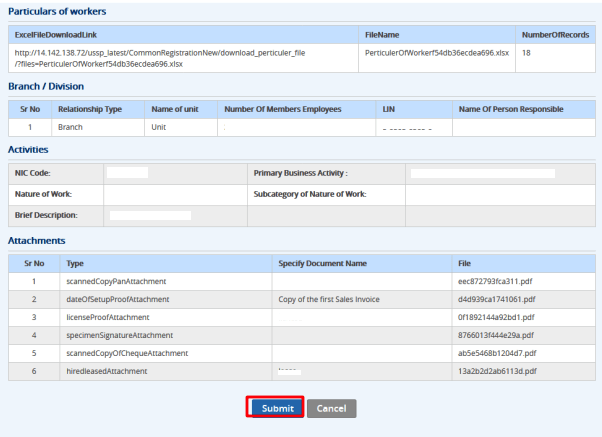

Step 6 - Once you click on apply, enter the details of your establishment, contact persons, identifiers, employment details, particulars of workers, branch/division, activities, and attachments in the next page.

Step 7 - Click on ‘Submit’ button

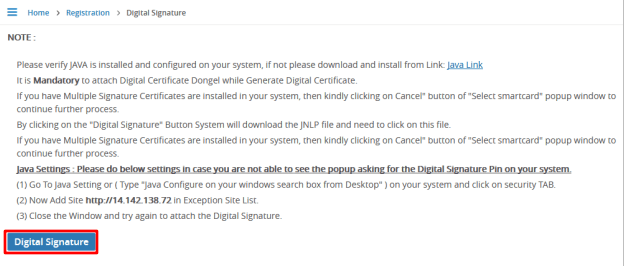

Step 8 - Now, to authenticate details submitted previously, register for your Digital Signature Certificate (DSC).

Step 9 - On completion of DSC registration, you will receive an email from Shram Suvidha to confirm that the registration has been completed.

EPF Payment and Return Filing Due Date

The EPF payment due date is by the 15th of the following month. For example, if you want to deposit the EPF contribution for June, you should clear all the payments before 15th July as an employer.

The EPF payment and return filing date are the same, and you can process EPF payment and return filing, both at the same time, as apparently the dates are the same.

Thus, the EPF return due date is the same as the payment date, before the 15th of the following month. The EPF annual return due date is 25th April of the following year.

Penalty for Late Payment

For late payment of EPF, these will be following two penalties applied,

- For delay in every single day in depositing the EPF contribution, an interest of 12% will be applied.

- In case of challan payment, below penalties will apply,

1. For a delay of up to 2 months - 5% interest p.a

2. For a delay of 2-4 months - 10% interest p.a.

3. For a delay of 4-6 months - 15% interest p.a.

4. For a delay of more than 6 months - 25% interest p.a

EPF Rules for Employer

Below mentioned are the EPF rules for employers.

- For EPF contribution minimum salary limit (fixed component) is less than Rs 15,000

- Insurance coverage - Per member Rs 3 lakh

- Eligibility - Company’s with 10 or more employees are eligible for EPF contribution

- For policy, building, or buying a house EPF withdrawals can be made

Methods to Check Your EPF Balance Online

Checking the Employees Provident Fund (EPF) balance has become very simple for the Employees' Provident Fund Organisation(EPFO). The four different methods to check the EPF balance. Below mentioned are the methods:

- EPFO Portal

- UMANG APP

- Missed Call

- SMS Service

Let us see these methods more in detail,

- EPFO Portal

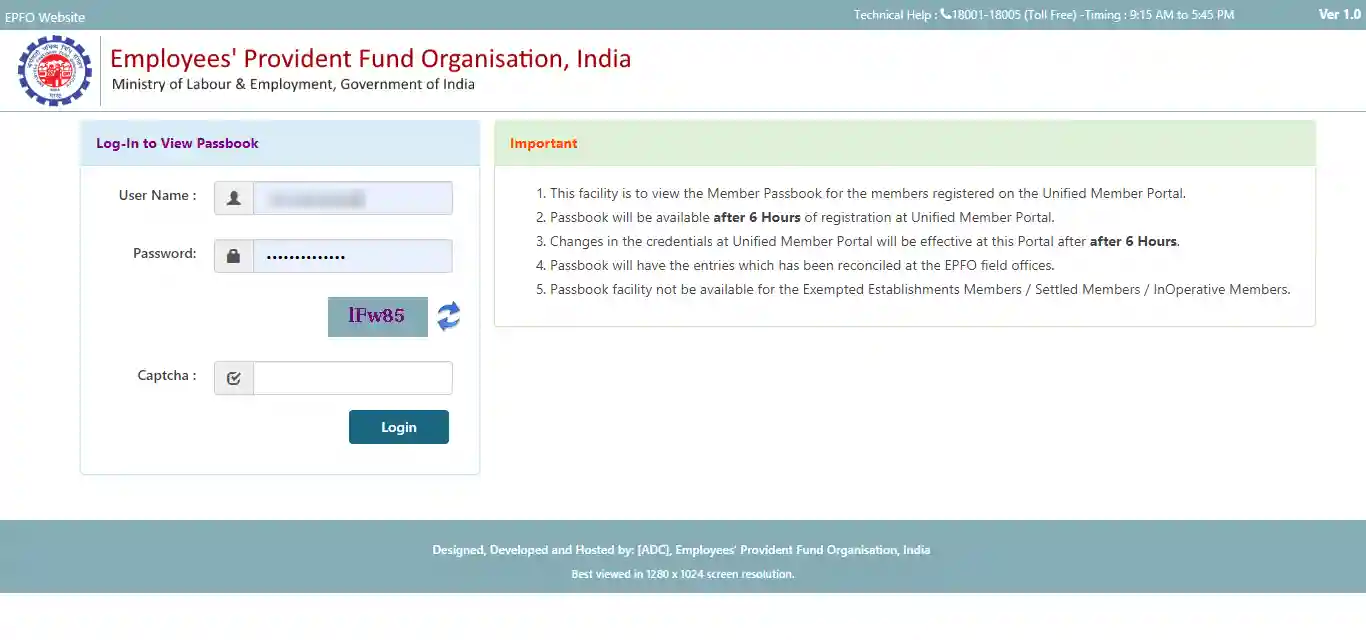

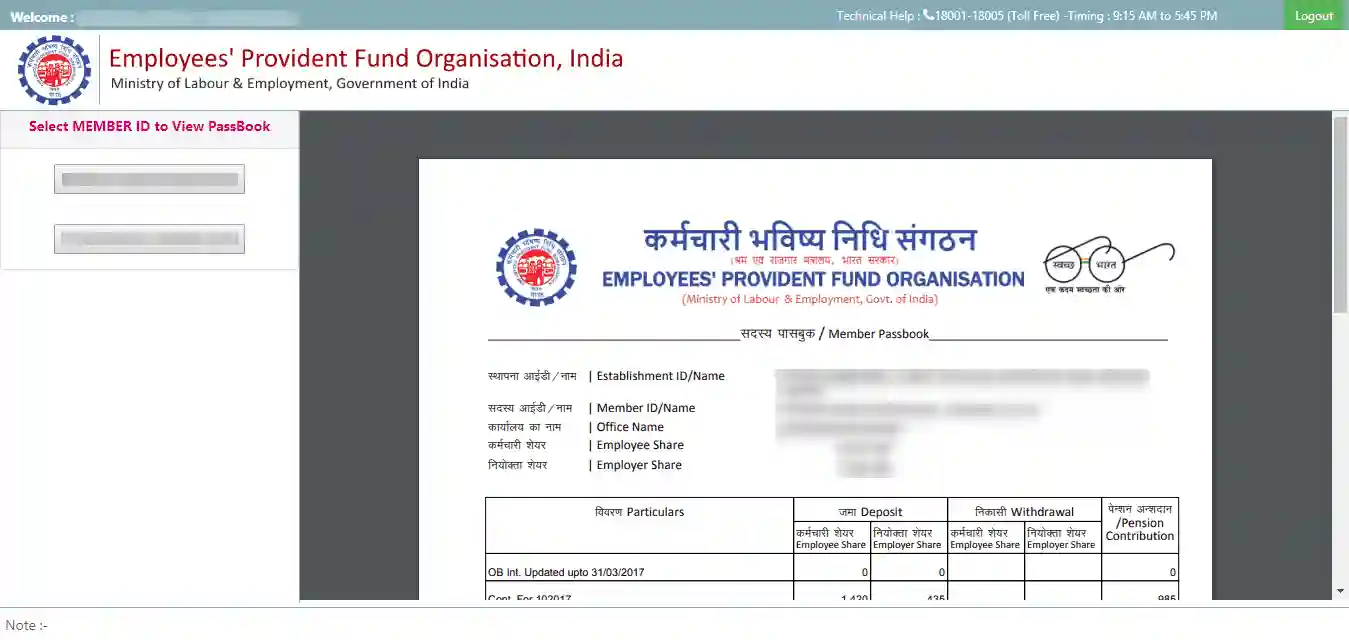

To access the EPF Passbook, employees can use the EPFO portal. For this, employees must have UAN, which must be activated. Below mentioned is the process that employees must follow to check the EPF balance using the EPFO portal:

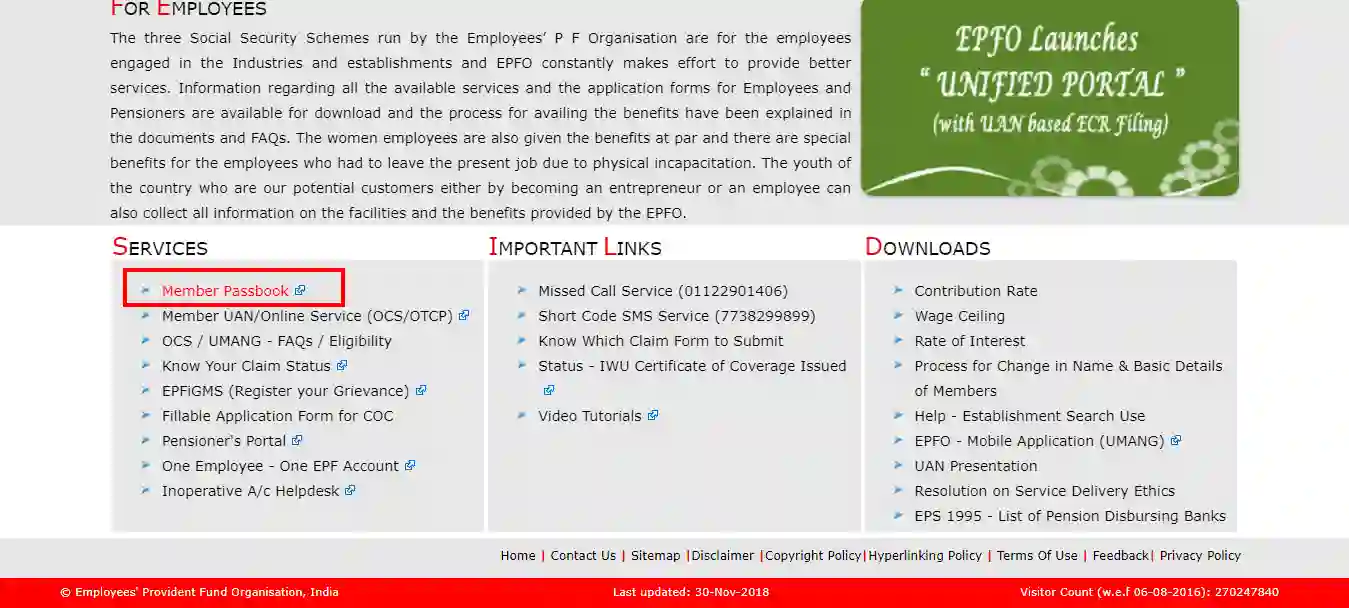

Step 1 - Visit the EPFO portal.

Step 2 - Next, the member must click on ‘For Employees’ under the ‘Our Services’ tab.

Step 3 - Under the ‘Services’ column, the member must click on ‘Member Passbook’.

Step 4 - Next, the member must fill in his/her UAN, password and captcha details and, then click on ‘Login’.

Step 5 - Under the respective Member ID the member will be able to check his/her EPF balance.

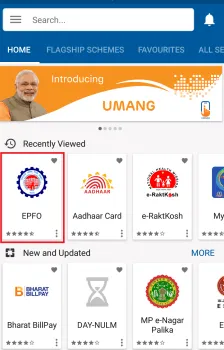

2. UMANG App

To check the EPF balance on a mobile phone, employees can download the UMANG app. The government introduced this app in 2018, and various government services are available on the app.

A one-time registration must be done using the member's mobile number, registered with the UAN to have access to the app.

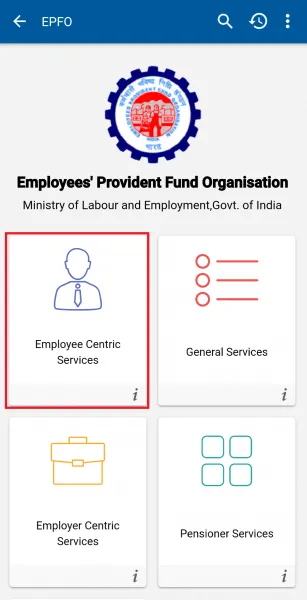

Let us see how you can view your past EPF transactions through the UMANG app:

- Install the app and open it on your mobile phone. Then, click on the EPFO option.

- Then, select “Employee Centric Services”.

- On the next screen, you will see the option to “View Passbook”. By clicking on this will display your EPF transactions, including withdrawals and deposits from your current and previous employment.

3. Missed Call

By giving a missed call on 011-22901406 from their registered mobile numberEPF members can also check their balance. To avail this service, the employee’s PAN, Aadhar and bank account details also need to be linked with the UAN.

4. SMS Service

Employees can check their EPF balance and the last contribution by sending an SMS to 7738299899 , if they have activated their UAN. The SMS format shall be sent in as EPFOHO UAN ENG.

What Are the Types of EPF Forms?

Different EPF forms are mandatory. For all activities that employees wish to undertake in their accounts, various EPF forms are required. These activities include registration, withdrawal, transfer of PF, availing loans from an existing EPF account, or any other reason.

Click here to read more about Employee Provident Fund Organization(EPFO)

What Is Employees State Insurance (ESI)?

Under the Employees State Insurance Act, 1948, ESI is governed and is a self-financed social security scheme designed to protect employees. Employees of an eligible organization are protected against financial distress arising out of sickness, disablement, and death due to employment injury.

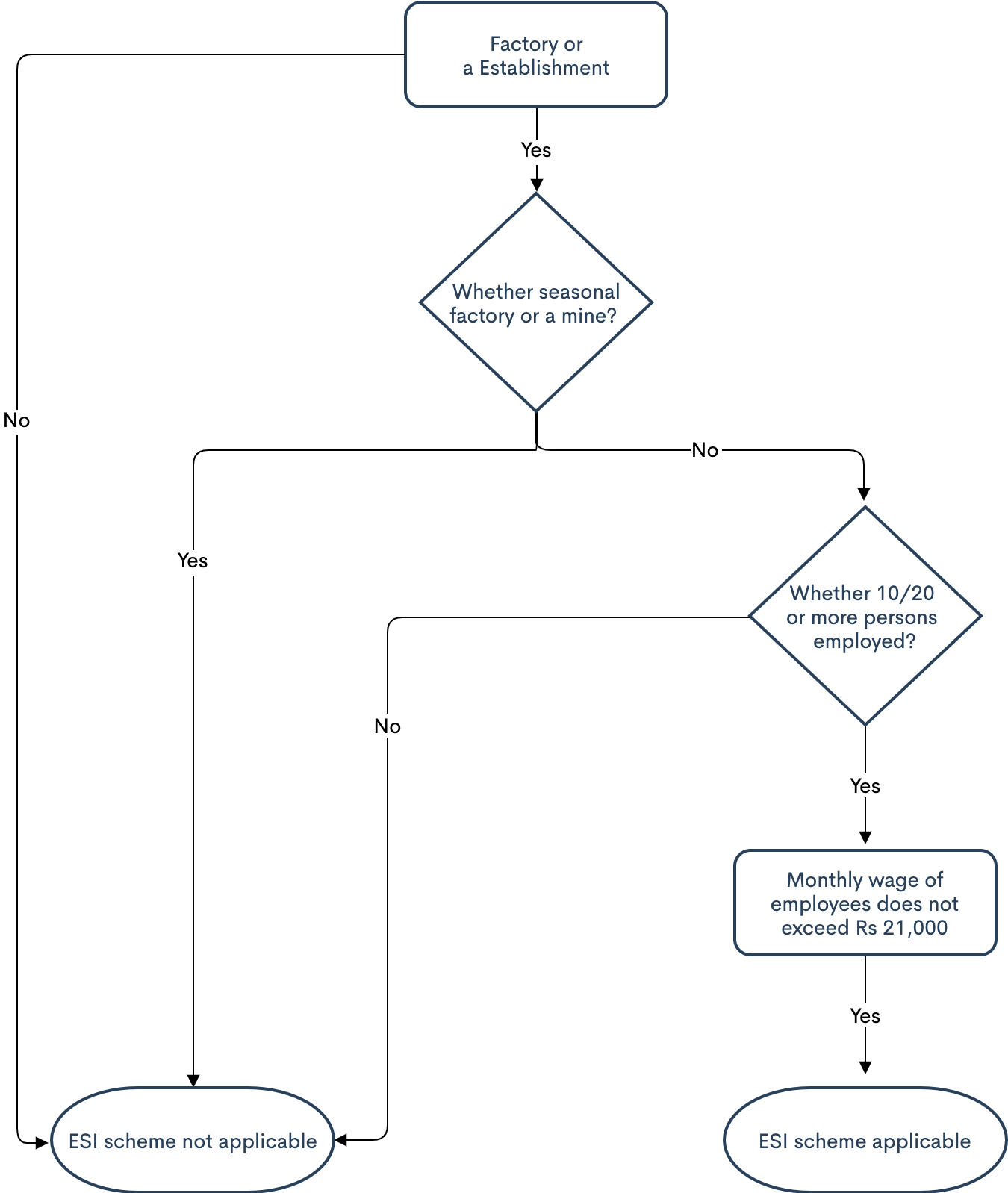

Who Is Eligible for ESI?

To be eligible for ESI(Employee State Insurance) scheme, every individual should meet the government's criteria. The Employee State Insurance scheme applies to,

- An organization with more than ten employees and those employed in the non-seasonal factory are eligible for the EIS scheme. This criterion is applicable under Section 2(12) of the Act.

- An individual earning Rs.21000 will be covered under the EIS scheme with effect from January 1, 2017.

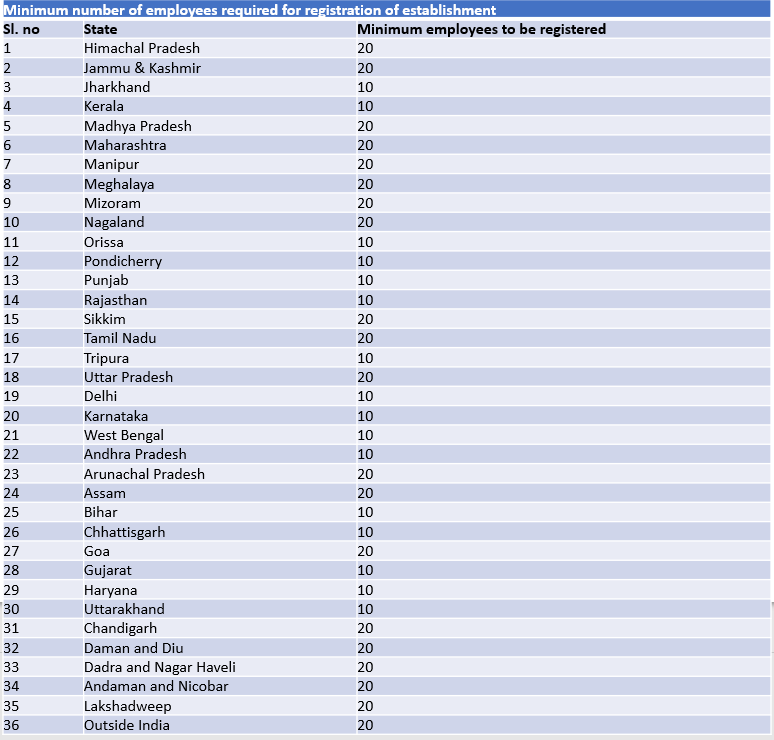

However, for PAN India, the strength of employee strength required for registration ESI for factories is 10. Depending on the state, the threshold is 10 or 20 for establishment.

Key Features and Benefits of ESI

The Employee State Insurance Corporation offers many attractive features and benefits. Some of these are listed below:

- Medical Benefits

- Disability Benefit

- Maternity Benefit

- Sickness Benefit:

- Unemployment Allowance

- Dependent's Benefit

What Are the ESI Contribution Rates?

There are specified rates for ESI contribution paid to the ESI corporation for both employee and employer. From time to time, these rates are revised.

Currently, the ESI contribution to the employer is 3.25% of the wages, and for employees is 0.75% of the wages payable in each wage period(Monthly).

Employees who earn up to Rs 176 on an average daily basis are exempted from the contribution payment. However, the employer will continue to contribute their share for such employees.

Employer ESI Registration Process

Any employer can get its factory or organization registered under ESI through the ESIC website after falling into the eligibility criteria. Earlier, the registration process was done manually, and a lot of documentation was required. To ease the process, the government has implemented a new online process.

To know more about ESI Employer Registration Process, click here.

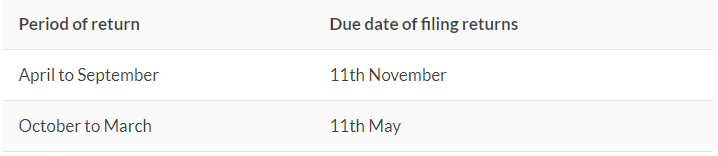

Due Dates for The ESI Payment and Return Filing

Every month, the employer shall pay their contributions and the employee's contribution to the ESIC. The due date for ESI filing contribution is the 15th of the following month.

The employer also needs to file an ESI return on a half-yearly basis. Below mentioned are the due dates,

Penalty for Non-payment or Late Payment of ESI Contributions

There will be a simple interest of 12% per annum for each day applied to every employer who fails to make an ESI payment contribution under the ESI Act for each delay on the payment. It may also lead to imprisonment for two years and a fine of up to Rs 5,000.

Click here to read more about (Employee State Insurance Scheme) ESI.

What Is Professional Tax (PT)?

PT or a Professional tax is a direct tax that applies to all individuals who earns income from employment, practicing their trading or professions such as doctors, lawyers, teacher, CA, etc.

The PT is deducted from the individual's monthly salary and is deposited to the state government. Professionals also pay it directly to the government.

As per the Income Tax Act, 1961, such professionals can claim a tax deduction for the PT paid during the financial year.

The PT calculation and the amount collected may differ from one state to another, but it has a limit of Rs.2500 per annum.

Professional Tax Slabs in the Various States

Each state has its professional tax slab. Listed below are the PT slabs for various conditions and Union territories in India.

Here’s the list of states where PT is not applicable,

Professional Tax Registration and Process

Within 30 days of employing individuals, all employers shall register under professional tax(PT). In the case of professionals, the PT registration must be done within 30 days they start their practice.

Wherever PT is applicable, it might be challenging for the employers to catch hold with the registration process of all the states.

To know more about the Professional Tax (PT) Registration Process click here.

Click here to read in detail more about Professional Tax

What Is TDS in India?

Tax Deducted at Source(TDS) means a collection of direct tax by Indian authorities according to the Income Tax Act, 1961. Central Board of Direct Taxes(CBDT) manages tax Deduction at Source(TDS), which comes under the India Revenue Services(IRS).

The tax deducted from an individual's income on a periodic or occasional basis is known as Tax Deducted at Source (TDS). TDS is applicable for the regular income as well as irregular in nature.

Before making full payment to the receiver as per TDS rules, the payee or employer deducts a certain amount of tax. TDS is applicable for salary, commission, professional fees, interest, rent, etc.

What Is TAN?

TAN or Tax Deduction Account Number is a ten-digit alphanumeric number required to be obtained by all persons responsible for deducting or collecting taxes. Under Section 203A of the Income Tax Act, 1961, it is mandatory to quote the Tax Deduction Account Number(TAN) allocated by the Income Tax Department(ITD) on all TDS Returns. The application procedure for TAN is straightforward and can be done online by just filling up the form 49B.

Please refer to NSDL Site to Apply For TAN.

TDS Exemption

TDS is exemption is made in two cases,

- If the receiver has made the required investments in FORM 15G/15H by giving a self-declaration

- If the Assessing Officer provides the certificate of exemption.

Tax Rates In India

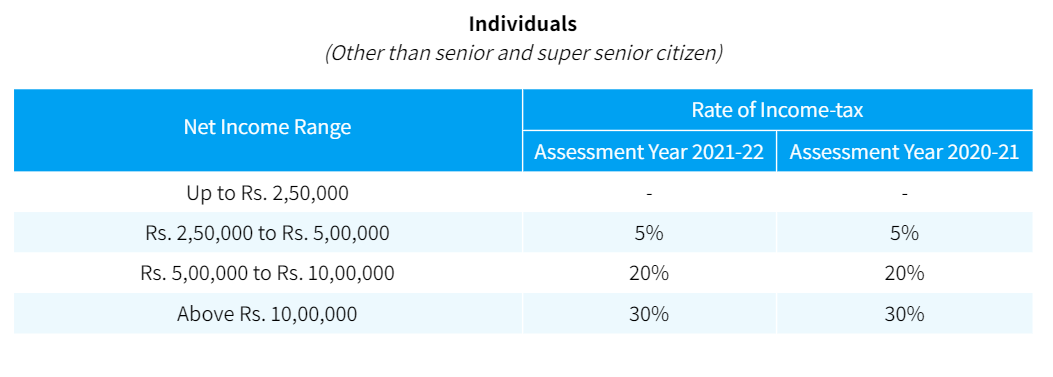

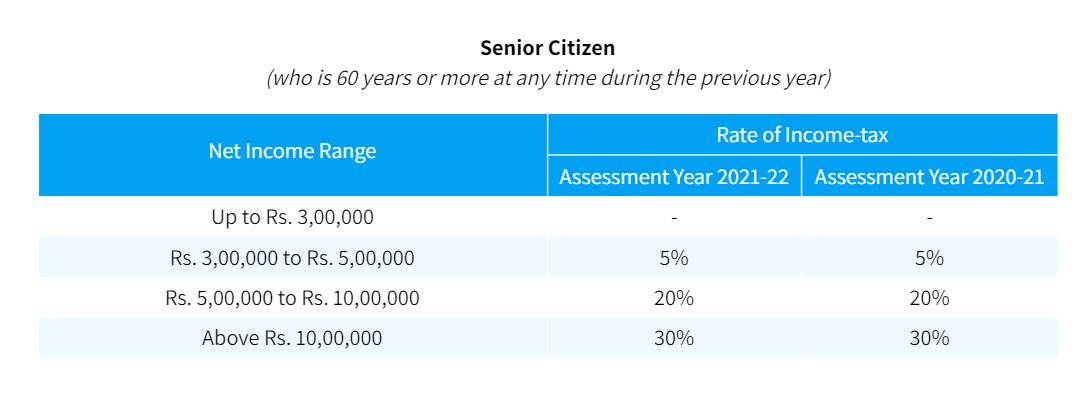

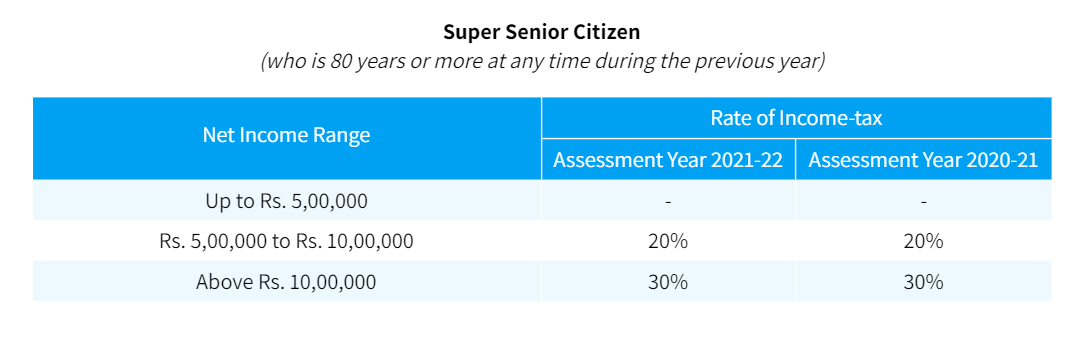

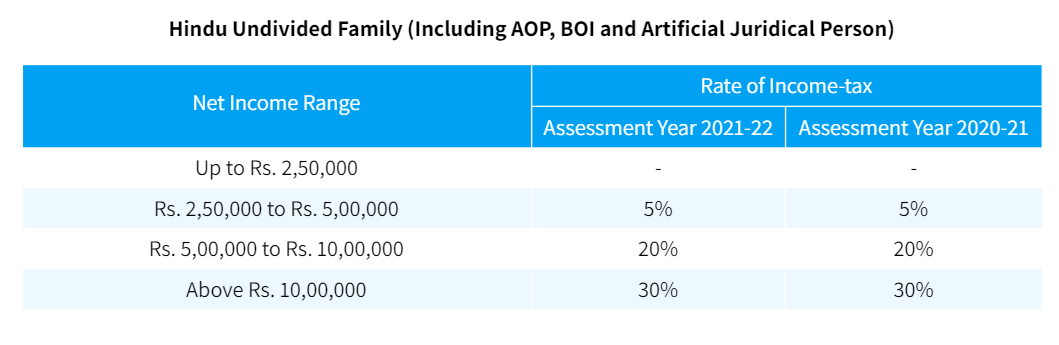

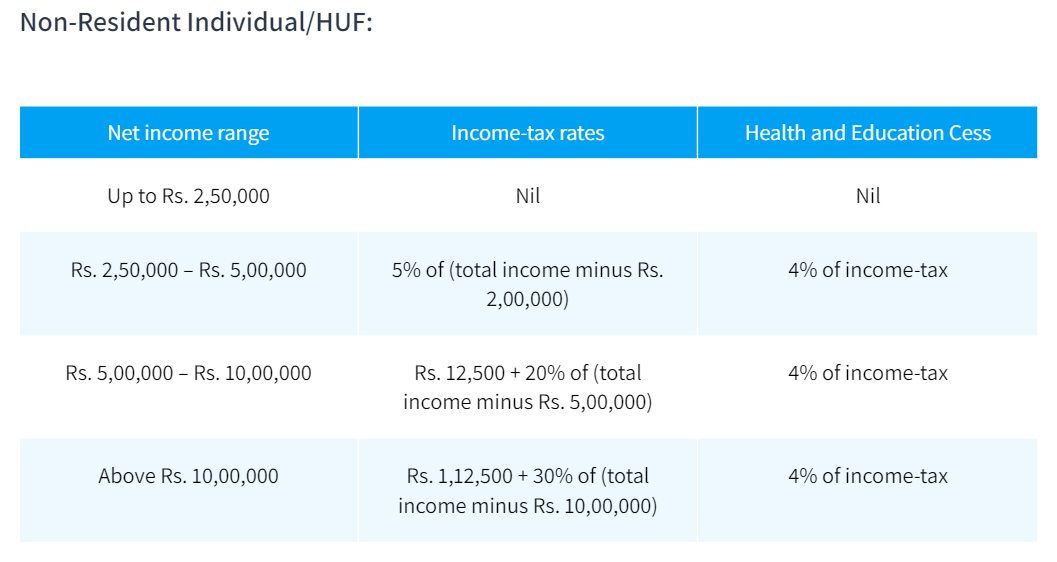

Normal Tax Rates for Individuals & HUF:

Depending on the age of the resident individuals, the normal tax rates will be applicable. In the case of non-resident individuals, the tax rates will be the same as per their age. Individual tax applicability is classified as below,

- Resident Individual - Below the age of 60 years

- Resident Individual - Age of 60 years or above during the year, but below 80 years if age.

- Resident Individual - Age of 80 years and above at any time during the year. Non-resident individuals are irrespective of age.

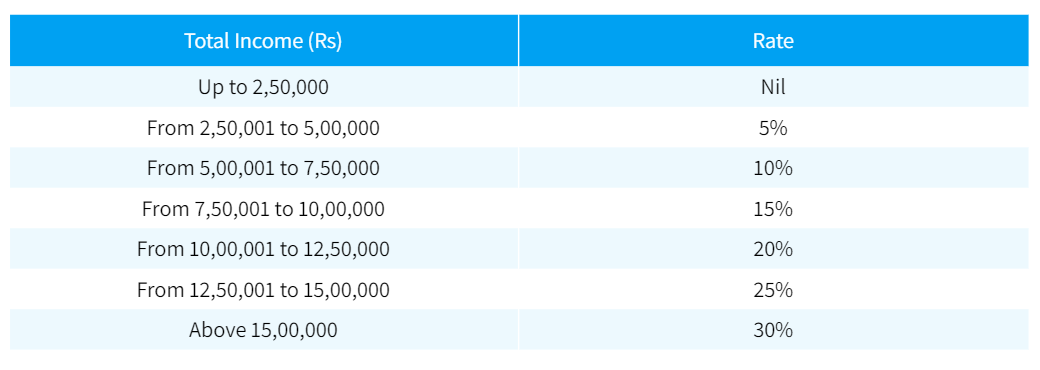

Special Tax Rates for Individual and HUFs:

From Assessment Year 2021-22 and onwards, the payment of tax rates have been reduced for individuals and HUF at the following reduced rates,

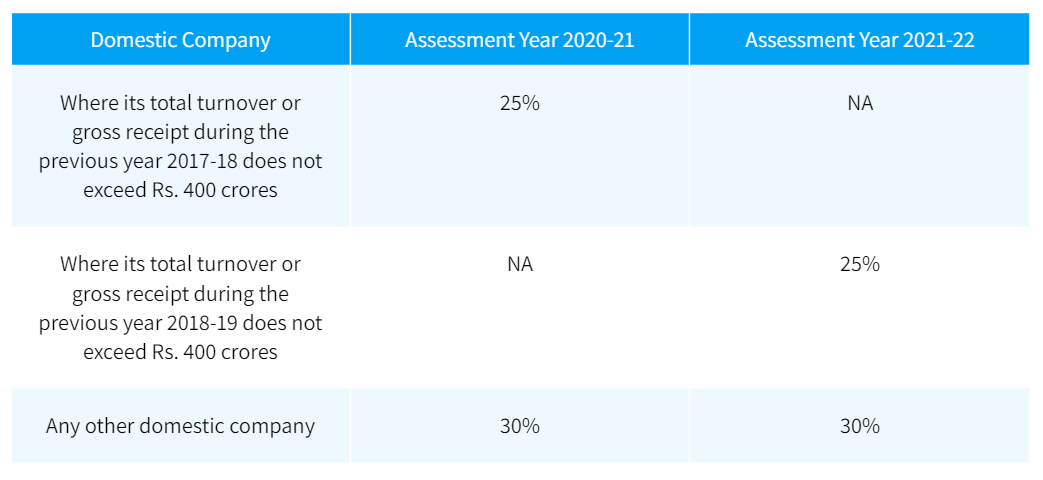

Normal Tax Rates applicable to a Domestic Company:

In case of the domestic companies for assessment year 2020-21 and 2021-22 below are the applicable Income Tax rates,

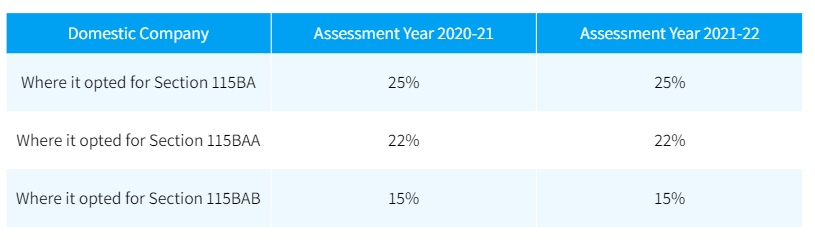

Special Tax Rates applicable to a Domestic Company:

In case of domestic companies for assessment year 2020-21 and 2021-22, special income tax rates are applicable as follows:

Source - Tax Rates

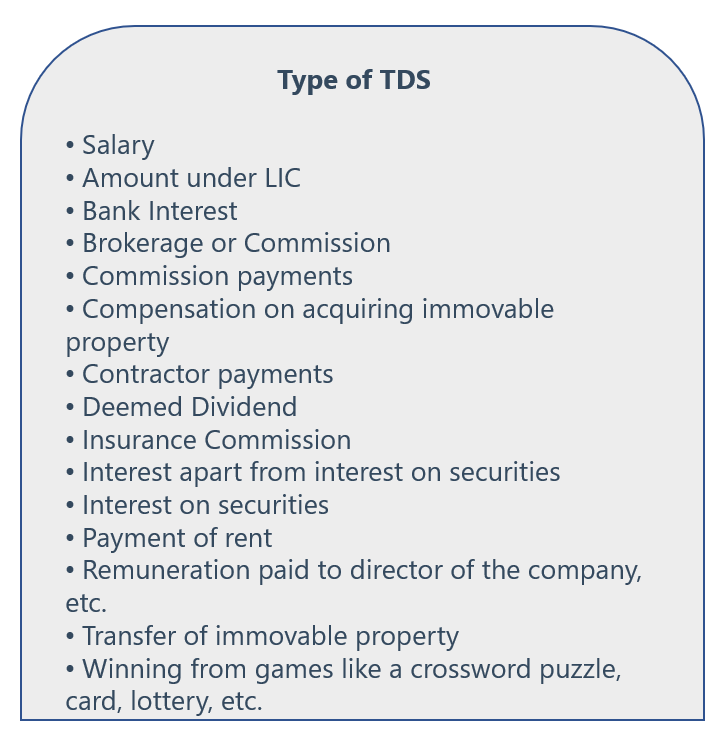

What Are the Types of TDS ?

Listed below are some of the income sources that qualify for TDS:

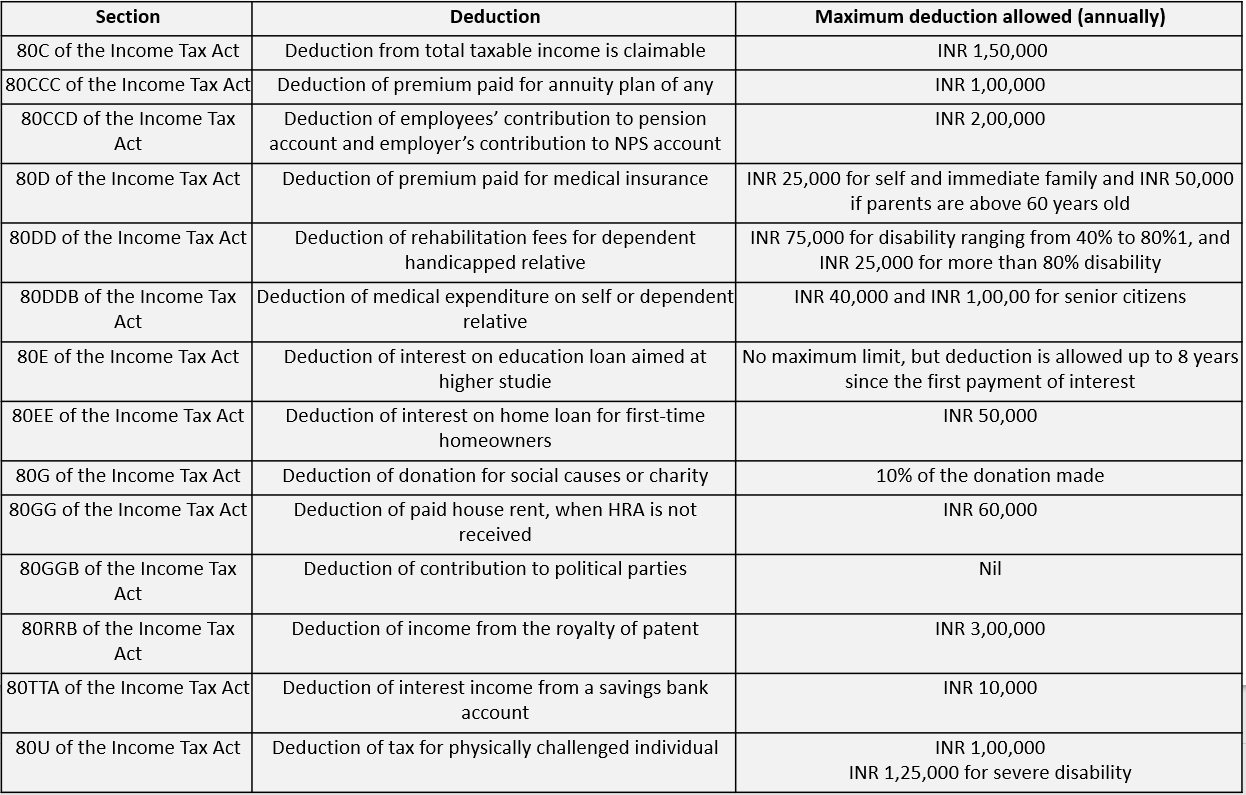

Which Sections Can Be Claimed under TDS Deduction?

The following 14 sections are claimable for deductions in the amount of TDS:-

How to Submit TDS Return on Income Tax e-Filing Portal?

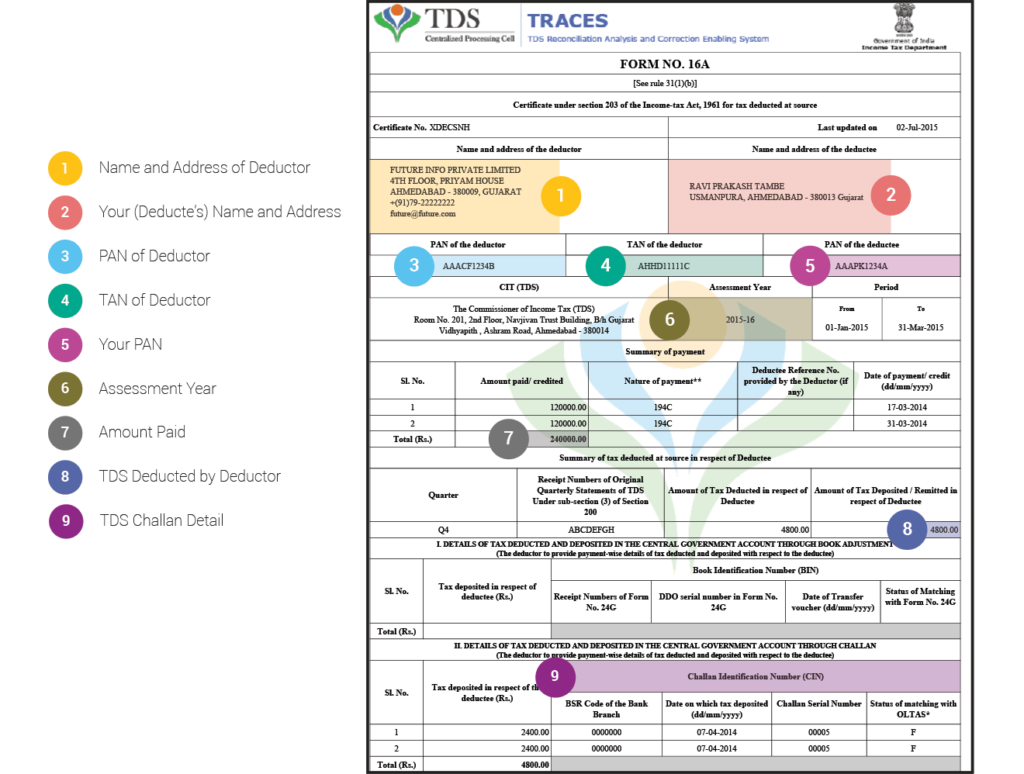

TDS is an indirect Income Tax collection method. It is a tax credit amount deducted from the person receiving payments after tax is entitled. Based on Form 16A, this tax credit can be claimed, issued by the deductor or Form 26AS, and downloaded from an e-Filing account. The Income Tax e-filing provides the option to upload the TDS return file.

Details In form 16A

- Name, address, PAN & TAN of the Deductor.

- Name, Address & PAN of the Deductee.

- Nature of the Payment, Amount Paid, and the Date of Payment.

- TDS challan details.

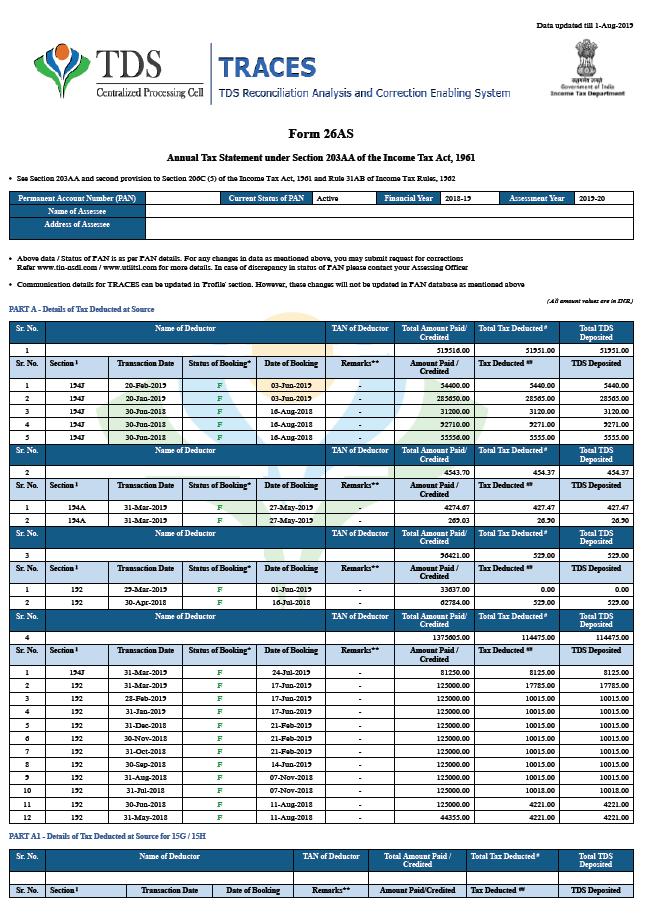

Details In form 26AS,

Form 26AS is a Tax Credit consolidated Statement which provides the below details to a taxpayer.

- Details of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) from the taxpayer’s income.

- Advance Taxes, Self Assessment Taxes and Regular Assessment Taxes paid by the taxpayers.

- Details of the Income Tax Refunds received during the year.

- Details of any high-value transactions (for eg. Shares, Mutual Funds, etc.).

Sample Tax Credit Statement Form 26AS

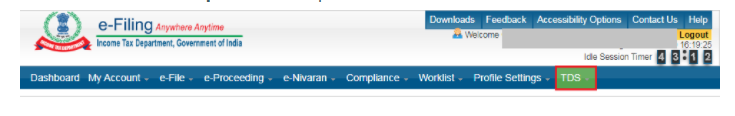

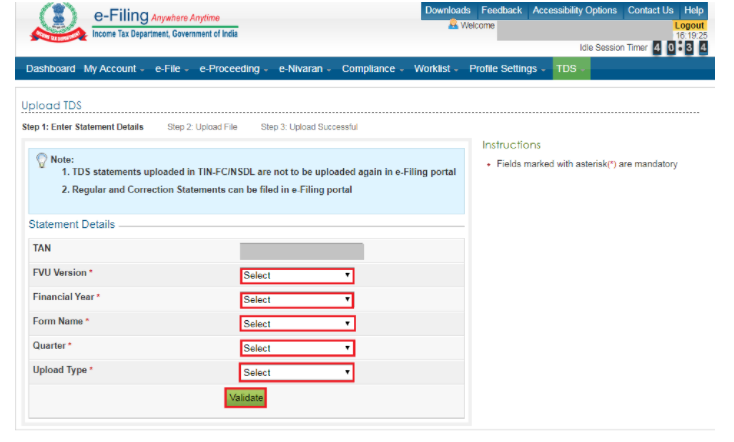

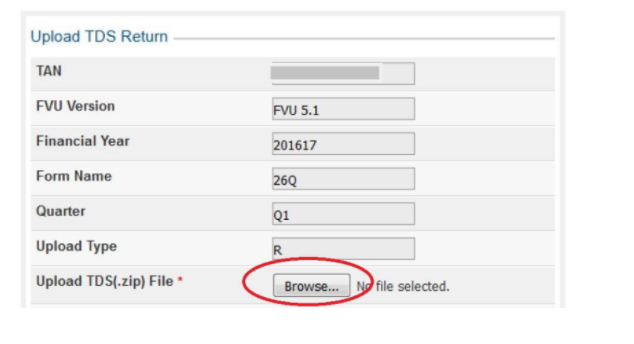

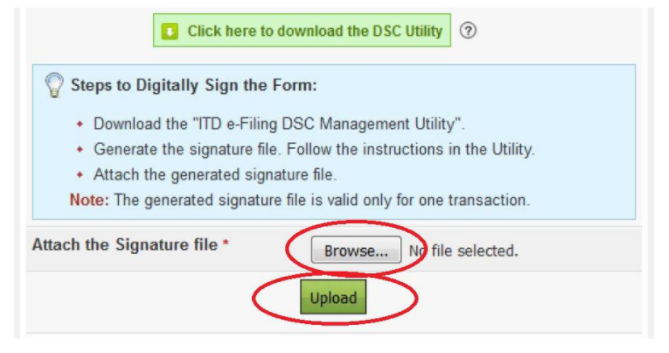

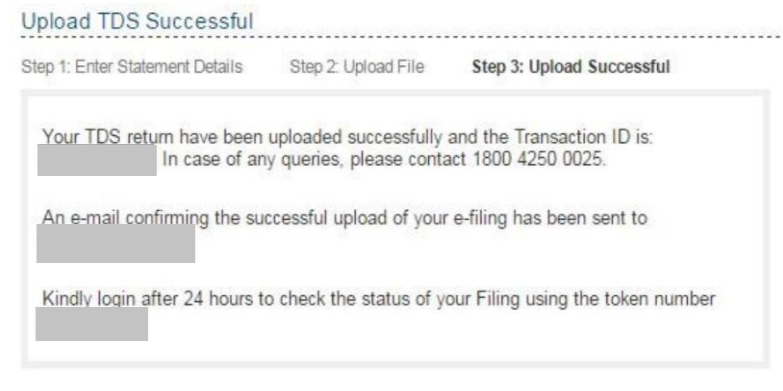

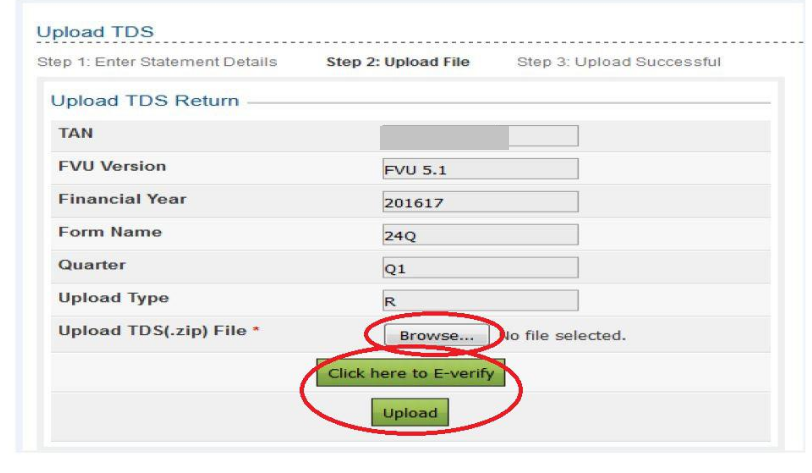

Steps to Upload TDS Return on Income Tax e-Filing Portal

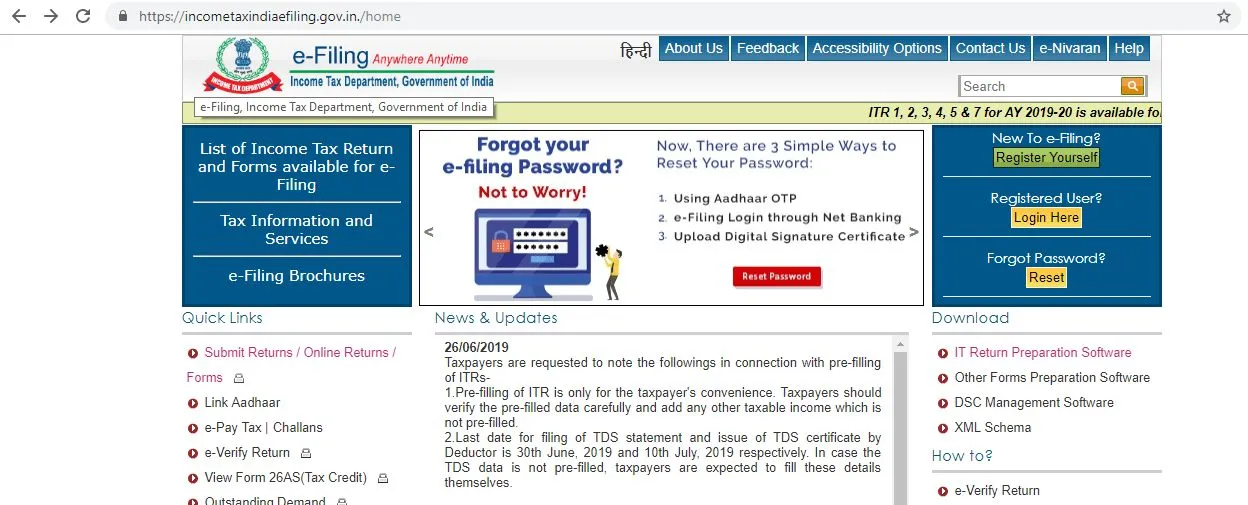

Step 1 - Visit the Income Tax e-Filing Portal and Log into your account using your credentials.

Step 2 - Then, click on TDS >>Upload TDS option from the dashboard

Step 3 - From the dropdown list enter the required details,

- FVU Version

- 1.Financial Year

- 2.Form Name

- 3.Quarter

- 4.Upload Type

Step 4 - Now, click on “Validate” option.

Step 5 - After the Validation is complete, now you need to upload the TDS file created. To upload the file click on Browse button.

Step 6 - Now, attach the DSC file and click on the “Upload” option.

Step 7 - After uploading the file you will receive a success message on the completion of the process.

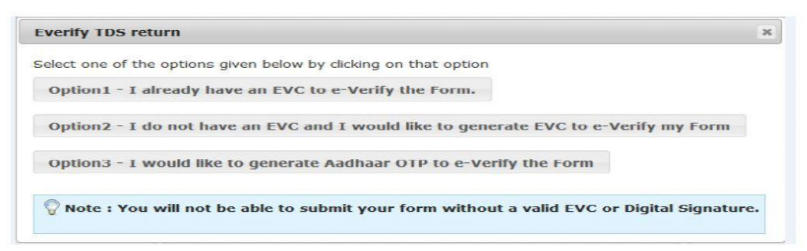

Step 8- If you have not generated your DSC, you will be able to validate the TDS statements using the Electronic Verification Code (EVC). After uploading the TDS file, click on the “e-Verify” option.

To e-verify your return you will be given 3 options to choose. Below are the three options given

- Already have EVC to e-verify the form

- Need to generate a new EVC in order to e-verify the form

- Generate Aadhaar OTP to e-verify the form

Step 9 - Lastly click on the Submit Option to complete the process.

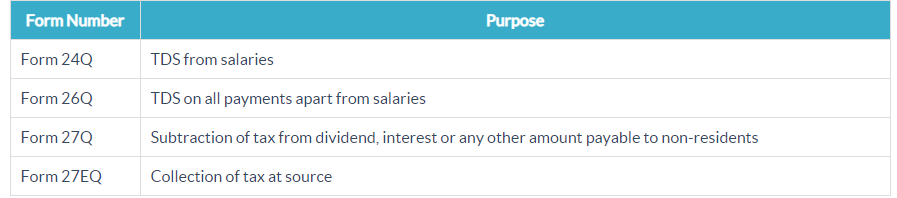

TDS Return Forms

Below mentioned are are the TDS return forms and the purpose for which they are used:

Due Date for Filing TDS Returns FY 2020-2021

What Is a TDS Certificate?

There are two types of TDS Certificates - Form 16 and Form 16A. Under Section 203 of the Income Tax Act, 1961, a certificate shall be provided to the deductee showing the amount that has been deducted as tax.

- For salaried class: For Salaried employees, form 16 is provided by their employers, mentioning the amount deducted as TDS. Form 16 contains details such as the tax computation amount, deduction of tax, and TDS payment. Before May 31 of the following financial year, the employers must issue this form to their employers.

- For non-salaried class: In this case, form 16A is provided by the deductor to the deductee and contains the details such as tax computation, deduction of TDS, and payments.

What Is Income Tax in India?

Income tax is the tax levied on the annual income earned by an individual. The tax amount must be paid, depending on how much money you have earned over the financial year. Taxpayers can make the income tax payment online for TDS/TCS payment and Non- TDS/TCS payment. All relevant details have to be filled in to make the payment. The online payment is simple and can be quickly completed.

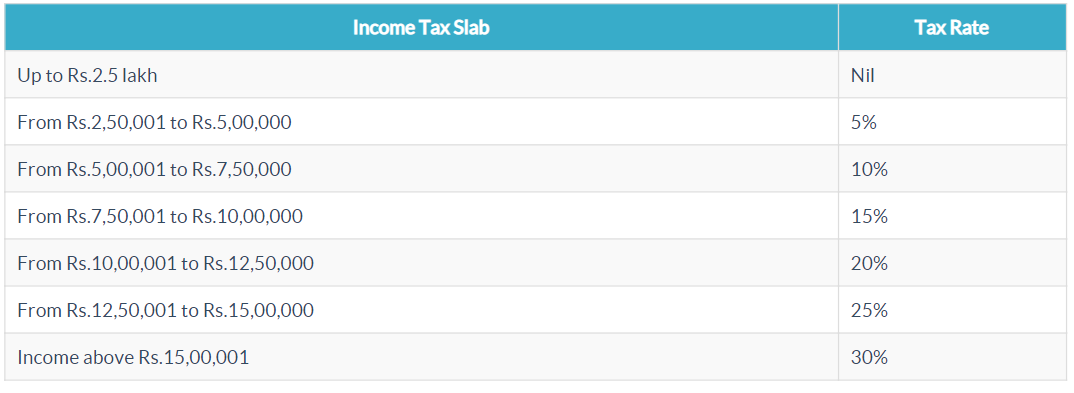

Income Tax Rates and Slabs For FY 2020-21 & FY 2021-22 Under New Tax Regime

ITR - Income Tax Return & IT Return

ITR(Income Tax Return) is a form that is used to declare the net tax liability, tax climbing deductions, and to report the gross taxable income. For every individual who earns a certain amount of money, it is mandatory to file the IT Returns. The ITR to the Income Tax Department of India must be filed by firms/companies, HUFs, and self-employed/salaried individuals.

What Is ITR filing?

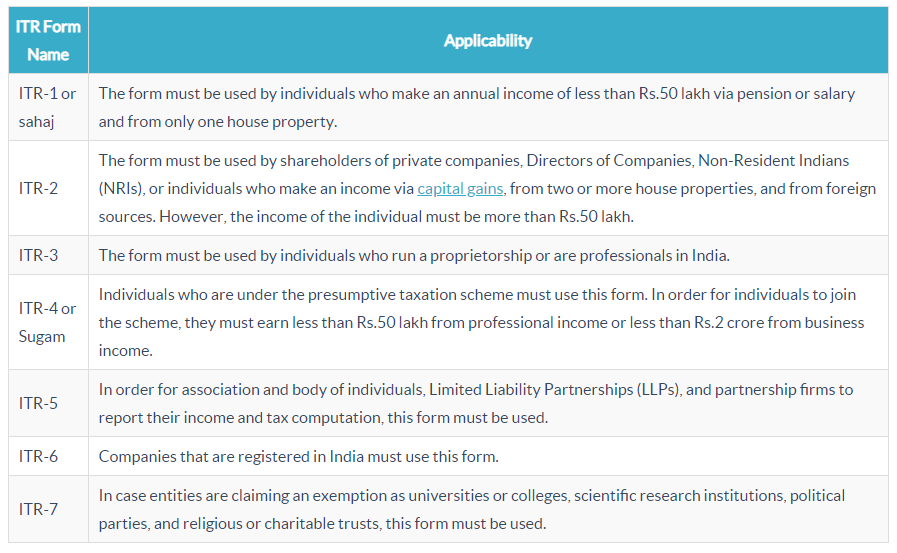

ITR filing means every taxpayer has to file a report of his total earned income in the financial year. Individuals can complete their filing returns process through the Income Tax Department Official Portal. It has seven various forms - ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7.

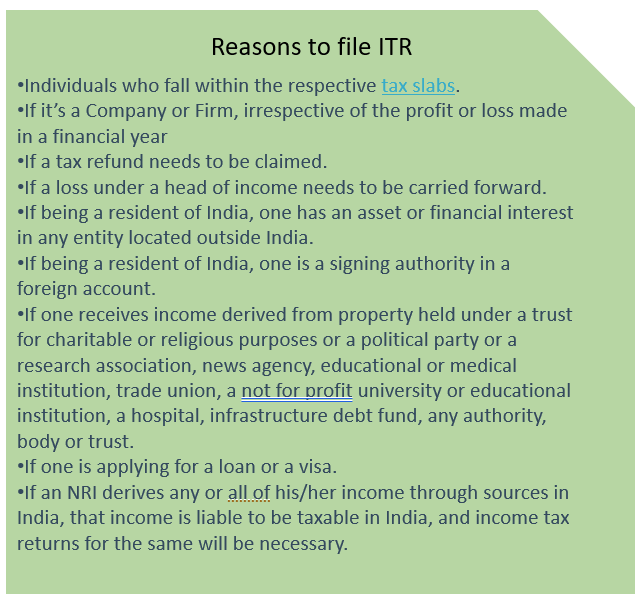

Why Should You File ITR?

It is mandatory for one to file income tax returns in India, if he comes under any of the following conditions,

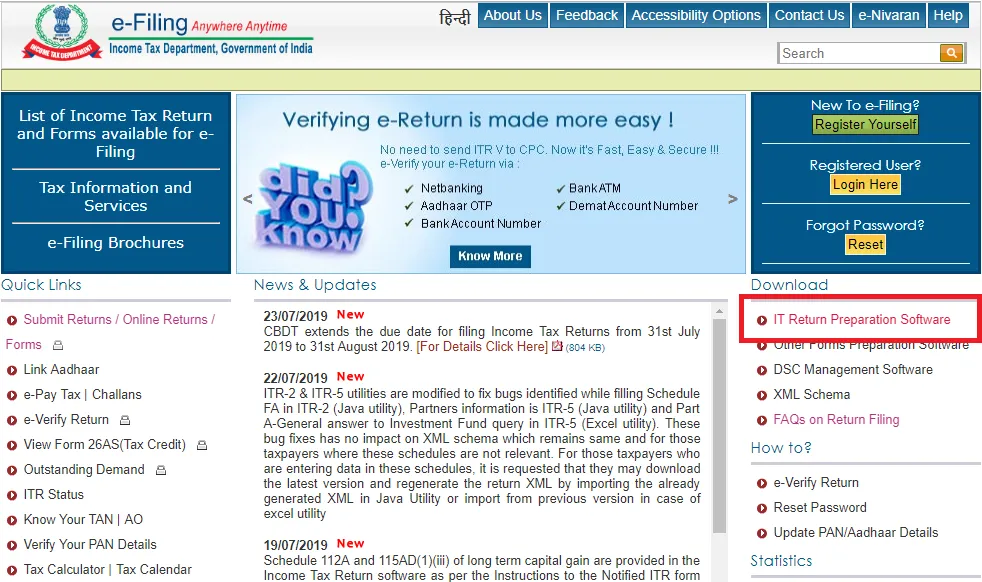

How to Download ITR Form?

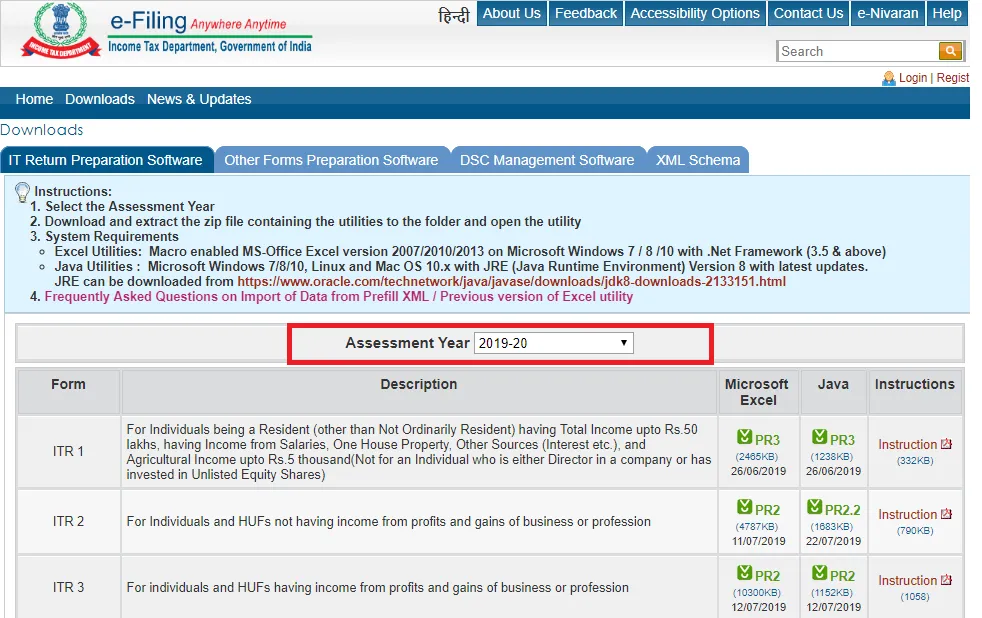

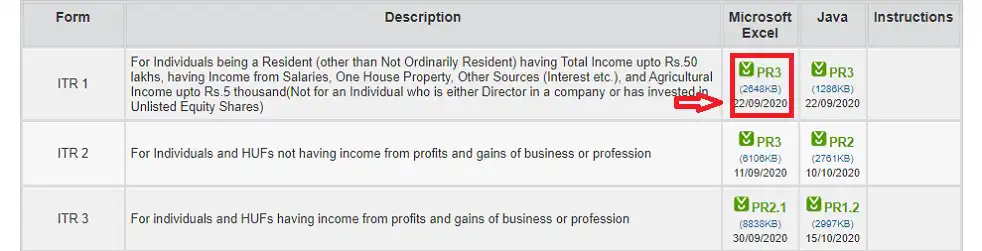

Below are the steps to download the ITR forms from Income Tax Department,

Step 1 - Log in to IT department online portal and, then click on "IT Return Preparation Software" under the "Download" section.

Step 2 - Select the correct Assessment Year

Step 3 - Next, download the ITR form required, which can be seen under the ‘Microsoft Excel’ column.

Which ITR Form to File?

The forms to be submitted will be different depending on the income type of the taxpayer generated.From the official website of Income Tax Department various forms can be downloaded

Below listed are the different types of ITR forms that are available,

What Are the Documents Required to Fill ITR?

For Filing IT returns Online, the following documents are needed for filing the IT Returns online-

- Pan card

- Form 26as

- Form 16A, 16B, 16C

- Salary Pay slips

- Bank statements

- Interest certificates

- TDS certificate

- Proof of tax saving investment

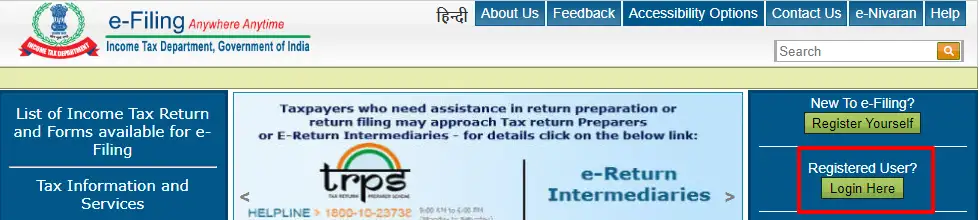

Income Tax e-Filing

When the Income Tax Return is filed online, then this process is called e-Filing. For all Indian Citizens ITR filing is Mandatory with the annual earning of a certain amount. Now for filing the returns, you do not need to visit the Income Tax Department, instead you can do an e-filing of your tax returns from your home or office.

Steps for e-Filing ITR Online

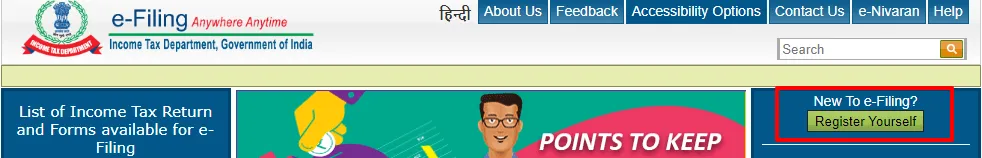

Step 1- Visit the Portal of the Income Tax Department. Login using your User ID, password, and enter the captcha displayed.

Step 2 - Using the ‘Register Yourself’ button,you can register yourself if you are a new user.

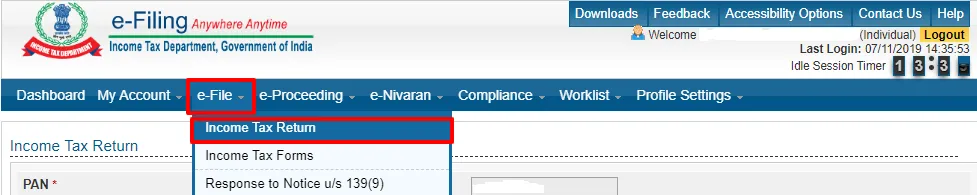

Step 3 - Once you login, you will find the ‘e-file’ section under which you need to select ‘Income Tax Return.’ Please note that you can fill only ITRs 1 and ITR4S online.

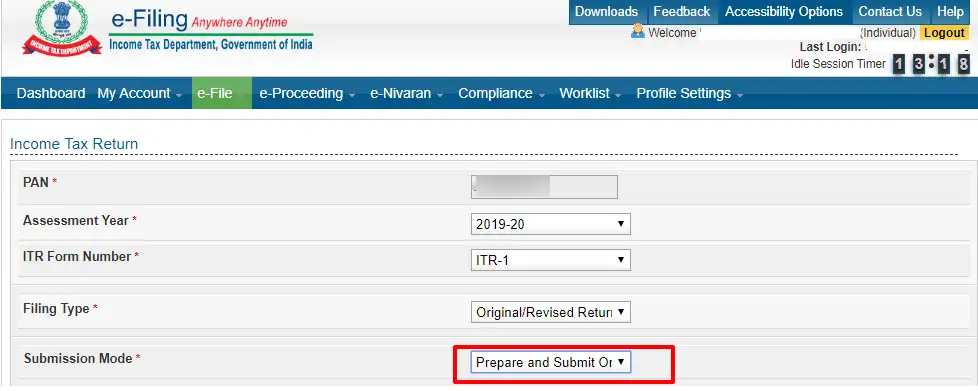

Step 4 - Select the assessment year, Income Tax Return Form ITR 4S/ITR 1 and ‘Prepare and Submit ITR Online’

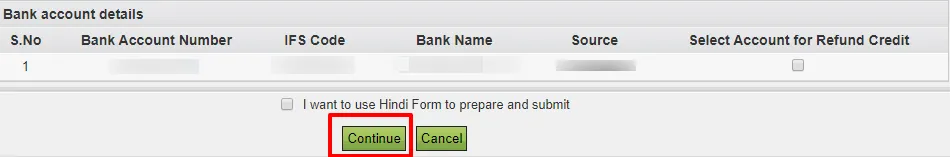

Step 5 - Check the bank details and click on the "Continue" button.

Step 6 - Upload a Digital Signature Certificate (DSC) if you have it. Make sure that your DSC is registered with e Filing.

Step 7 - Click on the ‘Submit’ tab.

Step 8 - If you have not used a DSC, your ITR-V will be displayed to you on successful submission. You can then download the ITR-V from the link displayed, sign it, and submit it to the CPC 120 days from the eFiling date.

Step 9- If you have uploaded your DSC, then your ITL filing process is complete.

Income Tax e-Filing Due Date

Income Tax Returns (ITR) need to be filed before the deadline set by the Income Tax Department (ITD). The due dates for filing ITR for the financial year 2020-21 are listed in the table below for different tax categories.

For the FY 2020-21 (AY 2021-22), the due date for Income Tax e Filing of all taxpayers extended to July 31, 2021.

Penalty for Late Income Tax e-Filing

For late ITR filing, a penalty is imposed by the Central Board of Direct Taxes(CBDT). The maximum penalty imposed for late e-filing is Rs.10,000. This penalty is charged under section 234F.

Form 16 for Income Tax Filing

In India, Form 16 is provided to the salaried individuals by their employers. Form 16 consists of information required by the employees at the time of filing his/her Income Tax Returns.

What Is Form 16?

Forms 16 needs to be filled and submitted as a Tax Deduction at Source(TDS) proof, and has been deducted by the employer which is deposited with the Income Tax Department.

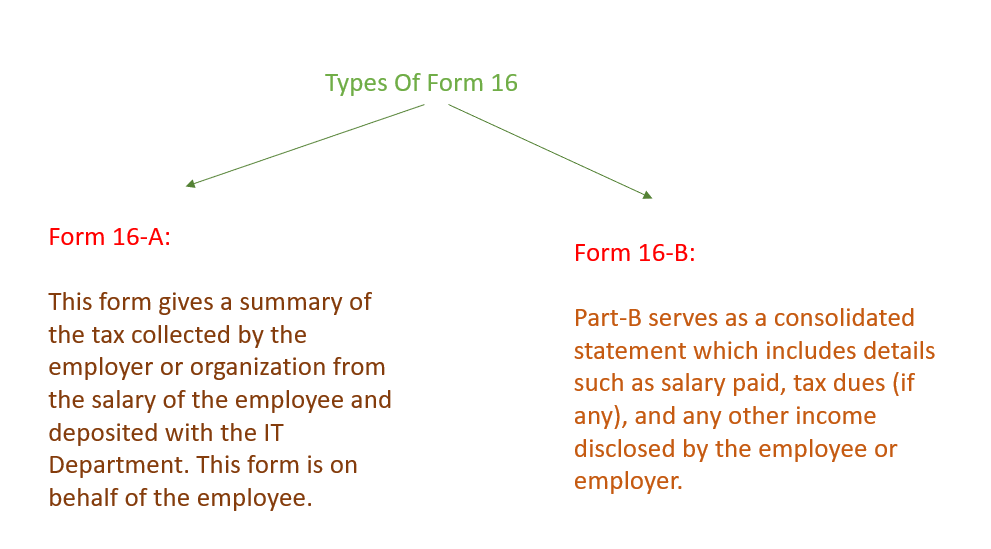

What Are the Types of Form 16?

The two types of Form-16 are:

Different Sections of Form 16

Below mentioned are two different sections of Form 16 :

- Part A

- Part B

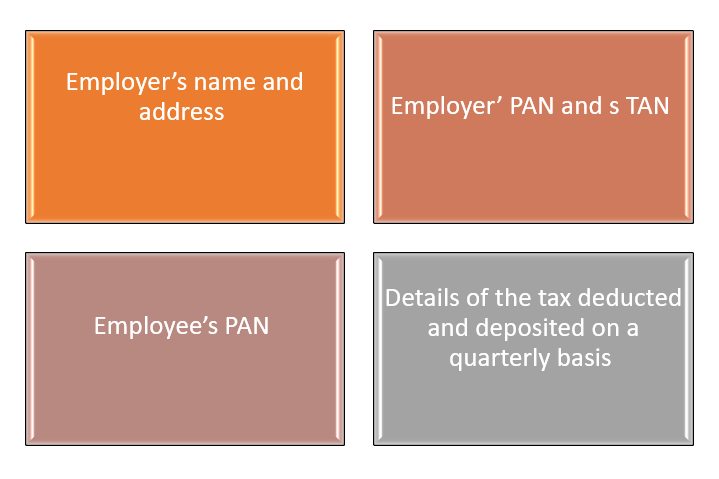

Part A

The employer must provide authentication before the certificate can be provided. Form 16 must be provided by the employer in case you move to a new job. Each new employee is provided with Form 16. Following are the main components of Form 16,

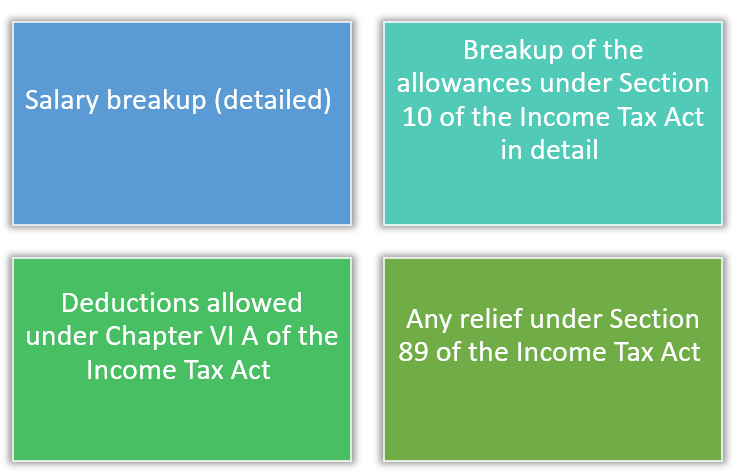

Part B:

Part B has the below-mentioned components to the annexure to the first part of Form 16:

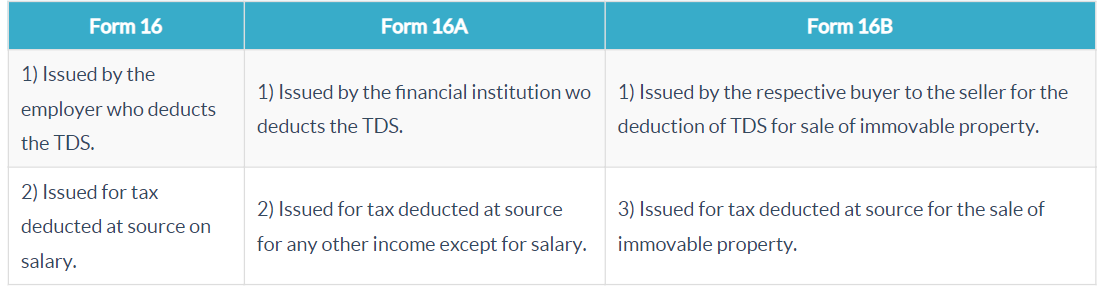

What Is the Difference Between Form 16, Form 16A, and Form 16B

Following table shows the difference between Form 16, Form 16A, and Form 16B.

Key Takeaways

And that's a wrap.

By now you would have developed the understanding of how India payroll and statutory compliance works, we covered the following topics in the article:

- How to start business in India

- Payroll in India

- Payroll Calculation in India

- Important elements of salary structure in India

- Payroll processing in India

- Leave, attendance and LOP in Indian payroll

- Statutory compliance in India

- Statutory Rules in India

- Employee Provident Scheme(EPF) in India

- Applicability of the EPF Act

- EPF Contribution Rate and Breakup

- The Breakup of EPF Contribution

- EPF Registration Process For Employers

- EPF Payment and Return Filing Due Date

- Penalty for Late Payment

- Methods to Check Your EPF Balance Online

- What Are the Types of EPF Forms?

- Employees State Insurance (ESI) in India

- Eligibility for ESI

- Key Features and Benefits of ESI

- ESI Contribution Rates in India

- Employer ESI Registration Process

- Due Dates for The ESI Payment and Return Filing

- Penalty for Non-payment or Late Payment of ESI Contributions

- Professional Tax (PT) in India

- Professional Tax Slabs in the Various States

- Professional Tax Registration and Process

- TDS in India

- TDS Exemption

- Tax Rates In India

- Types of TDS

- Sections Can Be Claimed under TDS Deduction

- Submit TDS Return on Income Tax e-Filing Portal

- Steps to Upload TDS Return on Income Tax e-Filing Portal

- Types of TDS Return Forms

- Due Date for Filing TDS Returns FY 2020-2021

- TDS Certificate

- Income Tax in India

- Income Tax Rates and Slabs

- ITR - Income Tax Return & IT Return

- ITR filing

- Download ITR Form

- Documents Required to Fill ITR

- Income Tax e-Filing and Steps for e-Filing ITR Online

- Income Tax e-Filing Due Date

- Income Tax e-Filing Due Date

- Form 16 for Income Tax Filing

- Types of Form 16

- Difference Between Form 16, Form 16A, and Form 16B

Conclusion

If you want to spend your valuable time in managing core business operations and not worrying about the statutory dues, experience payroll compliance automation like never before try Deskera People now!

It provides you with one-click, seamless and end-to-end automated payroll processing experience.

Get your free trial of Deskera People today

Please refer below articles to know how India Payroll works using Deskera People