Index

- What is income tax- The basics and the meaning of Income Tax

- Why should one know about income tax?

- Income tax in India

- Income tax brackets in India

- Calculating income tax in India (with income tax calculator)

- The US tax system

- Income tax brackets in the U.S.A.

- Calculating income tax in the U.S.A. (with income tax calculator)

What is the meaning of income tax?

Tax is a mandatory fee levied on individuals or corporations by the government. The money collected from the tax is used to finance government activities. Taxes that are levied on the earnings/incomes of organizations or individuals by the government are called income taxes. These earnings can be from different sources, like salaries, rent, dividends, etc.

Anybody who earns money should be aware of what income tax is and how much they are liable to pay. Most countries across the globe levy income tax but the tax rates can differ.

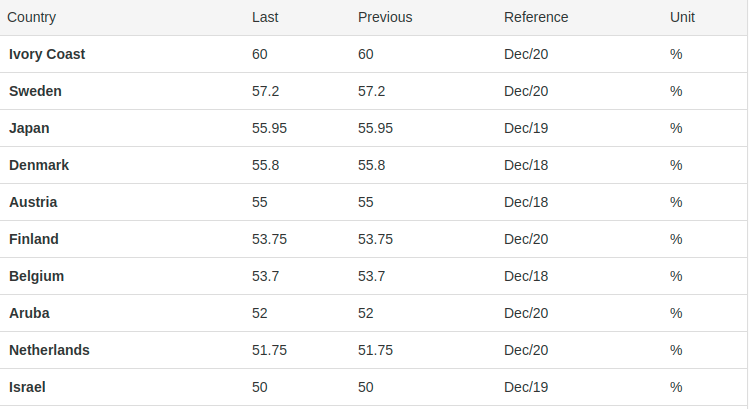

Here is a list of countries with the highest tax rates.

In this article, we will discuss the income tax of two of the biggest democracies in the world - India and the USA.

Why should one know about income tax?

You might have asked yourself this question multiple times: ‘Why should I pay income tax?’. Well, to put it simply, the government uses the money you pay them to give you back benefits like infrastructure, education, and healthcare.

Income tax in India

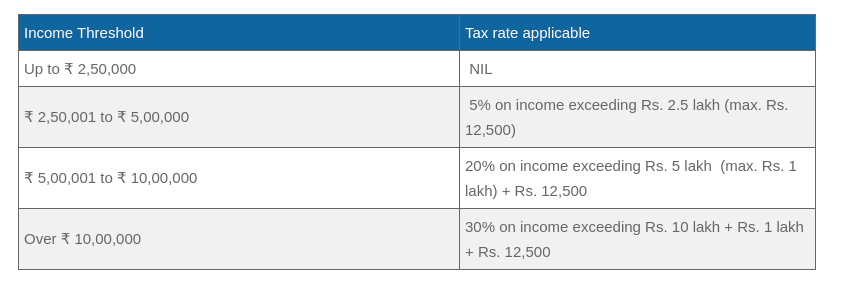

In India, the tax levied on income is applicable at incremental rates as per income tax bracket. This means that lower-income is taxed at a lower rate (including nil rate) and higher-income has a higher income tax bracket rate.

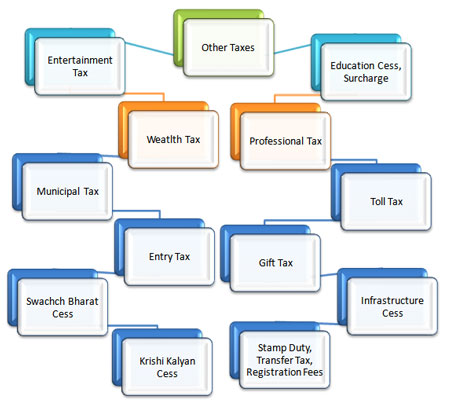

Today, income tax in India can be categorized as -

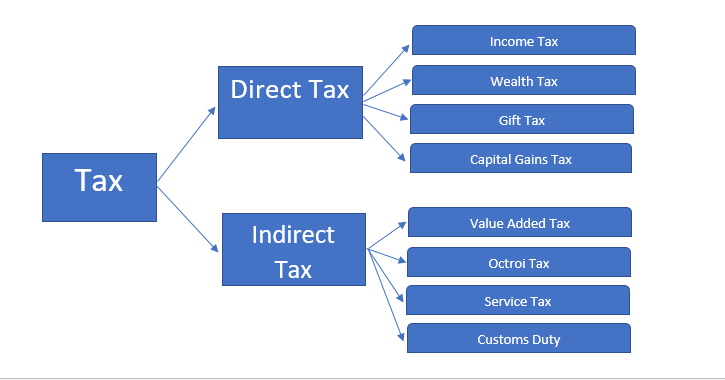

1. Direct Tax: It is a tax that is paid on your income and goes directly to the government.

2. Indirect Tax: It is a tax that an entity collects on one’s behalf and pays to the government. Eg. restaurants, movie theatres, massage parlors, etc.

The money from taxes is collected by the Income Tax Department of India via Tax Deducted at Source (TDS), Tax Collected at Source (TCS), and voluntary payment by taxpayers.

TDS - Tax Deducted at Source is a tool utilized by the Indian government to minimize tax evasion by collecting the tax at the same time the income is generated. This is applicable to incomes such as salaries, interest, commissions and, dividends.

TCS - Tax Collected at Source (TCS) refers to the tax that is payable by the seller, but it is collected from the buyer. For eg. if a person buys a pair of headphones from a shop, the seller or shop owner will have to pay the tax on these headphones, which will be a part of the price the buyer pays for the headphones.

Voluntary Payment - Here, the taxpayer has the liability to pay the income taxes themselves, depending on the income tax bracket they fall under. All the procedures are to be carried out by the taxpayer themselves.

Income tax brackets in India

So, who in India is liable to pay taxes?

- Individuals, Association of Persons (AOP), Hindu Undivided Family (HUF), and Body of Individuals (BOI)

- Firms

- Companies / Organizations

Each of these taxpayers is taxed in different ways under the Indian income tax laws. Firms and companies have a fixed rate of tax - 30% of profits. The individuals, AOP, HUF, and BOI taxpayers are taxed according to the income tax bracket they fall in.

5 categories that constitute the types of income taxpayers:

Income from salary: Salaried individuals and pensioners who earn from a steady source of financing.

Income from other sources: Interest earned from savings accounts, fixed deposits, etc.

Income from residential properties: Money earned from rent as well as money earned from the sale of a property

Income from capital gain: Income earned from the sale of capital assets, like mutual funds, shares, land, building.

Income from a business or self-employment: Income earned from freelancing, contracting, doctors, lawyers, etc.

Calculating income tax in India

To understand taxation in India, follow this income tax example.

Let’s assume that Sameer, a resident of India, earns Rs 15 lakhs per annum.

Disclaimer: For this example, we will assume that he is not taking any tax benefits from the government of India.

The first 2.5 lakhs of his income are tax-free. Post that, for every 2.5 lakhs he will be taxed at an incremental tax rate ranging from 5-25% as seen in the image below.

The total tax payable will be:

12500(@5%) + 25000(@10%) + 37500 (@15%) + 50000(@20%) + 62500(@25%)= Rs 187500. (cess not included)

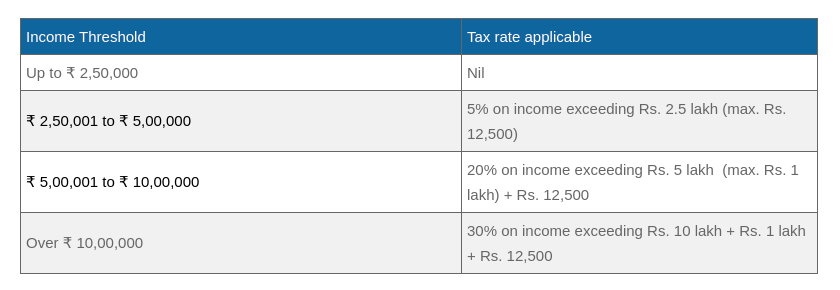

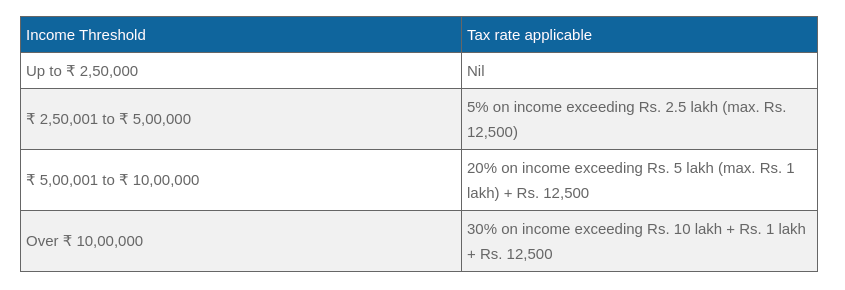

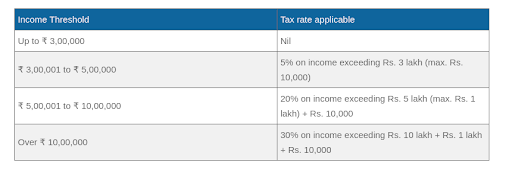

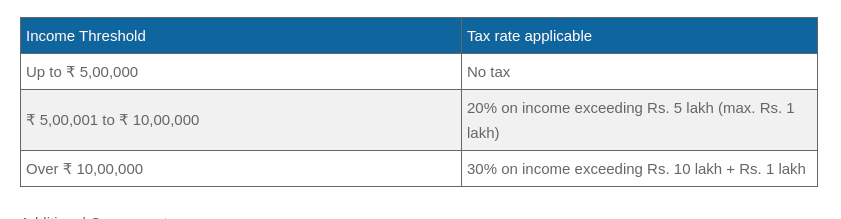

The below table provides different income tax brackets in India.

Resident Individuals & Non-Resident Indians

Hindu Undivided Families (HUFs)

Associations of Persons, Bodies of Individuals and Other Artificial Judicial Persons

Senior Citizens

Super Senior Citizens

Note: To know the additional components under these brackets, click here.

If you are a resident of India, use this income tax calculator to determine the tax that you have to pay. Income tax calculators are an easy tool to help you determine what you owe the government by just clicking on a few buttons.

The US Tax System

The United States is composed of a multi-tiered income tax system under which taxes are imposed by the federal and state, and in some cases, local governments.

Federal and state income taxes are similar when it comes to the percentage rate on taxable incomes, but they differ in the way they are applied, as well as to the type of income that is taxed.

Federal taxes are progressive in nature, with higher rates of tax on higher levels of income.

When it comes to state income taxes, some states have a progressive tax system, while others have a flat tax rate on all incomes.

Income tax brackets in the U.S.A.

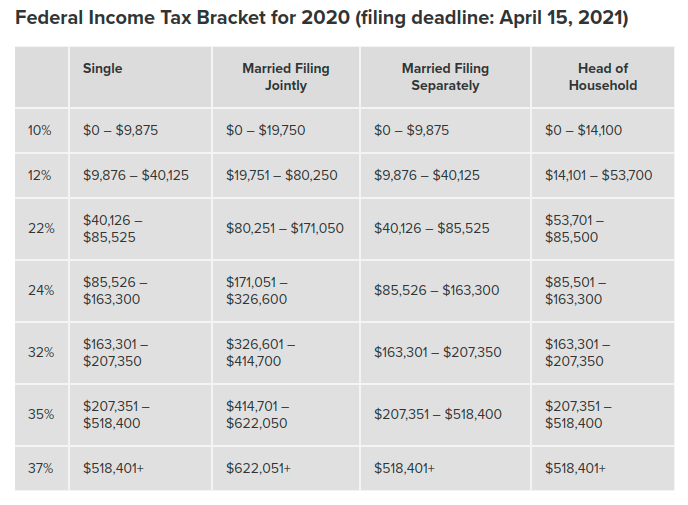

In the U.S.A, there are seven income tax brackets for most income groups:

10%, 12%, 22%, 24%, 32%, 35% and 37%.

The U.S. uses a progressive tax system, which means that as one moves up the pay scale, they also move up the income tax bracket. The income tax bracket depends on a person’s taxable income and filing status: single, married, filing jointly or qualifying widow(er), married filing separately, & head of household.

The standard deductions for each filing status would be:

- Single: $12,200

- Head of household: $18,350

- Married filing separately: $12,200

- Married filing jointly: $24,400

- Qualifying widow(er): $24,400

Calculating income tax in the U.S.A.

Since the income tax brackets vary depending on whether a person is single, married, or the head of a household, the tax is calculated differently for each of them. These different categories are called filing statuses.

Here is an income tax example. Based on the rates, a single tax filer with an income of $50,000 would have to pay a marginal tax rate of 22%. However, the taxpayer would not pay that rate on all of the $50,000. The rate on the first $9,700 of taxable income would be 10%, then 12% on the next $29,775, then 22% on the final $10,525.

Marginal tax rates only apply to incomes that fall within that specific bracket. Based on these rates, the person earning $50,000 owes $6,858.50 to the government, which is an effective tax rate of 13.7%.

US residents may use this income tax calculator to know how much tax they owe the government. This US income tax calculator will simplify your tax calculation woes.

Understanding income tax is essential for individuals and businesses alike. Whether you are an individual or are a small business wanting to manage your accounting, you can read this article to get a better idea of accounting practices.

Still having trouble with taxes? Don’t have a tax document checklist? When it comes to taxation, Deskera ERP proves really useful. It takes care of your tax filing documentation completely. Deskera ERP can help businesses meet their tax obligations with the regional regulatory bodies and is an easy-to-use accounting software. It assists companies with hassle-free and accurate tax filing. With Deskera, tax document checklists will be a thing of the past.