Imagine running a thriving business but constantly struggling with cash flow due to delayed customer payments. Unpaid invoices can tie up crucial working capital, making it difficult to cover operational expenses, invest in growth, or seize new opportunities.

This challenge is particularly common for small and mid-sized businesses that rely on steady cash flow to stay competitive. Fortunately, invoice factoring offers a practical solution by converting outstanding invoices into immediate cash, helping businesses maintain liquidity without waiting for customers to pay.

Invoice factoring is gaining traction as companies seek faster ways to manage working capital. The global invoice factoring market is experiencing significant growth—it is projected to expand from $3,094.16 billion in 2024 to $3,461.65 billion in 2025 at a CAGR of 11.9%.

By 2029, it is expected to reach $5,348.63 billion, maintaining a steady CAGR of 11.5%. This surge reflects the increasing adoption of factoring services as businesses prioritize financial flexibility and operational efficiency.

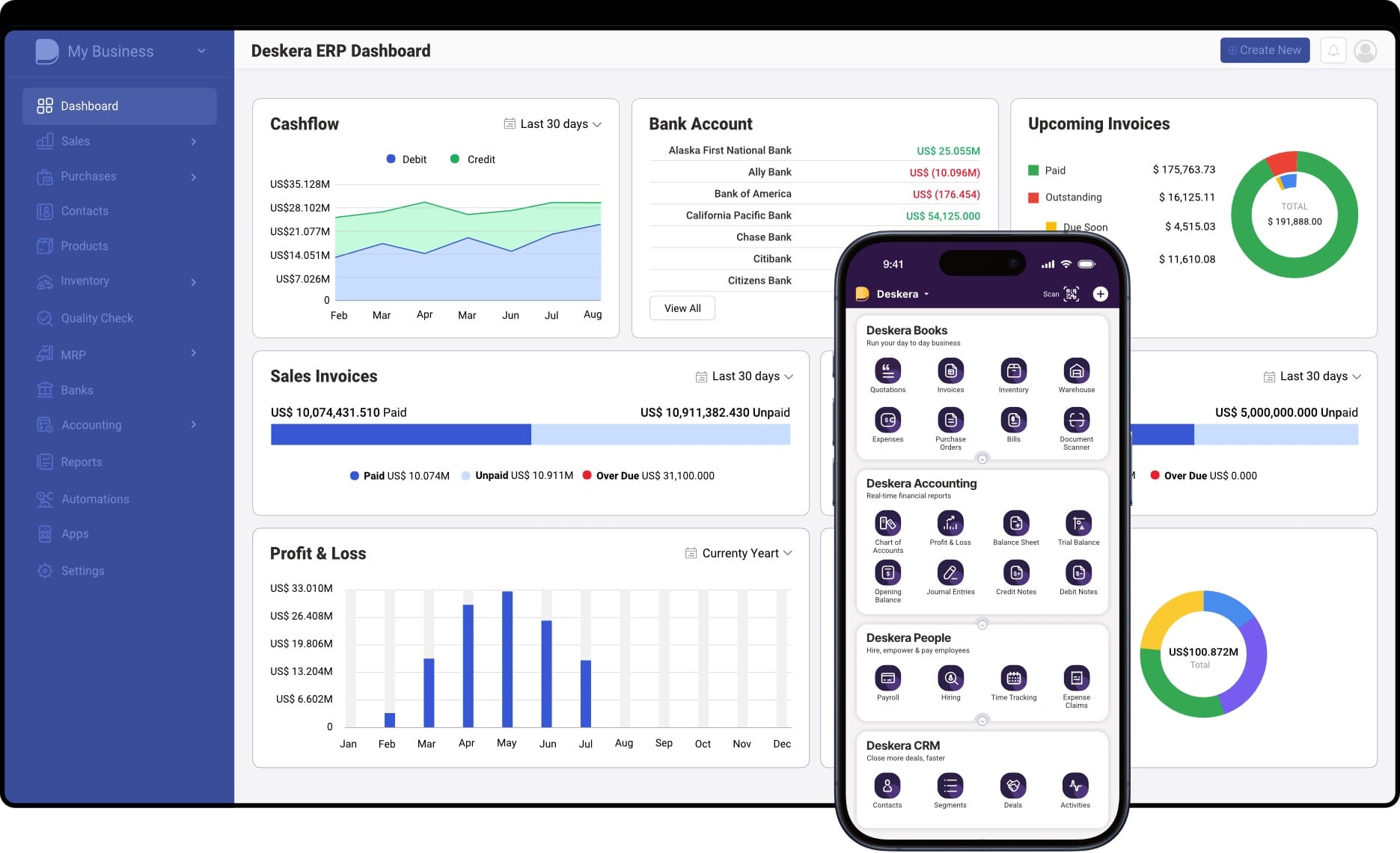

For companies looking to streamline financial management, ERP solutions like Deskera ERP can be a game-changer. Deskera ERP integrates accounting, invoicing, and inventory management, enabling businesses to track receivables, automate payments, and gain real-time insights into cash flow. By combining invoice factoring with an intelligent ERP system, businesses can optimize their financial operations while ensuring stability and growth.

In this guide, we’ll explore what invoice factoring is, how it works, and why it’s an effective tool for improving cash flow. Whether you're a small business owner or a finance executive, understanding invoice factoring can help you make informed decisions to enhance liquidity and keep your operations running smoothly.

What is Invoice Factoring?

Invoice factoring is a financial strategy that allows businesses to sell their outstanding invoices to a third-party factoring company in exchange for immediate cash. Instead of waiting weeks or months for customers to settle their invoices, businesses receive an advance—typically 70% to 90% of the invoice value—helping them maintain steady cash flow and cover operational expenses. Once the factoring company collects the payment from customers, it forwards the remaining balance to the business, minus a factoring fee for its services.

This process provides an efficient way for businesses to unlock capital tied up in unpaid invoices without taking on additional debt. Invoice factoring is commonly used in industries where long payment cycles are standard, such as manufacturing, logistics, and wholesale trade. It is also referred to as accounts receivable factoring or debt factoring, as it involves selling receivables to improve liquidity.

There are two primary types of invoice factoring: recourse and non-recourse factoring.

- In recourse factoring, the business remains responsible for unpaid invoices, meaning if a customer fails to pay, the company must refund the factor.

- In contrast, non-recourse factoring shifts the risk to the factoring company—if the customer defaults, the business is not liable. However, non-recourse factoring usually comes with higher fees due to the increased risk the factor assumes.

To illustrate, imagine a manufacturing company issues a ₹10,000 invoice with a 60-day payment term. Instead of waiting, they sell the invoice to a factoring company, which advances 80% (₹8,000) within a few days.

When the customer eventually pays, the factor sends the remaining ₹2,000 minus their service fee. This allows the manufacturing company to access working capital immediately, ensuring smooth operations without disruptions caused by delayed payments.

Invoice Factoring vs. Invoice Financing: Key Differences

While invoice factoring and invoice financing both help businesses improve cash flow by leveraging unpaid invoices, they operate differently. Understanding these distinctions can help businesses choose the best option based on their financial needs and operational preferences.

1. Definition and Process

- Invoice Factoring: A business sells its unpaid invoices to a factoring company, which advances a portion of the invoice value (typically 70-90%) and collects payment directly from the customers. Once the customer pays, the factor sends the remaining amount to the business after deducting fees.

- Invoice Financing: A business uses its unpaid invoices as collateral to secure a loan or line of credit from a lender. The business retains control over collections and repays the loan, usually with interest and fees.

2. Control Over Customer Payments

- Invoice Factoring: The factoring company takes over invoice collection, meaning customers are aware of the arrangement.

- Invoice Financing: The business remains responsible for collecting payments, keeping the financing arrangement private from customers.

3. Risk and Responsibility

- Invoice Factoring: Depending on whether it’s recourse or non-recourse factoring, the business may or may not be liable for unpaid invoices.

- Invoice Financing: The business is fully responsible for repaying the loan, regardless of whether customers pay their invoices.

4. Cost and Fees

- Invoice Factoring: Fees are typically higher (ranging from 1% to 5% per invoice) because the factoring company assumes collection responsibility and potential risk.

- Invoice Financing: Costs depend on the interest rate and lending terms, often making it a more cost-effective option for businesses with strong customer payment history.

5. Best Use Cases

- Invoice Factoring: Ideal for businesses that need immediate cash flow relief and don’t want to manage collections, such as transportation, logistics, and manufacturing companies.

- Invoice Financing: Suitable for businesses that want to retain control over invoice collection while accessing short-term capital.

If your business struggles with delayed payments and cash flow gaps, invoice factoring may be a better option, especially if you want to offload collection efforts. However, if you prefer to manage customer relationships and need a short-term financing solution, invoice financing could be a more flexible choice.

How Does Invoice Factoring Work?

Invoice factoring is a straightforward process that enables businesses to convert outstanding invoices into immediate cash. It involves three main parties: the business (seller), the factoring company (factor), and the customers (debtors). Here’s a step-by-step breakdown of how it works:

1. Issue an Invoice

The process begins when a business provides goods or services to a customer and issues an invoice with payment terms (e.g., 30, 60, or 90 days). This invoice represents an account receivable—a pending payment owed to the business.

2. Submit Invoices to a Factoring Company

Instead of waiting for customers to pay, the business sells the invoice to a factoring company. The factoring firm assesses the invoice’s validity and the customer’s creditworthiness before approving the transaction.

3. Receive an Advance Payment

Once approved, the factoring company advances 75% to 90% of the invoice value to the business—typically within 1 to 4 business days. This upfront payment provides working capital to cover operating expenses, payroll, or new investments.

4. Factor Collects Payment from Customers

The factoring company then assumes responsibility for collecting payment from the customer. The customer pays the invoice amount directly to the factor, who manages all follow-ups and collection efforts.

5. Receive Remaining Balance Minus Fees

After the customer pays in full, the factoring company releases the remaining 10% to 25% of the invoice value to the business, minus the factoring fee (which ranges from 1% to 5% per invoice).

Factoring Agreement: Recourse vs. Non-Recourse

- Recourse Factoring: If the customer fails to pay, the business must buy back the invoice or repay the advance to the factor.

- Non-Recourse Factoring: The factoring company assumes the risk of non-payment, but charges higher fees to cover potential losses.

What Types of Businesses Use Invoice Factoring?

Invoice factoring is widely used in industries where there is a significant delay between delivering goods or services and receiving payment. Businesses that operate on extended payment terms or rely on clients with slow-paying invoices benefit the most from this financing option.

Here are some of the key industries that commonly use invoice factoring:

1. Manufacturing

Manufacturers often face cash flow gaps because they produce goods upfront but may not receive payment for 30 to 90 days. Meanwhile, they need to cover expenses like raw materials, labor, and overhead costs. Invoice factoring ensures they have steady working capital to maintain operations and fulfill new orders.

2. Wholesale and Distribution

Wholesalers frequently sell products to retailers on credit terms, leading to delays in receiving payments. Factoring helps bridge the gap, allowing them to purchase inventory, manage logistics, and continue supplying customers without cash flow interruptions.

3. Transportation and Logistics

Trucking companies, freight brokers, and logistics providers often operate with high fuel, maintenance, and payroll expenses while waiting for shippers and brokers to pay invoices. Factoring provides quick access to funds, ensuring smooth operations and timely payroll for drivers.

4. Staffing Agencies

Temporary staffing agencies must pay employees weekly or biweekly, but client invoices might not be settled for 30, 60, or even 90 days. Invoice factoring helps them cover payroll expenses without taking on debt, ensuring business continuity.

5. Construction and Contracting

Subcontractors and general contractors often experience long payment cycles, as payments are typically tied to project milestones. Factoring allows them to cover material costs, equipment rentals, and employee wages while waiting for payments from developers or property owners.

6. Professional Services

Consulting firms, IT service providers, marketing agencies, and legal firms often complete projects before receiving payment. Invoice factoring helps them manage operational expenses and invest in growth without waiting for slow-paying clients.

7. Healthcare and Medical Services

Medical providers, including clinics, hospitals, nursing homes, and medical equipment suppliers, frequently wait weeks or months for insurance reimbursements. Factoring provides immediate cash flow to cover payroll, purchase supplies, and manage operational expenses.

8. Oil and Gas Industry

Companies in the oil and gas sector often work on large contracts with extended payment terms. Factoring helps them maintain cash flow for drilling, equipment maintenance, and operational costs while waiting for customer payments.

9. Government Contractors

Businesses working with government agencies typically face lengthy payment cycles due to bureaucratic processing. Invoice factoring helps them sustain operations, meet payroll, and cover project costs without financial strain.

10. Printing and Publishing

Printers and publishers often extend credit to clients for large orders, which can lead to cash flow challenges. Factoring provides the liquidity needed to purchase materials, pay employees, and fulfill orders without financial disruptions.

The Common Factor: Delayed Payments and Cash Flow Gaps

Any business that extends credit to customers and faces delays in payment can benefit from invoice factoring. By turning unpaid invoices into immediate cash, businesses in various industries can maintain liquidity, meet financial obligations, and focus on growth.

Key Factors to Consider Before Using Invoice Factoring

Invoice factoring can be a valuable financial tool for businesses looking to improve cash flow, but it’s important to evaluate whether it aligns with your company’s needs and goals. By understanding the costs, customer impact, and industry suitability, businesses can make an informed decision about whether factoring is the right solution for them.

Below are the essential factors to consider before opting for invoice factoring.

1. Immediate Cash Flow Needs

If your business requires quick access to funds for operational expenses, payroll, or growth opportunities, invoice factoring can provide a solution by converting unpaid invoices into immediate cash. This is especially useful for businesses with long payment cycles.

2. Customer Payment Habits

If your customers have extended payment terms (e.g., 30, 60, or 90 days) or frequently delay payments, factoring can help maintain steady cash flow. However, it’s essential to consider whether your customers are reliable payers, as factoring companies assess their creditworthiness before approving invoices.

3. Costs and Fees

Factoring companies charge fees based on a percentage of the invoice value, typically ranging from 1% to 5% per month. While this can be a convenient financing option, it is important to compare the costs with other financing alternatives, such as business loans or lines of credit, to ensure cost-effectiveness.

4. Control Over Customer Relationships

Since the factoring company will collect payments directly from your customers, this could impact your client relationships. Some businesses prefer to handle their collections internally to maintain customer rapport, while others see outsourcing collections as a way to reduce administrative burdens.

5. Qualification for Other Credit Options

If your business struggles to qualify for traditional financing, invoice factoring can be a viable alternative, as approval is based primarily on your customers' creditworthiness rather than your own business credit score.

6. Industry Suitability

Invoice factoring is widely used in industries with high accounts receivable turnover, such as manufacturing, wholesale, logistics, staffing, and B2B services. If your business operates in these sectors, factoring may be a practical financing option.

7. Administrative Considerations

Factoring companies handle collections and accounts receivable management, which can save time and resources. If your business lacks the infrastructure to efficiently manage collections, factoring can help streamline financial operations.

8. Scalability and Growth

Unlike traditional loans with fixed limits, invoice factoring grows with your business. As your sales increase, your access to working capital also expands, making it an attractive option for businesses looking to scale.

Advantages of Invoice Factoring

Invoice factoring is a financial tool that helps businesses maintain liquidity by converting unpaid invoices into immediate cash. Unlike traditional loans, factoring offers quick access to funds without adding debt, making it an attractive option for businesses needing working capital.

Below are the key benefits of invoice factoring in detail:

1. Accelerates Access to Cash

With invoice factoring, businesses don’t have to wait for customers to pay their invoices, which could take 30, 60, or even 90 days. Instead, they receive an advance—typically 70-90% of the invoice value—within 24 to 48 hours. This rapid infusion of cash helps cover payroll, operational expenses, and expansion costs without delays.

2. Establishes Predictable Cash Flow

Uncertain payment timelines can disrupt financial planning. Factoring agreements ensure a steady stream of cash, as businesses receive funds as soon as they issue invoices. This predictability allows for better budgeting, strategic investments, and long-term financial stability.

3. Easier Approval Compared to Bank Loans

Traditional bank loans require collateral, strong credit scores, and a lengthy approval process. Invoice factoring, on the other hand, is based on the creditworthiness of customers rather than the business itself. This makes it an excellent financing option for startups, small businesses, or companies with less-than-perfect credit.

4. No Additional Debt

Unlike loans or lines of credit, factoring is not a form of borrowing but rather a sale of receivables. This means businesses receive cash without increasing liabilities or affecting their debt-to-equity ratio. As a result, financial statements remain healthier, and future borrowing capacity is preserved.

5. Reduces Business Overheads

Managing accounts receivable requires time, resources, and dedicated staff. Factoring companies handle the collection process, reducing administrative burdens and potentially lowering payroll costs. Businesses can reallocate staff to more productive roles, enhancing overall efficiency.

6. Improved Customer Relationships

Payment collection can sometimes strain client relationships. Factoring companies professionally manage collections, allowing businesses to focus on delivering quality service instead of chasing late payments. This fosters better long-term relationships with clients.

7. Helps Businesses Work with Large Customers

Many large corporations and government entities have extended payment terms, sometimes stretching to 90 or 120 days. While these clients are valuable, long wait times can create cash flow issues. Invoice factoring bridges the gap, enabling businesses to take on big contracts without financial strain.

8. Fast and Flexible Funding

Bank loans can take weeks or months to process, while invoice factoring provides cash in as little as 24 hours. Additionally, factoring grows with the business—more invoices mean more funding—making it a scalable solution for companies with fluctuating revenue.

9. Reduces the Hassle of Collections

For businesses using non-recourse factoring, the factoring company assumes the risk of non-payment, relieving the business of bad debt concerns. Even with recourse factoring, where the business remains liable for unpaid invoices, the factor still handles collections, reducing stress and freeing up valuable time.

10. Better Business Survival Rates

Cash flow shortages are a leading cause of business failure. By ensuring immediate access to working capital, invoice factoring helps companies stay afloat, invest in growth, and withstand economic downturns. When used strategically, it provides a financial cushion that keeps businesses running smoothly.

The Risks and Disadvantages of Invoice Factoring

While invoice factoring can provide businesses with quick access to cash, it comes with several risks and drawbacks that must be carefully considered. Below are some of the key disadvantages associated with this financing method:

1. High Costs and Fees

Invoice factoring often incurs significant costs compared to traditional financing options such as bank loans or lines of credit. Fees typically range from 1% to 5% per invoice, but additional charges like application fees, credit check fees, and late payment penalties can add up. Over time, these costs can erode profit margins, making factoring an expensive financing solution.

2. Loss of Control Over Customer Relationships

When a business factors its invoices, the factoring company takes over collections. If the factor employs aggressive collection tactics, it can harm customer relationships and damage the company’s reputation. Customers may also perceive invoice factoring as a sign of financial instability.

3. Dependence on Factoring

Relying too heavily on invoice factoring can create a dangerous cycle of dependency, where a company continuously factors invoices to cover operating costs. This may mask underlying financial issues such as poor cash flow management or declining sales, making it difficult to regain financial independence.

4. Contractual Obligations and Lack of Flexibility

Many factoring agreements require businesses to sign long-term contracts or meet minimum invoice volume requirements. This limits flexibility and can lock businesses into costly commitments even if their financial situation changes.

5. Impact of Customer Creditworthiness

Factoring companies assess the creditworthiness of customers, not the business itself. If a company’s customers have a poor payment history, the factoring company may reject their invoices or charge higher fees, limiting access to funds.

6. Confidentiality and Data Security Risks

Invoice factoring requires sharing sensitive financial information with a third party. This includes customer details, sales data, and accounts receivable records, posing potential risks if the data is misused or compromised.

7. Non-Payment Risks (Recourse vs. Non-Recourse Factoring)

- In recourse factoring, if a customer fails to pay, the business must repurchase the unpaid invoice or replace it with another one, leading to financial strain.

- Non-recourse factoring shifts the risk to the factor, but it comes at a higher cost and typically involves stricter eligibility criteria.

8. Unsuitability for Businesses with Few Customers

Invoice factoring is less effective for businesses with a small customer base. Factoring companies prefer diversified risk and may reject businesses that depend on just a few clients for most of their revenue.

9. Increased Costs for High-Risk Customers

Factoring companies adjust their fees based on the perceived risk of non-payment. If a company has high-risk customers, it may face higher factoring rates or even rejection, reducing the overall benefits of this financing method.

10. Potential Damage to Business Reputation

If customers learn that a company is using invoice factoring, they may question its financial health. This can negatively impact future business dealings, especially if competitors highlight it as a weakness.

While invoice factoring can provide short-term financial relief, businesses must carefully assess the risks before committing to it. Evaluating costs, customer impact, and contract terms is crucial to determining whether factoring aligns with long-term financial goals.

How to Get Your Company Approved for Invoice Factoring

Getting approved for invoice factoring involves meeting specific eligibility requirements and going through an evaluation process. Since factoring companies focus more on your customers' creditworthiness than your business’s financial health, ensuring you meet their criteria can increase your chances of approval.

Here’s how you can prepare:

1. Complete the Application Process

Most factoring companies start with a basic application where you provide:

- Business details (structure, industry, years in operation)

- Annual revenue and profit margins

- Volume and value of invoices to be factored

2. Provide Accounts Receivable Details

Factoring companies assess your outstanding invoices and customer payment trends. You’ll need to submit:

- Accounts receivable aging reports (showing overdue invoices)

- Sales ledgers (records of past transactions)

- Customer lists (including key clients with pending payments)

3. Ensure Your Customers Have Good Credit

Since factoring companies rely on your customers’ ability to pay invoices, they conduct credit checks on your clients. Businesses with a history of late payments or financial instability may impact your approval chances. Ensuring a strong, creditworthy customer base is crucial.

4. Verify the Invoices

Factoring companies may confirm the validity of your invoices with your clients. Ensure:

- Invoices are correctly issued (not estimates or purchase orders)

- Payments are not tied to disputes or contract breaches

- Your customers acknowledge the invoices and payment terms

5. Maintain a Clean Business Background

Factoring companies may check your company’s financial health, tax records, and legal standing. To improve your chances of approval:

- Keep tax filings and financial records up to date

- Avoid major financial red flags like bankruptcy filings

- Ensure your business has no outstanding legal issues related to invoicing

6. Review and Sign the Factoring Agreement

Once approved, you will receive a factoring agreement outlining:

- Advance rate (percentage of invoice paid upfront)

- Factoring fees (cost per transaction or percentage of invoice)

- Recourse vs. non-recourse terms (who takes responsibility for unpaid invoices)

It’s essential to thoroughly review the contract and consult a financial expert or attorney before signing.

Key Factors That Impact Approval

- Annual revenue: Some factoring companies have minimum revenue requirements.

- Industry type: Certain industries (e.g., staffing, manufacturing, logistics) are more favorable for factoring.

- Client reliability: If your customers consistently delay payments or default, approval may be difficult.

Why Is Invoice Factoring So Expensive?

Invoice factoring can be a costly financing option compared to traditional loans or lines of credit. The high fees are due to the risks involved, the services provided, and the cost structures of factoring companies.

Here’s why invoice factoring tends to be expensive:

1. High Risk for Factoring Companies

Factoring companies purchase invoices before payments are received, assuming the risk of non-payment or delayed payments. In non-recourse factoring, if a client fails to pay, the factoring company absorbs the loss, increasing costs. The greater the risk, the higher the factoring fees.

2. Immediate Cash and Collection Services

Unlike loans, factoring provides immediate cash flow without collateral, and factoring companies take over credit control and collections. This service reduces administrative burdens for businesses but adds costs for the factoring company, which are passed on as fees.

3. Cost of Capital

Factoring companies fund advances using their own capital or borrowed funds. Their cost of borrowing influences the factoring fees they charge businesses. To remain profitable, they must price factoring rates higher than their financing costs.

4. Customer Creditworthiness Affects Fees

The creditworthiness of your customers impacts factoring costs. If your clients have a history of late payments or poor credit, the factoring company charges higher fees to offset the potential risk. Businesses with strong, reliable customers typically get better factoring rates.

5. Volume and Invoice Size Matter

- Smaller or fewer invoices incur higher fees because administrative costs remain high regardless of invoice value.

- Businesses that factor high volumes of invoices often negotiate better rates, as they provide consistent business for the factoring company.

6. Industry and Market Risks

Some industries, such as construction or trucking, face long payment cycles and disputes, making them riskier for factoring companies. Businesses in high-risk industries often pay premium rates for factoring services.

7. Contract Terms and Hidden Fees

Factoring agreements often include additional fees, such as:

- Minimum volume requirements (penalties if you don’t meet a minimum amount of invoices)

- Monthly service fees

- Wire transfer or processing fees

These extra costs can make factoring more expensive than it initially appears.

How to Choose the Right Invoice Factoring Company

Choosing the right invoice factoring company is crucial for maintaining a healthy cash flow while minimizing costs and risks.

Here are the key factors to consider when selecting a factoring provider:

1. Understand Their Factoring Options

Not all factoring companies offer the same type of financing. Ensure they provide the right option for your business:

- Recourse Factoring – You remain responsible for unpaid invoices if your customer defaults.

- Non-Recourse Factoring – The factoring company assumes the risk of non-payment, but fees may be higher.

- Spot Factoring – You can choose to factor individual invoices instead of committing to a long-term contract.

- Whole Ledger Factoring – Requires you to factor all invoices, which may help negotiate lower rates.

2. Compare Factoring Fees and Rates

Factoring costs vary widely. Look for a provider with transparent pricing and evaluate:

- Advance Rate – The percentage of invoice value you receive upfront (typically 70%-95%).

- Factoring Fees – Fees range from 1% to 5% per invoice per month. Higher-risk industries or lower credit customers may incur higher fees.

- Additional Charges – Check for hidden costs such as administrative fees, wire transfer fees, or early termination penalties.

3. Evaluate Contract Terms

Some factoring companies require long-term contracts, while others offer more flexibility. Look for:

- Commitment Length – Avoid being locked into a contract longer than necessary.

- Minimum Volume Requirements – Some providers require a minimum amount of invoices to be factored each month.

- Termination Clauses – Ensure you can exit the agreement without excessive penalties.

4. Assess Their Customer Service and Reputation

A reliable factoring company should provide:

- Strong customer support – Check online reviews, BBB ratings, and testimonials.

- Efficient collections process – Their approach to collecting payments from your customers should be professional and non-disruptive.

- Industry expertise – A company familiar with your industry can offer better terms and understanding of your cash flow needs.

5. Consider Funding Speed and Process

Speed matters when you need cash flow fast. Ask:

- How long does approval take? (It can range from a few hours to a few days.)

- How quickly will you receive funds? (Some companies offer same-day funding.)

- What documents are required? (Check if their application process is straightforward.)

6. Check Customer Credit Approval Process

Since factoring companies base approvals on your customers' creditworthiness, find out:

- Do they require a credit check on all your clients?

- Will they notify you if a customer has a low credit score before factoring an invoice?

- Can you verify which clients are eligible for factoring in advance?

7. Look for Flexibility and Scalability

Your financing needs may change over time. Ensure the factoring company:

- Can handle increased invoice volumes as your business grows.

- Offers flexible funding structures to accommodate seasonal fluctuations.

- Allows you to select which invoices to factor, rather than requiring an all-or-nothing approach.

How Can Deskera ERP Help You with Invoice Factoring?

Deskera ERP offers a comprehensive suite of tools that can streamline the invoice factoring process, helping businesses improve cash flow management and optimize financial operations.

Here’s how Deskera ERP can assist with invoice factoring:

1. Faster Invoice Generation and Tracking

- Automates invoice creation with customizable templates.

- Ensures invoices are accurate, professional, and compliant.

- Enables real-time tracking of outstanding invoices to determine which ones are eligible for factoring.

2. Seamless Accounts Receivable Management

- Provides a centralized dashboard for tracking customer payments and overdue invoices.

- Helps assess which invoices can be factored based on customer creditworthiness and payment history.

- Sends automated reminders to customers for pending payments, reducing the risk of delayed payments.

3. Improved Cash Flow Forecasting

- Offers built-in cash flow reports to analyze financial health and plan for future liquidity needs.

- Helps determine when and how much to factor, ensuring businesses maintain optimal working capital.

- Integrates with banking and financing tools to track fund inflows from factoring companies.

4. Customer Credit Assessment and Risk Mitigation

- Integrates with credit assessment tools to evaluate customer credit scores.

- Helps businesses choose the right invoices to factor by identifying reliable clients.

- Minimizes risk by flagging high-risk customers before submitting invoices for factoring.

5. Integration with Factoring Companies and Lenders

- Tracks factoring fees and payments to maintain accurate financial records.

6. Compliance and Audit Readiness

- Maintains detailed records of factored invoices, repayments, and associated fees.

- Ensures businesses stay compliant with accounting standards by categorizing factored receivables correctly.

- Provides easy access to financial reports for audits and financial reviews.

7. Scalability for Growing Businesses

- As businesses grow, Deskera ERP scales with them, handling increasing invoice volumes.

- Supports multi-currency transactions for businesses factoring invoices across international markets.

- Offers cloud-based accessibility, allowing finance teams to manage factoring from anywhere.

Key Takeaways

- Invoice factoring is a financing method where businesses sell unpaid invoices to a factoring company in exchange for immediate cash, helping bridge cash flow gaps.

- The process involves submitting invoices to a factoring company, receiving an upfront payment (typically 70-90% of invoice value), and getting the remaining balance (minus fees) once the customer pays.

- Businesses can choose between recourse factoring (where they remain liable for unpaid invoices) or non-recourse factoring (where the factoring company assumes the risk of non-payment).

- Sectors with long payment cycles, such as manufacturing, wholesale, transportation, staffing, and healthcare, commonly use factoring to maintain steady cash flow.

- Approval depends on customer creditworthiness, outstanding accounts receivable, and a company’s financial history rather than just its credit score.

- The cost of factoring includes risk assessment, service fees, administrative expenses, and industry-related risks, making it more expensive than traditional loans.

- Factors like fee structures, contract flexibility, funding speed, customer service, and industry specialization should be considered when selecting a factoring provider.

- Deskera ERP streamlines the factoring process by automating invoice management, tracking payments, assessing customer creditworthiness, and integrating with financing partners to enhance cash flow efficiency.

Related Articles