Undocumented immigrants cannot be employed in the United States unless they are able to prove both their identity and their eligibility. Therefore, they are needed to complete Form I-9 which requires them to provide documents that prove their eligibility to legally acquire employment in the country.

In this post, we have described the entire process along with a section-wise break-up of the guidelines for a clear understanding by the employers and employees, alike.

History of Form I-9

Introduced in 1986, the Immigration Reform and Control Act legalized over 2.5 million undocumented immigrants. It also aimed to deter future such occurrences and rule out illegitimacy while employing.

The newly hired employees must submit the 25 documents required from them to establish that their identity and eligibility for acquiring employment in the US are genuine. The form entails a lot of details and both employers, as well as employees, must comply with the guidelines of the form.

Further in this post:

- What is Form I-9?

- What are the two primary purposes of an I-9 form?

- What are the Prerequisites for the Employees?

- I-9 Form Guidelines

- Retaining and Storing I-9 Form

- What are the documents required for the I-9 Form?

- Filling put I-9 for a Rehire

- Completing Form I-9 for Remote Hire

- E-verify: What is it?

- What is the Penalty for Incorrect I-9?

- Form I-9 Compliance 2021

- What is Form i-9 Tentative Nonconfirmation?

- Form I-9 Best Practices to Avoid Penalties and Fines

What is Form I-9?

Employment Eligibility Verification, or Form I-9, is a United States Citizenship and Immigration Services (USCIS) document that verifies an employee's identity and employment authorization. All employers in the U.S. are required to complete Form I-9 for every employee they hire.

The form must be completed by employees as well as their employers or authorized representatives. A valid employment authorization must also be attested by the employee, along with acceptable documentation proving their identity and eligibility to work.

For I-9 verification, the employer has to examine the employment eligibility and identify the documents of an employee. This is to be done to assess the authenticity of the documents. The employers must then record the document information on the Form I-9.

What are the Two Primary Purposes of an I-9 form?

The two primary purposes of the I-9 form are:

- To verify the identity

- To verify the eligibility of an employee for employment

What are the Prerequisites for the Employees?

The employees are required to correctly identify the category that best describes them or under which they can place themselves. These categories are:

- A U.S. citizen

- A non-U.S. citizen

- A lawful permanent resident

- A foreigner authorized to work

I-9 Form Guidelines

All the hirers or employers in the U.S. are required to fill out form I-9 with complete accuracy. They must abide by the instructions and compliance policies with which the form needs to be filled out. Let’s learn about the instructions designed for the process:

Form I-9 Section 1- Employee Information and Attestation

As soon as an employer offers the job and the employee accepts the work offer, they must fill out Section 1 of the Form I-9 on the first day of work or before the first day.

Here are the detailed set of guidelines:

For Employees

- An employee fills out Section 1 of the form with their full legal name, middle initial, and maiden name, if applicable

- Address and birth date must be provided on the form

- Unless the employer uses E-Verify, employees do not have to provide their social security numbers

- A citizen or employment-authorized immigration status of the employee must be attested under penalty of perjury, as well as the Alien or Admission Number, if applicable, and the expiration date of employment authorization

- Section 1 must be signed and dated by the employee certifying that the information is true

- Even if a translator assists in completing Section 1, they still need to sign the form.

- Additionally required is the translator's name, address, signature, and date

For Employers

The employers must verify that true and accurate information is collected from the employees in the form. They just ensure the following:

- Mandatory fields are completely and accurately filled in

- The employees must provide their Social Security Number in case they opted to fill out through the E-verification system

- The employees have signed and dated the forms appropriately

- The translator, if used, has also signed and dated the document as required

Additionally, the employers must also ensure the following:

- Check if the employees have provided any indications in Section 1 that their employment authorization will be expiring

- Check if the expiration date provided by the employee in Section 1 is the same as the one in the List A or List C document which they presented for Section 2, Employer Review, and in Attestation

Form I-9 Section 2 - Employer Review and Attestation

Section 2 of the form is required to be completed by the employer within three working days from the hiring date of the employee. The hire date, here, refers to the first day of work of the employee.

Responsibilities of the Employee for Completing Section 2

Employees need to present original and valid documents to the employer which convey their identity and authorization for employment. The employees can choose the documents for presenting for validating their identity.

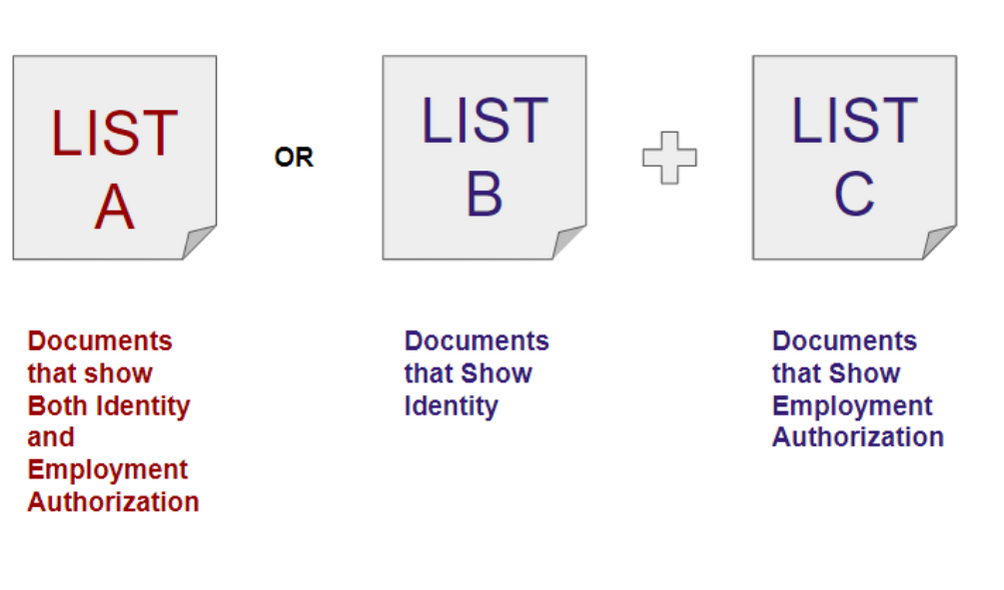

Employees need to provide:

One document from List A

OR

One document from List B combined with a document from List C

Where,

- List A comprises documents required for verifying both, identity and employment authorization

- List B comprises documents required that show only the identity

- List C comprises documents to show only the employment authorization

Responsibilities of the Employer for Completing Section 2

The responsibility of the employer requires them or any of their authorized representative to physically check and verify the forms and documents submitted by the employee. Once verified, the employer or the representative must sign the form.

Here is what the employer or the representative must do:

- At the top of Section 2, enter the employee's first name, last name, and middle initial and the employee's citizenship/immigration number

- If your employee presents a document, make sure it is original and on the list of acceptable documents or an acceptable receipt

- Check each document physically to ensure it appears genuine and is related to your employee presenting it. The employee can be allowed to present other documentation from the Lists of Acceptable Documents if the initially submitted document does not appear not to be genuine or related to the employee

- From Section 1, enter your employee's Last Name, First Name, and Middle Initial (if provided)

- If applicable, enter the title, the issuing authority, the number, and the expiration date of the original documents your employee presented. Indicate the date when your employee began work

- Provide the first and last name, signature, title, along with the date of completion of Section 2 for the person completing it

- Provide the address and name of the employer. If your company has multiple locations, choose the address that best represents the office of the employer.

- Return the documents to the employee

Entering Dates in Section 2

Section 2 requires entering the dates in two specific spaces. These dates are:

- Your employee’s first day of employment

- The day on which you (the employer) examined the documents provided by the employee to show identity and employment authorization

Retaining and Storing I-9 Form

A federal government inspection of an employer's I-9 record can happen at any time. Therefore, maintaining a record of the I-9 Forms by the employers is imperative. In other words, they need to be prepared to provide I-9 records for all current employees, including for terminated employees within the retention period. They must do this for either three years from the hiring date or one year from the date of termination, whichever is later.

Workplace or other locations may store I-9 records, but the documents must be accessible to a central location quickly. 72 hours' notice is legally required for official notices to produce documents for inspection.

Employee I-9 records should not be kept in individual personnel files because it may be difficult to retrieve the records in time for an official inspection within the three-day deadline. This is especially true for large organizations where the number of employees can be huge. In order to comply with retention requirements, monitor review dates, and prepare for government audits, it is critical to organize storage systematically.

What are the Documents Acceptable for the I-9 Form?

The prospective candidate or employee must provide documents in order to prove their eligibility for employment. The documents required could be from different Lists as shown in the image.

List A: Documents to Show Both Identity and Employment Authorization

The documents under this category are:

- U.S. Passport or U.S. Passport Card

- Form I-551, Permanent Resident Card or Alien Registration Receipt Card

- Foreign passport with a temporary I-551 stamp or temporary I-551 printed notation on a machine-readable immigrant visa i.e. MRIV

- Form I-766, Employment Authorization Document (EAD) accompanying a photograph,

- A foreign passport with Form I-94 bearing the same name as the passport and an endorsement of their nonimmigrant status, for nonimmigrant aliens who have been authorized for employment on the basis of their nonimmigrant status

- Passport from the Federated States of Micronesia (FSM) or the Republic of the Marshall Islands (RMI) with Form I-94 that indicates nonimmigrant admission under the Compact of Free Association Between the United States and the FSM or RMI

List B: Documents that Show Identity

In the case where the employees are not able to present the documents mentioned in the above section (List A), they are required to present a combination of the documents as mentioned in this section for List B and List C:

- Driver’s license or ID card issued by a state or outlying possession of the United States provided it contains a photograph or information such as name, date of birth, gender, height, eye color, and address

- U.S. Military card or draft record

- Native American tribal document

- U.S. Coast Guard Merchant Mariner Card

- ID card issued by federal, state, or local government agencies or entities, provided it contains a photograph or information such as name, date of birth, gender, height, eye color, and address

- Military dependent’s ID card

- Driver’s license issued by a Canadian government authority

- School ID card with a photograph

- Voter’s registration card

List of Documents to be Provided For Minors

The following list is for the employees who are under the age of 18. They may not have the documents enlisted in the previous sections, and therefore, may present the documents as stated:

- School report card

- Doctor’s or clinic record

- Nursery school record

List C: Documents that Show Employment Eligibility

One of the following documents must be provided in combination with a document from List B in order to prove the employment eligibility:

- U.S. Social Security Card received from the Social Security Administration, except a card that states that it is not valid for employment

- Obtaining a birth certificate from the U.S. Department of State (Forms DS-1350, FS-545, FS-240)

- Certified copy or original of a birth certificate received from a municipal authority, state, county

- Document of Native American tribal

- Form I-197 or U.S. Citizen ID Card

- Form I-179 or ID Card for use of a Resident Citizen in the United States

- Unexpired employment authorization document received from the Department of Homeland Security. This excludes the Form I-766, Employment Authorization Document, from List A

Filling out I-9 for a Rehire

Employers rehire workers based on company policies and on the date that the previous I-9 was completed. The employers have the authority to decide whether they want to use Section 3 of existing I-9 forms when possible, or if they will do a new I-9 for all rehires.

In the event that an employer rehires an employee within three years from the date the previous Form I-9 was completed, they can use Section 3 instead of completing a new one.

An employer must record the information in Section 3 of the Form I-9 if an employee previously indicated they were authorized to work for a limited period and that period has expired. This is known as verification. Employers who are reverifying employees with Section 3 should make sure to use the latest Form I-9 available.

A new Form I-9 must be completed if there has been an interval of over three years from the time the original I-9 was completed, with the employee being treated as a new hire.

Completing Form I-9 for Remote Hire

Employers who hire remote employees should follow I-9 verification requirements and ensure continued I-9 compliance. In situations where employers cannot physically verify I-9s with employees, employers onboard remote workers. They must appoint authorized representatives to complete Form I-9 in such cases.

Employers, through their authorized representatives, must ensure that all Form I-9 compliance responsibilities are met, including those of personnel officers, foremen, agents, or notaries. To determine whether the documents on Form I-9 have been verified as genuine and related to the presenter, the examiners physically examine the documents.

To ensure that standard procedures and instructions are followed, employers who authorize representatives to verify Form I-9 should develop standard procedures and instructions. Include instructions on what the representative should do, provide guidance on what to do after they have completed their role, and instruct the representative to sign any additional business documentation.

For employers who designate authorized representatives to fill out Form I-9, they must list standard procedures and instructions. In addition to directions for the representative to follow, the instructions should also include information for the employee on what to do after the representative has completed his or her duties. They must also add instructions for the employee to sign any additional business documentation if required.

When an employer assigns a notary to act as an authorized representative for the I-9 completion process, the notary performs the job as of the authorized representative. Thus, notary seals should not be provided on the I-9 Form.

E-Verify: What is it?

E-Verify is a web-based or online system that compares information from Form I-9, Employment Eligibility Verification, entered by an employer with records maintained by the United States Department of Homeland Security and the Social Security Administration to confirm employment eligibility.

Is E-Verify Mandatory?

Federal acquisition regulations (FAR) E-Verify clauses require E-Verify if an employer has federal contracts or subcontracts that contain the clause. Other than this case, in most cases, E-verification is voluntary.

Alabama, Arizona, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Nebraska, North Carolina, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Florida, and Virginia already have laws regarding E-Verify use.

E-Verify: How It Works

After the Form I-9 is completed, the E-Verify process can begin as soon as possible, but before three business days after the new hire's start date. A company enters I-9 form information into E-Verify.

- E-Verify compares the data entered into the system to a database maintained by the Social Security Administration and the Department of Homeland Security.

- When the information matches, E-Verify will return a result of Employment Authorized.

- An E-Verify mismatch will result in a Tentative Nonconfirmation (TNC) result.

In most cases, this is resolved within 3 business days.

Verifying I-9 Remotely during COVID-19

A remote I-9 verification of the original documents was permitted due to the Coronavirus outbreak. It wasn't acceptable to review documents using webcams until March 20, 2020, when DHS announced that there is a temporary amendment in the Form I-9 verification and re-verification procedures.

Even when an employer is unable to be physically present for the I-9 process, they can still comply with the I-9 requirements. It is important, however, that employers and their representatives follow the right procedures to avoid possible penalties in the event of a government inspection of I-9 forms.

Consequently, electronic I-9 verification enables remote workers to submit their I-9 forms on time by completing the form remotely.

Advantages of Using E-Verify for I-9 Verification

The advantages of using E-Verify are mentioned in the following:

- Employers can utilize third parties to conduct E-Verify. Additionally, with an internet connection and a computer, E-Verify can be accessed at any time

- Results of the I-9 verification check are available almost immediately

- The system is accurate at detecting errors and mismatches with government records

- By preventing document fraud and verifying the validity of the documents, the E-Verify photo tool ensures authenticity

What is the Penalty for Incorrect I-9?

The agents and auditors at the Immigration and Customs Enforcement (ICE) may discover technical or procedural errors while reviewing forms for I-9 compliance. Employers get a duration of 10 business days to correct errors in this case.

Any employer convicted of knowingly hiring or continuing to employ unauthorized workers will have to cease that illegal activity. For all technical and substantive violations, an employer can receive a monetary fine. They could also be fined or criminally prosecuted in certain situations.

ICE may also debar an employer who has knowingly hired or continued to employ unauthorized workers, preventing the employer from receiving federal contracts or other government benefits.

Penalties range from $375 to $16,000 for hiring and continuing to employ violations. Repeat offenders receive the most severe punishments. Penalties range from $110 to $1,100 per violation for substantive violations, such as failure to provide a Form I-9.

ICE considers five factors when determining penalty amounts, which are:

- The expanse of the business

- Business's compliance efforts

- The severity of the violation

- If unauthorized workers were involved

- Previous violations of I-9 compliance

Form I-9 Compliance 2021

Completing Form I-9 is a straightforward process. However, it is mandatory for employers to ensure and verify that all the documents and the data shared by the employees are clear and accurate. The form needs them to maintain compliance and follow the instructions closely to eliminate any chances of any human errors and dodge the penalties that follow.

In the next few sections, we shall learn about the steps to be taken after the TNC is initiated or issued to the employers. What follows are the steps to comply with the procedure after the TNC is issued.

What is Form I-9 Tentative Nonconfirmation?

A Tentative Nonconfirmation, also known as TNC, is issued to those employers whose I-9 information does not match the data of the Department of Homeland Security (DHS) or Social Security Administration (SSA).

An SSA TNC may be issued for the following reasons:

- SSA is not updated about the employee's citizenship or immigration status

- Any of the three factors: Employee's Name, Social Security number, or date of birth is incorrect in SSA records

- SSA was not reported about the name change of the employee

- the employer entered the information incorrectly

- SSA records contain another type of error

An employee may be issued a DHS TNC if:

- In DHS records, there is an error in the entry of name, A-number, I-94 number, and/or foreign passport number

- Immigration or citizenship status had not been updated

- The information on U.S. passports, passport cards, driver's licenses, or state ID cards could not be verified

- There's another error in the record

- Records at DHS had not been updated

- The employer failed to enter the information correctly

The TNC Result from E-Verify

This section elaborates on the instances that take place once a TNC is generated from E-Verify. Let’s learn more about the following cases:

Employees are informed of the TNC by their employers

A TNC case result displayed by E-Verify requires the employer to inform the employee. It is the employer's responsibility to print and give the employee the Further Action Notice (FAN). The FAN informs the employee about the following:

- There should be a clear indication of whether the TNC is part of the Social Security Administration or the Department of Homeland Security. Employees must know which agency to contact for further action.

- What prompted the TNC.

- What options are available for employees after receiving the TNC

- Ways to resolve it.

Employers are also instructed how to notify employees of a Further Action Notice in the Further Action Notice. In particular, the employer is required to do the following:

- On the first page, sign the employer section

- The Further Action Notice should be printed and discussed with the employee privately

- For employees who are unable to read it, read it to them

- Employees who do not fully understand English should be provided with an English and a foreign language version of the Further Action Notice

- The employer is required to provide a copy of the signed Further Action Notice to the employee and keep the original with their records

- On the second page of the Further Action Notice, the employee should complete and sign the employee section

Employee opts whether or not to contest the TNC

Having received a TNC also comes with certain rights and obligations. When an employee receives a TNC, they must decide whether they want to contest it. The decision must then be communicated on the Further Action Notice.

- To resolve an SSA TNC, an employee must visit the SSA field office within eight federal working days of the TNC's creation

- To begin resolving a DHS TNC, the employee must contact the agency within eight federal government working days of receiving the TNC

The TNC will result in a Final Nonconfirmation if the employee decides not to contest it, in which case the employee could be terminated based on E-Verify. E-Verify requires the employer to notify whether the employee is terminated.

Employer mentions the employee’s case to SSA or DHS

If an SSA TNC is received by an employee, they must go in person to an SSA field office to contest it. They can also speak to a DHS TNC within eight federal government working days. A Referral Date Confirmation will be generated when the employer refers to a case. The employer can print it and give it to the employee upon receiving it. The employee can then visit an SSA field office or call DHS to resolve the TNC on this date.

In the case where the employees contest a DHS TNC issued due to a photo mismatch, the employer should provide DHS with the document submitted by the employee.

The employers should allow the employee to continue working while the mismatch is resolved. Furthermore, employers should not take any kind of adverse action against employees because of TNC, till the matter is completely resolved.

Resolution by the Employee

The employee receives eight Federal Government working days from the time the employer refers the case to E-Verify to visit an SSA field office or call DHS. Employees should have their Further Action Notice along with any necessary documents when visiting SSA or contacting DHS. For resolving mismatches, the Further Action Notice consists of the description of the documents required.

If the employee is unable to take the required action to resolve the TNC within these 10 Federal Government working days, E-Verify automatically converts the case to SSA or DHS Final Nonconfirmation. An employer may terminate an employee only after receiving SSA or DHS Final Nonconfirmation.

Case updates in E-Verify

If the employee successfully resolves the mismatch, SSA or DHS will update their files and the E-Verify case will be updated. Once the mismatch is resolved, the Federal Government requires a couple of working days before the updated records are visible to the employer.

In most SSA TNC cases, the results are soon displayed as either Employment Authorized or SSA Final Nonconfirmation. On certain occasions, there may be additional actions required by the SSA from the employer, employee, or DHS.

When SSA updates a case, one of the following results will be reflected:

- Case in Continuance:

SSA may need more than ten Federal Government working days to confirm employment eligibility in rare cases. An employee may lose a document and apply for a replacement, like a birth certificate. SSA will not put a case on continuance until the employee visits SSA and tries to resolve the TNC. It is best to check the status of E-Verify regularly at such times.

- DHS Verification in Process:

Despite the employee's reconciliation with the Social Security Administration, E-Verify cannot instantly confirm employment authorization since it must manually review the records in government databases. E-Verify provides DHS with Verification in Process responses and in most cases results of I-9 verification within 24 hours for cases requiring manual review.

- Review and Update Employee Data:

The Social Security Administration may require the employer to review and correct the information entered into E-Verify and to update the case. The situation occurs when the SSA determines there are no errors in an employee's record after a TNC has been issued. This can be caused by the following:

- Typing error by the employee in E-Verify

- Form I-9, Employment Eligibility Verification, was filled out incorrectly by the employee

Employer closes the case in E-Verify

The employer must close the E-Verify case once the employee receives a final case status, such as Employment Authorized or SSA/DHS Final Nonconfirmation. Similarly, the employer must also indicate whether the employee was terminated if the employee received an SSA or DHS Final Nonconfirmation.

Form I-9 Best Practices to Avoid Penalties and Fines

Following are the recommended best practices for completing Form I-9 with compliance:

- All new employees should be screened for employment eligibility using E-Verify. Employers participating in E-verify demonstrate their commitment to keeping their employees within the legal boundaries

- The process requires only trained individuals to carry out a secondary review of the employee's verification. This ensures that there are no discrepancies and reduces the chances of human errors while filling it out

- The storage and retention of Form I-9 are to be done appropriately. Despite not having a legal regulation for the same, it is recommended that employers maintain a record of the same to produce, in case of ICE audits

- It is recommended that regular self-audits are performed to rule out any errors and thereby eliminate the possibility of penalties by the government

- Employers can also resort to using an effective electronic I-9 verification software to save time and reduce the potential for errors

How can Deskera Help You?

Deskera Books simplifies accounting for you and enables easy handling of online accounting and invoicing applications. With the tool, you can now access all your financial documents in one place, including invoices, expenses, and all your contacts.

If yours is a startup, then this platform is certain to impress you with its excellent enterprise features. Now, you can save your effort and time, and focus on the core aspects of your business rather than handling the mundane tasks.

Deskera also offers out-of-the-box templates that tend to uncomplicate your job with well-designed features. There are templates you can use to create quotes, purchase orders, back orders, bills, and payment receipts.

Drop shipping business owners can now expect to relax a bit with the platform making it convenient for them to create drop ship orders based on customer orders.

Another tool from Deskera is Deskera People that aims to expedite your regular tasks. Tasks like hiring, payroll, leaves, attendance, etc. are now a breeze owing to the tool.

Key Takeaways

Before we end the post, we must take a quick look at the major highlights of the article:

- Undocumented immigrants cannot be employed in the United States unless they are able to prove both their identity and their eligibility. Therefore, they are required to complete Form I-9

- Employment Eligibility Verification, or Form I-9, is a United States Citizenship and Immigration Services (USCIS) document that verifies an employee's identity and employment authorization

- The two primary purposes of the I-9 form are to verify the identity and to verify the eligibility of an employee for employment

- There are various guidelines the need to be adhered to by the employers as well as employees before completing the Form I-9

- A federal government inspection of an employer's I-9 record can happen at any time. Therefore, maintaining a record of the I-9 Forms by the employers is imperative

- Workplace or other locations may store I-9 records, but the documents must be accessible to a central location quickly

- Employees need to provide one document from List A OR one document from List B combined with a document from List C

- E-Verify is a web-based or online system that compares information from Form I-9, Employment Eligibility Verification, entered by an employer with records maintained by the United States Department of Homeland Security and the Social Security Administration to confirm employment eligibility.

- E-Verify compares the data entered into the system to a database maintained by the Social Security Administration and the Department of Homeland Security.

- Penalties range from $375 to $16,000 for hiring and continuing to employ violations. Repeat offenders receive the most severe punishments. Penalties range from $110 to $1,100 per violation for substantive violations, such as failure to provide a Form I-9

- A Tentative Nonconfirmation, also known as TNC, is issued to those employers whose I-9 information does not match the data of the Department of Homeland Security (DHS) or Social Security Administration (SSA)

Related Articles