Are you abiding with I-9 compliance regulations? If not, you could be on the verge of attracting unwanted liabilities and penalties.

The I-9 form is essential to your people management. All major and small businesses need to be mindful of the correct completion of the I-9s. When it comes to this ostensibly routine federal procedure, you could believe you have everything under control; yet, there are some factors to take into account when it comes to immigration law.

This article might assist you in avoiding the I-9 filing errors that employers make all too frequently.

- What is the I-9 form?

- Common Mistakes to avoid on your I-9 Forms for 2022

- Who corrects the mistakes in the I-9 form?

- How can the employers correct the mistakes in the I-9 form?

- Best practices for filling in I-9

- Penalties for I-9 Form Violations

- Things to Know about I-9 Internal Audit

- I-9 Form FAQs

- How can Deskera help you?

- Key Takeaways

What is the I-9 form?

Every person who is eligible for employment within the United States must have the I-9 Employee Eligibility form. Since the implementation of the Immigration Reform and Control Act of 1986, all employers are required to complete the I-9 form for each new employee they recruit. Although it was initially developed by the United States Citizenship and Immigration Services, it is now required of every employee recruited in the United States. This is to prevent the employment of anyone who is not legally allowed to work in the United States.

Even though volunteers and contractors are exempt from the I-9 requirement, hiring a contractor who is not authorized to operate in the nation will probably result in harsh consequences and penalties.

Despite its frequent use, we often tend to come across mistakes pertaining to the I-9. Even the smallest mistakes can result in fines of hundreds or even thousands of dollars.

Common Mistakes to avoid on your I-9 Forms for 2022

For ease of understanding, we shall be visiting the different sections of the I-9 form. This will helps us get a grip on the factors each section encompasses and the common errors that occur in each one of them.

Purpose of Section 1 of the I-9 Form

The employee must fill out Section 1 of the I-9 on or before they report for the first day of work. Employees are questioned in this part about their citizenship and employment authorization.

Employees are required to submit the following personal details:

- Name

- Address

- Date of Birth

- Citizenship status

- Social Security number

- Work Authorization status

Duties of the employer

Employers are required to check that each employee dates and signs their name. A violation occurs if even one of these items is absent. It is possible to enter your phone number and email address here, but doing so is not required. It is best to use a company official or employee as your translator rather than a family member.

Common mistakes in I-9 Section 1

The following mistakes are frequently found in the first section of the I-9:

- Failing to complete Section 1

- I-9 form misplacement

- The box for immigration status is not checked

- Incorrect date or signature

- Incomplete or missing address

- Missing A# number

Purpose of Section 2 of the I-9 Form

The employer is responsible for Section 2 and must be completed three business days after an individual has been hired. This implies that if an employee starts on a Monday, Section 2 must be completed by Thursday. In case they become separated, a piece of pro advice is to write the company name and ID at the top of each document.

Here is the list of recognized documents required for the completion of this section:

- List A: Documents that prove identification and authorization from the employer

- List B which comprises Identity-establishing documents

- List C, which includes Documents proving employment authorization.

Duties of the employer

The employers have the following responsibilities to fulfill:

- Examine the appropriate document(s) that prove the employee's identification and eligibility for work

- Refusing to accept expired documents. A new Social Security card receipt is accepted as documentation, but the new card needs to be presented within 90 days.

- List A or Lists B and C should be filled up with the title, number, and expiration date of the document.

- Enter the start date of employment

- Document(s) must be examined and signed, along with the firm name, representative's name, and other information.

Common mistakes in I-9 Section 2

I-9 form Section 2 mistakes that are frequently discovered include the following:

- Failing to complete and sign the I-9 form within three days of your first day of work

- Failure to finish List A, Lists B, or List C

- The company representative fails to Sign Section 2

- Over-documentation. This must be avoided as it implies an intent to discriminate. If List A is satisfactorily completed, there is no need to complete List C. This may cause the Department of Justice – Immigrant & Employee Rights division to launch an inquiry.

Purpose of Section 3 of the I-9 Form

The employer is also accountable for Section 3, which deals with re-verifying documents that have expired. This area is typically left empty.

Permanent residency cards, green cards, passports, and driver's licenses do not require re-verification. However, if an employer does not complete re-verification despite it being necessary, then the employer is deemed to have intentionally hired an undocumented worker.

The acceptable documents that require re-verification include visas and EAD– Employment Authorization documents.

Common Mistakes during the I-9 verification process

The section entails some of the common verification mistakes that employers need to watch out for. They must ensure the following to keep these verification mistakes at bay.

- Accept original documents only.

- Do not accept a document that has expired.

- Do not ask the job-seeking candidates to complete their I-9s until you have made an employment offer.

Who corrects the mistakes in the I-9 form?

The mistakes while completing the I-9 form must be corrected by the respective individuals who filled in the particular section of the form.

- Mistakes in Section 1 must be corrected by the employees.

- Mistakes in the Sections 2 and 3 must be corrected by the employer along with the individual responsible for the collection and verification of the documents.

How can the employers correct the mistakes in the I-9 form?

When there are several mistakes, it is advisable to fill out a new form and link it to the original. Include a message outlining the rationale behind the adjustments.

- Use a different color pen to add your initials and the date if there is any missing information.

- If the information has been written in the incorrect list, add initials and the date, again preferable, in a different color pen. You may point out and direct them to the correct list.

- Cross out any extra information in the documents.

Penalties for I-9 Form Violations

The United States Immigration and Customs Enforcement agency ICE has the authority to impose penalties for incomplete or erroneous I-9 forms. Over the years, I-9 offenses have begun to carry harsher consequences.

The number of breaches and firm size are two criteria that affect the severity of penalties.

The potential punishments now fall into the following categories:

- In 2022, the fines for 1–9 paperwork violations range from $252 to $2,507 for a first offense for substantive violations or the faults that remain uncorrected.

- The fine range for second and subsequent paperwork infractions is $1,161 to $2,322.

- Penalties for recruiting, referral, and rehiring violations for each knowingly hired unauthorized worker range from $627 to $5016 for first offenses.

- For second and subsequent crimes, the fines range from $5,016 to $25,076.

Has COVID-19 changed the I-9 Compliances?

The pandemic has hit all the sectors really hard and some federal procedures and compliances have also undergone some changes following the pandemic. When we speak of the recent changes, we must know about the I-9 compliance modifications.

Due to COVID-19, the Department of Homeland Security loosened its requirements for in-person I-9 verification in March 2020. Originally intended to be a temporary solution, this had recently been extended through the end of April 2022.

How do the changes affect the compliance scenario?

Although the changes mentioned have come into effect, there is no indication if they will be permanently implemented. Let’s look at how these changes play out in the context of I-9 compliance.

- Employers who have all of their staff working remotely as a result of COVID-19 are exempt from the requirement to physically inspect the employees' identity and authorization documents. Initially, this only applied to organizations where every employee worked from home. Employers who have both local and remote employees, nevertheless, now have more options.

- Employees who were onboarded remotely must personally verify their documents when "regular activities" restart. Employers need to add "papers physically examined" and the date of the inspection in Section 2 "additional information" section.

- Within three business days after hiring, employers may view Section 2 documents remotely. This could be done through video, fax, or email.

- Employers must fill out the Section 2 "extra information" field with "COVID-19."

- Employers will no longer be able to accept out-of-date List B documentation for I-9 identity verification as of May 1, 2022. During the COVID-19 epidemic, the Department of Homeland Security's temporary policy permitted expired documents.

- Employers must revise the form I-9 by July 31, 2022, for any workers who previously supplied an expired List B document between May 1, 2020, and April 30, 2022. If the employee is no longer employed, there is no further action required at the employer’s end.

Best practices for filling in I-9

Here are a few mistakes that are typically discovered during an I-9 audit. First off, section 1 of the form needs to be finished before the conclusion of the employee's first day of employment with you, following the employee's acceptance of the job offer. Before the end of the first three days of employment, Section 2 must be finished. Copies of the employee's original legal identification documents must be submitted with this section.

To ensure that you are as ready as possible for an ICE audit, keep all of this information organized and close at hand. You should also conduct internal audits on a regular basis to look for any flaws or errors in your I-9 forms. Keep in mind that you must maintain all I-9 paperwork for a minimum of three years after the employee was hired. You must keep the I-9 for at least a year after the employment ends if it is terminated before then.

The following list of best practices for your I-9 is provided by the USCIS and the pointers shall guide employers in eliminating common mistakes. Ascertain to abide by the following:

- You are utilizing the I-9 form's most recent version.

- Everything is understandable and readable.

- The employee start date in section 2 corresponds to your payroll data.

- Copies of all forms and documents can be read without difficulty.

- Any acronyms or abbreviations are defined or otherwise understood.

- There is no missing information that could be relevant to the case.

- You have an English-language version of the I-9 except for Puerto Rico.

- You are not treating any employees differently or discriminating among them.

- There are no illegible stains, perforations, or rips in the paper.

Things to Know about I-9 Internal Audit

Internal audits can help you ascertain your liability and find errors. You would not have to be concerned about an ICE Notice of Inspection in this manner. Primarily, it is the size of your business that determines how frequently you must conduct an audit.

If your business is in a high-turnover sector, like manufacturing, you will probably need more routine audits than the average company.

To conduct your audit, you should ideally contact a skilled specialist or immigration lawyer. Make sure the employee in charge of reviewing your I-9 forms is not the same one who first filled them out if you decide to keep the process internal.

How does ICE conduct an Inspection?

As opposed to the common myth, the ICE does not carry out a surprise inspection. The I-9 forms are stored locally rather than being submitted to the government, so federal agents can only perform an examination if you are there or if you send them supporting documentation via certified mail.

This implies that you will always be made aware of any inspections and will have a minimum of three days to provide documentation. Employers are required to display notices for employees if there is an inspection in California and Oregon.

I-9 Form FAQs

Some common questions regarding I-9 are depicted in this section.

Q: What is the purpose of the I-9 form?

A: The I-9 Form's goal is to guarantee that employers only hire persons who are legitimately able to work in the United States.

Q: An employee of my company has left. What should I do with their I-9 form?

A: According to federal law, forms I-9 must be kept for three years following the date of hire for an employee or for one year following the individual's last day of employment, whichever comes first.

Q: My recent hire never signed or dated the Form I-9's section 1. How do I act now?

A: Employers must never employ whiteout or backdate corrections on a Form I-9. Always keep written records of your efforts to adhere to Form I-9 standards. When a mistake is made, employers can create a written justification and include it with the Form I-9 in question. This is an excellent practice that could show that you are making an honest effort to complete the Form I-9 correctly.

Q: What types of violations of the Form I-9 can I be responsible for as an employer?

Within a specified number of days, the employee and employer must correctly complete and sign Form I-9. After being informed of infractions, employers often have a specific number of working days to fix them.

Q: How does I-9 play out when employees always work remotely?

A: Laws, in this case, differ from state to state; however, employers must authenticate the employees’ documents in person. (In person does not include video conferencing). Here are some methods employers can adopt:

- Inviting distant workers to in-person training.

- Making use of a distant company representative, a reliable agency, or a lawyer.

- Enabling two remote workers to confirm each other's paperwork.

Q: From where can I get the I-9 form in 2022?

A: The most recent I-9 form, with the code "10/21/2019," is accessible on the website of US Citizenship and Immigration Services. The most recent form became necessary on May 1, 2020. Since it was first produced in 1986, fresh I-9 forms are typically released every few years. It's crucial to remember that the present form will expire after October 31, 2022.

Q: Who is required to complete the I-9 form?

A: Both fresh employees and rehires must utilize the new form. Rehires may really also use Section 3 of the previous I-9 form. As long as they already have a valid I-9 on file, current employees should not fill out a new one.

Q: What obligations does an employer have while filling out an I-9 form?

A: Employers must ensure that the original I-9 documents submitted by the employees are verified to be true and pertain to the person submitting the document.

Q: How long should the employers retain the I-9s?

A: I-9 documents must be retained on file for every active employee. Former employees must be kept on file for either one year after their date of termination or three years after their date of hire, whichever comes later.

You can delete these records after the retention period has passed. However, it is recommended you always seek a second opinion to avoid having to explain to ICE why you mistakenly deleted the records they are requesting.

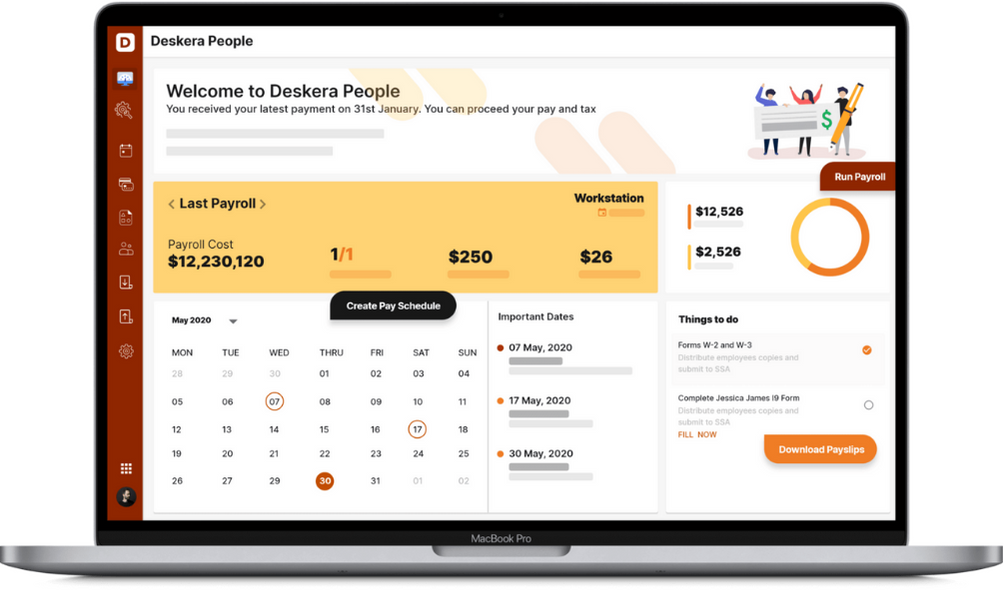

How can Deskera help you?

Deskera People is the HR-based software that you should rely upon when you want automation as well as efficiency when processing payrolls, generating customizable pay slips, calculating wages of your employees after considering their own pay components, managing employee leaves, and their on-boarding processes, and even fulfill the pay schedules of different groups of employees as per the industry-specific requirements.

Sign up now to avail more advantages from Deskera.

Key Takeaways

- All major and small businesses need to be mindful of the correct completion of the I-9s.

- Every person who is eligible for employment within the United States must have the I-9 Employee Eligibility form. Since the implementation of the Immigration Reform and Control Act of 1986, all employers are required to complete the I-9 form for each new employee they recruit.

- This is to prevent the employment of anyone who is not legally allowed to work in the United States.

- The employee must fill out Section 1 of the I-9 on or before they report for the first day of work. Employees are questioned in this part about their citizenship and employment authorization.

- Common mistakes in the Section 1 of the form include incomplete section 1, losing the form, incorrect date or signature, and missing A# number.

- The employer is responsible for Section 2 and must be completed three business days after an individual has been hired.

- Failing to complete and sign the I-9 form within three days of your first day of work and failure to finish List A, Lists B, or List C are some of the common mistakes made in the section 2 of the I-9 form.

- Common mistakes in the verification process of the I-9 form include accepting unauthenticated documents, accepting expired documents, among others.

- Mistakes in Section 1 must be corrected by the employees.

- Mistakes in the Sections 2 and 3 must be corrected by the employer along with the individual responsible for the collection and verification of the documents.

- In 2022, the fines for 1–9 paperwork violations range from $252 to $2,507 for a first offense for substantive violations or the faults that remain uncorrected.

- Ensure you are utilizing the I-9 form's most recent version and everything is understandable and readable.

- The employee start date in section 2 corresponds to your payroll data.

- Copies of all forms and documents can be read without difficulty. Any acronyms or abbreviations are defined or otherwise understood. Ascertain that there are no stains, perforations, or rips in the paper.

- There is no missing information that could be relevant to the case. Also, ensure that you have an English-language version of the I-9 except for Puerto Rico.

- Ensure you are not treating any employees differently or discriminating among them.

Related Articles