Happily Married! That is genuinely a nice space to be in. Apart from happiness, there are various other ways in which your marriage can benefit you.

Having your life partner as your business partner could be financially advantageous as you can save a lot on your taxes. Being a sole proprietor or an owner of a single-member LLC which has taxes similar to that of a sole proprietorship, you can look forward to cutting down your tax amounts. However, this is applicable only when your spouse is not your business partner.

If you are sure about getting your partner on board, this could be your opportunity to look at your business’s finances in a new light. We shall be giving away the top 5 things to be mindful of when you hire your spouse and yield profits with this husband-wife partnership in taxation.

Let’s see what this article has in it for you on this subject:

- 5 Things to keep in Mind while Hiring Your Spouse

- Let’s Talk about the Personal Benefits

- Final Thoughts

- How can Deskera Help you?

- Key Takeaways

5 Things to keep in Mind while Hiring Your Spouse

Spouses are a huge support system, and if you can get them to save you some dollars, then nothing like it! However, you must ensure you do not err here and invite trouble. Follow these tips to keep any trouble at bay.

Ensure your Spouse is a Bonafide Employee

First things first -- you must ensure that your spouse is not your partner in the company and you are the sole proprietor. When you determine to go ahead with an employment plan for your spouse in your business, know that it is not only about signing the offer letter and getting the basic documentation done.

The IRS will not take too long to pounce when it gets to learn that you have offered medical and health coverage without the spouse being your bonafide employee. What this means is that you must be able to generate proofs for the following situations:

Your spouse is not a partner in the business

If your spouse co-owns the business with you, that means they have entered a partnership with you; and that makes them a partner who is different from an employee. To avoid this, you must not have a shared business asset with your spouse. Besides, you must have your own separate business account, the control of which lies solely with you. This also implies that all the government filings and the contracts must be accomplished only under your name.

Your spouse receives a salary

Salary is yet another key aspect that helps your spouse emerge as a real employee. To achieve this, your spouse must have a separate salary account from which he or she makes monthly medical expenses and gets them reimbursed at the end of the month. Being the employer, the reimbursement must go from your business account to their salary account.

Your spouse works like any other employee at the office

Like all other employees in your company, you must have your spouse do chores that are helpful and related to your business. This could be either full-time or part-time, but the spouse must perform duties and carry out responsibilities in the office. They must also fill in the timesheet with all the particulars, including the type of work, the time spent doing a task, the date, and so on.

As the employer, it will be your duty to keep track of the number of hours worked by the spouse. Largely, it will be the timesheet that serves as a piece of evidence that your spouse is truly your employee and serves the company just like any other worker at the job.

Your spouse is subject to your authority and control

Your spouse should work for you and report to you on all management-related matters. This would be essential and effective in proving the "right of control" test that the IRS applies to assess if an individual is truly your employee. If they report to you and are subordinate to you, they become your employee.

Your spouse draws a fair and appropriate salary

Your spouse’s salary must primarily come from the fringe perks to facilitate tax savings. He or she must draw a reasonable salary to accommodate deductions. You may want to pay them more but refrain from any action that gets you under the lens.

The spouse must receive a salary that is well-suited for their job and which is at par with what others receive who perform similar duties. Obey employer regulations set forth by your state. Despite your spouse being the only employee, depending on your state's laws, you might still need to register as an employer and offer them workers' compensation insurance.

Paying Tax-free Employee Benefits to Your Spouse

Here, we must understand that the wages your spouse gets paid by you are completely taxable. Federal and state income taxes must be paid by your spouse's employer on all wages. Additionally, the Social Security and Medicare payroll taxes must be split equally between you and your spouse. You are required to withhold and pay these taxes to the IRS as your spouse's employer.

In your quest to achieve tax benefits, you must not miss out on the fact that by giving your spouse a salary, you are essentially shifting money from one area on your tax return to another.

So, how can you handle this?

You should pay your spouse wholly or primarily with tax-free employee fringe benefits rather than with salaries. Some job perks, including health insurance, are deductible expenses for you as the employer while they are not taxable income in the spouse-employee situation.

Additionally, you do not have to pay payroll taxes, file employment tax returns, or provide a W-2 for your spouse if you just pay them with tax-free fringe benefits.

Make Medical Reimbursement Arrangements

You should create a 105-HRA, or spousal health reimbursement arrangement, if your spouse is the lone employee of your company. This could be, by far, the greatest option to cover medical costs when you run your own business. Your 105-HRA is not restricted by the Affordable Care Act (ACA), which forbids stand-alone HRAs, because you only have one employee.

After all, the greatest financial employee fringe benefit you might furnish your spouse is typically health insurance. Health insurance premiums and other medical expenses for your spouse, yourself, and your family members under the age of 27 can be turned into totally deductible company expenses by hiring your spouse. You will need to work around it carefully and meticulously to bring about the appropriate kind of plan.

You can lower your taxable income for Social Security and Medicare taxes in addition to income taxes by deducting these medical expenses as a business expense.

At this point, you may wonder if there is a concept of minimum wages that you will have to pay to your spouse. Well, there is no federal or state regulation that mentions so. In most states, there is no concept of minimum wage if you are a sole proprietor who hires their spouse. It is only in the case of an LLC that you will have to abide by the minimum wage rules.

You can deduct the employee fringe benefits you give your spouse without having to pay them any monetary compensation. The only prerequisites are that your spouse is an actual employee (a bonafide employee) of your business and that the total remuneration you offer is fair.

What are 105 plans?

A sort of health reimbursement plan called a Section 105 plan enables small firms to tax-free cover their employees' medical expenses. Among Section 105 plans, health reimbursement arrangements or the HRAs are a common design. Especially in self-insured plans, Section 105 plans play a significant role in the market for company-sponsored health insurance.

Self-insured Section 105 medical reimbursement plans provide flexible, affordable, and long-lasting solutions for employee benefits. As a result, they're considered a replacement for standard group health insurance.

How does this work for you?

Here is how it works:

- Your spouse enrolls the entire family in their own health insurance policy under their name; this will also include you. Your spouse receives payment from you as the employer for the premiums.

- You pay your spouse back for all of your family's deductibles, copays, and other medical costs that aren't covered by insurance. Almost all deductible medical expenses can be reimbursed to your spouse.

- The amount you can compensate a spouse-employee with a 105-HRA is not capped by the IRS. However, the overall sum should be appropriate for the work that your spouse does.

- Your spouse receives the entire cost as a tax-free employee fringe benefit. Now, this entire sum can be written off by the employer as a regular business expense for an employee benefit program.

However, an important point to remember is that you will not be eligible to use the 105 plan if you have more employees, that is, employees other than your wife or husband. This is because there are restrictions imposed by the ACA. Yet, you may use ICHRA - Individual Coverage Health Insurance Arrangement to cover both your spouse and other employees.

Your spouse and other workers can get Medicare or their own private health insurance through an ICHRA. Your family should be a part of your spouse's HRA; also, your employees must provide proof of insurance at the end of the year.

Your spouse and other employees are given a monthly amount of tax-free money that they can use to cover their health insurance premiums and other uninsured medical expenses. You must set aside this amount being the employer.

Another advantage is that you do not have any caps on the amount you set aside for the allowance. Furthermore, you can also be selective when it comes to who gets a higher or a lower amount among your employees.

NOTE: The 105-HRA and the ICHRA would not be applicable if your company is an S corporation. In that case, your spouse is not regarded as your employee and is not eligible for employee health benefits if you own more than 2% of an S business.

Add-on Other Perks for your Spouse

The following are significant tax-free employee fringe perks that you can provide your spouse.

Education: You may deduct the cost of your spouse's employment-related education, which is not considered compensation for your spouse.

However, watch out for Section 127 education programs that state that the employers are permitted to make tax-free contributions of up to $5,250 annually to eligible employees for qualified educational costs under Section 127 of the Internal Revenue Code. Payments must be paid in line with an employer's approved educational assistance plan in order to be eligible.

Term life insurance: Employers are permitted to give employees tax-free group term life insurance coverage up to $50,000.

Fringe benefits for working conditions: These are costs for things that assist your spouse in performing their profession. For instance, you can write off the price of a smartphone your spouse uses for work. Your spouse is not required to document how the smartphone is used for work.

Marginal fringes: Certain forms of infrequent employee benefits that are reasonably affordable are tax-free and deductible by the employer. Sporadic meals and snacks, tickets to concerts, events or plays, and flowers or fruit on special occasions are some examples in this category.

Watch Out for Some Tax-Free Benefits

While you want to offer some employee perks to your spouse, be cautious about certain rules.

Education plan under Section 127: As we have learned in the previous subsection, the 5 percent ownership rule prohibits you from offering Section 127 benefits to your spouse and dependents.

Transport advantages: We are aware that you can give your spouse tax-free transportation perks if you both work from home. For parking close to your place of business or for transit passes in 2020, you can expect to pay up to $270 per month. The Tax Cuts and Jobs Act, however, prevents you as the employer from deducting the tax-free transportation perks provided to your employees.

Eventually, you shall realize that the transportation fringe perk isn’t really beneficial to you and your spouse as your spouse is your employee in this scenario.

Let’s Talk about the Personal Benefits

Having your spouse around you in the office can be an added advantage to the perks already discussed. Who doesn’t want to dwell on the feeling of being home away from home! Apart from the business operations, you can also get to devote a few moments to togetherness. Besides, here’s what you can achieve from the arrangement:

Ask for opinions and suggestions

You can freely ask your spouse to chip in suggestions and opinions even in cases where they are not really required. However, unlike in the case of a regular employee, your spouse can certainly go out of their way to reach a decision or cross over a dilemma. Likewise, it would be easier for you, too, to let them know if you feel something does not work for you.

For example, you may want a specific marketing assignment to take off in a particular way. You may convey the same to him or her without hesitating.

Recognize and honor each other’s strengths

Having your spouse as your employee could be a great boon in disguise. It offers you the opportunity to identify their strengths at work. You can get to know them beyond the person they are and help them in areas where they fall short. The same can be applied to you when you are looking for an expert comment or a second opinion on a specific task or business decision.

No Payroll Required

Although this may be more of a business benefit than a personal one, it is a benefit, after all. If you are the only owner or do not have any other employees except your spouse, you do not really need to have a payroll system. With much less employee-related work to take care of, you have to care only about paying your spouse. This could eventually be a huge relief.

Final Thoughts

You must be able to prove that your spouse is an actual employee for the IRS to not challenge your spouse-employee deductions.

If you pay your spouse exclusively or primarily with tax-free employee fringe benefits instead of taxable wages, hiring your spouse can result in significant tax savings. You are not required by the IRS to give your spouse any W-2 wages, either.

Reimbursement for health insurance and uninsured medical bills is the most beneficial fringe perk you can offer your spouse-employee. If your spouse is your only employee, you can do this through a 105-HRA plan. If you have many employees, you can do this through an ICHRA.

Health benefits are not the only tax-free employee fringe benefits; you can also offer specific education, life insurance, and working condition advantages.

How can Deskera Help you?

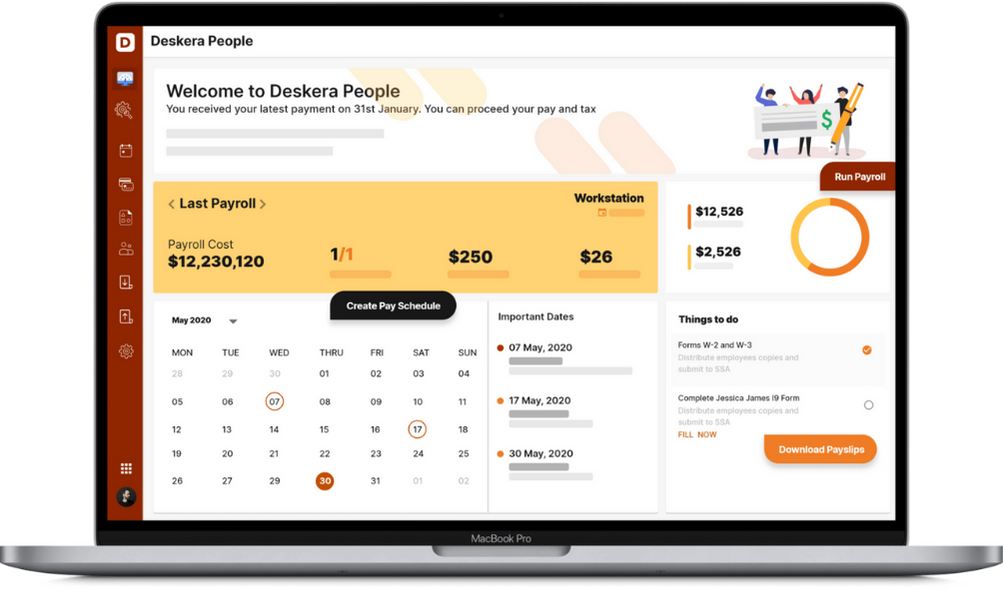

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, creating new leave types, and more, it makes your work simple.

Key Takeaways

Being a sole proprietor or an owner of a single-member LLC which has taxes similar to that of a sole proprietorship, you can look forward to cutting down your tax amounts. Here is a list of things to do and things to avoid:

- You must ensure that your spouse is not your business partner and is a bonafide employee instead.

- You can prove this by paying them appropriate salaries and assigning them responsibilities just like any other employee.

- Paying Tax-free Employee Benefits to Your Spouse is another way of saving on tax amounts.

- Making medical reimbursement arrangements is a fantastic way in which you can lower your taxable income.

- Self-insured Section 105 medical reimbursement plans provide flexible, affordable, and long-lasting solutions for employee benefits. As a result, they're considered a replacement for standard group health insurance.

- The 105-HRA and the ICHRA would not be applicable if your company is an S corporation. In that case, your spouse is not regarded as your employee and is not eligible for employee health benefits if you own more than 2% of an S business.

- Watch out for Section 127 education programs that state that the employers are permitted to make tax-free contributions of up to $5,250 annually to eligible employees for qualified educational costs under Section 127 of the Internal Revenue Code. Payments must be paid in line with an employer's approved educational assistance plan in order to be eligible.

- Recognizing each other’s strengths and capabilities is one of the personal benefits you can derive from the husband wife partnership in taxation.

Related Articles