All the goods and services to be used in India GST are classified by an HSN code (Harmonized System of Nomenclature) and by the SAC (Service Accounting Codes) and will help to remove the hurdle/obstacle in the international trade. In addition, these HSN and SAC codes have been used in invoices and record-keeping, wherein the goods and services offered can be identified easily.

With effect from 1st July 2017, Goods and Service Tax(GST) was introduced in India. GST is an indirect tax and follows the concept of one nation, one tax for the entire country. It is imposed on the supply of goods and services.

In this article, we will cover what these codes are, where you can find them under GST, and how you can use HSN in India.

What Is Harmonized System of Nomenclature (HSN)?

HSN (Harmonized System of Nomenclature) has been introduced for an orderly classification of goods worldwide. This code is a uniform 6-digit code that helps to classify more than 5000 products. It came into effect in 1988 and was developed by the WCO(World Customs Organization).

The HSN system is recognized internationally for codifying and classifying all the products worldwide. In addition, the WTO(World Trade Organization) and individuals use the HSN system to trade and trade negotiation.

21 sections of HSN code

What Is Service Accounting Code (SAC)?

Service Accounting Code, also known as SAC, is the code issued by the Central Board of Indirect Tax & Customs (Service Tax Department) to classify and identify the services offered. Each Service provided has a unique SAC code precisely like a unique HSN for different categories of products.

People involved in providing services can and should use the SAC code to understand the tax imposed on the services offered and received clearly.

SAC (Services and Accounting Code) codes are based on the Harmonized System of Nomenclature, an internationally recognized system for classifying and codifying all the products in the world. This system enables the compliance of GST based on international standards.

Who Can Use HSN & SAC Codes under GST?

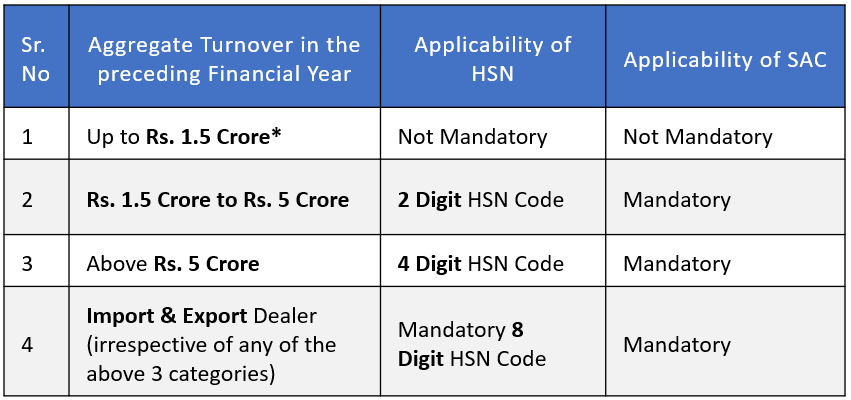

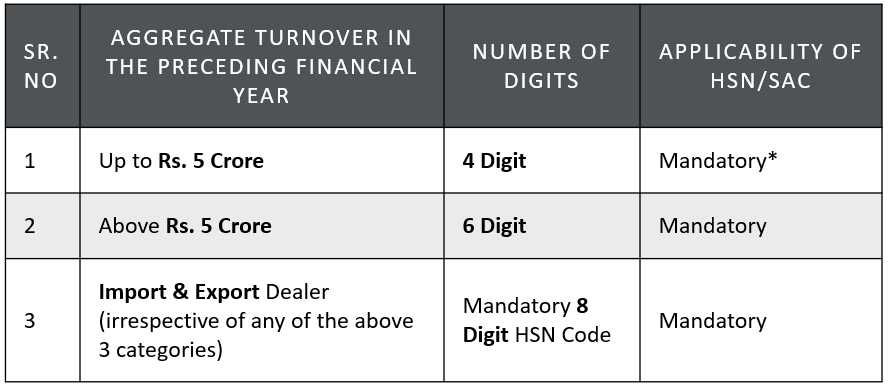

Under GST, HSN and SA codes shall have 3 different categories.

Dealers under Composition Scheme who are exempted are not required to quote HSN.

The above categories were amended vide Notification No. 78/2020- Central Tax, dated 15th October 2020 to mandate 4/6 HSN / SAC Code digits on supply of goods or services on the Tax Invoices w.e.f. 1st April 2021.

*In the case of B2C invoices, HSN/SAC is optional for turnover below Rs. 5 Crore.

Further, there was an addition in the above categories & was again amended vide Notification No. 90/2020- Central Tax, dated 1st December 2020, to provide for a class of chemicals supply. Therefore, the 49 chemicals are specified in the enclosed Annexure have to show under eight digits compulsorily.

Structure of HSN Code

Above, we have seen the basic concept of HSN. Now let us look at its structure.

The HSN code contains:

- 21 sections.

- 99 chapters.

- 1244 headings.

- 5224 subheadings.

For Indian manufacturers, it is required to follow the three tired HSN structures.

There are about 21 groups in the HSN structure, and further, these groups are categorized into 99 chapters. Then these chapters are divided into headings with 1244 in number. These headings are then subsequently divided into 5224 subheadings.

The HSN Codes plays out in the below manner:

- Named as a 2-digit HSN number for each chapter.

- 2-digit each HSN number is then sub-categorized into a 4-digit HSN code.

- Further, such four-digit HSN codes are sub-classified into the six-digit HSN code.

Example of an HSN code - schematic

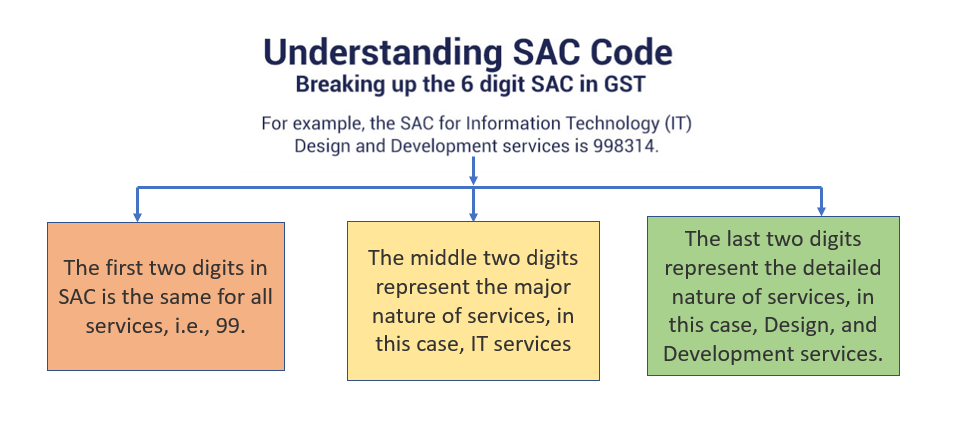

Structure of SAC Code

Breaking up the 6 digit SAC in GST

For example, the SAC for Information technology (IT) design and development services is 998314.

Where to Mention HSN / SAC Code?

The taxpayers shall mention all the following instances, HSN for goods and SAC for services.

1. GST Registration

Every business under GST will need to declare the goods and services type that they are dealing with. Thus, it is essential to mention the correct HSN/SAC code at the time of registration.

2. GST Rate

For goods and services, if the taxpayer is aware of HSN/SAC code, he can easily determine the GST applicable rate.

3. GST Invoice

When a seller issues an invoice for goods and services, he needs to mention the HSN/SAC code in the invoice, which is based on the total turnover of his business.

4. GST Returns

When the taxpayer files the GST Return, he needs to report the HSN Summary. The summary consists of the details of goods and services sold, classified based on HSN/SAC reported.

Why Are HSN and SAC Codes Important for Business?

- The HSN/SAC codes will help businesses identify the correct GST applicable rates to the specific goods and services.

- For registration, it is mandatory to insert these details.

- Among the vast number of goods and services available, these codes help identify specific goods and services.

The main difference between HSN and SAC codes is that HSN codes are meant only specifically for goods and services, and SAC codes specify for services only. Other, difference is in the number of digits in their code and their relevance. Example - HSN Code is an 8-digit code, and SAC code is a 6-digit code.

Click here to view the entire list for HSN and SAC codes

Conclusion

Under GST, all products and services have an associated HSN and SAC code for allocating the correct GST rate. Deskera Books has all these HSN and SAC codes inbuilt for goods and services, and will automatically apply the tax rates and cess, so you don't have to refer to an excel sheet every time.

Refer the below article to know how HSN and SAC codes work in Deskera Books.

Related Articles