There are myriad ways in which you can help your employees pay for their medical and healthcare expenses. Health Reimbursement Arrangements (HRAs) and Health Savings Account (HSAs) are the two ways that offer the benefits of tax-advantaged methods.

The variety of employee health plans can make it difficult to compare them effectively. A health reimbursement arrangement (HRA) and a health savings account (HSA) are two of the most commonly misunderstood health benefits.

Despite having similar names, they differ in several ways. Human Resources Accounts are owned by employers and Health Savings Accounts by employees. In addition, there are differences in terms of who may participate, how contributions are paid, and what type of health plan is compatible with each benefit.

A lot of times, people question if they can have both. Well, both of them are separate from each other in many ways and therefore, lay down distinct rules that need to be followed to have them. In this article, we shall learn how the two of them operate and if you can have both at the same time.

Here is what more this post has for you:

- Basics of HSA

- Basics of HRA

- Can you have an HSA and an HRA at the same time?

- Who’s eligible to participate?

- What’s a limited-purpose HRA?

- What’s a post-deductible HRA?

- What’s a suspended HRA?

- What’s a retirement HRA?

- Benefits of having HRAs and HSAs at the same time

- How can Deskera Help You?

- Key Takeaways

Basics of HSA

Qualifying individuals can use their Health Savings Accounts, or HSAs, as a way to save pre-tax (or before taxes) for future medical expenses. Invested money can either be in a regular account that pays interest or in a regular savings account. The best part is that it does not have a rule that says, use it or lose it. In other words, if money is not withdrawn, it grows from year to year instead of being lost completely.

The IRS has established a few basic rules concerning HSAs:

- When an employee's money is in their HSA, they own it. They can take it along with them when they leave the company

- Persons who have high deductible health plans (HDHPs) are eligible to contribute money to an HSA

- Employers, employees, and anyone else can contribute to an HSA. However, the rules state that the combined contributions cannot exceed the amounts set by the IRS each year

- Tax-free withdrawals of HSA funds can be made at any time for qualified medical expenses. A person can do this even if they no longer have HDHP coverage

Also, the important information here is that you will not be able to contribute to an HSA when you lose your HDHP coverage. Yet, you will be able to withdraw existing funds.

The contribution limits for 2021 and 2022 are:

- Individual HDHP had an annual contribution limit of $3,600 for 2021. For 2022, this limit has been raised slightly and stands at $3,650

- Family HDHP had an annual contribution limit of $7,200 in 2021. For 2022, it is $ 7,300

Basics of HRA

An employer can reimburse the employee's medical expenses by using a Health Reimbursement Arrangement, or HRA. IRS mandates that HRAs can only be offered with group health coverage.

An employer's contribution is deductible and an employee's contribution is tax-free. As opposed to HSAs, HRAs are funded by employers, and funds are only made available to employees when qualified medical expenses are incurred.

Contribution limits do not apply, and employers have the right to reimburse any medical expenses allowed by the IRS. Employers can reimburse some of those expenses, but not all.

Another note of significance is that Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs) are available to employers with up to 50 full-time or permanent employees. Also, the employers should not offer group health plans to be able to offer QSEHRA.

Can you have an HSA and an HRA at the same time?

Yes, HSA and HRA benefits can be availed of both at the same time. However, the IRS has some very specific rules one must meet in order to contribute to an HSA and receive HRA reimbursements at the same time.

Health Savings Accounts are available to people with only High Deductible Health Plans (HDHPs). Several supplemental policies are excluded, such as dental, vision, critical illness, accident, and so on.

HDHPs require individuals to make use of their own funds. This implies that whenever they have a medical expense before the HDHP deductible is met, employees can use the money from their HSA. In the case of employees who receive HRA reimbursements for their deductibles, they are not eligible for HSA contributions.

The IRS has brought together the benefits for all employees. Now, they can avail themselves of the advantages of limited-purpose HRAs, post-deductible HRAs, suspended HRAs, and retirement HRAs. We shall learn about all of these types of HRAs in detail in the upcoming sections.

Who’s eligible to participate?

Let’s see the eligibility factors for both HRA and HSA, here in this section:

HRA

Employees cannot open a health reimbursement account on their own. They must be offered through their employer.

An organization's HRA can be accessed by the following individuals:

- An employee with a W-2

- Employee's spouse

- Dependent on the employee

Often, some HRAs serve as a supplement to group health insurance such as the QSEHRA or the Qualified Small Employer HRA (QSEHRA). On the other hand, some others serve as individual health insurance premiums. An example here could be the Individual Coverage HRA (ICHRA).

HSA

If a person meets the following requirements, they are eligible for an HSA:

- They enroll in a high-deductible plan that qualifies for the HSA

- They don't have any other non-HSA qualified health plans

- A general-purpose flexible spending account (FSA) isn't available for them

- They cannot be claimed as dependent on the tax return of someone else

- There are no Medicare Parts A and B or Medicaid benefits for them

The individual can still open an HSA even if their employer does not offer one. If the individual meets the above requirements, they can open one on their own.

What’s a limited-purpose HRA?

All the expenses related to dental or vision, and also any other preventive care services are reimbursed under the limited-purpose HRA. This limited-purpose HRA can be offered as part of a group HDHP, giving your employees the opportunity to save for future medical expenses through HSAs. Nevertheless, it will not reimburse the employee's HDHP deductible. Limited-purpose QSEHRAs are compatible with HSAs, but only when paired with premium-only QSEHRAs

What’s a post-deductible HRA?

In essence, a post-deductible HRA has its own deductible and can also be used with an HSA. Employees can receive reimbursements for regular medical expenses before they’ve met their full HDHP deductible, provided they’ve met the HDHP deductible at least to the minimum allowable amount.

- The minimum HDHP deductible for 2021 under the category Individual HDHP was $1,400, while for Family HDHP it was $2,800.

- The minimum HDHP deductible for 2022 under the category Individual HDHP is $1,400, while for Family HDHP it was $2,800.

To summarize, there has not been any change in any of the categories.

What’s a Suspended HRA?

A suspended HRA is one where even before your HRA has begun, you suspend it by not requesting reimbursement for the medical expenditure. Therefore, you are eligible for HSA coverage during the suspension period. The HRA-eligible expenses are not affected by the suspension.

What’s a Retirement HRA?

A retirement HRS provides coverage for eligible expenses incurred after retirement. Until you retire, you may use your HSA to cover qualified expenses, but after retirement you lose HSA eligibility and can only use your HRA.

Benefits of having HRAs and HSAs at the same time

Human Resource Administrations and Health Savings Accounts (HSAs) are both ways to manage and pay for medical expenses. If you are permitted to do so, having both accounts at the same time will offer you the best of both worlds:

- A three-tiered tax benefit with pre-tax contributions, tax-free growth (interest and investment), and tax-free distributions for eligible expenses (HSA)

- An employer-funded account that pays qualified medical expenses tax-free

- Savings or the unspent amounts can be used for retirement (HSA)

- HSAs and HRAs can be used for any healthcare expense

- Lower health insurance premiums in the form of HDHP

How can Deskera Help You?

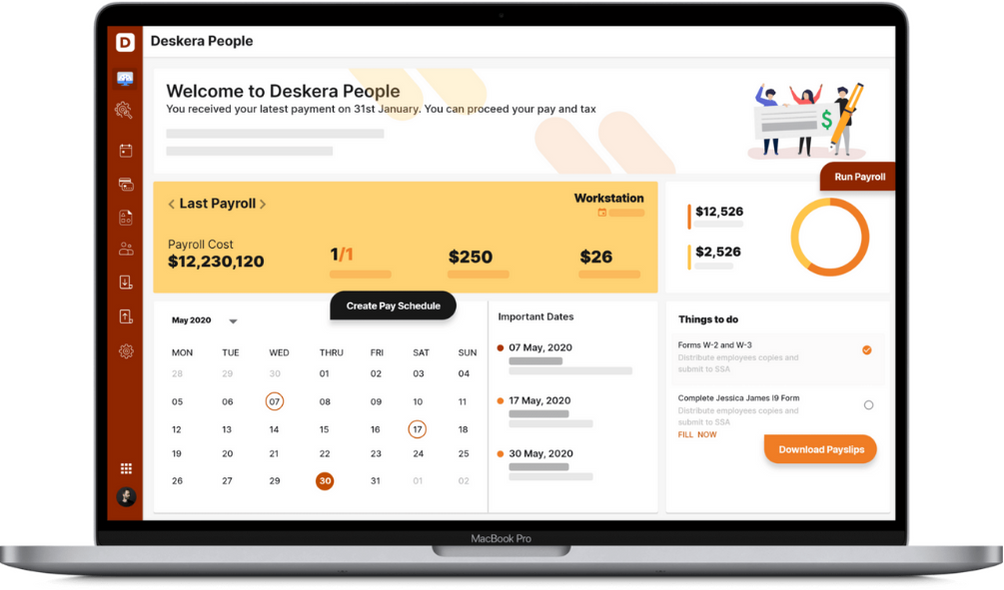

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

We have seen how despite being similar, HSAs and HRAs offer different advantages.

- HRAs are agreements between employers and employees that allow employees to be reimbursed for their medical expenses. On the other hand, a health savings account is portable, which means the employee keeps it after they leave the company

- With an HRA, an HSA, or both, you'll be able to offer your employees a flexible benefit that fits their health insurance needs

- Employers, employees, and anyone else can contribute to an HSA. However, the rules state that the combined contributions cannot exceed the amounts set by the IRS each year

- Individual HDHP had an annual contribution limit of $3,600 for 2021. For 2022, this limit has been raised slightly and stands at $3,650

- Family HDHP had an annual contribution limit of $7,200 in 2021. For 2022, it is $ 7,300

- An employer can reimburse the employee's medical expenses by using a Health Reimbursement Arrangement, or HRA. IRS mandates that HRAs can only be offered with group health coverage

- Contribution limits do not apply, and employers have the right to reimburse any medical expenses allowed by the IRS

- HSA and HRA benefits can be availed of both at the same time. However, the IRS has some very specific rules one must meet in order to contribute to an HSA and receive HRA reimbursements at the same time

- HDHPs require individuals to make use of their own funds. This implies that whenever they have a medical expense before the HDHP deductible is met, employees can use the money from their HSA

- In the case of employees who receive HRA reimbursements for their deductibles, they are not eligible for HSA contributions

- The IRS has brought together the benefits for all employees

- An organization's HRA can be accessed by any individual who is an employee with a W-2 or is employee's spouse or is dependent on the employee

- Enrolling in a high-deductible plan that qualifies for the HSA or not having Medicare Parts A and B or Medicaid benefits are some of the prerequisites for being eligible for an HSA

- This limited-purpose HRA can be offered as part of a group HDHP, giving your employees the opportunity to save for future medical expenses through HSAs. Nevertheless, it will not reimburse the employee's HDHP deductible

- A post-deductible HRA has its own deductible and can also be used with an HSA

- A suspended HRA is one where even before your HRA has begun, you suspend it by not requesting reimbursement for the medical expenditure

- A retirement HRS provides coverage for eligible expenses incurred after retirement

- Savings or the unspent amounts can be used for retirement (HSA), HSAs and HRAs can be used for any healthcare expense, lower health insurance premiums in the form of HDHP are some of the benefits of having both the HRA and the HSA

Related Articles