Most large corporations now provide internships to fresh graduates. While some interns prove to be excellent recruits, some others may tend to stifle your progress. Like any other process, there are numerous benefits and drawbacks to employing an intern.

For many young people who want to solidify their accomplishments in the professional world, acquiring some practical experience is a crucial step. An internship is one way to accomplish this goal, and it is appealing to both companies and job seekers.

This article brings to you the ways in which you can legally hire your interns along with the related components. Here is what we shall learn:

- What is an internship?

- What are the advantages and disadvantages of internship programs?

- A Short Overview of the FLSA

- FLSA Compliance Highlights

- Tips for hiring Interns Legally

- Consequences of Incorrect Classification of Unpaid Internships

- Top Skills to Look for While Hiring an Intern

- Internship Hiring Best Practices

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is an Internship?

A short-term working engagement between a corporation and a college student, university graduate, or entry-level professional is known as an internship. Interns are usually paid less than full-time employees, and in certain cases, they are not compensated at all.

However, an internship should not be viewed solely as a means of obtaining low-cost personnel. Whether you give an unpaid internship or pay your interns, the experience should be beneficial to both parties. Many companies provide internship programs that are aimed at providing work experience. Additionally, it also allows the employer to get to know possible future employees. Interns are frequently required to go through a screening process in order to secure a position that could last for any time, from a few weeks to an entire year.

What are the advantages and disadvantages of internship programs?

Internships can be beneficial for both the interns and the company that hires them.

Reduce the cost of hiring

Hiring an intern is certainly less expensive as opposed to hiring a full-time employee. There are many expenses related to onboarding a full-fledged employee, which could include HRAs, insurance, and other job-related benefits and perks. All of these are not offered to an intern, and thus, the company saves a considerable amount of dollars.

Fresh Perspective

Interns are an enthusiastic lot. They are eager to reach the depths of the areas they are professionally related to. This could be a huge benefit to the teams and the ongoing projects as the new interns are ready to go the extra mile to add value to those projects.

Allow you to offer permanent employment opportunities

When you find one of the interns has been performing exceedingly well, you can offer them a full-time employment opportunity. This way, the company does not have to spend time looking outside to hire for the role; moreover, this again helps them save a lot of time and money on this front.

Having learned about the advantages, now let’s also look at the disadvantages that come along with the hiring process for an intern. Here they are:

Inexperience

Well, the companies are well aware that the interns are no experts, and they are bound to make mistakes initially. However, they need to be careful that if the interns make more mistakes than the expectation, then hiring them could lead to a lot of time loss. Moreover, the company also invests in small training sessions that it offers to its interns. It all goes in vain in such a scenario.

Lack of professional maturity

The interns are new to the work projects, but your organization is not. There could be numerous advanced projects going on in the company, but only a few can be offered to the interns. This is due to their inexperience and inadequacy in terms of expertise as yet. So, you may encounter a sudden dearth of assignments that are fit for the role of the intern.

Lack of relevant assignments

The interns are new to the work projects but your organization is not. There could be numerous advanced projects going on in the company but only a few can be offered to the interns. This is due to their inexperience and inadequacy in terms of expertise as yet. So, you may encounter a sudden dearth of assignments that are fit for the role of the intern.

Legal ramifications of hiring interns

There could be potential legal implications surrounding the hiring of an intern if the organization has missed complying with the FLSA laws. There are certain laws and regulations you need to follow, and therefore, it is common for some companies to shy away from hiring interns despite the advantages.

We shall be learning about the FLSA and its compliance in the oncoming sections.

A Short Overview of the FLSA

Although internships can be mutually beneficial, employers must generally follow the FLSA's minimum wage, overtime compensation, and other standards unless unpaid interns are not considered workers for FLSA purposes.

The FLSA is federal legislation that governs the following aspects:

- Minimum wage

- Overtime

- Equal pay

- Record-keeping

- Child labor

It was first enacted in 1938. If your company employs interns or is considering doing so, it's critical to understand how and when this requirement relates. Most employees, including many interns, are covered by this law.

Unpaid Intern or Employee: The Primary Beneficiary Test

The United States Department of Labor (DOL) is used to assess whether or not an internship can be unpaid. The DOL uses these seven considerations to decide whether an intern is an employee for the purposes of the FLSA. The following considerations are taken into account by the DOL:

- The internship program's ability to deliver training that is comparable to what would be provided in a classroom setting. This also includes clinical and other hands-on training provided by educational institutions

- The degree to which the intern's internship is linked to his or her formal learning curriculum through integrated coursework or educational credit

- How well the internship fits up with the intern's academic commitments for the given academic calendar

- It also evaluates the measure to which both the intern and the employer are aware that no payment is expected. Any commitment or expectation of income shows that the intern is an employee

- The extent to which the internship's duration is confined to the period during which the intern gains valuable learning

- The degree to which the intern's job complements rather than replaces that of paid staff while also delivering important educational advantages to the intern

- The intern's and employer's understanding that the internship is undertaken without the promise of a paid job at the end of the program

Using these Principal Beneficiary Criteria, the Department of Labor (DOL) will examine each case individually as the decision does not depend on a single factor alone. As a result, an internship may not qualify as an unpaid internship unless it fully fits each component of this seven-part test.

FLSA Compliance Highlights

We have seen the regulations laid down by the FLSA. Based on this, if your internship falls into the category of unpaid, it does not imply that you are ineligible to hire interns. It simply means that you need to pay the interns based on the regulations of the state. You will have to take into account the minimum wage rules that apply in your region.

Let’s drive through the highlights of the applicable rules:

Minimum Wage

If your internship does not meet the Primary Beneficiary Test, then you must pay at least the federal minimum wage. Many states, counties, and municipalities have a minimum wage that applies depending on where the intern works for your organization. For the year 2021, it was $7.25 per hour.

Overtime

Offering an internship does not exempt you from paying overtime. This means that interns who work 40 hours or more in a week will be entitled to overtime pay. It's worth noting that overtime pay regulations differ by state and locality.

Child Labor

If you have hired interns that are below the age of 18, you'll need to follow the rules which are intended to protect underage workers or minors in the workplace. The age restrictions on the hiring of interns differ from state to state.

Record Keeping

As an employer of the intern, you are obligated to maintain a record that clearly mentions the wages, hours, and other details listed under the FLSA. This will also include the intern’s details, such as the permanent address and occupation.

Tips for Hiring Interns Legally

Now that we have gathered all the critical points pertaining to hiring interns, we understand that there are scenarios that could go wrong. This part of the article will guide you in eliminating such instances. Remembering the following points will help you make informed decisions regarding internships.

Profit Vs. Non-Profit

Unpaid internships for non-profit charitable organizations are more likely to be permitted. In such a situation, the intern volunteers for an internship without expecting to be paid.

Offer College Credit

As an organization, you should ensure your internship program offers due educational value to the intern. Here, you may connect with a school to provide the course credit. However, the company still needs to meet all criteria mentioned under the Primary Beneficiary Test.

Primary Beneficiary

As discussed in the previous section, ensure that while offering the internship program, you have read through and followed all the seven points mentioned under it. In case of doubt, get legal support and guidance to avoid hassles.

To pay or not to pay

You have been oscillating between the thought, ‘to-pay-or-not-to-pay-the-intern’, which leads to the question of whether to hire or not to hire. The best way to get rid of this thought is to do away with offering internships completely.

Pay Your Interns

You can take the simplest approach of paying your interns and keeping away all the problems related to their payment. Follow the FLSA clauses and pay them the minimum wages to maintain peace of mind.

Remote Interns

This is another area that will require you to comply with the state regulations. With remote interns, be mindful of including workers’ compensation, local tax filing, time-offs, wage and hour requirements, and so on.

Internship Hiring Best Practices

With all the information you have at hand, you are now set to hire unpaid interns legally. Integrate these best practices for a smooth hiring process:

No false promises

Do not falsely promise the intern that they will be hired as a permanent employee once the internship is over. Refrain from making any statements that would imply providing employment to interns, after the internship program is completed.

Set the expectations right

Ensure that you have made clear all the regulations and rules in advance. The interns should have no confusion about any rules regarding the internship. To achieve this, you can draft a formal agreement that will be signed by both the intern and their advisors at school.

Gather All Essential Details

Compensation, schedules, school credit, supervisors, length or duration of the internship are some of the crucial details you must gather and record before beginning the program.

Provide Equal Opportunity

You should follow equal opportunity laws and provide equal opportunities when you are hiring interns.

Create a clear Job Description

While offering the internship, mention all the details about the roles and responsibilities of the intern comprehensively. They must know what they will be required to do once they have joined the company as an intern.

Limit your Liability

Limit your liability exposure by including interns in your worker's compensation policy. Whether paid or unpaid, companies are virtually always required by law to provide workers' compensation coverage for all interns.

Consequences of Incorrect Classification of Unpaid Internships

For overstepping specific laws and going beyond the regulations, there could be consequences and actions. The final approach to avoid any kind of legal implication could possibly be to pay at least the minimum wage and follow all applicable labor laws and restrictions.

This section highlights the possible implications of having unpaid internships.

Top Skills to Look for While Hiring an Intern

When you are hiring interns, you certainly do not expect them to be experts in their field. However, you must ensure they have the basic cognitive skills that will help them perform at the job. We have shortlisted 7 top skills that you must seek while hiring your interns. Let’s take a look:

FAQs

We have gathered up a few questions which are commonly asked. Let’s check them here in this section:

Q: How many interns can you hire and employ at any given time?

A: You can hire and employ as many interns as you wish as The FLSA does not have a fixed limit on the number.

Q: Can school credits be used to compensate an intern?

A: No. Whether or not the intern obtains school credits, if the intern counts as an employee based on the definitions provided by the FLSA, he or she must be paid in line with current legislation.

Q: Is there a limit to how many hours an intern can work each day/week?

A: No, in most cases. For interns over the age of 18, the FLSA does not specify a maximum number of hours per week that an employee can work. If the internship is paid and the employee works more than 40 hours per week, he or she must be paid time and a half for those hours worked over 40 unless an overtime exemption applies. (There could be differences in the laws as they vary from State to State).

Q: Do we have to give interns time off or vacation days?

A: No, in most cases. The FLSA does not compel companies to grant any vacation time when hiring interns. Some state or local laws may need compliance in terms of providing sick days, depending on the location of the internship and the length of the internship.

Q: Is an intern a self-employed or independent worker?

An intern is highly improbable to be regarded as an independent contractor.

Q: Which employment-related tax documents must an intern complete, whether paid or unpaid?

A: There are no tax forms that an unpaid intern is expected to fill out. So under the law, an intern who is an "employee" must undertake the same recruitment paperwork just like every other employee.

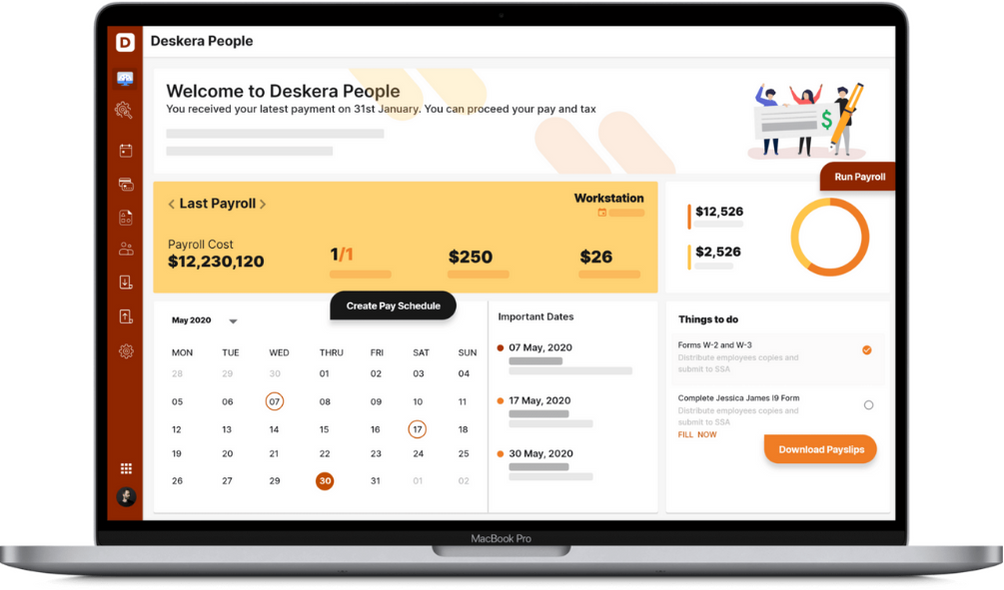

How can Deskera Help You?

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- A short-term working engagement between a corporation and a college student, university graduate, or entry-level professional is known as an internship

- Interns are usually paid less than full-time employees, and in certain cases, they are not compensated at all

- Reducing the cost of hiring, getting a fresh perspective, allowing you to offer permanent employment opportunities are some of the advantages of offering internship programs

- The inexperience of interns, lack of professional maturity, lack of relevant assignments, and legal ramifications of hiring interns are some of the drawbacks of hiring interns

- Although internships can be mutually beneficial, employers must generally follow the FLSA's minimum wage, overtime compensation, and other standards unless unpaid interns are not considered workers for FLSA purposes

- The United States Department of Labor (DOL) is used to assess whether or not an internship can be unpaid. The DOL uses these seven considerations to decide whether an intern is an employee for the purposes of the FLSA

- Using the Principal Beneficiary Criteria, the Department of Labor (DOL) will examine each case individually as the decision does not depend on a single factor alone. As a result, an internship may not qualify as an unpaid internship unless it fully fits each component of this seven-part test

- FLSA compliance includes abiding by the rules pertaining to overtime, minimum wage, child labor, record-keeping

- Unpaid internships for nonprofit charitable organizations are more likely to be permitted. In such a situation, the intern volunteers for an internship without expecting to be paid

- As an organization, you should ensure your internship program offers due educational value to the intern

- Ensure that while offering the internship program, you have read through and followed all the seven points mentioned under it. In case of doubt, get legal support and guidance to avoid hassles

- You have been oscillating between the thought, ‘to-pay-or-not-to-pay-the-intern’, which leads to the question of whether to hire or not to hire. The best way to get rid of this thought is to do away with offering internships completely

- You can take the simplest approach of paying your interns and keeping away all the problems related to their payment

- With remote interns, be mindful of including workers’ compensation, local tax filing, time-offs, wage and hour requirements, and so on

- Make no false promises, set the expectations right, and give a clear job description. These factors come under the best practices for hiring interns.

Related Articles