GSTR 3 is the third in the line of the many forms introduced by the government for the taxpayers to file the taxes based on diverse criteria. After having looked through GSTR 1 and GSTR 2, we shall be learning about the filing process, format, and other aspects related to the GSTR 3 form.

Here is all that we shall be observing closely:

- What is GSTR 3?

- What happens if GSTR 3 is not filed?

- What happens if GSTR 3 is filed late?

- Who should file GSTR 3?

- How to revise GSTR 3?

- How will GSTR 3 and GSTR 3B be reconciled?

- Details to be provided in GSTR 3

- PART A (entirely auto-populated)

- Part B

- Latest Information in GSTR 3 Form

What is GSTR3?

GSTR 3 is to be filed monthly and the taxpayers must report the details of their inter-state movement of the goods, sales, purchases for the month along with the tax liability. The GSTR 3 return is an auto-generated return that derives its information from the GSTR 1 and GSTR 2 forms.

This is a return that must be filed by the taxpayers who are registered under GST and have not opted for the composition scheme. This also applies to the taxpayers that do not have the Unique Identification Number or the UIN.

What happens if GSTR 3 is not filed?

Missing out the filing of GSTR 3 can have serious repercussions. If the taxpayers do not file the GSTR 3 for a month, then they will not be able to file the GSTR 1 form as well. Then, the taxpayer will be subject to fines and penalties.

What happens if GSTR 3 is filed late?

In case there is a delay in filing the returns for GSTR 3, then the taxpayers need to pay a late fee where the interest is 18% annually. The final amount will be calculated by the taxpayer based on the total outstanding amount payable. The duration is the next day or the 16th of the month up to the payment date.

The late fee for the same is Rs.100 per day for each Act. This implies that the late fee is Rs. 100 for CGST, Rs.100 for SGST; so, the total comes to Rs.200 per day. The maximum amount of late fee that can be charged is Rs. 5000.

IGST, however, has no late fee charges.

Who Should and Should Not file GSTR 3?

Irrespective of the number of transactions or zero transactions happening in a month, all the taxpayers registered under GST must file GSTR 3.

The following is the list of people who are not required to file the GSTR 3 form:

- Input Service Distributors

- Persons liable to deduct TDS

- Composition Dealers

- Persons liable to collect TCS

- Non-resident taxable person

- The OIDAR suppliers or the Providers of the online information and database access or retrieval services.

How to revise GSTR 3?

Once the filing completes for GSTR 3, then the revising of the same is not possible as the form is auto-generated and without much scope for revisions. However, if there are any corrections and mistakes, they can be revised in the next month’s GSTR 1 and GSTR 2 forms.

Reconciliation of GSTR 3 and GSTR 3B

From July and August 2017, CBEC (Central Board of Indirect Tax and Customs) has introduced GSTR 3B. Along with that, the GSTR 3 form also needs to be filed.

In case there is a difference between the data provided in GSTR 3 and GSTR 3B, then these differences will automatically be updated by the system. If the liabilities are higher in GSTR 3 than the ones declared and paid in GSTR 3B, then the taxpayers will need to pay the surplus amount (or the remaining amount) along with the interest on this remaining amount.

It must also be noted that the taxpayers must file GSTR 3 only once they have completely paid their tax liabilities. If not, then it would not be considered a valid return. Later on, when the taxpayer will be paying for the remaining liability, then they must file the Part B of the form GSTR 3 again in order to achieve a valid return.

Prerequisites for filing GSTR 3

Here are the conditions or the prerequisites to filing the GSTR 3 form:

- The individual must be registered under GST having a 15 digit PAN-based GSTIN.

- The individual must have also filed their GSTR 1 and GSTR 2 returns.

- Before filing the GSTR 3 form, the individual is required to pay the Owed amount of GST to the government. The information regarding this can be accessed inside the GSTR 3 summary. This summary is generated on the GST portal prior to the filing of returns in GSTN.

- The individual will also need to keep handy their OTP which they would receive on their registered phone number. This OTP will be required if the individual chooses to file through the EVC option. i.e. the Electronic Verification Code or a DSC i.e. a Digital Signature Certificate. Alternatively, they can also make use of Aadhar-based electronic signature to file the returns.

Filing GSTR 3

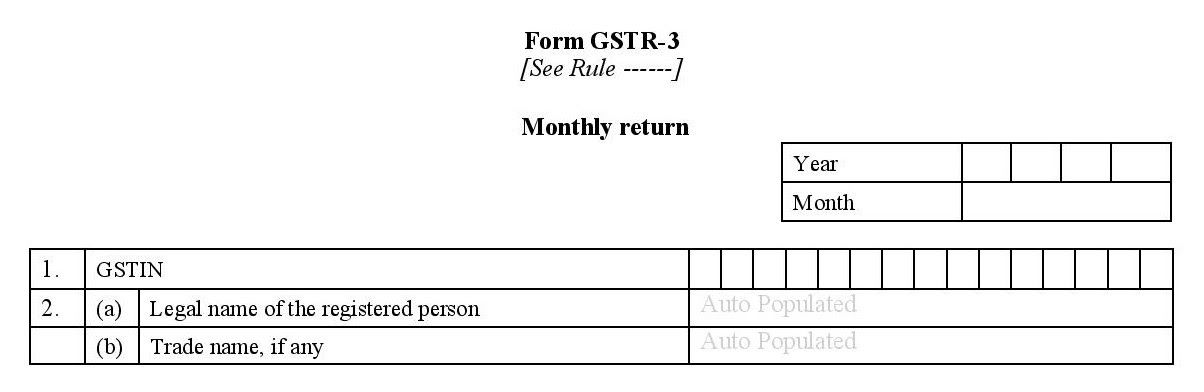

The first section of the form requires you to fill in the year and the month for which the filing needs to be done.

We shall look at the details that need to go into the form in this section:

- GSTIN: Enter the unique 15 digits PAN-based GSTIN.

- Name of the registered taxpayer along with the trade name if available.

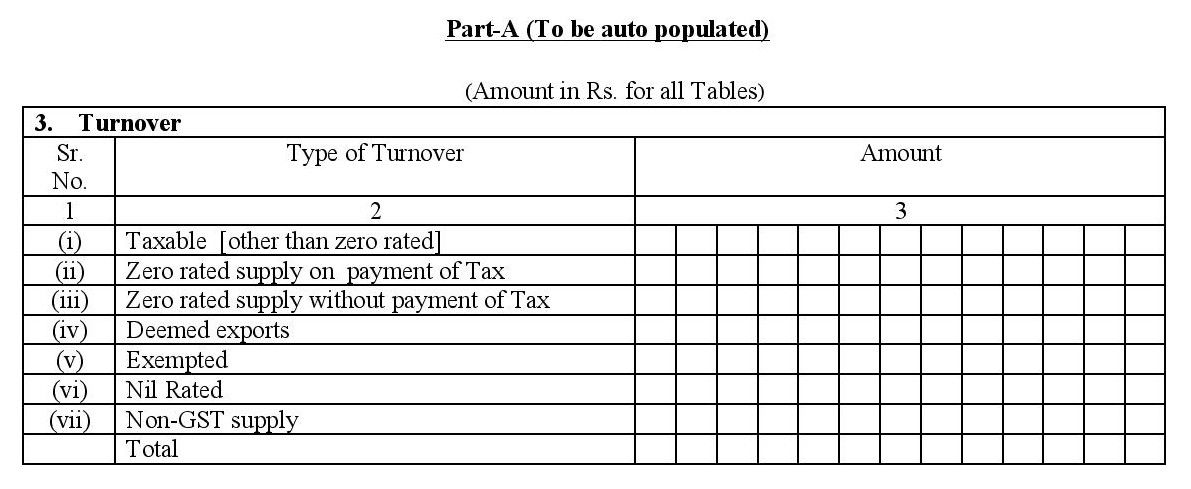

PART A: Auto-Populated

3. Turnover Details

It requires you to enter all the types of turnovers:

- Taxable Turnover (other than the zero rated ones).

- Zero rated supply on payment of Tax: Here, you need to enter all those exports, deemed or otherwise made without a Letter of Undertaking. Owing to this reason, the exporter is liable to pay GST on the exported goods and services. They can get a refund back later.

- Zero rated supply without payment of Tax: This refers to exports made along with a LUT or the Letter of Undertaking. This is a letter that enables the exporter to sell goods overseas/to SEZ units without charging GST.

- Turnover from deemed exports: This refers to the deemed exports are items sold to overseas customers and specialized units. However, in this case, the goods don’t leave the country.

- Turnover from exempted supplies: This refers to the goods and services that do not attract GST. However, the taxpayer can’t claim a refund on the tax paid on input services and goods that were used to render them.

- Turnover from Nil-rated supplies: These are the goods that come under 0% GST. However, the taxpayer can claim a refund of tax paid on the input goods and services used for creating them.

- Turnover from non-GST supplies: This refers to the goods and services which are beyond the dimensions of GST but still attract some local taxes.

- Finally, mention the Total Turnover.

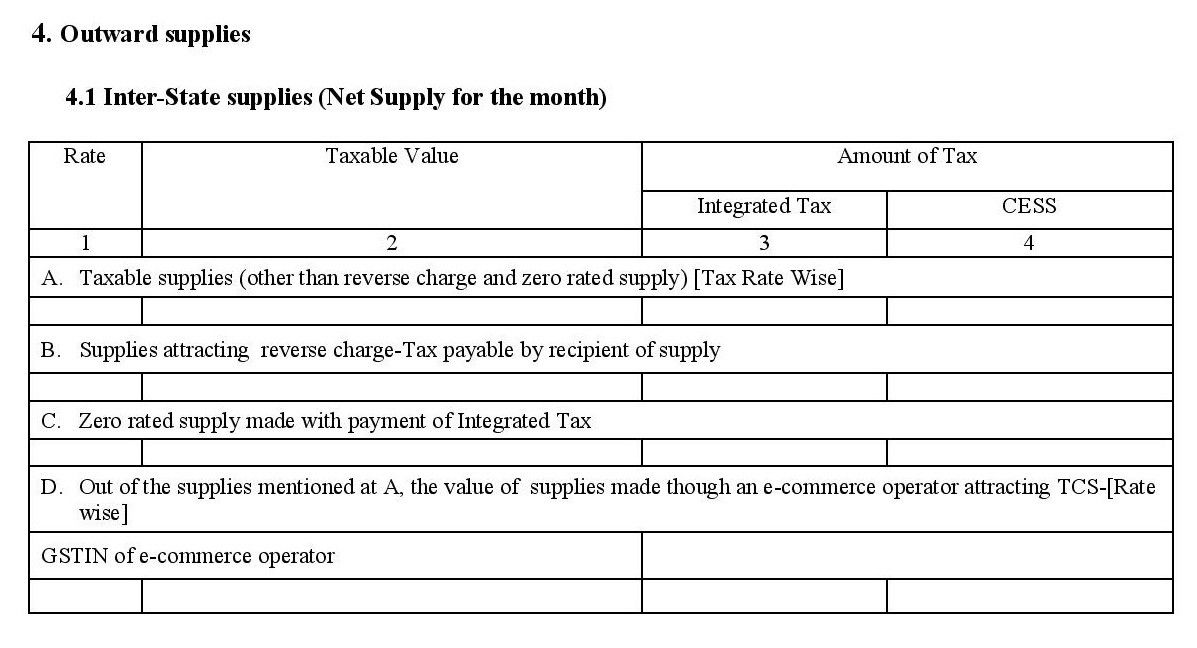

4. Outward Supplies

The information under this section will be auto-populated from your GSTR 1 form and will provide all the information related to your sales for the month.

4.1 Inter-State supplies (Net Supply for the month)

Under this heading, we have:

- Taxable supplies (other than reverse charge and zero-rated supply) [Tax Rate Wise]: This will have all your sales except the ones on which reverse charge has been applied. It also includes exports.

- Supplies with reverse charge-tax payable by the recipient of supply: This includes your sales on which the recipient or the buyer pays a reverse charge.

- Zero rated supply made with payment of IGST: This includes the exports which are paid by paying IGST. These can be reclaimed later as a refund.

- Out of the supplies mentioned at A, the value of supplies made through an e-commerce operator attracting TCS-[Rate wise]: This includes the sales made through the e-commerce system. It will also display the GSTIN of the e-commerce operator.

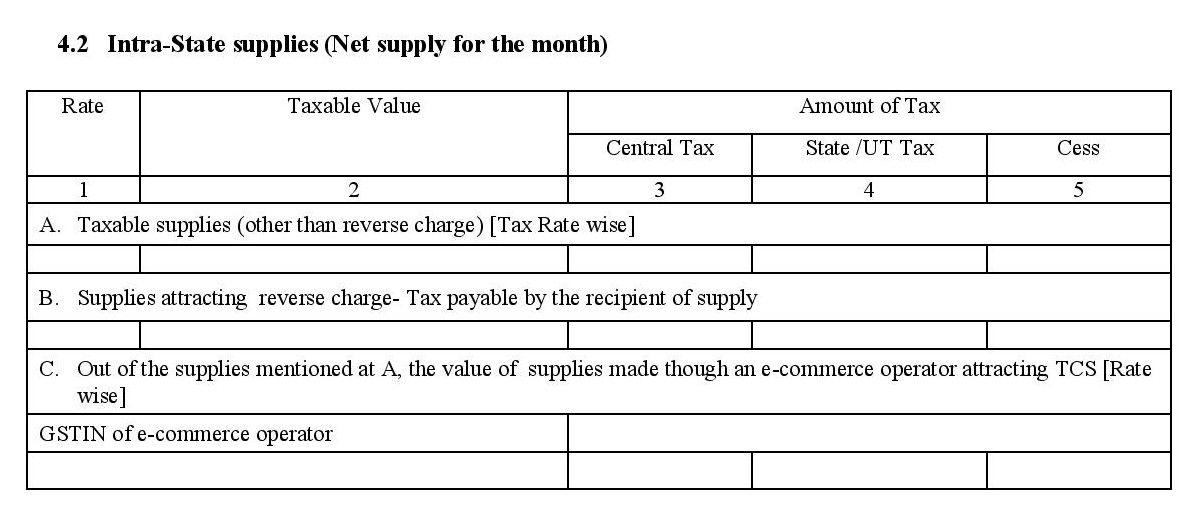

4.2 Intra-state Supplies

This includes the net supply of goods that are taxable and are in the same state. This may or may not include the reverse charge. This also includes your online sales on the e-commerce portal.

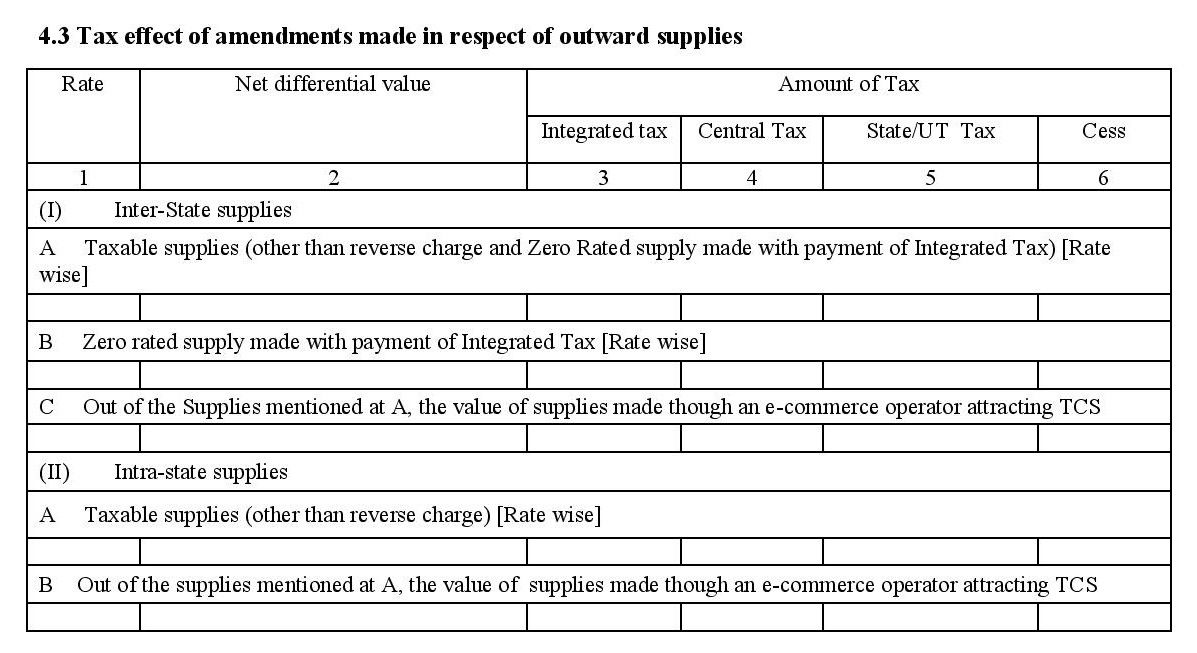

4.3 Tax effect of amendments made in respect of outward supplies

This section is about your tax credits, tax liabilities, and the amendments made to the sales documents and invoices.

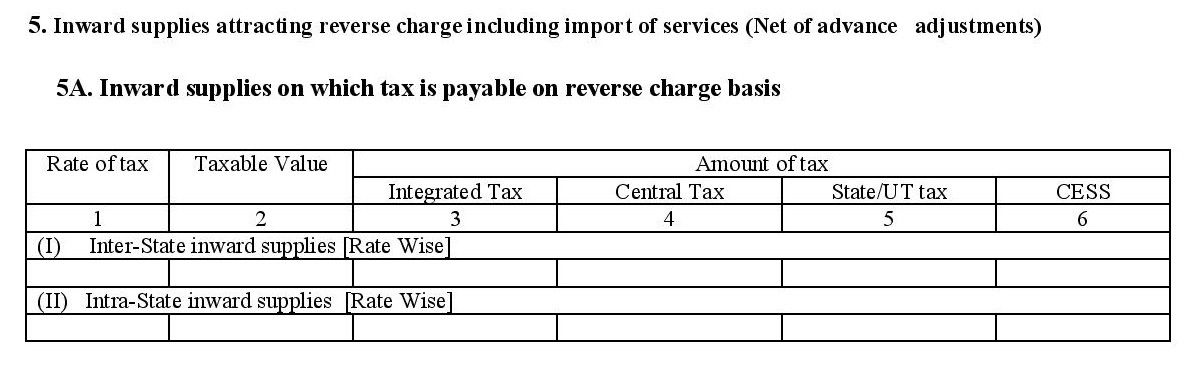

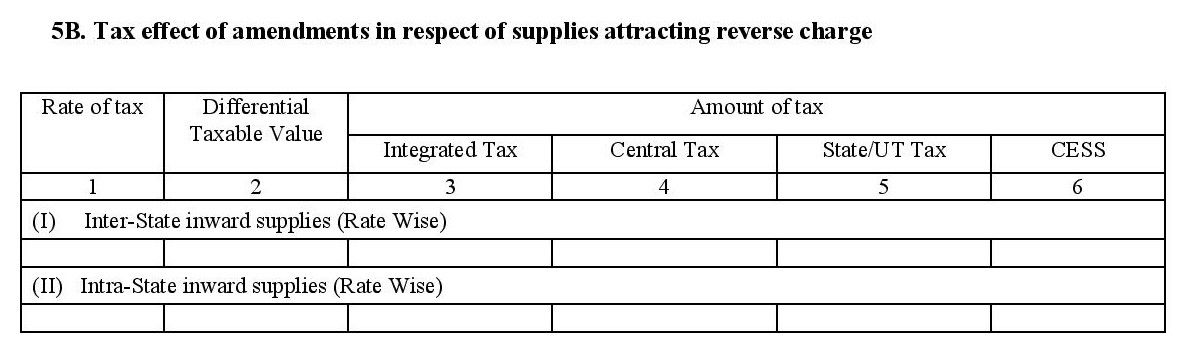

5. Inward Supplies attracting GST on reverse charge

It consists of 2 parts: A and B.

Part 5A includes all your received supplies for which you must pay the GST directly to the government on behalf of your vendors.

5B is about the Tax effect of amendments in respect of supplies attracting reverse charge.

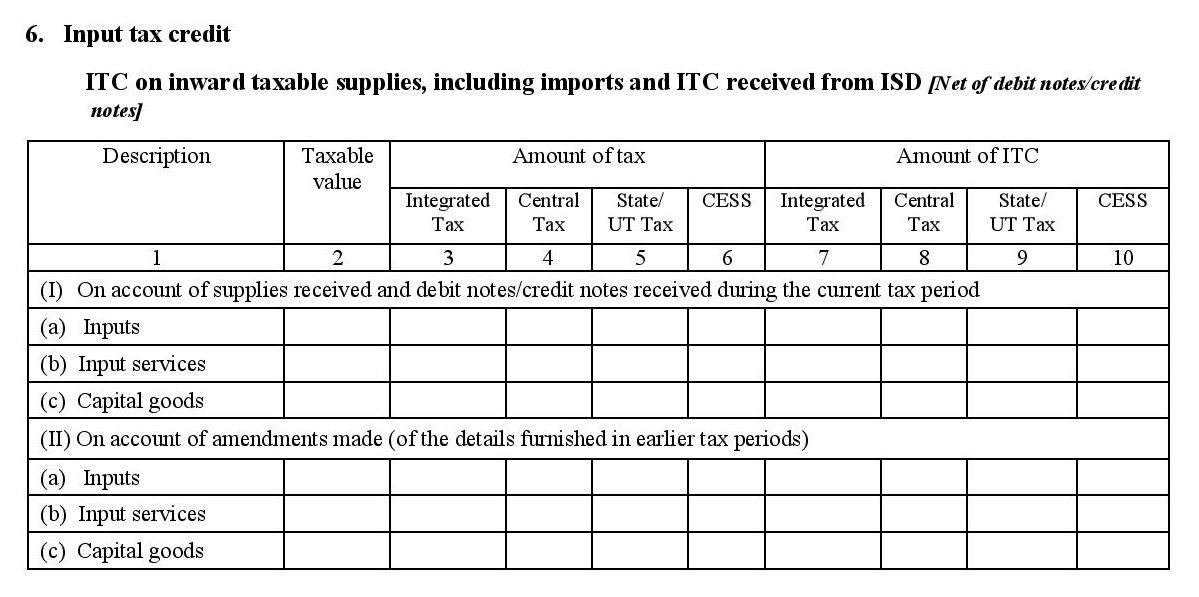

6. Input Tax Credit

This refers to the inward supplies you have received and the tax paid by you on these supplies. Input Tax Credit will be provided to you as a credit by the government when you raise an invoice for the purchase.

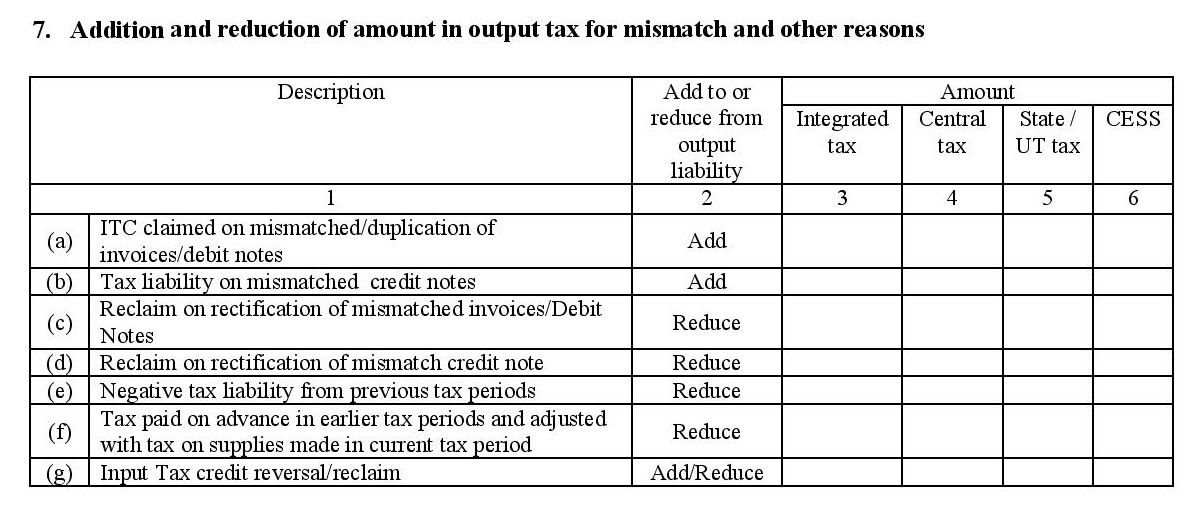

7. Addition and reduction of amount in output tax for mismatch and other reasons

This will include any mismatches, addition, or reduction in the amount in output tax.

It comprises the following fields:

- ITC claimed mismatched/duplication of invoices or debit notes.

- Tax liability on mismatched credit notes.

- Reclaim on rectification of mismatched invoices/Debit Notes.

- Reclaim on rectification of mismatch credit note.

- Negative tax liability from previous tax periods.

- Tax paid in advance in earlier tax periods and adjusted with a tax on supplies made in the current tax period.

- Input Tax credit reversal/reclaim.

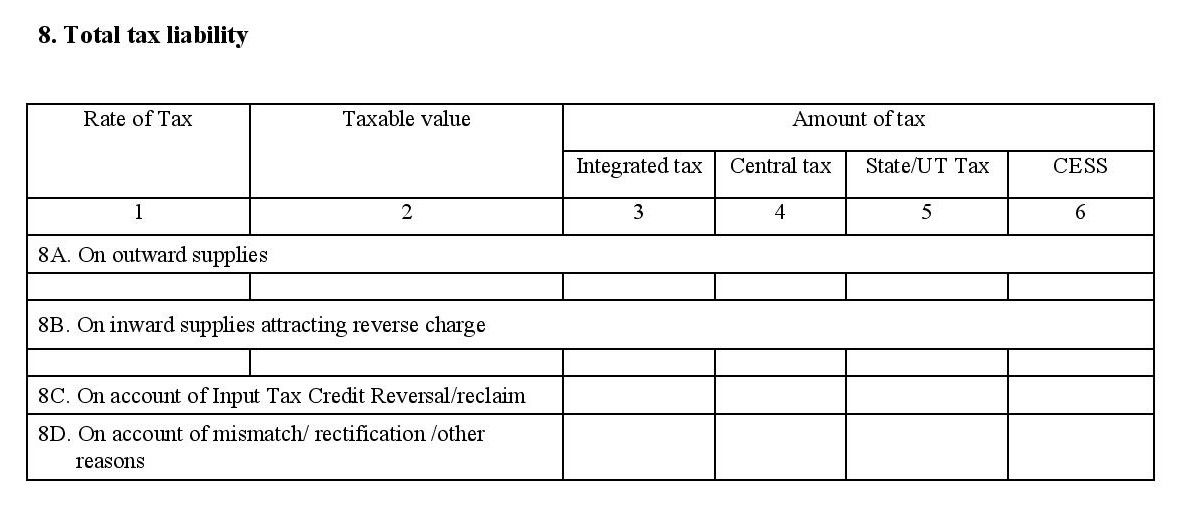

8. Total Tax Liability for the month

Once you have entered all your details related to the sales, purchases for the month, the GSTN will present you with the information of the tax that you must pay under CGST, SGST, and IGST. All this information will be depicted in this section.

The information for each part is as follows:

8A: Includes the tax for all the goods sold by you.

8B: Includes the tax under the reverse charge purchases from the unregistered sellers.

8C: this information is fetched from Table 11 of the form GSTR 2.

8D: This information is fetched from Table 12 of the form GSTR 2.

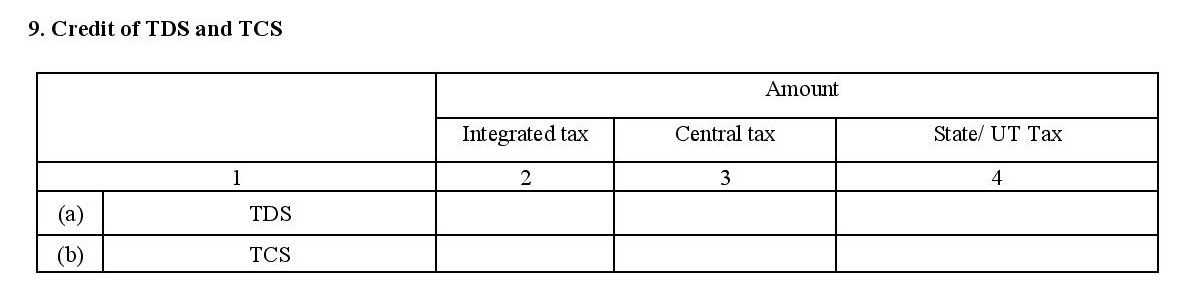

9. TDS and TCS credit received

This includes two parts, a and b which are shown in the image as follows:

- Information for section 9A is fetched from the forms GSTR 2 and GSTR 7.

- Information for section 9B is fetched from your forms GSTR 2 and GSTR 8.

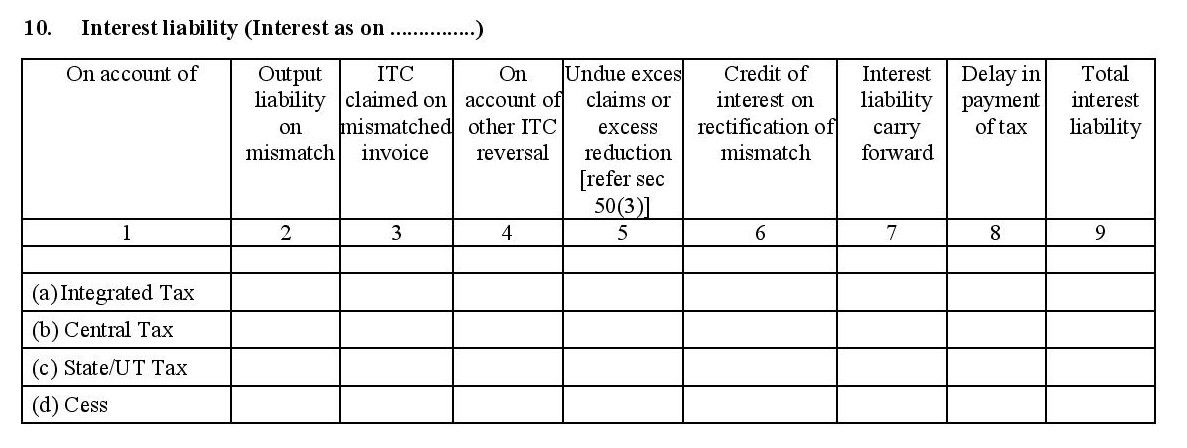

10. Interest liability

This includes a summary of all the various taxes you owe to the government.

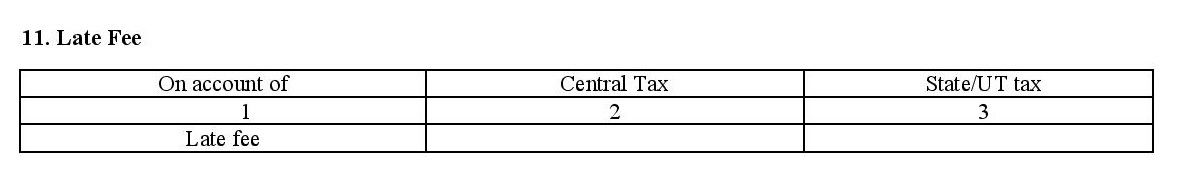

11. Late Fee

This will show the late fee under various tax heads.

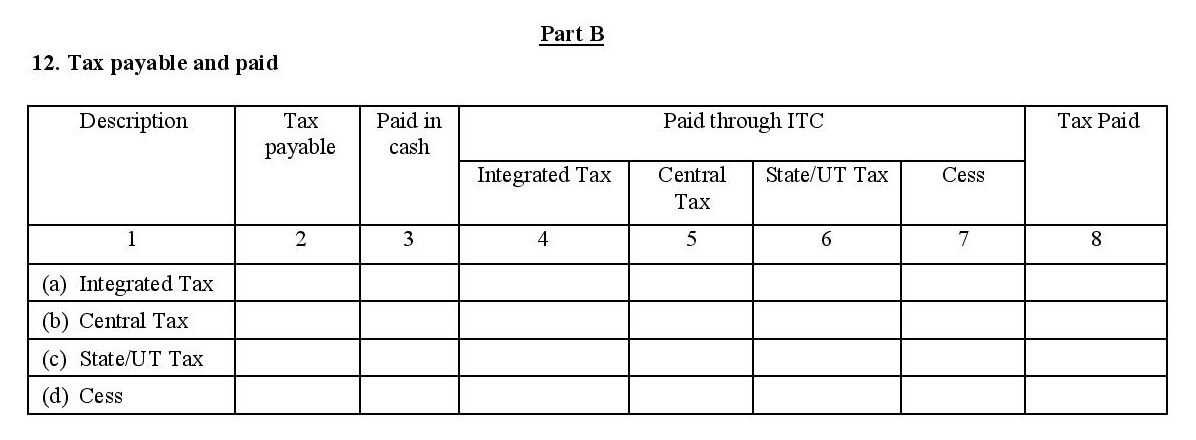

Part B: To be Filled Manually

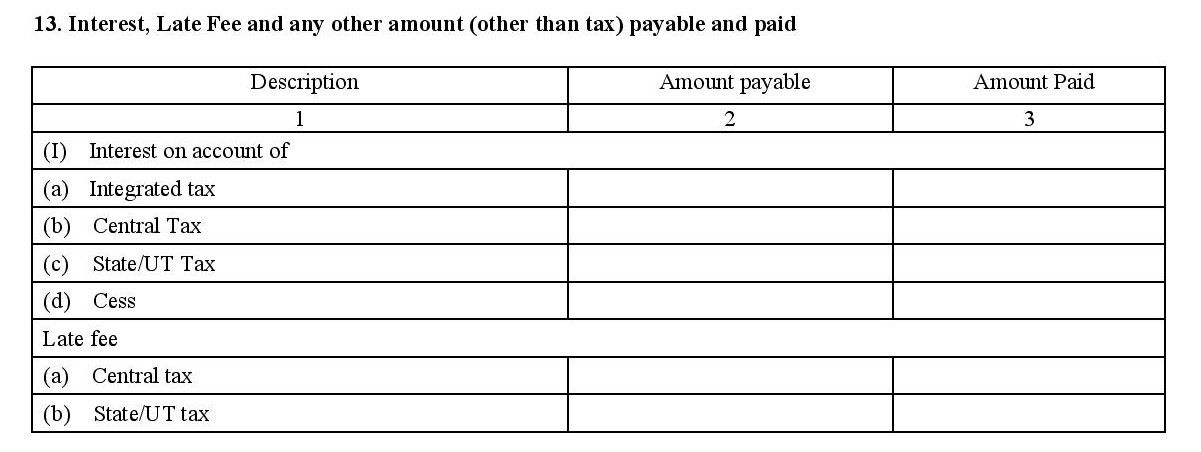

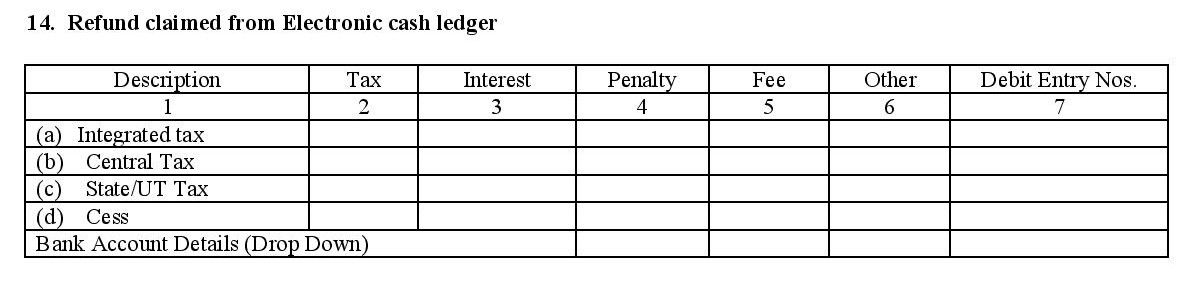

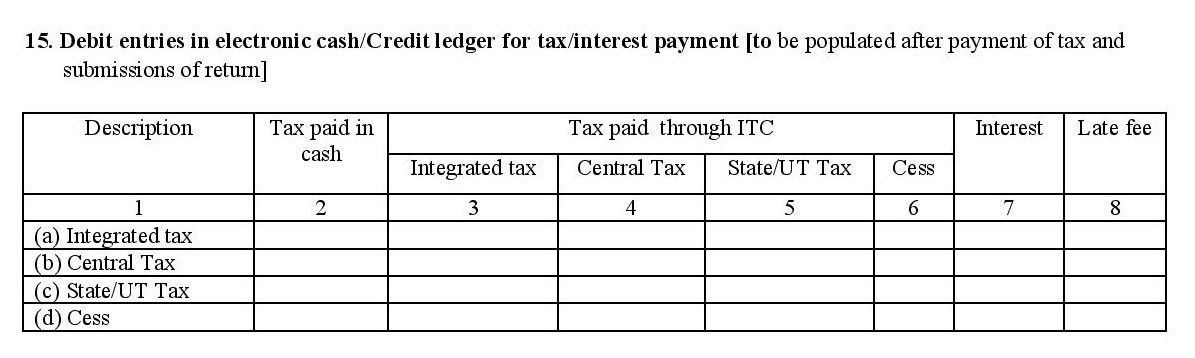

To fill in the information under this section, you shall be required to keep your receipts handy. It comprises points 12, 13, 14, 15, which are shown as follows:

Mention the amount of tax you need to pay under various heads: IGST, CGST, SGST, and Cess.

This point will cover all the interests, late fee or any other amount you need to pay.

Enter the refund claimed by you in this part.

This is an auto-fill section that gets updated once you have paid your taxes and filed the returns.

To mark the end of the process, you need to submit a verification that must have your DSC or an Aadhar based signature.

Latest Information in GSTR 3 Form

How can Deskera Help You?

Deskera Books is impeccable one-stop accounting software that addresses all your needs pertaining to the accounting process. It ensures that the process runs smoothly. You shall have a completely refreshed experience; from journal entries to inventory and invoices to customers and suppliers.

If you also find taxation issues, accounting processes, GST queries hassling you, then knowing Deskera Books is certainly going to revive the way you view these processes; apart from streamlining it for you.

Let Deskera guide you step by step towards achieving the exact information you always wanted to get through. Take a look at how easy it is to use the accounting software!

If you wish to get a better grip over Deskera’s offerings in terms of GST information, then this is one guiding video you wouldn’t want to miss!

Key Takeaways

We have observed the following points in this article:

- GSTR 3 is to be filed monthly and the taxpayers must report the details of their inter-state movement of the goods, sales, purchases for the month along with the tax liability.

- This is a return that must be filed by the taxpayers who are registered under GST and have not opted for the composition scheme.

- This also applies to the taxpayers that do not have the Unique Identification Number or the UIN.

Related Articles