Since its introduction in India in 2017, the Goods and Services Tax - GST - has streamlined indirect taxation considerably. In spite of the reduction in complexity, it's still in its infancy relative to the previous tax system. Due to this, its functioning and GST returns filing still leaves some ambiguity in the minds of businessmen in India.

GST forms are required as part of a business's operations to ensure compliance with GST guidelines and to reap the benefits. Among the many forms, the business owners also have to file the GSTR 2A at times. Hence, it is crucial to know what it is, how it works, and the role it plays within the GST framework.

We will be learning about the following terms and aspects related to the form GSTR 2A:

- What is GSTR 2A?

- How is GSTR 2A different from GSTR 2B?

- What are the Details Featured in GSTR 2A?

- How to file GSTR 2A?

- What happens if the seller delays GSTR 1 or fails to upload invoices?

What is GSTR 2A?

The GSTR 2A is automatically generated when a business’s seller or partner/supplier uploads the GSTR 1 and 5 Forms. Every business registered with the GST portal receives this purchase-related document. In this document, company purchases are mentioned in detail, including every invoice during a particular month.

As a read-only document, the GSTR 2A form only informs businesses of the invoice details of its vendors or sellers. Prior to filing their returns on the GST portal as GSTR 2, businesses need to check this form for accuracy and rectify any discrepancies.

Using information from a business's counterparties' returns, the GST portal auto-generates GSTR 2A according to the following:

- GSTR 1

- GSTR 5

- GSTR 6

- GSTR 7

- GSTR 8

Fundamentally, the GSTR 2A is generated in the cases when:

- A registered resident seller uploads the information of the transaction through the GSTR 1 form.

- A non-resident uploads the information of the transaction through Form GSTR 5.

- A counterparty does the GSTR7 and GSTR 8 filing, noting the TCS and TDS information.

- The GSTR 6 form is submitted by an Input Service Provider.

The GSTR 2A form must be verified before GSTR2 can be filed. Occasionally, the seller may defer their GSTR 1 filing in certain situations. As a result, they will need to manually enter their GST details when filing their GST returns. In order to ensure consistency in information recording, a seller's details submitted in GSTR 1 will appear in the next month's GSTR 2A of that business.

Difference Between GSTR 2A and GSTR 2B

The following table summarizes the difference between GSTR 2A and GSTR 2B:

List of Details Featured in GSTR 2A

According to the mandate of the government, it has seven headings. These are:

- GSTIN: The 15-digit GSTIN of such business

- Taxpayer's name: The legal and commercial name of the taxpayer

PART A

3. Inward supplies received from a registered person other than the supplies attracting reverse charge

When the sellers file GSTR 1, the majority of their purchases will be auto-filled here. It consists of information including rate and amount of GST, type, eligible ITC, and amount of ITC. There will, however, be no reverse charge purchases in that list.

4. Inward supplies on which the reverse charge attracts tax

This comprises information of purchases and supplies received for which the taxpayer has to pay GST under reverse charge. This is for both taxable and non-taxable persons.

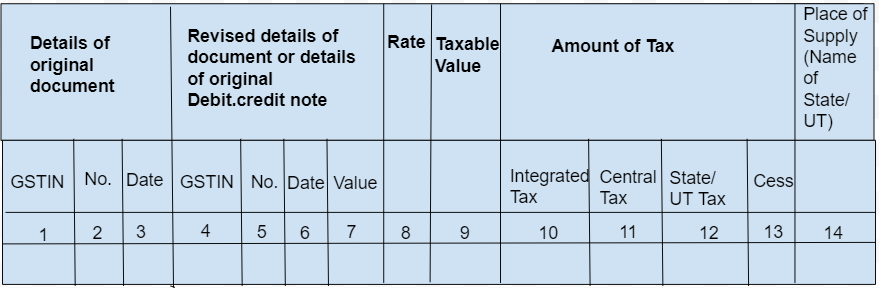

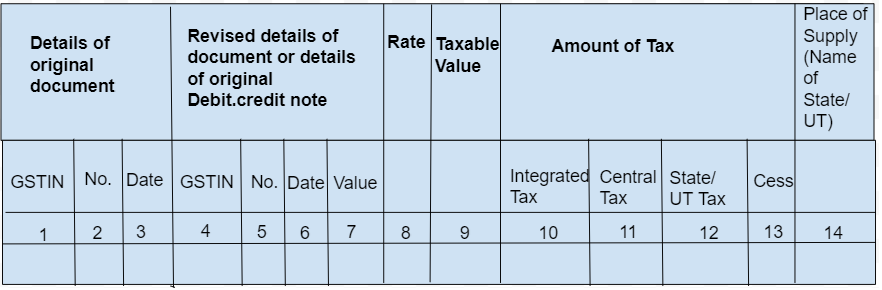

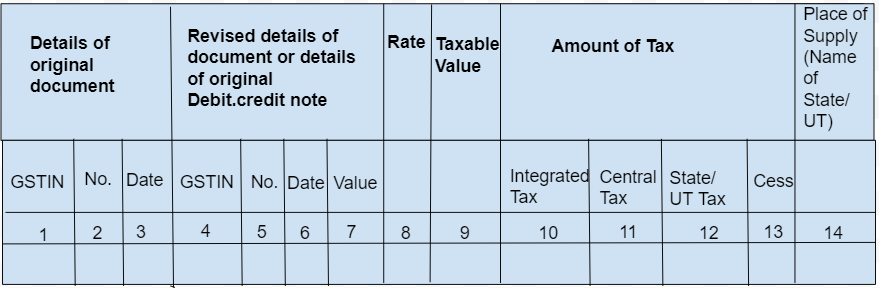

5. Debit / Credit notes (including amendments thereof) received during current tax period

You will be able to view the debit notes and credit notes issued by your sellers during the month. In addition, the original and revised documents will be compared to show any changes made to them.

Part B

6. ISD credit (including amendments thereof) received

As a branch of your business, the information in this section gets auto-filled when your main office or the head office files GSTR 6 returns for the particular period.

PART C

7. TDS and TCS Credit received

TDS Credit Received: This section applies to contracts you enter into with specified individuals that are usually government agencies. Tax deduction at source is a deduction made by the receiver (government) from the transaction value. The deducting party's GSTR-7 will populate here with all the required information.

TCS Credit Received: Only online sellers registered with e-commerce operators can use this heading. Tax is collected at the time of payment to sellers by e-commerce platforms. The GSTR-8 form data of e-commerce operators will be used to automatically populate this information.

How to file GSTR 2A?

GSTR 2A cannot be filed as it is a read-only statement that consists of all the invoices in front of the sellers; however, it can be viewed and downloaded.

Consequences of Delays in GSTR 1 or Failure to Upload Invoices?

In case if someone delays the GSTR 1 or fails to upload the invoices, then the tax credit will not appear in the GSTR 2A form for that particular tax period. In such a case, the buyer can intimate the concerned sellers about the delay or the missing invoices.

Since August 2020, all the buyers are required to refer to GSTR 2B to determine the amount of input tax credits allowed for a tax period.

In GSTR-3B, however, the buyer may include an input tax credit for up to 5% of GSTR-2B tax credits for invoices that were not found on GSTR-3B.

How Can Deskera Help You?

Discover how you can combine accounting, finances, inventory, and much more, under one roof with Deskera Books. It's now easier than ever to manage your Journal entries with Deskera. The remarkable features, such as adding products, services, and inventory, will all be available to you from one place.

Experience the ease of implementation of the tool and try it out to get a new perspective on your accounting system.

Deskera Books is a time-saving strategy for managing your work contacts, invoicing, bills and expenses, connecting to your bank. In addition, opening balances can be imported and chart accounts can be created through it.

Deskera Books can handle every aspect of the organization, including inviting colleagues and accountants.

Key Takeaways

Let's take a quick recap of the important points in the article:

- The GSTR 2A is automatically generated when a business’s seller or partner/supplier uploads the GSTR 1 and 5 Forms.

- As a read-only document, the GSTR 2A form only informs businesses of the invoice details of its vendors or sellers.

- According to the mandate of the government, GSTR 2A has seven headings.

- GSTR 2A cannot be filed as it is a read-only statement that consists of all the invoices in front of the sellers.

- In case if someone delays the GSTR 1 or fails to upload the invoices, then the tax credit will not appear in the GSTR 2A form for that particular tax period. Therefore, the buyer can intimate the concerned sellers about the delay or the missing invoices.

Related Articles