For all those who are a part of the Goods and Services Tax regime to file GST Returns. The tax returns specify the income details that can be further used for the calculation of taxes. In order to file GST Returns, you require GST compliant invoices for sales and purchases. In this list you most importantly need GSTR 1.

GSTR 1 is the base for all the information for all the other forms to get your information automatically. To help you understand in depth what GSTR 1 form is and what it includes, we have this article ready for you.

Article comprises of the following points:

- What is GSTR 1?

- Details of GSTR 1 form.

What is GSTR 1?

GSTR 1 is a form that records for all the outward stock of goods. This is a month to month, or now and again quarterly, return that you need to document to represent something very similar concerning your business.

This implies that any person that is associated with the excursion of the stock of products needs to determine subtleties relating to the inventory and the receipt as well. This way the profits for the internal stock will be auto-populated with the subtleties documented in GSTR 1.

Along these lines, as GSTR 1 is the establishment that influences other GST frames also, you should fill it with extreme attention to detail.

Details in GSTR 1 Form

There are 13 sections/details that needs to be filled in your GSTR 1 form:

1.Provide GSTIN. In case you don’t have a GSTIN then you can also use a provisional ID.

2. You need to mention the legal name of the registered person. The name of the taxpayer will be then auto-populated at the time of logging into the common GST portal.

3. Aggregate Turnover in the preceding Financial Year and for the period between April to June 2017. For all those who are confused as to what is an aggregate turnover- Aggregate Turnover is the total value of all taxable supplies made except for the value of inward supplies on which tax is payable by a person on a reverse charge basis, exempt supplies, exports of goods or services or both.

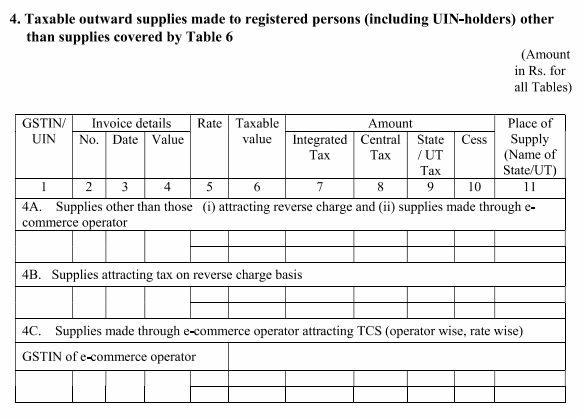

4. Taxable outward supplies made to registered persons. For that matter even UN holders too.

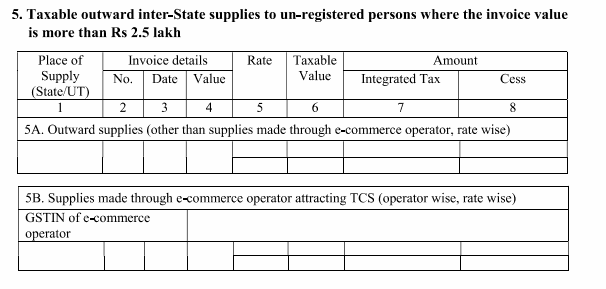

5. Taxable outward inter-State supplies to unregistered persons where the invoice value is more than Rs 2.5 lakh. Invoice-wise details of all supplies made to unregistered dealers is to be mentioned here.

Part A: This will include B2B invoices, sale to unregistered dealers.

Part B: The details of B2C supplies made online through e-commerce operators.

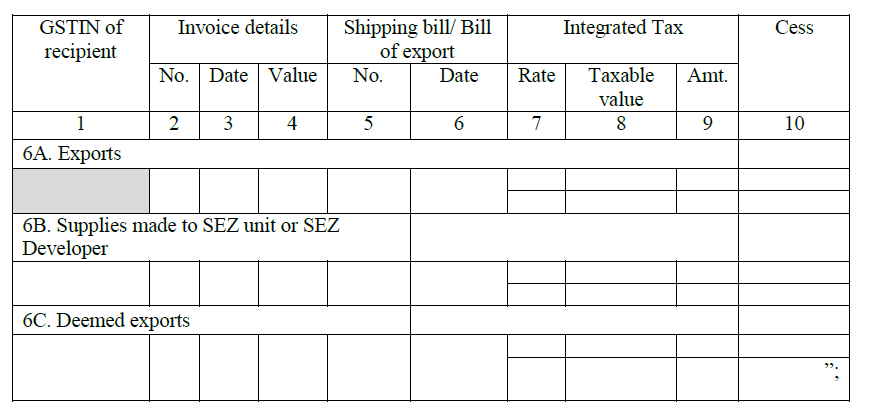

6. Zero-rated supplies and deemed exports have to be mentioned under this heading. A registered dealer has to give details of invoice, bill of export or shipping bill.

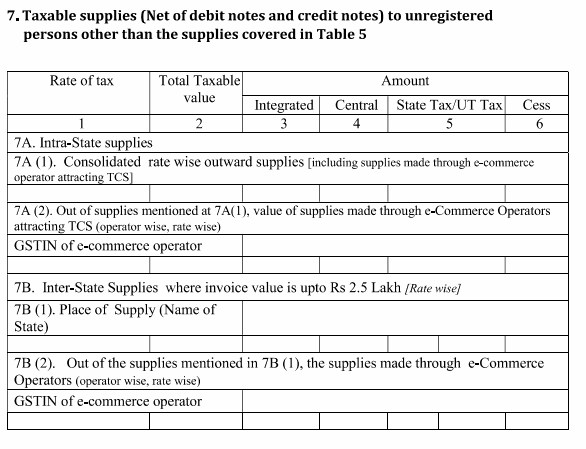

7. In this section there will be a rate wise summary of all sales made during the month.7A. All sales including sales made through e-commerce operators have to be mentioned here. Separately mention the supplies made through e-commerce operators.

Part A: B2C interstate supply along with place of supply i.e. name of state where invoice value is up to Rs 2.5 lakhs should be specified here.

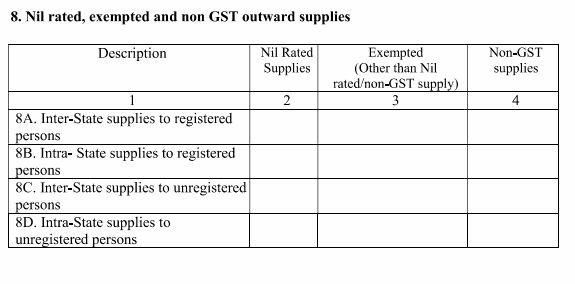

8. Nil-rated, exempt and non-GST outward supplies: All the other supplies whether nil rated, exempt or non-GST which have not been reported under any of the above needs to be reported under this head. This needs to be further bifurcated into Inter-State, Intra-State to registered and unregistered persons.

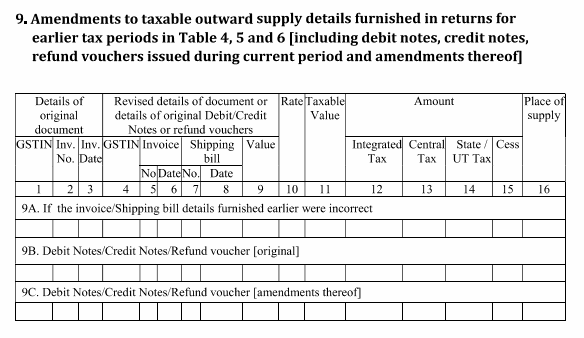

9. Amendments to taxable outward supply details furnished in returns for earlier tax periods in table 4, 5 and 6. This will include current and amended debit notes, credit notes, and refund vouchers. Any correction to data submitted in GSTR 1 of previous months can be done by filling in this section. The type of amendments covered here are with respect to B2B, B2C Large and exports.

This section must have the following:

- Credit notes

- Debit notes

- Refund vouchers

The following must not be amended from this section:

- Changing a tax invoice into bill of supply

- The Customer GSTIN

- Following with respect to Export Invoices cannot be amended:

-Shipping Bill Date/Bill of Export Date

-Type of Export- i.e With/Without payment of tax

- Following with respect to Credit Debit Notes cannot be amended:

-Receiver/Customer GSTIN.

-Place of Supply

-Reverse charge applicable

Note: All the above details with respect to Credit Debit Notes are based on the original Invoice which it is linked to, Hence these details must match with the details of the linked invoice.

- No Amendment can be made with respect to those invoices that are accepted or modified by the receiver of goods. The reason is that those invoices will automatically get reflected in the GSTR-1 of the supplier in the month of such acceptance under the relevant amendments.

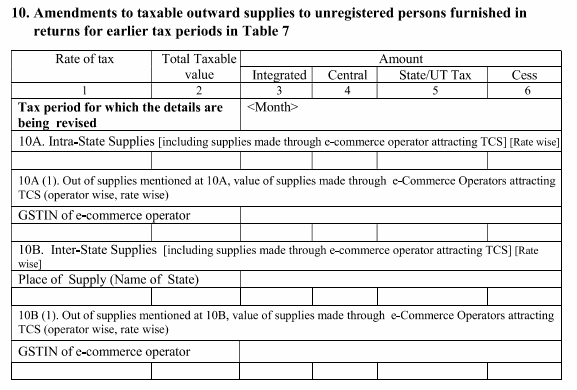

10. Amendments to taxable outward supplies to unregistered persons furnished on returns for earlier tax periods.

Details that cannot be amended here:

- Nil Rated

- HSN summary of Outward supplies

- Cannot add a new place of supply

Note: You can replace the existing place of supply with another place of supply with some limitations. Declare the amended invoices or details in the tax period in which the amendment takes place.

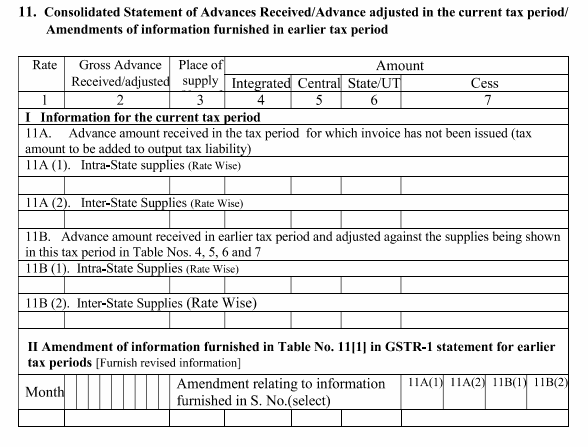

11. Consolidated Statement of Advances Received or adjusted in the current tax period, plus amendments from earlier tax periods.

Key points to remember in this section:

- Mention all advances received during the earlier period corresponding to invoices raised during the current period.

- Specify all advances received in the month for which invoice was not raised.

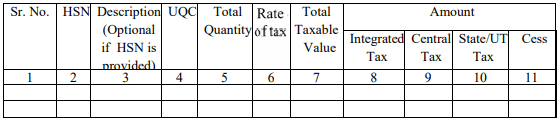

12. HSN-wise summary of outward supplies. This section requires a registered dealer to provide HSN wise summary of goods sold.

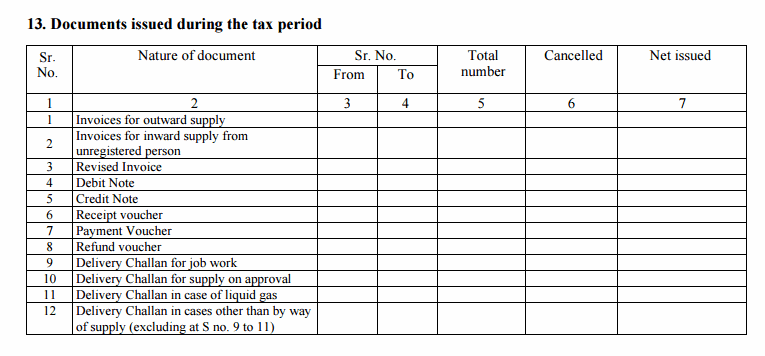

13. Documents issued during the tax period: This head will include details of all invoices issued in a tax period, any kind of revised invoice, debit notes, credit notes, etc.

How Can Deskera Help You With GST Filing?

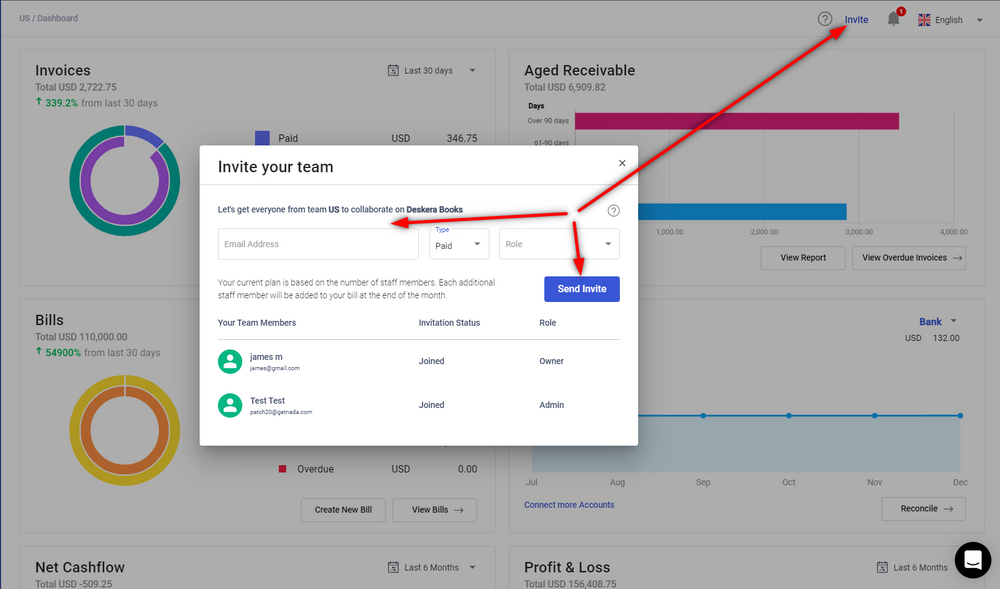

Deskera Books is an inventive way to work with managing your invoicing, bills and expenses. It also assists you with setting up chart accounts and importing opening balances. You can also invite your accountant or colleagues to use Deskera Books.

For that matter, creating Journal entries is now a breeze with Deskera Books. Moreover, you can even avail of the remarkable features including adding products, services, inventory, all under one roof.

Acquaint yourself with a new-age system that takes care of Accounting, finance, inventory, and much more, all under one single roof.

Key Takeaways

- GSTIN of the person filing the return.

- Auto-populated result of the name of the person filing the return.

- The total turnover of the previous financial year that needs to be filled once.

- Details of the outward supplies to a registered person that are taxable.

- Details of the outward supplies to an end customer where the transaction exceeds rs. 2.5 lacs.

- Zero-rated supplies as well as deemed exports along with details of invoice, shipping bill or bill of export.

- A total consideration of all outward supplies for the month, including through e-commerce operators and up to Rs. 2.5 lacs.

- Details of exempted, non-GST and nil supplies if they aren’t already mentioned.

- Any revisions/amendments that need to be made towards the outward supplies of the previous tax periods, including debit/credit notes and refund vouchers.

- Any tax due to advance payment received.

- Any taxes paid for the previous periods or reporting periods.

Articles Related