This article aims at helping the taxpayers to gain an insight into the filing process of GSTR-5A.

Let us first understand who is this form meant for.

The non-residents need to file a return form GSTR-5A for the services they provide to unregistered persons or non-taxable customers from a place outside India. By the 20th of the month following the tax period to which the return relates, or by an extended date as determined by the Commissioner, the return must be filed.

After making full payment of taxes and other liabilities, the GSTR-5A for a particular tax period can be filed only if the previous tax period's return has not been filed.

So, let’s dive in.

- Steps to file GSTR-5A on the official GST Portal

- Latest Information on GSTR-5A

Steps to file GSTR-5A on the official GST Portal

Steps to file GSTR 5A on the GST portal are given as follows:

Step 1: Log in to the GST Portal.

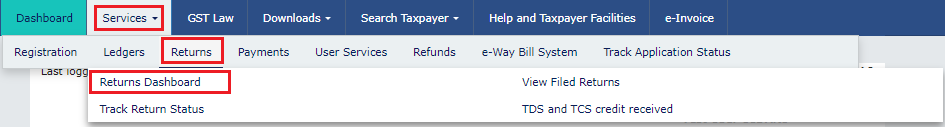

Follow the path: Services>Returns>Returns Dashboard

You may also click Returns Dashboard.

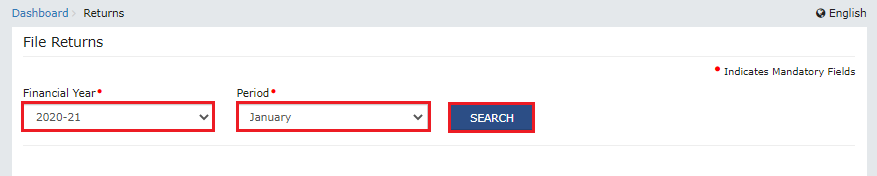

Step 2: On the File Returns page, Select Financial Year and Year for which the returns are to be filed.

Then Click Search.

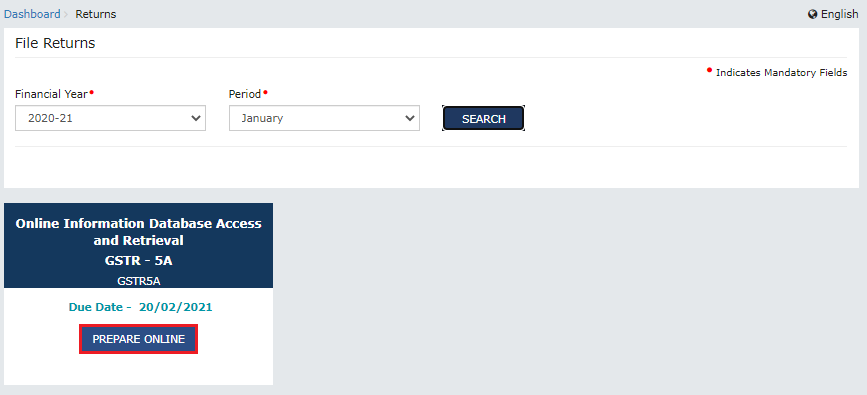

Step 3: Click PREPARE ONLINE within the GSTR-5A tile.

Step 4: Enter all the required details in the various tiles.

On clicking Help, you can get the necessary help required to proceed further.

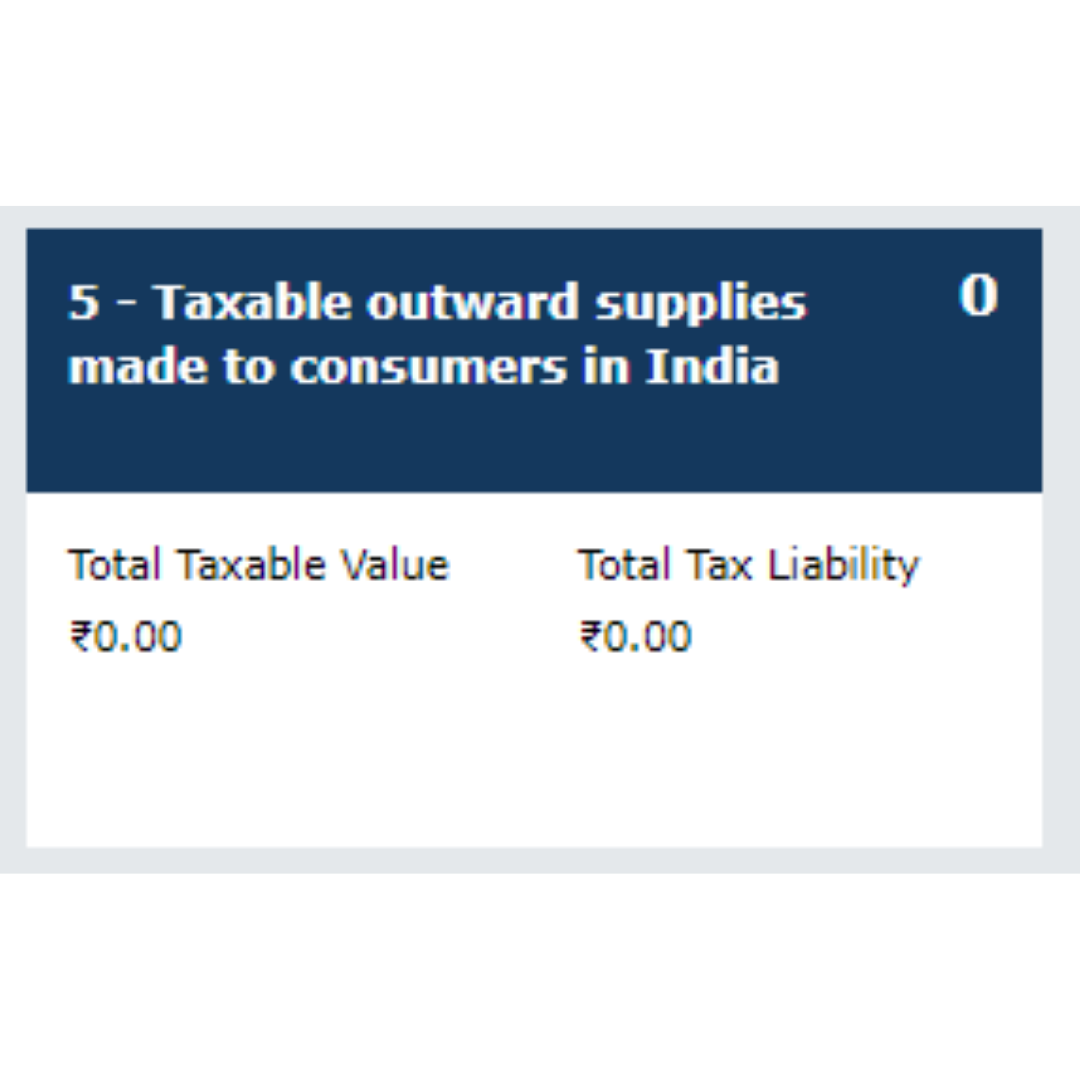

Table 5- Taxable outward supplies made to consumers in India

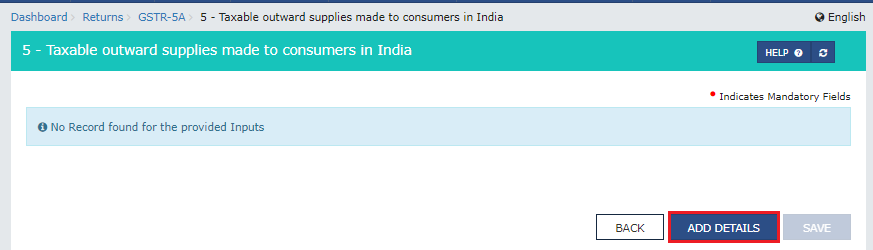

Step 5: Click on the Taxable outward supplies made to consumers in India tile. By doing this, you can add details pertaining to the supplies made to consumers in India.

Step 6: On the Taxable outward supplies made to consumers in India page, click Add Details. By doing this, you can add information pertaining to the new POS.

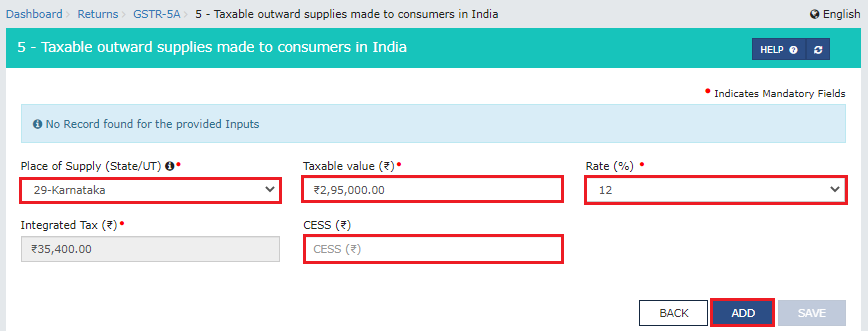

Step 7: From the drop-down, select the Place of Supply.

Enter the Taxable Value in the field provided.

Enter Cess in the field for cess.

Select Rate and click ADD.

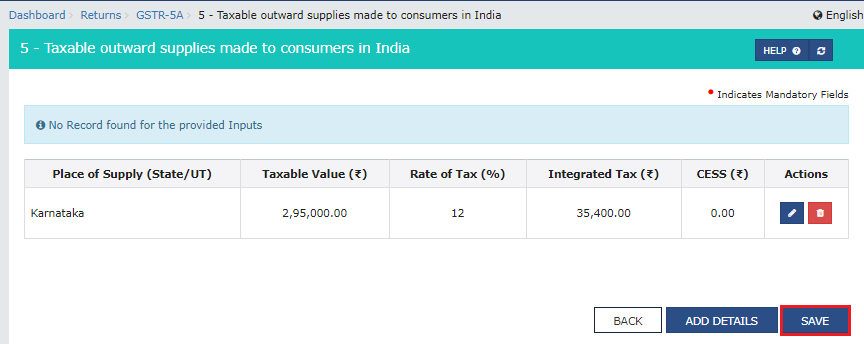

Once all the details are added, click SAVE.

Important:

You can Edit and Delete the details provided by clicking the respective buttons.

You may also Add Details using the button.

Once the confirmation message is displayed about the details being saved, you may now click the Back button and go to the Dashboard.

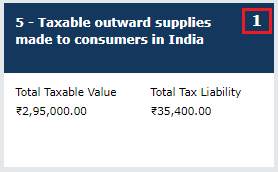

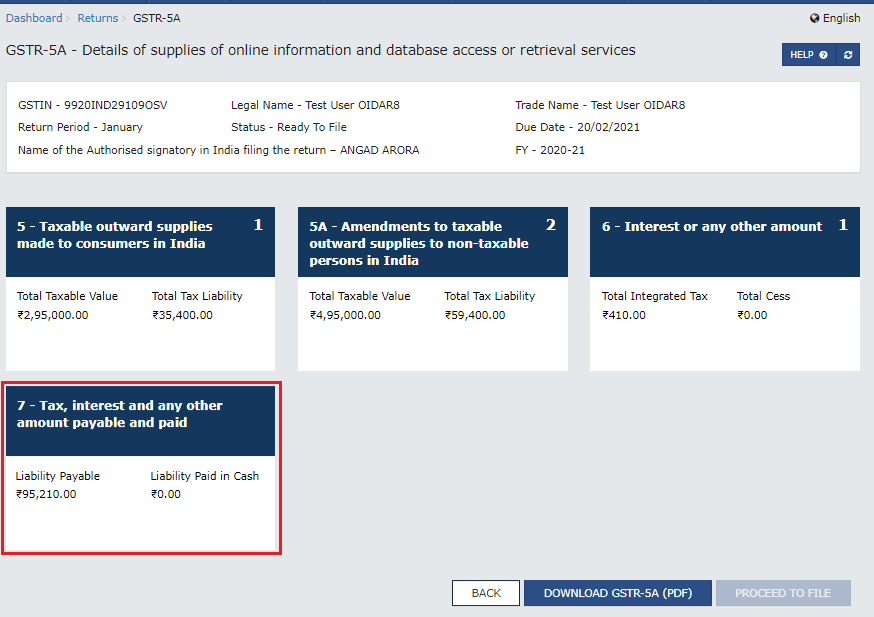

Now, you will land on the GSTR-5A dashboard with this tile on your screen: 5-Taxable outward supplies made to consumers in India.

In the same way, you will be able to add information of POS wise supplies.

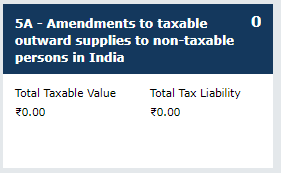

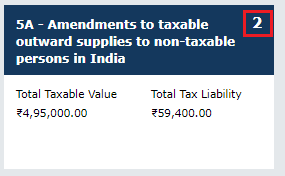

Table 5A - Amendments to taxable outward supplies to non-taxable persons in India

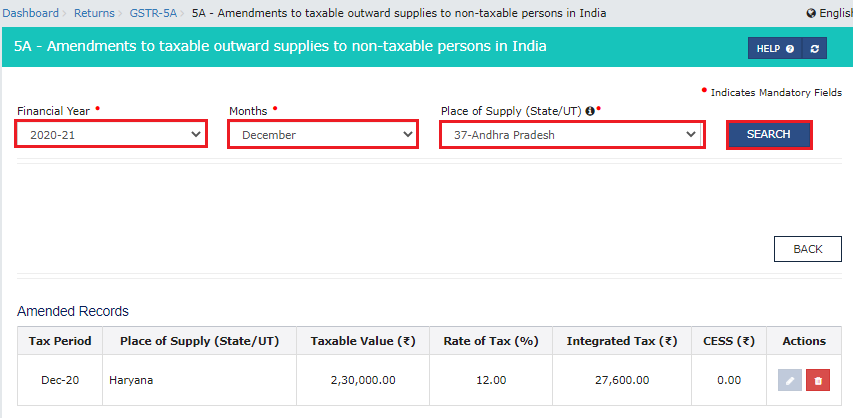

Click 5A - Amendments to taxable outward supplies to non-taxable persons in India tile.

This part is divided in to two classes:

- To Add Details

- To Amend Details

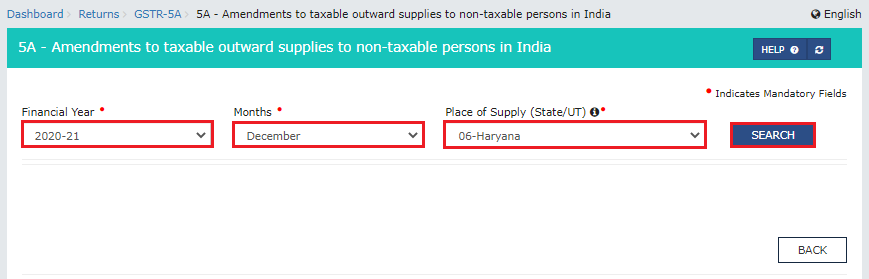

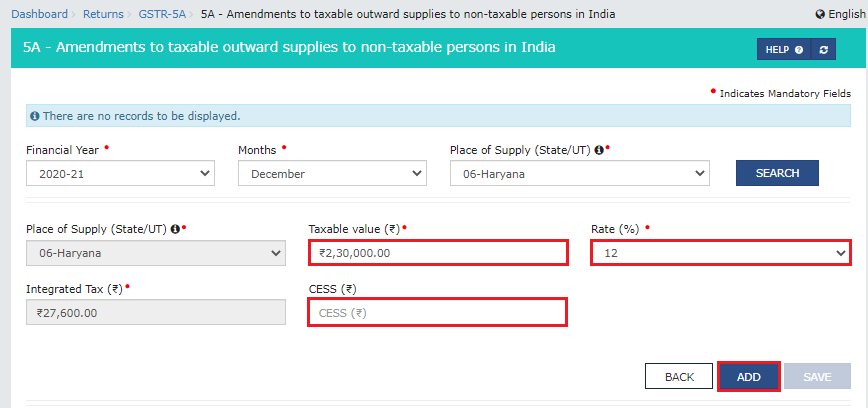

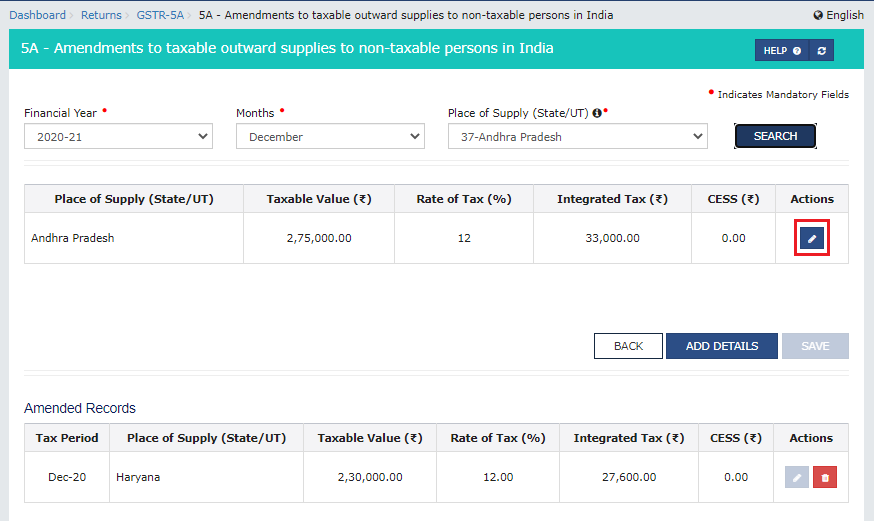

To Add Details:

Select the Financial Year, Place of Supply, and Months.

Click Search.

Enter Taxable Value, Rate and Cess in the respective fields.

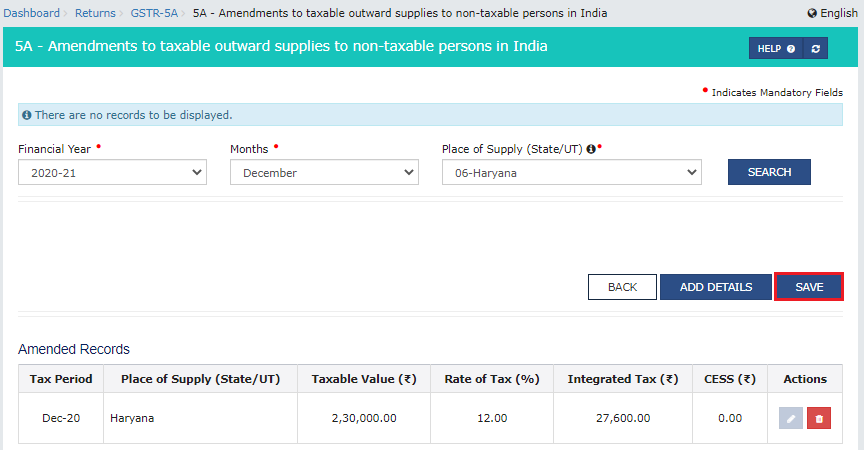

Click ADD.

Click SAVE.

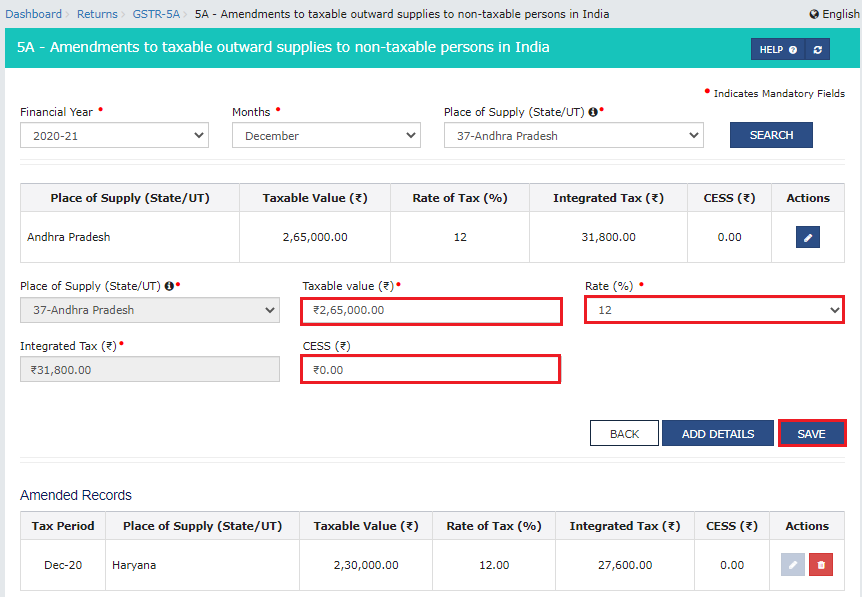

To Amend Details:

Select the Financial Year, Place of Supply, and Months.

Click Edit.

Click SAVE.

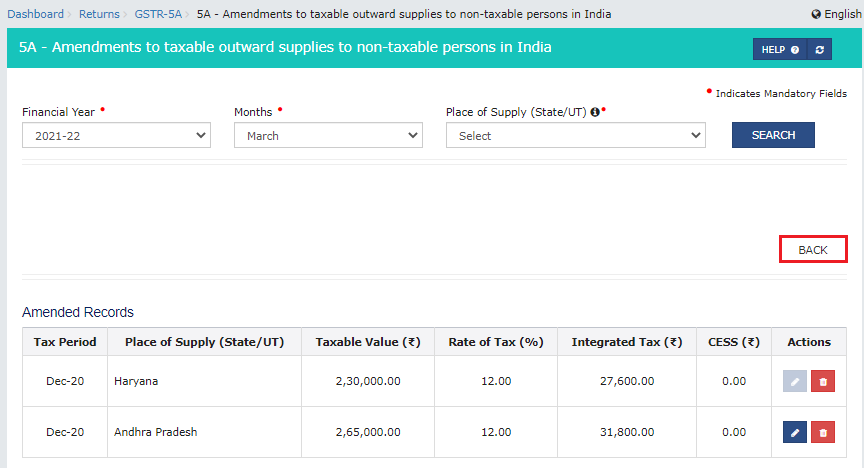

Once details added, click BACK to go to GSTR-5A Dashboard.

You will be directed to the following page of the dashboard.

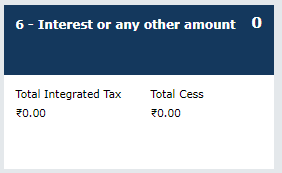

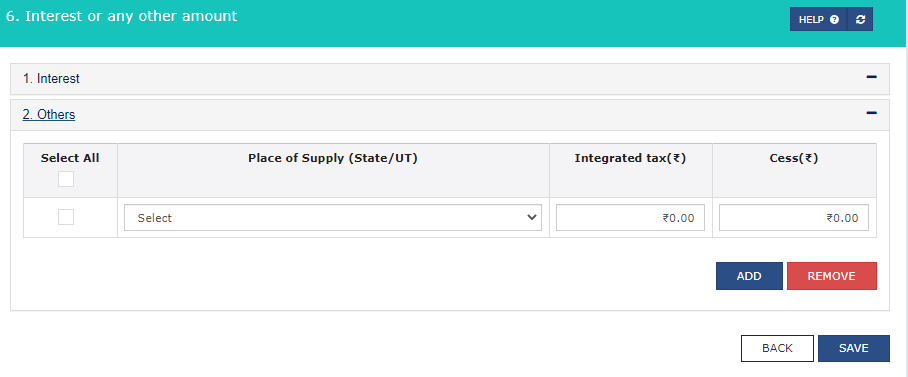

Table 6 - Interest or any other amount

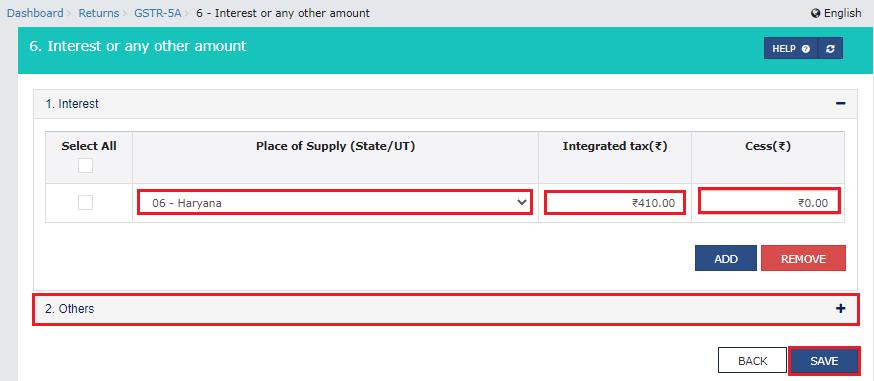

For adding interest and other details, click the 6 - Interest or any other amount tile.

Select Place of Supply, Integrated Tax, Cess and enter the details.

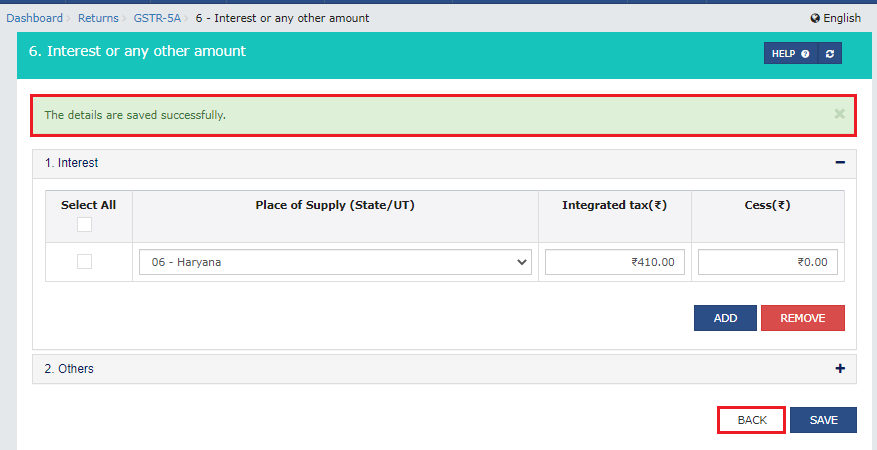

Click SAVE.

You shall receive a confirmation message.

In the same way, you may click Others to add information related to other amount.

Click BACK to go back to the dashboard.

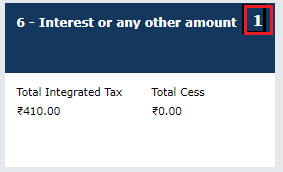

Once you are on the dashboard, 6 - Interest or any other amount tile in GSTR-5A shall present the Total Interest and Cess amount.

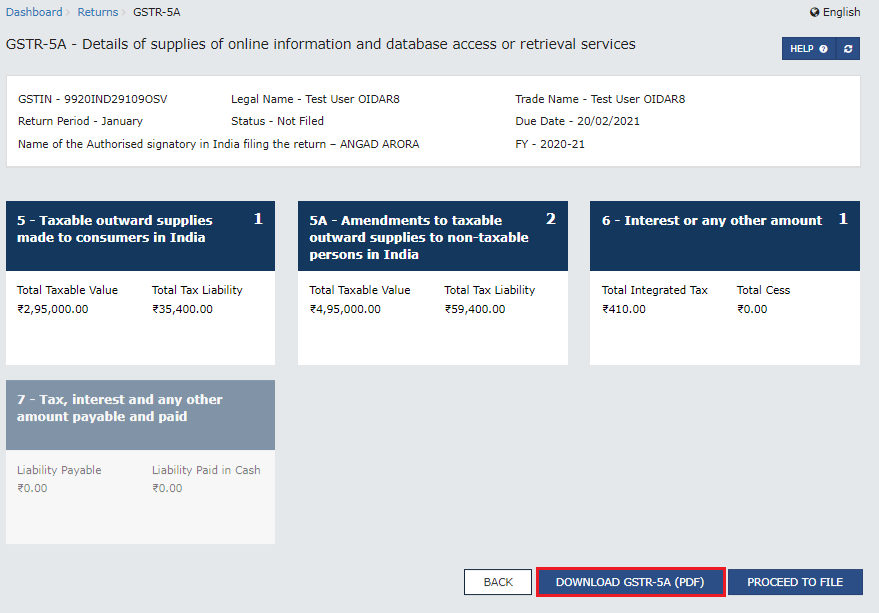

Preview Draft for GSTR-5A

Click the DOWNLOAD GSTR-5A (PDF) to view the pdf file.

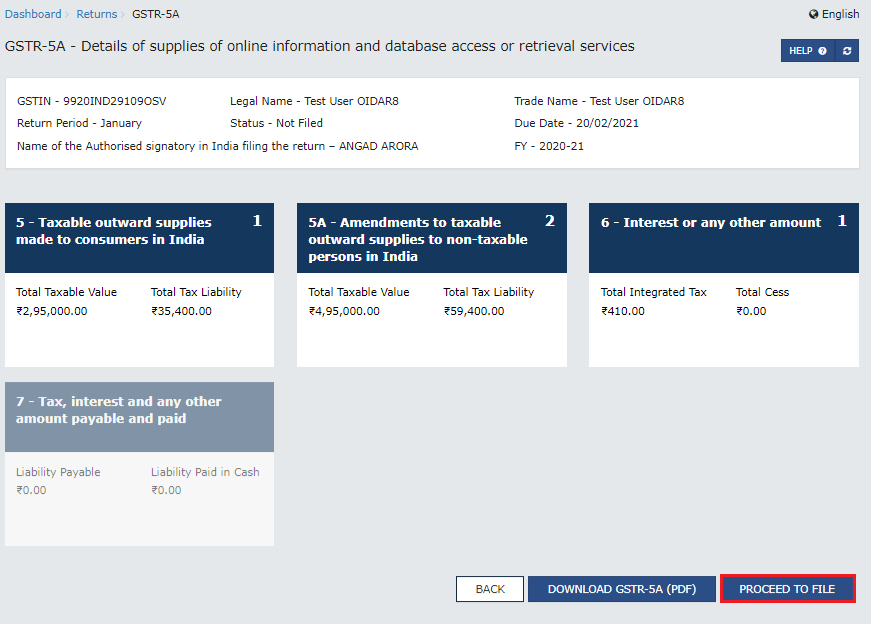

Initiate Filing for GSTR-5A

Proceed to File button shall help you proceed with filing.

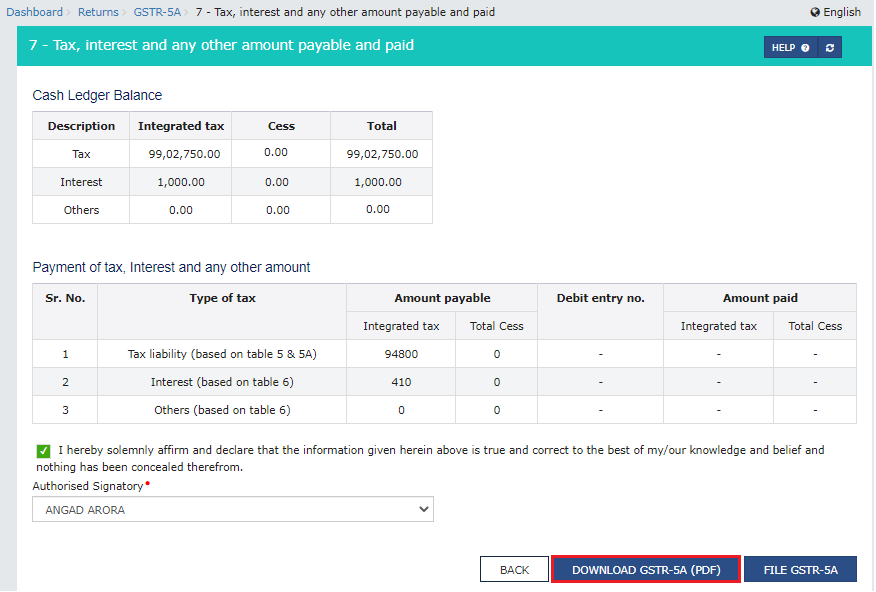

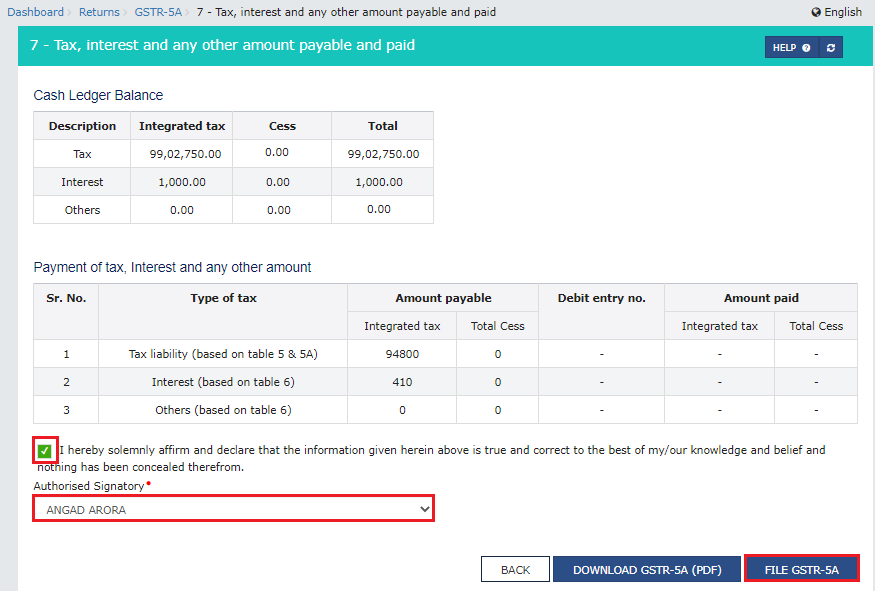

On clicking PROCEED TO FILE button, you shall enable the 7 - Tax, interest and any other amount payable and paid tile. Click on this tile.

Click the DOWNLOAD GSTR-5A (PDF) to get the file in the pdf format.

NOTE:

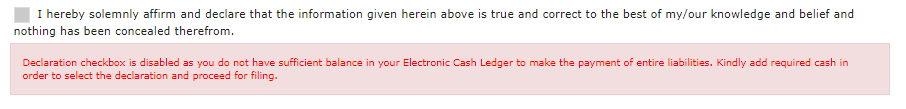

You cannot file the returns for GSTR-5A until you have filed full payment of taxes and other liabilities for the tax period.

For this case, you have to create a challan.

Services>Payments>Create Challan.

You shall get the PDF format.

On the Declaration checkbox, go to Authorized Signatory and click FILE GSTR-5A.

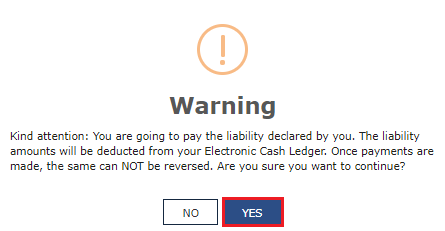

You will receive the Warning message, click Yes.

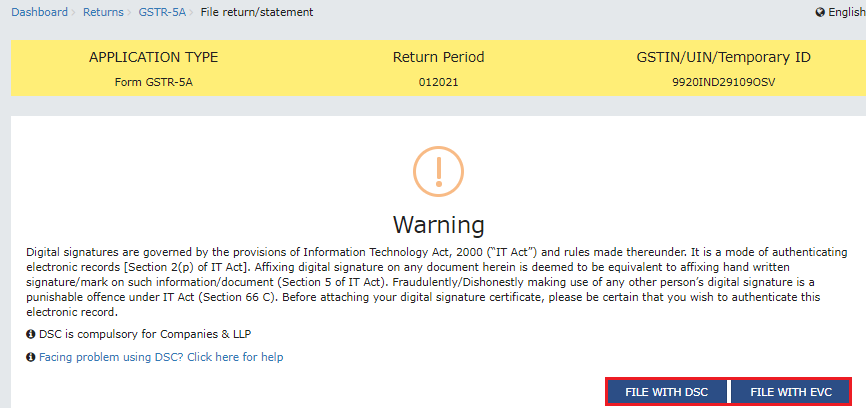

Select FILE \WITH DSC or FILE WITH EVC button to file GSTR-5A.

File with DSC:

Click PROCEED, and select the certificate. Then click SIGN.

File with EVC:

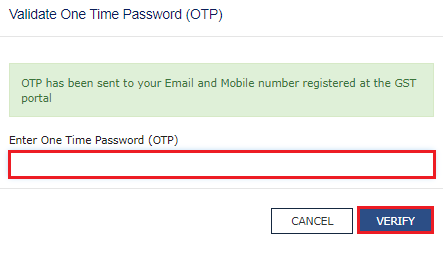

Fill in the OTP that you receive on your mail or your phone. Click VERIFY.

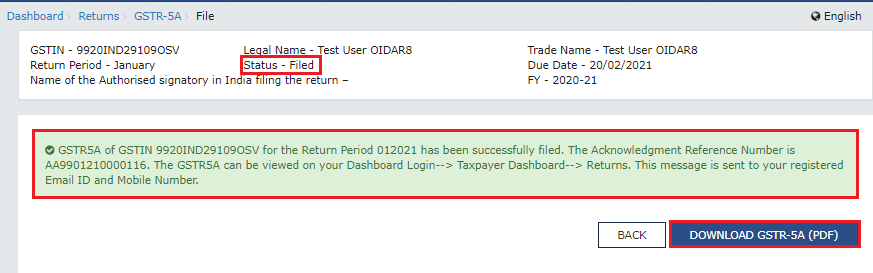

You shall receive a success message.

DOWNLOAD GSTR-5A (PDF) button will present you with the PDF format of the file.

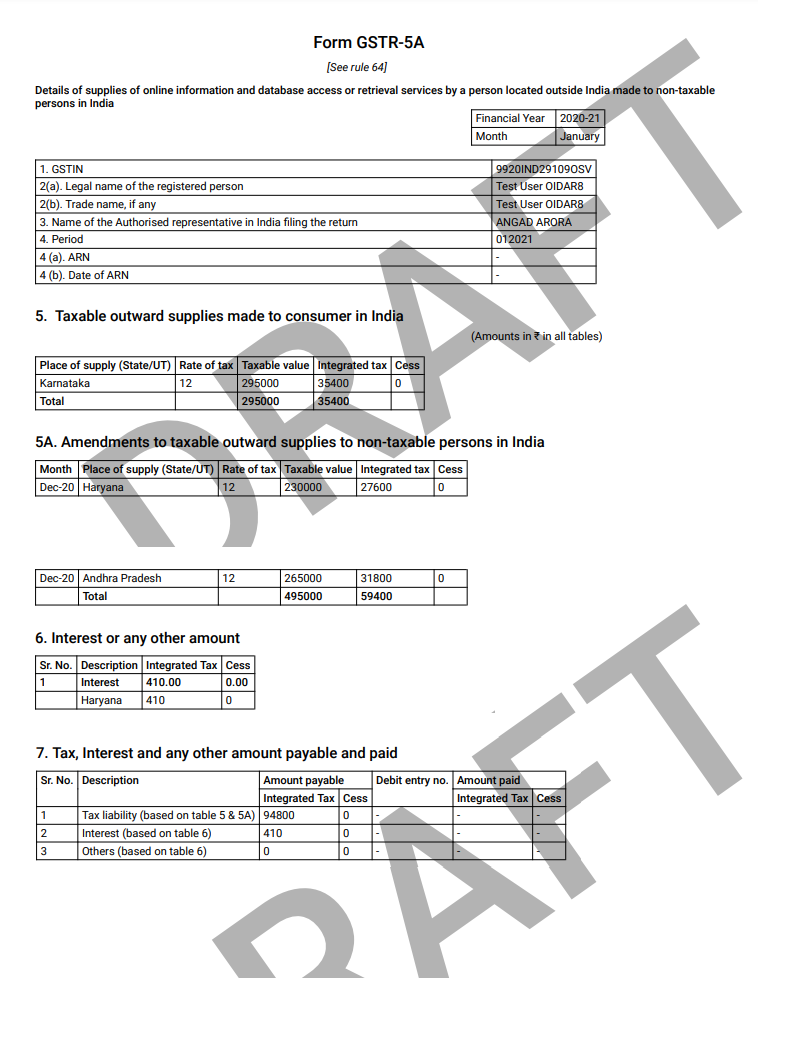

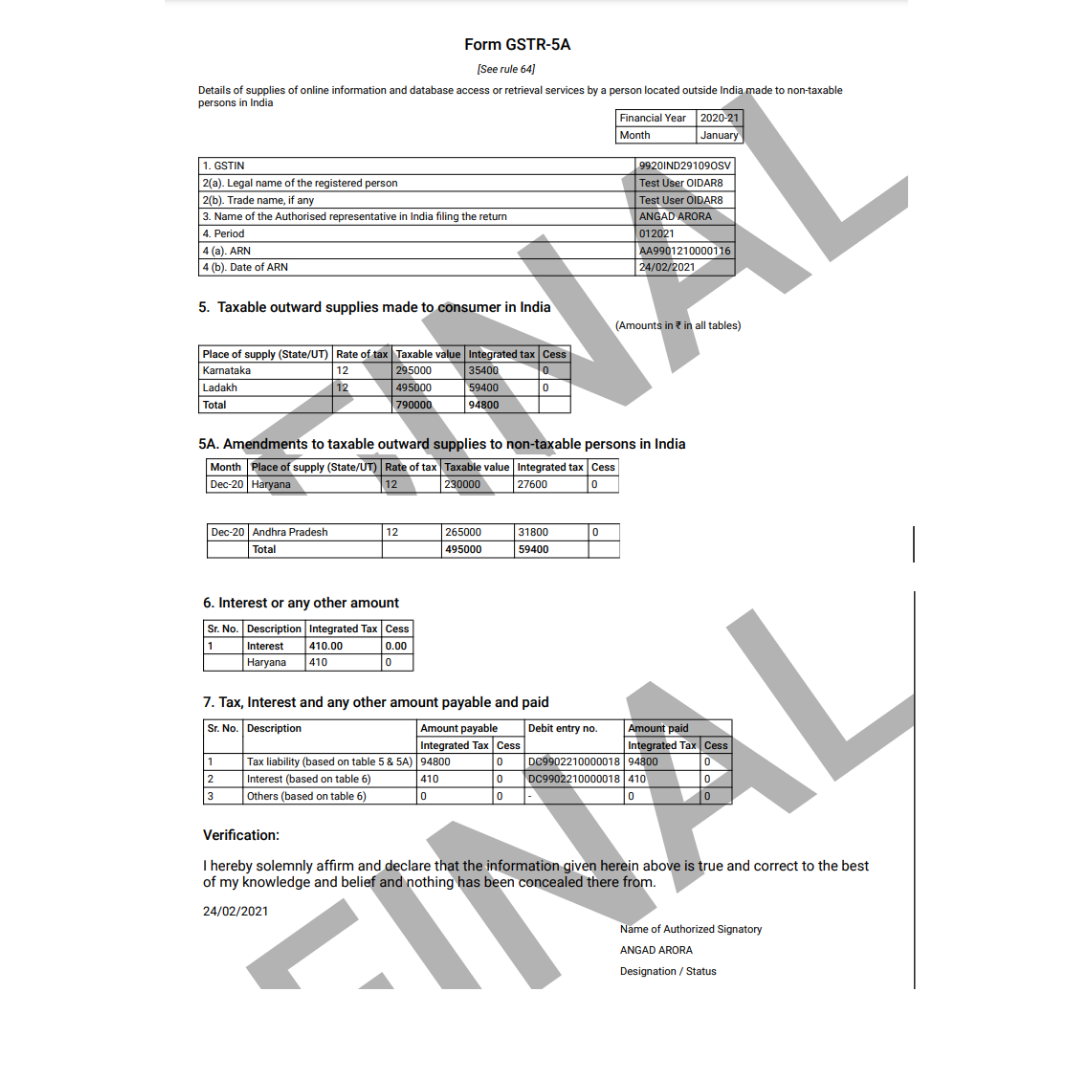

This is how your final GSTR-5A form will be displayed in the PDF format.

The process completes.

Latest Information on GSTR-5A

How can Deskera Help You?

Deskera Books is a one-stop accounting software you need for your accounting process to run smoothly, from journal entries to inventory and invoices to customers and suppliers.

Donning a Business Owner’s hat is not an easy job! If you, too, are someone who needs clarification about the various aspects concerning the GST, then Deskera Books is the place you need.

Let Deskera guide you step by step towards achieving the exact information you always wanted to get through. Take a look at how easy it is to use the accounting software!

With Deskera, you can obtain information pertaining to the GST forms like GSTR 1, GSTR 2A and GSTR 2B, and many more including GSTR9 and GSTR 9C.

If you wish to get a better grip over Deskera’s offerings in terms of GST information, then this is one guiding video you wouldn’t want to miss!

Key Takeaways

We have observed the following points:

- The non-residents need to file a return form GSTR-5A for the services they provide to unregistered persons or non-taxable customers from a place outside India.

- The returns for the form are to be filed by the 20th of the month following the tax period to which the return relates, or by an extended date as determined by the Commissioner.

- We have seen the detailed process of filing the GSTR-5A form on the GST portal.

Related Articles