Running a business in India demands a lot of knowledge, caliber, and talent to retain customers. But that is not all that you need. To run a business, you or your accountant also need to thoroughly understand the Taxation system under GST guidelines.

It is essential to keep a track of the revenue generated and maintaining the cash flow for a high net profit generating business. Indian taxation system demands businesses to generate GST Tax invoices for each sale. The same GST Tax Invoice also helps the businesses in keeping a record of the revenue and cash flow. It is alright if you do not know how a GST Tax Invoice is made and works. This article will give you complete information about a GST Tax Invoice. Let’s understand how to build it and how to file it as well.

What are we covering in this article -

- What is a GST Tax Invoice?

- What is included in GST Tax Invoice?

- Types of GST Invoices

- Tax Invoice

- Bill of Supply

- Invoice and Bill of Supply Combined

- Receipt Voucher

- Refund Voucher

- Payment Voucher

- Credit/ Debit Note

- How to Create a GST Tax Invoice

What is a GST Tax Invoice?

GST Tax Invoice is a demanded instrument by the Indian taxation system’s GST law. It acts as proof of the supply made after a sale by the business. Section 31 of the CGST Act, 2017 mentions the issuance of a GST Tax Invoice as a mandatory practice for each sale made of goods and supplies. The seller has to issue a GST Tax Invoice for each sale made above INR 200/-.

A GST Tax invoice is substantially an instrument that the seller issues to the buyer. This instrument holds the details of both the buyer and the seller. It also holds information quantities, description, a list of the goods and services sold, transportation costs, delivery method, payment method, discounts, and any other charges that are put along with GST tax amount. This GST tax invoice stands as a demand for payment by the buyer and later acts as the document of proof of payment.

This is not it, a GST Tax Invoice not only acts as a legal document but is also necessary for anyone to claim Input Tax Credit. The taxation system demands a credit note or a GST Tax Invoice when one wishes to avail Input Tax Credit (ITC). You don’t always have to be the seller to issue a GST Tax Invoice. If you are registered under GST, you can also issue the tax invoice to attain your legal document.

With this, we hope you have understood the vital importance of a GST Tax Invoice. Moving on, let’s know what all is included in a GST Tax Invoice.

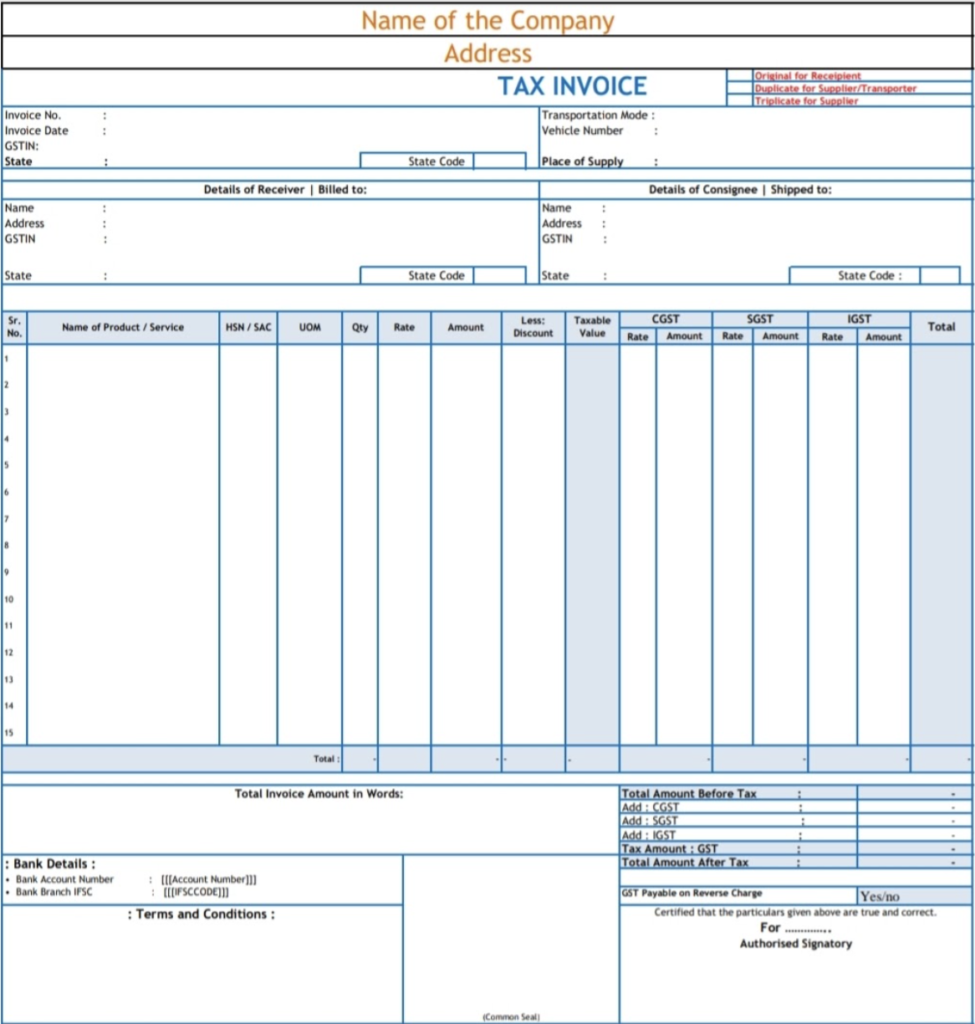

What is included in GST Tax Invoice?

A GST Tax Invoice acts as a vital document of the sale made, GST and other taxes charged, and for ITS claims as well. You just read in the above paragraphs how important GST Tax Invoices are. This means you cannot make mistakes or leave out important details on a GST Tax Invoice.

A GST Tax Invoice acts as solid proof and holds detailed information of the sale made, the seller, as well as the buyer. Here is a list of details that are mandatorily mentioned on a GST Tax Invoice.

- Header “Tax Invoice”(Should be centrally aligned)

- Invoice number (Should be serial wise)

- Date of Issue

- Name of Buyer

- GSTIN of such buyer (If they have it)

- Shipping and Billing Address of the buyer

- Place of supply

- Specific codes of each good and service sold (HSN/SAC codes)

- List of goods/services

- Quantity, unit, price, discounts, and other information of Goods and Services

- Applicable GST tax rate and others (SGST/UTGST, CGST, IGST)

In case the sale made is lower than INR 200/-, issuing a Tax Invoice is not mandatory. In case of multiple sales under INR200/- on different dates to the same buyer, you can consolidate the invoices and share them day-wise in a single Tax Invoice.

Types of GST Invoices

Tax Invoice

We have discussed a lot about it already. A tax Invoice under GST acts as a legal document and proof of tax charged. The document is also important for a registered person or company to claim ITC benefits. The document shared acts as a payment term between the seller and the buyer and benefits both equally.

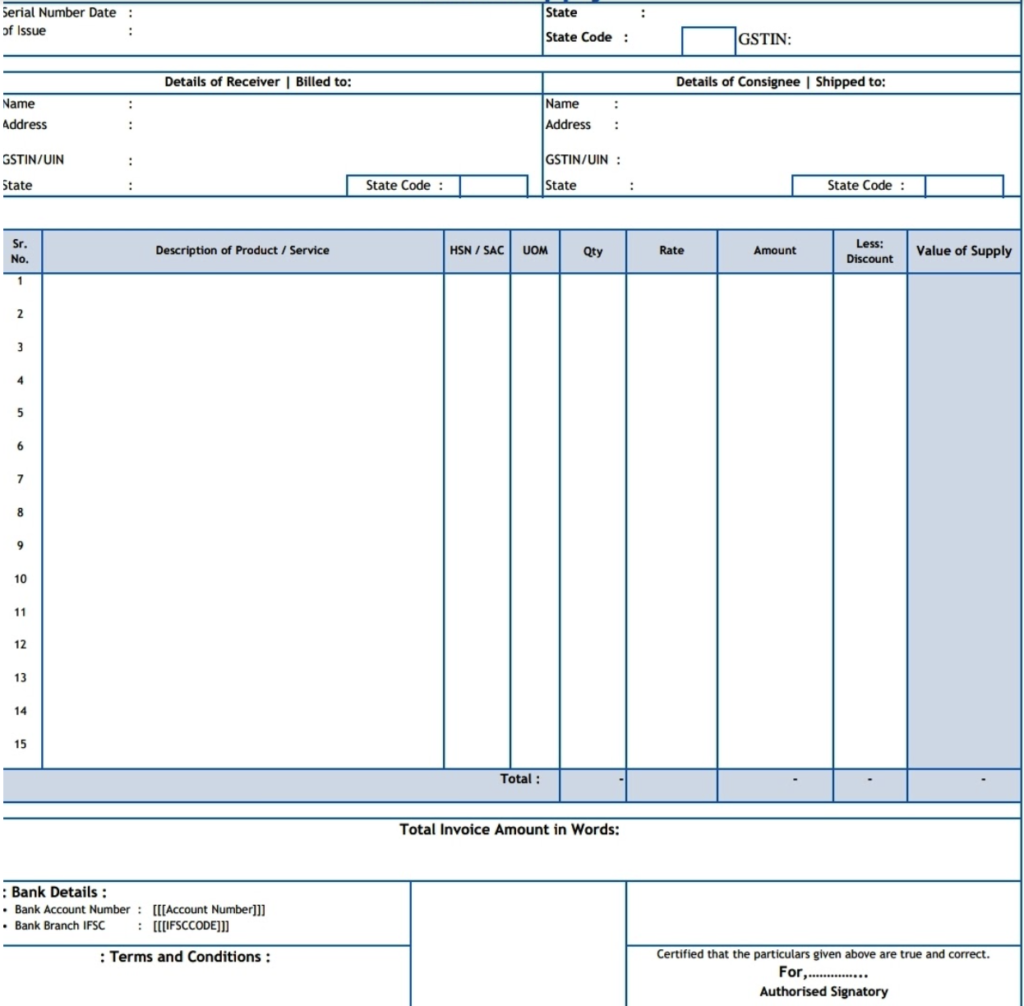

Bill of Supply

GST section has a lot of clauses that vary tax chargeable from one sale to another. As per the same, in a certain case, the supplier of goods and services is not allowed to charge taxes. In the place of Tax Invoice, in this case, the seller or the buyer has to generate a Bill of Supply.

Here are the two cases in which a Bill of Supply is issued.

- The supplier is dealing in goods or services that fall under the “exempted under GST” list.

- The supplier registered under GST has opted for “Composition Scheme” instead of “Regular Scheme”.

Since in this case, the buyer is not paying any GST, they will not be allegeable to claim Input Tax Credit.

Also, make sure to use the header “Bill of Supply” with central alignment.

Invoice and Bill of Supply Combined

A supplier is not bound to sell only GST applicable products or go for exempted under GST products. Suppliers can sell both. For such cases, the GST system of India issued notification 45/2017 on 13.10.2017. The notification says that the supplier can generate and mention all the services and goods in the same invoice. This invoice will act in a way of a combination of Bill of Supply and Tax Invoice. This is why it is called “Invoice-Cum-Bill-of-Supply”.

Receipt Voucher

As the name suggests, it is a receipt that is generated against the payment made. This acts as proof of the payment made. This comes into the act when a supplier receives an advance on payment by a buyer. Rather than generating a Tax invoice, a receipt voucher works the best.

Refund Voucher

There are situations in which a supplier is not able to serve the buyer with the goods and services ordered. In case the supplier has already received an advance payment of the supply and still fails to fulfill the order under any circumstances, they are required to generate a Refund Voucher. This voucher will act as proof of the refund made.

Payment Voucher

In some cases, the supplier is not registered under GST but the buyer is. If the supply made to the buyer is of goods and services that are subjected to “Reverse-Charge” then the buyer has to generate a payment voucher to the concerned supplier.

Credit/ Debit Note

There are situations in which the supplier has to make a supply but at the same time has to return some extent of the payment as well. This can be because of a sudden decrease in the price of the goods or services to be supplied or in case of discounts. The supplier may also have to return the amount in case of a return of the supply. In such a case, the supplier will have to issue a credit note. This note will also help in understanding the variation in chargeable tax and will act as proof of reduced tax as well.

If the supplier by mistake or in any other situation mentions a lower chargeable amount on the invoice than the original price, the supplier has to issue a debit note. This debit does not act as a token demanding the remaining amount meeting the correct price. GST debit notes are mandatory to be shown in the return filing to improve the tax liability of the supplier.

When a registered supplier makes a mistake and charges the wrong tax amount, they generate a supplementary tax invoice. The tax amount charged in excess or less can be matched to the correct amount using a supplementary tax invoice in the form of a credit or debit note.

How to Create a GST Tax Invoice?

A GST Tax Invoice is not only an instrument to demand payment but also acts as a legal document of the payment made and tax charged. This is why a GST Tax Invoice has complete information of the buyer as well as the seller.

A GST Tax invoice is detailed work but you don’t have to work hard on each one of it. You can create a GST Tax Invoice by hand or through software. There is multiple software available in the market that helps in creating invoices without much effort. Deskera offers GST Tax Invoice creating software, multiple invoice templates to suit your choice and thousands of other facilities for your business’s smooth operations.

Here are the steps to create a GST Tax Invoice no matter what software you are using. The layout remains the same. All you or your accountant needs to do is enter the details of each sale and buyer accordingly.

Step 1 – Surf through the software and click on the “Invoice” tab. This will automatically bring you to creating the invoice you need.

Chose the kind of invoice you wish to build, in this case, a GST Tax Invoice. It may happen that the software does not have a GST Tax Invoice option. In that case, you can simply choose a simple invoice and fill in the details according to the GST Tax Invoice.

Step 2 – Mention the Date

The date of the GST Tax Invoice is the most important part and you cannot get it wrong. You can set the date in the invoice as the date of payment received if the supply was not made on the same day. If the payment received and supply made falls on the same date then you can mention that particular date in the GST Tax Invoice.

Step 3 – Mention the Buyer’s Details

Mention all the details like name, address, contact, email id, etc. about the buyer. Remember, the details of the buyer go before you create the invoice. If it is an existing buyer, feed in the details for the drop-down list. If it is a new buyer, you can feed in fresh information in no time.

Step 4 – Mention the Seller’s Details

If you are using software, you will most probably have your details saved permanently to go as default on each GST Tax Invoice. In case you are doing it manually, mention all the details of your business like the logo, name, contact information, address, etc.

Step 5 - Supply Address

Mention the address of supply. This is essential to understand what type of tax the seller needs to charge. The supply address will decide the kind of GST tax that shall be charged from ‘IGST or CGST & SGST.’ If you are making the tax Invoice on software, the software will automatically pick the address of supply and use the State to ensure the right GST tax is being charged on the sale.

Step 6 – Enter the Details of Goods and Services

Mention all the services and goods that you sold. Now select the type of goods or services and put down all the details. Mention the units and quantities in the details. Choose the type of GST tax to be charged. The software will automatically calculate the tax amount for each good and service mentioned in the invoice.

Step 7 – Create the Final Tax Invoice

You are done with mentioning all the details. The tax charges are also applied to the invoice. All you need to do now is click the create button. The invoice will be created and you can now forward it or print it out and send it to the buyer.

Follow these seven steps and you will face no trouble in creating an invoice. Remember, in case the software does not apply GST Tax on its own, you will have to do it manually.

How can Deskera Books Help?

Deskera Books is accounting software that makes your operations swift. You can create invoices, bills, manage expenses, record inventory, record payments, receive payments, prepare financial reports, manage books, and a lot more.

Key Points

We hope you have gone through the entire article. From how to start gathering details to how to finish up the GST Tax Invoice, the article has it all. Here we have mentioned all the highlights and key points from the article that you need to keep in mind. These key points will not only help you understand the functioning of a GST Tax Invoice but will also help you know how does it work. Let's dive into it and go through all the key points.

- A GST Tax Invoice is an instrument demanded by the GST law of India. It acts as a demand of payment and later as a legal documented proof of the transaction and sale made.

- The particulars a GST Tax Invoice includes are

- Header “Tax Invoice”(Should be centrally aligned)

- Invoice number (Should be serial wise)

- Date of Issue

- Name of Buyer

- GSTIN of such buyer (If they have it)

- Shipping and Billing Address of the buyer

- Place of supply

- Specific codes of each good and service sold (HSN/SAC codes)

- List of goods/services

- Quantity, unit, price, discounts, and other information of Goods and Services

- Applicable GST tax rate and others (SGST/UTGST, CGST, IGST)

- A GST Tax Invoice is different from a tax invoice. It clearly mentions all the taxes the seller has to implement on the sale.

- A GST Tax Invoice is not the only type of GST Invoice. Here are all the types of GST invoices we have –

- Tax Invoice

- Bill of Supply

- Invoice and Bill of Supply Combined

- Receipt Voucher

- Refund Voucher

- Payment Voucher

- Credit/ Debit Note

- Creating a GST Tax Invoice is not a difficult process. Follow our 7 step process of building a GST Tax Invoice and it will be done in no time.

- The address of the buyer is mandatory to be filled. Remember, the supply address is the detail that decides which GST Tax is to be implemented on the sale.

Related Articles