Under the GST taxation system, the state and union territories are represented by their given codes. These codes are mentioned in the GST state code list in numerical form.

The benefit of having short, numerical codes is that it helps in preventing the chaos that arises from writing an alphabetic GST state code in GST invoice and GST return data. This would lead to problems with processing invoices, finding the correct GST liabilities and filing GST returns.

Similarly, the taxpayers can enjoy a lot of transparency after knowing their jurisdiction. They would be able to report their grievances to this jurisdictional officer and even streamline any jurisdictional issues between the center and state.

This article will take you through both- GST state code list and GST jurisdiction list.

Where Do We Need State Code in GST?

In GST, state code is used in:

GST Identification Number (GSTIN)

When getting your GST registration done, it is most likely that you would have received a 15-digit provisional ID or GSTIN. Knowing the structure of your GSTIN is important as this would help you in verifying whether your supplier has quoted the correct GSTIN in their invoices. It is also important as you would then be able to verify that you have mentioned your GSTIN correctly in the invoices to your customers so that you get your input tax credit. The 15 digit of your GSTIN includes:

- 2 digits signifying the state code

- 10 digit PAN number

- 1 digit signifying the number of registrations

- 2 digits having the default and checksum values

In identifying the “place of supply”

Knowing the place of supply is important to know whether IGST or CGST and SGST will be charged. If the Supplier State Code and “place of supply” state code is different, then IGST would be charged, whereas if the Supplier State Code and “place of supply” state code is the same, then CGST and SGST would be charged.

GST State Code List

Where Do We Need GST Jurisdiction?

GST jurisdiction plays an important role in the hassle-free processing of the returns, applications, assessments and in availing facilities under the law. The Indian Government has classified the jurisdiction based on the geographical regions, pin codes of distinct locations and distinct districts. A taxpayer must know the jurisdiction he is part of and declare the same while applying for GST registration.

Classification of GST Jurisdictions

GST jurisdictions are classified into 2 main categories:

- Central Jurisdiction- These are administered by the Center directly

- State Jurisdiction- These are assessed and administered by the respective state administration

As per the CGST Circular No. 21/2017, dated as 20th September 2017, the prescribed manner in which the Central and State Jurisdictions are demarcated are:

- 90% of the taxpayers whose total turnover falls below Rs. 1.5 Crore shall vest with the state administration, while the remaining 10% shall vest with the Central administration.

- On the other hand, 50% of the taxpayers have a total turnover of more than Rs. 1.5 Crore shall vest with the state administration, while the remaining 50% shall be taken up by the center administration.

The division of GST taxpayers is computer initiated and done at the state level using stratified random sampling while taking into account the taxpayer’s geographical location and type of registration. Accordingly, the jurisdictions under GST are classified in order of their hierarchy and size, into the following levels:

- Zone

- Commissionerates

- Division Offices

- Range Offices

GST Jurisdiction List

However, if you are unable to find your jurisdiction through this table, the steps to finding it are given in the next section of this article.

The Process to Know Your GST Jurisdiction

These steps are to be followed on visiting the Central Board of Indirect Taxes (CBIDT) website in order to find which jurisdiction they fall under.

- Login to the GST CBIDT website and find the “services” tab. Then click on the “know your jurisdiction” button that is visible in the drop-down menu.

- Select your state from the left column provided on the screen

- You will be then prompted to select your zone and the commissioner’s office. After you have entered these details, the fields under division and range will be populated.

- On selecting appropriate options from the drop-down menu, you will get to know your GST jurisdiction.

How Can Deskera Assist You With the Accounting of Your Business?

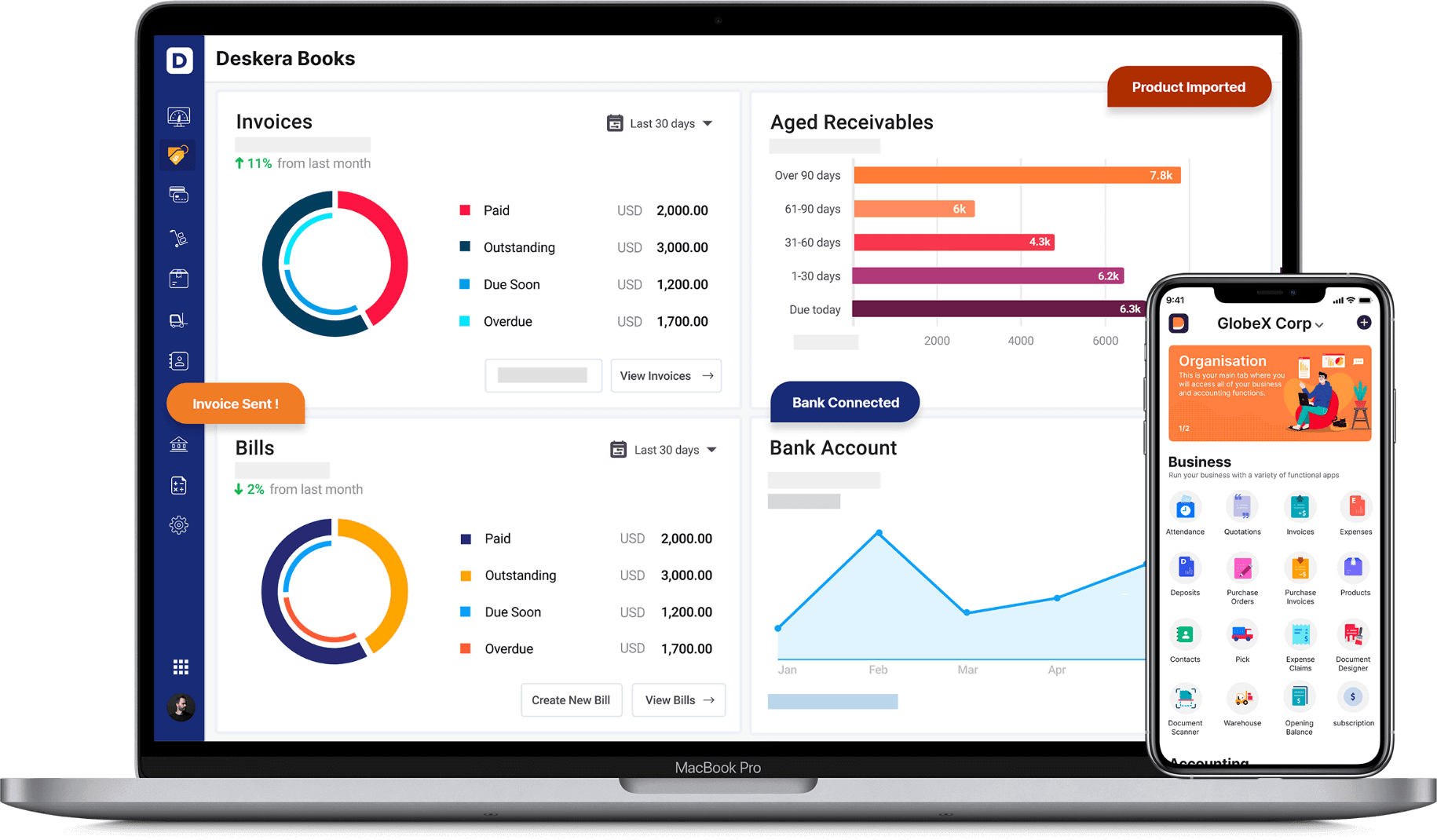

Deskera Books is accounting software that is dedicated to making accounting easier, hassle-free and error-free for you. It is automatic software that handles all your business accounting be it invoice generation and sending, making of balance sheets, income statement, profit and loss statement, cash flow statement and even bank reconciliation statement.

This is in addition to all the real-time insights and analysis that it provides which will help you to gauge your business performance and decide your further strategies. Deskera Books is equipped to track all your sales, purchases, pending receipts and expected account receivables and account payables.

Deskera Books will also help you in keeping track of your financial KPIs and marketing KPIs so that you can optimize your operating income against your operating expenses. This will also help you to identify the marketing strategies and the sales strategies that are working the best for you.

Most importantly, Deskera Books will assist you in complying with all the taxation regimes of the Government where your business is based. So, what are you waiting for? Sign Up for Your Free Trial Now!

Key Takeaways

With the implementation of GST in the Indian taxation system, the whole system has become more automatic, less prone to fraud and more clear. GST state code and jurisdiction list assist further in maintaining this. Knowing your way around GST and acknowledging the benefits of GST will make it easier for you to comply with its requirements.

Related Articles