When you have a registered your business, it becomes mandatory for you to file a monthly/quarterly and a yearly GST (Goods and Service Tax) return. Your GST return will be based on the type of business you have. The government has simplified the process to file the GST returns on the GST portal.

For business owners, big or small, GST is a way of letting the government know about all the transactions taking place in a particular duration in your business. It. therefore, becomes important that you make yourself familiar with the facts related to GST such as GSTIN, registering for GST, and so on.

This article concentrates on the following facets of the GST:

- What is GST Return?

- Who must File GST Returns?

- Types of GST Returns (based on the New GST Law)

- How to File GST Returns Online?

- How to check the Status of GST Returns?

- Downloading GST Returns

- Fine or Penalties for Late Filing of GST Returns

What is GST Return?

An official document that provides exhaustive data of all your purchases, sales, tax paid on your purchases, along with the tax collected on your sales is called a GST Return. This is to be paid by every GSTIN or the taxpayer so that the tax administrative authorities can calculate the net tax liability.

When you register for GST, you have to file GST returns on the categories broadly depicted here:

- Sales

- Purchases

- Sales Output on GST

- Paid GST on Purchases (also called Input Tax Credit)

Who Must File GST Returns?

All the business owners who have a registered business under the GST system must file the GST returns, based on the nature of their transactions and business.

- Regular Businesses

- Amendments

- Businesses registered with Composition Scheme

- Auto-drafted returns

- Tax Invoice

Types of GST Returns (based on the New GST Law)

There are 3 categories that broadly classify the GST returns. Here is a comprehensive list of the types of GST Returns:

Regular Businesses

Companies registered under the Composition Scheme

Other types of businesspeople and dealers

Amendments

Auto-drafted Returns

Tax Notice

How to File GST Returns Online?

Here are the steps we need to follow to file the GST Returns online:

How to Check the Status of GST Returns?

You can easily check the status of your filed returns on the GST portal. Here are the three techniques to achieve that:

- Use the ‘Return Filing Period’ option to fetch status

- Use the ‘ARN’ to fetch status

- Use the ‘Status’ to fetch status

Here’s how you can use the ‘Return Filing Period’ option

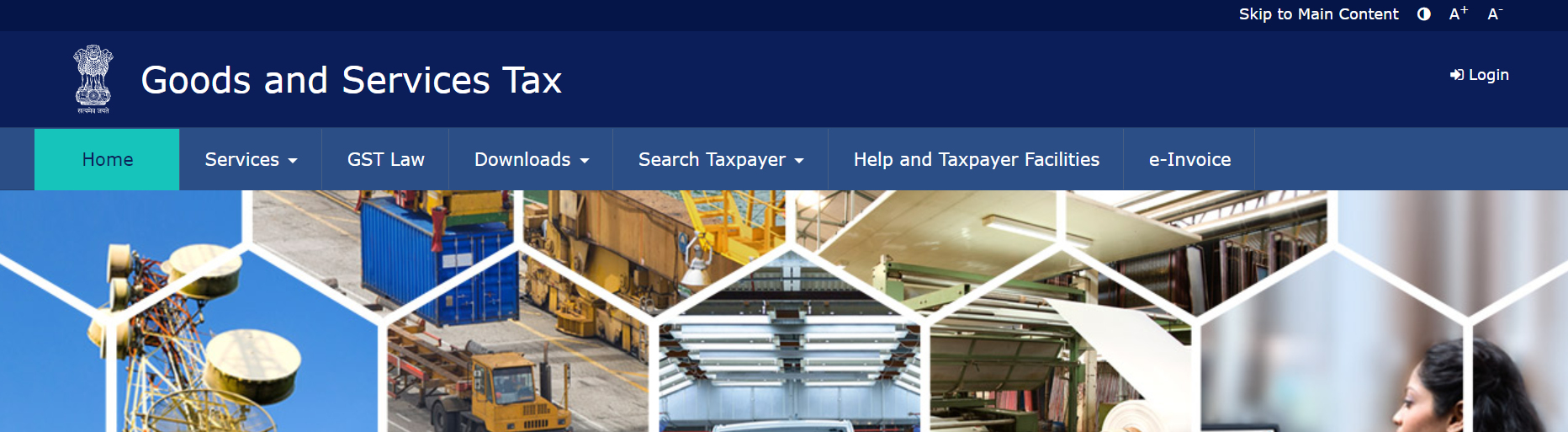

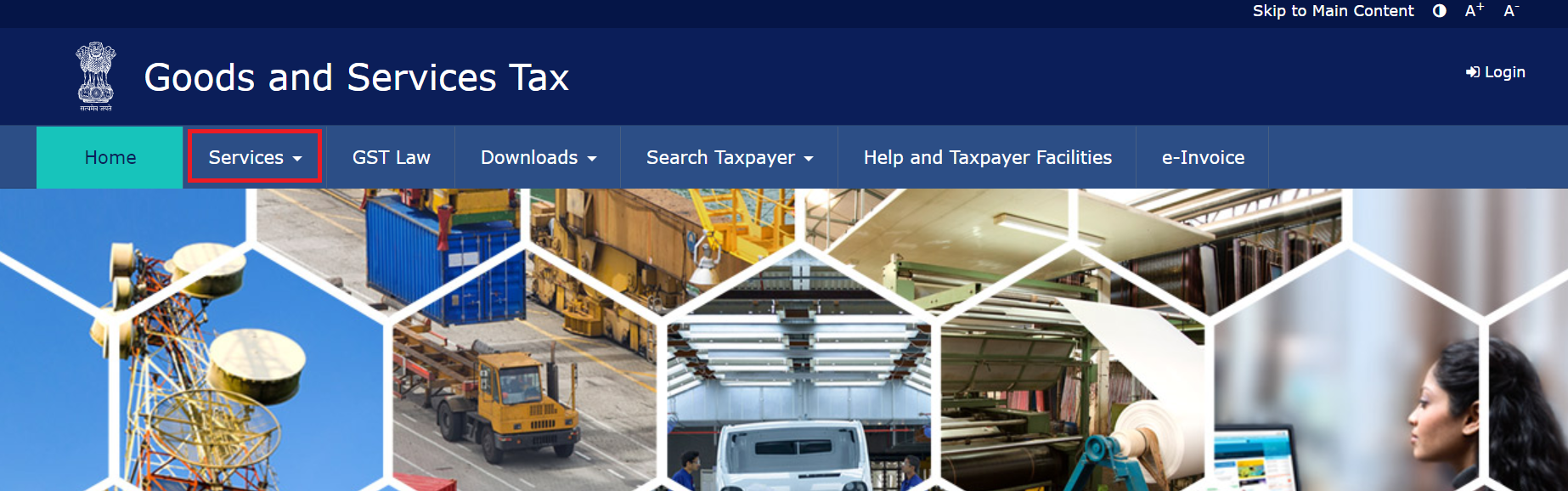

- Log in to the GST portal at https://www.gst.gov.in/ using your credentials.

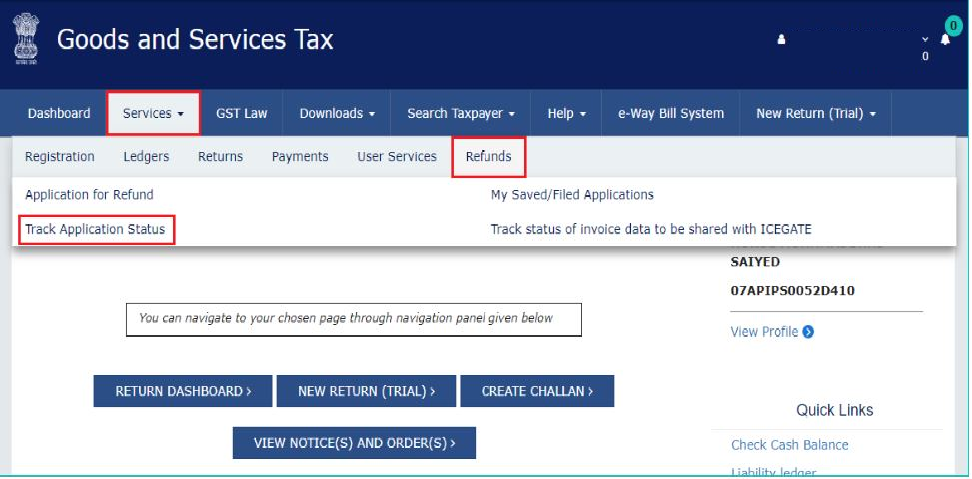

- On the top menu, click ‘Services’.

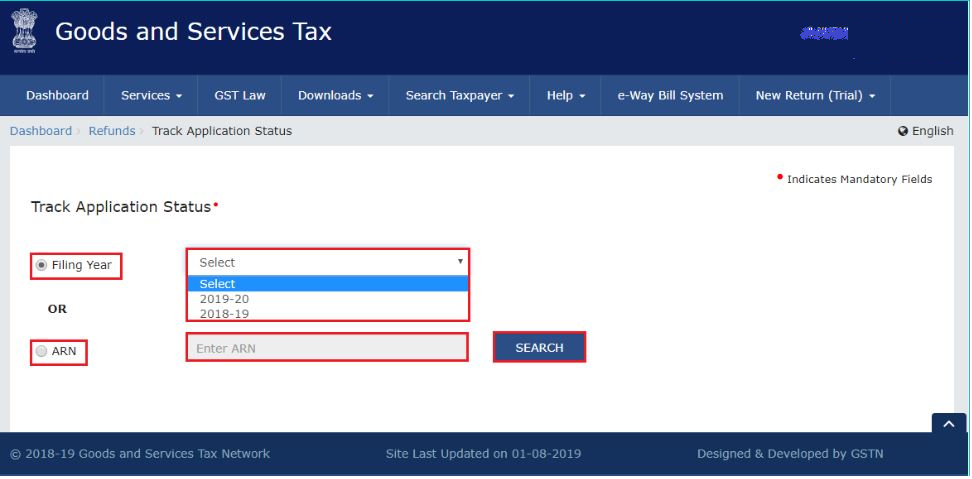

- Under the Refunds option, go to ‘Track Application Status’.

- Choose the ’Filing Year’ option.

- On the next page, you will have to choose the applicable financial year and corresponding filing period.

- In this step, click ‘Search’, which will present the status of your GST Return.

Here’s how you can use the ‘ARN’ option

- Log in to the GST portal at https://www.gst.gov.in/.

- Go to the ‘Services’ tab in the top menu.

- Under the Refunds option, go to ‘Track Return Status’.

- Here, choose the ’ARN’ option.

- Fill in the ARN in the given field.

- Finally, click Search, which gives you the status of your GST Return.

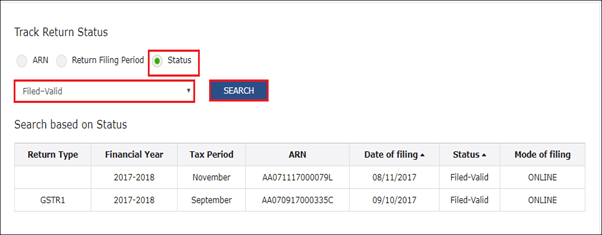

Here’s how you can use the ‘Status’ option

- Log in to the GST portal at https://www.gst.gov.in/.

- Go to the ‘Services’ tab in the top menu.

- Under the Refunds option, go to ‘Track Return Status’.

- Select the ‘Status’ option.

- Choose the Status of Return from the provided drop-down box.

- Upon clicking the search button, you shall be presented with the status of your GST return.

Downloading GST Returns

Here are the steps you need to take to download the GST returns:

- Log in to the GST portal at https://www.gst.gov.in/.

- Go to the ‘Services’ tab in the top menu.

- Under the ‘Returns’ option, go to ‘Returns Dashboard’.

- You’ll be taken to the next page where you’ll be selecting the financial year and the return filing period.

- Click the Search button. Then choose the GSTR.

- Under the chosen GSTR, click on the ‘Prepare Offline’.

- Click ‘Download’ and then on ‘Generate File’.

- In this step, you shall have the file generated along with the download link.

- Here, in the final step, opt for the ‘Click Here’ option which downloads the ZIP file giving you all details of your GST Returns.

Fine or Penalties for Late Filing of GST Returns

GST Returns should be filed within the timeframe mentioned to avoid any late fees. A rate of 18% per annum is charged as a late fee. The taxpayer must calculate it based on the amount of tax that still needs to be paid. The time period considered will be from the next day of filing to the date of payment.

There is a late fee of Rs. 100 per day per Act. The CGST and the SGST have a late fee of Rs. 100 each. Rs.5000 rupees is the maximum amount. IGST does not have a late fee. For those who file GSTR-1 and GSTR-3B, a reduced late fee of Rs. 50 per day of delay is currently applicable, whereas it is Rs. 20 for NIL returns.

How can Deskera Books Help You with Filing GST Returns?

It is essential that the returns are filed in a standardized format. While it is challenging to understand the process and then follow it as prescribes, Deskera Books comes to our rescue in such as scenario.

It is an innovative system for invoicing, accounting, and inventory management, all in one place that helps businesses focus on their core tasks and goal accomplishment.

With Deskera Books, it is now easy to view your financial reports anytime, anywhere, and create invoices apart from tracking expenses and getting a real-time view of the inventory details.

Key Takeaways

Let us run through the vital points discussed in the document:

- An official document that provides exhaustive data of all your purchases, sales, tax paid on your purchases, along with the tax collected on your sales is called a GST Return.

- GST is to be paid by every GSTIN or the taxpayer so that the tax administrative authorities for calculation of the net tax liability.

- GST is applicable to any business that processes Sales, Purchases, Sales Output on GST, and/or, Paid GST on Purchases (also called Input Tax Credit).

- All the business owners who have a registered business under the GST system must file the GST returns.

- The GST returns are based on the nature of the business and that of transactions.

- The types of GST returns can be broadly classified as Regular Businesses, Companies registered under the Composition Scheme, Other types of business people and dealers, Amendments, Auto-drafted Returns, and Tax Notice.

- GST can be filed online conveniently by logging in to the GST Portal.

- There are 3 ways in which the status of the GST returns filing can be checked. These are through the Return Filing Period, ARN, and Status, on the GST website.

- GST returns can be downloaded from the website following some simple steps.

- In events of late filing, a rate of 18% per annum is charged as a late fee.

Related Articles

https://www.deskera.com/blog/sales-invoice/

https://www.deskera.com/blog/how-india-gst-registration/

https://www.deskera.com/blog/fica/

https://www.deskera.com/blog/when-not-to-charge-gst/