GST is known as the Goods and Services Tax. GST is an indirect tax that has replaced many indirect taxes in India like the service tax, VAT, excise duty and many more. It is hence a tax that is levied on the supply of goods and services.

GST law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. The prime benefit of GST is that it is a single domestic indirect tax law for the entire country.

Under the GST regime, the tax is levied at every point of sale. This hence means that each business has its own GSTIN as mentioned on its GST registration certificate. This article will take you through the steps to get your GST certificate downloaded.

What is a GST Registration Certificate?

A GST registration certificate is a valid document that is the proof of getting registered under GST in India. A GST registration certificate is needed by any business in India whose turnover exceeds the threshold limit for GST registration. However, there are also certain businesses like casual taxable persons, non-resident taxable persons, etc who need to get registered under GST mandatorily.

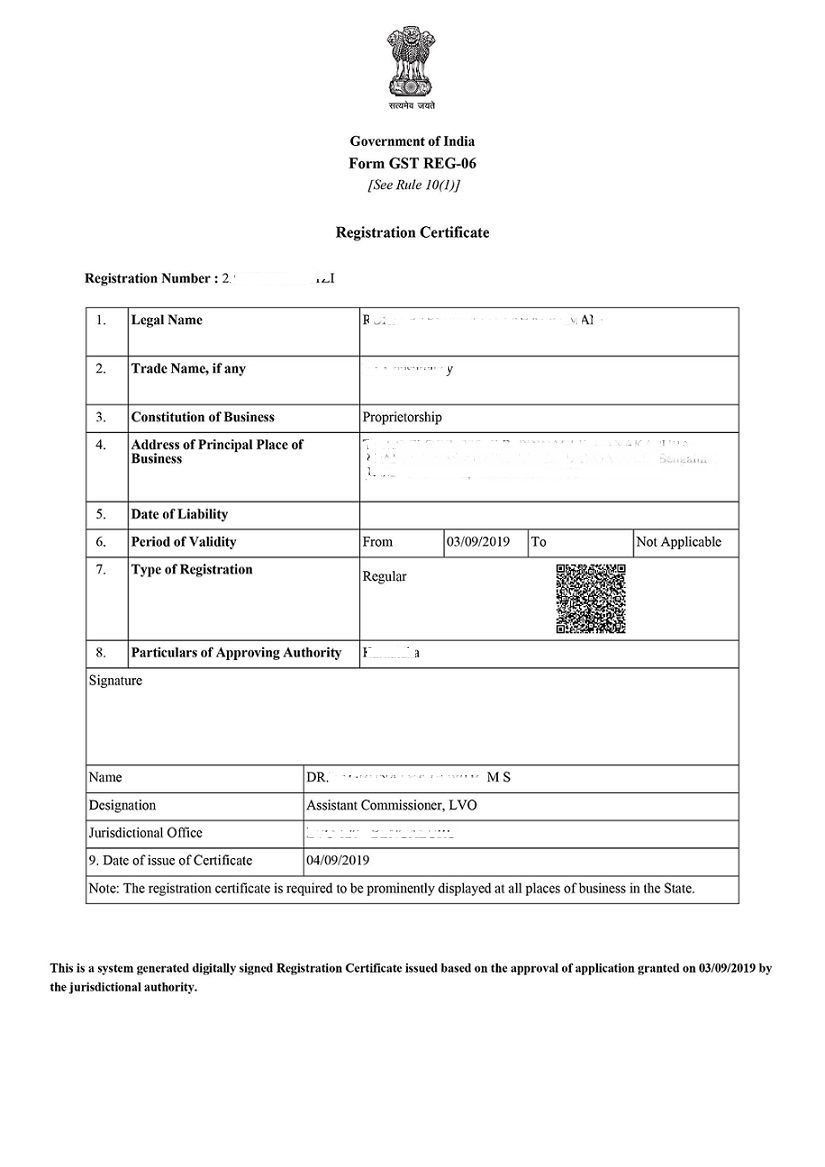

Every taxpayer who has successfully registered under GST is issued a GST registration certificate in form GST REG-06. The registration certificate can be downloaded only from the GST Portal. What needs to be kept in mind is that the government does not issue any physical certificate.

The type of taxpayers includes regular, TDS and TCS applicants under GST, those who are liable to obtain unique Identity Number under Section 25 (9) of the CGST Act, non-residents including those that are providing OIDAR services and the taxpayers who migrated from the pre-GST laws.

The certificate is required to be displayed at the taxpayer’s primary place of business as well as other additional places of business listed in the Form FST REG-06. This is laid down in CGST Rule 18 and any failure to comply with it can attract a penalty of up to Rs. 25,000.

If issued to all the regular taxpayers, then the certificate does not have any time limit for expiry. This means that their GST registration is valid up till the point that is not surrendered or cancelled. In the case of a casual taxable person, the GST registration remains valid for a maximum of 90 days post which it becomes invalid. However, if needed, its validity can be extended or the certificate can be renewed by the end of the validity period.

In case if there is an amendment to the GST registration particulars, the GST portal allows the taxpayer or the user to download the fresh GST registration certificate with the updated or amended particulars.

How to Obtain a GST Registration Certificate?

Any eligible person can apply for GST registration on the GST portal- www.gst.gov.in on the web browser. To have a complete application for GST registration, you need to ensure that you have all the GST registration documents submitted. Your application would then be verified by a proper officer, post which your registration would get approved.

The registration will be effective from the date when liability for registration arises in the case where the application was submitted within 30 days from that date. However, if your application submission was delayed, then your GST registration would be valid from the date on which it got granted.

Step-by-Step Process to Download GST Certificate

To download the GST certificate, you need to go to the GST portal, as no physical copies are being issued by the government. Before you go to the GST certificate downloading option, first check your GST registration status. It is after your registration has been approved, that your GST certificate would be generated. The steps to download your GST certificate are:

Step 1: Log in to GST Portal

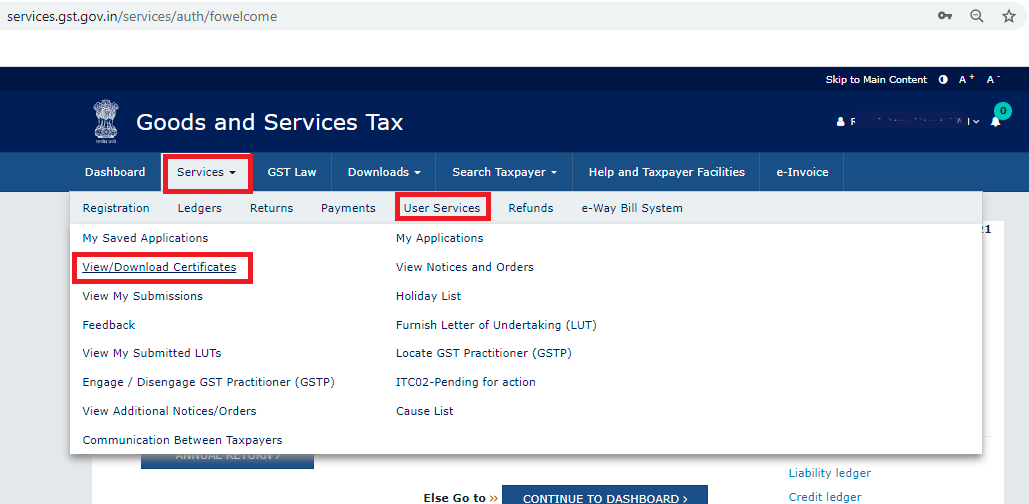

Step 2: Go to “services”> “user services”> “view/download certificate”

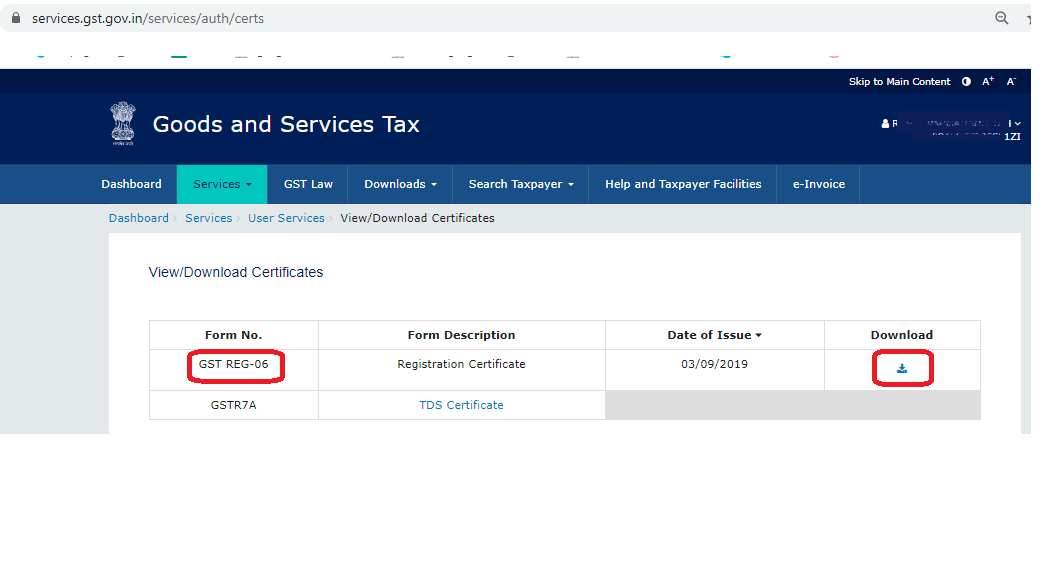

Step 3: Click on the “download” icon

Step 4: Open the downloaded PDF document and take a printout

Step 5: Display the printed certificate prominently at all your places of business in the State or UT.

How Can Deskera Help With Your Business Accounting?

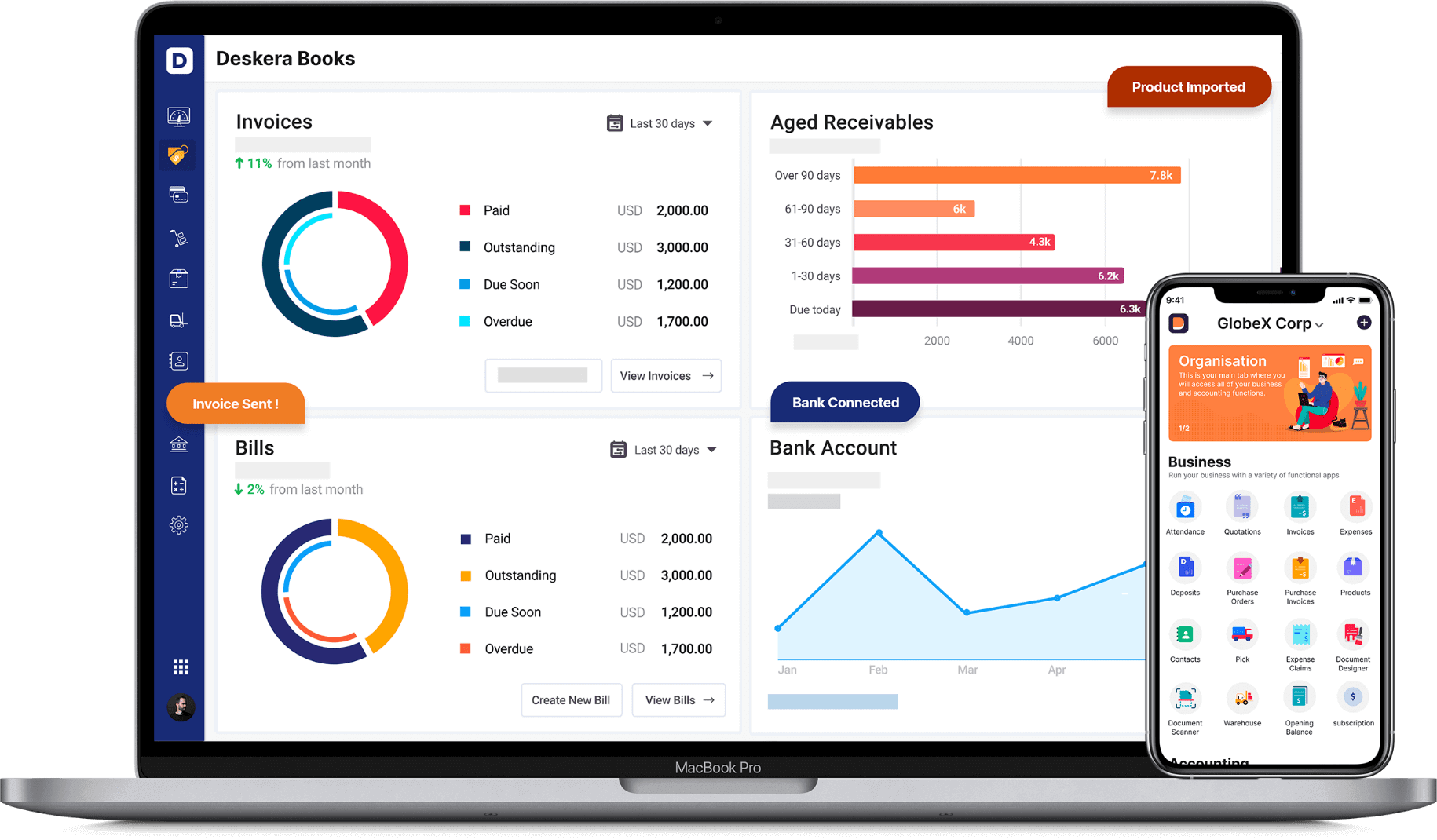

Deskera is an all-in-one software through which you can combine accounting, financial management, inventory management and many more such features using Deskera Books.

While the taxation regimes followed by most countries tend to be intimidating and nerve-wracking, the key to understanding them is by starting to understand each of their nitty-gritty. In the case of GST in India, this involves understanding the Forms GSTR-1, GSTR-2A, GSTR-2B, GSTR-3B, the difference between GSTR-9 and GSTR-9C, reverse charge mechanism under GST and many more such details.

While this all seems a lot to take in, what the businesses can be relieved about is that their accounting is handled by Deskera Books. Be it tracking of financial KPIs, marketing KPIs, journal entries, financial statements, invoices, account receivables and accounts payable, Deskera Books will do it all for them- including making it easier to comply with the taxation regime of the base country.

To learn about how to manage and set up India GST in Deskera, go through this video:

Then test out our tool through the below mentioned clickable link and you will be amazed by how easy accounting has become for you.

Key Takeaways

As discussed in the article above, GST certificate downloading is a super easy and accessible task, involving 3 main steps:

- Login to GST Portal

- Going to the user services to get the option of view/download certificate

- Downloading the certificate

Related Articles