Do you know the percentage of gross profit that comes from net? It's a method that financial analysts, business owners, and investors frequently use to gauge a company's profitability. Knowing this number can also assist you compare your company to rivals and monitor your financial health over time.

You will learn from this post how to better manage your gross profit margins in order to expand your company. You'll be one step closer to acquiring additional insight into the nature of a firm or business by comprehending these useful formulas. Following are the topics covered:

- What Is Gross Profit?

- What is the Gross Profit Percentage?

- Gross Profit Percentage Example

- Why is gross profit important?

- Relevance and Uses

- Key takeaways

What Is Gross Profit?

People who come across the term "gross" in economics are frequently perplexed by it. The consumer's gross income is always requested when they apply for a credit card, a bank loan, or when they need to declare their income.

An individual's gross income is their pay before any deductions are made for things like taxes, 401(k)s, insurance, and FSAs. It's a useful number, but it's also deceptive. Because gross profit pertains to a business rather than an individual, it varies from gross income. And what exactly is gross profit?

- The gross profit in economics is the revenue a business receives from the sale of its products or services less the cost of making those products or providing those services. A phase in the process of determining a company's net profit is the value of gross profit, which is shown on a balance sheet of a business.

- The Generally Accepted Accounting Principles require businesses to separate and identify the components of their income, with gross profit being one of them. Depending on the revenue generated from the sale of products or services, gross profit may be positive or negative.

- Gross profit consists of two essential words that must be understood and defined. Before any costs are subtracted, a company's revenue is the total income it receives from the sales of its products or services. The amount of money left over after certain costs have been deducted is referred to as a profit. Depending on how the numbers are computed, there are various levels of both income and profit.

- Does the distinction between profit and gross profit exist? In most circumstances, the word "profit" will be followed by a descriptor that clarifies the kind of profit being reported. Gross profit and net profit are the two primary types of profit.

The income that a business makes after all costs are deducted is known as net profit. The costs of producing the goods, running the firm, and any applicable taxes, fees, and interest are all included in this list of outlays.

Gross Profit Components

Once the elements that go into calculating gross profits are described, learning how to do so is a straightforward procedure. Total revenue, often known as gross sales, is the first part of gross earnings.

Net sales are the next component that is utilized to compute gross profits. Net sales are the total revenue, or gross sales, less any sales-related expenses that might reduce the gross sales.

It's crucial to keep in mind that not all businesses include net sales as a line item. Before determining gross sales, some companies will take into account factors like returns.

The cost of goods sold, or COGS, is the last factor to consider. The quantity of costs directly connected to the creation of the commodity or the provision of a service makes up the cost of goods sold. Raw materials, equipment, and other costs directly associated with the good are all included in COGS. COGS do not include costs related to business operations, such as marketing, human resources, and rent.

How to compute gross profit

The money remaining from the sale of your goods or services after operating costs incurred to produce them are subtracted is measured by the gross profit margin calculation (e.g. labour and material costs). Cost of goods sold (COGS) is subtracted from total receipts to determine gross profit. Let's take a closer look at each of these.

Cost of goods sold (COGS)

All direct costs and expenses incurred in manufacturing or delivering your goods and services are referred to as the cost of goods sold. It excludes indirect expenses like staff pay, advertising, and marketing. Here are a few COGS illustrations:

• The cost of the raw materials or components used in manufacturing;

• The direct labour costs involved in production;

• The cost of shipping;

• The time spent helping a client;

• The cost of the equipment used in production;

• The cost of utilities for the production facility.

Revenue

It is the total amount of income your company generates from the sale of your products or services. It shows you clearly how much money you’re bringing in from your total sales. It does not include the costs of running your business, such as taxes, interest and depreciation.

Gross profit formula

What's the difference between net and gross profit?

The primary distinction between gross profit and net profit is that the latter also takes into account additional costs incurred by the business, such as general, administrative, marketing, and non-operating expenses. Since they don't change much over time, these expenses might be referred to as fixed costs.

They are also known as indirect costs. Marketing, advertising, depreciation, amortization, dues, leases of equipment, interest on loans taken, insurance, taxes, rent, utilities, subscriptions, and wages are a few examples of these expenses. Some additional payments that a company pays that are required to operate the business but are not directly related to the cost of manufacturing the items sold are called fixed or indirect expenses.

Therefore, it is completely feasible for a business to achieve a gross profit, but after paying out fixed expenditures, end up with a net loss rather than a profit.

What is the Gross Profit Percentage?

Gross profit %, also known as cost of sales, is a profitability indicator that assesses a company's cost effectiveness after subtracting its cost of goods sold, which largely consists of raw material expenses, direct labor costs, and factory overhead.

In other words, the GPP allocates the directly assignable cost of production before capturing the profit. Additionally, it calculates the gross profit made from each dollar of revenue.

It can be thought of as the proportion of sales over the direct costs incurred in producing the good. Raw materials and direct labour make up the majority of these direct costs, also known as COGS. As a result, the gross profit is divided by the total sales stated in percentage terms to arrive at the gross profit percentage formula.

The money is then used to pay for other operating expenses, such as selling and commission costs, general and administrative costs, costs associated with doing research and development, costs associated with marketing, and interest costs, which are listed further below in the income statement. The better it is for a business to pay off operational expenses, the greater it is.

How to Calculate Gross Profit Percentage in 5 Steps

If you know what to look for in a company's financial reports, it's very simple and straightforward to compute the gross profit percentage. However, you must get ready by compiling the data required by the gross profit ratio formula. Here are 5 simple actions you can take to quickly start figuring out your gross profit percentage.

1. Determine Sales Revenue: Determine your overall sales revenue to start. The formula's denominator and numerator both take into account your overall sales revenue. Finding the line item on your income statement or dividing the cost of products sold by the quantity of sales will yield your revenue.

2. Identify All Cost of Goods Sold: Add up your COGS after calculating revenue. The gross profit is the numerator in the calculation for the gross profit %, which you must determine using your costs of products sold. It appears as a line item on your income statement and is determined by totaling all of your direct inputs, including labor expenses.

3. Determine Gross Profit: Investors and business owners can determine your gross profit after determining sales revenue and totaling all COGS. Subtract your COGS (determined in the step above) from your total sales revenue to arrive at your gross profit.

4. Divide Gross Profit by Revenue: Now that the relevant variables have been computed, we can use the gross profit ratio calculation. Divide your overall sales revenue by your computed gross profit.

5. Converting to Percentages: Convert your money to a percentage. You're not nearly finished if you think the outcome you just obtained looks strange. Since gross profit margin is calculated as a percentage, you must multiply the figure by 100 to obtain the right answer.

Gross Profit Percentage Example

Example 1:

As an illustration, consider the corporation ABC Ltd., which manufactures items for rigid and flexible packaging. The most recent annual report shows that the company had total revenues of $80.0 million for the year. Additionally, the subsequent cost breakdown is offered; based on the provided data, determine the company's annual gross profit %.

Cost of Raw Materials: $20.0 million

Cost of Direct Labor: $10.0 million

Cost of Factory Rental = $2.0 million

Solution:

Cost of Goods Sold is calculated by using the formula given below

Cost of Goods Sold = Cost of Raw Materials + Cost of Direct Labor + Cost of Factory Rental

Cost of Goods Sold = $20.0 million + $10.0 million + $2.0 million

Cost of Goods Sold = $32.0 million

[Note that because they are not direct costs of production, interest costs, depreciation, and income taxes are not included in the cost of goods sold.]

The formula below is used to compute gross profit percentage.

Gross Profit Percentage = (Total Sales – Cost of Goods Sold) / Total Sales * 100

GPP = ($80.0 million – $32.0 million) / $80.0 million * 100

GPP = 60.0%

Therefore, ABC Ltd.’s gross profit percentage stood at 60.0% during the year.

Example 2:

Let's use an example to put what we've learnt so far into practice. Say you are the owner of a business called XYZ Ltd. You produce and market measuring instruments and rulers exclusively for construction companies.

The most recent fiscal year's financial statement shows that the revenue was $200,000.

After factoring in the salaries of their staff, the price of raw supplies, and other expenses. They discover that their COGS for the previous fiscal year were $60,000 as a result.

Solution:

Gross Profit = Sales Revenue – COGS

($200,000 – $60,000) = $140,000

Gross Profit = $140,000

Next, divide your gross profit by your revenue:

Gross profit / revenue = $140,000 / $200,000 = 0.7

Finally, convert your dollars into a percentage by multiplying the resulting number by 100 percent:

Gross Profit Percentage = (Gross Profit / Revenue) x 100%

0.7 x 100% = 70%

XYZ Ltd. achieved a gross profit percentage of 70% in the previous fiscal year. The company owner may start by reviewing their records to determine how this number contrasts with previous years' numbers. Has the gross profit margin shifted upward or downward?

It's a good indication that the company's financial situation has improved if it rose. It's a good indication that the company owner should look at any potential weak places if it decreases. It can be rather amazing how insightful and effective such a straightforward technique can be.

Example 3:

Let's figure out the gross profit for a company that produces mugs. We must determine the company's gross profit for the entire fiscal year. First, we determine the company's annual total sales revenue from the sale of the mugs, which comes to $20,000 in our calculations. The total cost of making the mugs over the same time period, including materials, labor, overhead, and storage, is $10,000. As a result, we employ the gross profit formula, which is:

Solution:

Gross Profit = Total Sales Revenue – Cost of Goods Sold

Total Sales Revenue= $20,000

Cost of Goods Sold= $10,000

Gross Profit = $20,000 – $10,000= $10,000

So, the gross profit of the company is $10,000 for the financial year

Therefore, the net profit of a firm is a better indicator of how profitable your company is. A healthy net profit demonstrates that the business is operating profitably. It is a significant figure that investors and financial institutions use to assess the company's financial health. It makes it clearer how much money the business has on hand after paying all of its obligations and bills.

Why is gross profit important?

The gross profit rate is an important indicator because it illustrates how profitably businesses may invest in operations. Additional justifications for computing this metric include:

• Acquire knowledge of profitability: To better understand how efficiently a business can turn a profit from the costs it incurs to create goods and services, one of the most crucial reasons to examine the gross profit percent is to look at past performance.

A lower profit percentage may be a sign that a company is struggling to fulfill its revenue targets. Profit ratios are frequently taken into account by shareholders and investors when assessing a company's effectiveness and financial health.

• Every business's ultimate objective is to be profitable and generate revenue from its manufacturing. The business must be able to recoup the cost of producing its products through sales of its products in order to be profitable. This is referred to as the gross profit in accounting.

• Develop pricing and sales strategies: The gross profit rate can be calculated for the benefit of sales teams as well because it can be used to identify key sales areas. For instance, a retailer of clothing might use the gross profit rate to identify the best-selling items. Sales teams may evaluate the products selling less frequently to create new price models and formulate new advertising strategies since these products can still generate money.

• If the gross profit and, consequently, the gross profit margins are declining, the company must be losing money. A declining profit margin alerts management to the need to reduce the cost of manufacturing sold items in order to boost the gross profit margin. The company could need to review its purchasing guidelines and renegotiate its price. They might also need to reduce labor costs, control overhead, or boost productivity.

• Evaluate operational efficiency: The gross profit rate can also be calculated by businesses to determine how effectively manufacturing teams support sales objectives. For instance, a manufacturing organization may examine the gross profit margin to assess the effectiveness of teams in achieving production goals to prepare goods for sale.

Sales revenue may be impacted if inventories are low due to teams' failure to reach production targets, which ultimately results in changes in the gross profit rate. As a result, tracking this measure might be useful for determining how efficiently things are produced and distributed.

• On the other side, a declining gross profit can mean that you are selling your products for a far lower price than is necessary for the business to turn a profit. Therefore, the management may need to adjust their pricing to increase profitability.

• Consider ways to improve: The determination of the gross profit margin is crucial in determining which manufacturing and sales techniques require improvement. For instance, if the gross profit margin shows that costs are higher than revenues, manufacturing organizations may apply tactics that enhance production techniques.

The profit rates can also be used by retail businesses to identify which sales procedures need to be improved in order to foster stronger client relationships that boost sales.

• As previously noted, a high gross profit margin is a reliable sign of your company's sound financial condition. You, your rivals, and investors can all benefit from having access to this useful information about your company. Business owners and investors like to use gross profit % because it's an easy indicator to compare a company's profitability to that of its rivals rapidly.

Marketing costs and the gross profit formula

Only the variable costs directly related to the manufacturing of your goods or services are included in the gross profit margin formula. The final metric excludes larger business costs like rent for the corporate office. Instead, these expenditures are commonly listed as "Selling, General and Administrative" charges on an income statement.

- These can include the pay for staff members in the marketing, IT, and accounting departments as well as for materials used in advertising and promotion. It also includes any rent, utilities, or office supplies that are not specifically required for the production of a particular good. This means that the gross profit formula typically does not take marketing expenses into account.

However, just because marketing expenses and other indirect expenditures aren't taken into account when determining gross profit doesn't mean you shouldn't pay close attention to them as well. Your cash flow is impacted by these "costs of doing business" just as much as expenses that are directly connected to goods and services.

Setting up real-time expenditure reporting to know what is being spent throughout the entire organization and card payment reminders to know what has to be paid when will help you reduce the time it takes to track these indirect costs.

Relevance and Uses

- Assume a business can maintain gross profit margins that are far greater than most of its competitors. In that situation, it has more effective operations and processes, making it a secure long-term investment.

- On the other side, a business may find it challenging to cover its operational costs if it is unable to generate an acceptable gross profit margin. As a result, unless and until significant changes are made to the business model of the company, the gross profit percentage of the company should remain consistent.

- Any funds remaining after deducting the cost of items sold are applied to other operating costs. The more it is, the more money the business may save on each dollar of sales to pay for its greater operating expenses and financial commitments.

- For an investor, understanding it is crucial since it demonstrates how profitable the company's core business operations are without taking indirect costs into account. This ratio can be used by an analyst to compare a company's operating performance to that of other participants in the same industry and sector, particularly as an assessment metric. Additionally, businesses use this ratio to demonstrate the profitability and feasibility of a specific commodity or service.

What Gross Profit Percentage Doesn’t Tell You

Investors can benefit from knowing the gross profit ratio, but it's also necessary to be aware of some of the drawbacks of the gross profit %. It won't tell you everything, to start. The gross profit margin of a business does not necessarily represent its entire performance and financial standing.

- As we previously said, this number is typical for indicating when a corporation has a weak point. It won't, though, so you'll have to make a guess as to where that weak point is. Making big assumptions when making wise business decisions is, of course, never a good idea.

- Second, the gross profit % is not a perfect predictor of a company's overall profitability. For instance, a business may have a high gross profit margin but a weak overall sales volume, which won't be enough to cover expenses not taken into account in the gross profit ratio formula. In contrast, a business with a low percentage point could have a high profitability if its sales or popularity unexpectedly soar.

- The gross profit percentage is still a fantastic financial instrument for obtaining a quick overview of a business's or asset's performance. To assess common financial trends and potential future growth, it's also crucial to look at a company's gross profit percentages over time.

As always, it's critical to comprehend the workings of the gross profit ratio formula and the significance of its inputs. This manner, you can always consider your results tentatively. Now that we are clear on what the gross profit percentage means, let's examine the gross profit ratio formula's operation and the precise meanings of its many components.

Advantages of GPP

The following are some of the main benefits of GPP:

- It provides a reasonable grasp of the company's cost effectiveness;

- It can be utilized as a performance indicator over time and for peer comparison.

Limitations of GPP

Some of the major limitations of GPP are:

- The influence of indirect costs is not adequately captured by GPP, which results in only partial information regarding overall profitability.

- There isn't a set standard for what GPP levels are considered appropriate.

Tips for evaluating gross profit percentage

When examining the gross profit rate, take into account the following advice:

- Incorporate other financial parameters with the gross profit rate. This can assist you in assessing profitability and giving you a more precise picture of a company's financial situation.

- Consider product pricing tactics. Sales teams may enhance their current pricing models by having a better understanding of how different product prices impact the gross profit rate.

- Be mindful of shifting profit margins. Although adjustments to a company's organizational structure, operational procedures, or sales tactics may have an impact on its gross profit margin, it's crucial to be aware of any frequent changes because they may be a sign of inefficiency in one or more of its production and sales processes.

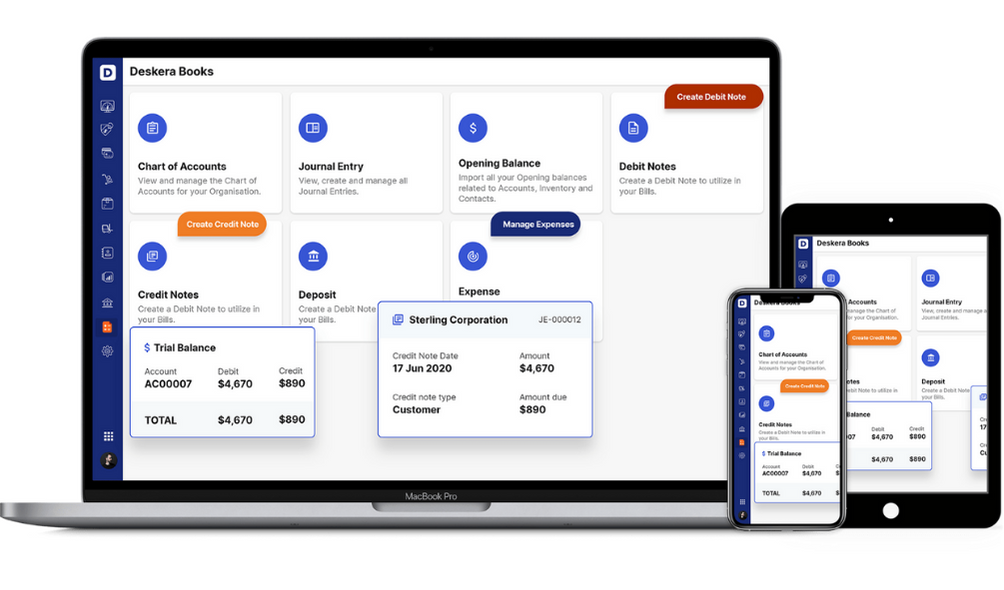

How can Deskera Help You?

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Key Takeaways

- The cost of goods sold is the cost associated with producing or manufacturing the products that a business sells (COGS). The gross profit of your company is the sum of the sales income you generate less the cost of goods sold.

- In general, a high gross profit margin signifies you're making money on the goods, whereas a low margin means your sale price isn't much greater than the cost. Although these numbers serve as a helpful guide, it's crucial to keep in mind that margins vary significantly by industry and firm size.

- After deducting the cost of sales, the management, investors, and financial analysts use the gross profit % method to determine the company's economic health and profitability. It is computed by subtracting the gross profit from the net sales of the business.

- The gross profit percentage, put simply, is the amount of profit earned for each dollar invested in creating or producing things. The gross profit margin gauges how effectively a business can use its cost of production to produce and financially market its goods.

Related articles