The two critical profitability metrics for any business or company include the gross income and net income. The gross income is also known as gross profit, and net income is also known as net profit. These terms are interchangeable. Understanding the differences between gross income vs. net income can help investors determine if a business is earning a profit, and if not, where the company is losing money.

The Gross income or profit represents the income or profit remaining after the total production costs have been subtracted from revenue. The revenue is the amount of income generated from the sale of a company's services and goods. The gross income helps investors to determine how much profit a company earns from its production and sale of its services and goods. Meanwhile, net income is the profit that remains after all costs and expenses have been subtracted from the revenue. Net income or net profit helps creditors or investors determine a business's overall profitability, which reflects on how effectively a business has been managed.

What is Gross Income? How is it calculated?

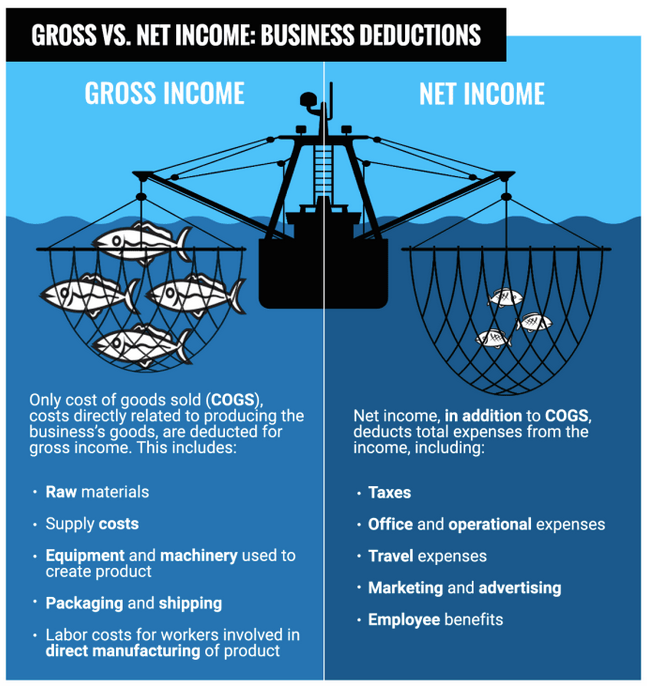

Gross income is a business's profits earned after subtracting the costs of selling and producing its products, called the cost of goods sold (COGS). Gross income provides insight into how efficient a business is at managing its production costs, such as supplies and labor, to produce income from the sale of its services and goods. The gross income for a company is calculated by subtracting the cost of goods sold for the accounting period from its total revenue.

Revenue

The revenue is the total amount of money earned from the sales of a particular period, such as the first quarter. The revenue is listed as net sales because it may include deductions and discounts from damaged or returned merchandise. For example, businesses in the retail industry often report the net sales as the revenue figure. The merchandise that has been returned by their customers is subtracted from the total revenue. Revenue is often referred to as the "top line" number since it is situated at the top of the income statement.

Cost of Goods Sold (COGS)

Cost of goods sold or COGS refers to the direct costs involved in producing a business's goods. COGS typically includes the following:

- Utilities for production facilities

- Equipment costs used in production

- Direct materials, such as inventory and raw materials

- Direct labor such as wages for production workers

- Repair costs for equipment

- Shipping costs

We can see from the cost of goods sold, items listed above the gross income mainly includes variable costs or the costs that fluctuate depending on the production output. Usually, gross income does not include the fixed costs, which are the costs that are incurred regardless of the production output. For example, the fixed costs might include salaries for the rent, corporate office, and insurance.

Some businesses might assign a portion of their fixed costs used in production, and report is based on each unit produced, called absorption costing. For example, let us say a factory produced 4,000 automobiles in one quarter, and the company paid $20,000 in rent for the building. Under absorption costing, $5 in costs would be assigned to each automobile produced.

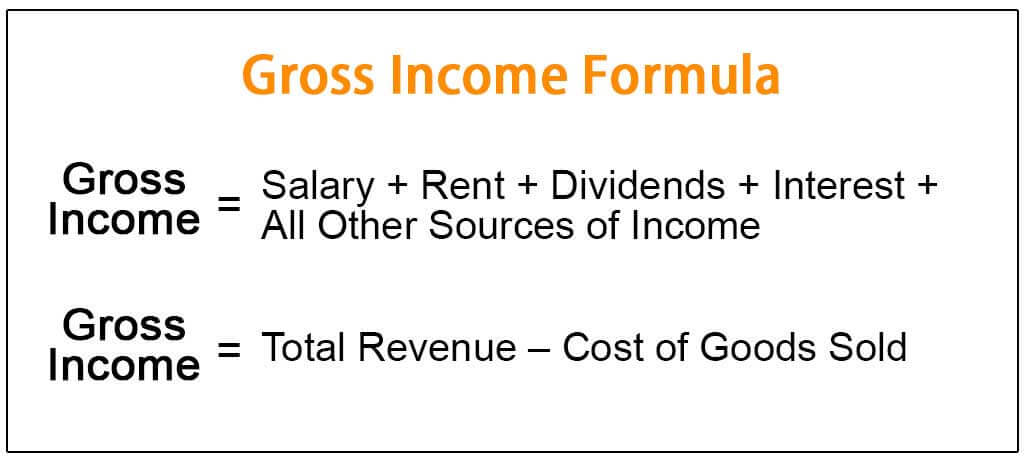

How To Calculate Gross Income?

Gross income or profit is calculated by subtracting revenue or net sales from a business's cost of goods sold, as shown below:

The equation used to calculate gross income for a business is:

Gross income = Gross Revenue - Cost of Goods Sold

If revenue totaled $2,500,000 and the cost of goods sold (COGS) was $500,000, your company's gross income would be $2,000,000.

What is Net Income? How is it calculated?

Net income is the business's profit for its accounting period. Net income or net profit includes all of the expenses and costs that a company incurred, which are then subtracted from the revenue. The net income is referred to as the bottom line due to its positioning at the bottom of the income statement.

Even though many items can be listed on a business's income statement, depending on the company's industry, usually the net income is derived by subtracting the following expenses from revenue:

- Interest on debt and loans

- Operating expenses

- Interest on debt and loans

- Selling, general and administrative expense (SG&A)

- Overhead

- Depreciation, which is the allocation of the costs of fixed assets, such as equipment, over their useful life or life expectancy

Additional income sources are also included in the net income. For example, business often invests their cash in short-term investments, which is considered a form of income. Also, proceeds from the sale of assets are considered income.

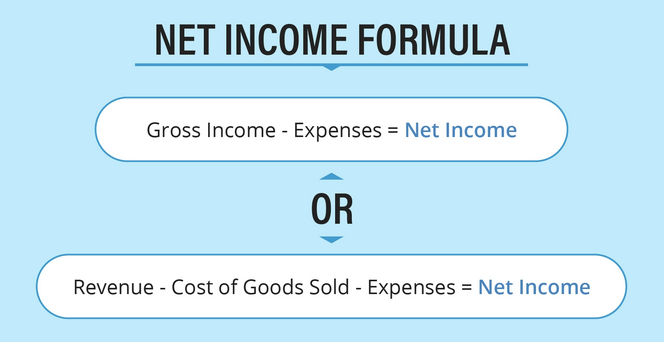

How To Calculate Net Income

The net income is the result of subtracting all expenses and costs from the revenue while also adding the income from other sources. Depending on the industry, a business could have multiple sources of income besides revenue and various types of expenses. Some of those income sources or costs could be listed as separate line items on the income statement.

For example, a business in the manufacturing industry would likely have the COGS listed, when a company in the service industry would not have COGS, but instead, their costs might be listed under the operating expenses.

The general formula for the net income could be expressed as:

- Net Income = Total Revenue — Total Expenses

The more detailed formula could be expressed as:

- Net income = Gross Profit — Operating Expenses — Other Business Expenses — Taxes — Interest on Debt + Other Income

Let's say Company X Inc. had revenue from the sale of $ 200,000 for the year 2020. It paid $ 30,000 employee wages, $ 40,000 for raw materials and goods, $ 6,000 for other office and factory maintenance expenses.

Company X had an interest income of $ 4000 and paid $ 2000 in taxes.

The Total revenue of the Company X = Revenue from sale + Interest Income

- Total revenue = 200000 + 4000 = 204,000

The Total expenses = Employee wages + raw materials + office and factory maintenance + interest income + taxes

- Total expenses = 30000 + 40000 + 6000 + 4000 + 2000 = $ 82, 000

The Net Income = Total revenue – total expenses.

- Net income = 204000 – 82000

- Net income = $ 122,500

Let us say that Paul's Magic Shop wants to find its net income for the first quarter of 2021. Here are the numbers Paul is working with:

- Total revenues: $80,000

- Cost of goods sold (COGS): $30,000

- Rent: $5,000

- Utilities: $3,000

- Payroll: $10,000

- Advertising: $2,000

- Interest expense: $2,000

First, Paul could calculate his gross income by subtracting the COGS from total revenues:

Gross income = $80,000 - $30,000 = $50,000

Next, Paul adds up his expenses for the quarter

Expenses = $5,000 + $3,000 + $10,000 + $2,000 + $2,000 = $22,000

Now, Paul can calculate his net income by subtracting expenses from gross income:

Net income = $50,000 - $22,000 = $28,000

Paul's net income for the quarter is $28,000

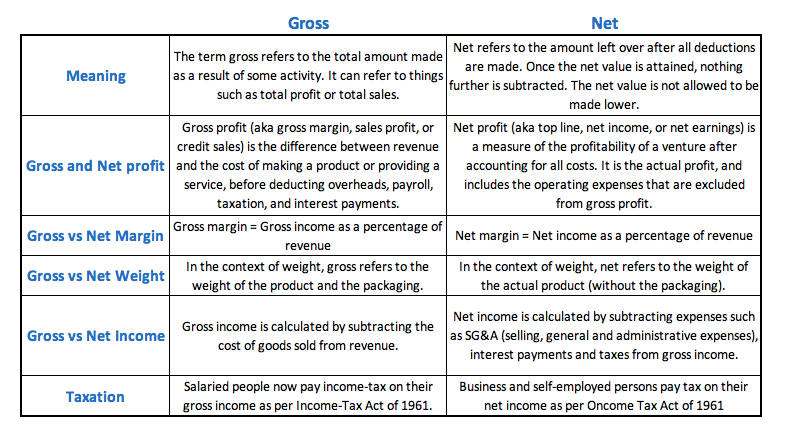

How is Gross Income Different from Net Income?

The gross income assesses a company's ability to earn a profit while simultaneously managing its labor and production costs. It is an essential metric in determining why a company's profits are decreasing or increasing by looking at production costs, sales, labor costs, and productivity. If a business reports an increase in revenue, but it is more than offset by the rise in production costs, such as labor, the gross income will be lower for that period.

For example, if a company hired too many production workers for its busy season, it would lead to more overtime pay for its existing workers. The result would be an even higher labor cost and an erosion of gross profitability. Using gross income as an overall profitability metric would be incomplete since it doesn't include all of the other costs of running a successful business.

The net income represents the profit from all aspects of a company's business operations. Hence, net income is more inclusive than gross income and can provide insight into the management team's effectiveness.

For example, a company might increase its gross income while simultaneously mishandling its debt by borrowing too much. The additional interest expense for servicing the debt could reduce net income despite the company's successful sales and production efforts.

Gross income can have its limitations since it does not apply to all industries and companies. For example, a services business would not likely have production costs nor (COGS) costs of goods sold. Though net income is a complete measurement of a business's profit, it too has its limitations and can be misleading. If a company sold a building, the money from the sale of the asset would increase net income just for that period. Therefore, investors looking only at net income might misinterpret the business's profitability as an increase in the sale of its services and goods.

Gross Income vs. Net Income

Gross income is the key profitability metric since it shows how much profit remains from the revenue after the deduction of production costs. Gross income helps to show how efficient a business is at generating profit from the production of its services and goods. Net income, on the other hand, represents the profit or income remaining after all the expenses have been subtracted from the revenue while also including any sources of income, such as income from the sale of an asset. Both gross income and net income are important; they show the profitability of a company at different stages.

Which Financial Report Shows the Net Income and Gross Income?

Net income appears on a business's income statement and can be calculated by subtracting the cost of goods sold (COGS) from the revenue (sales). Calculating the net margin of a business is a routine part of financial analysis and financial ratio calculations. It is part of a type of analysis known as the vertical analysis. This takes every line item on the income statement and divides it into revenue.

The easiest way to calculate your Gross Income, Net Income, Gross Profit Margin and Net Profit Margin is by using accounting software for invoicing and sales management.These figures can be found on a company's income statement.

Calculating your net income could mean switching between analytics platforms, advertising platforms, your e-commerce platform and more. With Deskera Book's accounting software for invoicing, bookkeeping and sales management, discovering the net profit is easy, since all your data is pulled into one central location and platform.

Net profit margin shows the percentage of profit that's been generated from each dollar of revenue. Similarly, the gross profit margin is calculated by dividing gross income by revenue and multiplying the result by 100. Both gross margin and net profit margin are popular profitability metrics used by investors and analysts when comparing the level of profitability between one company to another.

Key Takeaways

- Gross income refers to a business's profits earned after subtracting the costs of producing and distributing its products.

- Gross income assesses a business's ability to earn a profit while simultaneously managing its labor and production costs.

- Net income indicates a business's profit after all of its expenses has been deducted from its revenues.

- Net income is an all-inclusive metric for profitability and provides insight into how well the management team runs all aspects of the business.

- If your gross income is higher than your net income, you should understand how both affect your taxes and budget

- Gross income helps determine your AGI and taxes, while your net income can help you create your monthly budget.

- Net income is often referred to as the "bottom line" due to its positioning at the bottom of the income statement.

- Net income can give you a more realistic idea of how much you can afford to spend and is a good indicator of how much you will end up paying in taxes each year.