Every business person ensures that he files the income tax return on time to get the returns from the Indian government after the payment of annual income tax. While according to the rule, the individuals in the different states of the country can file for annual returns, each state in India has its own rules. The state government of Goa has made a rule that asks the small business owners, entrepreneurs or employers to fill the form 35 half-yearly returns. Let us understand what is 35 half through this article. We will be covering the following points in this article -

- What is Factories Act, 1948?

- What are the features of the Factory Act 1948?

- What are the duties of the occupier mentioned under the sections of the Factories Act, 1948?

- User manual for 35 half

- Conclusion

- How can Deskera Assist you?

- Key Takeaways

What is Factories Act, 1948?

According to the Constitution of India, a Factories Act was passed to protect the rights of workers who business owners in the manufacturing sector employed. As per the available information, this Factories Act was passed in the year 1948. It emphasizes the regulation of health and physical conditions for the employees in the manufacturing sector.

Furthermore, it focuses on the formation of fair policies for annual leaves as well as ensures facilitating welfare amenities by the employer. The Act also includes special provisions that are in respect of the young employees, women and even children that work in these factories. The main objective of the Factory Act, of 1948 is to ensure that there is adequate safety for the workers employed in the factory.

It not only promotes health and safety measures within the factory premises but also ensures there is no haphazard growth of the factory unit by the business owner. Furthermore, it provides support to the employees working at the centre by ensuring they are not exploited by the employer. It casts certain duties, mandatory rules and even responsibilities on the factory owner as well as the manager to improve the working conditions within the premises.

What are the features of the Factory Act 1948?

According to the available data on the internet, the features of the Factory Act, of 1948 are related to the working hours, safety, health and welfare which can be understood from the points given below -

Working hours: As per the provision of working hours of adult employees, a worker cannot be allowed to work for more than 48 hours in a week by the business owner. A weekly off is a compulsion under this act.

Health: To protect and safeguard the health of workers, this Act has laid down some rules for the factor owner. IT specifies that the owner must keep the premises of the factory neat and clean as well as take all the necessary precautions for ensuring this within the company. Furthermore, the factories must have enough lighting, a proper drainage system, temperature and proper ventilation.

The business owner must also make proper arrangements for drinking water. It should include personal hygiene necessities at convenient places like sufficient urinals and washrooms. Also, these places must be kept clean and accessible for the employees.

Welfare: The Act mentions that the factory should have suitable washing facilities. This means the factory premises must have proper facilities for storing and drying clothes. Moreover, the factory should provide the provision of first-aid appliances, restrooms, creches, shelters and even lunchrooms for the employees.

Safety: To ensure the safety of the workers, the Factory Act says that the machinery should be properly fenced to prevent any damage to them. Also, no young employee must be allowed to work with any dangerous machine. There should be a proper provision of adequately-sized manholes near the machines so that in case of an emergency, the worker can escape from the area.

What are the duties of the occupier mentioned under the sections of the Factories Act, 1948?

As per the available data, before the factory is fully engaged in the manufacturing process, the factory owner is expected to send a written notice to the chief inspector who is within the scope of this Act. The following are his duties in detail -

Worker participation in safety management (Section 41-G)

The factory owner must set up a safety committee for the department where hazardous processes are carried out. The job of the safety committee is to promote cooperation between the workers and management for maintaining the proper safety and health of the workers at the workplace.

Workers must be warned about the possible dangers (Section 41-H)

The factory owner who handles the business must take possible remedial action for the dangers existing at the workplace and also send the report of the action taken to the nearest inspector.

Sitting and Canteen Facility (Section 42 to 49)

It is the duty of the business owner who runs the factory outlet to provide welfare amenities such as a creche, lunch room, canteens, first aid appliances, washing facilities etc. to all the employees and even appoint a welfare officer who manages all these facilities.

Notice of period of work for adult employees (Section 61)

The manager at the factory is responsible for displaying and maintaining every factory of the business owner in accordance with the provisions of subsection (2) of Section 108. He should display a notice that specifies the period of work in which the adult employees are required to work at the place. Furthermore, he should classify the employees into different groups as per the nature of their work and indicate them accordingly on the notice.

Register of adult workers (Section 62)

The factory manager is responsible for maintaining an up-to-date register of the adult employees that can be made available to the inspector anytime during working hours or when the work is being processed in the factory.

Annual leave with wage (section 79)

To ensure continuity of work, the representatives of the workers must lodge a scheme with the chief inspector in a prescribed manner chosen by them. This scheme will ensure the allowance of grant of leave.

Safety and occupational health survey (section 91-A)

The business owner of the factory or the manager or any other professional must take the charge of carrying out safety and occupational health surveys. He must take the responsibility to afford all the facilities including those for the examination and testing of the manufacturing plant, machinery at the factory as well as collection of samples or other relevant data which is a part of the survey.

What is the relation of 35 half with the Factories Act in Goa?

The government of India and particularly the government of Goa has recently released an order on the 28th may 2019 to file the 35 half returns through online mode under the Ease of Doing Business and the Factories Act, 1948. This was issued under the Department of Industrial Policy & Promotion, Ministry of Commerce & Industry, Government of India and the state government of Goa. It has made a compulsion to the inform the business owners and managers about the online facility to file the returns.

User manual for 35 half

If you are a business owner who is handling the factory for the first time and have no idea about how to fill the 35 half form for the half-yearly returns, here is user manual about how to fill this form online -

- Visit the state government website online - www.goaonline.gov.in . Here the factory owner can get all the information about the services provided by the Government of Goa.

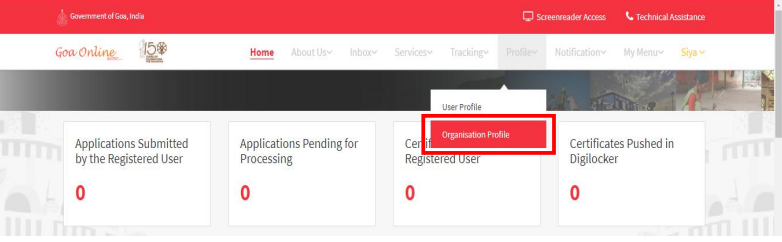

2. The factory owner must click on the login option in the menu bar. Once he has logged in on this page, he must select the Organization profile under the profile tab. He must enter a username and password on this page, and enter the correct captcha for the further process. This will permit the business owner to enter his factory details on the page.

3. If the factory owner has already logged in and entered the details earlier, it will be displayed on this page. Click on the Edit details page and add the unit you want to enter in your organization details

4. Now click on the edit button to edit the business entity profile. In this step, the business owner has the option to edit details such as legal name of business entity, constitution, scale, category, incorporation number, date, company PAN as shown in the figure below -

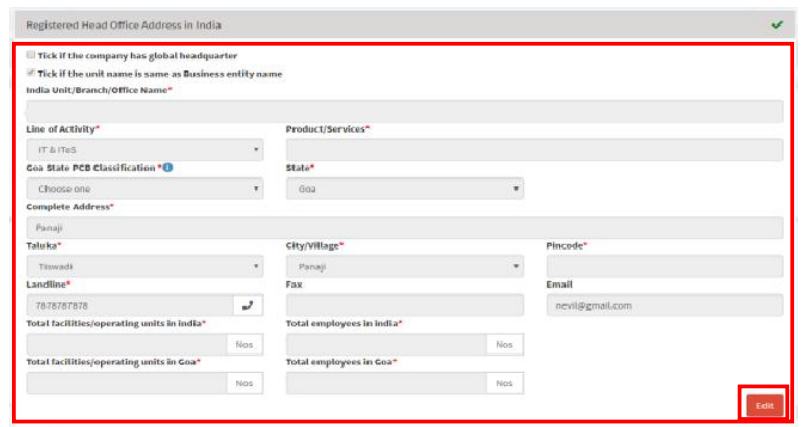

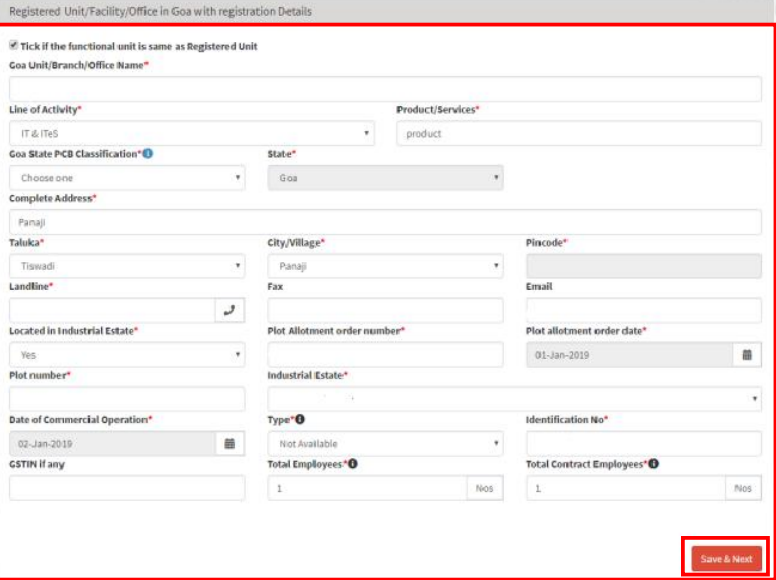

5. The next step in the 35 half form permits the owner to edit the registered address of the factory in India. He should tick the check box if his company has a global headquarter and enter its details. He must tick the checkbox if his factory’s unit name is similar to the business entity name. The business owner then should provide details of the address of the organization by giving complete details about office name, branch, line of activity, product / service. He should also give details about the taluka, village of the factory and even contact details.

6. An important part to be included in the form 35 half is the number of employees and facilities operating in India and Goa in their respective textboxes. Once the owner has filled in all the details, he would be able to press on the Update button present on the page.

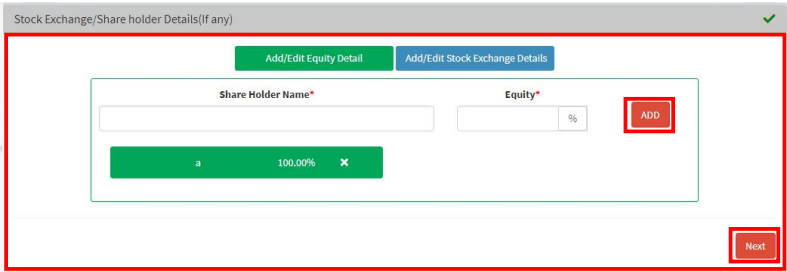

7. The factory owner must then enter the names of shareholders and equity on the form 35 half if applicable. He should add the equity details and stock exchange name. On clicking the next button the shareholder details or stock exchange details can be saved. The applicant of the factory would be then directed to the next tab as given in the figure -

8. Once the stock exchange or share holder details are saved, the owner would be directed to a page where he is supposed to enter the register factory in goa with appropriate registration details such as -

a. Choose whether the functional unit name in Goa is same as registered unit. I it is not the case, the factory owner must provide the details in 35 half form by giving unit/ branch office name in Goa and line of activity or the product/ service provided.

b. Choose the Goa PCB classification. Giver details of complete address with taluka and city/village of the factory along with the contact details. If the factory is located in the industrial estate, select yes. The next thing on form 35 hald is to enter the date of commercial operations and its type. He should then tell the number of employees and even the number of contract employees in the the business. Press save and click on the next button

c. The factory owner then can add other office address in Goa to include the details of the other outlets. If it is not applicable he can skip this part.

9.If the business owner selects add, he would be directed to a page to mention details of other factories where he must mention the complete address along with the contact details.

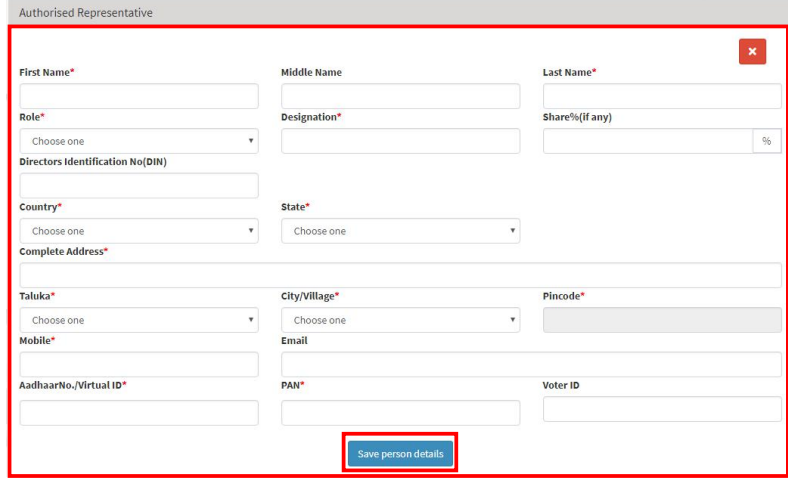

10. Once the factory addresses and details have been mentioned on the form 35 half, the owner can then add details of the authorized representative that his name, role, designation, complete address and contact details. The factory owner should also include the representative’s Aadhar no./ virtual id proof and PAN as well as save these details as shown in the figure -

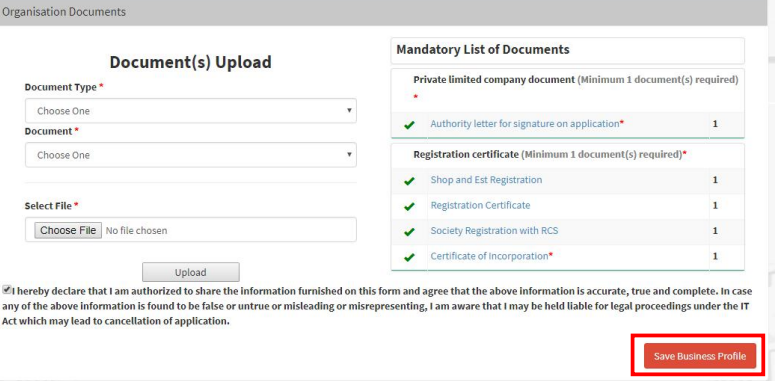

11. The next step in the form 35 half is to upload the required documents on the page. Click on upload to upload the documents. Once the documents have been uploaded tick the checkbox present on the page to accept the declaration. Next click on save business profile to save the information of business entity profile.

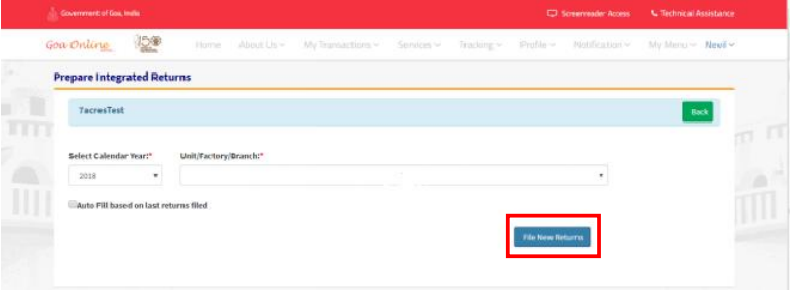

12. Next step is to click on all services provided by the Goa government portal online. Then the employer must select the desired service under the respective department. In this case it is the 35 half yearly returns. Once the employer has selected this service, its procedure will be displayed. Click on the Proceed to apply to apply for the integrated returns.

13. Once the business owner has selected Proceed to apply, the 35 half form for online returns will be displayed. Click on File New Returns on this page. Select the calendar year and the integrated unit for which the factory owner wants to get returns as shown below

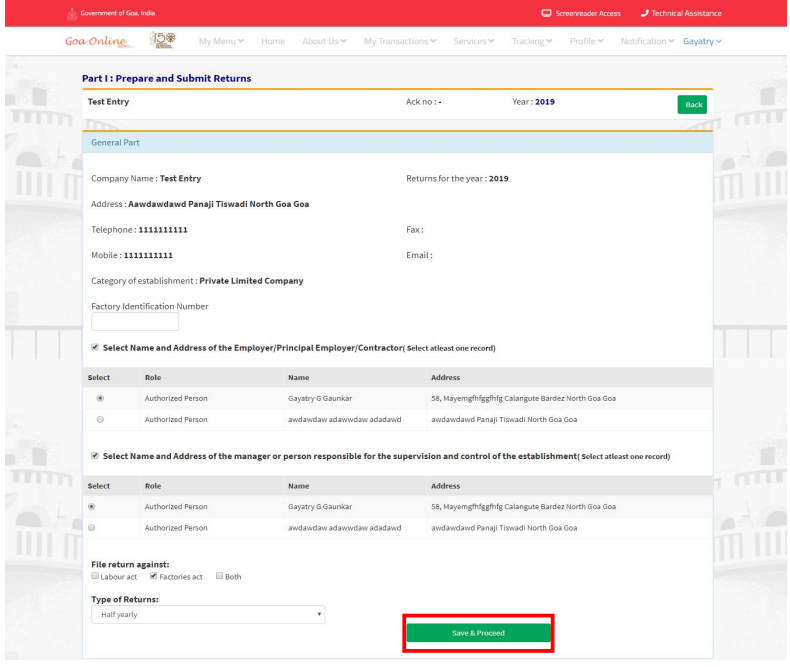

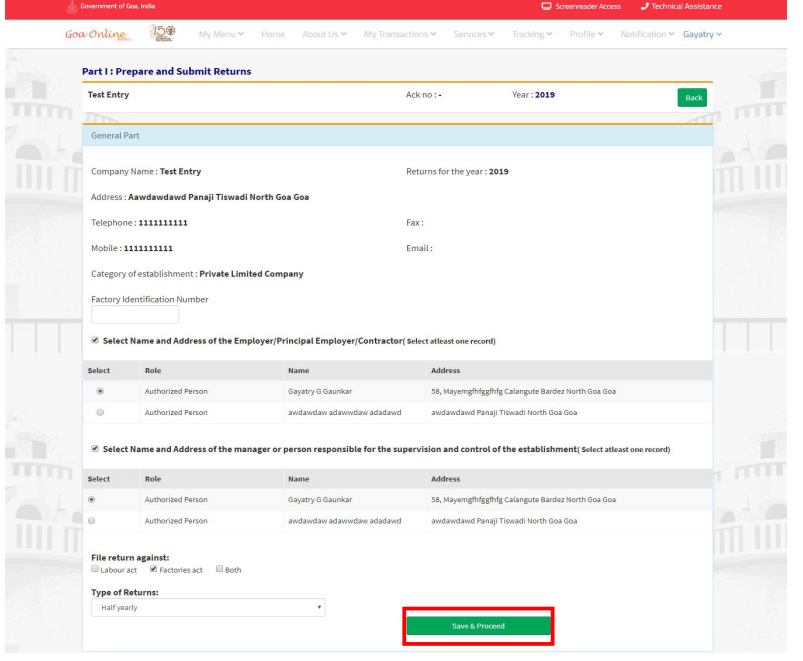

14. The basic unit details would be displayed next on the page. The next step is to select the name of the employer, address and manager as the textboxes provide on the page. Once this is done, the factory owner must select the file returns against and the type of returns by choosing the appropriate option and click on save & proceed as given in the figure below

15. On successfully completing this part, a new section will be displayed where the factory owner can enter the details of employees/ workmen employed and go on the next tab. In this page, select File Returns Against and Type of Returns by selecting appropriate option. Click Save and proceed.

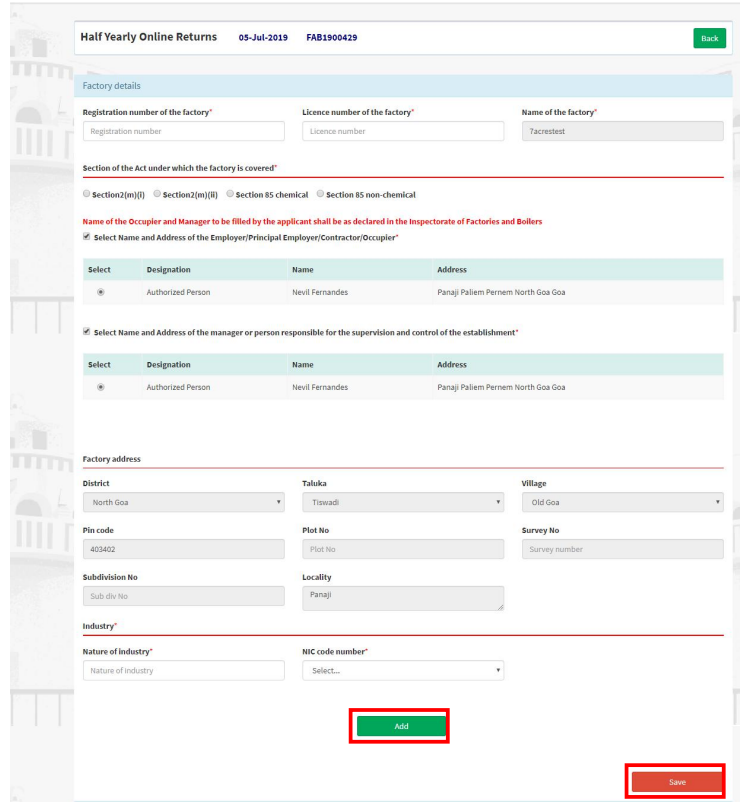

16. To file 35 half yearly returns, enter the registration number, license number and name of the factory in textboxes. Select the section in which the factory is covered. Choose the name and address of the employer. Select the nature of the industry and NIC code. Click on the Add button and then save it.

17. The next step in form 35 half is to click on the number Man Days tab to enter the details. Click on the number of days factory was operational during the half year ending. Enter the number of Man days worked and the number of employees at the manufacturing center daily. Also write the number of medical officer and number of employees examined in their respective textboxes. Save it.

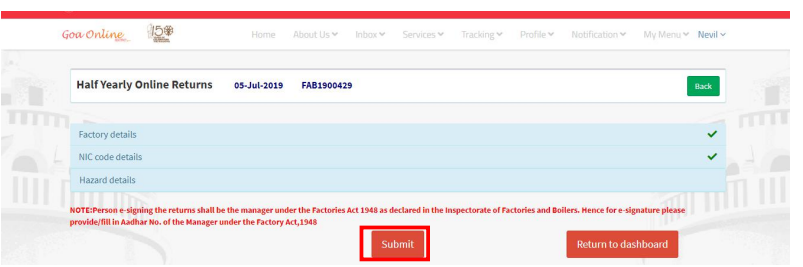

18. In the next step, write down the total number of workers working in the hazardous process and write the name of this process. Click on save and continue. Once the factory details, hazardous processes and NIC code details are successfully entered on the form 35 half, click on submit the application to submit the form.

After submitting the form, a confirmation regarding saving of the form 35 half will pop up with yes and no option.

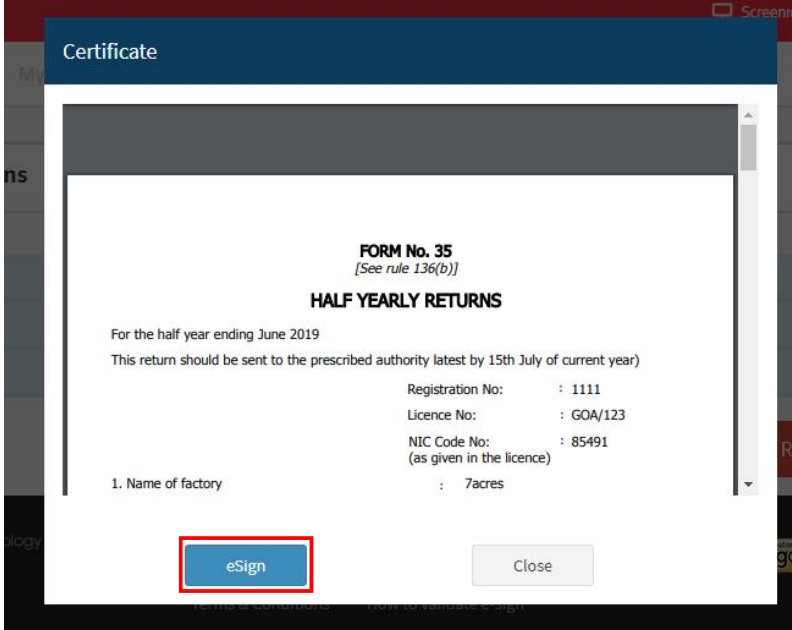

19. Once there is a submission of the application, the applicant needs to fill the box of eSign on form 35 half to digitally sign on the half yearly returns as indicated in the figure below -

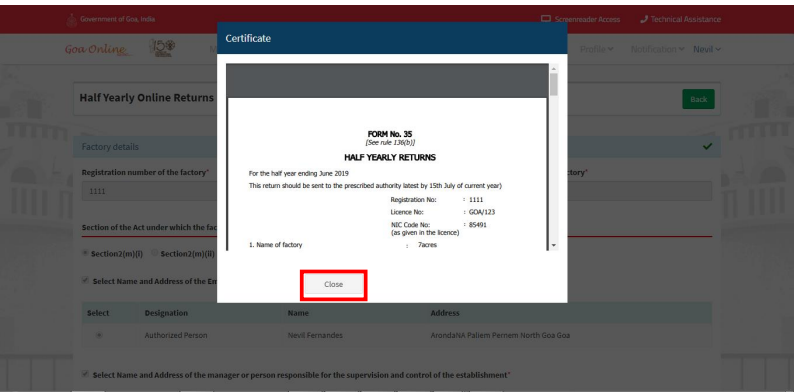

20. Once eSign is completed by the user, the page will be redirected to write virtual Aadhar number. Upon entering this, OTP will be sent to the registered mobile number. Once the OPT is verified on the digitally signed certificate, the user can close the 35 half yearly returns form. He can then return to the dashboard on the website.

Conclusion

The 35 half form can be filled online only by the employers. It is very necessary for the business owners to fill it if they want to claim the half yearly returns from the Goa state government and also continue operations of the factory before June end of the financial year.

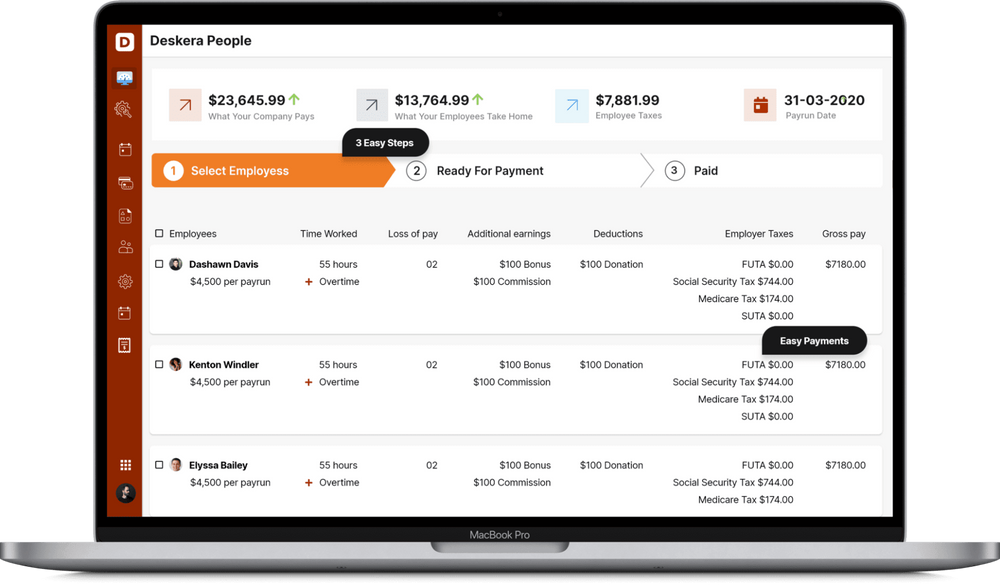

How Can Deskera Assist You?

Employees plan vacations around holidays; this may also include taking some extra leaves, so managing their payrolls can be a lot of work. Imagine software that could do that for you. Yes, Deskera can help you with that. Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

Employers in Goa need to fill the 35 half yearly returns form in the state of Goa to get half yearly returns.

According to the Factories act, 1948, the employer must have his workers for not more than 48 working hours in a week. He should also look after their health, safety and overall welfare by providing facilities such as rest rooms, creche, dining area etc.

The business owner must take care of his employees working in hazardous area. He should register the adult employees, mention their wages and take all safety precautions for hazardous departments as per the act.

The 35 half yearly returns for can be filled digitally by employers in Goa by logging on the portal. He should register on the state government site of Goa and complete all the steps required to fill the form.

The employer must digitally sign the document after filling in the details of the employees, factory and its departments as required.

Related Articles