The average HSA balance among account members who received individual or employer contributions in 2018 increased to $2,803 at year's end from $2,071 at the start. Only 8% of accounts with contributions had a balance of 0 at the end of 2018.

Although the two acronyms may sound identical, that tiny F or H alters everything. Both FSAs and HSAs are tax-advantaged medical savings accounts, enabling you and your staff to make significant financial savings on healthcare-related costs.

To help their staff better budget their healthcare expenses throughout the year, several businesses include them in their benefit packages.

Table of contents

- What’s an FSA?

- What are the FSA categories?

- Dependent Care FSA

- How to get financing?

- How is an FSA for health financed?

- What exactly is an HSA?

- What kind of health insurance programme do you offer to your employees?

- Are employee balances transferable?

- What to choose: HSA vs. FSA

- Balances in HSAs vs. FSAs

- Tax Savings for HSA vs. FSA

- HSA vs. FSA Portability

- But which one ought to I pick for my group?

- What are the benefits of offering an account-based health plan (ABHP)?

- What happens if I have an HDHP, an HSA, and another kind of medical insurance plan?

- How exactly do I set up an HSA or FSA?

- Has COVID-19 resulted in any updates to health FSAs and HSAs?

- Which One Fits You Best?

- How to Use Your Team's FSA Funds Before They Expire?

- How do Employee spending accounts function?

- What are Unexpected FSA-eligible products?

- Overview for employers

- Key Takeaways

What’s an FSA?

You can put pre-tax money into a Flexible Spending Account (FSA) to cover out-of-pocket expenses that are allowed by the IRS. You don't pay taxes on these accounts because the money is pre-tax (unless you use it for an expense that isn't allowed), which will ultimately save you money.

What are the FSA categories?

Health FSA: Permits contributions to be used for copays, prescription drugs, specific over-the-counter medications, or first aid supplies that are considered to be acceptable medical expenses. A list of medical costs that qualify for health FSA coverage is provided by the IRS.

Dependent Care FSA

Contributions may be used to pay for child care costs for kids under 13 (or 14, depending on your plan) or for the support of a spouse or dependent of any age who is incapable of caring for themselves due to physical or mental impairment, fsa or hsa. More information on dependent care FSA qualified expenses can be found in IRS Publication 503.

Limited Purpose FSA: Unlike general-purpose health FSAs, which also cover vision and dental costs, limited-purpose FSAs (LPFSAs) exclusively pay for certain medical expenses.

How to get financing?

A company must sponsor a health FSA since it is seen as a benefit plan, much like a regular medical, dental, or vision group plan. The employer (or plan sponsor) specifies the prerequisites an employee must satisfy in order to join an FSA, such as a waiting period or the number of hours they must put in at work for fsa or hsa.

Employees who already have an HSA account can add a limited purpose FSA (LPFSA) to it to pay for vision and dental care costs, fsa or hsa. For the purpose of preserving HSA eligibility, enrollment in any other sort of health flexible spending account is not permitted.

One thing to bear in mind is that if you're a highly rewarded player or a significant employee, specific restrictions might be put in place.

How is an FSA for health financed?

A member makes a contribution to their health FSA by deciding how much of their earnings they want their employer to deduct from it. Participants must specify their desired contribution level at the start of the plan year, and their employers will deduct money on a periodic basis. $2,750 per employee is the highest yearly contribution cap for 2021.

It is significant to emphasise that unless a qualifying life event occurs, people cannot modify or rescind their election, fsa or hsa. A participant may alter their annual contribution amount up to the maximum amount even if they change jobs. Even if they chose to donate the maximum amount at their prior work, this is permitted.

Employers have the option but are not required to make contributions to an LPFSA or a health FSA. The combined maximum allowed by the IRS for health FSA or LPFSA contributions from the employer and employee cannot be exceeded, fsa or hsa.

What exactly is an HSA?

An HSA, or health savings account, is comparable to a health flexible spending account in that it enables you to deposit money aside before taxes to cover certain out-of-pocket medical expenses. These costs do not include premiums; they also include copayments and other sums. The primary distinction between an HSA and a health FSA is that in order to join an HSA, you must already be a member of a High Deductible Health Plan that is HSA-eligible (HDHP).

To put it briefly, HDHPs are health plans that, in comparison to other plans like PPOs or EPOs, typically have larger deductibles, lower monthly premiums, and greater out-of-pocket maximums.

Employees can open health savings accounts through their employers or directly with a financial institution. These accounts are tax-favored. The funds that are deposited into these accounts may be used by employees to cover specific medical costs or to get reimbursed for those costs.

The main purpose of health savings accounts is to assist employees in accumulating enough money to pay for the amount of their medical expenses that they must cover out of pocket, fsa or hsa. As a result, a worker must have health insurance that meets the criteria for a high-deductible health plan in order to be eligible to make contributions to an HSA.

These high-deductible health plans, or HDHPs for short, feature yearly deductibles that are larger than those of more comprehensive health insurance plans, as well as a cap on the total amount of out-of-pocket medical expenses that you are responsible for paying, fsa or hsa.

What kind of health insurance programme do you offer to your employees?

Offering a health savings account in addition to comprehensive health insurance with low deductibles is not particularly beneficial. That's because even if you make an HSA available to your employees, they won't be able to contribute to one if the insurance you offer does not meet the criteria for a high deductible health plan.

Flexible spending accounts, on the other hand, can be the ideal complement to a company providing comprehensive health insurance because they are permitted independent of the sort of health insurance plan you offer, fsa or hsa.

Making an HSA available, however, can be a wonderful approach to persuade workers to select an HDHP if you do decide to give the choice, fsa or hsa. Because of the often much lower monthly premium expenses associated with high-deductible health insurance, this helps the employer.

In many cases, you can contribute more money from your employer to an HSA for employees and still come out ahead, fsa or hsa. You can have both an HSA and an FSA if you have both an HDHP and standard insurance.

Are employee balances transferable?

Regarding the employees' freedom to use the funds anyway they choose, HSAs and FSAs are different. When money is deposited into an HSA, it becomes the employee's property. There is no time limit on when the employee must utilise the money, and any unused funds may be carried over to subsequent years.

In contrast, employees often must use all of their FSA funds within a given year to avoid losing them. Some plans give employees a few extra months to use up their FSA funds in the next year, while other plans have provisions that enable employees to carry up to $500 forward into the following year, fsa or hsa.

However, since none of those clauses must be present, administering FSAs can be a little simpler than managing HSAs' long-term carryforwards.

What to choose: HSA vs. FSA

Anyone who qualifies may make an HSA contribution. Employers can also make HSA contributions on behalf of their employees. Employees can make pre-tax payroll deductions toward an HSA through a cafeteria plan, as well as after-tax contributions, fsa or hsa.

Employees can alter the amount they contribute to their HSA at any time during the plan year, which is one way why HSAs are more flexible than FSAs. But only money that has already been paid in can be accessed, fsa or hsa.

FSAs are often funded by contracts with the employer for voluntary wage reductions. This means that the employee makes a voluntary deduction from their income, sometimes known as a salary reduction agreement, to fund their FSA, fsa or hsa. You as the employer may potentially make contributions to your employees' FSAs, depending on how your plan is set up.

Employees must specify their FSA contribution amount at the start of the year, unlike HSAs. Only a change in employment or family circumstances will allow for an adjustment to this sum, fsa or hsa. However, regardless of when the funds are paid in, employees have access to them at the beginning of the plan year, fsa or hsa.

Balances in HSAs vs. FSAs

The way residual balances are handled at the end of the year is one of the key distinctions between HSAs and FSAs. The balance an employee has with an HSA at year's end is carried over to the following year, fsa or hsa.

FSAs, on the other hand, are use-it-or-lose-it types of plans. As a result, funds that aren't used by the end of the plan year are typically forfeited (and returned to the employer) and cannot be carried over, requiring participants to consider their anticipated healthcare costs before enrolling. However, as the employer, you can create a plan that offers a grace period or carryover.

Tax Savings for HSA vs. FSA

Employers can benefit from tax advantages with both HSAs and FSAs. You won't be liable for the employer's share of Social Security taxes on employee contributions as contributions are often excluded from an employee's income and aren't taxable, fsa or hsa. Additionally, your donations are tax deductible. But employees can also profit from the programmes' tax advantages, fsa or hsa.

Withdrawals from HSAs and FSAs are tax-free if used for eligible medical costs. The IRS Publication 502, Medical and Dental Expenses, details the medical and dental expenses deduction that normally applies to these costs. Employees may choose to pay for expenses with a debit card or they may have to submit claim papers for reimbursement, fsa or hsa.

Although the treatment of using funds for medical expenses is the same under both types of plans, the options for using funds for non-medical reasons are different, fsa or hsa. FSA funding specifically cannot be used for non-medical costs, fsa or hsa.

HSA funds, however, may be withdrawn, but doing so will result in taxes and a 20 percent penalty for employees under the age of 65. (those over 65 will still have to pay income tax on distributions for non-medical expenses).

HSA vs. FSA Portability

An HSA is portable because it is an employee-owned savings account. Employees retain ownership of all funds, including any contributions made by their employers, even if they switch employers or quit their jobs. FSAs, on the other hand, are owned by employers. Any unused money in an employee's FSA will be lost when they stop working for you because they can no longer be maintained.

Both accounts have advantages that can help you manage your yearly out-of-pocket medical spending more easily. In general, those who are younger, healthier, and have fewer prescriptions or medical issues will likely benefit more from an HSA and HDHP because they are less likely to require frequent medical attention or pay for ongoing medications, fsa or hsa.

Even though HDHPs are among the most affordable health insurance options, they come with hefty out-of-pocket maximums that could reach $14,100 for a family in 2022, fsa or hsa. Even if you made the maximum contribution to your HSA, you would still need to come up with a sizable amount of cash if your medical expenses were high.

Other health plans have higher monthly prices but provide greater upfront coverage, fsa or hsa. Because of this, individuals with significant medical expenses frequently discover savings with plans that are more generous than HDHPs, ruling out the HSA as a viable choice, fsa or hsa.

The math on any plans you're comparing is worthwhile: Determine the annual premiums, deductibles, and out-of-pocket expenses for both plans, taking into account any employer payments.

Even while FSAs are less flexible than HSAs, they still enable you to save money and can be combined with any plan, provided that your employer supports them, fsa or hsa.

As you start considering how much to give, the following rule of thumb is helpful: Set up a starting amount that will cover your deductible, projected pharmaceutical prices, regular over-the-counter pharmacy expenses, and anticipated doctor visits.

Although HSAs and FSAs have a similar appearance, they differ in terms of who controls the account. With an HSA, the account belongs to the employee. That holds true regardless of whether the company also contributes to the HSA or if the employee is the only one doing so. No matter how long the individual has worked there, once the employee retires or leaves the company, the whole HSA amount is theirs to keep.

Although the individual has the option to make contributions to the account, the employer owns the FSA balances. If an employee quits their job while there is still money in their FSA, they forfeit that money, which is returned to the employer, fsa or hsa.

But which one ought to I pick for my group?

An employer may provide both a health FSA and an HSA. Nevertheless, a worker's enrollment options may be restricted based on their plan. Here, it's crucial to remember that in order to be eligible for an HSA, employees must be enrolled in a high-deductible health plan, fsa or hsa.

The effectiveness of an HSA may be diminished if a company does not provide an HDHP because the employee would be required to enrol in an acceptable HDHP elsewhere. The short answer is that depending on the demographics of the workforce at the firm, if high-deductible health plans are offered, employees will have an option.

What are the benefits of offering an account-based health plan (ABHP)?

Let's first discuss the benefits of ABHPs for small enterprises before moving on.

With ABHPs, small businesses can use pre-tax funds to compensate their staff for medical expenses, giving staff members a means to reduce their out-of-pocket costs. An ABHP can be created by employers to best suit the requirements of their business and workforce, fsa or hsa.

Furthermore, if you already have a plan in place or want to offer one in the future, you can frequently choose to connect your ABHP with a group health insurance plan so that it can provide additional coverage to your standard insurance.

Alternatively, you may create a whole new ABHP that just provides medical spending accounts to employees, fsa or hsa. Employees who participate in this sort of ABHP may choose to enrol in their spouse's health insurance plan or purchase an individual health insurance policy using funds provided by their employers.

The FSA is the last entity. Another benefit programme established by an employer that enables tax-free reimbursement of eligible medical expenses is an FSA. In this instance, unlike an HSA, it is held by the employer.

Employers collect money from employees' paychecks for their FSA on a pre-tax basis, up to the yearly contribution cap, fsa or hsa. The employer may also make financial contributions, just like an HSA.

FSAs, in contrast to HSAs, are dependent on employment and are forfeited if the employee leaves the employer.

The rollover has restrictions as well. Employers are permitted to permit a maximum $500 rollover at the end of the year; otherwise, any unused monies are lost at that time, fsa or hsa.

What happens if I have an HDHP, an HSA, and another kind of medical insurance plan?

Typically, HSAs can only be used in conjunction with the necessary HDHP insurance. You do, however, have the choice of a Limited Purpose FSA in this situation. These FSAs do not contravene the no additional coverage requirement for HSAs because they only provide coverage for dentistry and vision.

One who is aware that they might require financial assistance this year: Let's assume that your employee needs to have their wisdom teeth removed, is pregnant, or needs to undergo some anticipated medical operation, fsa or hsa. Because individuals have quick access to the funds when they need them, a health FSA can be a smart choice. Just keep in mind that an HSA permits your employee to make larger contributions than a health FSA does.

The individual who is uncertain whether they will need to use money: For this employee, an HSA might be a better option. Going this option makes more sense for the employee who isn't anticipating many urgent medical needs because people can only use their HSA money as they contribute to it. The money is also not use it or lose it. You may still use money from the HSA even if you are no longer qualified to contribute.

How exactly do I set up an HSA or FSA?

Your employer must provide you with access to an FSA Plan. You can then decide whether to opt in and specify how much you wish to contribute at the start of the plan year. You must first be enrolled in a high-deductible health plan in order to be eligible for an HSA, fsa or hsa. You can create an HSA through your employer or one you create yourself after enrolling in an approved plan.

Give your health insurance broker a call as an employer once you have a general notion of which account is best for you and your company. Tell them which one you're considering setting up and any other features you wish to add, fsa or hsa. Your broker will go over the accounts you have access to based on your current health insurance plan and all associated charges.

Hopefully, this has helped you feel a lot calmer about the FSA vs. HSA argument. With this breakdown, you'll be able to identify the strategy that suits your business the best while enabling your staff to act in a way that is best for them as well, fsa or hsa.

Has COVID-19 resulted in any updates to health FSAs and HSAs?

Yes! Health FSAs and HSAs were modified by the Coronavirus Aid, Relief, and Economic Security (CARES) Act in order to increase coverage and financial flexibility. Some of these modifications are transient, while others are more long-lasting.

Prescription and non-prescription over-the-counter medications, as well as menstruation care products, are now included in the CARES Act's extended list of qualifying out-of-pocket medical expenses for health FSA coverage. This compensation is ongoing for fsa or hsa.

Be aware that not all over-the-counter medications are acceptable; for instance, unless prescribed and continued by a doctor to address a medical condition, vitamins and supplements are not accepted. Examine a list of allowable and disallowable medical costs. In order to pay for telehealth services before a patient has reached the plan deductible, HDHPs can now be coupled with HSAs.

Qualified Medical Costs

The purpose of HSAs and FSAs is to pay for eligible medical costs. HSAs normally do not count health insurance premiums as eligible medical expenses unless you are paying for COBRA coverage or getting unemployment benefits. Both types of accounts allow for the purchase of prescription drugs, including insulin. Expenses for telehealth services, including online prescriptions, are considered qualified medical expenses for HSAs and FSAs. Menstrual hygiene items and over-the-counter medications are also considered eligible expenses.

Usually, copayments and deductibles for doctor appointments and hospital stays can be paid out of these accounts. Teeth whitening is not regarded as a qualified health expense, but necessary dental care is, fsa or hsa. Glasses are another acceptable expense. In general, you can use HSA or FSA funds to pay for anything that you could claim as a medical expense on your taxes.

Restrictions

Both kinds of plans have limitations because they both provide a tax-free opportunity to save for medical costs. FSAs, however, tend to be the more limiting of the two types of plans. When you switch employment, for instance, you cannot move your FSA to the new employer, and you may only alter your contribution during open enrollment or in the case of a qualified life event, like getting married or having a kid. For HSAs, these restrictions don't apply.

The ability to deposit money and the duration for which it can be held there are the greatest differences between the two accounts, fsa or hsa. An HSA allows you to contribute more each year and roll over any unused funds at the end of the year.

Tax incentives and the potential for savings

The upfront tax benefits of HSAs and FSAs are identical; you can deposit money into the accounts and take it tax-free to cover medical expenses, fsa or hsa. HSAs, however, provide even bigger tax benefits and savings opportunities.

Your HSA becomes another savings vehicle in your larger financial portfolio because you can roll over your balance each year. Additionally, the growth of this money is tax-deferred, so you won't have to pay taxes on it until you remove the money, fsa or hsa. You can withdraw that money tax-free if you wait until after age 65 and throughout retirement.

Which One Fits You Best?

HSAs are more adaptable overall. They allow you to reduce your tax burden and save money over the long run since any money you don't utilise in a given year rolls over and builds up as savings. However, you are required to have an HDHP, and not everyone finds high-deductible health plans to be comfortable, fsa or hsa.

You can lose unused funds at the end of the year with an FSA because it doesn't accumulate over time. If you switch employers, you risk losing your FSA as well. If you are not eligible for an HSA, an FSA is also a smart choice because it allows you to budget for medical spending while simultaneously offering tax benefits.

One significant modification included telehealth appointments. Patients with high-deductible health plans and HSAs are permitted to schedule telemedicine appointments prior to reaching their deductible under the CARES Act. The second provision, which was not possible prior to the new law, permits over-the-counter medical supplies to be considered acceptable expenses for HSAs and FSAs without a prescription.

How to Use Your Team's FSA Funds Before They Expire?

One of the benefits of being an employer is that you may instruct your staff on how to pack their carts with a variety of beneficial FSA-eligible expenses at the end of the year. How come that? Many employees may be in danger of losing their FSA funds when the plan year expires because they have an excess of funds, fsa or hsa.

Flexible Spending Accounts, or FSAs, are employer-sponsored accounts that let your team make pre-tax contributions (up to $2,750 in 2021) for medical costs.

FSA monies often expire on December 31st of each year, unlike Health Spending Account (HSA) funds, which typically roll over each year. Some workplace benefit plans permit staff to carry over $500 to the following year or push back the deadline for spending to March 15 of the following year, fsa or hsa.

Therefore, it's beneficial to be knowledgeable about the specifics of your plan so you can assist your staff in making the most of their FSA funds.

How do Employee spending accounts function?

Employee spending accounts can be established through the majority of insurance carriers and third-party administrators, just like a conventional benefits package. Your benefits broker can help you locate the SA that best suits your staff's needs.

Employees are enrolled and the employer establishes the rules.

There is hardly any work left to be done after that. Until they have used up their annual allowance, employees can file claims to their insurance provider or plan administrator and obtain compensation. Employers have the option of allowing unused funds to rollover, but SAs often reset annually.

What are Unexpected FSA-eligible products?

New eyewear, including new glasses

With their readily available health FSA cash, employees can upgrade their prescriptions and update their appearance, fsa or hsa. The majority of prescription eyeglasses, including sunglasses and stylish frames, is reimbursed up to a set sum. Reading glasses also count and do not require a prescription! Additionally covered are yearly eye tests, glasses maintenance, and eye drops.

Contact lens wearers can take advantage of their health FSA to stock up on lenses, solution, and cases for the next year. Another innovative way to use FSA funds is to get the LASIK operation for vision correction if any employee is ready to completely give up their glasses or contacts.

Items for feminine hygiene

The CARES act has made feminine hygiene items like pads, tampons, liners, and menstrual cups eligible costs, fsa or hsa. This means that period underwear, both disposable and non-disposable, can be purchased with health FSA funds. Many more feminine hygiene goods, such as suppositories, itch creams, heating patches, menstrual cup wash, and UTI medicines, are also covered!

Fitness programmes and equipment

Participants can use their health FSA funds on a variety of interesting health-related goods and services, including equipment for exercising. In many situations, customers can use it to buy specific fitness monitors, exercise equipment, fitness courses, and even health club memberships if they meet the requirements, fsa or hsa.

Presents for parents

There is a vast variety of useful family health FSA-eligible products, from thermometers to sunscreen, that can boost financial savings throughout the household. Parents can save money by stocking up on frequently used nursery products like diaper rash cream, baby breathing monitors, infant thermometers, and breast pump accessories using their health FSA funds.

Pregnancy tests, fertility kits, and other family-planning products are among the coverage benefits that even individuals who are considering parenthood can take use of. Some of the categories listed below have more information on this, fsa or hsa.

Emergency supplies

Some of the emergency necessities covered by health FSAs are first aid kits, aspirin, bandages, allergy medication, continuing medications, and dust masks. Neosporin or Bacitracin are acceptable reimbursements for unexpected wounds and scrapes, as well as antibacterial ointments and wound treatment. The use of some over-the-counter drugs, such as painkillers, may also be permitted.

Family planning and contraceptive goods

The morning-after pill and other emergency contraceptives, as well as family planning items like prenatal vitamins, are also available here. Condoms are regarded as FSA-eligible medical expenses, fsa or hsa.

Products including sperm test kits, fertility medications, breastfeeding accessories, ovulation tests, and pregnancy tests are also included. With a doctor's prescription, you can purchase birth control with your health FSA dollars.

Services for mental health and wellness

Health FSAs provide coverage for a wide range of mental health treatments and services, including certain telemedicine and online counselling options. This covers psychological counselling as well as specific treatment plans like outpatient therapy sessions or resident treatment plans at addiction treatment centres, fsa or hsa.

With a valid prescription from a qualified doctor or therapist, prescriptions for mental health issues may also be reimbursed. More details regarding FSA eligibility for mental health services can be found at the FSA store.

Face masks, hand sanitizers, and other COVID-19 personal protective equipment (PPE)

This contains gloves, tissues, face masks, hand sanitizers, and sanitising wipes. It's a terrific method to use up that extra FSA money because these things are non-perishable and can be kept for a long time, fsa or hsa.

Any claims for COVID-19 safety gear acquired after January 2020 and to the end of December 2022 may also be paid out or reimbursed retroactively by FSA providers. However, unless their employer took advantage of a temporary FSA grace period extension through the Consolidated Appropriations Act of 2021.

A health FSA participant can only be reimbursed for expenses incurred during the current plan year. The purchase of COVID-19 protective equipment throughout the plan year may be retrospectively reimbursed, so workers should look for any receipts they may have.

Pampering splurges

You can use your health FSA to treat yourself and unwind. Shoe insoles and foot massagers are two examples of qualifying expenses. Other possible acceptable expenses include acupressure mats, face massagers, and sleep eye masks.

Consider acupuncture and other complementary therapies

Numerous studies have demonstrated the effectiveness of acupuncture in treating conditions like chronic pain, depression, arthritis, and nerve discomfort. The list of health FSA-covered items also includes health-improving treatments including acupuncture, chiropractic care, and numerous alternative medicines.

Please be aware that an LMN may be needed for some of these services. Using your health FSA dollars is a terrific opportunity to learn more about these treatments if you've ever been interested in them.

Dental must-dos

Employees can maximise the most of their health FSA funds by using any leftover money for dental procedures or maintenance. Most health FSA plans cover sealants, fillings, checks, X-rays, and even veneers for specific diseases. The price of braces and cleaning fees (together with co-pays and deductibles) may also be covered. Dollars from health FSAs can be spent on dental cleaning products or mouthguards to stop teeth grinding. Employees might stock up on certain dental needs as well.

Get ready for a trip

Employees' unused health FSA funds can be used to purchase travel-sized painkillers, carry-on-size first aid kits, motion sickness remedies, including acupuncture wristbands to reduce nausea, or sunscreen for tropical vacations. For lengthy flights, orthopaedic neck pillows and compression stockings are also covered (just make sure they're rated at 30-40 mmHg or above). It's crucial to check and stock up on all of the necessities since there may be many more mentioned at the health FSA store.

Improve your quality of sleep

Spending money from your health FSA can be used to have better sleep by purchasing sleep masks, thermal eye masks, and even certain over-the-counter sleep aids.

Additionally addressed are bed warmers for chilly evenings, air purifiers, air filters, and vaporizers, albeit some of these may need a medical professional to explain how they might be utilised to treat a specific medical problem.

Many nighttime flu treatments are health FSA qualifying and can help you achieve better shape with a decent night's sleep on those evenings when you're recovering from a cold or the flu.

Try some cutting-edge devices and gadgets

Many high tech devices, such as light therapy treatments for acne, electrical stimulation devices for chronic pain, smart thermometers and blood pressure cuffs, cloud-connected stethoscopes, vibrating nausea relief bands, vibrating arthritis gloves, and more, may be covered by people who have a lot of health FSA funds left over.

Health reports with ancestry kits

Many ancestry kits, like 23andme, are often regarded as a health FSA qualified expense for people who would like to learn about their heritage and the subtleties of how their DNA can affect their health. These kits typically need to include a health report in order to be covered.

Treatment for addiction and quitting smoking

Health FSA funds can be used to purchase nicotine gum, lozenges, patches, inhalers, and nasal sprays for people trying to quit drinking or smoking. Online therapy programmes and counselling for quitting smoking are both eligible for reimbursement. Meetings of AA and NA, as well as travel to and from them, are deductible expenses. Please check your health FSA's terms to see if a doctor's letter of medical necessity is necessary.

Travel, housing, and other costs associated with a disease or treatment for a medical condition

Meals and lodging costs incurred as a result of medical treatments may be paid. Additionally, any travel expenses incurred to attend medical conferences linked to a pre-existing condition are covered. However, these conferences are not provided with hotel or meals.

Health FSA funds can be used to pay for house modifications that certain people might need to make because of their medical issues. This covers costs for things like ramp installation, entryway enlargement, stairway modification, home accessibility, car accessibility, and more.

If all eligibility requirements are met, mileage to and from medical appointments may also be eligible for reimbursement. Review the conditions of your health FSA to discover what costs might be eligible for reimbursement.

Weight loss methods and programmes

As long as they are diagnosed by a doctor and a statement of medical necessity is prepared, many weight loss programmes are covered. This includes wellness exams and advice for weight loss. Unfortunately, reimbursement is not available for weight loss supplements. However, some weight loss procedures are eligible.

Care for diabetics and wounds

The average person with type 1 diabetes spends little more than $2,400 on diabetic consumables on their own dime, according to a 2020 study on the cost of diabetic care. The acceptable health FSA expenses include diabetic monitors, glucose tablets, test kits, strips, and insulin supplies including syringes and needles.

You may be paid for blood pressure monitors, cholesterol drugs, and hypertension meds. Additionally, certain diabetic wound and foot treatment is available for reimbursement using health FSA funds. This includes bandages, antibacterial ointments, foot supports, and braces. Another excellent incentive to stock up is that many of these goods have very extended shelf lives and no expiration dates.

Provide FSAs and HSAs to your staff members for retention

You can attract and keep top talent by providing ways for your employees to use tax-free money to better manage their healthcare bills. However, it's crucial to comprehend the benefits and drawbacks of providing these programmes from a business standpoint.

Tax incentives for the business

The employer is no longer required to pay his share of the Social Security (6.2%) and Medicare (1.45%) taxes on the employee's contributions to those accounts when the employee enrols in an HSA or FSA. As a result, the employer pays 7.65 percent less in payroll taxes than the sum of all employee contributions.

Consider a business with 20 employees and a $1 million annual payroll. The business would have to pay $76,500 in Social Security and Medicare taxes if it didn't have an FSA or HSA plan. However, the business would save $3,978 in annual taxes if each of the 20 employees made a $2,600 FSA contribution.

Cons: The organisation can experience liquidity shortages

According to the Uniform Coverage Rule, an employee who has been enrolled in an FSA since the plan's inception is entitled to receive the full amount of her yearly election, regardless of how much she has contributed.

This means that in the case of our 20 person company, if all 20 employees made an annual election of $2,600, the company would need to be prepared to refund up to $52,000 from the start of the FSA. Additionally, once an individual is laid off or fired, the employer is not able to recoup expenses.

A corporation must set aside enough money to cover FSA reimbursements that are less than current employee contributions in order to prevent a liquidity constraint. Employers who offer FSAs are permitted by the IRS to keep any unused funds to pay for programme administration expenses. Another option to address a cash shortage is to provide an HSA. The current level of contributions is the ceiling for all HSA reimbursements.

Overview for employers

In conclusion, there aren't many financial differences between offering an FSA or HSA from the employer's perspective. It ultimately depends on the desires of the employees to budget for their medical costs. However, due to HIPAA, businesses aren't allowed to delve too deeply into an employee's medical history, so it's frequently advisable to collaborate with a third-party provider to learn what employees would actually desire.

If you decide to outsource administration to a trustworthy supplier, be sure to weigh the expense of doing so against the cost of adopting and managing the plan internally, fsa or hsa. Even while the costs of outsourcing may reduce some of the tax benefits, they could ensure that your business complies with all legal criteria set forth by the IRS and other government organisations.

To manage your costs and expenses you can use many available online accounting software.

How Deskera Can help You?

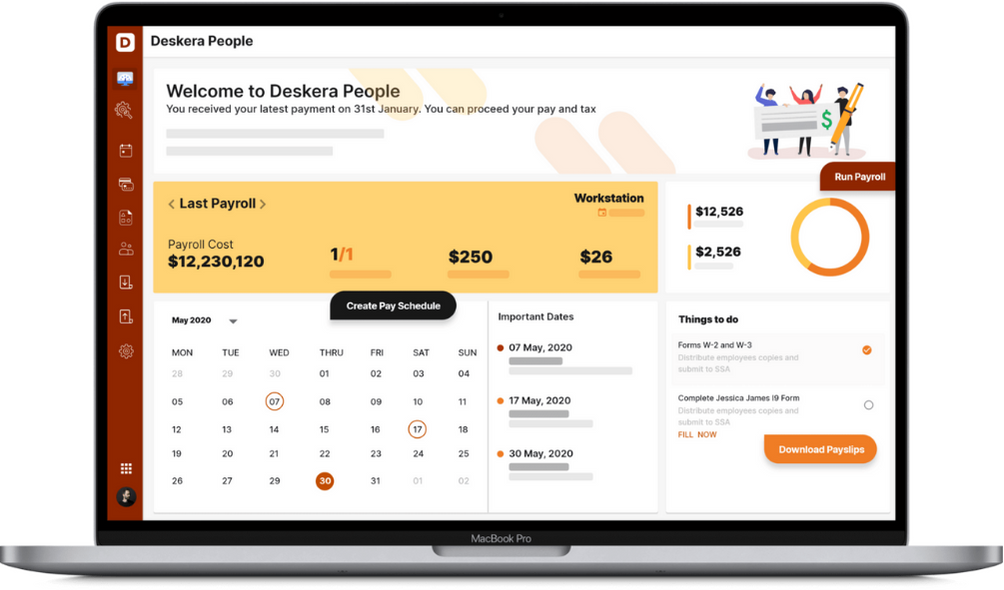

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

You can put pre-tax money into a Flexible Spending Account (FSA) to cover out-of-pocket expenses that are allowed by the IRS. You don't pay taxes on these accounts because the money is pre-tax (unless you use it for an expense that isn't allowed), which will ultimately save you money.

A company must sponsor a health FSA since it is seen as a benefit plan, much like a regular medical, dental, or vision group plan. The employer (or plan sponsor) specifies the prerequisites an employee must satisfy in order to join an FSA, such as a waiting period or the number of hours they must put in at work.

An HSA, or health savings account, is comparable to a health flexible spending account in that it enables you to deposit money aside before taxes to cover certain out-of-pocket medical expenses. These costs do not include premiums; they also include copayments and other sums. The primary distinction between an HSA and a health FSA is that in order to join an HSA, you must already be a member of a High Deductible Health Plan that is HSA-eligible (HDHP).

Offering a health savings account in addition to comprehensive health insurance with low deductibles is not particularly beneficial. That's because even if you make an HSA available to your employees, they won't be able to contribute to one if the insurance you offer does not meet the criteria for a high deductible health plan.

A member makes a contribution to their health FSA by deciding how much of their earnings they want their employer to deduct from it. Participants must specify their desired contribution level at the start of the plan year, and their employers will deduct money on a periodic basis. $2,750 per employee is the highest yearly contribution cap for 2021.

Typically, HSAs can only be used in conjunction with the necessary HDHP insurance. You do, however, have the choice of a Limited Purpose FSA in this situation. These FSAs do not contravene the no additional coverage requirement for HSAs because they only provide coverage for dentistry and vision.

Although HSAs and FSAs have a similar appearance, they differ in terms of who controls the account. With an HSA, the account belongs to the employee. That holds true regardless of whether the company also contributes to the HSA or if the employee is the only one doing so. No matter how long the individual has worked there, once the employee retires or leaves the company, the whole HSA amount is theirs to keep.

Employers can benefit from tax advantages with both HSAs and FSAs. You won't be liable for the employer's share of Social Security taxes on employee contributions as contributions are often excluded from an employee's income and aren't taxable. Additionally, your donations are tax deductible. But employees can also profit from the programmes' tax advantages.

Offering a health savings account in addition to comprehensive health insurance with low deductibles is not particularly beneficial. That's because even if you make an HSA available to your employees, they won't be able to contribute to one if the insurance you offer does not meet the criteria for a high deductible health plan.

You can attract and keep top talent by providing ways for your employees to use tax-free money to better manage their healthcare bills. However, it's crucial to comprehend the benefits and drawbacks of providing these programmes from a business standpoint.

Related Articles