According to the most recent data EPI sourced from the Organization for Economic Cooperation and Development in 2017, it was found that public spending to fund early child care and education is about $34 billion, with the federal government kicking in about $22.2 billion and state and local municipalities spending about $11.8 billion.

By 2020, according to a report from the progressive think tank Economic Policy Institute, American parents with children under the age of 5 were forking over a total of $42 billion for early child-care and education like pre-school programs.

Considering this, Americans are forced to stretch their budget and make substantial sacrifices to meet these expenses. Therefore, it is important to know about the important government measures that come to your rescue here and how much you can expect from them.

This article is aimed to be your guide for the same by covering the following topics:

- Financial Preparations for Child-Care

- What is Dependent Care FSA?

- How to Use Dependent Care FSA?

- Expenses that Qualify for Dependent Care FSA Reimbursement

- Expenses that Do Not Qualify for Dependent Care FSA Reimbursement

- How Can You Manage Dependent Care FSA?

- Things to Consider in Regards to Dependent Care FSA

- Potential Benefits and Drawbacks of Dependent Care FSA

- What is Child Care Tax Credit?

- Potential Benefits and Drawbacks of Child Care Tax Credit

- Is it Possible to Simultaneously Use a Child Care Tax Credit and a Dependent Care FSA?

- Which is Better for Daycare Expenses- the Child and Dependent Care Tax Credit or Dependent Care FSA or Child Care FSA Funds?

- How Can Deskera Help with Daycare FSAs and Dependent Care Tax Credit?

- Key Takeaways

- Related Articles

Financial Preparations for Child-Care

Each family has its own ways of financially preparing for child-care. Some parents might opt for an option where one parent starts staying at home full-time for their children who are not yet at the age of joining the school. Often, this is a viable solution because it costs less than having a dual-income household that pays for full-time child care.

Other families might choose to start saving in advance for their child-care expenses. Or, look for lower-cost options like in-home daycare, care from relatives, or a schedule that involves drop-off programs, babysitters, and flexible work arrangements for the partners so that they can toggle between work and child-care. It is here that knowing and understanding the difference between part-time and full-time employees can be very beneficial.

While budgeting, saving up for child-care costs, and having appropriate insurances in place like term life insurance will help prevent a dent in the immediate upfront costs, child-care expenses tend to grow quickly, putting your family budget at risk.

This is why the top 2 strategies that are most capable of augmenting your family’s child care costs are:

- Dependent Care Flexible Spending Account (FSA)

- Child Care or Dependent Care Tax Credit

Each family would have to choose any one of these two options, and hence to figure out which option is the best for your family, you might need to talk to a financial advisor.

What is Dependent Care FSA?

Dependent care FSA, which also includes FSA daycare and child-care FSA, is an employer-sponsored, pre-tax account. Through this, you would be able to set up a system of automatic deductions from your paychecks that are then contributed to this account. To set this system up, you would have to authorize your employers to withhold a specific amount from your paychecks for each pay period. These funds can then be used by you for qualifying child care expenses.

This is applicable in cases where you are caring for a child or an adult who is incapable of self-care and lives at your home for at least 8 hours a day. By claiming such an individual as dependent on your income taxes, you would be able to reap the benefits of dependent care through a flexible spending account (FSA). This account would let you pay for qualified child and dependent care expenses while lowering your taxable income.

Hence, for example, if you fall in the 24% federal income tax bracket, then using this service would let you save $240 in federal taxes for every $1,000 spent on either FSA daycare or child-care FSA or dependent care with an FSA.

Currently, the maximum contribution to the dependent care FSA per each household is $5,000. This means that even if you and your spouse both are earning separately and have dependent care FSA available through your individual employers, you would be able to contribute a total of $5,000 to one or across both accounts.

How this works is that:

- First, you pay for these expenses directly.

- Apply for reimbursement from the FSA money by filling out the claim form provided by your employer

- Attach receipts or proofs of payment with the form. Make sure that the receipt includes specific information to prove that the payment was for the qualified expense.

The details that your receipt must include are:

- Patient or Child’s Name- Name of the individual who received the service

- Provider’s Name- The provider that delivered the service

- Date of Service- The date when the services were provided

- Type of Service- A detailed description of the service provided

- Cost- The amount paid for the service

How to Use Dependent Care FSA?

The total amount of money that can be contributed to the dependent care FSA, and therefore for child-care FSA and FSA daycare. In 2021, this limit was increased by the American Rescue Plan Act to $10,500 for single filers and couples filing jointly and $5,250 for married couples filing separately. Earlier, these amounts were $5,000 and $2,500, respectively.

However, for 2022, the limit of the dependent care FSA or FSA daycare or child-care FSA was returned to $5,000 for single filers and couples filing jointly and $2,500 for married couples filing separately.

In case if you and your spouse are divorced, then the child care FSA funds would be only for that parent who has custody of the child or children. In case if you are married, then you both would have to work and earn income in order to qualify for the reimbursement unless one of the spouses is in between jobs and actively looking or is disabled and thus unable to work.

If this condition is not met, then the money that you have contributed to the account of child-care FSA would be forfeited, and you would become liable to pay taxes on it as you did not pay taxes on the child care FSA amount earlier.

The Federal Flexible Spending Account Program (FSAFEDS) has an app that will help you manage your receipts and claims in regards to dependent care FSAs or child care FSAs, or FSA daycare. Additionally, its website also provides detailed information about what these care-specific FSAs can and cannot fund.

The money in your FSA can only be used for the expenses for:

- A dependent who is younger than 13.

- A spouse who is unable to work and care for himself or herself.

- Another adult dependent who is unable to care for himself or herself and for whom you claim the dependent exemption on your taxes.

Note: While dependent care FSAs or FSA daycare, or child-care FSA cannot be used for private school tuition, they can be used for summer day camps.

Expenses that Qualify for Dependent Care FSA Reimbursement

Once you have deposited money into an FSA, you can start using those funds towards reimbursement for qualified expenses. This amount can only be used for reimbursing those bills that meet the IRS definition of eligible dependent care services. What this means is that the dependent care services that you are seeking reimbursement for have to be a must in order for you and your spouse or both to work and earn an income.

The expenses that are qualified for dependent care FSA or FSA daycare or child care FSA reimbursement are:

- Physical care

- In-home care like babysitters, nannies - who are there to cover for a parent who is at work versus recreational reasons. Or au pair, institutional setting care such as child or adult daycare services, by qualified caregivers.

- Summer day camps

- Before-and after-school care

- Transportation provided by a caregiver

- Application fees, deposits, etc. required for obtaining care, but only if care is subsequently provided. These fees can also be paid to an agency to obtain the services of a care provider.

- Household services like maid, cook, or housekeeper if they at least partly provide for the well-being and protection of a qualifying dependent.

Note: The IRS Publication 503: Child and Dependent Care Expenses outlines expenses that qualify for FSA reimbursement.

The IRS also issued a statement that notified the taxpayers that at-home COVID-19 tests and personal protective equipment such as face masks and hand-sanitizer are both considered eligible medical expenses that can be paid or reimbursed under FSAs.

Do Dependent Care FSAs Cover Daycare Expenses?

Based on what we discussed earlier, it is quite clear that dependent care FSAs can cover daycare expenses, including some specific child-care if they are work-related. Work-related means that the dependent care expenses will enable you and/or your spouse to go to or search for work.

For example, the cost incurred for a babysitter or a daycare provider who watches your child while you go to work is eligible for dependent care FSA or child care FSA reimbursement. But, if this cost is incurred during the hours where you have gone for dinner after work, then it becomes an ineligible expense.

This hence means that all the expenses of a qualifying child in nursery school, pre-school or similar programs for children below kindergarten are eligible. Depending on the age of your child, expenses for care before and after school for children in kindergarten or higher grades are also covered in the dependent care FSA or child care FSA reimbursement.

Expenses that Do Not Qualify for Dependent Care FSA Reimbursement

What needs to be remembered when it comes to dependent care FSA or child care FSA or FSA daycare reimbursement is that the FSA money can be used for reimbursing only those expenses that were necessary for you and your spouse to work and earn an income.

Thus, the expenses that do not qualify as FSA approved and are therefore not eligible for its reimbursement are:

- Education like kindergarten, summer school, tutoring, school tuition

- Overnight summer camps

- Enrichment programs and lessons like music, dance, and sports lessons

- Meals

- Housekeeping

- Forfeited deposits to an agency or pre-school because you decide to send your kid to a different pre-school and, in the process, lose the deposit.

How Can You Manage Dependent Care FSA?

Your dependent care FSA or child care FSA or FSA daycare comes with a variety of convenient payment and reimbursement options that will make it easier for you to meet your expenses for eligible dependent care services.

One of the most initial steps for managing your dependent care FSA is to enroll in or renew your enrollment in your dependent care FSA through FSAFEDS during the open season each year, before the enrollment deadline. Post that, you will just have to log in to your FSAFEDS online account at any time to manage all aspects of your dependent care FSA:

- Check account balances

- Submit claims and view claims status

- Look up eligible expenses

- Select your reimbursement methods (through check or direct deposit)

- Choose to receive account alerts by email or text

Note: You can even log in to your account with the FSAFEDs app. The username and password that you will have to use would be the same as your online account. This is an easier way of managing your FSAs when on the go.

Note: Make sure to save all your receipts and other supporting documentation relating to your dependent care FSA expenses and claims. This is because the IRS might request itemized receipts to verify the eligibility of your expenses before reimbursing the same. Credit card receipts, canceled checks, and balance forward statements do not meet the requirements for acceptable documentation for reimbursement.

Things to Consider in Regards to Dependent Care FSA

Before you create a child care FSA or FSA daycare or basically, dependent care FSA, things that you should consider are:

- FSAs are not pre-funded. With some of the healthcare FSAs, the employer “fronts” the money and is repaid through paycheck withholding. However, in the case of dependent care FSAs, you first pay the expenses incurred out of your pockets and then receive the reimbursement for the same based on how much you have withheld from your paycheck for dependent care expenses.

- Typically, FSAs operate with a “use it or lose it” policy. This means that you will have to use all the money you have deposited in your dependent care FSA account for qualified expenses by the end of the plan year. If you do not, you will lose your money. However, there was an exception to this rule due to the Consolidated Appropriations Act provisions. Due to this exception, for the year 2021, employers were able to allow all unused funds to be carried over from 2021 to 2022 and use them throughout the year.

- You will be required to report your FSA contributions on your federal tax return.

- Participation in the dependent care FSA or child care FSA or FSA daycare is not automatic. You would be required to re-enroll yourself to it every year by the enrollment deadline.

- You can change the amount of money you choose to have withheld from your paycheck for the FSA within a 31-day window after a “qualifying event” like marriage, birth or adoption of a child, death of a dependent, divorce, or change in your or your spouse’s employment.

- Before you set up your child-care FSA or FSA daycare, or dependent care FSA, you should compare the potential tax benefits with the dependent care or child care tax credit. By doing this, you would be able to make a more informed decision, such that your cash flow improves, you have more savings or returns on investment and lower expenses incurred.

Potential Benefits and Drawbacks of Dependent Care FSA

The potential benefits of dependent care FSA or child care FSA or FSA daycare are:

- Dependent Care FSA or child care FSA or FSA daycare is funded with your pre-tax dollars. This will assist in reducing your total taxable income, requiring you to pay fewer taxes overall.

- Dependent Care FSA or child care FSA or FSA daycare are sheltered from the 7.65% Social Security and Medicare Taxes (i.e. FICA taxes).

- Usually, Dependent Care FSAs are sheltered from the state taxes as well.

Hence, for example, if you contribute a maximum of $5,000 towards dependent care FSA or child care FSA or FSA daycare in a given year, and you fall into the 24% tax bracket, then you would be saving around $1,583 a year in taxes including both federal income tax and the 7.65% Social Security and Medicare tax.

In contrast, the potential drawbacks of a dependent care FSA or child care FSA or FSA daycare are:

- FSAs are use-it or lose-it accounts. This means that the funds that you have contributed towards these accounts cannot be carried forward from one year to the next. Hence, if you and your partner’s child care plans change, then you would be unable to recover the money you have already contributed, which might create a situation where you and your partner are out of money for your new child-care plans.

- Not all employers offer Dependent Care FSA or child care FSA or FSA daycare options.

- In order to avail all the benefits of this, you will have to make sure that all the expenses incurred you qualify for the reimbursement. To get your reimbursement, you will need to track your receipt, reimbursement claims, and even other qualifying costs associated with your child care. By doing this, you would also be able to ensure that all the child care services that you are using are eligible for the funds in the dependent care FSA.

- Considering that FSAs do not allow year-to-year rollover, you will need to carefully budget the actual amount of qualifying childcare-related expenses. This is because if you over-contribute to this account and do not use the full amount, then by the end of the year, you will lose all the money.

Note: While child care FSA or dependent care FSA or FSA daycare funds cannot be carried forward to the next year, your employers might choose to offer you a grace period of up to 2.5 months to spend the funds that were unused at the year-end.

What is Child Care Tax Credit?

In order to qualify for the Child Care and Dependent Care Tax Credit, you will be required to:

- Have work-related expenses for the child-care or dependent care. This means that in order for you and/or your spouse to work, child care or dependent care was vital. To prove this, you would have to submit proof of income to the government. The exception to this rule is if your spouse is a full-time student or disabled.

- The care has to be for qualifying kids, i.e., those who are 13 years old or under. A spouse of a dependent who lives with the taxpayer for more than half the year and is either physically or mentally incapable of caring for themselves also qualifies for the dependent care tax credit.

- The set limit for the credit’s worth is typically between 20-35% of the qualifying child care costs. This percentage directly correlates with your income.

As of 2019, the total expenses that you can claim are $3,000 for one child, and for two or more children, you can claim $6,000. For the lowest income earners, the credit starts at 35%, a percentage that drops to 20% for all those who are earning $43,000 or more.

This hence means that if you are earning $43,000 or more than that, and you are paying for your child’s child care expenses, then you would be eligible for a federal tax credit of up to 20% of the cost of the care.

What this implies is that irrespective of how much you pay, the potential maximum child and dependent care credit that you would get is $600 (20% of $3,000) for the care of one person and $1,200 for the care of two or more people.

What also needs to be remembered here is deducting any financial help offered by your employer for child care prior to calculating your credit. This is because, in the occasional cases where your employer is providing a child care stipend, that amount is to not be counted towards your tax credit.

Potential Benefits and Drawbacks of Child Care Tax Credit

Child Care Tax Credit is one of the best options through which you would be able to reduce the effect that child care costs have on your monthly budgets. Some of the potential benefits of child care tax credit are:

- It is a direct way of lowering the amount of taxes that you owe to the government.

- If yours is a family that is earning less than $43,000 a year, then the tax credit might give you a larger benefit than to a family that is earning more than you.

- Child care tax credit is one of the best ways for individuals and families to offset some of the cost of child care without opting for dependent care FSA or child care FSA option.

Some of the drawbacks of child care tax credit that you should consider are:

- The child care tax credit limits are lower than what families spend on child care each year.

- If you are a high-income family that earns more than $43,000 each year, then for you, tax benefits from using dependent care FSA might save your family more money than child care tax credit.

Is it Possible to Simultaneously Use a Child Care Tax Credit and a Dependent Care FSA?

With both of these options helping to save you money, you might be wondering if you can use them both simultaneously in order to maximize your savings.

However, what needs to be kept in mind here is that there are some stipulations involved with the utilization of each, which will end up restricting their usage in your financial planning. Hence, several times a family ends up choosing only one option for his or her family.

However, there are some exceptions to these restrictions. For example, if your family has two or more kids and you have already maxed out your dependent care FSA or child care FSA limit of $5,000, and your qualifying child care expenses have hit or exceeded the $6,000 limit for the child care tax credit, then in such a case, you would be able to take advantage of both the FSA and tax credit.

In such a scenario, the child care tax credit will only be applicable on the excess $1,000 that could not have been reimbursed from your FSA. Hence, if your income puts you in the 20% credit range, you would have saved another $200 on taxes.

Which is Better for Daycare Expenses- the Child and Dependent Care Tax Credit or Dependent Care FSA and Child Care FSA Funds?

Generally, the child care or dependent care tax credit is available for up to $3,000 annually in care expenses for one child or dependent. If there are two children or dependents, then the credit available is $6,000 annually.

The maximum annual credit available is 35% of the expenses, which means $1,050 for one child or dependent and $2,100 for more children or dependents.

However, when adjusted gross income (AGI) exceeds $15,000, this credit percentage starts dropping. In fact, when your AGI exceeds $43,000, the maximum credit you would be qualified for is 20% of the qualified expenses, which means $600 for a single child and $1,200 for more.

In comparison, the dependent care FSA or child care FSA tends to give more savings through a reduction in your taxable income, especially if you have a single child. This is because you would be able to contribute and therefore reduce your taxable income by up to $5,000 for care expenses, whereas in contrast, the maximum credit you would be able to get is $2,100.

However, if you have more children or dependents, then you would be able to maximize your tax benefit by using dependent care FSAs as well as a dependent care tax credit.

You can start out by first contributing $5,000 to dependent care FSA for your first expenses for dependent care or child care. Then, you should claim the applicable percentage claim on up to $1,000 ($6,000 is the maximum allowable expenses less the $5,000 DCFSA contributions excluded from income) in additional eligible expenses through the dependent care tax credit.

How Can Deskera Help with Daycare FSAs and Dependent Care Tax Credit?

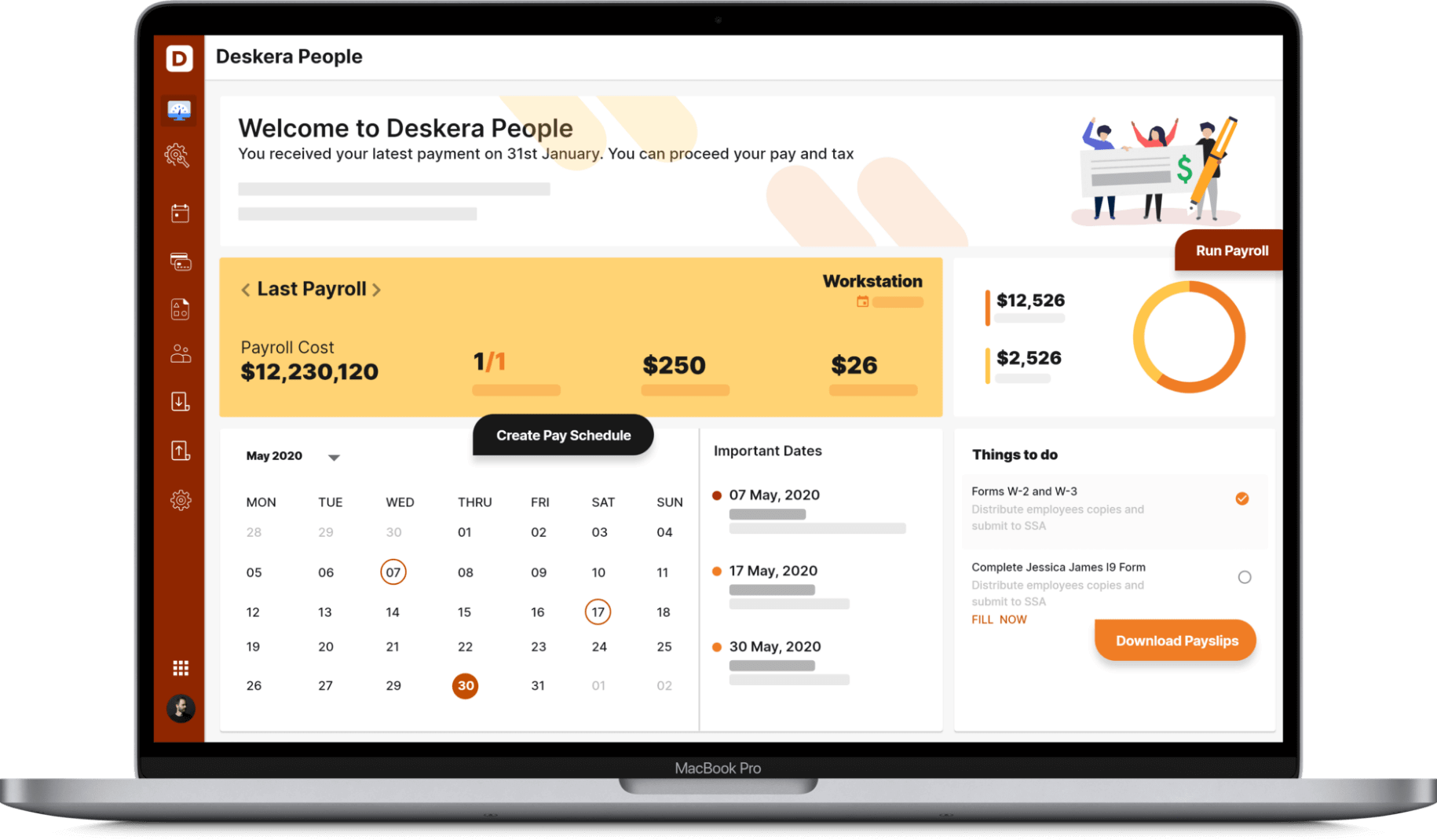

With Deskera People, your employer would be able to generate your payroll and payslips within minutes. As an employee, you would be able to use the same portal to view your payslips, apply for time off, and even file for your claims and expenses online like for example, expenses related to dependent care and applying for reimbursement for the same through the dependent care FSA funds.

Through Deskera People, your employer would be able to assign you pay components like employee bonuses and voluntary deductions like child care FSAs. These components would be identified by Deskera People to automatically calculate the wages taking in the specific conditions which can be configured in each component like pre-tax deduction and post-tax deductions.

Lastly, Deskera People also has a self-service portal for the employees which will allow you to fill in your own personal information while facilitating a harmonious collaboration between you and your firm’s payroll team.

Key Takeaways

If you and/or your spouse find yourself in a situation where you need to choose between dependent care FSA or child care FSA or FSA daycare and child care tax credit, then you should start by calculating your total child care expenses for each year and then the benefits you would be able to avail by using both the programs individually. This will also help you in figuring out ways by which you would be able to maximize your tax savings.

One of the best ways to know how to maximize your tax savings is by being informed of the expenses that qualify for dependent care FSA or child care FSA and those that qualify for child care tax credit. For example, while everyone knows that daycare qualifies as deductible child care cost, did you know that work-related after-school care or day camp can also qualify for both these plans?

In addition to this, what you must remember is to keep all your receipts, contracts, and other proof of expenses incurred in order to get reimbursement from a dependent care FSA or child care FSA or to have them tax credited through the child care tax credit.

What you need to remember while choosing either of these two options for meeting your daycare expenses is to choose an option that is right for you and your family and fits your big-picture financial goals. In fact, you should even consider talking to a tax professional to help choose the best option for you and your family.

Additionally, speaking with a comprehensive financial planner will give you the required help in structuring a plan that addresses your child care costs while also balancing them with your other expenses and savings goals for your family.

Related Articles