Ever since the Covid 19 wave the Government is trying everything in its power to improve the face of economy. PPP loans aka forgiveness loan is one of those movements that intends to help the businesses. Form 3508s is one of the forms that you are required to fill to have a PPP loan. In this article we will tell you all about form 3508s.

This article covers the following:

- What is form 3508S?

- Who is allowed to apply for form 3508S?

- What is the criteria to fill out form 3508S?

- List of documents to fill out form 3508S?

- How long must I maintain documents for PPP forgiveness loan?

- When can I apply for PPP loan?

- How will I know how much of my loan is forgiven?

- What is the difference between 3508s and 3508EZ?

- How to fill out application 3508S?

- Latest changes in 3508S?

- What is the covered period?

- FAQs on 3508S

- How can Deskera assist you?

What is Form 3508S?

To apply for forgiveness, you can use three types of forms.

Form 3508 and Form 3508EZ require multiple calculations and various supporting documents to show the forgiveness amount you’ve requested. Alternatively, Form 3508S requires you to:

- Provide the amount you spent on payroll

- Provide the forgiveness amount you’ve requested

- Certify the conditions via initials and signatures

As your application is getting reviewed, your lender and the SBA can request supporting documentation for some accuracy. Penalties for knowingly making a false statement to obtain forgiveness include up to 30 years imprisonment and fines of up to $1 million.

Who is Allowed to Apply for 3508s?

If your PPP loan amount was less than $150,000, you could use the forgiveness Form 3508S. However, you are ineligible to use Form 3508S if your business has a contract or agreement of affiliation with other companies. The PPP loan total across all affiliates is greater than $2 million. Any business type can use Form 3508S, from contractors to corporations.

Criteria for Filling-out 3508s

When filling out this new application form, there are seven total representations and certifications the borrower must verify:

- The amount requested is not greater than the PPP loan amount, was used to cover eligible costs for forgiveness, includes eligible payroll costs of at least 60% of the loan forgiveness amount, and was used within the covered period.

- The government would pursue recovery of loan amounts if they were knowingly used for unauthorized purposes.

- The borrower accurately verified all payroll and non-payroll costs that make up the forgiveness amount requested.

- The borrower will provide the required documents verifying all costs and that the existence of any rent, lease, mortgage, or utilities was in place prior to February 15, 2020.

- The information provided in the application and supporting documentation is true in all material ways.

- Any tax documents provided are accurate and consistent with what has been or will be provided to the IRS.

- The borrower acknowledges that the SBA may request additional information, and a failure to provide the information will result in a denial of the forgiveness application.

List of documents required:

You do not need to submit any documentation when applying for forgiveness using form 3508S. However, the SBA can request any of the following to verify your approved forgiveness amount:

Verifying your payroll expenses:

- Bank account statements or a report from your payroll provider is documenting payments to employees.

- Tax forms (or equivalent payroll provider reports) including:

-Payroll tax filings reported (typically Form 941)

-State quarterly business and individual employee wage reporting

-Unemployment insurance tax filings

- Payment receipts, canceled checks, or bank account statements showing employer contributions to group employee benefits plans.

Verifying your non-payroll expenses:

- Business mortgage interest payments: A copy of the amortization schedule with corresponding receipts OR mortgage statements from February 2020 and the months of the covered period.

- Business rent or lease payments: A copy of the current rent/lease agreement with receipts verifying payments OR lease statements from 2020 and from the covered period through one month after the end of the covered period.

- Business utility payments: A copy of invoices from February 2020 and those paid during the covered period with corresponding receipts or account statements.

- Covered operations expenditures: A copy of invoices, orders, or purchase orders paid during the covered period with corresponding receipts or account statements.

- Covered property damage costs: A copy of invoices, orders, or purchase orders paid during the covered period with corresponding receipts or account statements.

Documentation will need to be provided to prove that the costs were related to property damage and vandalism or looting due to public disturbances that occurred during 2020 and were not covered by insurance or other compensation.

- Covered supplier costs: A copy of contracts, orders, or purchase orders in effect at any time before the covered period (except for perishable goods), copy of invoices, orders, or purchase orders paid during the covered period with corresponding receipts or account statements.

- Covered worker protection expenditures: A copy of invoices, orders, or purchase orders paid during the covered period with corresponding receipts or account statements.

-Documentation will need to be provided that proves that the expenditures were used by the borrower to comply with applicable COVID-19 guidance during the covered period.

If you are a sole proprietor, contractor, or self-employed, you are eligible to take owner compensation replacement (OCR). If you are taking OCR, you will have to provide your 2019 or 2020 Schedule C.

This is because your forgiveness amount is based on the 2019 or 2020 Schedule C. You can calculate your OCR by taking 8/52 or 24/52 (depending on your covered period length) of your net income reported on line 31 of your Schedule C.

How Long Must I Maintain Documents for PPP Loan Forgiveness?

All records relating to the borrower’s PPP loan must be kept for at least six years after the loan is either forgiven or paid off. That means holding onto any payroll reports, non-payroll cost receipts, and tax documents you used to apply for forgiveness and a PPP loan.

By submitting a forgiveness application, you permit the SBA to request any of these documents during those six years.

When can I apply for PPP loan forgiveness?

The SBA has not set a deadline to apply for forgiveness. You have ten months after the end of your covered period before you are required to start paying back your loan with monthly payments.

Lenders have been reaching out in waves to PPP loan recipients. Keep your eyes peeled on your inbox and visit any PPP resources they have available for an update on when they will be ready to accept your forgiveness application.

How Will You Know How Much of My Loan is Forgiven?

The lender has 60 days to review your forgiveness application regardless of what form was used to apply. Your lender may decide to forgive all, some, or none of the PPP loan amount.

From there, your application is sent to the SBA for a final review and confirmation of your forgiveness amount. The SBA has up to 90 days to evaluate your application and may contact you directly for additional information.

Once this is done, your lender will let you know the final result of your application. If your loan is partially forgiven or not forgiven at all, interest will start accruing, and payments must start being made ten months after the end of your covered period.

What is the Difference Between 3508s, 3508EZ vs. 3508S?

Form 3508EZ and S are simplified documents for eligible employers and solopreneurs. Unless you qualify to use the EZ or S versions, you must apply with the regular Form 3508.

The difference between the forms lies in the calculations you need to do. Form 3508 requires the most calculations, Form 3508EZ requires fewer calculations, and Form 3508S is nearly calculation-free (cue the celebration).

The form you use depends on certain factors such as:

- -How much you borrowed

- -Whether you reduced employee salaries and headcount

Form 3508: All borrowers who do not qualify to use Form 3508EZ or 3508s

Form 3508EZ: Borrowers who did not reduce employee levels, wages, or hours.

Form 3508s: Borrowers who took out loans of $150,000 or less.

How to Fill Out Application 3508s?

Step 1: Provide basic business and loan information

In order to successfully fill out Form 3508, you’ll need the following information:

- Your business’s legal name, DBA or trade name, and your business EIN or personal Social Security Number

- Your business address, phone number, primary contact, and email address

- Your SBA PPP Loan Number

- The lender’s PPP Loan Number

- The total number of employees you had when you applied for your PPP loan

- The total number of employees you have when applying for PPP loan forgiveness

- Your PPP loan disbursement date

- EIDL advance amount and application number (if applicable)

Step 2: Confirm your payroll schedule

Next, you’ll need to provide your payroll schedule. How frequently do you pay your employees? Choose between weekly, biweekly (every other week), twice a monthly, monthly, or other.

Step 3: Determine your covered period

The “covered period” refers to the eight weeks after you receive your PPP loan when you are expected to use your loan to cover payroll and pay for other eligible expenses. To receive full PPP loan forgiveness, you must use your loan entirely during this period.

Therefore, your covered period will likely be from the day you receive your loan to eight weeks, or 56 days, later.

We’ll discuss an exception in detail below, which is an “alternative payroll covered period.” You can utilize this option to better align your existing payroll schedule with the disbursement of your loan. For example, if you receive your loan on April 20, but your next payday isn’t until April 25, you can elect to begin your covered period (specifically for your payroll, not for other expenses) on April 25 instead.

Input the dates of your covered period and your alternative payroll covered period, if necessary.

Step 4: Confirm whether your loan amount was above $2 million

The federal government plans to audit PPP loans over $2 million to ensure that businesses that received these loans truly needed them due to the coronavirus pandemic. Check the box on the application if this applies to you.

Step 5: Perform forgiveness amount calculations

The rest of the form requires you to input calculations that will add up to your forgiveness amount. You will use the included PPP Schedule A form (as well as the Schedule A form worksheet) to make some of these calculations. The application has a breakdown of each requested amount, line by line.

- Line 1: Payroll costs (this should equal the amount from PPP Schedule A, Line 10)

- Line 2: Business mortgage interest payments

- Line 3: Business rent or lease payments

- Line 4: Business utility payments

- Line 5: Total salary/hourly wage reduction (this should equal the amount from PPP Schedule A, Line 3)

- Line 6: The sum of Lines 1-4, minus Line 5

- Line 7: FTE Reduction Quotient (this should equal the amount from PPP Schedule A, Line 13)

- Line 8: Your modified total (multiply Line 6 by Line 7)

- Line 9: Your PPP Loan amount

- Line 10: Payroll cost 75% requirement (divide Line 1 by 0.75)

- Line 11: Your forgiveness amount (the smallest of Lines 8, 9, and 10)

Step 6: Certify your forgiveness request

On page four of the forgiveness application, you’ll initial and sign to certify that you used your PPP loan as per the required guidelines. You’ll also certify that your payroll and tax documentation is accurate and that the SBA can request more supporting information from you if necessary.

Latest Changes in 3508s

The key changes to Form 3508S are as follows:

- Borrowers with PPP loans of $150,000 (up from $50,000) or less can now use the form.

- The borrower’s NAICS code is now required.

- There is a new “check box” to indicate whether the application is for the forgiveness of a First Draw or Second Draw PPP loan.

- The borrower must provide the date range of its Covered Period (between 8 and 24 weeks).

- A new “check box” indicates whether the borrower and its affiliates received First Draw or Second Draw loans of $2 million or more (previously, such borrowers could not use Form 3508S).

- The boxes for the EIDL Advance amount and EIDL Application Number have been removed.

- The borrower must provide the amount of the PPP loan spent on payroll costs (must be at least 60% of the requested forgiveness amount).

- There are only two (compared to seven) borrower certifications that need to be initialed.

a. In essence, the certifications are that the borrower has followed all the PPP rules and that the information in the application is true and correct.

Following submission of this forgiveness application, the Borrower must retain all records necessary to prove compliance with Paycheck Protection Program Rules for four years for employment records and three years for all other records.

SBA may request additional information to evaluate the Borrower’s eligibility for the PPP loan and for loan forgiveness, and the Borrower’s failure to provide the information requested by SBA may result in a determination that the Borrower was ineligible for the PPP loan or in a denial of the Borrower’s loan forgiveness application.

These two-document retention periods above are reduced from the six-year retention period included in the original Form 3508S. The instructions also clarify that the retention periods start when the forgiveness application is submitted to the lender, rather than on the date the PPP loan was paid or forgiven in full, as before.

Finally, Form 3508S includes a second, optional page asking for the borrower's “demographic information.”

While all of the above is relatively straightforward, with the revised Form 3508S, the “the devil is in the details.” The instructions for the revised Form 3508 include the following additional or revised guidance regarding Form 3508S – in particular; please note the last bullet point.

- Each PPP loan must use a separate loan forgiveness application form. Borrowers cannot use one form to apply for forgiveness of both a First and Second Draw PPP loan.

- The exception to the “no supporting documents required” is that Borrowers who did not submit documents with their Second Draw PPP loan application supporting the 25% gross receipts reduction certification on the Borrower’s loan application must provide those documents with their forgiveness application.

- Employer contributions for employee group health, life, disability, vision, or dental insurance, including employer contributions to a self-insured, employer-sponsored group health plan, but excluding any pre-tax or after-tax contributions by employees.

- As authorized by the Economic Aid Act, eligible non-payroll expenses now include four new categories:

- covered operations expenditures: payments for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting of tracking of supplies, inventory, records, and expenses;

- covered property damage costs: costs related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that were not covered by insurance or other compensation;

- covered supplier costs: expenditures made to a supplier of goods for the supply of goods that are essential to the operations of the Borrower at the time at which the expenditure is made and made under a contract, order, or purchase order in effect before the beginning of the Covered Period (for perishable goods, the contract, order, or purchase order may have been in effect before or at any time during the Covered Period); and

- covered worker protection expenditures: operating or capital expenditures that facilitate the adaptation of the business activities of an entity related to standards for sanitation, social distancing, or any other worker or customer safety requirement related to COVID-19, but does not include residential real property or intangible property (see additional details in instructions).

- FTE and Salary/Wage Reductions: Borrowers using Form 3508S with loans between $50,000.01 and $150,000 (and borrowers with loans of any amount in an affiliate group with total loans of $2 million or more) must also perform FTEE reduction and wage rate reduction calculations to determine their amount of loan forgiveness unless:

- The Borrower did not reduce annual salaries or hourly wages of any employee by more than 25% during the Covered Period compared to the most recent full quarter before the Covered Period, AND;

- The Borrower did not reduce the number of employees, or the average paid hours of employees between January 1, 2020, and the end of the Covered Period OR the Borrower was unable to operate during the Covered Period at the same level of business activity as before February 15, 2020, due to compliance with certain COVID-19 requirements (further detailed in the Form’s instructions).

Suppose the Borrower does not satisfy these requirements. In that case, it must calculate the amount of potential forgiveness using SBA Form 3508 and its instructions to calculate its Requested Loan Forgiveness Amount net of any FTEE or wage rate reductions.

The Borrower is not required to submit Form 3508 or any related documentation with its Form 3508S forgiveness application. Still, the SBA may request those calculations as part of its loan review and audit process.

- FTE and Salary/Wage Reductions: Borrowers using Form 3508S with loans between $50,000.01 and $150,000 (and borrowers with loans of any amount in an affiliate group with total loans of $2 million or more) must also perform FTEE reduction and wage rate reduction calculations to determine their amount of loan forgiveness unless:

- The Borrower did not reduce annual salaries or hourly wages of any employee by more than 25% during the Covered Period compared to the most recent full quarter before the Covered Period, AND;

- The Borrower did not reduce the number of employees, or the average paid hours of employees between January 1, 2020. The end of the Covered Period OR the Borrower was unable to operate during the Covered Period at the same level of business activity as before February 15, 2020, due to compliance with certain COVID-19 requirements (further detailed in the Form’s instructions).

If the Borrower does not satisfy these requirements, then it must calculate the amount of potential forgiveness using SBA Form 3508 and its instructions to calculate its Requested Loan Forgiveness Amount net of any FTEE or wage rate reductions.

The Borrower is not required to submit Form 3508 or any related documentation with its Form 3508S forgiveness application. Still, the SBA may request those calculations as part of its loan review and audit process.

What is the Covered Period?

The covered period is the time you have to spend the funds in order to qualify for forgiveness. It starts when the loan is disbursed (into your bank account). Economic Aid Act, PPP Flexibility Act, changed the Covered Period for purposes of the calculations above.

Originally it was eight weeks, then the PPP Flexibility Act changed it to 8 or 24 weeks, and now, with the Economic Aid Act, the borrower gets to choose a time period of 8—24 weeks.

As the application explains,” It ends on a date selected by the Borrower that is at least eight weeks following the date of the loan disbursement and not more than 24 weeks after the date of loan disbursement. For example, if the Borrower received their PPP loan proceeds on Monday, April 20, 2020, the first day of the Covered Period is Monday, April 20, 2020, and the final day of the Covered Period is any date selected by the Borrower between Sunday, June 14, 2020, and Sunday, October 4, 2020.”

Choosing the covered period can make a significant difference in how much of your loan is eligible for forgiveness. You will want to choose carefully to maximize forgiveness, and get advice from a legal or accounting professional if you are unsure. We’ll discuss this further in a moment.

If Borrower (together with affiliates, if applicable) received PPP loans in excess of $2 million, check here: ☐

Check the box if the Borrower, together with its affiliates (to the extent required under SBA’s interim final rule on affiliates (85 FR 20817 (April 15, 2020)) and not waived under 15 U.S.C. 636(a)(36)(D)(iv)), received PPP loans with an original principal amount in excess of $2 million. If you received more than $2 million (with affiliates) make sure you review this with your advisors.

Amount of Loan Spent on Payroll Costs: _______________

On page two of the application, you’ll see a description of eligible payroll costs. It’s pretty straightforward if you have no employees or few employees and haven’t reduced headcount, but you still have to make sure you choose the right covering the period to maximize forgiveness. Review the other forms we suggest for calculating forgiveness.

Requested Loan Forgiveness Amount: _________________

The application instructions here state: “Enter the total amount of your PPP loan eligible for loan forgiveness. This amount is the “Amount of Loan Spent on Payroll Costs” plus any amount spent on eligible nonpayroll costs (described below) minus any required reductions (described below), up to the principal amount of the PPP loan.” It then goes into detail on acceptable nonpayroll expenses. It later reminds the borrower that “Eligible nonpayroll costs cannot exceed 40% of the total forgiveness amount.”

This form has been greatly simplified. But what’s likely to be confusing is that you still need to calculate how much of your loan is forgivable, but it’s not laid out step-by-step as with the other forms. How easy it will be to calculate forgiveness depends on your loan amount and other factors, such as whether employee wages and/or headcount were reduced. We’ll provide what we think is a better approach.

Loan amounts of $50,000 or less

If your loan amount is less than $50,000 (and affiliates received First Draw PPP Loans or Second Draw loans of less than $2 million), do not have to calculate a reduction in forgiveness for a reduction in employee salaries or wages.

The SBA, in the Interim Final Rule originally announcing this form, notes that this change is likely to have a minimal impact on overall forgiveness:

“There are approximately 3.57 million outstanding PPP loans of $50,000 or less, totaling approximately $62 billion of the $525 billion in PPP loans. Approximately 1.71 million PPP loans of $50,000 or less were made to businesses with zero employees (presumably not counting the owner as an employee) or one employee. To the extent that these businesses have no employees other than the own, they are not affected by these exemptions.”

Loan amounts of $50,001 to $150,000

On page 3 of the application form you’ll see a notice that “Borrowers that received a PPP loan of more than $50,000 and borrowers of $50,000 or less that together with their affiliates received First Draw or Second Draw PPP Loans totaling $2 million or more must adjust their “Requested Loan Forgiveness Amount” due to statutory requirements concerning reductions in either full-time equivalent employees or employee salary and wages.” If you read it carefully, this is essentially telling you whether you need to follow the calculations in the 3508EZ or 3508 forms, which we will describe next.

All loans of $150,000 or less

As we mentioned before, even with this simplified form, you must calculate how much of your loan is eligible for forgiveness. On page 3 of the application, it states:

“The Borrower must accurately calculate the Requested Loan Forgiveness Amount and verify the payments for the eligible costs included in it.”

If you try to do that reading this form, but you’re not familiar with the forgiveness calculation, you’re likely to find it confusing. There is a better way.

Ignore your loan amount for a moment and choose which of the following would apply to you:

- If you are self-employed with no W-2 employees, you may qualify for forgiveness largely based on what you pay yourself in your business (“owner’s compensation replacement”). Read this article to help you better understand how to calculate forgiveness:

- If you have W-2 employees, take a look at the PPP Forgiveness Application Form 3508EZ and see whether you would qualify to use that form by answering the questions in the section titled “Who Can Use This Form?” If so, use this form to help you calculate your forgiveness.

- If not, use the full PPP form 3508 to calculate forgiveness.

You can use these forms to calculate your forgiveness amount, then keep those calculations in your records in case the SBA audits your loan in the future.

The application says “The Borrower must comply with all requirements in the Paycheck Protection Program Rules (Sections 7(a)(36), 7(a)(37), and 7A of the Small Business Act, the PPP interim final rules, and SBA guidance issued through the date of this application), and must attest to its compliance on the Loan Forgiveness Application.”

That’s a lot of information to review! The January 2021 Interim Final Rule on Loan Forgiveness summarizes and has an extensive Q& A section that may be helpful if you have questions. It’s also 62 pages long, so be prepared to settle in to read it.

FAQs on 3508s

Employment Information – Can you clarify for what period they are requesting this information?

The number of employees at the time of the forgiveness application is the number of employees through your covered period.

What coverage period should I use with my forgiveness application?

The SBA allows you to select a coverage period between 8 and 24 weeks. Supposed you do not apply on or prior to the end of the 10-month period. In that case, your monthly payments will automatically begin, and the responsibility for the repayment of the balance of your PPP loan will revert to you. Allegiance Bank must receive your application 60 days prior to this date to allow for our review.

How do I determine the Borrower Calculated Forgiveness Amount?

Use the “Get help calculating forgiveness” hyperlink for guidance on eligible expenses to be included in your forgiveness total. The details of the eligible expense in each category, such as cash compensation, owners’ compensation, health insurance, 401K, utilities, rent, and mortgage, are all included in the guidelines. You must indicate the amount spent on Payroll Cost, at least 60% of the forgiveness amount requested.

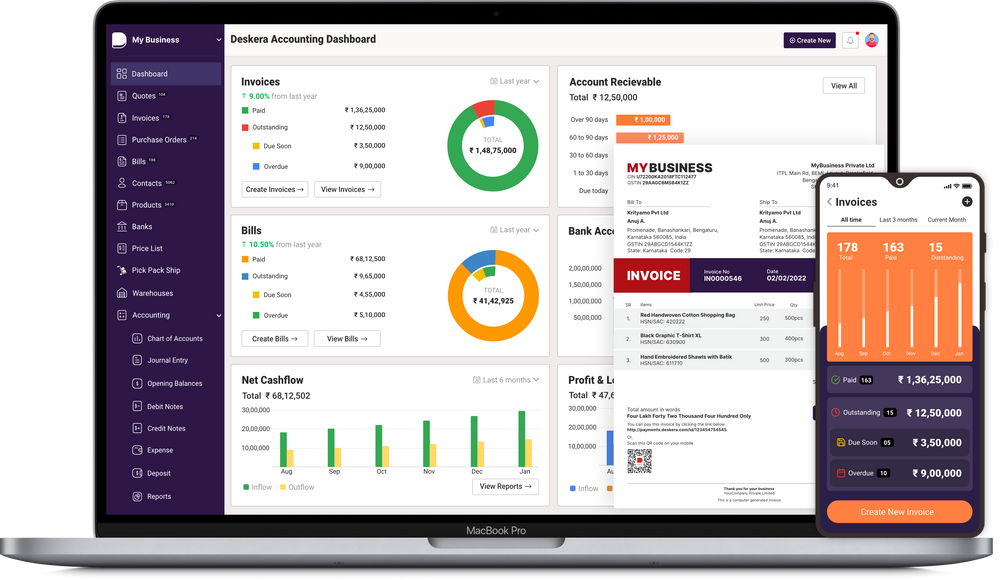

How Can Deskera Assist You?

With all this data, you need software that can help you manage it. With Deskera, you get a dedicated bookkeeper and powerful reporting software for a clear view of your financial health.

Key Takeaways:

- Form 3508S requires you to provide the amount you spent on payroll, the forgiveness amount you’ve requested, and certify the conditions via initials and signatures.

- If your PPP loan amount was less than $150,000, you could use the forgiveness Form 3508S.

- You do not need to submit any documentation when applying for forgiveness using form 3508S.

- All records relating to the borrower’s PPP loan must be kept for at least six years after the loan is either forgiven or paid off.

- The SBA has not set a deadline to apply for forgiveness. You have ten months after the end of your covered period before you are required to start paying back your loan with monthly payments.

- The lender has 60 days to review your forgiveness application regardless of what form was used to apply.

- Form 3508EZ and S are simplified documents for eligible employers and solopreneurs. Unless you qualify to use the EZ or S versions, you must apply with the regular Form 3508.

Related Articles: