In today's competitive job market, employers are increasingly looking for ways to attract and retain top talent. While competitive salaries are certainly important, offering a comprehensive benefits package that includes fringe benefits can be a key differentiator for businesses.

Fringe benefits are additional perks and services provided by employers to their employees that go beyond traditional compensation. These benefits can include health insurance and wellness programs, retirement plans and pensions, flexible work arrangements, life insurance and disability insurance, employee discounts and perks, and education and training opportunities.

By offering these benefits, employers can demonstrate their commitment to the well-being and satisfaction of their employees, which can lead to improved morale, higher retention rates, and increased productivity. However, offering fringe benefits can also come with costs and administrative challenges, which employers need to consider when developing their benefits packages.

In this article, we'll explore the different types of fringe benefits, the benefits of offering these benefits, and considerations for employers when implementing and administering them.

- What are Fringe Benefits?

- How Fringe Benefits Work

- Types of Benefits

- Advantages of Offering Fringe Benefits

- Are Fringe Benefits Taxable?

- Fringe Benefits Frequently Asked Questions (FAQs)

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What are Fringe Benefits?

Fringe benefits are non-salary perks or services provided by an employer to employees in addition to their regular wages or salaries. They are designed to provide additional value and support to employees, beyond their basic compensation package.

Fringe benefits can come in various forms, such as health insurance, life insurance, retirement plans, flexible work arrangements, employee discounts, gym memberships, childcare services, transportation allowances, educational opportunities, and more.

Employers provide these benefits to their employees as a way to attract and retain top talent, demonstrate their commitment to employee well-being and satisfaction, and differentiate themselves from competitors. Additionally, fringe benefits can have a positive impact on employee morale, productivity, and loyalty.

While the types and extent of fringe benefits offered vary by company and industry, many employers are now recognizing the importance of offering these benefits to attract and retain employees. It is important for employers to consider the costs and administrative challenges associated with offering fringe benefits, as well as ensuring compliance with legal and regulatory requirements.

How Fringe Benefits Work

Fringe benefits are a form of compensation that employers provide to employees in addition to their regular wages or salaries. These benefits can be offered in a variety of forms, such as health insurance, retirement plans, flexible work arrangements, and more.

In general, fringe benefits work by providing additional value and support to employees beyond their basic compensation package. For example, an employer may offer a health insurance plan that covers medical, dental, and vision care, along with wellness programs that encourage healthy habits and behaviors. Another example is a retirement plan that provides employees with a savings vehicle for their future, such as a 401(k) plan.

Employers typically fund these benefits through a combination of employer contributions and employee contributions. In some cases, employers may cover the full cost of certain benefits, while in other cases, employees may be required to contribute to the cost.

Fringe benefits are important to both employers and employees. Employers use them as a tool to attract and retain top talent, while employees value them as a way to improve their overall compensation package and achieve a better work-life balance. However, it is important for employers to carefully evaluate the costs and administrative requirements of offering fringe benefits to ensure they are providing value to both the company and its employees.

Types of Benefits

Fringe benefits can come in a variety of forms, depending on the needs and priorities of the employer and its employees. Here are some of the most common types of benefits:

Health Insurance

Health insurance is a common type of fringe benefit offered by many employers. It provides employees with access to medical care and helps cover the costs of health care services, such as doctor visits, hospitalizations, and prescription medications.

Employer-provided health insurance can take several forms, including:

- Traditional indemnity plans, which allow employees to choose their own health care providers and pay a portion of the cost out of pocket.

- Preferred provider organizations (PPOs), which offer a network of providers and lower costs for in-network services.

- Health maintenance organizations (HMOs), which require employees to choose a primary care physician and generally provide care through a network of providers.

- High-deductible health plans (HDHPs), which have lower premiums but higher deductibles and may be paired with health savings accounts (HSAs) to help employees save for health care expenses.

Employers typically pay a portion of the cost of health insurance premiums, while employees are responsible for the remainder. The employer's portion of the premium is tax-deductible, and employees generally do not pay taxes on the value of employer-provided health insurance.

Health insurance is an important benefit for many employees, as it helps protect them and their families from the high costs of medical care. It can also help attract and retain top talent, as many job seekers consider health insurance benefits when evaluating potential employers.

Retirement Plans

Retirement plans are another common type of fringe benefit offered by many employers. They provide employees with a way to save for retirement and can help them achieve financial security in their later years.

Employer-provided retirement plans can take several forms, including:

- 401(k) plans, which allow employees to contribute a portion of their pre-tax income to a retirement account, with some employers matching a portion of the employee's contribution.

- Defined benefit plans, which provide a specific benefit amount to employees upon retirement based on their years of service and salary history.

- Simplified Employee Pension (SEP) plans, which allow employers to contribute to employees' individual retirement accounts (IRAs).

- SIMPLE IRA plans, which allow employees to contribute a portion of their pre-tax income to an IRA, with some employers matching a portion of the employee's contribution.

Employers typically contribute to the retirement plan on behalf of the employee, although some plans may require employee contributions as well. The contributions are tax-deductible for the employer and tax-deferred for the employee, meaning that the employee does not pay taxes on the contributions until they withdraw the funds in retirement.

Retirement plans are an important benefit for many employees, as they allow them to save for the future and plan for a comfortable retirement. They can also help attract and retain top talent, as many job seekers consider retirement benefits when evaluating potential employers. Employers may also benefit from offering retirement plans, as they can help reduce turnover and improve employee satisfaction and productivity.

Flexible Work Arrangements

Flexible work arrangements are a type of fringe benefit that allows employees to have greater control over their work schedules, work location, and work hours. This can include options such as:

- Telecommuting: Allowing employees to work from home or another location outside of the office.

- Flexible schedules: Allowing employees to adjust their start and end times, work part-time or job share, or work compressed schedules (such as four 10-hour days instead of five 8-hour days).

- Reduced schedules: Allowing employees to work fewer hours per week or take extended periods of time off for personal or family reasons.

Flexible work arrangements can benefit both employees and employers. For employees, they can provide a better work-life balance, reduce commuting time and costs, and allow for greater flexibility in meeting personal or family obligations. For employers, flexible work arrangements can lead to improved employee morale, increased productivity, and reduced absenteeism and turnover.

However, flexible work arrangements also present challenges for employers, particularly in terms of maintaining communication and collaboration among team members, monitoring work performance, and ensuring that employees are meeting their job responsibilities.

Employers may need to establish clear guidelines and expectations for flexible work arrangements, provide training and support for managers, and use technology tools to facilitate communication and collaboration among remote team members.

Overall, flexible work arrangements can be a valuable fringe benefit for employees, and can help employers attract and retain top talent while also improving work-life balance and productivity.

Life Insurance and Disability Insurance

Life insurance and disability insurance are two types of fringe benefits that provide financial protection for employees and their families in the event of death or disability.

Life insurance is a benefit that pays a lump-sum benefit to the designated beneficiaries upon the employee's death. Employers may offer group life insurance policies that provide coverage at a lower cost than individual policies. The benefit amount may be a set amount or may be based on the employee's salary or position within the company. The employer typically pays for the cost of the life insurance policy, and the premiums paid by the employer are tax-deductible.

Disability insurance is a benefit that provides income replacement if an employee becomes disabled and is unable to work. Employers may offer short-term or long-term disability insurance policies. Short-term disability insurance typically covers a period of a few months and may pay a portion of the employee's salary. Long-term disability insurance may cover a longer period of time and may provide a lower percentage of the employee's salary. Disability insurance premiums are typically paid for by the employer, and the premiums are tax-deductible.

Both life insurance and disability insurance can be important benefits for employees, as they provide financial protection for the employee and their family in the event of unexpected circumstances. They can also help attract and retain top talent, as many job seekers consider insurance benefits when evaluating potential employers. Employers may also benefit from offering insurance benefits, as they can help reduce turnover and improve employee satisfaction and productivity.

Employee Discounts and Perks

Employee discounts and perks are another type of fringe benefit that can provide valuable savings and incentives for employees.

Employee discounts are discounts offered by the employer or partner companies on products or services that employees may use in their personal lives. These discounts may be offered on a wide range of products or services, including travel, entertainment, clothing, electronics, and more. Some employers may negotiate discounts with local businesses in the community as a way to support local commerce and provide benefits to their employees.

Employee perks are additional benefits that can enhance the overall employee experience. These may include things like:

- Gym memberships or wellness programs

- Free snacks and beverages in the workplace

- Paid time off for volunteer work or community service

- Access to on-site or off-site childcare

- Employee assistance programs for mental health support or financial counseling

- Company-sponsored social events and activities

Employee discounts and perks can be important benefits for employees, as they can help improve work-life balance and provide financial savings. They can also help attract and retain top talent, as many job seekers consider employee discounts and perks when evaluating potential employers.

Employers may also benefit from offering employee discounts and perks, as they can help improve employee morale and productivity, as well as reduce absenteeism and turnover.

Educational Opportunities

Educational opportunities are a type of fringe benefit that can provide employees with opportunities to enhance their skills and knowledge through education and training.

These opportunities may include tuition reimbursement, which can provide financial assistance for employees who are pursuing educational programs related to their job or career goals. Employers may set specific guidelines for the types of programs that are eligible for tuition reimbursement, as well as the maximum amount of reimbursement available.

Employers may also offer training and development programs, which can include on-the-job training, workshops, seminars, or courses offered by outside organizations. These programs can help employees develop new skills, stay current with industry trends, and enhance their performance on the job.

In some cases, employers may also offer formal apprenticeship or internship programs, which can provide employees with hands-on training and mentorship in a specific trade or industry.

Educational opportunities can be important benefits for employees, as they can help employees advance their careers and increase their earning potential. Employers may also benefit from offering educational opportunities, as they can help attract and retain top talent, improve employee performance, and enhance the overall reputation of the organization as a place that invests in the professional development of its employees.

Childcare Services

Childcare services are a type of fringe benefit that can provide working parents with access to high-quality childcare options.

Employers may offer on-site childcare facilities, which can provide a convenient and affordable option for employees with young children. These facilities may be staffed by qualified childcare professionals and may offer a structured curriculum and age-appropriate activities.

Alternatively, employers may partner with local childcare providers to offer discounts or subsidies on childcare services for their employees. This can help reduce the financial burden of childcare and make it easier for working parents to balance their work and family responsibilities.

Childcare services can be important benefits for employees, as they can help reduce the stress and financial burden of finding and paying for childcare. They can also help attract and retain top talent, especially among working parents who may value access to high-quality childcare options.

Employers can improve employee morale and productivity, as well as reduce absenteeism and turnover. Additionally, offering childcare services can help demonstrate the employer's commitment to work-life balance and family-friendly policies.

The types and extent of fringe benefits offered can vary depending on the employer's size, industry, and location. It is important for employers to carefully evaluate their options and consider the needs and priorities of their employees when designing their benefits packages.

Advantages of Offering Fringe Benefits

Offering fringe benefits can have many benefits for both employers and employees. Here are some of the key benefits of offering fringe benefits:

- Attract and retain top talent: Offering fringe benefits can be an effective way to attract and retain top talent. In today's competitive job market, job seekers often evaluate potential employers based on the benefits and perks they offer. Offering attractive fringe benefits can help set your organization apart and make it more appealing to job seekers.

- Improve employee morale and productivity: Fringe benefits can help improve employee morale and job satisfaction. When employees feel that their employer cares about their well-being and invests in their professional development, they are more likely to feel motivated and engaged in their work. This can lead to increased productivity and higher levels of job performance.

- Reduce absenteeism and turnover: By offering benefits that support work-life balance, such as flexible work arrangements, child care services, and health and wellness programs, employers can help reduce absenteeism and turnover. When employees have access to benefits that support their personal and family needs, they are less likely to miss work or leave their job.

- Enhance organizational reputation: Offering attractive fringe benefits can enhance the reputation of your organization as a desirable place to work. This can help attract not only job seekers, but also customers and business partners who value organizations that invest in their employees.

- Tax advantages: Some fringe benefits may offer tax advantages for both employers and employees. For example, contributions to retirement plans are tax-deductible for employers, and contributions to health savings accounts are tax-deductible for employees.

Overall, offering fringe benefits can be a valuable investment in the well-being and productivity of your employees, as well as in the long-term success of your organization. By carefully selecting and designing benefits that meet the needs of your employees, you can create a positive work environment and attract and retain top talent.

Are Fringe Benefits Taxable?

Fringe benefits may be subject to taxation depending on the specific benefit and the tax laws in the jurisdiction where the employer and employee are located. Here are some general guidelines for determining the taxability of fringe benefits:

Taxable Fringe Benefits

Some fringe benefits are taxable and must be included in the employee's income for tax purposes. These may include cash bonuses, vacation pay, and other forms of compensation that are not specifically excluded from income by tax law. The value of these benefits is typically subject to income tax withholding, Social Security tax, and Medicare tax.

Tax-exempt Fringe Benefits

Some fringe benefits are tax-exempt and are not subject to income tax withholding or payroll taxes. Examples of tax-exempt benefits include contributions to qualified retirement plans, health insurance premiums paid by the employer, and certain educational assistance programs.

Partially Taxable Fringe Benefits

Some fringe benefits may be partially taxable, meaning that only a portion of the benefit is subject to taxation. For example, if an employer provides an employee with a company car for both business and personal use, the employee may be required to include a portion of the value of the car in their income for tax purposes.

Reporting Requirements

Employers are generally required to report the value of taxable fringe benefits on the employee's W-2 form at the end of the year. Employers may also be required to report the value of certain fringe benefits on other tax forms, such as Form 1099-MISC or Form 1095-C.

It's important for employers and employees to understand the tax implications of fringe benefits in order to avoid unexpected tax liabilities and comply with applicable tax laws. Employers may wish to consult with tax professionals or attorneys to ensure that they are properly administering fringe benefits and complying with all relevant tax laws.

Fringe Benefits Frequently Asked Questions (FAQs)

Here are some common FAQs about fringe benefits with answers:

Q: What are fringe benefits?

A: Fringe benefits are non-wage compensation provided by an employer to an employee in addition to their regular pay. They can include things like health insurance, retirement plans, vacation time, and more.

Q: Are fringe benefits taxable?

A: In general, fringe benefits are taxable, meaning that they are subject to federal income tax, Social Security tax, and Medicare tax. However, some fringe benefits may be exempt from taxation, depending on the specific benefit and the circumstances under which it is provided.

Q: Can employers choose which fringe benefits to offer?

A: Yes, employers can choose which fringe benefits to offer based on their business needs and goals. However, some benefits may be required by law or collective bargaining agreements.

Q: Are all employees eligible for fringe benefits?

A: It depends on the specific benefit and the employer's policies. Some benefits, such as health insurance, may be offered to all employees, while others may be limited to certain groups, such as full-time employees or those with a certain length of service.

Q: How are fringe benefits valued for tax purposes?

A: The value of fringe benefits is generally calculated based on their fair market value. For some benefits, such as health insurance, the employer's cost of providing the benefit may be used instead.

Q: Can employees choose which fringe benefits to receive?

A: In some cases, employees may be able to choose which fringe benefits to receive based on their individual needs and preferences. For example, they may be able to select between different health insurance plans or retirement options.

Q: Can employees opt out of fringe benefits?

A: In some cases, employees may be able to opt out of certain fringe benefits, such as health insurance, if they have coverage from another source. However, other benefits may be mandatory or required by law.

Q: Can employers change or discontinue fringe benefits?

A: Yes, employers may change or discontinue fringe benefits at any time, although they may need to provide notice and comply with any legal requirements or contractual obligations.

How can Deskera Help You?

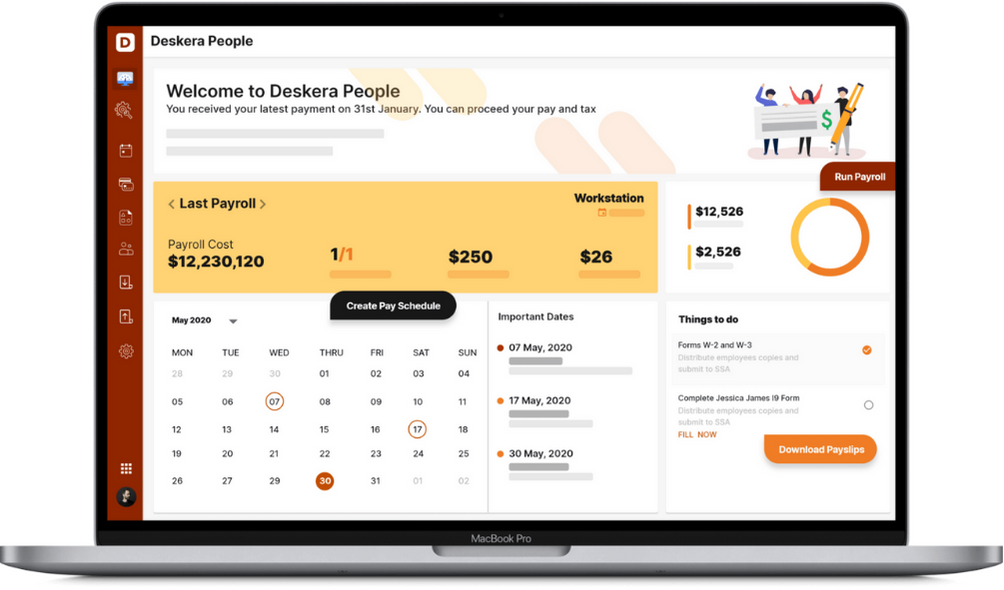

Deskera is a cloud-based business software platform that offers a range of HR management tools to help businesses manage their employee benefits, including fringe benefits.

Here are some ways Deskera can help:

- Benefits Management: Deskera's HR module allows businesses to manage employee benefits easily, including fringe benefits, from a centralized location. This includes tracking benefit enrollments, managing employee contributions, and generating reports on benefits usage.

- Compliance: Deskera helps businesses stay compliant with government regulations regarding employee benefits, including fringe benefits.

- Employee Self-Service: Deskera's employee self-service portal allows employees to view and manage their benefits information, including fringe benefits.

- Analytics and Reporting: Deskera provides real-time analytics and reporting on employee benefits usage, including fringe benefits. This helps businesses make data-driven decisions about their benefits offerings and optimize their benefits strategy.

Other efficient tools from the house of Deskera include the following:

Additionally, Deskera's CRM module can be used to manage communication with beneficiaries and other stakeholders, while its inventory management module can help track physical assets held in the trust.

Deskera Books can be used to track income and expenses related to the trust, while its reporting tools can generate financial statements for the trust.

Deskera People helps you with all the administrative tasks pertaining to the human resource unit of your business.

Deskera ERP is a cloud-based enterprise resource planning software that integrates multiple business functions and processes, such as finance, human resources, inventory management, and customer relationship management, into a single platform.

Key Takeaways

- Fringe benefits are non-wage compensations provided by an employer to their employees. These benefits are in addition to an employee's regular salary or wages.

- Some common types of fringe benefits include health insurance, retirement plans, life insurance, paid time off, flexible work arrangements, education assistance, and transportation benefits.

- Employers are not required by law to provide fringe benefits, but they can be an important factor in attracting and retaining talented employees.

- Fringe benefits can be tax-deductible for employers and tax-free for employees in some cases. However, tax rules can be complex, so it's important to consult with a tax professional for guidance.

- In addition to attracting and retaining employees, providing fringe benefits can also lead to increased job satisfaction, productivity, and loyalty.

- Some employers may offer a cafeteria plan or flexible spending account (FSA) to allow employees to choose the fringe benefits that best fit their individual needs.

- Fringe benefits can also include perks and discounts, such as gym memberships, tickets to events, or free meals.

- While fringe benefits can be a valuable part of an employee's compensation package, it's important to understand the costs and trade-offs. For example, some benefits may have higher administrative costs or may not be as valuable to certain employees.

- Employers may need to communicate effectively with employees about the availability and value of their fringe benefits. This can include providing regular updates and education on how to take advantage of different benefits.

- As the job market becomes increasingly competitive, fringe benefits can be an important tool for employers to differentiate themselves and attract top talent. It's important for employers to regularly review their benefits offerings to ensure they are meeting the needs of their employees and the business.

Related Articles