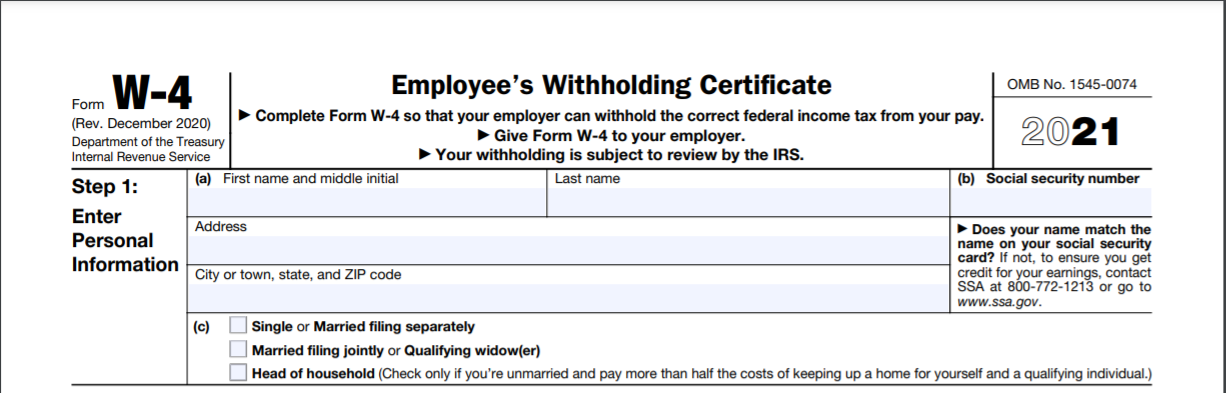

Why should you care about filling out a W-4? Well, if you are switching jobs, you'll soon find out that the W-4 form that every employee has to fill out in order to determine the amount of taxes that are withheld from each paycheck has changed.

The form was re-designed in 2020 to make withholdings more accurate, and while there isn’t a big difference between the 2020 and the 2021 form, it’s important to stay current.

Modern solutions like ERP.AI help HR and payroll teams automate W-4 processing, reduce errors in tax withholding, and ensure compliance with the latest IRS guidelines.

Taxpayers who fill out the 2021 form are less likely to wind up with a large tax bill or a giant refund when they file tax returns in 2022 money that could have been invested or spent on essential expenses throughout the year. Now to learn more about form W-4 continue reading this article.

What is Form W-4?

A W-4 form, formally titled "Employee's Withholding Certificate," is IRS form employees use to tell employers how much tax to withhold from each paycheck. Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and the state on behalf of employees.

You do not have to fill out the new W-4 form if you already have one on file with your employer. You also don't have to fill out a new W-4 every year. If you start a new job or want to adjust your withholdings at your existing job, though, you'll likely need to fill out the new W-4. Either way, it's a great excuse to review your withholdings.

What Has Changed in The Form W-4?

In the past, employees could claim allowances on their W-4 to lower the amount of federal income tax withheld from their wages. The more withholding allowances an employee claimed, the less their employer would withhold from their paychecks. However, the 2017 Tax Cuts and Jobs Act overhauled a lot of tax rules, including doing away with personal exemptions. That prompted the IRS to change the W-4 form.

The new W-4, introduced in 2020, still asks for basic personal information but no longer asks for a number of allowances. Now, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet.

What is the Purpose of W-4 Form?

The purpose of a W-4 form is to determine an employee’s federal income tax withholding amount. Employees use the tables and worksheets to fill out the form. Then, you use the form to calculate the employee’s FIT withholding.

To determine how much FIT to withhold from an employee’s wages, use the tax tables in IRS Publication 15-T. Use the information from the employee’s W-4 form (e.g., filing status) and the IRS tax tables to determine the employee’s withholding amount.

Keep in mind that IRS Publication 15-T also includes tax tables that work with 2019 and earlier W-4 forms. Be sure you’re looking at the correct tax table before determining the employee’s withholding.

If you use payroll software like Deskera, the software calculates the employee’s federal income tax withholding for you each time you run payroll. And if you use online payroll software, it will automatically update the tax tables for you each year.

How to Fill Out Form W-4 in 2022?

Step 1: Add personal data

This step must be completed by all employees. If an employee does not fill out the form, you are required to calculate their withholding as “Single” so you can withhold their taxes at the higher “Single” rate.

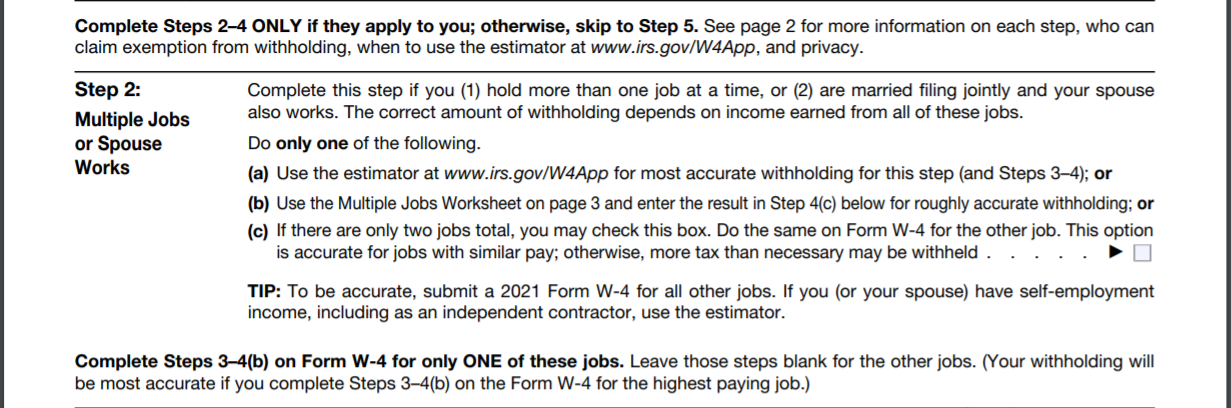

Step 2: Multiple jobs/spouse Works

The message before step two gives instructions on where to find guidance for any employees who may be exempt from withholding. If your employee asks, direct them to that language, outlined below.

For step 2, employees only need to complete option (a), (b), or (c). Options (a) and (b) will take employees away from the form itself, while option (c) can be done right on the form.

The IRS has stated that option (a) will give employees the most accuracy and privacy of the three since the new withholding estimator will compute all the relevant entries for the form. Option (b) also provides accuracy but requires manual work, and (c) is the least accurate since it assumes the jobs have similar pay, but it’s the easiest to complete.

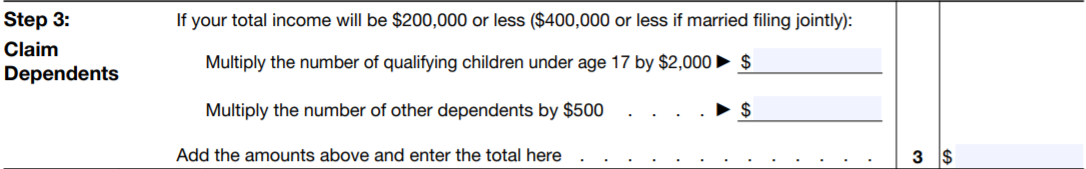

Step 3: Claim your dependents

Single taxpayers with a total income of $200,000 or less ($400,000 if married filing jointly) are eligible for the child tax credit. Employees should pay attention to the definitions in IRS Publication 972 – Child Tax Credit if they’re looking to claim the credit.

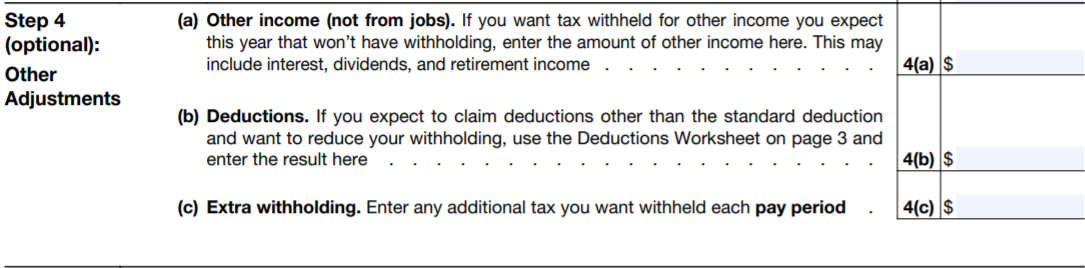

Step 4: Other adjustments

This section is for various things that an employee may want to account for when considering their withholding. These areas include the following:

- Other income (not from jobs): Additional income that might not be subject to withholding, like retirement income or dividends.

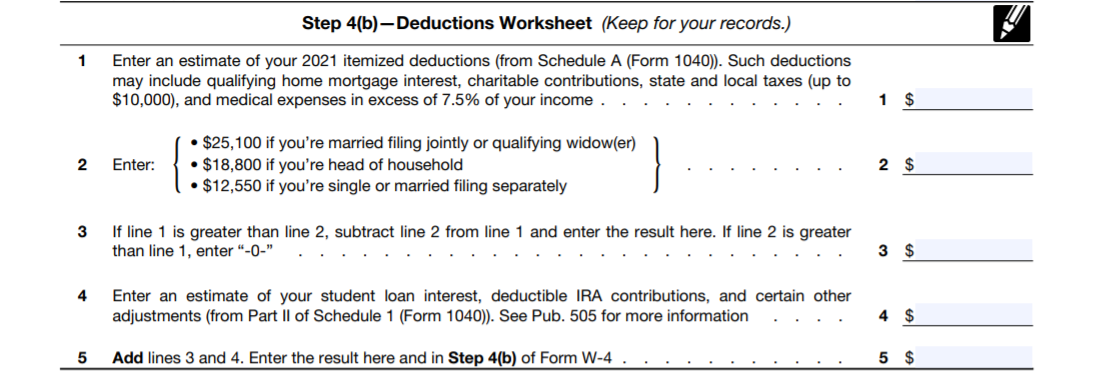

- Deductions: This line is for deductions other than the standard deduction. This includes all itemized deductions like mortgage interest and charitable contributions minus the standard deduction. Remember that, in general, the standard deduction reduces a taxpayer’s adjusted gross income to arrive at taxable income. The greater of the standard deduction or itemized deductions will help reduce the amount of tax due. The 2021 standard deduction is $25,100 for married taxpayers filing jointly; $12,550 for single and married filing separately taxpayers; $18,800 for those filing as head of household.

- Extra withholding: Any extra withholding that the employee would like to withhold each pay period.

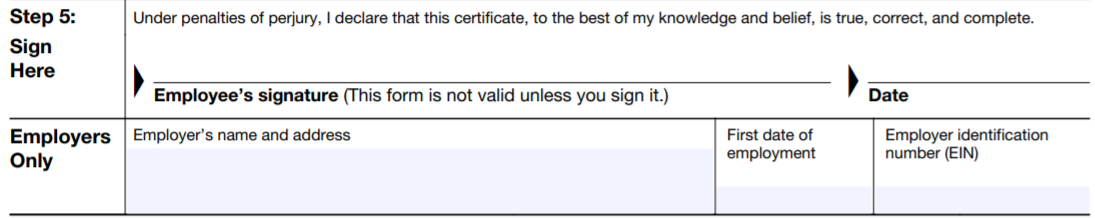

Step 5: Signature on the form

If your employee doesn’t sign and complete this final step, the form stands invalid.

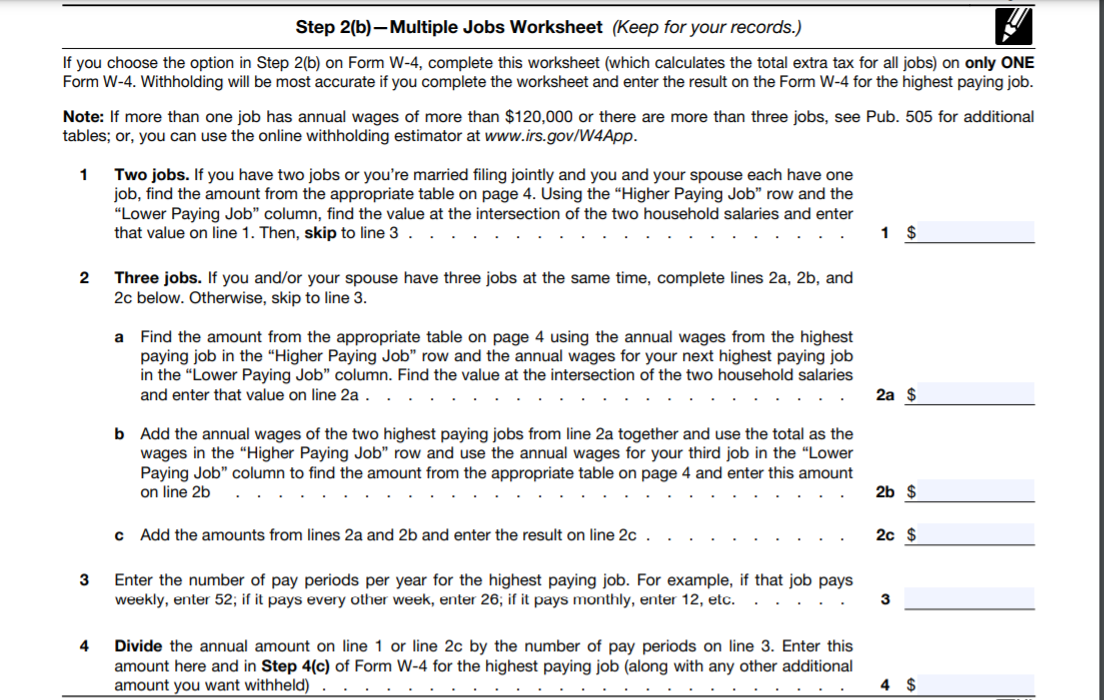

Multiple Jobs Worksheet Explanation

LINE 1

Line 1 is for anyone who has two jobs or is filing jointly with a spouse who also works. Using the tables on page four, find the wages or salary for the “Higher Paying Job” and cross reference it with the amount of wages or salary from the “Lower Paying Job” in the columns moving left to right.

At the intersection of these two amounts is the figure you will enter on line 1.

LINE 2

Line 2 is for someone who has three total jobs on their own or with a spouse.

Line 2a is for the two highest-paying jobs. Again, find the wages or salary for the highest-paying job in the column on the left and the wages or salary for the second-highest across the top. The figure at the intersection of those two figures will go on line 2a.

For line 2b, the wages and salaries for the two highest-paying jobs need to be added together and found in the column on the left. The wages and salaries for the third job will be found in the row across the top of the table. The value at the intersection of those two figures will go on line 2b. The sum of lines 2a and 2b goes on line 2c.

LINE 3

Lines 3 and 4 apply to everyone who chooses to fill out the multiple Jobs worksheet.

Line 3 is the number of pay periods per year for the highest-paying job. For example, if that job pays weekly, then 52 goes on line 3. If the jobs pays bi-monthly, then 24 should be entered.

LINE 4

Line 4 simply divides the amount on either line 1 or 2c by the number of pay periods on line 3. It’s the amount that’s provided in step 4c.

Deductions Worksheet

The deductions worksheet is for anyone who plans to itemize deductions. Since the TCJA increased the standard deduction, way fewer people will itemize their deductions. Many high-earners will still itemize, however, so proceed accordingly.

Anyone filling out this worksheet should have their prior-year tax return handy to help get a good idea of what those deductions might be.

Exemption on Form W-4

Some employees may be exempt from federal income taxes in rare cases. This means you do not withhold any federal income tax from the employee’s wages. Only certain employees can be exempt from federal income tax. An employee is exempt if:

- Had no federal income tax liability in the previous year

- Expect to have no federal income tax liability in the current year.

If an employee is exempt from FIT, they claim it on Form W-4 by writing “Exempt” in the space below Line 4(c). Exempt employees must also fill out their name, address, SSN, and signature on their W-4 form.

Keep in mind that Form W-4 information does not expire. However, an exemption from withholding does. Employees claiming exempt on Form W-4 must give you a new form every year by February 15.

Considerations in Filing Form W-4

Assuming you start some work in the year and were not utilized before that year, here's an assessment wrinkle that can set aside you cash. If you will be utilized close to 245 days for the year, demand recorded as a hard copy that your boss utilize the part-year technique to figure your withholding.

The standard saved portion recipe expects entire year work, so without utilizing the part-year technique, you'll have an excessive amount of kept and you'll need to delay until charge time to get the cash back.

Tax Withholding Estimator

For your assistance there is a tax withholding estimator made available by IRS.

Anyone who wants to use the estimator will need to be prepared with similar information that’s requested on the W-4 worksheets.

If you’re interested in using the estimator, you should have the following:

- Your most recent pay stub. It should include the amount of federal income tax withheld so far in the current tax year (2020).

- A completed copy of your most recent tax return. It will help with estimating income and other items for the current tax year.

It’s important for anyone using the estimator to know that it will only be as accurate as the information entered. If you throw in a “best guess” for the requested information, the result will not be as precise.

The withholding estimator will spit out an approximation of what someone’s tax liability will be for their tax return and whether their current withholding is enough to meet that obligation. Depending on a person’s situation, this information may cause them to make changes to their W-4.

How AI Improves Payroll Accuracy and Tax Withholding

By automating data entry and interpretation, AI helps reduce errors in withholding calculations and ensures employees’ tax forms are processed accurately. It can cross-check employee inputs against current tax regulations, minimizing the chances of incorrect deductions.

AI also identifies patterns in employee income and work history to recommend more precise withholding adjustments over time. Overall, AI makes payroll processing more efficient and accurate—reducing manual work, improving compliance, and helping employees receive correct paychecks without delays or mistakes.

How Can Deskera Assist You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

The platform works exceptionally well for small businesses that need to figure out a lot of things when they are setting out. This delightful software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

The platform works exceptionally well for small businesses that need to figure out a lot of things when they are setting out. This delightful software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

With the well-thought and well-designed templates, you can now anticipate your work to become simpler. These templates can be used for transactions like invoices, quotations, orders, bills, and payment receipts.

If yours is a drop shipping business, you can easily track your orders and create new dropship orders for your suppliers based on the customer orders.

Watch this video for a quick Deskera demo:

Related Articles