The Maharashtra Shops and Establishments (Regulation of Employment and Condition of Service) Act 2017, which replaces the Maharashtra Shops and Establishments Act 1948, became effective from 7 December 2017. Let us dive deeper into this act and the modifications under it. This guide covers:

- What is Maharashtra Shops & Establishment Act?

- Rule 10: Notice to make modifications in the registration certificate

- List of documents required for Notice of Change (Form I)

- Provisions under Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Act 2017

- Modification of Provisions in MSEA 2017

What is Maharashtra Shops & Establishment Act?

An Act to accommodate the guideline of conditions of business and different conditions of service of laborers utilized in shops, private hotels, cafés, restaurants, theaters, different spots of public entertainment or amusement, and different establishments and for issues associated therewith or incidental thereto.

With the introduction of Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Act 2017 (hereinafter alluded to as MSEA 2017), on December 19, 2017, the last act, i.e, Maharashtra Shops and Establishments Act 1948 (hereinafter alluded to as MSEA 1948), has been revoked.

Assuming we investigate the foundation and the purpose for enactment of this rule, we will see that in July 2016, Central Government published the Model Shops and Establishment (Regulation of Employment and Conditions of Service) Act 2016, and the states were allowed to take on something very similar with important state-specific modifications. The introduction of this Model SEA 2016, was having three significant explanations for this –

1. to make these lawful arrangements more contemporary

2. to improve the ease of doing business

3. to execute a uniform statute all through the country.

Maharashtra is the primary state to take on the Model SEA 2016, with few state-specific amendments to stay at the front line of modern turn of events and changes. It is the primary state to change the 70-year-old resolution. Considering the way that Maharashtra is having two leading commercial and industrial cities of the state - Mumbai, and Pune, this is definitely a long step forward.

While making the variation of Model SEA 2016 and keeping in mind canceling the previous relevant rule of 1948, few changes have been presented.

Rule 10: Notice to make modifications in the registration certificate

1. Any changes in the certificate of registration will be informed online in Form 'I' to the Facilitator according to section 9 of the Act within thirty days from the date the change occurred alongside the required documents to be uploaded as determined in the application and Part 'D' of the Schedule.

2. On receipt of such notice, the Facilitator will examine and carefully sign and issue a new fresh modified certificate within working seven days from the date of receipt of such notice. Notwithstanding, in the event that the notice isn't finished or isn't upheld by the required documents he will dismiss the notice by referencing the reasons thereof.

List of documents required for Notice of Change (Form I)

1. Aadhar card of the employer (if there should be an occurrence of a legal statute like an organization, copy of Aadhar card of the concerned individual under the particular act.).

2. Actual photograph of the organization showing the inside and the Name Board (Marathi) at the appropriate spot of the foundation.

3. Old registration certificate

4. Copy of the License, Registration which is obligatory under some other law from the competent authority prior to the beginning of such business.

5. In the instance of business directed in owned premises, any of the following:-

· Sale/Purchase Deed

· Current Property Tax paid Receipt

· Current Electricity Bill

· Current Society Maintenance Receipt

6. In the instance of business-led in rental premises any of the following:-

· Lease Agreement

· Leave and License Agreement

· In the situation where the possession is held via some other order of the Court or order of any competent authority, copy of such order

· Any one document mentioned at Sr. No. 5 concerning the owner of the Establishment whose premise is leased or rented.

7. If the business space is possessed or rented or leased by any individual from the family or relative No objection certificate from such party or relative.

8. If the business space is arranged in any private residential society No objection certificate from the residential society or any such authority is liable for its upkeep.

9. All such documents as referenced wherever in the forms.

Provisions under Maharashtra Shops and Establishments (Regulation of Employment and Conditions of Service) Act 2017

Employer

Section 2(3) (Regulation of Employment and Conditions of Service) Act 2017: MSEA 2017 expanded the scope of the definition and has incorporated the partners of firms, heads of organizations, and people selected by the Government to oversee undertakings.

Registration of Establishment

Section 6(1): It is relevant to establishments where at least 10 employees are employed. Establishments utilizing under 10 laborers are not expected to apply for registration. The application is to be made within 60 days. In any case, establishments previously covered under MSEA 1948 are not needed to get registered under MSEA 2017 till the prior registration is substantial.

Section 6(3): The term of the registration certificate isn't fixed. It will be totally based upon the application made by the candidate. The maximum tenure can be of 10 years. The application for renewal of the registration certificate or the renewal registration declaration must be made somewhere around 30 days before the date of expiry with required fees.

Opening Hours & Closing Hours

Section 11: Under MSEA 2017 nothing is endorsed with regards to the opening and the closing hours. State Government holds the power to notify in the authority newspaper opening and shutting hours for various establishments, premises, shopping complexes, or shopping centers. This might differ for the various regions for a different period.

Notwithstanding, For Permit Rooms, Beer Bars, Dance Bars, Hookka Parlors, Discotheques and all such different establishments where alcohol in any sort is served or for wine and a wide range of alcohol shops, explicit opening and shutting hours have been indicated vide notice dated 19 December 2017.

Working of Women Workers

Section 13: Women laborers are permitted to work after 9.30 pm subject to satisfaction of the accompanying conditions

· Consent of the Women laborer has been acquired

· The business gives satisfactory security and insurance of honor and nobility.

· The business gives sufficient insurance from cases of lewd behavior in the working environment.

· Women laborers are given legitimate transportation office from their work environment to their doorstep by the business.

· Be that as it may, the state government can disallow the work of Women laborers after 9.30 pm and before 7 am of the next day for any business or exchange or occupation such areas as deem fit.

Rest Interval, Hours of work, Spread Over Time and Overtime

Section 12: The every day and week by week limit stays the same as that of MSEA 1948. Be that as it may, if there should be an occurrence of urgent work, working long stretches of week-by-week occasions might be loosened up in view of prior consent of the Facilitator.

Rest interval has been decreased to thirty minutes for the adult laborers in any establishment, for every 5 hours of work performed.

Section 14: The spread over time has been decreased to 10½ hours on a typical day. Nonetheless, it tends to be reached out as long as 12 hours when the work is of irregular or urgent nature.

Section 15: In MSEA 2017 the consolidated extra time hours are permitted a maximum of up to 125 hours in a time of 90 days. The hours will be determined past 9 hours every day or 48 hours per week.

Close Day and Weekly Holiday

Section 16(1)(b): Establishments can stay open all through the week without shutting for one entire day. The main proviso is that each worker is to be permitted a week by week holiday of somewhere around 24 hours.

Section 16(1)(c): On the off chance that such a week by week holiday was denied, compensatory off is to be given in lieu of such week by week holiday within 2 months from the date of the week by week holiday alongside double the rate of common wages.

Identity Card

Section 17: Identity Card to be given to the employees by the business for any organization. Aside from the boss' and laborer's basic details, it should contain the employee’s blood group and Aadhaar card number.

Leaves, Holidays, and Leave Encashment

Section 18(7): 8 paid holidays in a year - 26th January, first May, fifteenth August, and second October and 4 others as will be commonly settled upon between the laborers and the business. These are to be imparted before the initiation of the year.

Section 18(2): According to MSEA 2017, 8 days of casual leave is distributed in a year which is to be credited to the laborer's leave information on a quarterly premise. In the event that unveiled, those leaves will slip by toward the year's end.

Section 18(3): According to MSEA 2017, 1 day of yearly leave with wage has been allocated for at regular intervals of work performed given that the worker has worked for something like 240 days in the first year. This is corresponding to the provision of yearly leave with compensation under the Factories Act 1948.

Section 18(5): Yearly accumulation of leave is permitted to 45 days

Section 18(6): In the event of a refusal of yearly leave by the business (dependent upon application 15 days ahead of time), the worker will get the right to encash the number of yearly leaves, according to section 18(3), more than 45 days.

Compensatory off for Festival Holidays

Section 18(7): The provision (i.e., according to section 35(4) of MSEA Act 1948) is relevant for the employees according to MSEA Act 2017.

Enforcement and Inspection

Section 28: Rather than Inspectors MSEA 2017 has presented Facilitators. The State Government will designate the Chief Facilitator for the state and other Facilitator(s) including a particular region within the State.

The primary goal of the Facilitator is to prompt the businesses and the laborers towards better compliance with the act.

Rather than examination at any sensible time based on circumspection of the work authorities, assessments will be done in an irregular web-generated way.

Penalties & Offences

Section 29 to 31: For legal infringement of the provisions of the rule, the fines are gone from Rs.1,00,000/ - to Rs.5,00,000/ - . On the off chance that the repudiation proceeds, an extra-fine of Rs.2000/ - per day will be forced. Nonetheless, the absolute fine will not surpass Rs.2000/ - per worker employed.

MSEA 2017 states that assuming the business is found liable if there should be an occurrence of negation of any provision(s) of the act that has brought about the substantial injury or passing of the worker, the business will be awarded the punishment of imprisonment as long as a half year or fine at the very least Rs.2,00,000/ - and up to Rs.5,00,000/ - or with both.

Modification of Provisions in MSEA 2017

· Section 30:MSEA 2017 states that assuming the business is found guilty if there should arise an occurrence of contradiction of any provision(s) of the demonstration that has resulted in the real injury or demise of the laborer, the business will be awarded the punishment of imprisonment as long as a half year or fine at least Rs.2,00,000/ - and up to Rs.5,00,000/ - or with both.

· Section 3(11): Showing a rundown of laborers in the administrative, supervisory or private job either in the website of the business or at an obvious spot of the organization. These laborers will be covered within the scope of the act.

· Section 25(2): Bosses are presently allowed to keep records in electronic format. They will be needed to submit appropriately marked printed copies of something similar to the Facilitators upon request at the hour of assessment.

· Section 18(2): Casual Leaves of 8 days in a year.

· Section 13(1): In accordance with the Equal Remuneration Act 1976, MSEA Act 2017 brings the provision of no segregation for women laborers in issues like enrollment, promotion, pay, transfer, or training.

· Section 18(8)(b): Paid Leaves will not be considered for the maternity advantage of the women laborers. However, these days will be thought about for calculation of 240 days in a year.

· Section 23: Crèche Facility for foundations utilizing at least 50 laborers. A gathering of foundations might work a typical crèche inside a sweep of one kilometer, liable to earlier contingent consent by the Chief Facilitator.

· Section 24: Canteen Facility is to be given by the business where somewhere around 100 or more workers are there. A group of establishments might work a typical canteen, likely to prior consent by the Chief Facilitator

· Section 16(1): Manager has the discretionary power to run any office or any section of something similar in more than one shift. The worker will get the work in any shift, as will be chosen by the business.

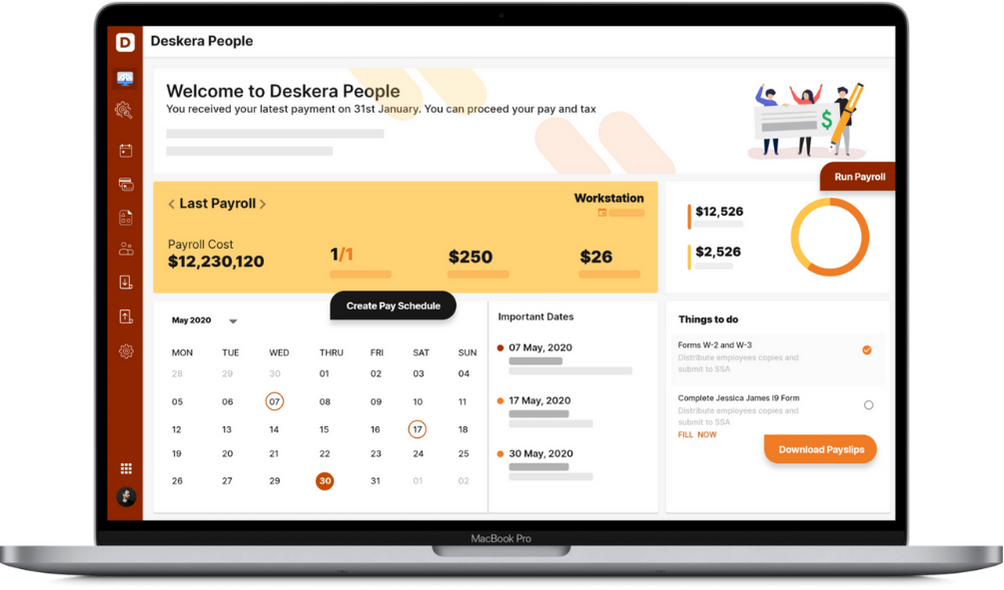

How can Deskera Payroll Help

Payroll management and employee management are integral to any organization. If you are looking for a holistic and automated tool to manage payroll, employees, expenses, contractor management, Deskera People could be the apt solution.

Process your payroll now with Deskera People:

Related Articles