Assuming you are a salaried individual, it is vital to ensure you nominate the right beneficiaries for your gratuity proceeds. Generally, gratuity is payable to a worker if he/she leaves an association after the finish of five years of service.

In any case, if there should be an occurrence of a demise of a worker, the gratuity amount will be payable to the nominee irrespective of whether or not the five years are finished. Let us take a glance at all the aspects involved in Gratuity.

- What is Gratuity?

- What are Eligibility Criteria for Gratuity?

- How is Gratuity calculated?

- What is Gratuity Act 1972?

- What Is Gratuity in Salary?

- What is Nomination in Gratuity?

- How to nominate someone for your gratuity?

- Who would you be able to nominate to receive your gratuity proceeds?

- When are you expected to file a nomination for gratuity?

- Gratuity Rules, 1972-1

- Would gratuity nomination be able to supersede the beneficiary mentioned in the will?

- New rules with respect to the gratuity of central government workers

What is Gratuity?

Gratuity is an amount that is payable under the Payment of Gratuity Act 1972. Gratuity is an amount of cash paid by a business to a worker for services delivered in the organization. However, gratuity is paid distinctly to workers who complete at least five years with the organization.

What are Eligibility Criteria for Gratuity?

Following are examples of when you will qualify to get Gratuity.

1. A worker ought to qualify for superannuation

2. A worker retires

3. A worker resigns after working for 5 years with a single boss

4. A worker passes away or suffers disability because of ailment or mishap

How is Gratuity calculated?

For a gratuity amount computation for the estimation of 5 years, 1 year is considered as 240 working days. Then again, for laborers, engaged with mining works and related fields, a year is considered as 190 days. An organization with a workforce of 10 laborers on a single day in the first year is supposed to pay gratuity.

Even in the event that the number of workers lessens to under 10, the association will, in any case, need to pay the gratuity, as indicated by the Act. Industrial facilities, mines, organizations, ports, ranches, mines, and that multitude of firms are obligated to pay gratuity.

Following are the components that go into the estimation of the pay gratuity. The sum is additionally reliant upon the number of years served in the organization and the last drawn compensation.

Gratuity = N*B*15/26

N = number of years of service in an organization

B = last drawn basic salary in addition to DA

Gratuity can be determined over the basic compensation and the DA. 2 main considerations to decide the Gratuity are the last drawn compensation and the total number of years of services.

What is Gratuity Act 1972?

Under the Gratuity Act, 1972, workers are entitled to gratuity in the event that they have finished 5 years of consistent work with a particular organization or manager. In any case, whether the five years have been fulfilled or not, the Gratuity amount will be paid to the candidate in case of a worker’s demise. Just relatives can be nominated under the Gratuity Act, a worker can nominate any Indian resident assuming that the individual has no relatives.

Under the Gratuity Act, a family of a worker is characterized for a male representative as his wife, children (married or unmarried), dependent parents or dependent parents of his wife, and the widow and offspring of his expired son if any.

Though for a female worker, the family alludes to her husband, children (married or unmarried), dependent parents or her husband's dependent parents, and widow and children of her deceased son if any, under the Gratuity Act 1972.

What Is Gratuity in Salary?

Gratuity is a monetary part presented by a business to a worker in acknowledgment of his/her service delivered to an association. It is a piece of the compensation a worker gets and can be considered to be an advantage plan intended to help a person in his/her retirement.

Gratuity is paid by a business when a worker leaves the occupation subsequent to serving a similar association for a base time of 5 years. One can believe it to be a monetary thank to a worker for delivering persistent support to a business.

What is Nomination in Gratuity?

A nomination will be in the given form and submitted in copy by private service by the worker, in the wake of taking appropriate receipt or by sending through registered post service due on the business.

The due date for accepting nomination is ;

(i) if an employee works for a year or more on the date of initiation of these rules, usually, within 90 days from such date, and

(ii) if an employee works one year of service after the date of initiation of these rules, usually within 30 days of the completion of one year of service

Here is a glance at what the law states about, who can be nominated if there should arise an occurrence of gratuity, how the nomination should be made and when a candidate won't be qualified to receive the gratuity proceeds

(1) Each worker, who has finished one year of administration, will make, within such time, in such structure and in such way, as might be endorsed, nomination with the end goal of the second proviso to sub-section (1) of section 4

(2) A worker may, in his nomination, distribute the amount of gratuity payable to him under this Act among more than one nominee.

(3) If a worker has a family at the hour of making a nomination, the selection will be made for at least one individual from his family, and any nomination made by such worker in favor of an individual who is not a member of his family will be void.

(4) If at the hour of making a nomination the worker has no family, the selection might be made for any individual or people however assuming the worker thereafter gains a family, such nomination will forthwith become invalid and the worker will make, within such time as might be recommended, a new nomination for at least one individuals from his family.

(5) A nomination may, dependent upon the arrangements of sub-section (3) and (4), be altered by a worker whenever, subsequent to providing for his boss a written notice in such structure and in such way as might be endorsed, of his intention to do so.

(6) If a nominee predeceases the worker, the interest of the nominee will return to the worker who will make a new nominee, in the endorsed structure, in regard to such interest.

(7) Every nomination, new nomination, or change of nomination, by and large, will be sent by the worker to his boss, who will keep the same in his protected custody.

How to nominate someone for your gratuity?

The nomination in Form F is needed to be put together by an individual with his/her manager. Where the worker doesn't have "family" as characterized under the Gratuity Act at the hour of starting recording of the nomination and has consequently obtained a family, then, at that point, a new nomination will require to be documented utilizing Form G.

It will be a decent practice for organizations to require their workers to review their gratuity nominations after their marriage. When the new nomination is documented, the previous nomination recorded (i.e., before getting family) will become invalid.

Who would you be able to nominate to receive your gratuity proceeds?

A worker can nominate possibly only family members and on the off chance that there is no 'relative, only then can he/she nominate any other individual.

According to the Gratuity Act, 'family' in the event of the male is characterized as a spouse, kids (independent of whether they are married or unmarried), dependant guardians, dependant guardians of his wife, and the widow and offspring of his predeceased son if any.

For a female worker, the meaning of 'family' is her husband, her kids (married or unmarried), her dependant guardians, dependant guardians of her husband, and widow and offspring of her predeceased son if any.

Unlike under the Employees' Provident Fund Scheme (EPF), where a female worker has a choice to eliminate her husband and his dependant guardians from the list of nominees, such a choice isn't accessible under the Gratuity Act. The choice to eliminate the spouse from the meaning of family has been erased vide a change in 1987.

Unlike EPF, gratuity nomination doesn't get dropped consequently after marriage. Accordingly, assuming you had nominated any other individual other than the characterized 'relatives' (assuming that you didn't have any 'family'), then, at that point, you should document a new nomination after marriage as then you would have obtained a partner who might then qualify as 'family'.

However, assuming you have nominated your dependant parents before marriage, a similar will be substantial even after marriage, and the employer will undoubtedly pay the gratuity benefits to the nominated individual in case of the untimely death of the worker.

When are you expected to file a nomination for gratuity?

Under the Payment of Gratuity Act, 1972, the nomination is needed to be made by a worker within 30 days of the consummation of one year of service. This would imply that the law determines that once a worker finishes one year of service, he/she should make the nomination within 30 days.

In any case, by practice, this isn't true. Managers expect workers to submit the nomination structure at the hour of joining the association. Accordingly, on the off chance that you don't know about submitting the nomination structure, then, at that point, you might check with your manager on the same.

Gratuity Rules, 1972-1

The Central Government sets the following nomination rules in the righteousness of the power given by subsection (1) of section 15 of the Payment of Gratuity Act, 1972 (39 of 1972).

1. A nomination will be in Form 'F' and submitted in copy by personal service by the worker, in the wake of taking appropriate receipt or by sending through registered post acknowledgment due on the business, on in the case of a worker who is already in employment for a year or more on the date of initiation of these guidelines, usually, within ninety days from such date, and in the case of a worker who completes one year of service after the date of initiation of these guidelines, commonly within thirty days of the finishing of one year of service:

Given that nomination in Form 'F' will be accepted by the business after the predefined period, whenever recorded with sensible justification for delay, and no nomination so accepted will be invalid simply on the grounds that it was documented after the predetermined period.

2. Within thirty days of the receipt of nomination in Form 'F' under sub-rule (1), the business will get the service particulars of the worker, as referenced in nomination, verified regarding the records of the foundation and return to the worker, subsequent to acquiring a receipt thereof, the copy of the nomination form 'F' appropriately validated either by the business or an official approved for this role by him, as a token of recording of the nomination by the business and the other copy of the nomination will be recorded.

3. A worker who has no family at the hour of making a nomination will, within ninety days of gaining a family submit in the way indicated in sub-rule (1), a new nomination, as needed under sub-section (4) of section 6, copy in Form 'G' to the business and from that point, the provisions of sub-rule (2) will apply mutatis mutandis as though it was made under sub-rule (1).

4. A notice of modification of a nomination, including situations where a nominee predeceases a worker, will be submitted in copy in Form 'H' to the business in the way determined in sub-rule (1), and from there on the provisions of sub-rule (2) will apply mutatis mutandis.

5. A nomination or a new nomination or a notice of change of nomination will be signed by the worker or on the other hand, if illiterate, will bear his thumb impression, within the sight of two witnesses, who will likewise sign a declaration with that impact in the nomination, new nomination or notice of modification of nomination, accordingly.

6. A nomination, new nomination, or notice of modification of nomination will produce results from the date of receipt thereof by the business.

Form F

A nomination shall be in the given format and submitted in duplicate by personal service by the employee, after taking proper receipt or by sending through registered post acknowledgement due to the employer.

Due date for accepting nomination is ;

(i) in the case of an employee who is already in employment for a year or more on the date of commencement of these rules, ordinarily, within 90 days from such date, and

(ii) in the case of an employee who completes one year of service after the date of commencement of these rules, ordinarily within 30 days of the completion of one year of service:

FORM ‘F’

[See sub-rule(1) of rule 6]

Nomination

T o ..................................................................................................................

[Give here name or description of the establishment with full address]

I, Shri/ Shrimati/ Kumari.....................whose particulars are given in the statement below,

[Name in full here]

hereby nominate the person(s) mentioned below to receive the gratuity payable

after my death as also the gratuity standing to my credit in the event of my death before that amount has become payable, or having become payable has not been paid and direct that the said amount of gratuity shall be paid in proportion indicated against the name(s) of the nominee(s).

2. I hereby certify that the person(s) mentioned is a/ are member(s) of my family within the meaning of clause (h) of section (2) of the Payment of Gratuity Act, 1972.

3. I hereby declare that I have no family within the meaning of clause (h) of section (2) of the said Act.

4. (a) My father/ mother/ parents is / are not dependant on me.

(b) my husband’s father/ mother/ parents is/ are not dependant on my husband.

5. I have excluded my husband from my family by a notice date the ...... to the controlling authority in terms of the proviso to clause (h) of section 2 of the said Act.

6. Nomination made herein invalidates my previous nomination.

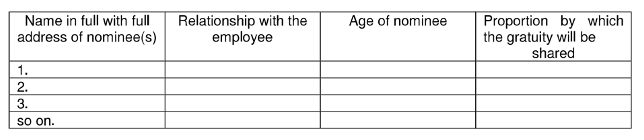

Nominee(S)

Proportion by which the gratuity will be shared

Statement

- Name of employee in full

- Sex

- Religion

- Whether unmarried/ married/ widow/ widower

- Department/ Branch/ Section where employed

- Post held with Ticket or Serial No., if any

- Date of appointment

- Permanent address

Village....................Thana......................Sub-division..................Post Office...

Place Signature/ Thumb impression

of the employee

Date

Declaration by witnesses

Nomination signed/ thumb impressed before me Signature of witnesses

Name in full and full

- 1.

- 2.

Place

Date

Certificate by the employer

Certified that the particulars of the above nomination have been verified and recorded in this establishment.

Employer’s Reference No., if any

Signature of the employer/ Officer authorized

Date Designation

Name and address of the Establishment or rubber stamp thereof

Acknowledgement by the employee

Received the duplicate copy of nomination in Form ‘F’ filed by me and duly certified by the employer.

Date Signature of the employee

Would gratuity nomination be able to supersede the beneficiary mentioned in the will?

In case of the demise of a worker, the guidelines regarding gratuity payments are extensively like those governing payment of EPF benefits. If you pass your EPF proceeds to anybody other than the characterized family, then, at that point, it is impossible that they would be qualified for the returns as that isn't considered under the EPF Scheme.

Where a nomination is legitimately made, the nominee just holds the assets on behalf of the lawful successors to the deceased worker - subsequently, upon receipt of gratuity funds, the candidate legitimately will pay the same as per a will general succession laws. In any case, in the event an individual nominates somebody else 'family' (as characterized under the Gratuity Act), such nomination will be invalid, and the individual would not be qualified to get the Gratuity proceeds regardless of whether they are a recipient under a will.

New rules with respect to the gratuity of central government workers

The union government of India has as of late advised the Central Civil Services (Payment of Gratuity under National Pension System) Rules, 2021 for the central government workers including civilian government workers for the Defense Services, who were selected on or after January 1, 2004.

Regulation of claims to gratuity incorporates, any claim to gratuity will be controlled by the provisions of these principles in power when a government worker retires or is retired or is released or is permitted to leave service or dies, according to the situation.

Additionally, the day on which a government worker retires or is retired or is released or is permitted to leave service, according to the situation, will be treated as his last working day and the date of death of a Government worker will likewise be treated as a working day.

The retirement gratuity will be equivalent to 1/fourth of the worker’s remittances for each finished 6 monthly periods of qualifying service, dependent upon a limit of 16½ times the payments. The amount of retirement gratuity or demise gratuity payable under the rule won't surpass Rs. 20 lakh.

Wrapping Up

Gratuity is a sum that is paid by the business to the worker. A worker will be qualified to get the gratuity if he/she serves the organization for 5 years or more, under the Payment of Gratuity Act, 1972. Gratuity gets its term from the word gratitude, and it is paid in a lump sum amount by the business. A worker will get the gratuity upon his/her Retirement, Resignation, Demise, Disablement because of a mishap or a sickness, VRS, Termination, or Lay off.

Key Takeaways

- A government worker is qualified for tax-free gratuity. Then again, for managers who are covered under the Payment of Gratuity Act, only the last drawn compensation of 15 days will be absolved from the annual income tax from the workers.

- The act applies to all manufacturing lines, mines, oilfields, manors, ports, and railway organizations. In any case, on account of shops or foundations, other than those mentioned previously, it applies to those associations with at least 10 workers on any day of the preceding year.

- Suspension from service o a worker for any period on the closure of the unit or in any case does not influence the continuity of service.

- The worker becomes qualified for gratuity after his/her finish of 5 years of service with one business. In the event of death or disablement, the prerequisite of the minimum qualifying period has been totally deferred.

Related Articles