Gratuity is a financial advantage a business gives to its employees for the administration delivered to the organization. It is paid at the hour of retirement or retirement, given that the employee has finished no less than 5 years of assistance before leaving the organization.

In specific conditions, for example, demise or disablement, the standard of 5 years is relaxed. We will learn a little more about the Payment of Gratuity Act 1972 and the Notice of Change act. For your reference, we have also added the replica of the form in the article. So, let’s get started!

What will you learn in this article?

- The Payment of Gratuity Act of 1972

- Purpose of the act

- Extent of the act

- Eligibility for payment of gratuity

- Filing nomination

- Amount of gratuity

- Recovery of gratuity

- Form B: Notice of Change

- Penalties

- Cognizance of offenses

- How can Deskera assist you?

The Payment of Gratuity Act 1972

Purpose of the Act

The Payment of Gratuity Act 1972 is an Act to provide a scheme for the payment of gratuity to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops, or other establishments for matters connected in addition to that or incidental.

The Extent of the Act

The act extends to the whole of India provided that in so far as it relates to plantations or ports, it shall not extend to the State of Jammu and Kashmir. It shall apply to:

(a) every factory, mine, oilfield, plantation, port, and the railway company.

(b) every shop or establishment within the meaning of any law for the time being in force about shops and establishments in a State, in which ten or more persons are employed, or were employed, on any day of the preceding twelve months.

(c) such other establishments or class of establishments, in which ten or more employees are employed, or were employed, on any day of the preceding twelve months, as the Central Government may, by notification, specify on this behalf.

A shop or establishment to which this Act has become applicable shall continue to be governed by this Act, notwithstanding that the number of persons employed therein at any time after it has become so applicable falls below ten. It shall come into force on such date as the Central Government may, by notification.

Eligibility Criteria for Gratuity Payment

Here are a few conditions that qualify an employee for gratuity payment:

- An employee shall be said to be in continuous service for a period if he has, for that period, been in uninterrupted service, including service which may be interrupted on account of sickness, accident, leave, absence from duty without leave treating the absence as a break in service has been passed by the standing orders, rules or regulations governing the employees of the establishment.

- Lay-off, strike or a lock-out or cessation of work not due to any fault of the employee, whether such uninterrupted or interrupted service was rendered before or after the commencement of this Act.

- For any period of one year or six months, he shall be deemed to be in continuous service under the employer

(a) For the said period of one year, if the employee during the period of twelve calendar months preceding the date with reference to which calculation is to be made, has actually worked under the employer for not less than

i) One hundred and ninety days, in the case of an employee employed below the ground in a mine or in an establishment that works for less than six days in a week.

(ii) Two hundred and forty days, in any other case

(iii) Period of six months, if the employee during the period of six calendar months preceding the date with reference to which the calculation is to be made, has actually worked under the employer for not less than ninety-five days, in the case of an employee employed below the ground in a mine or in an establishment which works for less than six days in a week; and one hundred and twenty days, in any other case.

iv) Gratuity shall be payable to an employee on the termination of his employment after he has rendered continuous service for not less than five years:

(a) on his superannuation

(b) on his retirement or resignation

(c) on his death or disablement due to accident or disease

Provided that the completion of continuous service of five years shall not be necessary where the termination of the employment of any employee is due to death or disablement.

Provided further that in the case of death of the employee, gratuity payable to him shall be paid to his nominee or, if no nomination has been made, to his heirs, and where any such nominees or heirs is a minor, the share of such minor shall be the controlling authority who shall invest the same for the benefit of such minor in such bank or other financial institution, as may be prescribed, until such minor attains majority.

Compulsory Insurance

With effect from such date as may be notified by the appropriate Government in this behalf, every employer, other than an employer or an establishment belonging to, or under the control of, the Central Government or a State Government, shall, subject to the provisions of sub-section 2.

Obtain insurance in the manner prescribed, for his liability for payment towards the gratuity under this Act, from the Life Insurance Corporation of India, established under the Life Insurance Corporation of India Act, 1956 (31 of 1956) or any other prescribed insurer.

Provided that different dates may be appointed for different establishments or class of establishments or different areas. The appropriate Government may, subject to such conditions as may be prescribed, exempt every employer who has already established an approved gratuity fund in respect of his employees and who desires to continue such arrangement.

Every employer employs five hundred or more persons who establish an approved gratuity fund in the manner prescribed from sub-section 1. For the purpose of effectively implementing the provisions of this section, every employer shall, within such time as may be prescribed get his establishment registered with the controlling authority in the prescribed manner.

No employer shall be registered under the provisions of this section unless he has taken insurance referred to in sub-section 1 or has established an approved gratuity fund referred to in sub-section.

The appropriate Government may, by notification, make rules to give effect to the provisions of this section and such rules may provide for the composition of the Board of Trustees of the approved gratuity fund and for the recovery by the controlling authority of the amount of the gratuity payable to an employee from the Life Insurance Corporation of India or any other insurer with whom insurance has been taken under sub-section, or as the case may be, the Board of Trustees of the approved gratuity fund.

Where an employer fails to make any payment by way of premium to the insurance referred to in sub-section 1 or by way of contribution to an approved gratuity fund referred to in subsection 2, he shall be liable to pay the amount of gratuity due under this Act including interest, if any, for delayed payments forthwith to the controlling authority.

Whoever contravenes the provisions of sub-section 5 shall be punishable with a fine which may extend to ten thousand rupees and in the case of a continuing offense with a further fine which may extend to one thousand rupees for each day during which the offense continues.

Power to Exempt

The appropriate Government, may, by notification, and subject to such conditions as may be specified in the notification, exempt any establishment, factory, mine, oilfield, plantation, port, railway company, or shop to which this Act applies from the operation of the provisions of this Act if, in the opinion of the appropriate Government, the employees in such establishment, factory, mine, oilfield, plantation, port, railway company or shop are in receipt of gratuity or pensionary benefits not less favorable than the benefits conferred under this Act.

The appropriate Government may, by notification and subject to such conditions as may be specified in the notification, exempt any employee or class of employees employed in any establishment, factory, mine, oilfield, plantation, port, railway company, or shop to which this Act applies from the operation of the provisions of this Act, if, in the opinion of the appropriate Government, such employee or class of employees receive gratuity or pensionary benefits not less favorable than the benefits conferred under this Act.

Filing Nomination

Each employee, who has completed one year of service, shall make, within such time, in such form and such manner, as may be prescribed, nomination for the second proviso to sub-section 1 of section 4.

An employee may, in his nomination, distribute the amount of gratuity payable to him under this Act amongst more than one nominee. Suppose an employee has a family at the time of making a nomination.

In that case, the nomination shall be made in favor of one or more members of his family, and any nomination made by such an employee in favor of a person who is not a member of his family shall be void.

If at the time of making a nomination the employee has no family, the nomination may be made in favor of any person or persons. Still, if the employee subsequently acquires a family, such nomination shall immediately become invalid.

The employee shall make, within such time as may be prescribed, a fresh nomination in favor of one or more members of his family. A nomination may, subject to the provisions of sub-sections 3 and 4, be modified by an employee at any time after giving to his employer a written notice in such form and such manner as may be prescribed of his intention to do so.

If a nominee predeceases the employee, the nominee's interest shall revert to the employee who shall make a fresh nomination, in the prescribed form, in respect of such claim.

As the case may be, every nomination, fresh nomination, or alteration of nomination shall be sent by the employee to his employer, who shall keep the same in his safe custody.

Amount of Gratuity

A person who is eligible for payment of gratuity under this Act or any person authorized, in writing, to act on his behalf shall send a written application to the employer, within such time and in such form, as may be prescribed, for payment of such gratuity.

As soon as gratuity becomes payable, the employer shall, whether referred to in sub-section 1 has been made or not. In that case, determine the amount of gratuity and give notice in writing to the person to whom the gratuity is payable and also to the controlling authority specifying the amount of gratuity so determined.

The employer shall arrange to pay the amount of gratuity within thirty days from the date it becomes payable to the person to whom the gratuity is payable. If the amount of gratuity payable under subsection 3 is not paid by the employer within the period specified in sub-section 3.

The employer shall pay, from the date on which the gratuity becomes payable to the date on which it is paid, simple interest at such rate, not exceeding the rate notified by the Central Government from time to time for repayment of long-term deposits, as that Government may, by notification specify.

Provided that no such interest shall be payable if the delay in the payment is due to the employee's fault and the employer has obtained permission in writing from the controlling authority for the delayed payment on this ground.

Suppose there is any dispute as to the amount of gratuity payable to an employee under this Act or as to the admissibility of any claim of, or in relation to, an employee for payment of gratuity or as to the person entitled to receive the gratuity. In that case, the employer shall deposit with the controlling authority such amount as he admits to being payable by him as gratuity.

Recovery of Gratuity

If the amount of gratuity payable under this Act is not paid by the employer, within the prescribed time, to the person entitled thereto, the controlling authority shall, on an application made to it in this behalf by the aggrieved person, issue a certificate for that amount to the Collector, who shall recover the same, together with compound interest thereon 1 at such rate as the Central Government may, by notification, specify, from the date of expiry of the prescribed time, as arrears of land revenue and pay the same to the person entitled.

The controlling authority shall, before issuing a certificate under this section, give the employer a reasonable opportunity to show cause against the issue of such certificate. Provided further that the amount of interest payable under this section shall, in no case, exceed the amount of gratuity payable under this Act.

Form B: Notice of Change

Within thirty days of the rules becoming applicable to an establishment, a notice in Form ‘A’ shall be submitted by the employer to the controlling authority of the area. The employer shall submit a notice in Form ‘B’ to the controlling authority of the area within thirty days of any change in the name, address, employer, or nature of business.

Replica of Form B of Change:

Place: Signature of the employer:

Date with name and designation:

To,

The Controlling Authority ................................................ ................................................

FORM ‘B’

NOTICE OF CHANGE

Take notice that the following changes have taken place with effect from .....................in the particulars furnished by me in a notice dated ..................................... on Form ‘A.’

Penalties

Whoever, for the purpose of avoiding any payment to be made by himself under this Act or of enabling any other person to avoid such payment, knowingly makes or causes to be made any false statement or false representation shall be punishable with imprisonment for a term which may extend to six months, or with fine which may extend to 3 ten thousand rupees, or with both.

An employer who contravenes, or makes default in complying with, any of the provisions of this Act or any rule or order made thereunder shall be punishable with imprisonment for a term which shall not be less than three months but which may extend to one year, or with fine which shall not be less than ten thousand rupees but which may extend to twenty thousand rupees, or with both.

Provided that where the offence relates to non-payment of any gratuity payable under this Act, the employer shall be punishable with imprisonment for a term which shall not be less than 5, six months but which may extend to two years unless the court trying the offence, for reasons to be recorded by it in writing, is of opinion that a lesser term of imprisonment or the imposition of a fine would meet the ends of justice.

Cognizance of Offences

No court shall take cognizance of any offence punishable under this Act save on a complaint made by or under the authority of the appropriate Government. Provided that where the amount of gratuity has not been paid, or recovered, within six months from the expiry of the prescribed time.

The appropriate Government shall authorize the controlling authority to make a complaint against the employer, whereupon the controlling authority shall, within fifteen days from the date of such authorization, make such complaint to a magistrate having jurisdiction to try the offence.

How Can Deskera Assist You?

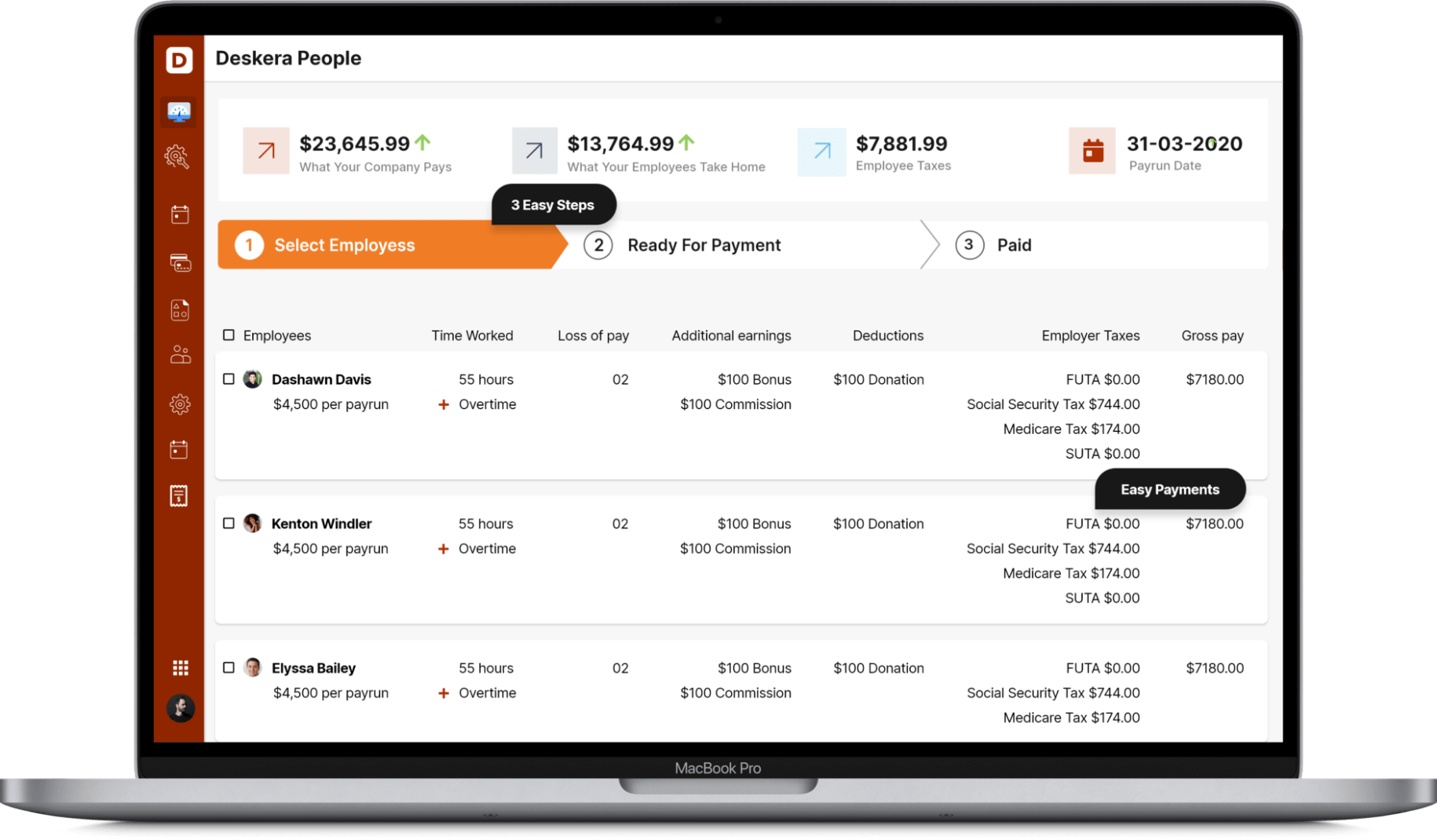

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each grid column, it is easier to get the information you want.

Key Takeaways

- Gratuity is a financial advantage a business gives its employees for the administration delivered to the organization.

- Payment of Gratuity Act 1972 is an Act to provide a scheme for the payment of gratuity to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops, or other establishments.

- The act extends to the whole of India, provided that in so far as it relates to plantations or ports, it shall not extend to the State of Jammu and Kashmir.

- The employer shall submit a notice in Form ‘B’ to the controlling authority of the area within thirty days of any change in the name, address, employer, or nature of business.

Related Articles