Paying bonus as an employer in India first happened during the First World War. In certain cases of industrial disputes demand for payment of bonus was also included. In 1950, the Full Bench of the Labour Appellate evolved a formula for determination of bonus. A plea was made to raise that formula in 1959.

An Act to provide for the payment of bonus to persons employed in certain establishments on the basis of profits or on the basis of production or productivity and for matters connected therewith.

In this article we will discuss Form A of computation of Allocable Surplus. Let’s get started!

This article covers the following:

- What you must know about the payment of bonus act?

- What is allocable surplus?

- Stepwise guide to computation of allocable surplus.

- How can Deskera assist you?

What You Must Know About The Payment of Bonus Act?

- It extends to the whole of India

- It shall apply to:

(a) Every factory

(b) Every other establishment in which twenty or more persons are employed on any day during an accounting year. Provided that the appropriate Government may, after giving not less than two months’ notice of its intention so to do, by notification in the Official Gazette, apply the provisions of this Act with effect from.

Such accounting year as may be specified in the notification, to any establishment or class of establishment including an establishment being a factory within the meaning of sub-clause (ii) of clause (m) of section 2 of the Factories Act, 1948

Employing such number of persons less than twenty as may be specified in the notification; so, however, that the number of persons so specified shall in no case be less than ten.

Save as otherwise provided in this Act, the provisions of this Act shall, in relation to a factory or other establishment to which this Act applies, have effect in respect of the accounting year commencing on any day in the year 1964 and in respect of every subsequent accounting year:

In payment of bonus act, computation of allocable surplus is one of its sections that we are going to discuss in the article today and what it means for you as a business owner.

What is Allocable Surplus?

Bonus payable under the Act is linked with profits. The employer has to calculate "gross profits" of his establishment in the manner specified in section 4. Then, from "gross profits" so calculated he has to deduct the sums referred to in section 6 as prior charges.

The balance is called "available surplus". A percentage of the available surplus calculated in accordance with the provisions of sub-section (4) of section 2 is called "allocable surplus."

Where, in respect of any year the allocable surplus exceeds the amount of minimum bonus payable to the employees' the employer must pay to every employee in respect of that year bonus in proportion to the salary or wage earned by the employee during the year subject to a maximum of twenty per cent of such salary or wage.

Provided that the available surplus in respect of the accounting year commencing on any day 1968 and in respect of every subsequent accounting year shall be the aggregate of-

(a) the gross profits for that accounting year after deducting therefrom the sums referred to in section 6; and

(b) an amount equal to the difference between

(i) the direct tax, calculated in accordance with the provisions of section 7, in respect of an amount equal to the gross profits of the employer for the immediately preceding accounting year; and

(ii) the direct tax, calculated in accordance with the provisions of section 7, in respect of an amount equal to the gross profits of the employer for such preceding accounting year after deducting therefrom the amount of bonus which the employer has paid or is liable to pay to his employees in accordance with the provisions of this Act for that year.

Set on and set off of allocable surplus:

1) Where for any accounting year, the allocable surplus exceeds the amount of maximum bonus payable to the employees in the establishment under section 11, then, the excess shall, subject to a limit of 20% of the total salary or wage of the employees employed in the establishment in that accounting year, be carried forward for being set on in the succeeding accounting year and so on up to and inclusive of the fourth accounting year to be utilized for the purpose of payment of bonus in the manner illustrated in the Fourth Schedule.

2) Where for any accounting year, there is no available surplus or the allocable surplus in respect of that year falls short of the amount of minimum bonus payable to the employees in the establishment under section 10, and there is no amount of sufficient amount carried forward and set on under sub-section.

a) Which could be utilized for the purpose of payment of the minimum bonus, then, such minimum amount or the deficiency, as the case may be, shall be carried forward for being set off in the succeeding accounting year and so on up to and inclusive of the fourth accounting year in the manner illustrated in the Fourth Schedule.

3) The principle of set on and set off as illustrated in the Fourth Schedule shall apply to all other cases not covered by sub-section

a) or sub-section for the purpose of payment of bonus under this Act.

4) Where in any accounting year any amount has been carried forward and set on or set off under this section, then, in calculating bonus for the succeeding accounting year, the amount of set on or set off carried forward from the earliest accounting year shall first be taken into account.

In the first five accounting years, after the establishment has started selling and manufacturing goods or rendering services, it has to pay bonuses only in case of profits.

However, in the sixth, seventh and eighth accounting year, after the establishment has started selling and manufacturing goods or rendering services, the bonus shall be paid, taking into account the set on or set off.

In the case of the sixth year, the allocable surplus of the fifth and the sixth year would be taking into account and in the case of the seventh year, the allocable surplus of the sixth and the seventh year is taken into consideration.

Highlights of the Act

If the employer has paid any puja bonus or any other customary bonus or has paid the bonus before the date on which the bonus becomes payable, then, in that case, the employer has the right to deduct the amount of bonus from the actual bonus payable, and the employee shall get the remaining amount.

Under the provisions of this Act, the employees must be awarded the bonus within 8 months from the closure of the accounting year. However, in cases of disputes (under the purview of the Industrial Dispute Act), the bonus has to be paid within 1 month from the time when the settlement becomes effective.

If any public establishment manufactures or sells any product or renders any services and the income from them is less than 20% of the gross income of such public establishment then the provisions of this Act shall apply to it in the same manner as if it is a private establishment.

However, except for the above case, the provisions of this Act would not be applicable to the employees working in the public establishment.

In case of any amount of the bonus which is due from an employer, the employee can or any of his assignees or in case of his death his heirs, have the right to make an application to the government and if it is satisfied with the veracity of the application then it shall issue a certificate to the collector who shall proceed to recover the amount in the like manner as if it were an arrear of land revenue.

However, such an application must be within one year after the payment has become due, if the application is made after the expiry one year and the government is satisfied with the reasons for doing so, then that application could be entertained.

Dispute Under the Act

In case of any dispute between the employee and the employer, that shall be treated as an industrial dispute within the meaning of Industrial Dispute Act or any other Act which is dedicated to the investigation and settlement of the disputes of like nature. Such law shall be applied as expressed.

The disputes falling under the purview of the Industrial Dispute Act or any other law dedicated to the investigation and settlement of the disputes of like nature would be referred to an arbitrator or a tribunal in accordance with the above-mentioned laws.

If the balance sheet or the profit and loss account of the corporations or the companies are audited by the Auditor General of India or any other auditor who is empowered to do so under the Companies Act, then there is no need to file an affidavit to prove its accuracy.

However, if the tribunal or the arbitrator is certain about the inaccuracy of the balance sheet or the profit and loss account then it can take any steps that it deems necessary to find out the accuracy of the balance sheet and the profit and loss accounts.

The trade unions or the employees, being a party to the dispute, can file an application to the authority for any clarification in the balance sheet or the profit and loss statement.

The authority, after satisfying itself about the need for such clarifications, would further direct the company and corporation to tender the required clarification to the other party.

The disputes falling under the purview of the Industrial Dispute Act or any other law dedicated to the investigation and settlement of the disputes of like nature would be referred to an arbitrator or a tribunal in accordance with the above-mentioned laws.

If the balance sheet or the profit and loss account of the corporations or the companies are audited by the Auditor General of India or any other auditor who is empowered to do so under the Companies Act, then there is no need to file an affidavit to prove its accuracy.

However, if the tribunal or the arbitrator is certain about the inaccuracy of the balance sheet or the profit and loss account then it can take any steps that it deems necessary to find out the accuracy of the balance sheet and the profit and loss accounts.

The trade unions or the employees, being a party to the dispute, can file an application to the authority for any clarification in the balance sheet or the profit and loss statement.

The authority, after satisfying itself about the need for such clarifications, would further direct the company and corporation to tender the required clarification to the other party.

In case of the dispute (as per Section 22 of the Act), where one of the party is a banking company and it has rendered its account, to the authority which is duly audited, the trade union or the employee which is the other party has no authority to question the accuracy of the accounts.

However, it can ask for information to verify the amount of bonus. The trade union or the employee cannot ask for any information which the banking company is not obliged to give as per the banking regulations Act.

In case of a dispute between an employee and the other party not being a corporation or company and if it has tendered an account which is duly audited by an auditor empowered to do so under the Companies Act, 2013 then Section 23 of the Act would be applicable.

If however the accounts are not audited and the said authority thinks that it is necessary to have an audited account for making a decision, then it can direct the employer to get the accounts audited by the specified time.

If the employer fails to get the accounts audited then, in that case, the authority itself can get the accounts audited by the auditor and the authority is also entitled to levy punishments in accordance with Section 28 of this Act.

The expenses incurred by the authority, in this case, shall be recoverable from the employer and if the employer does not pay the expenses then it would be recovered as per Section 21 of the Act.

Maintenance of Records

Every employer is responsible to maintain records and register in the manner as it is prescribed in the provisions of this Act.

Inspectors

The government by way of notification in the official gazette may appoint a person to be an inspector under the provision of this Act.

The inspector can enter any premises at a reasonable time and ask for an examination of the accounts. The employer is legally bound to furnish the information asked by the inspector.

Penalty

If any person contravenes a provision of this Act or fails to comply with any of the directions made under this Act, it would be punishable for imprisonment which shall extend up to 6 months or fine up to ₹ 1000 or both.

Offences by companies

If any offence is committed under the provisions of this Act and the offence is committed by the company, then everyone who is in charge of the company or responsible for the affairs of this company would be liable and could be proceeded against. However, if the offence has been committed while taking all due diligence or the offence so committed was beyond the knowledge of the person, then such person shall not be punishable under this Act.

However, if the offence so committed was in the knowledge of the director, manager, secretary or officer of the company then such person shall be liable and can be punished accordingly.

Cognizance of offences

No court shall take cognisance of the offence committed under this Act except there is a complaint by or under the authority of the government or by an officer of the government not below the rank of the regional labour commissioner or labour commissioner in the central and the state government respectively.

Moreover, the court under which such complaints would be filed shall not below the court of presidency magistrate or magistrate of the first class. The government and the government officers are protected from any suit or any other legal proceedings against them for their actions done in good faith in pursuance of the provision of the given Act.

Under the given Act, the procedure for the computation of the bonus has been delineated, however, in certain circumstances, the payment of the bonus is linked with the productivity and production of the given employee.

Such an arrangement will take place when there is any settlement or agreement between the employer and the employee in this regard.

The Act Does Not Apply to The Following

- Life Insurance Corporation,

- The Indian Red Cross Society or any other institution of a like nature,

- Universities and other educational institutions,

- Institutions (including hospitals, chambers of commerce and social welfare institutions) established not for purposes of profit,

- Employees employed through contractors on building operations,

- Employees employed by the Reserve Bank of India,

- The Industrial Finance Corporation of India,

- Financial Corporations,

- the National Bank for Agriculture and Rural Development,

- the Unit Trust of India,

- the Industrial Development Bank of India,

- Employees of inland water transport establishment passing through another country.

Effect of laws and agreement inconsistent with the Act

With regards to the Section 31A of the Act, the provisions of this Act shall apply even if there is an inconsistency with any other law in force at that time or with respect to any agreement or settlement.

Saving

The provisions of this Act would not be applicable to the Coal Mines, Provident Fund and Bonus Schemes Act, 1948.

Power of exemption

If the central government finds it necessary in the public interest to prevent the application of a certain provision of this Act in certain establishment or class of establishment then it may, through the notification in the official gazette, specify the time for which the application of those provisions would be ceased for that particular establishment or class of establishment

Power to make rules

The central government has the power to make rules with regard to the provisions of this Act. The government can make rules with respect to the accounting year, maintenance of records and registers, working of the inspectors under this actor any other matter which may be prescribed.

The new rule shall be presented before each house of the parliament while it is in the session and if both the house have agreed that the rule shall be applicable or shall be applied will have the same effect accordingly. However, any modification or annulment made shall not be contrary to the rule previously made.

Application of certain laws not barred

Certain enactments like the Industrial Dispute Act, 1947 or any other statutory provision dedicated to the investigation and settlement of the dispute in the distribution of the be applicable in such cases. The applicability of the given legislation does not in any way bar the relevancy of other statutes.

Stepwise Guide Computation of Allocable Surplus

Computation of the Allocable surplus under section 2(4) of Bonus Act

Step 1 – Calculate Gross Profit as per Second Schedule

COMPUTATION OF GROSS PROFITS

Item No. Particulars Amount (Rs.)

1- Net Profit as per Profit and Loss Account.

2- Add back provision for:

(a) Bonus to employees.

(b) Depreciation.

(c) Direct Taxes, including the provision (if any) for previous accounting years-

3- Add back also:

(a) Bonus paid to employees in respect of previous accounting years. The amount debited in respect of gratuity paid or payable to employees in excess of the aggregate of

(i) the amount, if any, paid to, or provided for payment to, an approved gratuity fund; and

(ii) the amount actually paid to employees on their retirement or termination of their on employment for any reason.

(b) Donations in excess of the amount admissible for income tax.

(c) Any annuity due, or commuted value of any annuity paid, under the provisions of section 280D of the Income-tax Act during the accounting year.

(d) Capital expenditure (other than capital expenditure on scientific research which is allowed as a deduction under any law for the time being in force relating to direct taxes) and capital losses (other than losses on sale of capital assets on which depreciation has been allowed for income-tax or agricultural income tax).

(e) Losses of, or expenditure relating

(1) to, any business situated outside India. Total of Item No. 3.

4- Add also income, profits or gains (if any) credited directly to reserves, other than -

(i) capital receipts and capital profits (including profits on the sale of capital assets on which depreciation has not been allowed for income-tax or agricultural income-lax).

(ii) profits of, and receipts relating to, any India.

(iii) income of foreign concerns from investments outside India. Net total of Item No. 4

5- Total of Item Nos. 1, 2, 3 and 4

6- Deduct

(a) Capital receipts and capital profits

(b) Profits of, and receipts relating to, any business situated outside India.

(c) Income of foreign concerns from investments outside India.

(d) Expenditure or losses (if any) debited directly to reserves, other than-

(i) capital expenditure and capital losses (other than losses on sale of capital assets on which depreciation has not been allowed for income-tax or agricultural income-tax;

(ii) losses of any business situated outside India.

(e) In the case of foreign concerns proportionate (over-head) expenses of Head Office business.

(f) Refund of any direct tax paid for previous accounting years and excess provision, if any, of previous accounting years relating to bonus, depreciation, taxation or development rebate or development allowance, if written back.

Refund of any direct tax paid for previous accounting years and excess provision, if any, of previous accounting years relating to bonus, depreciation, taxation or development rebate or development allowance, if written back.

(g) Cash subsidy, if any, given by the Government or by any body corporate established by any law for the time being in force or by any other agency through budgetary grants, whether given directly or through any agency for specified purposes and the proceeds of which are reserved for such purposes.

Total of Item No. 6. Gross Profit for purposes of bonus (Item No. 5 minus Item No. 6)

Things to Remember

(1) If, and to the extent, charged to Profit and Loss Account.

(2)If, and to the extent, credited to Profit and Loss Account.

(3)In the proportion of Indian Gross Profit (Item No. 7) to Total World Gross Profit (as per Consolidated Profit and Loss Account, adjusted as in Item No.2 above only)

Step 2 – Calculate Depreciation Under Section 6

(a) It is depreciation admissible in accordance with the provisions of sub-section

(1) of section 32 of the Income-tax Act.

Step 3 – Calculate Development Rebate or Development Allowance Section 6

It is development rebate or investment allowance or development allowance which the employer is entitled to deduct from his income under the income-tax Act.

Step 4 – Calculate Direct Taxes payable by Employer

It is any direct tax which the employer is liable to pay for the accounting year in respect of his income, profits and gains during that year as per Income Tax Act.

Step 5 – Calculate sum as specified under the third schedule to the Act Particulars Amt (Rs.)

1- Company, other than a Banking Company:

(i) The dividends payable on its preference share capital for the accounting year calculated at the actual rate at which such dividends are payable.

(ii) 8.5 per cent of its paid up equity share capital as the commencement of the accounting year.

(iii) 6 per cent of its reserves shown in its balance-sheet as at the commencement of the accounting year, including any profits carried forward from the previous accounting year:

Provided that where the employer is a foreign company within the meaning of section 591 of the Companies Act, 1956 (1 of 1956), the total amount to be deducted under this Item shall be 8.5 per cent, on the aggregate of the value of the net fixed assets and the current assets of the company in India.

After deducting the amount of its current liabilities (other than any amount shown as payable by the company to its Head Office whether towards any advance made by the Head Office or otherwise or any interest paid by the company to its Head Office) in India.

2- Any other employer not being Banking Co., Corporation or Co-operative society 8.5 per cent, of the capital invested by him in his establishment as evidenced from his books of accounts at the commencement of the accounting year:

Provided that where such employer is a person to whom Chapter XXII-A of the Income-tax Act applies, the annuity deposit payable by him under the provisions of that Chapter during the accounting year shall also be deducted.

3- Where such employer is a firm an amount equal to 25 per cent, of the gross profits derived by it from the establishment in respect of the accounting year after deducting depreciation in accordance with the provisions of clause

(a) of section 6 by way of remuneration to all the partners taking part in the conduct of business of the establishment shall also be deducted, but where the partnership agreement, whether oral or written, provides for the payment of remuneration to any such partner.

(i) the total remuneration payable to all such partners is less than the said 25 per cent, the amount payable, subject to a maximum of forty-eight thousand rupees to each such partner; or

(ii) the total remuneration payable to all such partners is higher than the said 25 per cent, such percentage, or a sum calculated at the rate of forty-eight thousand rupees to each such partner, whichever is less, shall be deducted under this provision.

(iii) forty-eight thousand rupees, whichever is less, by way of remuneration to such employer, shall also be deducted.

4- Where such employer is an individual or a Hindu undivided family

(i) an amount equal to 25 per cent, of the gross profits derived by such employer from the establishment in respect of the accounting year after deducting depreciation in accordance with the provisions of clause

(a) of section 6; or (ii) forty-eight thousand rupees, whichever is less, by way of remuneration to such employer, shall also be deducted.

Explanation- The expression “reserves” shall not include any amount set apart for the purpose of

(i) payment of any direct tax which, according to the balance-sheet, would be payable;

(ii) meeting any depreciation admissible in accordance with the provisions of clause (a) of section 6.

(iii) payment of dividends which have been declared, but shall include:

(a) any amount, over and above the amount referred to in clause (i) of this Explanation, set apart as specific reserve for purpose of payment of any direct lax.

(b) any amount set apart for meeting any depreciation in excess of the amount admissible in accordance with the provisions of clause (a) of section 6.

FAQs

Should we pay bonus to contractual employees?

No, it is not the prerogative of the employer to pay bonus to the contractors working under him. The bonus liability lies with the vendor who has contracted out the employees.

Some employers pay out bonus to their contractors for their welfare on goodwill when the vendor is unable to pay out the bonus. This is considered ex-gratia and not bonus and is the discretion of the employer in this case and he is not legally bound to pay bonus to his contractors.

If I own a startup, should I pay out bonus for my employees in the first year?

For the first 5 years, organizations need not pay bonus if they have made losses. If they have made profits in any year in the first 5-year period, they will have to pay out bonus for that particular year.

After the completion of 5 years, organizations are required to pay bonus as per Sec 16-1b, irrespective of whether they are making a profit or loss. Refer to section 16-1b for detailed clarifications on the calculation of bonus in the 6th accounting year and the 10th accounting year.

How do we settle bonus if an employee exits the organization before the completion of the financial year?

Bonus needs to be paid as part of the settlement to the employee, when he exits, on a pro-rata basis. If the bonus percentage is later increased due to increase in profits, then the difference in the bonus amount needs to be transferred to the employee or a cheque sent before Nov 30th of that year.

It is important to ensure that this is done as any amount due to be paid to any employee and not paid will appear on the liability side of the balance sheet of the employer and will be considered as non-compliance.

I have paid bonus, but have not maintained records for it. Would it cause a problem?

This will be deemed non-compliance and will be checked during labor inspection. It is mandatory to maintain Forms A, B, C and D as required.

What are compliance requirements to be satisfied by the employer with respect to payment of bonus act?

Form A – The computation of allocable surplus.

Form B – The set-on and set-off of the allocable surplus.

Form C – Details showing the amount of bonus due, deductions and actual bonus amount disbursed.

Form D – Annual returns to be filed before 1st

Penalty – If the employer has not maintained any of the register mentioned above then the employer may be imprisoned for upto 6 months and may liable to pay fine.

Are there deductions from bonus payments?

If an employee has been a part of any misconduct during a financial year and if this has resulted in any financial loss to the employer, the amount of loss suffered can be deducted from the amount of bonus payable by the employer or the company and balance after such deductions shall be paid to the employee.

What are the provisions related to start-ups or new establishments?

Under the act, start-ups and new establishments are exempted from bonus payments for the first five years. Employers are eligible to pay statutory bonus only in the year in which they derive profit after the commencement of operations.

Are there exemptions in bonus payments?

Companies incurring losses can be exempted from paying a minimum bonus to their employees for a certain period. Although, the factors of occurrence of losses to the company must be justifiable, and the employer must have no intentions to avoid payment of bonus by creating fake losses.

How is disqualification of bonus payments applicable?

Employers can disqualify employees from receiving bonus payments on the basis of any misconduct, absenteeism, or fraud. Also, before disqualifying the bonus payment, employers must ensure that the process of domestic inquiry, appropriate documentation, and employee acceptance of misconduct are as per the standing orders.

Payment of Bonus act is applicable to which companies/ establishments?

The Act is applicable to Factories employing 10 or more persons and other establishments employing 20 more persons on any day during the financial year.

When once applicable, the Act will continue to be applicable even when the number of persons employed have reduced in the subsequent financial year.

Is Payment of Bonus Act is applicable to newly established factories and establishments?

Yes, the Act is applicable to newly established factories and establishments from the date of profits being derived as stipulated under the Act irrespective of completing 5 years or not.

For Clarity, the financial year in which the first invoice is raised is taken as the year of commencement of business. After the said year, during the first five years, bonus will become payable only for the financial years in which the new factory or establishment derives profit.

If the company has not derived profit during the first 5 years of its existence after completion of the financial year in which first invoice has been raised, the company is not required to pay bonus under the Act.

One company may have different units established at different times. Some unit may be profitable and some other units may be incurring losses. Whether all the units are entitled for bonus or not?

As long as separate accounts and individual balance sheets are maintained for distinct units, bonus is payable in accordance with profit derived by the respective units.

In the matter of workmen of Modern Mills Vs General Manager [1986 (2) LLJ 329] it has been held that where a separate profit and loss account and balance sheet has been maintained by the employer as regards any unit or branch thereof, employees of that unit would be entitled to bonus on the basis of the financial statements of that unit but the requirement being that he has done so in the previous year also.

The Supreme Court in the matter of workmen of HMT Vs National Tribunal [AIR 1973 SC 2300] held that in case where the different units have been treated separately for the purpose of computation of bonus and separate balance sheet, profit and loss accounts have been prepared in respect thereof the unit would not lose their separate identity as establishment.

Is employer liable to pay bonus even when the company has not made any profits?

Yes, after completion of first 5 years after the financial year in which first invoice is raised, the company is liable to make payment of bonus to its eligible employees at a rate of 8.33 percent of the wages or salary earned during the financial year subject to other conditions stipulated in this regard even though the company does not have allocable surplus in the accounting year.

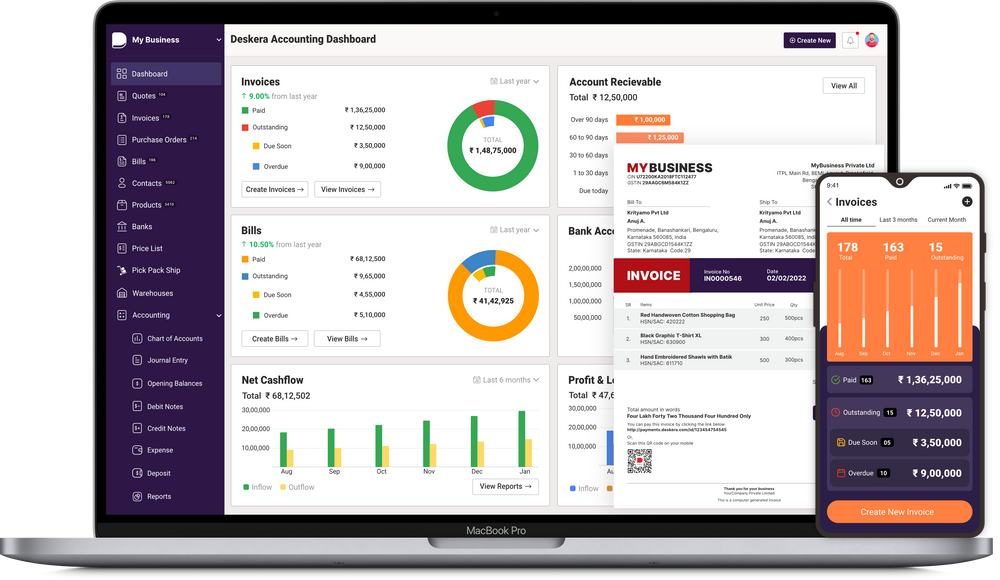

How Can Deskera Assist You?

Want to manage your finances and budgets? Look no further than Deskera. Whether it is invoicing, inventory, CRM, accounting, or HR & payroll, as a business owner, you need to manage thousands of things. This is where Deskera Books can help you.

Key Takeaways

- Paying bonus as an employer in India first happened during the First World War.

- Allocable surplus exceeds the amount of minimum bonus payable to the employees' the employer must pay to every employee in respect of that year bonus in proportion to the salary or wage earned by the employee during the year subject to a maximum of twenty per cent of such salary or wage.

- Every employer is responsible to maintain records and register in the manner as it is prescribed in the provisions of this Act.

- The Act is applicable to Factories employing 10 or more persons and other establishments employing 20 more persons on any day during the financial year.

- When once applicable, the Act will continue to be applicable even when the number of persons employed have reduced in the subsequent financial year.

Related Articles