Do you own a business or an organization with multiple employees working for you? Then, Form 941 is something that you just can not miss not knowing it. You are required to submit the IRS Form 941 Employer's Quarterly Federal Tax Return, four times a year. Let’s understand the ins and outs of this form and how you can fill the form.

Introduction to Form 941

Businesses or organizations submit the income taxes and payroll taxes deducted from their employees' earnings on IRS Form 941, commonly known as the Employer's Quarterly Federal Tax Return, as well as assess and report the employer's Social Security and Medicare tax burden.

Many businesses and organizations are obliged to file quarterly tax returns, unlike individual taxpayers who only have to file one tax return each year. The IRS may levy fines if you fail to submit IRS Form 941 on time or underreport your tax liability.

Form 941 requires you to report on the following items:

- You paid your wages.

- Tips your workers received and reported to you.

- You withheld federal income tax from your workers' paychecks.

- Social Security and Medicare levies are split between employers and employees.

- Employees have an additional Medicare tax deducted from their paychecks.

- Adjustments to Social Security and Medicare taxes for fractions of a penny, sick pay, tips, and group-term life insurance for the current quarter.

- Increased research efforts qualify for a qualified small-business payroll tax credit.

IRS Form 941 will inform you how much amount you should have paid or will need to submit to the government to meet your payroll tax duties for the quarter after you've accounted for all of these factors.

Who is Required to File Form 941?

If you pay wages to an employee (remember: there's a difference between staff and independent contractors), you must withhold or 'hold onto' portion of an employee's compensation to cover items like income taxes, social security, and Medicare. And you should also file Form 941.

If you're a seasonal employer, you only need to file Form 941 for the quarters in which you've paid pay to your employees.

You're exempted from paying employment tax if you pay less than $1,000 in a given tax year (but you'll have to file Form 944 instead).

You should only fill out Schedule H from Form 1040 if your staff are "household employees" (such as home cook or nanny).

What if you have become an employer recently and have never hold onto your employee’s paychecks? Let’s have a quick look on this situation.

As a New Employer, How Do You Start Witholding the Taxes?

If you're a novice employer who has never withheld money from an employee's paycheck or filed Form 941, consult an accountant to ensure that your accounting and payroll systems are in order and that you're signed up for EFTPS deposits.

You can do this over the phone (have your bank account information handy) by contacting the IRS directly at 1-800-555-3453 or online. For the online procedure, you'll need to create a password for your Electronic Federal Tax Payment System account, and finally log in.

Special Case:

In case you didn’t have any employees working for you in the 1st quarter, you'll almost certainly need to file Form 941. Form 941 is not required to be filed by seasonal and agricultural employers who declare their status on line 18 of the form. (For additional information on who doesn't have to file, see the IRS's Form 941 guidelines.)

Deadline for Submitting Form 941

The deadline for submitting Form 941 is one month after the reporting period ends. The following are the filing deadlines for Form 941:

First quarter: April 30, for the period encompassing Jan 1 to March 31.

Second quarter: July 31, for the period encompassing April 1 to June 30.

Third quarter: October 31, for the period encompassing July 1 to September 30.

Fourth quarter: January 31, for the period encompassing October 1 to December 31.

You must submit by the following business day if the due date occurs on a weekend or holiday. If you file by mail, the date of postage will be used to monitor your return. If you paid your employment tax deposits in whole and on time for the entire quarter covered by the return, you get an extra 10 business days to file.

Penalties You Can Face For Late Submission of Form 941

When you fail to file the Form 941, for each month or portion of a month, a penalty of 5% of the tax owed with that return may be imposed. The maximum penalty is 25%. If you pay your taxes late or less than what you owe, you'll face a separate penalty. Depending on how many days you are late paying the right amount, the IRS will assess a penalty of 2 to 15% of your underpayment.

The total amounts reported on the four Form 941s must equal the sum of all amounts reported on the W-2 forms you issue to workers and the Form W-3 you send to the IRS at the end of the year. If things doesn't add up, the IRS will most likely contact you.

Changes Made in Form 941 for Q2 of 2021

The American Rescue Plan Act was presented in March, and the COVID-19-related tax credits were extended and enhanced under this new legislation. As a result, there have been several revisions to the Form 941 for Q2 2021. Employers can still claim the sick and family leave credits, as well as the employee retention credit, after March 31, 2021, but they will be computed differently. Employers who are qualified can also take advantage of the new COBRA premium assistance credit.

Introduction of the 941 Worksheets & Changes Made in Q3 & Q4 of 2021

Employers can use the Form 941 Worksheets to compute the refundable and nonrefundable components of the sick and family leave and employee retention credits. In previous quarters, the 941 Worksheet 1 was used to calculate these credits, but it hasn't been updated since the second quarter of 2021. It has also been divided into five different Worksheets.

Worksheet 1's third step has been eliminated and replaced with its own worksheet. The refundable and non-refundable components of the employee retention credit for the second quarter of 2021 were calculated using Worksheet 2. Form 941 Worksheet 4 should now be used to determine the employee retention credit for the third and fourth quarters.

Methods to File Form 941

Form 941 can be filed on paper, which takes extra time and effort. Many hidden expenditures are involved, such as printing, envelopes, and postal sending fees. Employers may be concerned about the status of their Form 941 submission since they are unsure whether the return will be approved by the IRS.

The IRS prefers e-filing of Form 941 for 2021 since it is the simplest approach. Employers will be able to instantaneously obtain their IRS filing status, and the whole filing procedure will take less than 5 minutes. This strategy saves time for employers while also allowing them to pay their outstanding bill.

Filing the Form 941

Form Submission:

The federal e-File system is the quickest way to file Form 941. Most small company tax preparation software allows business taxpayers to use e-File. Your accountant or tax expert should be able to use e-File as well.

Form 941 can also be mailed. The mailing address is determined by the state in which your business is located, whether you're paying with your return, and the quarter in which you're filing. Make sure the payment voucher is included.

Making the Payment:

You can use the EFTPS — Electronic Federal Tax Payment System — to make a payment if you need to. EFTPS can be used to make any tax payments relating to Form 941. You can also send the IRS a cheque.

Step-by-Step Procedure to Fill Form 941

Form 941 is a three-page IRS document. If you're mailing the form with payment, it comprises five parts and a payment voucher at the bottom.

For submitting IRS Form 941, here's a step-by-step explanation and guidance.

Gather the information you'll need to fill out Form 941.

The entire amount of tax you've remitted on behalf of your employees for the quarter is requested on Form 941. Gather the information you'll need ahead of time to complete IRS Form 941 accurately and efficiently. This data comprises the following:

- Basic information about the company, such as the address and the employer identification number, or EIN.

- Employees' number.

- This quarter's total salaries paid.

- Wages from Social Security and Medicare that are taxable for the quarter.

- This quarter, the total amount of federal income taxes, Social Security taxes, and Medicare taxes deducted from employees' earnings.

- Deposits for employment tax that you've already made for the quarter.

You should be able to access the data you need for IRS Form 941 if you utilise payroll or accounting software. In addition, most companies are obliged to submit monthly or semiweekly employment tax contributions. You should be able to access information from your EFTPS payment history or your company bank account statements as well.

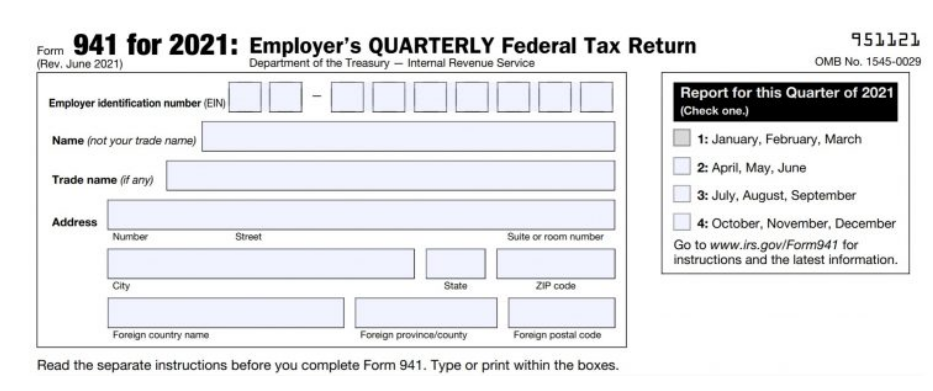

Fill out the top of Form 941 with your business details.

The first part of the form requests basic information about your company as well as the quarter for which you're reporting. You'll provide your employment identification number, name, and trade name (if applicable), as well as your address, in this part.

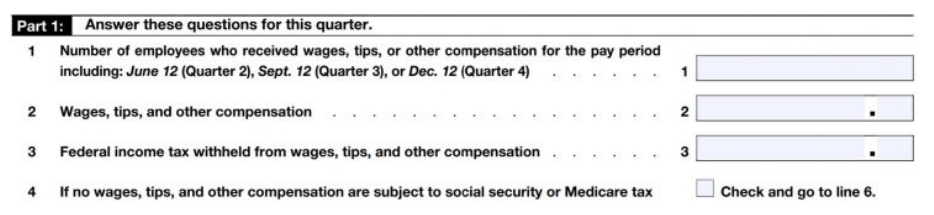

Complete Part 1 of Form 941

Part 1 consists of 15 lines regarding your pay, federal income taxes withheld, and so forth.

Because of the calculations on line 5, this is the most complicated portion of Form 941. Lines 1-4, on the other hand, are based on data from your accounting or payroll programme. These lines will request the following:

Line 1: Total number of workers paid throughout the quarter.

Line 2: The total amount you paid in salary, tips, and other forms of remuneration throughout the quarter.

Line 3: For the quarter, federal income tax was taken from your salary, tips, and other remuneration.

Line 4: Check this box if the salary, tips, or other remuneration you received aren't subject to Social Security and Medicare taxes.

You may leave line 4 blank because it won't apply to most firms. If you're not sure if this exemption applies to you, IRS Publication 15 discusses the sorts of firms that qualify.

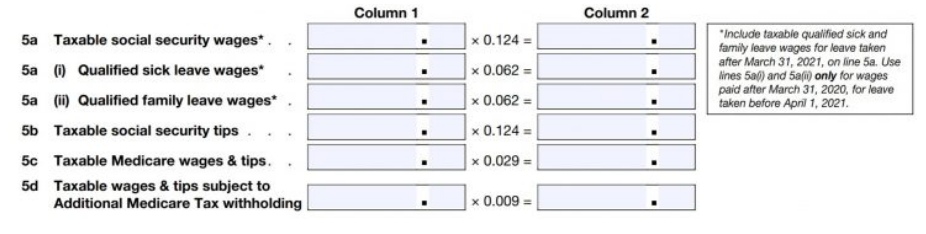

Lines 5a to 5d of Form 941 are the most difficult, since they compute your taxable Social Security and Medicare earnings. This portion of the form has a lot of decimals. The proportion of salary and tips deducted for Social Security and Medicare tax is represented by those digits.

You must break down the salaries by type for lines 5a and 5b to ensure that your calculations are right (i.e., regular wages or tips). Here's an example of lines 5a to 5d for a one-employee company. This quarter, that employee made $25,000 in pay and $5,000 in tips.

- Line 5a: $25,000 x 0.124 = $3,100.

- Line 5b: $5,000 x 0.124 = $620.

- Line 5c: $30,000 x 0.029 = $870.

- Line 5d: Leave blank because the employee doesn’t earn more than $200,000 per year.

You'll add Column 2 from these lines and fill in the total on line 5e once you've completed the calculations in lines 5a through 5d. Then, on line 6, add lines 3, 5e, and 5f (if appropriate) to calculate and fill in your total taxes before adjustments.

After that, you may figure up your entire quarterly employment tax liability. If your company has any modifications to report for fractions of cents, sick pay, tips, or group term life insurance, fill out lines 7 through 9. If, for example, an insurance provider paid a portion of your employee's salary while they were on short-term disability, the adjustments for sick pay and life insurance come into play. Fill in your total taxes after adjustments on line 10 by adding the amounts from lines 6 through 9.

Fill out lines 11a through 11g and attach IRS Form 8974 if your company can claim payroll tax credits for boosting research efforts. (Companies that do research and development in technology, science, medicine, or similar subjects are eligible for payroll tax credits.) To compute your total taxes after adjustments and credits, subtract line 11g from line 10 on line 12 and fill in the total.

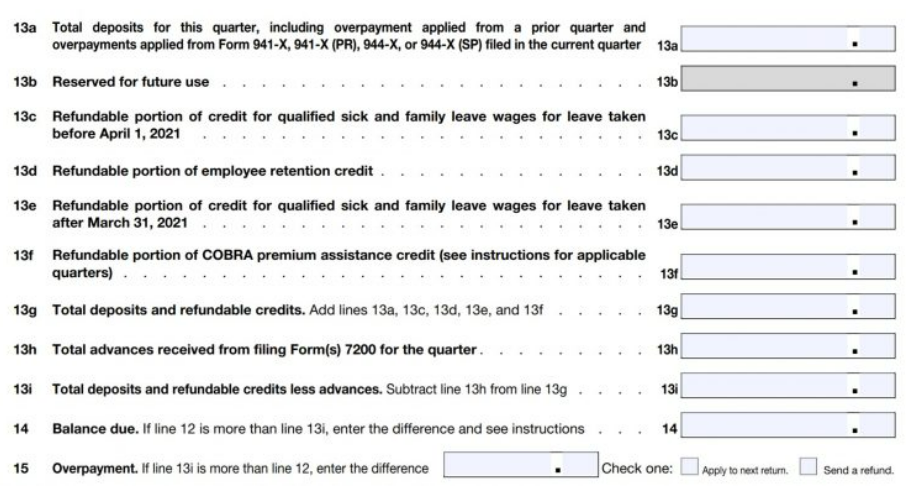

Then add up your total deposits and refundable advances on lines 13a to 13i. If your responsibility exceeds the contributions you've previously made, a balance due will be indicated on line 14.

The overpayment is mentioned on line 15 if your employment tax liability is less than the deposits you've made. By marking one of the boxes next to line 15, you can opt to get a refund check or have the overpayment applied as a credit on your future tax return.

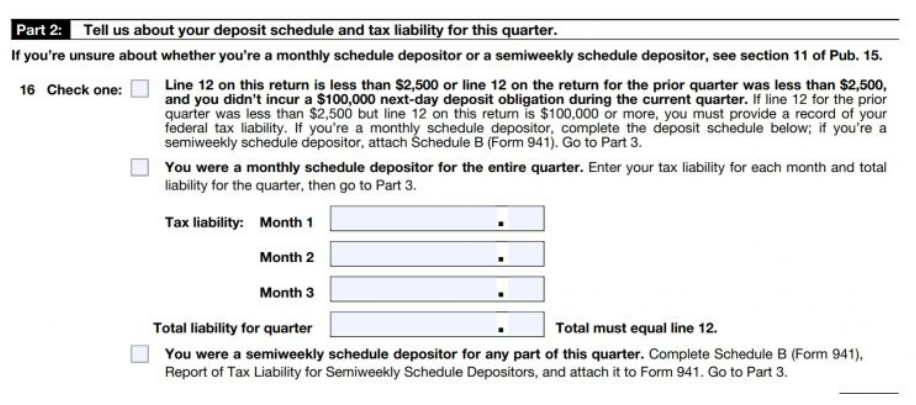

Filling the Part 2 of Form 941.

Part 2 inquires about your quarterly deposit schedule and tax obligation. You'll indicate whether you're a monthly or semiweekly depositor in this section. Fill in the three boxes labelled Month 1, Month 2, and Month 3 if you're a monthly depositor; the total must equal the number on line 12 on Part 1.

If you're a semiweekly depositor, you'll need to fill out Form 941 Schedule B and attach it to this form if your tax due for the quarter exceeds $50,000. Your tax due for each day of the quarter is broken down on Schedule B.

Filling Part 3 & 4 of Form 941

If your firm closed, if you stopped paying wages, or if you're a seasonal employer who doesn't have to submit IRS Form 941 every quarter, you'll be questioned in Part 3. You'll also have to submit your health plan, salaries, and sick leave if you want to take advantage of COVID-related incentives like the employee retention credit.

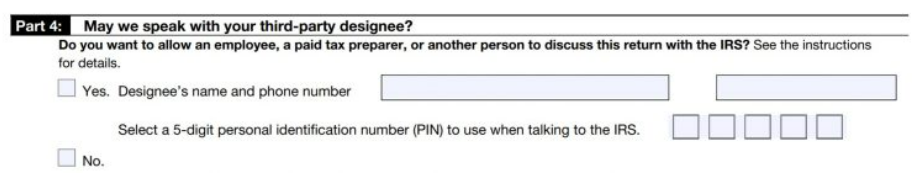

You'll be asked in Part 4 whether you permit a third-party designee to speak with the IRS on your behalf regarding this return. Your CPA, enrolled agent, or tax counsellor might be a third-party designee. Check the "Yes" box and type in the person's name and phone number if you're providing authority to a third-party designee. You'll click the "No" option if you're not.

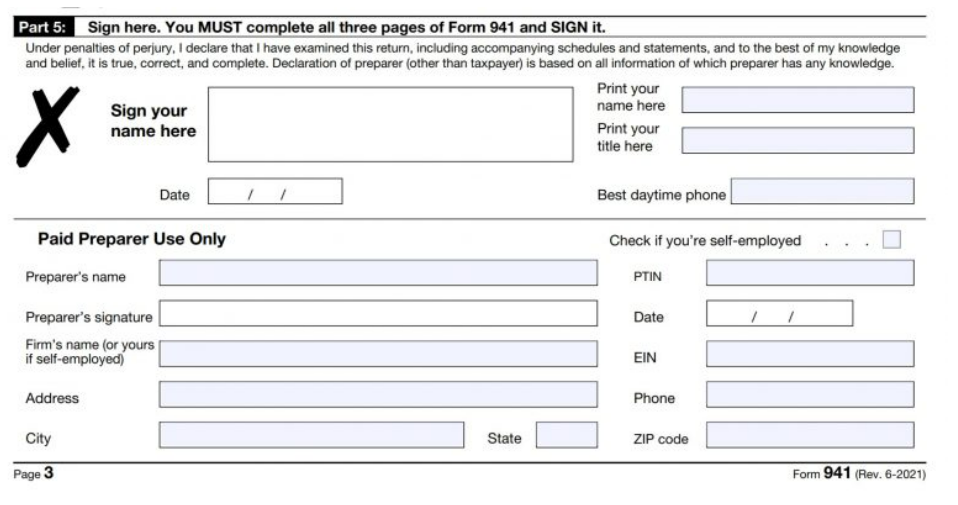

Review the Form and Fill Part 5

Before signing and completing Part 5, double-check that all of the information you've entered is correct. If you engage with a tax counsellor or a company accountant, you may want them to double-check the return. You can sign and date Part 5 once you've reviewed your completed IRS Form 941.

If you utilised a paid preparer (someone you paid to do this form on your behalf, such as a CPA or tax expert), they'll sign the Paid Preparer Use Only area under your signature.

File Form 941 with the IRS and pay any outstanding taxes.

You may pay your tax bill via EFTPS if you file online. If your current quarter's amount is less than $2,500, or if you're a monthly depositor who owes a modest balance (no more than $100 or 2% of the total tax owed), you can submit the payment together with the payment voucher (Form 941-V) on the third page of Form 941.

How Deskera Can Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Owning a business or an organization is just not enough, you need to be aware of all the taxes and deadlines to file the taxes for the betterment of your company

- Many businesses and organizations are obliged to file quarterly tax returns, unlike individual taxpayers who only have to file one tax return each year

- IRS Form 941 is one such form that will inform you how much amount you should have paid or will need to submit to the government to meet your payroll tax duties for the quarter after you've accounted for all of these factors

- In case you didn’t have any employees working for you in the 1st quarter, you'll almost certainly need to file Form 941

- The deadline for submitting Form 941 is one month after the reporting period ends

- When you fail to file the Form 941, a penalty of 5% of the tax owed with that return may be imposed. The maximum penalty is 25%

- Form 941 can be filed offline or e-filing is also a preferred option

- You can use the EFTPS to make a payment if you need to. You can also send the IRS a cheque

Related Articles