A flourishing business is not just a game of play. There are multiple angles to be looked after - project, project team, target audience, client’s feedback and government tax. When you are on the other side of the table, there are multiple points to be considered.

Whether you are a Director of a multinational conglomerate or a small business, a businessman, he is expected to abide by the rules of the government. In the United States of America, where there is strict legislation for all, you should collect proper information on the relevant forms. This becomes your prime step if you are planning to start a business in the largest economy in the world.

What is Form 940?

Each year, a business company is liable to fill the form 940. It is an authenticated tax report filed by the organization. In this, the business owner has to report his unemployment tax with form 940. This is known as his annual Federal Unemployment Tax Act or FUTA.

As per the available statistics, in the United States of America, the FUTA tax rate has been fixed at 6% for the year 2021. It is applicable for the first 7000 dollars that each employee earns. However, after the final calculation of all the wages of your employees, the actual amount that an entrepreneur would be paying is very minimal. The amount depends on your state’s individual FUTA tax credit.

Who Must File Form 940?

According to the law, all employers must fill out form 940. In the U.S., along with other state unemployment tax systems, the FUTA tax is used. This generates funds to give unemployment compensation to the workers who had to put in papers due to multiple reasons. The current example of a pandemic situation is the best example for this Act.

The entrepreneur has to share this contribution separately without deducting a single penny from the employees’ wages.

Who collects it?

The tycoon has to set aside the calculated amount in form 940 as unemployment tax. This is deposited to the Department of Internal Revenue Service (IRS) which is the Revenue Service Department for the United States Federal Government. It is through this sector, that unemployed people are given a specific amount as compensation for living. This is done in conjunction with the state’s tax systems.

In simple words, form 940 is an authoritative document that the IRS collects annually from employers.

What is the Federal Unemployment Tax Act?

FUTA or Federal Unemployment Tax Act is a law passed in 1939 by the US Government. It has been prescribed by the US Parliament and imposes a payroll tax on a businessman with employees. It serves as a medium to generate unemployment insurance which is deposited in accounts of unemployed individuals. Apart from insurance, this Act also provides job service programs.

What does form 940 consist of?

Form 940 is designed to assist both, IRS and business persons to be on the same page. It helps them to understand the amount of FUTA tax an entrepreneur owes to the government.

When you will check the form, you will notice its standard simple design. The document is a report of annual wages given to full-time and part-time employees by the firm. An important point to be noted here is FUTA can be calculated only up to 7000$ per employee, and hence, all the wages are reported. Based on this report, the entrepreneur’s corresponding tax calculation is done.

Am I required to fill out Form 940?

Every entrepreneur who has satisfied the conditions set by the IRS must fill it. Let us understand what these conditions are. A businessman should make the FUTA payments if he has

- Paid an annual salary of 1500 dollars or more to these employees

- At least one employee was working under you (full-time or part-time) in any of the 20 or different weeks in a year (Temporary employees working on a contractual basis shall also be counted)

Exception:

The rule is that if you are a businessman that employs independent contractors for a specific work tenure, you are exempted from filing Form 940.

Link: https://www.irs.gov/pub/irs-pdf/i940.pdf

When to fill it?

This form must be filled out annually or quarterly. Let us understand it in more detail. It means the form is to be submitted only once per year or four times in different quarters.

An important point to be noted -

If you need to deposit the FUTA tax of 500 dollars or more for a quarter or increasingly more in the subsequent quarters, then you must pay it quarterly. However, in case of a circumstance where your quarterly liability falls below $500, then you can carry over the pending tax balance to the next quarter. When the amount surpasses the said threshold, you should immediately clear the balance in the ongoing quarter.

The quarterly deadlines for form 940 are -

- 31st January

- 30th April

- 31st July

- 31st October

How to Submit this Form?

It is possible to fill this tax - manually and digitally. While you can submit the physical copy of form 940, today, a provision of filing it digitally makes the task simpler. In this tech-savvy world, you have a plethora of options like -

- Electronically file and pay the tax amount online on the government IRS website

- Send your form 940 via mail and do online payment

- Appropriately pay an accountant who would file form 940 on your behalf

- Any combination from the above 3 options

How to Fill Form 940?

When you are filing a government form, you need to be extra cautious. Even if the FUTA form is relatively simple to fill, you might find certain sections challenging. Hence, it is always better to keep all the required information ready. Follow these steps for a hassle-free procedure to fill your form 940 before the deadline -

- Complete information about your company’s business and its income generated for a particular financial year

- Maintain a correct update of your Form 940 status

- Calculate your FUTA tax for the year. Take into consideration the adjustments done to gross pay for workers that do not come under this tax (contractors).

- Determine adjustments for your state unemployment tax payments

- Pay the whole amount annually or quarterly. If you have already paid for one quarter, then check the remaining balance and understand how much you owe.

You can get a step-by-step guide for any questions related to this tax on the IRS portal.

Instructions for form 940

Whenever you are filing an important government form, whether personal or company-related, certain guidelines become necessary. It ensures correct filing for any form and reduces your chances of being rejected at the government portal.

- Enter correct details of business name, address, Employer Identification Number (EIN). For the sole proprietor of the business, only his name and trade are to be written.

- Indicate what type of return is filed by selecting the correct checkbox.

- Calculate the total tax by entering the wages of your employees. The amount offered to the employees as health plans, retirement plans or other benefits shall not be included in their wages.

- Enter the total payment given to each employee of more than $7000. This assists to calculate taxable wages which are then multiplied by 0.006 to calculate tax before adjustments.

- Do the required adjustments - that is credit reduction amounts as said earlier

- Determine your final tax payment

- Check if the previous balance is due or there has been overpayment for the previous year. If its amount exceeds 500 dollars, it should be immediately deposited. If it is less, the remaining dues can be made when you file the return. In case, you have accidentally made an overpayment and realize it later, you can request a refund or adjust it with the next return (Form 940-V, Payment Voucher)

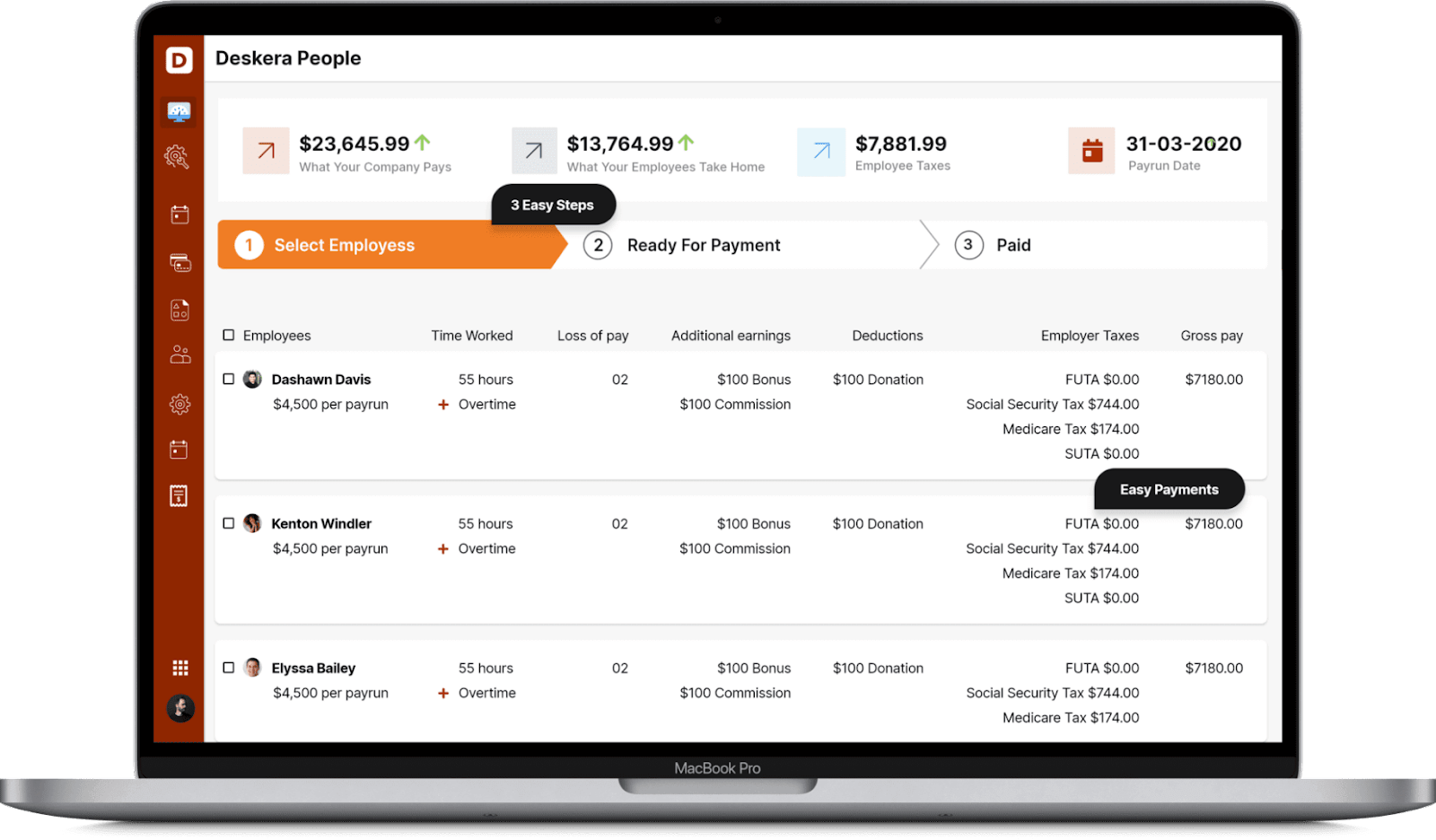

How Deskera Can Assist You?

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

Key Takeaways

- Every employer in the U.S.A, who has at least one worker, employed full-time or part-time for 20 weeks or different times of the year must file form 940

- It is legislation formed by the government of America under the Federal Unemployment Tax Act, 1939

- Under this law, employers have to pay a specific amount for the welfare of unemployed people

- The form is filled out manually or digitally via the IRS website

- There is a provision to fill this tax annually or quarterly, depending on the employer. The only precaution is to complete it before the deadline

- All additional pay like healthcare, retirement plans and other benefits shall be exempted from an employee's salary while calculating wages i.e. only Basic employee pay is used for calculation

- The pending payments can be adjusted in the next quarter for this form. In case the entrepreneur has done additional payment while filing, he can claim returns from the IRS government site

Related Articles