George runs a departmental store in the US. During the Coronavirus Pandemic Lockdown period, he made quite a few advance payments of employer credits due to covid-19 owing to personal and professional reasons. Now he wants to claim advance employer credits on tax returns.

The IRS has issued a new version of Form 7200 specifically for this purpose. But this is a detailed form and requires you to know everything before you start filling out the form. Also, only the latest version of form 7200 will be accepted, and all previous versions of the form stand null and void. So here is a full-fledged list of instructions that you must follow to fill out Form 7200.

Let's understand form 7200 instructions with the help of the following points:

- What is Form 7200

- What is the Purpose of Form 7200?

- Who May File Form 7200?

- Employment Tax Return Filed by a Third-Party Payer

- When should you file form 7200?

- How Long Does It Take to Process the Form 7200 Advanced Tax Credit Application?

- Correcting or Amending Form 7200

- Instructions On How To File Form 7200

- Part I: All About Your Employment Tax Return Lines A–H

- Part II: Enter credits and advance requested Lines 1-9

- Signatures Required on Form 7200

- Payroll agents can sign and submit Form 7200 on behalf of their clients

- For paid preparers only

- What are the common mistakes to avoid when filling out Form 7200?

- Conclusion

- Key Takeaways

What is Form 7200?

The Federal Government extended its support and provided relief for businesses affected by the pandemic. It introduced the CARES - Coronavirus Aid, Relief, and Economic Security (CARES) Act and FFCRA - Families First Coronavirus Response Act (PL 116-127). Both legislations assist businesses in claiming advance employer credits on tax returns using an IRS Form 7200.

Advance Employer Credits on Form 7200, request advance payment for sick leave, COBRA incentive support credits, eligible family leave, and eligible wage tax credits on employee retention credits received on employment tax forms such as Form 941, Form 941PR, Form 941SS, Form, 943, Form 943PR, Form 944, Form 944 (SP), Form CT1, etc.

What is the Purpose of Form 7200?

Form 7200 incorporates all kinds of advance employer credits that can be claimed using the forms mentioned below:

- Form 941 - Quarterly Employer's Federal Tax Return

- Form 941PR - Planilla para la Declaración Federal TRIMESTRAL del Patrono

- Form 941SS - Quarterly Employer Federal Tax Return

- Form 943 - Employer's Annual Federal Tax Return for Farm Employees

- Form 943PR - Planilla para la Declaración Anual de la Contribución Federal del Patrono de Empleados Agrícolas

- Form 944 - Annual Employer Federal Tax Return

- Form CT1 - Employer's annual railroad pension tax return

Self-employed people cannot apply for illness or advance payment for family time and cannot use Form 7200 for these credits. All references to Form 941 in this guide also apply to Forms 941SS, 943PR, and 941PR.

Who May File Form 7200?

In general, an employer submitting Form 941, 943, 944, or CT1 submits Form 7200 to request an advance payment for eligible wage deficiency and family leave tax credits, employee retention credits, and COBRA Premium Support approval. All prepaid and reduced deposits must be matched against the income tax return filed in 2021. As an employer, you can submit Form 7200 to request an advance payment of credits over your reduced deposit or wait for a refund when you claim your credits on your income tax return.

- New businesses established after December 31, 2020, cannot submit Form 7200 to request advance payment of employee retained earnings

- Employers who submit the employment tax form 941, 943, 944, or CT1 can submit Form 7200 to request an advance payment for eligible wage illness tax credits, family leave tax credits, and employee retention tax credits

- All prepaid and reduced deposits must be matched against the income tax return filed in 2021

- Employers who meet the requirements of CARES and FFCRA are eligible for an early tax credit

Other things you need to know

- SMEs (less than 500 employees) are eligible for FFCRA credits as long as they provide paid sick leave and family leave

- Eligible employers can only apply for prepaid credit if the reduced 941 tax deposit does not cover the costs of eligible illness and family leave payments and temporary sales tax deductions

- Self-employed and government employers cannot submit Form 7200

- An employer who submits 941 in a quarter may not request a refundable tax credit advance payment in the same quarter

Employment Tax Return Filed by a Third Party Payer

If you are an individual general law employer of employees who are eligible for sick leave or family leave, are paid a wage that is eligible for employee retention credits, or are provided support for the COBRA credit, you are eligible for credit irrespective if you are a third party payer/PEO/CPEO/Section 3504 agent.

- You should be reporting and paying your federal employment taxes

- The third-party payer is not eligible for credit-related to wages and taxes he transfers on your behalf or COBRA Premium Assistance they transfer on your behalf as a third party "employer" for other purposes whether or not you qualify

- Regarding COBRA Premium Support Credits, the preamble assumes that the employer is a common law person who is paid a premium for credit purposes. If the insurer or multi-employer plan is the payee of the premium, the reference to the employer in this paragraph refers to the insurer or multi-employer plan

When Should You File Form 7200?

- Wages used between April 1, 2021, and September 30, 2021, are subject to employer tax credits for eligible illness allowances and eligible family leave allowances

- For 2021, the employee retention tax credit for eligible compensation paid will apply before December 31, 2020, and January 1, 2022

- COBRA Premium Assistance Credits can be used from insurance periods beginning on or after April 1, 2021, to insurance periods beginning on or before September 30, 2021

- The final date for filing Form 7200 for the second quarter of the 2021 advance payment request is August 2, 2021

- The final date for filing Form 7200 for the third quarter of the 2021 Prepaid Request is November 1, 2021

- The final date for submitting Form 7200 to request an advance payment for the fourth quarter of 2021 is January 31, 2022. The last day to submit Form 7200 is the same for Quarterly Form 941 or Annual Form Submission 943, 944, or CT-1

- After submitting Form 941 in the same quarter, you cannot submit Form 7200 in that quarter. If you submit Form 7200 after the end of the quarter, the submitted Form 941 may not be processed before it is processed into the quarter

- Advance payment requests on Form 7200 for a quarter will not be paid after Form 941 for that quarter has been processed

- If desired, you can submit Form 7200 multiple times each quarter for subsequent payments that are eligible. However, see the fix or fix form 7200 above

How Long Does It Take to Process the Form 7200 Advanced Tax Credit Application?

There is no time frame to process the request. However, if you submit Form 7200 after the end of the quarter, it may not be processed before Form 941 is submitted during that period. If the IRS cannot accept your application for any reason, the IRS will send you a notice 6312.

Correcting or Amending Form 7200

You cannot submit a modified Form 7200. For example, if you apply for advance and find that some wages are not eligible, or if your income tax return has less credit than expected, you will not be able to submit amendments or supplements on Form 7200. If you make a mistake, requesting credit on Form 941, 943, 944, or CT1 will fix the error. Submitting a modified Form 7200 may delay the processing of the original request.

Instructions On How To File Form 7200

Before you fill the form 7200, you need to consider certain important factors like:

Recordkeeping

All relevant payroll tax records should be kept for at least six years after the tax is paid/due, whichever is later. If you agree to extend the IRS's evaluation period, you may need to keep these records for an extended period and should be kept handy for IRS review. The record should contain the following information:

- A document showing how the eligible amount of eligible sickness allowance and family leave allowance was calculated

- Documents certifying the contribution of collective bargaining agreements for sick leave and family leave to defined benefit pension plans and training programs

- A document showing how the amount of retained credit for an employee was determined

- A document showing how the amount of eligible medical insurance costs included in the credit was calculated

- A document showing how employees qualify for sick and family leave wages

- A document certifying the eligibility of an employee retention loan due to a business suspension or reduced gross profit, or, if applicable, start-up eligibility for recovery

- A document certifying the eligibility of your COBRA Premium Support balance. This includes a copy of the invoice or other supplementary statement from the insurance company and proof of timely payment of all premiums to the insurance company under COBRA or in the case of self-insurance

2. Plans, proof of premiums, and proof of beneficiary coverage.

- Evidence of individual eligibility for COBRA Premium Support and selection of COBRA coverage

- A copy of the advance payment amount received and the completed Form 7200 submitted to the IRS

- If you use multiple third-party payers, or if you submit your statement about some wages, a document showing which wages related to the credit were paid by which third-party payer

3. Other instructions

- Enter your business information - At the top of Form 7200, enter your name, trade name (if any), employer identification number (EIN), and address. Make sure they exactly match your business name and the IRS EIN assigned to your business

- Third-party payer information - A third-party payment that you are using, if applicable, or that you use to file an employment tax return (such as Form 941) if applicable, in the input field just above Part I of Form 7200. Enter the person's name and EIN. The payer uses their own EIN on the state's income tax return. This will ensure that the credit advance payment you receive is correctly matched to the federal payroll tax return of the third-party payer for the calendar quarter in which you received the credit advance payment

- rter in which you received the credit advance payment

- Use the name of a third-party payer to file a federal tax return on your behalf to ensure proper processing of Form 7200 and adjustment of credit advance payment with the federal tax return for the calendar quarter. The EIN of the party's payer must be stated on the 7200 form. CPEOs, PEOs, and other Section 3504 agents typically fall into this category of third-party payers. If a third party submits a state income tax return using your name and EIN on your behalf and does not use the third party's name and EIN, do not provide the third party's name and EIN

- Applicable calendar quarter - Select the check box to specify the appropriate 2021 calendar quarter to submit Form 7200. Even if you file an annual income tax return (Form 943, 944, or CT1), you must also select the check box to indicate the appropriate 2021 calendar quarter in which your wages will be paid. Only one box can be checked in a quarter. You cannot submit Form 7200 in two separate quarters with one Form 7200. If you need to submit separate Form 7200s for two separate quarters, please submit separate Form 7200s for each quarter

Form 7200 Instructions

Part I: All About Your Employment Tax Return Lines A–H

Line A

Select the check box to show which 2021 income tax return to or will be submitted. Check only one box. When filing two income tax returns in the same period. For Form 941 and Form 943, you must submit a separate Form 7200 for advance payment of the credits charged on each Form and show the relevant Employment Tax Return for each Form 7200.

- Rail employers require Form 941 and Form Submission CT1; all they have to do is check the "CT1" box

- Some multi-employer and insurance company plans typically do not file a payroll tax return. Still, if you want to take advantage of the COBRA Premium Assistance Loan, you will need to file a tax return

- If you plan to claim the credit on your payroll tax return and you want to submit Form 7200 to request advance payment of expected credits, select the check box on Form 941 to have a "Multiple Employer Plan" or "Insurer."

Line B

Enter the total number of employees who have paid eligible wages for retained credits this quarter. This includes all employees who have paid eligible wages in the current quarter. If you later submit another Form 7200 requesting advance payment of retained credits, please enter the total number of employees who received qualified wages during the quarter, including new employees whose advance payment was considered. Do not change this number if you later submit another Form 7200 requesting advance payment of retention credits for employees in the same group.

Line C

Skip line C for new entities that have not yet filed an income tax return.

Also, skip line C for the plan mentioned above in the procedure for row A or a multi-employer insurance company.

For income tax returns for at least one tax period, you must complete line C. Enter the amount, wages, tips, and other rewards listed on the second line of the recently submitted Form 941. The IRS uses this information to ensure that the loan is paid to the correct employer. Suppose the amount you enter does not match the amount reported on your recently filed employment tax return. In that case, the processing of Form 7200 will be delayed, or the EIN's third-party payer on your recently submitted Schedule R (Form 941) will be hampered.

If the wage is on Schedule R (Form 943), enter the social security tax reported by the third-party payer for the EIN in column (d) of the recently submitted Schedule R (Form 943). You must enter the following amounts in this segment if you are filing for a separate employment tax return:

- Form 941-PR, line 5a, Salarios sujetos a la contribución al Seguro Social

- Form 941-SS, line 5a, Taxable social security wages

- Form 943, line 2, wages subject to social security tax

- Form 943-PR, line 2, Salarios sujetos a la contribución al Seguro Social

- Form 944, line 1, Wages, tips, and other compensation

- Form 944(SP), line 1, Salarios, propinas y otras remuneraciones

- Form CT-1, line 1, Tier 1 employer tax—compensation (other than tips and sick pay). You must enter the amount arrived at in the compensation box as given on the form

Line D

Skip line D for new entities that have not yet filed an income tax return. Also, in the case of the multi-employer plan or insurance company mentioned above in the instructions of line A, line D is skipped.

If you have already filed an income tax return for at least one tax period, you will need to fill out line D. Enter the tax period for your recently filed income tax return with a checkmark in row A.

Line E

- 2021 retention bonuses are limited to small employees with an average of 500 or fewer full-time employees (defined in Section 4980H) in 2019

- If you request retention credits in advance (Part II, line 1), enter the average number of full-time employees in 2019

- If your business did not exist in 2019, enter the average number of full-time employees in 2020

- If you enter 501 or more in line E, you will not be able to receive advance credit payments. However, you can reduce your income tax contributions and claim the credits you are entitled to on your current income tax return

Line F

If you request an advance payment of eligible sickness or eligible family leave credits (Part II, lines 2 or lines 3), you must enter the number of employees you had when the leave was taken. If an employee is on leave and the facility employs less than 500 full-time and part-time employees, the facility is considered.

Line G

Enter the number of people who received COBRA premium Support during the quarter for the advance payment requested in Line 9. Each beneficiary who receives the assistance is counted as one, regardless of whether COBRA's coverage covers multiple beneficiaries. In addition, each person is reported only once a quarter.

COBRA - The Consolidated Omnibus Budget Reconciliation Act of 1985 temporarily continues health insurance at group rates for certain ex-employees, retirees, spouses, ex-spouses, and dependent children. COBRA typically covers health insurance for multiple employers and health insurance maintained by private-sector employers with 20 or more full-time and part-time employees. These plans are subject to parallel requirements under the 1974 Employee Retirement Income Security Act (ERISA). Under the Public Health Services Act, COBRA requirements also apply to health insurance for state or municipal employees. Similar requirements apply to some state laws.

Line H

- This applies only to the third and fourth quarters of 2021. Skip line H when filling out Form 7200 for the second quarter of 2021. Select the check box if you are eligible for an employee retention loan just because your business is a recovery start-up.

- Recovery start-ups are employers such as:

- Started exercising trade or business activities after February 15, 2020

- The average annual gross revenue for the three tax years ending in the tax year before the calendar quarter in which retention credits are charged less than $ 1 million

- Businesses will not be eligible for 3rd or 4th quarter holding credits if all or part of your business has not stopped as a result of government orders or gross income (as defined in Section 448 (c)), or if you are a tax-exempt organization, section 6033) is more than 80% of total revenue for the same calendar quarter in 2019

Part II: Enter credits and advance requested Lines 1-9

Line 1. Total employee retention credit for the quarter.

Enter the total down payment for the employee retention loan for the quarter. This is the least amount of the given options - the eligible wage credits paid in the quarter up to the submission date of Form 7200 or the amount eligible for advance payment.

- If your average number of employees in 2019 exceeds 500, you will not be able to enter the amount on the first line

- Quarterly retained credit is 70% of the eligible wages paid to employees during that quarter

- Eligible wages, including eligible medical expenses, should not exceed $10,000 for quarterly employees

- Therefore, the maximum retained credit per employee per quarter is $7,000 ($ 10,000 x 70%), the maximum amount you can enter in the first row of the quarter multiplied by the number of employees entered in row B is $ 7,000

- Certain government agencies, including Federal agencies described as under, are qualified for the credit

- Agencies under Section 501(c)(1), and attaining tax exemptions under Section 501 (a)

- A Government university, institution, college, organization, or company that provides medical care or hospital care

Line 2 - Total eligible sick leave covered by credits paid this quarter

- Enter the eligible illness absentee wages paid so far in the quarter. You can add the following amount to this line:

- Costs to maintain employee health insurance coverage during sick leave, including eligible medical insurance costs due to eligible sick leave and family leave wages

- Collectively agreed defined benefit pension contributions based on eligible sickness wages paid

- Customs-based training contributions that apply to eligible sickness wages paid

- The employer's portion of the social security and Medicare tax that applies to eligible sickness wages paid

Exceptions:

- If you are a private employer and have more than 500 full-time and part-time employees on leave, you will not be able to claim credit or enter the amount on the second line.

- You can also not claim credit or claim a second line during the quarter when you qualify for sick leave for an employee and grant the leave in a way that discriminates against high-paying employees, permanent employees, or employees with employment relationships.

Line 3 - Total eligible family leaves covered by credits paid during the quarter.

- You must enter the eligible family leave wages paid so far in the quarter. You can add the following amount to this line:

- Costs to maintain employee health insurance coverage during family leave including eligible medical insurance costs due to eligible sick leave and family holiday wages

- Collectively agreed defined benefit annuity insurance contributions due to eligible family hourly wages paid

- Customs-based training contributions that apply to wages paid for eligible family leaves

- The employer portion of social security and Medicare taxes resulting from eligible family leave wages

Exceptions

- If you are an individual employee and have more than 500 full-time and part-time employees on leave, you will not be able to claim credit or enter the amount on the third line.

- Also, you may not claim credit or enter an amount in the third line during a quarter that grants leave in a way that discriminates against high-paying employees, full-time employees, or qualified employees.

Line 4 - Total COBRA Premium Support deployed this quarter

Enter the amount of COBRA Premium Assistance you have provided so far in the quarter. After the individual chooses to continue COBRA coverage, they can apply for insurance period credits. You can also apply for insurance period credits from the beginning of the insurance period after the election when the individual has not paid the coverage premium.

You can reduce your federal employment tax payments during the insurance period from the date you are eligible for the COBRA Premium Support Credit. Suppose the expected credit exceeds the available credit reduction. In that case, you can request an advance payment after the end of the billing period in which you are eligible to receive the credit. Do not include the amount included as a qualified salary or eligible health insurance expense for employee retention credits due to illness and eligible family leave wages.

Line 5. Add lines 1, 2, 3, and 4

Add lines 1, 2, 3, and 4, and write the result to line 5.

Line 6 - The total amount of these quarterly credits already reduced the federal payroll tax deposit

Enter the amount already deducted from the total wage tax deposits for these credits for this quarter. The amount entered on this line should be positive. If you do not enter this amount or enter it incorrectly, you may incur underpayments when you file your income tax return.

Line 7 - The total number of advance payments requested for previous submissions of this form for this quarter.

Enter the amount of down payment requested for previous submissions of this form for this quarter. If you do not enter this amount or enter it incorrectly, you may incur underpayments when you file your income tax return.

Line 8 - Add lines 6 and 7

Add lines 6 and 7 and enter the amount on line 8

Line 9 - Advance request

Subtract the 8th line from the 5th line and enter the amount in the 9th line. Do not submit this form if the amount is less than or equal to zero. The minimum amount paid as the advance payment is $ 25. Do not submit Form 7200 if the amount on line 9 is less than $ 25.

However, you can claim the credits you have the right to in your income tax return. You must include the amount of down payment required on your payroll tax return during the filing period and the amount requested on line 9 of the other Form 7200 you submit during the filing period.

Line 13h of Form 941 reports the total amount of down payments received from the submission of Form 7200 for the quarter.

If you are submitting Form 943, 944, or CT1, please review the form you submitted and the specific line reporting credits and advance payment description.

Signatures Required on Form 7200

Fill out all the information and sign Form 7200. The following individuals are authorized to sign Form 7200 for all types of entities:

- Self-employed – the individual who owns the business

- Legal entity (including limited liability companies (LLCs) treated as legal entities) – President, Vice President, or another officer officially authorized to sign

- Partnerships (including LLCs treated as partnerships) or unincorporated organizations – Responsible, officially licensed partners, members, or officers with knowledge of their business

- A single-member LLC – LLC owner or officially authorized officer is treated as an entity ignored for federal income tax purposes

- Trust or real estate-trustee - Form 7200 may be signed by an officially licensed taxpayer representative if a valid adult guardianship system has been submitted

In many cases, Form 7200 does not indicate whether the person signing Form 7200 is properly approved or has knowledge of the business of a partnership or unincorporated organization. If the taxpayer is not explicitly permitted by the position to sign Form 7200, submit Form 7200 and a copy of Form 2848, Adult Guardianship, and Agent Declaration, and allow Form 7200 to be signed.

Payroll agents can sign and submit Form 7200 on behalf of their clients

The Payroll Reporting Agent (RA) can sign Form 7200 for clients approved through Form 8655 for signing and submitting income tax returns, and approval of reporting agents (such as Form 941). The signer must be the chief or responsible person listed on the RA's electronic file application. Signers can sign in to the paper with ink or use a different signing method (stamp, mechanical, or computer software program).

- RA must obtain written approval from the customer to perform these Form 7200 actions. The RA does not need to present this approval to the IRS, but it does need to keep it in a file so that the RA can present it to the IRS upon request

- Customers who do not have a reporting agent license from a third party can either fill out and print the form or provide the customer with a means to fill out and print the form, but the customer must sign it

- The RA signer must sign, date, and print the name on the appropriate fields on Form 7200

- In the Printed Title field, the signer must enter the RA company name or company name shown on line 9 of Form 8655. Form 7200 cannot be processed if Form 8655 does not have an RA company name or company name

For paid preparers only

A paid preparer must sign Form 7200 and provide information in the "Paid preparer Use Only" section. A paid preparer must sign the paper declaration with a manual signature. The preparer must provide a copy of Form 7200 in addition to the copy submitted to the IRS. If you are a paid preparer, enter the preparer taxpayer number (PTIN) in the field provided and the full address. If you work for a company, enter the company name and company EIN.

- Approval of reporting agents to sign and submit income tax returns (such as Form 941)

- The signer must be the chief or responsible person listed on the RA's electronic file application

What are the common mistakes to avoid when filling out Form 7200?

- One of the commonest mistakes many employers make is filing form 7200 with an incorrect or a missing EIN. This may cause issues in form acceptance

- The other mistake many businesses make is the selection of multiple calendar quarters

- Next, at times, the calculation on lines 4, 7, and 8 of Part 2 of the form is mathematically incorrect. It is highly recommended for all employers to cross-verify and recheck the amount they are entering on every line of Form 7200

- Finally, many business entities fill the entire form appropriately but omit the Signature Section

Conclusion

IRS may refuse to apply for advance payment of credits due to missing, incomplete, or inaccurate information, so please review all details. When you're done, you can fax the form to IRS on the given number or seek professional assistance from experts who can help you fill the form and guide you towards its submission.

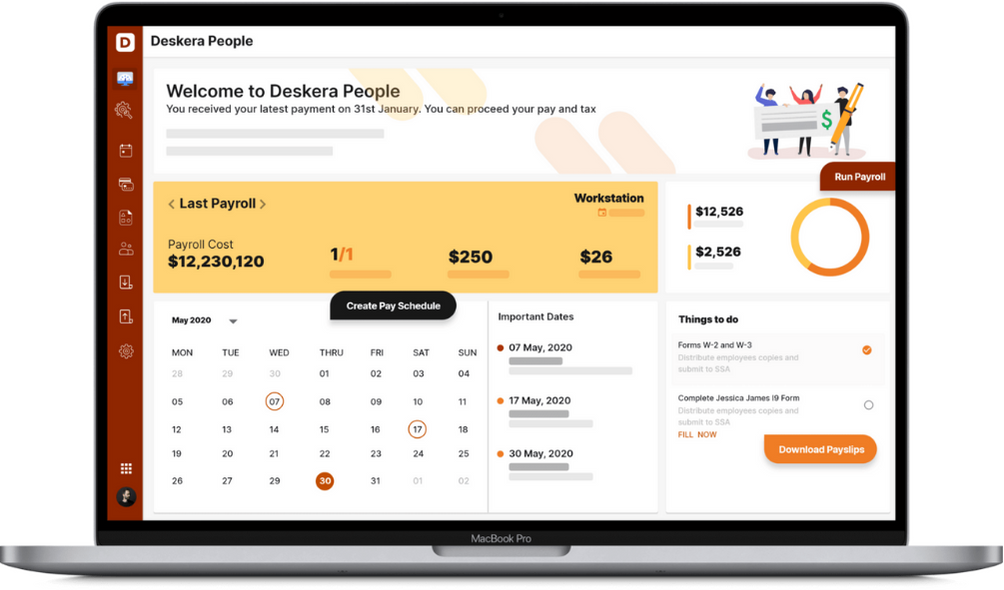

How can Deskera Help You?

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

1. Form 7200 is filled to claim a tax credit advance payment.

2. To verify the need for leave taken by employees, the employers must maintain proper documentation and maintain information that justifies the need for leave. The employer must request the following information in writing:

- The name of the employee

- One or more dates for which leave is requested

- Explanation of COVID 19 related reasons why employees are requesting leave and written support for that reason

- A statement that workers cannot work for this reason, including working from home.

- If the leave requirement is based on a quarantine order, the employee statement must include the name of the government agency ordering the quarantine

- If the leave requirements are based on the health care provider's self-quarantine recommendations, the employee statement should include the name of the health care provider who advises the self-quarantine

- Suppose leave is required to take care of a person subject to a quarantine order or a person requested self-quarantine. In that case, the worker provides (in addition to the name) the person's name and relationship with the worker, the name of the government agency issuing the quarantine or the name of a medical professional who advises self-quarantine

- Suppose the leave requirement is due to the school's closure or the availability of a nursery. In that case, the employee's declaration will include the name and age of the caring child (or multiple children), the closed school, or the care location. It must include that they may not be available due to the added responsibility of care for children in connection with the inability of workers to work or commute as a result of no other person taking care of the child while the worker is on family leave

3. Statement of need - A statement of special circumstances requiring the care of employees over 14 during the day.

- The employer needs to maintain, archive, and store certain documents and records to apply for a tax credit:

- A document showing how the employer determined the amount of eligible sickness and family leave wages paid to eligible workers. This includes records of work, telecommuting, eligible illness, and eligible family leave

- A document showing how the employer has shown the amount of eligible health insurance costs

- A copy of the employer's credit advance payment form 7200, Advance of Employer Credits Due To COVID-19, submitted by the employer to the IRS

- A copy of the federal tax return filed by the employer every quarter

- A completed Form 941, submitted by the employer to the IRS

4. The employer must retain these documents for six years from the tax payment date.

5. The employer, after gathering all necessary documents, needs to fill every line, row, and given space of form 7200, making sure no information is entered incorrectly or omitted, else the procedure to cater to the claims is unduly extended

Related Articles