If you are a business owner, then Form 7004 can be extremely relevant to your area of operation. Let’s learn how!

We often observe that individual taxpayers often face issues with a timely filing of tax returns; for which they need to file for an extension. The same scenario may occur with businesses and they, too, may require to file for an extension to be able to file their returns.

IRS Form 7004 is an Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. Partnerships, multiple-member LLC firms filing as partnerships, corporations, and S corporations use it to request more time to file tax returns.

Let's take a close look at what the form entails. Here is what we shall be learning about:

- What is Form 7004?

- Who Uses Form 7004?

- How to Fill Out Form 7004?

- Where to Get Form 7004?

- Can Form 7004 be E-Filed?

- For How long can I extend my IRS Filing?

- Where can I Mail Form 7004?

- Form 7004 - Extension Period

- How can Deskera Help You

- Key Takeaways

What is Form 7004?

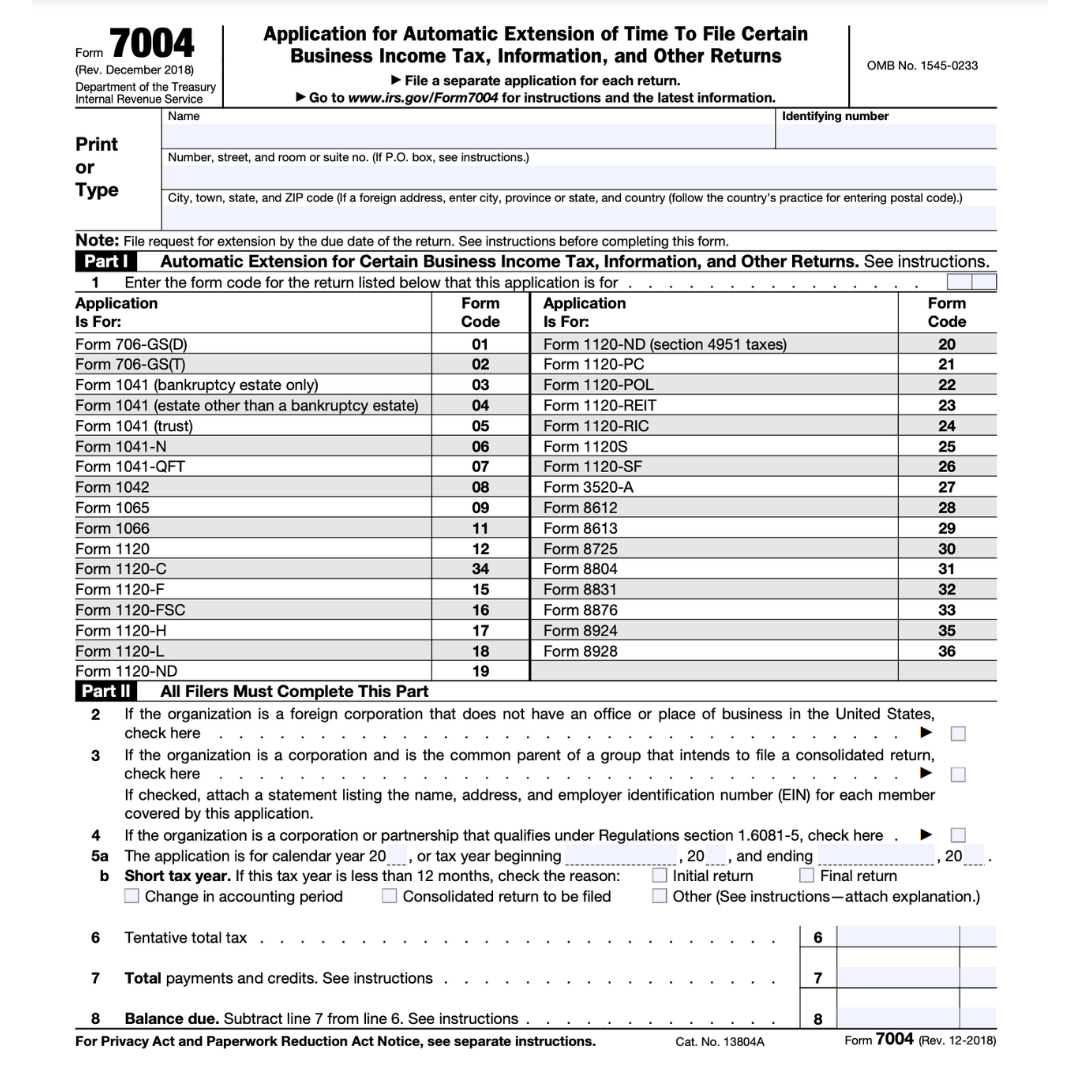

The IRS Form 7004 allows an automatic six-month extension for submitting your business tax paperwork if you need more time. You must still pay all your taxes in time and in full. Form 7004 is a one-page IRS form titled Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

Several different types of returns can be filed using Form 7004, and it gives you six extra months to file. Payment deadlines are not extended. It must reach the IRS on or before March 15, which is the original business tax deadline.

Here is what the form 7004 looks like:

However, according to the IRS, they will grant you the extension only if you:

- Fill out Form 7004 appropriately

- Estimate the tax you owe using the information on the form

- Fill out Form 7004 before or on the deadline of the form you need an extension for

- Make the payment

Who Uses Form 7004?

By completing Form 7004, the following business entities will receive an extension on:

- Form 1065, which is filed by partnerships

- Form 1065, filed by limited liability companies (LLCs) as partnerships

- Form 1120, which is filed by C corporations

- Form 1120-S, which is filed by S corporations

How to Fill Out Form 7004?

Form 7004 is divided into two parts. We will be learning about filling out the required details in these two parts in this section.

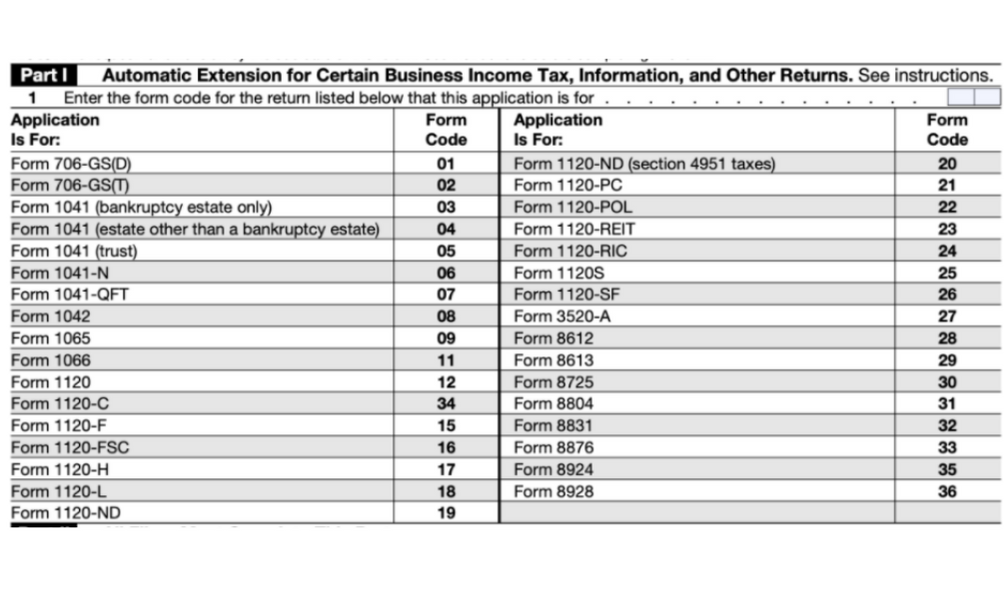

Part 1: Forms for which the application will be filed

It presents a list of forms. Determine which form you apply an extension for on Form 7004

In this section, you mention the exact tax form you are filing the 7004 for. You'll need to submit a different Form 7004 for every tax form you need an IRS extension for.

Here you must choose which form you are requesting an IRS filing extension for from the following list:

- Form 706-GS(D), which is the form for Generation-Skipping Transfer Tax Return for Distributions

- Form 706-GS(T), which is the form for Generation-Skipping Transfer Tax Return for Terminations

- Form 1041, which is U.S. Income Tax Return for Estates and Trusts

- Form 1041-N, or the U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

- Form 1041-QFT, which is the form for U.S. Income Tax Return for Qualified Funeral Trusts

- Form 1042, which is the form for Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

- Form 1065, which is the form for U.S. Return of Partnership Income

- Form 1066, which is the form for U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

- Form 1120, which is the form for U.S. Corporation Income Tax Return

- Form 1120-C, which is the form for U.S. Income Tax Return for Cooperative Associations

- Form 1120-F, which is the form for U.S. Income Tax Return of a Foreign Corporation

- Form 1120-FSC, which is the form for U.S. Income Tax Return of a Foreign Sales Corporation

- Form 1120-H, which is the form for U.S. Income Tax Return for Homeowners Associations

- Form 1120-L, which is U.S. Life Insurance Company Income Tax Return

- Form 1120-ND, which is the form for Return for Nuclear Decommissioning Funds and Certain Related Persons

- Form 1120-PC, or the form for U.S. Property and Casualty Insurance Company Income Tax Return

- Form 1120-POL is the form for U.S. Income Tax Return for Certain Political Organizations

- Form 1120-REIT is the form for U.S. Income Tax Return for Real Estate Investment Trusts

- Form 1120-RIC is the form for U.S. Income Tax Return for Regulated Investment Companies

- Form 1120S which is the form for U.S. Income Tax Return for an S Corporation

- Form 1120-SF which is for U.S. Income Tax Return for Settlement Funds (Under Section 468B)

- Form 3520-A, which is for Annual Information Return of Foreign Trust With a U.S. Owner

- Form 8612, which is for Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts

- Form 8613, Return of Excise Tax on Undistributed Income of Regulated Investment Companies

- Form 8725, which is for Excise Tax on Greenmail

- Form 8804, which is for Annual Return for Partnership Withholding Tax (Section 1446)

- Form 8831, which is for Excise Taxes on Excess Inclusions of REMIC Residual Interests

- Form 8876, which is for Excise Tax on Structured Settlement Factoring Transactions

- Form 8924 which is the form for Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests

- Form 8928, which is for Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

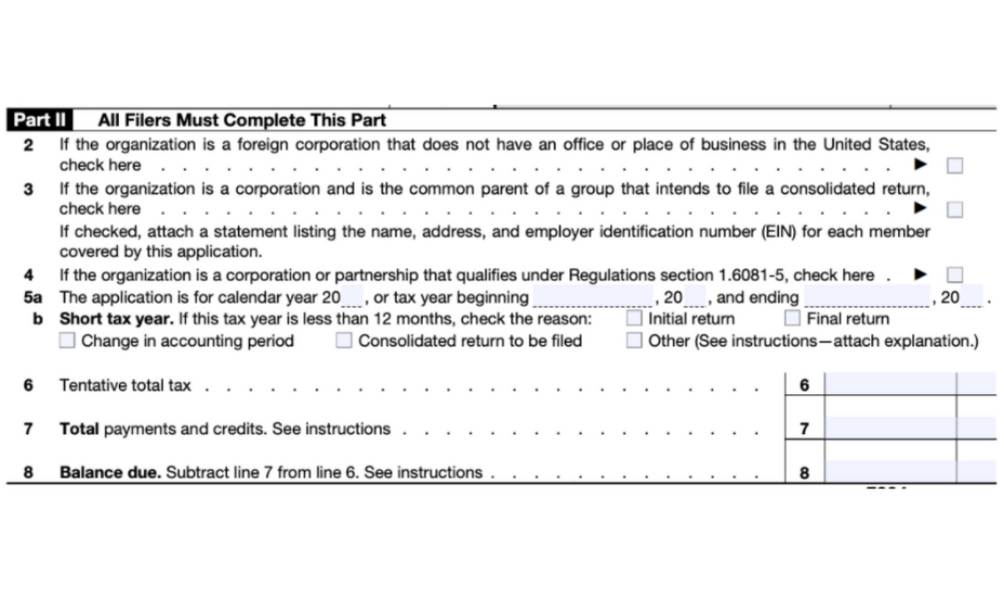

Part 2: Organization and tax information

Lines 2-5

This section requires you to furnish information about your business whether it is a foreign corporation or if you have any corporate subsidiaries. Also, you must add information about the tax year for which you are filing. Furthermore, mention if you are following the calendar year of the financial year.

Lines 6-8

This is where you will need to provide details about how much tax you are expected to owe this year. Provide details about what you have already paid and if you have any remaining dues.

Where to get Form 7004?

You can access a version of Form 7004 that is interactive on the IRS website. The form can be filled out online or printed out and completed by hand.

Can Form 7004 be E-Filed?

Yes. You may electronically file Form 7004 using the IRS modernized e-filing system. You must have a login id and password ready.

For how long can I extend my IRS filing?

IRS tax forms for businesses typically allow you to file a six-month extension. If you fill out Form 1041, you can extend your tax return for five and a half months, and if you have a tax year ending June 30, you can extend your tax return for seven months.

Where can I Mail Form 7004?

While both mailing and e-filing, are possible while filing Form 7004, it is important to note that the mailed forms take longer than the electronically filed forms. Moreover, a delay in mailing can attract a penalty.

You can mail form 7004 on the mailing addresses as included in the following table in this section.

Form 7004 - Extension Period

The IRS does not share an extension approval notification any longer but notifies if the request for an extension is declined. When you file Form 7004, you will automatically be granted the maximum extension from your return's due date.

Maximum extension period

- Generally, the time to file will be extended by six months unless you file Form 1041 or you are a C corporation with a June 30 tax year

- Estates and trusts that file Form 1041 are eligible to receive an automatic extension of time to file

- C corporations whose tax years end June 30 are eligible for an automatic extension of time to file

- There are exceptions here including foreign corporations, certain domestic corporations, and partnerships with records kept outside the U.S. and Puerto Rico

Termination of the extension period

If you request an extension from the IRS and it is not granted, the IRS notifies you by mailing a termination notice. A termination notice will be sent or mailed at least 10 days before the date mentioned on the notice.

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- IRS Form 7004 is an application for the Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

- Partnerships, multiple-member LLC firms filing as partnerships, corporations, and S corporations use it to request more time to file tax returns

- The IRS Form 7004 allows an automatic six-month extension for submitting your business tax paperwork if you need more time

- Several different types of returns can be filed using Form 7004, and it gives you six extra months to file

- Payment deadlines are not extended. The IRS must receive it on or before March 15, which is the original business tax deadline

- Form 7004 is divided into two parts. Part 1 includes the forms for which the extension is being filed. Part 2 comprises organization and tax information

- You can access a version of Form 7004 that is interactive on the IRS website

- You may electronically file Form 7004 using the IRS modernized e-filing system

- IRS tax forms for businesses typically allow you to file a six-month extension

- If you fill out Form 1041, you can extend your tax return for five and a half months, and if you have a tax year ending June 30, you can extend your tax return for seven months

- If you have requested an extension from the IRS and it is not granted, the IRS notifies you by mailing a termination notice

Related Articles