If you are setting up your business as a Partnership or Limited Liability Company(LLC) in the USA, you need to comply with many tax documents throughout the year.

All of these tax documents are issued by the Internal Revenue Service(IRS), which is the USA's government agency responsible for collecting taxes and enforcing tax laws.

Out of them, Form 1065: U.S. Return of Partnership Income is one of the most critical annual tax forms that a partnership or LLC needs to complete with the Internal Revenue Services (IRS).

Under this form, all declarations related to profits, losses, deductions, and credits are made by the business partnership or Limited Liability company.

In this article, we will cover the in-depth insights about the Form 1065: U.S. Return of Partnership Income related to the following:

• What is Form 1065: U.S. Return of Partnership Income?

• What is the purpose of Form 1065: U.S. Return of Partnership Income?

• Who must File form 1065: U.S. Return of Partnership Income?

• What's the process to file Form 1065: U.S. Return of Partnership Income?

• What are the instructions mentioned while filling the Form 1065: U.S. Return of Partnership Income?

• When to file Form 1065: U.S. Return of Partnership Income?

What is Form 1065: U.S. Return of Partnership Income?

The form 1065: U.S. Return of Partnership Income is an informational tax form used to report the income, gains, losses, deductions, and credits of a partnership or LLC operated in the USA.

However, it is important to know that no taxes are calculated or paid from this form.

The form's purpose is to help gather data using accounting software. Form 1065 requires various financial documents and additional tax reforms to complete the procedure.

In addition, to form 1065, each member or partner of the entity must complete their own schedule K-1 file along with the personal tax returns. The partners are also liable to pay the income tax on their earnings regardless of whether the earnings were distributed or not.

Overall, form 1065 gives the International Revenue Services a snapshot of the partnership's financial status or financial position for the year.

Therefore, it is required for a partnership or LLC to file the single IRS Form 1065.

What is the purpose of Form 1065: U.S. Return of Partnership Income?

The purpose of Form 1065: U.S. Return of Partnership Income is to showcase the data input and information of a partnership firm and LLC in the USA.

Form 1065 provides a systematic format of entering data into the form such that there are fewer chances of errors in the final process of filing the income tax return. The data entered into the form helps you organize information and review the data for comprehensive problems.

Since the process is carried through tax software, it makes it more viable and operational for the taxpayers and business owners.

With the help of form 1065, they get the mirror image of their financial position for the year.

Who must File form 1065: U.S. Return of Partnership Income?

As per the IRS, the following are the entities that need to complete and file the form 1065 on an annual basis:

- Domestic partnerships can be described as relationships between two or more persons who agree to carry on a trade or business. Each person contributes money, property, skills, and their respective share of profit and losses.

- Limited liability companies that are classified as partnerships for tax purposes

- Non-profit religious or apostolic organizations are included under section 501 (d). Here, they are required to show the profits that they have distributed to their members as dividends.

- Any kind of foreign partnership that has a gross income derived from the sources in the U.S.

If there are foreign partnerships that earn less than 20000 $ in the country or receive less than 1% of the income in the U.S., then they are not obliged to file the form 1065

What's the process to file Form 1065: U.S. Return of Partnership Income?

The process to file Form 1065: U.S. Return of Partnership Income is simple and easy to carry forward.

The partnership or LLC can find the 1065 tax form available on the IRS website. It is a five pager from where you need to fill out the details using

- Tax software

- Tax program

- Take a printout and complete it manually

The form consists of significant income information about the partnership's annual status. It includes gross receipts, deductions, operating expenses like rent, electricity, and operating costs.

It also includes the interest on business loans and related costs associated with the same.

Accordingly, if your partnership has more than a hundred partners, you will be required to file form 1065 via online medium.

Other than that, the other partnerships can file by mail after following the IRS form 1065 instructions.

Form 1065 also requires information related to partners and the percentage of an ownership stake in the company.

Rest, all the detailed instructions for the respective five pages are mentioned in the form. The partnership and the LLC are required to fill the required information and submit it to the IRS.

However, before completing form 1065: U.S. Return of partnership income, the filers will need information from the following:

- Form 4562 related to depreciation and amortization

- Form 4797 related to the sale of business property

- Form 1125-A is associated with the cost of goods sold

- Form 8918 related to the material advisor disclosure statement

- Copies of Form 1099 issued by the partnership

- Form 3520 pertaining to annual Return to report transactions with foreign trust and receipt of certain foreign gifts

- Form 114 related to reporting of foreign bank and financial accounts disclosure statement

- If the partnership is related to farming, it needs a copy of form 1040 individual income tax return to be attached

What are the instructions mentioned while filling the Form 1065: U.S. Return of Partnership Income?

As stated earlier, the tax Form 1065 is a 5-page document that requires information from a variety of business financial documents.

On each page, there is a list of particulars and instructions that need to be filled by the partnership or LLC.

Let's take a look at the instructions and schedules in detail:

Main page (Form 1065: U.S. Return of Partnership Income)

Following is the specimen of Form 1065: U.S. Return of Partnership Income

1. The first page of form 1065 highlights the U.S. Return of Partnership Income that comes under the Treasury International Revenue Services Department, which is the regulatory body in the U.S. for tax purposes.

2. The partnerships and LLCs are required to share important documents that reflect the financial performance mainly:

- Profit and loss statement

- Balance sheet

- Deductible expenses

- Gross receipts and sales

- Cost of goods sold

3. The next thing is to file the IRS form 1065 that contains sections A to K mentioned at the top of the form 1065.

4. In this section, you will be required to fill in the following details

- The tax year from the beginning till the end.

- The name of your partnership and mailing address

- A-C: It includes the principal business activity, principal product or services, and the business code number

- D: It includes an employer identification number

- E: It showcases the date of commencement of the business

- F: It contains the total value of assets of the partnership at the end of the year

- G: It indicates the type of Return applicable. The business can choose from five alternatives as mentioned in the form.

- H: It indicates the type of accounting method used by the partnership. The businesses can choose from three alternatives as mentioned in the form

- I: The partner or LLC member must complete the Schedule K-1. The schedule k1 is attached to form 1065

- J: The partnerships need to check if schedule C or M-3 is attached.

5. The next thing comes up to find the remainder of the IRS form 1065 broken into three categories mainly; income, deductions, and tax payment.

Following is the specimen of Remaining Form 1065: U.S. Return of Partnership Income

- Boxes 1-7 include income related to gross receipts, cost of goods sold, gross profit, ordinary income, net farm profit, net gain loss, and other incomes. All of these are summed up as total income in box 8.

- Boxes 9-20 includes deductions related to salaries and wages, guaranteed payment to partners, repairs and maintenance, bad debts, rent, taxes and licenses, interest, depreciation, depletion, retirement plans, employee benefit programs, and other deductions. All of these are summed up in box 21.

- Box 22 showcases ordinary business income by subtracting box 21 from box 8

- Boxes 23 to 26 include tax and payments related to interest due, BBA, and other taxes.

- Box 27 records the total balance due.

- Box 29 showcases the amount owed, subject to box 28 being smaller than box 27

- Box 30 showcases overpayment, subject to box 28 being larger than box 27

6. At last, the signers need to declare that they have an exam in the Return, including the schedules and statements, and are best of the knowledge. After that, the signature of the partner or limited liability company members and the date are required to mention.

7. In addition, if you want, the IRS should discuss the Return with the preparer when you need to select Yes or otherwise No.

Schedule B: Other Information (Page 2)

Following is the specimen of Schedule B: Other Information

1. Schedule B contains a total of 29 items and continues till page 3.

Schedule B is headed as "Other Information" and asks technical questions about the partnership.

Each and every section is required to be answered in a Yes or No.

2. However, specific questions may need to be answered based on the type of corporation.

3. As far as the one to ten points are concerned, the page contains detailed and specific information related to

- Partnership investments

- Partnership debts

- Ownership percentage of the partnership

- Partnership involvement in the foreign financial accounts

- Partnership receiving a distribution from grantor or transfer

As you can see in the form, the answers to these questions are precise to the business. It is recommended that the partnership have all the financial information organized and available.

It is also recommended to consult a certified public accountant such that every information is mentioned correctly.

Schedule B: Other Information(Page 3)

- Page 3 of Form 1065 is an extension to schedule B that contains lines 11 to 25.

- Unlike page 2, these lines are related to Yes or No questions that cover a variety of topics which includes:

- Property distributed or received in the partnership

- Foreign partners associated with the partnership

- Number of partners that are foreign governments

- Form related to 8996 to certify as a qualified opportunity fund

- Any transfers between the partnership and partner subject to disclosure requirements of regulations

- Tax obligations regarding forms 1099, 5471, and 1042.

Following is the specimen of Schedule B: Other Information

Schedule K:Partners’ Distributive Share Items (Page 4)

Following is the specimen of Schedule K: Partners’ Distributive Share Items

- After completing the details mentioned in schedule B, the next page you need to fill in is schedule K.

- Schedule K under Form 1065 is a summary schedule of all the partners' share of the partnership's income, credits, and deductions.

- Points 1 to 11 cover the income related to ordinary business income, rental income, interest income, royalties, collectibles, other income, and so on.

- Points 12-13 d covers deductions and contributions related to investment in interest expense, expenditure, or other deductions.

- Point 14 is related to self-employment, covering net earnings, fishing income, and non-farm income.

- Point 15 includes rental real estate credits, low-income housing credits, and other credits.

- Point 16 is related to International transactions that need to attach with schedule K-2.

- Point 17 includes alternative minimum tax items adjusted for gain or loss, depletion, and other AMT items.

- Points 18-21 highlight other information related to tax exemptions, non-deductible expenses, distribution of cash and marketable securities, investment income, investment expenses, other items, and the total foreign taxes paid or accrued.

Schedule L: Balance Sheet per Books (Page 5)

Following is the specimen of Schedule L:

Balance Sheet per Books

- Schedule L is the final page under form 1065. It is headed as 'Balance sheets per books'

- To complete schedule L, you are required to fill out lines 1-22 and record the partnership's assets, liabilities, and capital.

- Points 1-13 includes Assets like cash, account receivable, inventory, tax-exempt securities, intangible assets, loans to partner, buildings and depreciable assets, and other assets. All of these are summed up under point 14 as total assets.

- Points 15-22 include liabilities and capital like accounts payable, mortgages, notes and bonds payable, other current liabilities, partners' capital accounts, and other liabilities. These are summed up under point 22 as a total of liabilities and capital.

- If your balance sheet differs from one in the company's financial statement, the partnership will need to explain the discrepancies.

Schedule M-1: Reconciliation of Income per books with Income per Return

In case of differences between the partnership's net income on financial statements and the partnership's net income on tax returns, the partnership or LLC are required to fill the schedule M-1 present at the end of the form.

It includes points 1-9 that contain a few factors that might contribute to the differences between the two.

The specimen of Schedule M-1: Reconciliation of Income per books with Income per Return is as follows:

Schedule M-2: Partners Capital Account

The schedule M-2 is the last section of form 1065 that showcases the partner's capital account changes.

The form, in general, is an analysis of the Partners Capital account, which includes points 1-9 related to balance, net income, distributions, or other lines.

Final Review of Form 1065

After filling all the five pages of Form 1065, the last step is to review the document thoroughly. It is recommended to hire a certified public accountant or tax professional to ensure that every information at your end is correct.

After the detailed inspection and check, the business must sign the document and file it via the preferred method.

As mentioned before, in the process, the tax Form 1065 is accompanied by several other forms that need to be submitted with the same.

These include:

- All the five pages of form 1065

- Form 1040 schedule F

- Any other schedules indicated based on the application

- Schedule K-1 for each partner or LLC member

And now you are done filling with your partnership income for the year.

When to file Form 1065: U.S. Return of Partnership Income?

As far as the form filling of 1065 is concerned, then every partnership is required to fill it by the 15th day of the third month following the date of the tax year ended.

Which means,

- If you find the IRS form 1065 for the 2021 calendar year, the deadline is March 15, 2022.

- If the due date falls on the weekend or is declared a legal holiday, then the filing will be on a succeeding day, subject to it being a non-weekends or a legal holiday.

How can Deskera Help You?

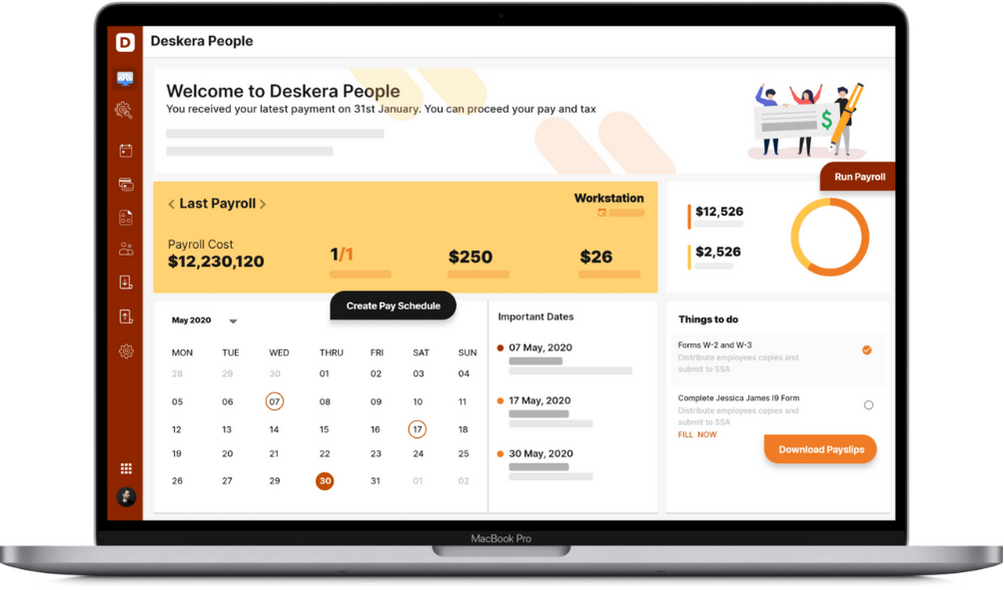

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Conclusion

Overall, it is important for any partnership for LLC operating in the U.S. to file form 1065 subject to the Partnership Income.

With this form, the partnership firm can analyze its financial position and has systematic records of every information related to business and partners.

Key Takeaways

This article covered everything about form 1065 related to the U.S. return of the partnership income. It covers everything from A to Z related to applicability, filing instructions, and process.

Let's take a look at the key takeaways of the article:

- The form 1065: U.S. Return of partnership income is an informational tax form used to report the income, gains, losses, deductions, and credits of a partnership or LLC that are being operated in the USA

- The purpose of form 1065 is to provide a systematic format of entering data into the form and make the process viable and operational for the taxpayers and business owners

- With form 1065, the partnerships and LLCs get the mirror image of the financial position

- Form 1065 applies to domestic partnerships, limited liability companies, nonprofit religious organizations, or any kind of foreign partnership

- The process to file form 1065 can be done through the tax software and programs

- Form 1065 is a 5 Pager document that requires information from a variety of business financial documents

- Form 1065 consists of the main page, Schedule B, Schedule K, Schedule L, Schedule M-1, and Schedule M-2

- Every schedule has a particular set of information, and instructions must be filled in

- After filing all five stages of the form, it is recommended to review the document throughout such that every information at your end is correct

- The filing of form 1065 takes place on the 15th day of the third month following the end of the tax year

Related Articles