Nonexempt workers in the state of Florida are mandated to get overtime pay if they work more than 40 hours per week. Businesses are also required to abide by federal and state overtime requirements, regardless of their size or industry. You've arrived at the right place whether you're just establishing your business or thinking about making your first hires in Florida.

Let’s understand Florid’s Overtime Law and its other aspects.

Table of Content

- What are Florida’s Overtime Laws?

- Minimum Wage Provided for Overtime in Florida

- Who Gets Exemptions from Overtime Pay?

- Other Specific Exemptions

- What are the Penalties/ State Law Remedies?

- What About Hiring Independent Contractors in Florida?

- Final Thoughts

- Key Takeaways

We've covered all you need to know about Florida overtime regulations so you can operate a successful company and make sure your staff members are paid what they are owed. Continue reading to find out how these specific regulations apply to you and how to streamline your company's overtime procedures.

What are Florida’s Overtime Laws?

Fair Labor Standards Act, or FLSA, regulations are closely mirrored in Florida's overtime legislation. If a qualified employee works more than 40 hours in a workweek, they are entitled to overtime pay under the FLSA. A workweek is defined by the U.S. Department of Labor as seven consecutive days or a span of 168 hours that can happen on any day or time.

Due to the fact that overtime payments must be made at a time plus one-half of the employee's usual compensation, overtime rates are based on that rate. Let's look at the minimum wage in Florida as an illustration. If a full-time worker makes $8.65 per hour and puts in 45 hours, the overtime rate for each additional hour would be $12.98. Simply multiplying an employee's hourly compensation by 1.5 will get their overtime rate.

Holiday pay in Florida

Florida firms are not required by law to pay employees more than the minimum wage for hours worked on holidays or weekends. Employers may choose to provide additional remuneration for working today. However, if a worker's workweek includes a holiday or weekend and they worked more than 40 hours, they must be paid overtime.

Minimum Wage Provided for Overtime in Florida

One and a half times an employee's regular hourly rate is overtime pay, sometimes known as "time and a half pay." The overtime minimum pay in Florida is thus $15.00 per hour, which is 1.5 times the state's normal minimum wage of $10.00 per hour. You are entitled to at least 1.5 times your usual hourly compensation for all overtime performed if your income exceeds the Florida minimum wage.

Florida mandates that manual labourers working more than 10 hours in a single day earn overtime compensation for those hours as well as being guaranteed extra for any hours worked above 40 in a single week.

In general, hourly workers in non-exempt industries who make less than $455 per week ($23,660 annually) are entitled to overtime compensation.

Certain categories of workers are automatically eligible under the Fair Labor Standards Act (FLSA) to receive overtime compensation for any hours beyond 40 in a single workweek (or daily overtime limits set by Florida overtime laws). You are likely protected by the overtime legislation if your job involves manual labour (for example, construction worker, factory attendant, cashier, etc.).

Certain jobs are expressly covered under the FLSA while others are excluded from overtime compensation. Federal overtime compensation statutes particularly address the following jobs:

· Under the FLSA, overtime protection is particularly provided for all first responders, including police, paramedics, and firemen.

· Because they frequently put in long hours of work and may otherwise be abused or overworked by their employers, practical nurses and paralegals, who would ordinarily come under the exempt category, are also particularly covered by the overtime rule.

Florida and federal overtime rules are intended to protect employees from being taken advantage of by their employers, with hourly wage earners (especially those in blue-collar sectors) being the main protected class. There is a wide range of particular exclusions to Florida overtime eligibility due to the nature of the work environment and the hours required by various vocations. Nearly 50 million of the 120 million projected workers in America are exempt from the overtime rule.

Under Section 13(a)(1) of the Fair Labor Standards Act, executives, administrators, and other professionals who make at least $455 per week are exempt from receiving overtime pay.

Additionally free from FL overtime regulations are various categories of computer-related professionals and external salesmen (who frequently establish their own hours). Independent contractors are likewise excluded from the overtime rule since they are not regarded as legal employees. Some workers in the transportation industry, some farm and agricultural workers, and some live-in staff like housekeepers are also excluded from this rule.

The FLSA offers a set of tests to establish an employee's eligibility for overtime compensation based on pay rate, working circumstances, skill level, and other considerations in order to decide if a job is exempt from overtime.

Who Gets Exemptions from Overtime Pay?

You are not covered by Florida or federal overtime laws if your position falls under one of the four primary exemptions from the overtime legislation (executive, administrative, professional, and outside sales).

Executive Overtime Exemptions

If you manage two or more people on a full-time basis, your position qualifies as an executive one. You must work a paid occupation, and you must not spend more than 20% of your time on other activities (or 40% in a retail setting).

Administrative Overtime Exemptions

If your major responsibility is non-manual tasks associated with business operations, management principles, or administrative training, your employment is categorised as administrative. To meet the requirements, your employer must provide a salary, and you must devote no more than 20% of your time to pursuits that do not fall into the previously listed categories (or 40% in a retail environment).

Professional Overtime Exemptions

If your major responsibilities call for sophisticated knowledge and significant education, such as those of artists, licenced instructors, or competent computer specialists, your employment is categorised as a professional role. Your work must be paid, mostly intellectual, and include using judgement and discretion. To be categorised as a Professional, you must devote no more than 20% of your time to pursuits that are unrelated to the aforementioned responsibilities.

Outside Sales Overtime Exemptions

If the primary responsibilities of your role are making sales or accepting orders away from your employer's primary workplace, then it is considered an outside sales position. You may get a salary or a commission-based payment structure, but to qualify for this categorization, you must only devote 20% or less of your time to work that is not sales-related.

If any of the four aforementioned categories apply to your line of work, you are not subject to Florida or federal unemployment laws, and your employer is not obligated to compensate you for overtime.

Your employer is obligated by law to pay you overtime compensation for all legally permissible overtime hours worked if your position qualifies for overtime protection under Florida and federal overtime laws as stated above. A Florida Department of Labor office will work with you to guarantee you receive fair compensation for all hours worked if your employer owes you overtime pay.

In 2008, over 200,000 workers successfully filed FLSA violation claims against their employers, winning a total of $140,200,000 (140.2 million dollars) in overtime and minimum wage back pay.

Other Specific Exemptions

Holidays / Vacation

There is no state legislation in Florida that mandates overtime compensation for labour performed on holidays or weekends. Additionally, employers are not compelled to provide paid time off for vacation, holidays, or other absences. The employer has the option to change these regulations.

Meal Breaks / Rest Periods

Employers are not required to provide their staff breaks in Florida. If breaks are nevertheless provided, companies must abide by federal regulations mandating payment for breaks lasting 20 minutes or fewer. If the worker is relieved of all obligations, meal breaks lasting 30 minutes or more may be taken without compensation.

Reporting Time Pay

If a person reports to work intending to work a specific number of hours but does not complete their full schedule, neither Florida nor Federal law mandates payment.

Pay Periods

Neither Florida nor federal law needs specified pay intervals.

Deductions

The sorts of deductions that may be made are not directly addressed by Florida law; nevertheless, under the FLSA, deductions for things like uniforms, shortages, damaged goods, or trade tools cannot bring an employee's hourly pay below the minimum rate.

What are the Penalties/ State Law Remedies?

Florida has the same legal recourse for overtime offences as the federal government. All unpaid overtime for the two or occasionally three years before a lawsuit is filed is recoverable by the employee. In virtually all circumstances, they also have the right to receive "liquidated damages" in the amount of unpaid overtime. This implies that a productive worker may recoup twice as much unpaid overtime. Attorney fees and costs may also be granted to a victorious plaintiff.

An employee who asserts his or her entitlement to overtime compensation or the minimum wage may not face retaliation from an employer. The State Constitution safeguards the following rights among others:

· Submit a complaint over a company's apparent failure to pay employees the legal minimum wage.

· Let anybody know if you believe an employer has violated the law's minimum wage obligations.

· Any individual should be made aware of their prospective rights under Section 24, Article X of the State Constitution, as well as given assistance in pursuing such rights..

After giving notice to the employer and giving the business 15 days to address any claims for unpaid wages, an employee who has not received the legal minimum wage may file a civil lawsuit in court against the employer to recover back pay, as well as damages and legal costs.

Employers that commit willful infractions may be fined $1,000 per infraction.

Written or verbal employment contracts may be the basis for an employee's wage claim against an employer.

What About Hiring Independent Contractors in Florida?

The FLSA does not apply to independent contractors, thus they are not required to pay overtime wages or the minimum wage in Florida. Instead, the payment for these kinds of employees depends on how well their task is completed. For instance, if you hire a freelance writer, you may pay them for each word they produce.

A written contract between you and the employee isn't enough to designate them as an independent contractor, either. There are requirements that must be satisfied before a person may be claimed to be such. For someone to be considered an independent contractor, they must:

· Freedom to carry out their responsibilities as they deem appropriate

· being compensated for every assignment or job finished

· employed temporarily

· bringing their own supplies, tools, or equipment to the task.

In order to prevent future problems, every employee engaged by your company must be appropriately categorised. The last thing you want to do is recruit someone under the FLSA as an employee when they are actually an independent contractor.

Final Thoughts

Understanding your state's labour laws is essential, but with so many overtime regulations, it's not always simple. It might be burdensome to make sure a worker is appropriately designated as exempt or nonexempt or to provide pay stubs that correctly represent overtime pay. However, receiving overtime pay need not be a cause of annoyance or irritation.

How Deskera Can help You?

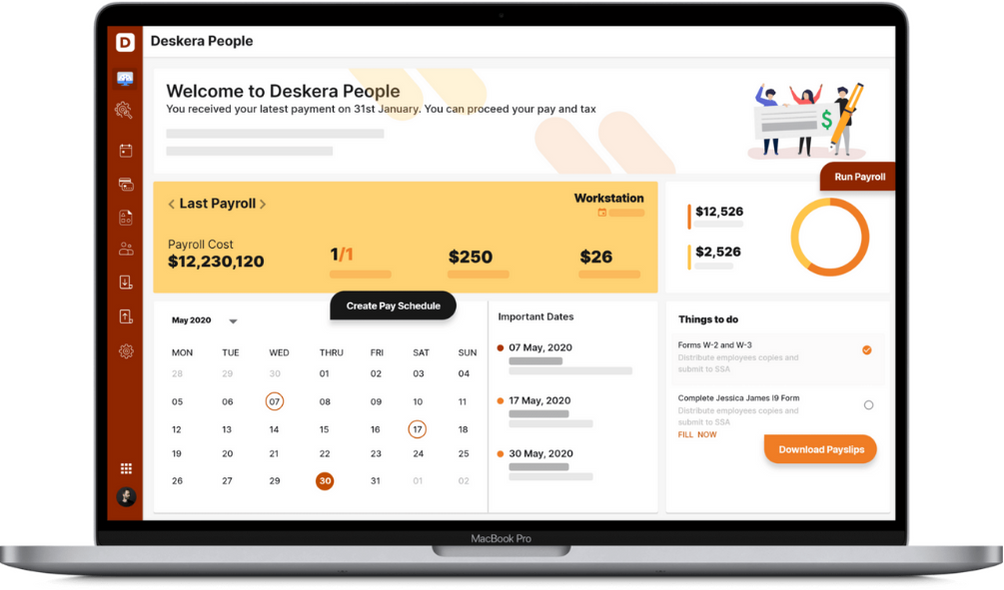

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

· Businesses are required to abide by federal and state overtime requirements, regardless of their size or industry.

· If a qualified employee works more than 40 hours in a workweek, they are entitled to overtime pay under the FLSA.

· Florida firms are not required by law to pay employees more than the minimum wage for hours worked on holidays or weekends.

· One and a half times an employee's regular hourly rate is overtime pay, sometimes known as "time and a half pay."

· The FLSA offers a set of tests to establish an employee's eligibility for overtime compensation based on pay rate, working circumstances, skill level, and other considerations in order to decide if a job is exempt from overtime.

· The FLSA does not apply to independent contractors, thus they are not required to pay overtime wages or the minimum wage in Florida.

Related Articles