Have you ever come across the term Fixed Asset? Or maybe Property, Plant and Equipment?

Fixed Assets are all around us at the workplace. The company's laptop that you are currently using, the projector in the conference room, and even the coffee machine in the pantry - they are all Fixed Assets!

A fixed asset is any tangible item that your business own to generate revenue in the long term.

How are Fixed Assets different from Inventories? And what is the accounting treatment for Fixed Assets? We will go through all these details and more in this article to give you the complete lowdown on fixed assets.

What Is a Fixed Asset?

A fixed asset is a long-term item, piece of equipment, or property that your business owns to generate income. Fixed assets are not expected to be converted into cash in less than a year, which differentiates them from inventory.

Unlike the treatment of an expense, the cost of purchasing the items is spread out over time through depreciation. Most assets face depreciation except specific assets such as land.

Depending of the usage, an item can be classified as either Inventory of Fixed Assets in the business. For example, a laptop that you bought and then resell is an inventory, whereas another laptop that you bought for your employer is an Asset. Hence it is up to the business to decide whether it is a Fixed Asset for long-term internal use or an Inventory to be sold to customers

To sum up, Fixed Assets (Also called Capital Assets) are

- Tangible, long-term items

- Not intended to be sold as regular inventories

- Listed on the balance sheet under Assets, Fixed Assets or Property, Plant, and Equipment (PP&E)

- Subject to loss in value due to depreciation

What is Fixed Asset Depreciation?

Depreciation or Depreciation Expense is the portion of the assets that has been used up (wear and tear). The depreciation gradually reduce the acquisition cost of the fixed asset until the value of the assets become zero or a negligible amount.

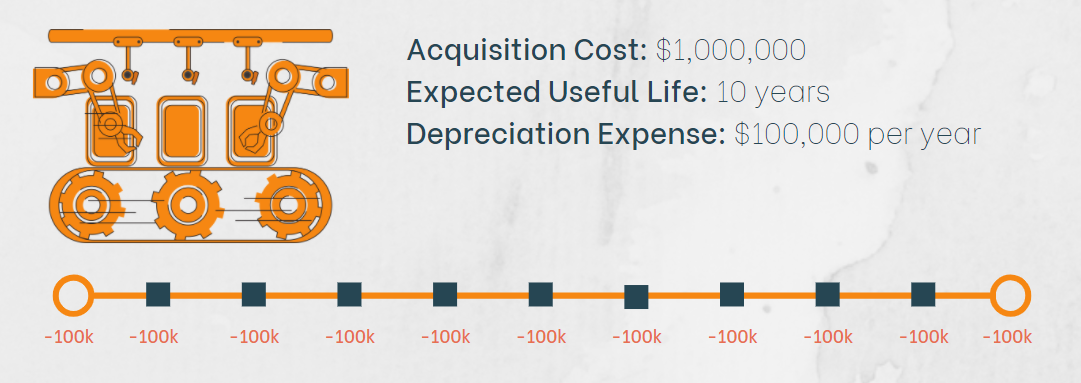

For example: A manufacturing factory bought a assembly line for $1,000,000 that is expected to last 10 years. In this case, the factory decides to depreciate the assembly line $100,000 each year for the next 10 years. The $100,000 is called depreciation expense and will appear in the company's Income Statement each year.

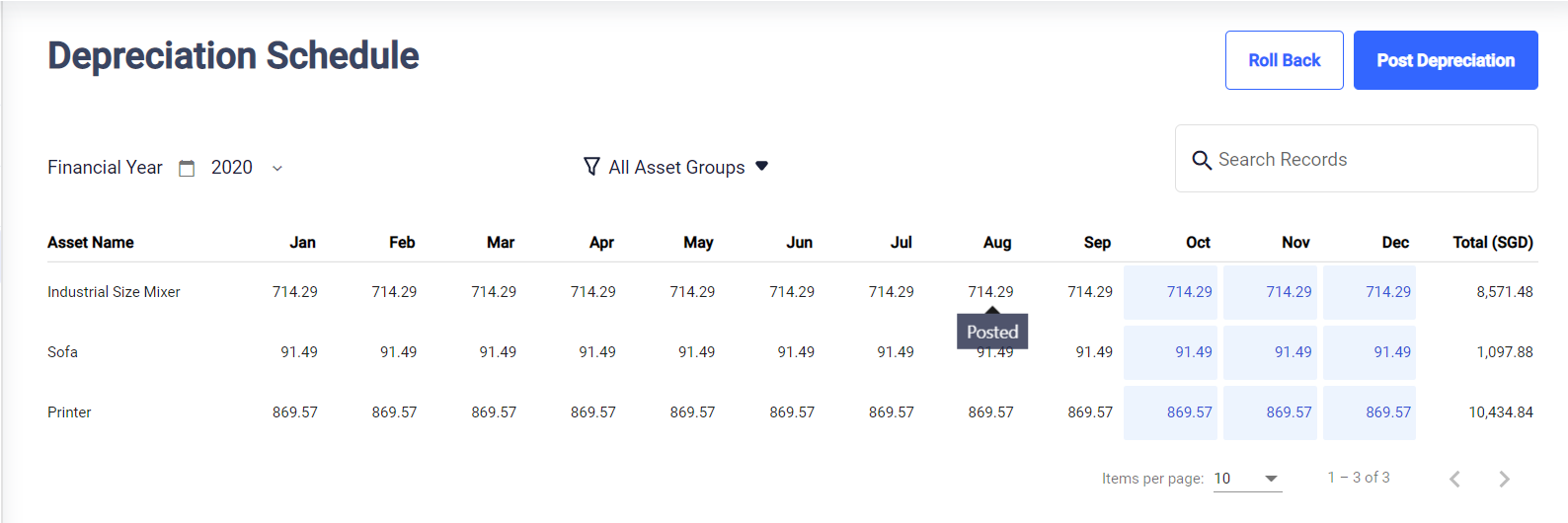

What Is a Depreciation Schedule of Fixed Asset

A Depreciation Schedule is a table that shows the depreciation of the assets over the years. Using the Schedule, the accountants can track how much depreciation should be posted, CFOs can forecast the cash flow easier.

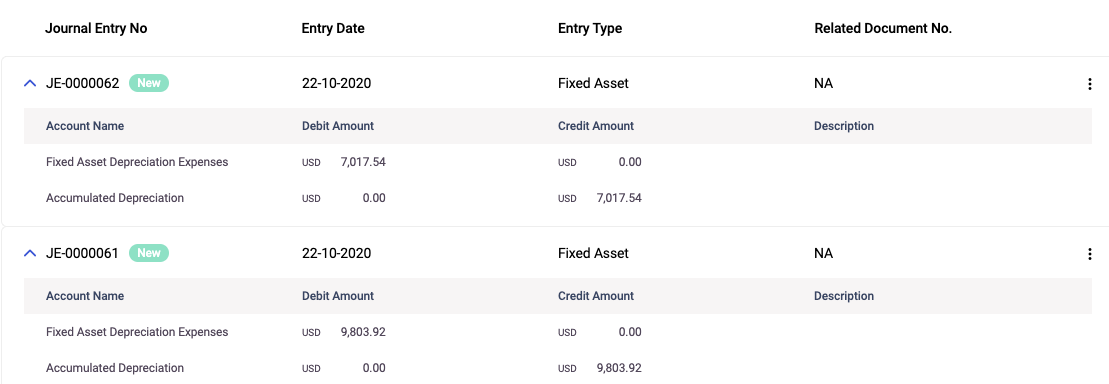

Below is a screenshot of a Depreciation Schedule generated with Deskera Books, where users can track which depreciation has or has not been posted.

What Is the Difference Between Fixed Asset and Assets?

Assets comprise of Long-term Assets and Current Assets. Fixed Assets is a part of Long-Term Assets.

Assets are everything that a company owns, short-term or long term such as cash, money sitting in banks, account receivable, inventory, prepaid rent, lands, buildings, etc.

Fixed Assets are long-term tangible assets that are used in growing the business and appreciated over their useful life. It is classified under Property, Plant and Equipment under Long-term Asset.

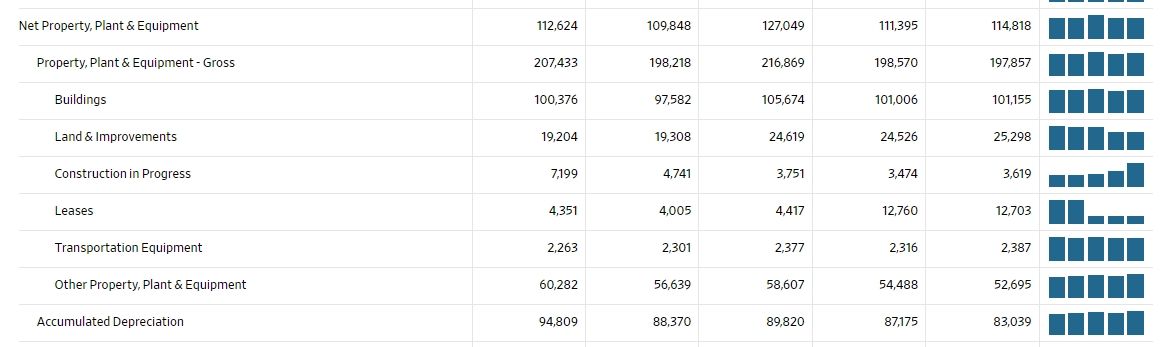

For example: You can see how Walmart Inc. listed its Fixed Assets in its Balance Sheet.

For a better understanding, click here to read our article about Balance Sheet

How Do I Report Fixed Asset in the Balance Sheet?

You can report the Fixed Assets in two ways in the Balance Sheet:

Using The Gross Book Value of Fixed Asset

First, list the Gross Book Value of the Asset (Original acquisition cost of the asset, which includes installation fee, delivery fee, taxes, etc.) of the asset.

Then on a separate line "Less Accumulated Depreciation", report the sum of all depreciation expenses ever posted for this asset. (Hence it is called "Accumulated")

Finally, take the Gross Book Value minus Accumulated Depreciation . This will tell you the current value of the Assets (Net Book Value).

Net Book Value= Original Cost- Accumulated Depreciation till date

Using the Net Book Value of Fixed Asset

Report directly the Net Book value of the Fixed Assets in one line and indicate that it is a Net Value.

Net Book Value= Original Cost- Accumulated Depreciation till date

How is Fixed Asset Different From Inventory and Expenses?

Inventories or Inventory are/is finished goods or raw materials used in finished goods production that the company owns. They are expected to be converted into cash within a year.

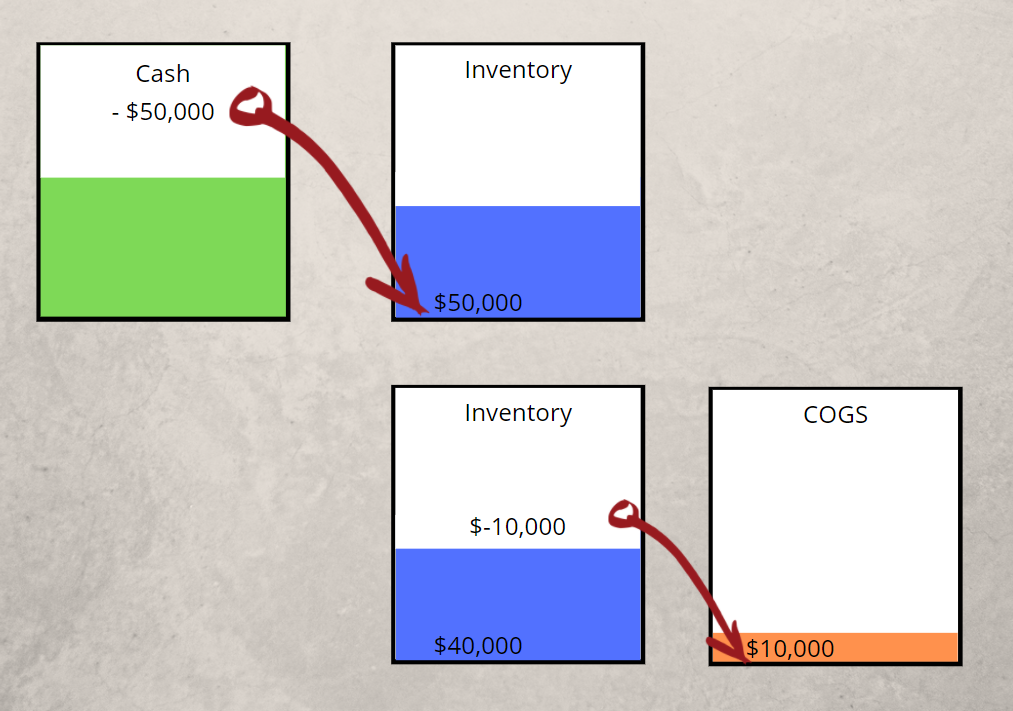

When received, inventories’ costs are captured in the Inventory Account (under Current Assets heading in the Balance Sheet). Once the inventories are sold, the cost of sold inventories is transferred from the Inventory Account Cost of Goods Sold account.

Fixed Assets are assets that the company owns, but are more costly and are expected to help the business generate Revenue in the long-term. Their costs are distributed over multiple years.

The Acquisition Cost of assets are first stored in Fixed Assets Accounts (under Non-Current Assets in the Balance Sheet), then the depreciation expense will be recorded periodically by posting a journal entry to the Depreciation Expense Account and Accumulated Depreciation Account.

Note that the Accumulated Depreciation Account holds a Credit balance while Fixed Assets holds a Debit balance. Since both accounts belong to the same Fixed Assets category on the Assets side of the Balance Sheet, the net amount of Fixed Assets Account and Accumulated Depreciation Account represents asset's Net Book Value.

Expenses are costs that are usually small and are only beneficial in the period your business incurs them, and it is accounted for in the incurred period.

Expenses such as buying printing paper, adhesive tape, or paying for cleaning service fee are either too small to be tracked or only beneficial to that specific period. Such costs are immediately recorded in the period by posting a journal entry to the expense account.

In summary

| Fixeds Asset | Inventories | Expenses | |

|---|---|---|---|

| Cost | Generally expensive | Vary | Depend on each businessVary |

| Benefit | Can help business generate revenue in the long run | Able to converted into revenue within a year | Only benefit the period when the expenses were incurred |

| Accounting treatment | First capture Acquisition Costs using Fixed Assets Account. Each Period, record the depreciation expense by increasing the depreciation expense and Accumulated Depreciation Account | First capture Purchase Cost using Inventories Account. Once the inventories are sold, reduce the inventory account and capture the expense using Cost of Goods Sold Account | Record the expense immediately through the respective expense account |

Commonly Used Terms - Fixed Asset

Let us familiarize ourselves with some common terms associated with fixed assets.

What Does “Capitalize” Mean in Fixed Asset?

Capitalization is a process in which the total cost of acquiring an asset, including taxes, delivery fee, installation fee, etc. are spread out and expensed over the useful life time of the Asset, instead of being expensed when the cost is incurred.

So when you hear the term “capitalize a cost,” it simply means the cost will be spread over a period of time.

Is “Amortize” the Same Thing as“Capitalize”?

The process is similar to “Capitalization”, but while “capitalization” deals with tangible fixed assets, “amortization” deals with intangible assets such as patents, trademarks, franchise agreement, etc.

For natural resources such as oil, gas, timber, the process is called Depletion.

The Benefit of Capitalizing Fixed Assets

Due to the high cost of some fixed assets, spreading the expenses over a period would greatly reduce the fluctuation in income.

If a business expenses a costly long-term asset immediately, it would skew the profit and loss to the month when the transaction took place. This would distort important financial ratios such as Debt to Equity and should be avoided.

What is the Impact of Capitalizing Fixed Assets

On the Balance Sheet

When a fixed asset is purchased and capitalized, the acquisition cost is recorded under the Fixed Assets account.

All depreciation of the asset will be summed up and accumulated over time in its Accumulated Depreciation Account, a contra account to reduce the Fixed Assets to arrive at their Net Book Value

On the Income Statement

The depreciation posted to Accumulated Depreciation Account is to calculate the value of the Fixed Asset to the current value in the Balance Sheet and is not relevant to the Income Statement.

The depreciation posted to Depreciation Expense Account is to record the expense from wear and tear of the fixed assets, bringing down the Net income of the company in the Income Statement for that particular period.

On the Statement of Cash Flows

When a fixed assets is purchased or sold with Cash, it will reflect as a reduction or increase of cash in the Cash Flow From Investing Activities section

Fixed Asset Accounting

First of all, you need to understand the 3 main accounts in your Chart of Accounts that we need for a fixed asset:

The 3 Accounts Involved

Fixed Asset Account: This is an Asset Account under the Non-current Asset header. It captures the Original acquisition cost of the Fixed Assets and will not be changed for the Assets until the Assets are disposed of.

Each asset might use a different Fixed Asset Account, so you might see different Fixed Asset Accounts, suffixed with its group (e.g Fixed Assets - Office Equipment, Fixed Assets - Buildings, Fixed Assets - Machinery, etc.)

Accumulated Depreciation Account: A contra account that will reduce the balance of Fixed Asset Account. This will store the total amount of depreciation ever posted for the Fixed Asset. (Hence the name "Accumulated")

Depreciation Expense Account: An Expense account in the Income Statement. Unlike Accumulated Depreciation account, the depreciation expense do not accumulate and will be reset to 0 before the beginning of every new accounting cycle.

Accounting Process for Fixed Assets

For acquiring a fixed asset, first record a reduction in Cash Account and an increase in the Fixed Asset Account by the acquisition cost. Think of this Fixed Asset account as a temporary storage tank that will “leak out” periodically to the Depreciation Expense Account.

Note: We want the Fixed Asset Account to retain the original acquisition cost (Gross Book Value), so the Accumulated Depreciation Account will accumulate all the depreciation posted to the fixed assets over time instead of reducing the Fixed Assets Account directly.

Below is an example of an asset with Book Value of $40,000 with a useful life of 4 years.

Each year the asset will depreciate $10,000 and the depreciation is recorded by periodically posting a Journal Entry to the Depreciation Expense Account. Instead of reducing Fixed Asset accounts directly, the Accumulated Depreciation accumulate all the depreciation of the assets.

To know the current value of the Fixed Asset (Net Book Value), you need to net off the Fixed Assets Account and Accumulated Depreciation Account.

Journal Entry for Fixed Asset Transactions

When you purchase a new asset:

| Dr | Cr | |

|---|---|---|

| Fixed Assets Account | Acquisition Cost | |

| Cash | Acquisition Cost |

When Depreciation need to be posted:

| Dr | Cr | |

|---|---|---|

| Depreciation Expense Account | Period’s Depreciation Expense | |

| Cash | Period’s Depreciation |

How To Account for Disposal of Fixed Assets?

Here are the cases when disposing a fixed asset:

The Fixed Assets Are Fully Depreciated

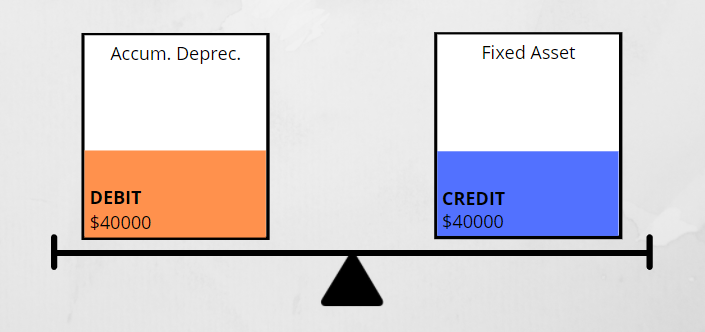

When the fixed assets are disposed after it have been fully depreciated, we have to remove completely the Fixed Assets Account along with the Accumulated Depreciation:

| Dr | Cr | |

|---|---|---|

| Accumulated Depreciation | Full amount as of date of disposal | |

| Fixed Assets | Full amount as of date of disposal |

For example: Macrosoft International bought a machine for $40,000 and recognized $10,000 of depreciation expense per year over the last fours years. When the machine is fully depreciated, Macrosoft discarded the machine and posted the following entry:

| Dr | Cr | |

|---|---|---|

| Accumulated Depreciation | $40,000 | |

| Fixed Assets | $40,000 |

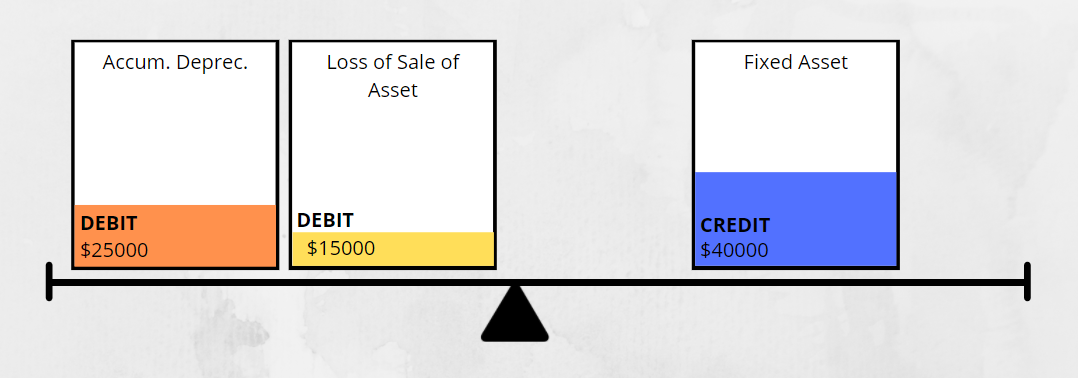

The Fixed Assets Are Fully Depreciated with a Residual Value

When the fixed assets are disposed after it have been fully depreciated, but the asset still has a scrap value (also known as residual value); we have to remove completely the Fixed Assets Account along with the Accumulated Depreciation. The difference will be Debit to the Lost on Asset Disposal Account

| Dr | Cr | |

|---|---|---|

| Accumulated Depreciation | Full amount as of date of sale | |

| Loss on disposal of asset* | The difference | |

| Fixed Assets Account | Full amount as of date of sale |

*You will usually see accountant use a combined account called "Gain/Loss on disposal of asset".

For example: Macrosoft International bought a machine for $40,000 and recognized $10,000 of depreciation expense per year. In the 3rd year, the machine no longer functioned and Macrosoft had to discard it. Macrosoft posted the following entry:

| Dr | Cr | |

|---|---|---|

| Accumulated Depreciation | $30,000 | |

| Loss on disposal of asset | $10,000 | |

| Fixed Assets | $40,000 |

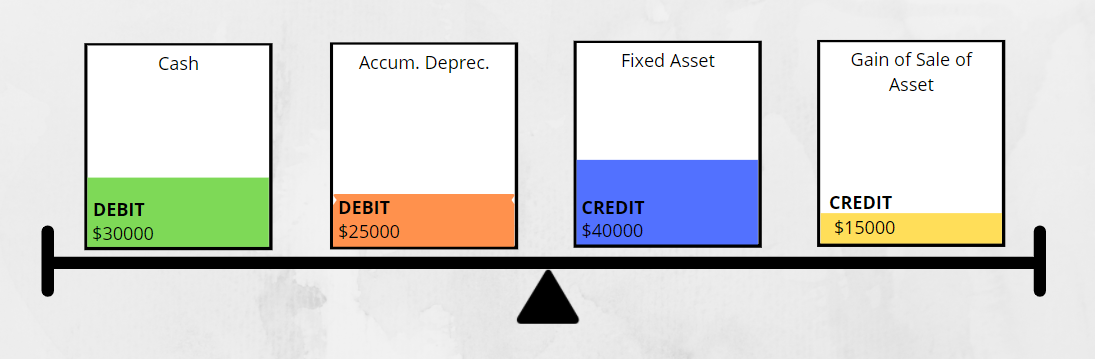

When the Fixed Assets Are Sold

When the fixed assets are sold, we have to depreciate the asset up to the sales date, then completely remove the balance in Fixed Assets Account and Accumulated Depreciation.We also have to record the proceeds from the sales and the gain or loss (if any) on sales of fixed asset.

Gain on sales of asset

| Dr | Cr | |

|---|---|---|

| Cash | Proceeds from the sale | |

| Accumulated Depreciation | Full amount as of date of sale | |

| Fixed Assets Account | Full amount as of date of sale | |

| Gain on sale of asset* | The difference |

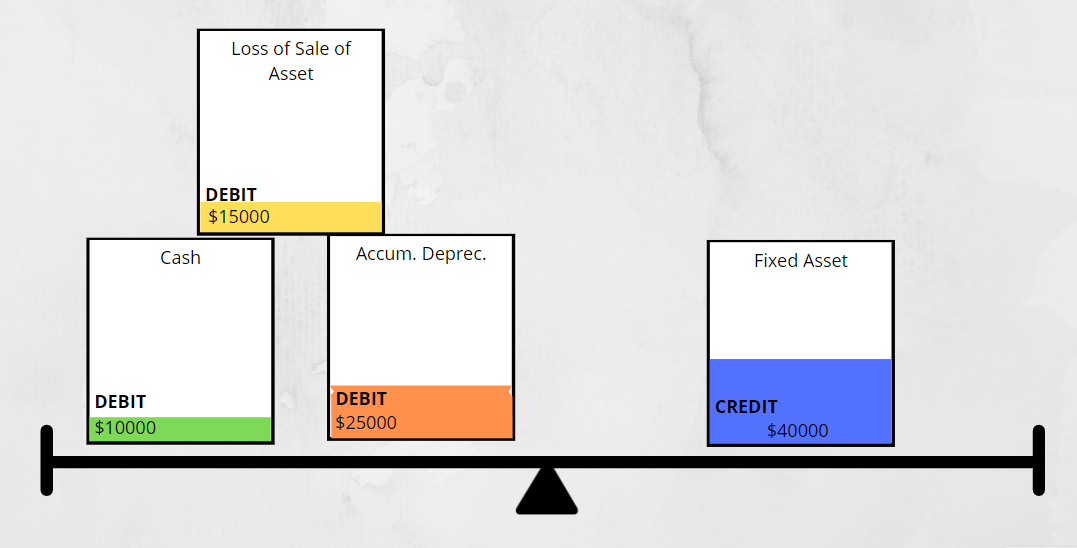

Loss on sales of asset

| Dr | Cr | |

|---|---|---|

| Cash | Proceeds from the sale | |

| Accumulated Depreciation | Full amount as of date of sale | |

| Loss on sale of asset* | The difference | |

| Fixed Assets Account | Full amount as of date of sale |

*You will usually see accountant use a combined account called "Gain/Loss on sale of asset". "Gain/Loss on disposal of asset" account can be used also.

For example: Macrosoft International bought a machine for $40,000 and recognized $10,000 of depreciation expense per year. In the mid of second year, Macrosoft decided to sell the machine for $30,000.

Step 1: Macrosoft had to depreciate the fixed asset up to the date of the sale.

| Dr | Cr | |

|---|---|---|

| Depreciation Expense | $5,000 | |

| Accumulated Depreciation | $5,000 |

Step 2: Macrosoft then calculated the Net book value of the asset.

Step 3: Macrosoft calculated the difference between the proceeds from the sales and Net Book Value.

- If the difference was positive, Macrosoft realized a gain

- If the difference was negative, Macrosoft realized a loss

Step 4: Macrosoft posted the following journal entry to:

- Record the receipt of Cash

- Remove the balance in Fixed Assets and Accumulated Depreciation Account

- Record the gain on the transaction:

| Dr | Cr | |

|---|---|---|

| Cash | $30,000 | |

| Accumulated Depreciation | $25,000 | |

| Fixed Assets Account | $40,000 | |

| Gain on sale of asset* | $15,000 |

Key Takeaways

- Fixed Assets are long-term, tangible items, and are used in the business to generate revenue.

- Fixed Assets are listed on the balance sheet under Property, Plant, and Equipment (PP&E)

- Capitalization is the process to spread the acquisition cost of the Fixed Assets to multiple periods.

- The Depreciation Expense is Debited in each period, along with a Credit to Accumulated Depreciation Account

- When the Fixed Assets are disposed, the balance in related Fixed Assets and Accumulated Depreciation Account have to be reversed out completely. Any difference will be Credit/Debit to the Gain/Loss on disposal of asset account.

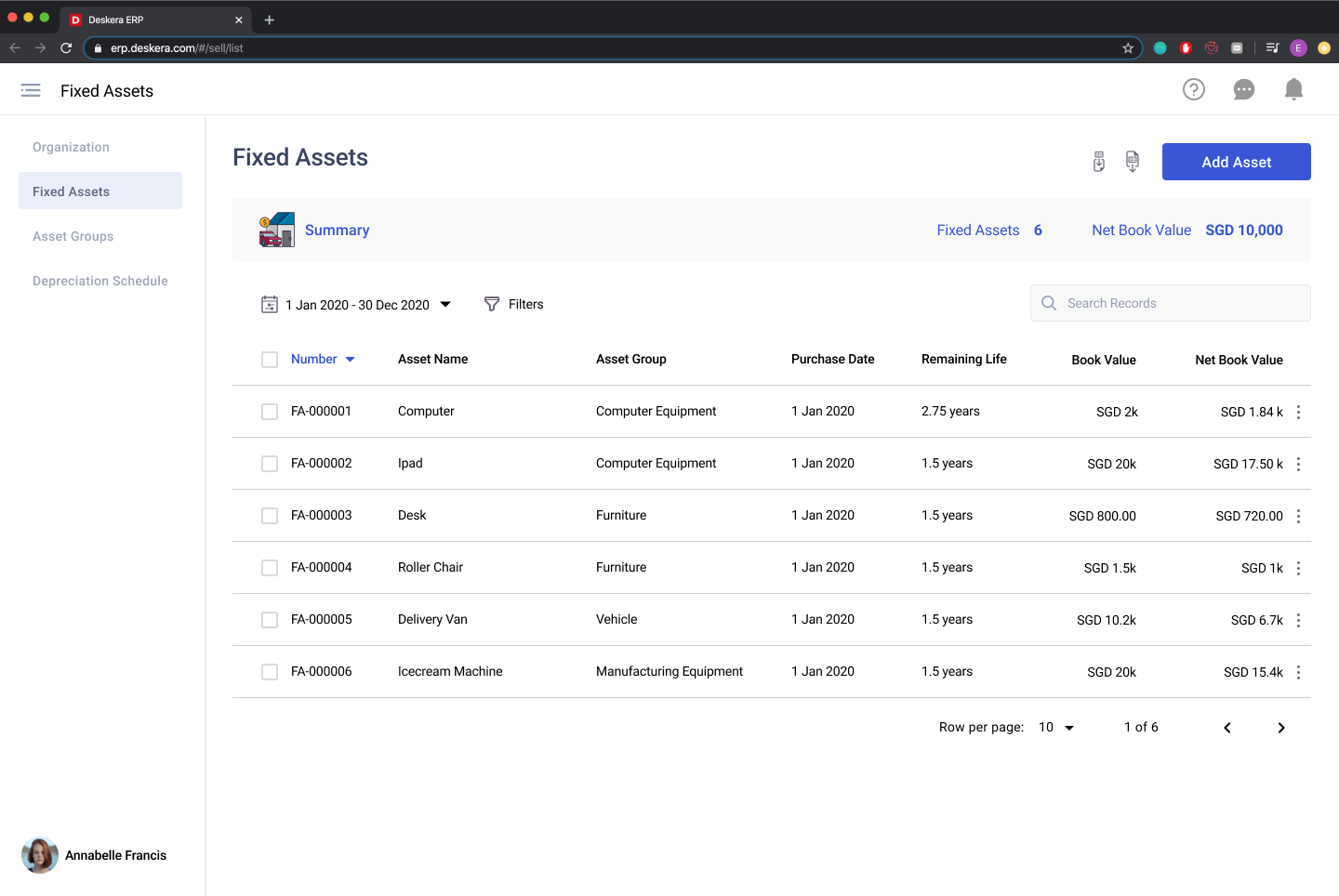

How Deskera Books Can Help You with Fixed Assets

We hope by now you have now grasp the ideas and the accounting process for Fixed Assets.

We know how challenging it is to deal with Fixed Assets accounting process, so we have designed a Fixed Asset Management App in the Deskera App Store. The fixed assets module connects seamlessly with Deskera Books.

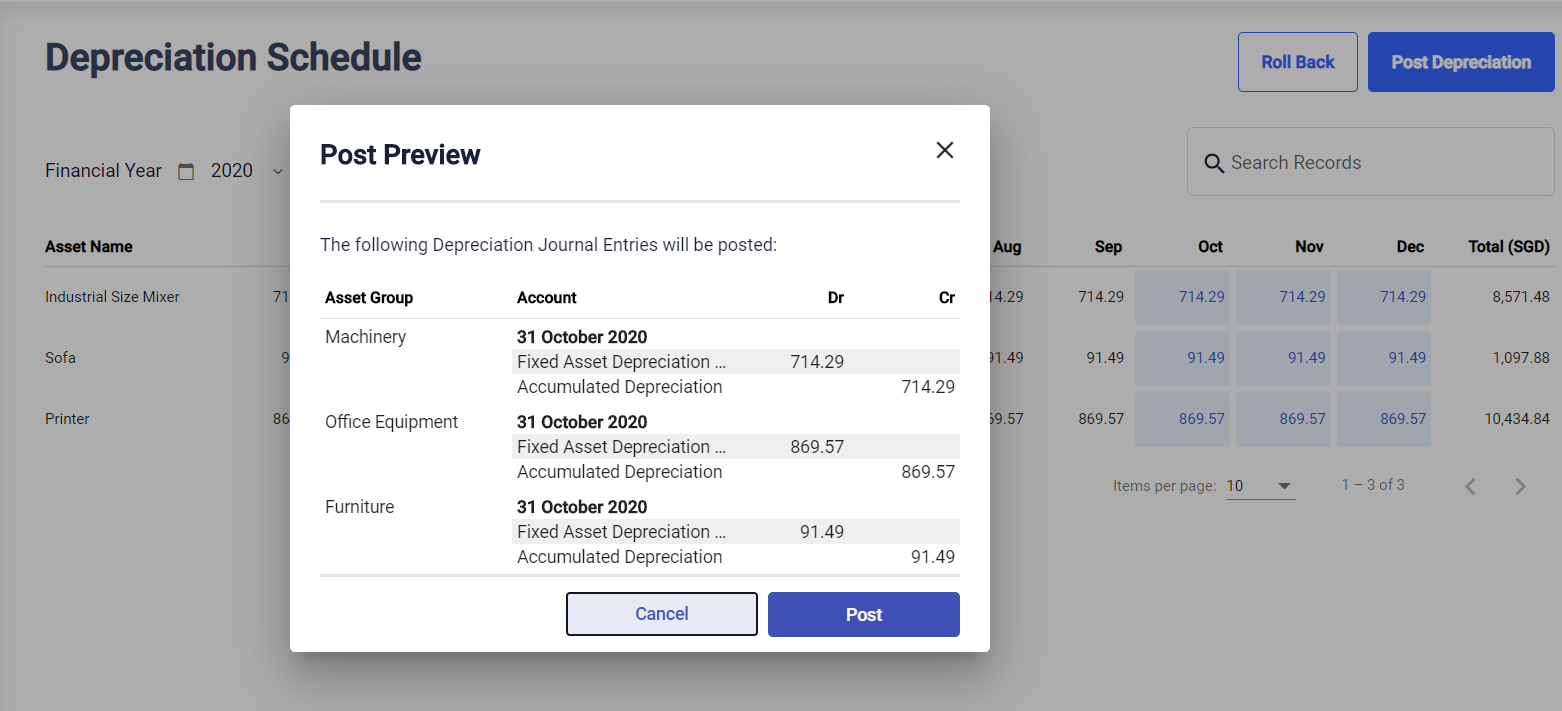

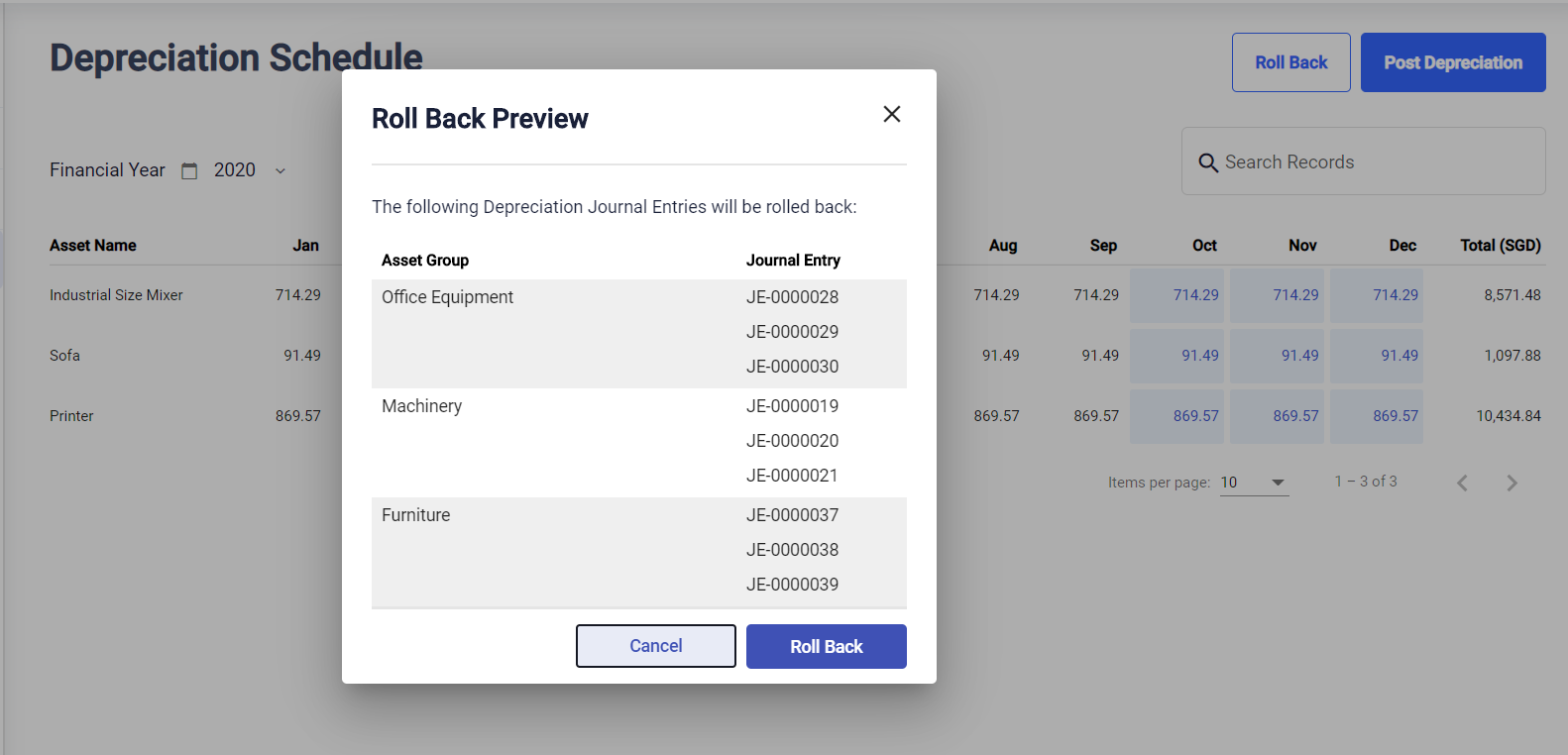

With this module, you can easily:

- Manage your fixed assets in one place

- Auto-calculate Depreciation Expense with ease with Depreciation Schedule to quickly see which assets need to have depreciation recorded

- Review the Journal Entry for depreciation before posting

- Made a mistake? No worries, you can always roll back the Journal Entry

So what are you waiting for? Check out Deskera Books today!

Related Articles