"We represent 80% of all Small Businesses and Markets, and this is our specialty."

These words by the Co-founder of a leading Fintech Company, Kabbage, is a story in itself.

With the hit of the COVID-19 pandemic, the operations of small businesses were forced to close or limit their activities to slow down the spread of the virus.

This issue was operated by the US state and local governments targeting the small businesses whose employees count ranges from 10 or less to deal with the pandemic.

As a result of this action, the small business owners faced many difficulties operating their businesses in the local areas. One of the major difficulties that the small businesses faced was a hindrance in loan approvals and denials by several big banks who only worked with the existing customers or prioritized their more prominent clients.

After the launch of the Paycheck Protection Program (PPP), the small business owners received a sign of hope. With this effect, the Federal government partnered with almost 5500 lenders that processed nearly 800 billion in 100% forgivable small business loans for the business owners.

Out of these lenders, Fintech companies became a lifeline for many smaller businesses who helped them provide PPP loans and proved a significant contribution in getting the loans to companies that the big banks have denied.

In this article, we will be discussing the crucial role of fintech companies and lenders in helping the small businesses to access the PPP funds in detail, along with the following:

• What is a Fintech Company?

• How did Fintech lenders play an important role in helping businesses access PPP?

• Who are the current Fintech PPP lenders?

What is a Fintech Company?

Financial Tech, commonly known as Fintech, describes the companies that automate and facilitate financial services through technology.

These entities help businesses and customers to manage their finances with the help of software, devices, and algorithms at the back end.

If you talk about the industries that Fintech serves, it covers education, investment management, retail banking, and others.

Fintechs also help keep track of the digital economic clock and impact the lives of small business owners. This establishment also provides ways for the businesses to save money, perform more and build better customer relationships. There are a lot of fintech companies helping millions of businesses process payments. Stripe, Squarespace, Ant Group, etc. are among the biggest fintech companies across the globe.

Most Fintechs offer tools that digitize the business finances, small business lending, point of scale, and payroll.

How did Fintech lenders play an important role in helping businesses access PPP?

As we know that COVID-19 outsized the impact on the small firms and local businesses. When the big banks raised their hands to not offer support due to their size and revenue, the Fintech lenders were the ones who extended their support.

Following are the three points that reflect the role of Fintech lenders in helping the business to access the PPP:

1. Fintechs originated smaller loans than lenders

2. Fintechs serves small businesses in multiple ways

3. Fintechs helped in reducing fraud

1. Fintechs originated smaller loans than lenders

Small and medium banks accounted for half of the loans, with medium loans with values of $27,500 and $35,390.

Fintechs made 757,137 loans with a median value of $15000 to small businesses that served smaller firms on an average.

2. Fintechs serves small businesses in multiple ways

Fintechs played a crucial role in helping the nation's small businesses without a prior banking relationship access PPP. It also offers Digital technology application performs and know-how to the traditional lenders such that it can reach the smallest of small businesses.

Fintechs also concentrated a massive effort to serve new customers, especially from the underserved communities.

3. Fintechs helped in reducing fraud

Commonly, every government program is subject to fraud, especially if you talk about PPP lenders.

But the role of Fintech changed the entire outlook and process to process funds from the PPP.

When Fintech entered the program, they were advised by the Small Business Administration (SBA) to rely on the certifications of the borrowers to facilitate the speedy distribution of the PPP funds.

As a result, the lenders acknowledged and addressed the risk during the program and took concrete steps to reduce the chances of fraud through PPP.

In addition, fintech companies prove to be instrumental in assisting the law and enforcement agencies in bringing up the offender in the eyes of the law.

So as you can witness from the points mentioned above, the role of PPP in rescuing America's small business economy and the critical contribution of fintech companies changed the entire map of operating small businesses.

Marshaling this duo partnership to a positive extent helped small businesses expand their access significantly added to their growth and, ultimately, PPP's success.

Who are the current Fintech PPP lenders?

As per the Consolidated Appropriations Act of 2021, the act reviews the PPP with $284 billion in new and unused funds.

If you are a previous or first-time PPP applicant, you may be eligible for loans up to $2 million.

Following is the list of popular Fintech companies that have participated in the PPP:

|

Some other lists of popular Fintech companies haven't yet participated in the PPP but may have different lending options.

The list of the companies is as follows:

|

How Deskera Can help You?

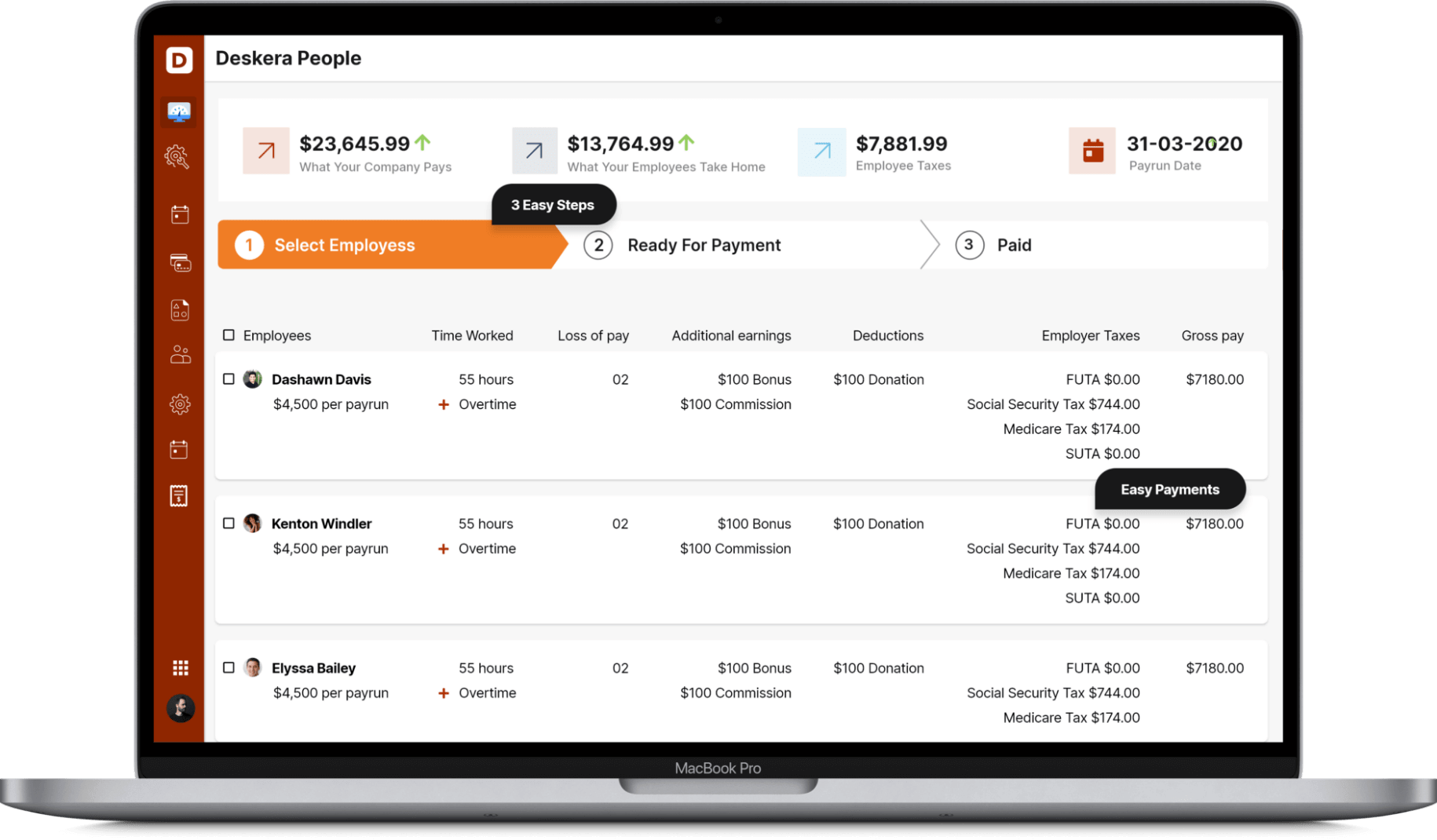

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

The Paycheck Protection Program (PPP) was a fintech's 'Movement to shine' that dispersed billions of dollars in the pandemic to the small businesses.

The Fintechs specifically targeted the small business market and the owners that provided the opportunity to keep their businesses alive with the PPP loans.

There is no doubt that the Fintechs will continue to be the key player in serving the smaller businesses and providing them with the services that these businesses want and needs

Let's take a short glimpse of the article:

- After the hit of the COVID-19 pandemic, small business owners were forced to close all limited activities to slow down the spread of the virus.

- After the Paycheck Protection Program launch, the small business owners received a sign of hope to sustain their business.

- Fintech companies significantly contributed to getting the PPP loans to businesses that the big banks have denied.

- Fintech describes the companies that automate and facilitate financial services to technology.

- The fintech lenders extended their support in helping the businesses to access the PPP.

- The three major roles performed by the Fintech lenders were originating smaller loans than lenders, serving small businesses in multiple ways, and reducing fraud.

- The role of PPP in rescuing America's small business economy and the critical contribution of fintech companies changed the entire map of operating small businesses.

- The current list of popular fintech companies that have participated in the PPP are

- Biz2credit

- Brex + Womply

- BlueVine

- Cross River Bank

- Fundera

- Funding Circle

- Divvy

- Lending

- Ready Capital

- SOFI lantern

- Other popular fintech companies haven't participated in the PPP but have other lending options. It includes:

- Credibly

- Fundbox

- Intuit

- Kabbage

- NAV

- Ondeck

- PayPal

- Square

- The PPP was a fintech's 'Movement of Shine' that targeted the small business market and extended the opportunity to keep their business alive with the PPP loans

Related Articles