Do you run a small business? The success of your business may then finally depend on the clients' financial capabilities. Retailers with online storefronts and ecommerce businesses may think about using a financing platform to improve customer loyalty and boost sales as COVID-19 affects how consumers shop.

Customer financing is one approach that might be used. Instead of paying in full up once, customer financing enables small company clients to spread out the cost of a transaction. Continue reading to find out more about customer finance, its expenses, and how to provide it to your clients. Following are the topics covered:

- What is customer financing?

- How customer financing works

- What does customer financing cost?

- Benefits of offering customer financing

- Disadvantages of customer financing

- Alternatives to customer Financing

- Key takeaways

What is Customer Financing?

Customer financing is a service or program provided by a company to assist customers in making payments over time for goods, services, or products. Financing typically requires filling out an application and doing a credit check to determine the customer's overall credit risk.

Any buy-now-pay-later arrangement is referred to as customer financing. Prior to the delivery of the products or services, the customer will typically be required to pay a fraction of the whole price. Instead of being a business-to-business (B2B) arrangement, this type of financing is typically a business-to-customer (B2C) arrangement.

When a customer wants a service but can't immediately afford the whole cost, it gives them a simpler payment option. When you give customers finance, you are compensated when the work is finished. Until the job is fully paid for, the consumer makes incremental monthly payments. Consumer finance enables service providers to hire more people for greater assignments.

Customers can receive the services they require faster in the interim. The consumer may be required to pay interest on their monthly installments through a third-party provider, but the company usually gets paid in full at the time of purchase.

Since the business normally receives the money up front and the client makes payments to a third party, the mechanics can be comparable to a credit card for both the business and the customer. Customer financing can occasionally be obtained in the form of a store credit card.

Types of Customer Financing

Primary financing

Primary financing is referred to as financing where a company serves as a lender and provides consumers with its own financing program. Compared to third-party financing, primary financing is usually a more time-consuming process for the company. Internal consumer financing that you arrange and control on your own for monthly payments. If you're thinking of providing in-house client financing, be ready to devote time to running the operation and educating staff. How to determine whether a customer is creditworthy is a crucial issue that you must resolve. Make sure the folks to whom you are providing financing are able to pay you back.

Additional actions could consist of:

• Establishing a system for monitoring payments and collecting overdue payments.

• Adding new entries to the journal to represent the accounts receivable

• Making sure you have a procedure in place for protecting client credit information.

• Deciding on the terms you'll use and how a client will pay you.

Because you'll need to develop your own procedure and spend time monitoring customer payments, in-house customer financing may take significantly longer than using a third-party customer financing provider, depending on the volume. Since some third-party customer finance firms don't charge merchant fees, it can even be more expensive if you need to engage additional support to keep track of the unpaid invoices.

Third-party financing

A type of financing known as third-party financing involves small business owners depending on a third-party finance provider to serve as a lender at the point of sale. In the majority of these programs, the consumer establishes a payment schedule to pay for a product in full over time, frequently in monthly installments.

Being able to keep your hard-earned money is always good, but now that we've covered some of the key factors for offering client financing in-house, you might be able to see the hassles that go along with it as well. Unlike other, stricter forms of financing, third-party financing companies allow a wide range of credit to be accepted.

Some of these businesses don't charge you anything for referring a consumer to them for finance, while others ask for a fee in exchange for your referral of a customer. Additionally, they will keep any fees and interest that the customer pays to acquire finance. In exchange, they handle all the administrative and legal challenges associated with customer financing on your behalf.

The general procedures for customer financing through a third-party source are as follows:

1. The company promotes the availability of a payment method: Businesses will handle that either on their website while you're purchasing a product or at their point-of-sale system, depending on how customers make purchases.

2. The customer submits an application for financing: After choosing a financing plan, the client or a representative of the company may submit a brief form.

3. The customer completes the transaction and pays the company in full: The approval process should take just a few seconds. Following approval and a consumer purchase, the finance company may pay the business in full.

Be sure you comprehend the specifics of how the financing company operates before signing a contract if you decide to continue working with a third-party financing firm. Recognize the profit and sales growth you anticipate. Make sure that these financing costs don't exceed your profit margin if you sell low margin products.

Otherwise, all of this trouble would have been for nothing. While some of these financing plans may not charge interest, others may do so at predetermined rates. Through third-party customer financing, the job of establishing and maintaining the program is delegated to an outside provider.

You give your clients the opportunity to pay using a financing option rather than doing a credit check, providing financing options, and keeping track of monthly payments. A business will frequently get paid up advance if a consumer is accepted by a third-party payment processor.

Your customer will pay the provider rather than you, much like they would with a credit card. You will have to pay more money, but there will be less labor for you. As an illustration, you might pay a merchant fee that is a percentage of each transaction, albeit this price may be comparable to what you would pay to accept credit cards or other payment methods.

After the transaction is complete, the customer will get the item and start paying the financing firm. If you choose to get in touch with one of these businesses because you're interested in working there, make sure to ask them things like:

• Is there a fee for referring a client to submit a financing application?

• How does management handle defaults? Some businesses assign defaults back to you, and dealing with those seems to give you extra hassles.

• Do you receive payment for introducing customers?

• How quickly do you receive funding, and when does a sale constitute as a sale?

• How do they handle complaints and charge backs? What about false claims made by a customer that you shipped a product when, in fact, you did?

• How do they handle returned goods? Are you compelled to accept a return or do you have the option to decline? Do you have to give the customer their money back? Or is that arranged between the customer and the financier? If so, will the merchant be required to pay the financing business the money back?

• Who provides customer support? How do you split the accountability if this is between the merchant and the finance company?

Before contacting a finance firm, make sure to list all of your questions so that you don't forget any of them. You won't unintentionally forget to ask a question if you do this.

Layaway

In a layaway payment arrangement, a company holds a product for a customer until the customer makes full payment, usually in a series of installments. In contrast to other forms of financing, a layaway arrangement prevents the consumer from taking possession of the item until the whole purchase price has been made.

If the consumer does not finish paying for the item as specified in the layaway agreement, the item will be returned to stock. Depending on the conditions of the agreement, the customer's money may either be forfeited or reimbursed in full, less a fee. Some companies decide to charge a fee for keeping the product on hold while the consumer finishes making their payment.

As credit cards became more widely used, layaway's appeal waned but it may still be a viable alternative for some companies and customers. In most cases, a layaway arrangement enables the consumer to avoid interest fees while keeping the item's price stable. Layaway options can be provided to clients with bad credit and lower seller risks.

You can help your consumers avoid sticker shock and change the subject from overall expenses by utilizing consumer financing. Instead, you may demonstrate to buyers how affordable monthly payments can enable them to purchase whatever item they choose. With financing, you can re-frame the discussion with the customer such that the value of the purchase rather than the buyer's limited budget is the main topic.

How Customer Financing works

Whether you run a physical store, an online store, or both, how you notify your customers that financing is available and urge them to apply will depend on your decision to offer financing to your customers. It also relies on whether you've made the decision to handle this internally or by hiring an outside expert.

If you've chosen to provide finance internally, you can advertise anyway you like as long as you make the application simple for a potential client to complete. However, there are a number of ways to communicate information regarding the financing offer and payment alternatives if you've chosen to work with a third-party source.

Step 1: Inform your clients that you provide financing

First, let your clients know that financing is a possibility. You can immediately put this information on your estimates and quotes or on your website.

If they have indicated concerns about their finances, you can also inform them in person. The customer can apply immediately from the quote if your partner offers integrated finance.

Step 2: The customer and a partner apply for funding.

Through your financing partner, your consumer must submit a financing application. They'll typically run a credit check to discover if your client is eligible.

Some partners use a soft credit check that doesn't influence the homeowner's credit score to let them examine their options first. When the customer agrees to apply, a rigorous credit check will be performed. If they were accepted or rejected, the partner will inform your customer.

Step 3: Start performing services

Your chance to excel comes once your consumer has been granted financing and has accepted the terms and conditions. Whether the client requested a retaining wall or a new HVAC installation, you fulfill their request.

Step 4: The buyer pays gradually, and you are fully compensated.

After the work is completed, the partner pays you in full, and the client begins making installment payments. Up until their debt is completely paid off, your client will keep making the installment payments to the partner.

When customers are unable to pay the whole cost of a significant purchase, firms might offer them flexible payment alternatives through customer financing. The easiest and safest way to offer consumer financing is to use a third-party lending provider. It guarantees that you are paid promptly and in full for all of your sales and removes the non-payment risk that businesses experience when they offer their own financing options to clients directly.

Businesses can improve sales, win bigger contracts, and increase the amount of the average sales transaction by providing financing to clients. Instead of paying the whole cost of a large item up front, financing enables buyers to make modest, recurring payments against the cost of the item.

When making a significant purchase, people occasionally consider price as the first consideration because they want to determine whether the good or service will fit within their budget.

The majority of buyers don't know to ask about financing when they're shopping for a significant purchase, so it's important to constantly bring it up with potential customers at the beginning of the sales process. Describe in detail the costs incurred by selecting a financing option as opposed to paying the complete sales price up front.

Is Customer financing good for small businesses?

Consumer lending is offered by numerous sizable firms. For instance, any of the big automakers can help you finance a car purchase. Some chain furniture retailers for the house and big electronics retailers offer consumer finance as well. These are all big companies that can afford to have a distinct division, and occasionally even a separate corporate entity, to handle consumer lending.

More customers can afford your services thanks to consumer financing. Customers who use financing can obtain the services they desire without being concerned about making a sizable payment at the time of invoice.

Service providers in sectors like HVAC, plumbing, electrical, and tree care provide financing to clients because it benefits them in the following ways:

• Remove obstacles that prevent clients from accepting a quote to.

• Look more professional and stand out from the competition;

• Win more jobs, close bigger agreements, and make it simpler to up sell.

Sales often increase by 20% when clients are informed up front that they can pay in installments.

However, you run a tiny firm. It's possible that you only have a small number of staff, and they are all already preoccupied with other duties. Even when you work twelve-hour days, nothing gets done. When you are already overburdened, how can you offer consumer financing?

Here are various cues that indicate you ought to provide consumer financing:

• Your services come with a premium price tag. Offering customer financing might make large purchases more affordable if your typical service costs $500 to $1,500.

• You want to set yourself apart through customer service. By providing funding, you help your clients land the career of their dreams. They will value the easy and flexible payment alternatives, especially if your rivals are unable to provide them.

• You want to sell more services. You can increase your revenue from current clients and jobs by up-selling. Higher-ticket things are simpler to market when the buyer finances them.

Even if your company doesn't meet all of these requirements, you can still provide finance to your clients. Especially if you believe it will increase your sales or if your clients have requested it.

Utilizing independent client finance firms can be something you want to think about. If you choose an in-house financing option with a contract that doesn't have early termination fees, this doesn't prevent you from attempting it in the future. It's a quick method to begin going and introduces you to a field you can learn more about so you can make future decisions with greater knowledge.

What does Customer Financing cost?

Offering consumer financing can range in price from being completely free to costing as little as a credit card swipe. However, it's not always simple to find this price on the provider's website. (Determining the cost to the customer of accepting the financing offer is significantly simpler.) Business owners should budget 3 to 6 percent of each transaction as a charge. This will help the homeowner save money.

Very frequently, the business simply fails to inform the merchant of the fees and instead focuses on marketing its services in an effort to boost sales. Only after contacting them will you be able to learn the price.

- Depending on the volume of transactions, some finance partners may potentially charge you a monthly fee of up to $50. Before agreeing, make sure to get your partner's whole payment terms. Your clients pay interest on the financed amount in the interim. Some financial partners may be able to extend 0% financing for three months to your clients.

- Conduct a cost-benefit analysis to determine whether the additional revenue will be sufficient to cover the financing costs. There are numerous arguments supported by data that claim offering finance to your consumers increases sales.

- The simplest method to do this as a small business owner is to employ a third-party finance company, as you won't have to deal with the paperwork, potential cash flow problems, legal ramifications of lending, or defaults when a customer refuses to pay.

Depending on the finance service you use, your company model's cost to include consumer financing will vary. You'll be responsible for covering the costs of conducting credit checks and obtaining customer payments for in-house financing.

Additionally, processing and finishing those administrative chores would require labor, which will affect your expenditures. You must pay a fee to use third-party financing services. A set monthly fee or a percentage of each transaction's processing cost could be the fee.

Fees for third-part financing

Of course, third-party lenders are not eager to perform all of this for nothing. Some will charge you a fee, therefore it's critical to comprehend how this price is calculated. Other matters, such as how charge backs and returns will be handled, should also be considered. Many of the businesses we examined above don't share anything at all about their interactions with the retailer.

How to do a cost-benefit analysis?

1. Determine your average invoice price at the moment. Use this as a baseline to determine if giving customer financing can help you increase it.

2. To determine whether buyers are interested or if high pricing are a barrier, including optional add-ons or good, better, best packages in your price estimations.

3. Find out whether your present clients are interested in consumer financing for bigger works. When you estimate jobs, you can send a feedback form or ask your clients.

4. Estimate how much higher your typical invoice price might be if you do offer up sells or premium packages. Keep in mind that clients who can use monthly payments frequently pay up to 20% extra for improved services.

You should now be better able to determine whether providing consumer finance is a wise move for your company after conducting this cost-benefit analysis. The fees might be justified if you continually land bigger jobs and boost sales by 20%.

Offering consumer finance can boost your credibility, increase client loyalty, and boost sales. The best part is that your consumers can obtain the services they require at the appropriate time. That makes it possible for them to obtain better jobs.

Benefits of offering Customer Financing

Allow your clients to make their own selections. Your clients are empowered to select the best option for them without being constrained by budgetary constraints, whether it be a package that boosts the service they require or the exact things they desire for their house.

Boost your sales and the size of your average transaction

With financing, customers have more purchasing power and can afford larger goods. In addition to making it simpler to clinch a potential sale, financing is an effective tool for up selling. Without having to provide discounts or other incentives, you may show clients how a slight increase in their monthly loan payments can enable them to buy upgrades or extra products.

A study indicated that average sales transaction size improves 15% for businesses that offer consumer financing, demonstrating how well financing may raise your revenue. Additionally, the buyer gets to get exactly what they want rather than settling for a choice that might not be what they need.

Obtain payment in advance.

When you receive the payment right away thanks to consumer financing, you don't have to worry about clients paying invoices. This enhances cash flow and makes it simpler to maintain and expand your company.

Since business owners don't receive the whole sales price at the moment of the sale, giving financing can negatively affect their cash flow, which is a major hurdle that deters small firms from doing so.

However, you can avoid the dangers of running your own lending program by partnering with a third-party loan provider. You receive payment for the entire purchase price in your bank account within two business days after they do a credit check and decide your customer qualifies for a loan.

Your cash flow is unaffected, and you are not exposed to risks in the event that a client is unable to make loan payments or even defaults on the loan.

Increase the value of your jobs.

You can increase sales of your higher-value jobs and packages by providing client financing alternatives that make it simpler for customers to pay for jobs. That raises the average ticket price, which helps your bottom line.

Minimize the hassle

You won't have to worry about payments if you use third-party consumer finance. Instead of chasing down the down payment once a task is finished, you may concentrate on the next one and expand your business.

You won't have to worry about managing accounts or dealing with nonpayment problems if you choose to work with a third-party finance provider. Instead, you may concentrate on the expansion of your business and count on more reliable income flow.

Be more competitive

You can get a competitive edge by providing consumer finance, which will help smaller businesses compete with big-box stores. To increase their competitiveness, retailers can provide more customer incentives. To entice clients, you might think about providing promotional programs like payment delays, interest rate buy-downs, or interest-free loans.

These incentives can help you close sales and drive repeat business.

Closing more jobs

The main advantage of client financing is that it lowers sales barriers. After comparing price estimates with and without financing, we discovered that granting credit often boosts sales by 20%. When consumers are contemplating whether to make a purchase, the upfront cost and sticker shock can be a significant challenge.

Customers may be able to afford those smaller payments if you can spread out the expense of a good or service over a number of months. The phrase "buy now, pay later" is an excellent strategy to increase sales of both pricey things and significant quantities of less expensive goods.

Capture new clients

By providing consumer financing options, your firm can draw in new clients. A potential consumer may be more likely to pick your business over a rival that doesn't offer financing if they are shopping around for a significant buy.

Due to the fact that consumer credit programs frequently encourage clients to make additional purchases, it can also help you gain repeat business. According to a research, 93% of consumers who utilize consumer financing for the first time will do it again.

Earn customers' loyalty.

By providing a simple method of payment, you might entice repeat business from current clients. Reducing the anxiety associated with large payments makes it simpler to maintain pleased consumers.

Disadvantages of Customer Financing

Minimum transaction amounts.

Before you may give financing to customers during the checkout process with some suppliers, you may need to reach a minimum transaction amount. Finance is intended for expensive services.

For a customer to be eligible, the majority of consumer finance providers will set a minimum transaction amount. As a result, your clients might not be able to afford your less expensive projects.

Service charges

Service fees are frequently assessed by third-party financing companies per transaction or per month. These businesses are able to offer your consumers a handy service thanks to fees. If you choose to give financing to consumers, be careful to pick a source who doesn't impose penalties for late or early payments.

You may probably have to pay fees if you employ a third-party financier. Some companies charge a set monthly fee, while others take a portion of each transaction as their fee. It might be necessary to make manpower and software resource investments in order to offer in-house finance.

Cost of acquiring a customer.

Financing is a fantastic way to attract new clients, but the cost might not be justified. Your client acquisition cost will grow as a result of the service costs you pay to your consuming financing provider (CAC). To determine whether financing is a lucrative choice for your company, perform a cost-benefit analysis.

After a few months of employing client financing, you should evaluate the return on investment to make sure it's the best course of action for your business.

Alternatives to Customer Financing

Check out some of our loan articles if you determine that offering client finance is just not for you but you still want to look into ways to boost the amount of cash you have on hand to expand your company. We offer guides for the small business loans, pointers for obtaining a line of credit, and even details on startup awards. You can also consider invoice factoring or invoice financing.

How Deskera Can help You?

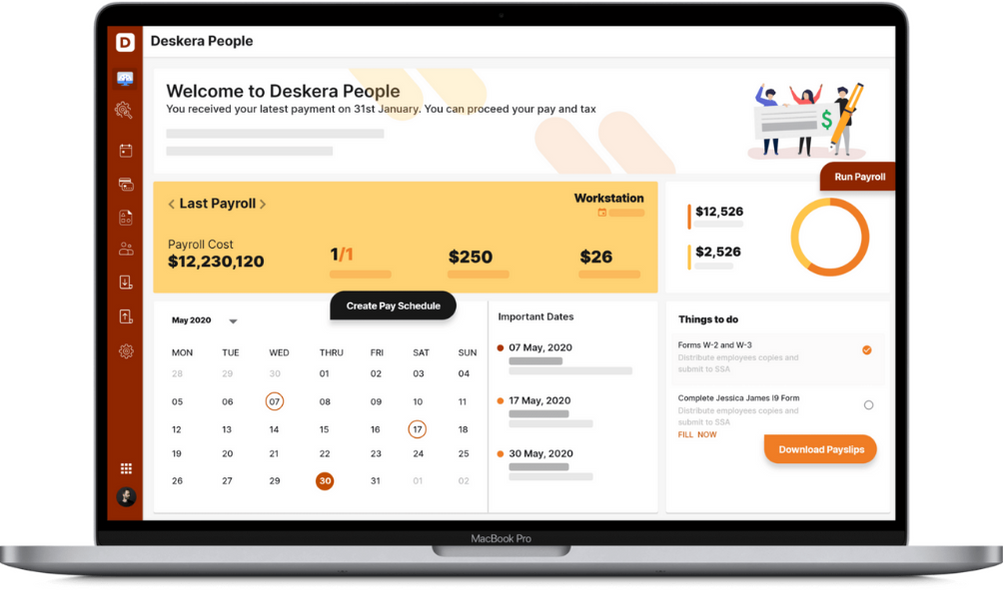

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

- Customer financing enables consumers to pay for goods and services over time, rather than all at once. By providing financing options to your clients, you lower the cost of your services and increase the likelihood that they will land their ideal positions.

- In-house finance might be a good fit for your company if you sell more expensive items or services. Furniture, electronics, appliances, and home repairs are a few examples of goods and services clients can desire to finance.

- You may show customers how a significant purchase can fit into their budget by bringing up financing possibilities during the sales conversation. This helps your firm improve sales and average sales transaction size.

- Buy-now-pay-later financing is how customer financing functions. You have the option of using a third-party financing business or offering financing internally. Customers get the product they desire, and you close sales on full-priced goods and services. This is a win-win situation for both customers and business owners.

- When using third-party consumer finance, you'll either pay a flat monthly fee or a cost for each transaction that is processed for financing. The advantage of working with a third-party financing firm is that they handle a lot of the work on your behalf, relieving you of the burden of running credit checks or collecting payments.

Related articles