What Are Financial Statements

Financial statements refer to the formal records that business entities - from corporations to proprietors - are required to maintain, which shows the financial position and the business performance of a company over a period of time. These statements are thoroughly vetted and audited by service providers, government agencies, and regulatory bodies, depending on the rules and regulations governing the nature of the business. For instance, if you’re a sole proprietor, regulatory bodies may only choose to scrutinize your tax returns. But if your business is a body corporate (like a limited liability corporation, or even a company), maintenance of financial statements and ensuring their audit is mandatory.

Financial statements are public documents available for everyone to view and are mandated to have three components:

Let’s take a closer look at each component forming the financial statement in brief.

Statement of Profit & Loss (Income statement)

When it comes to determining a company's financial health, an income statement is the most important document in the financial statements. It consists of data pertaining to a business' income and expense, and the net profit in two formats - the single-step, and the multi-step income statement.

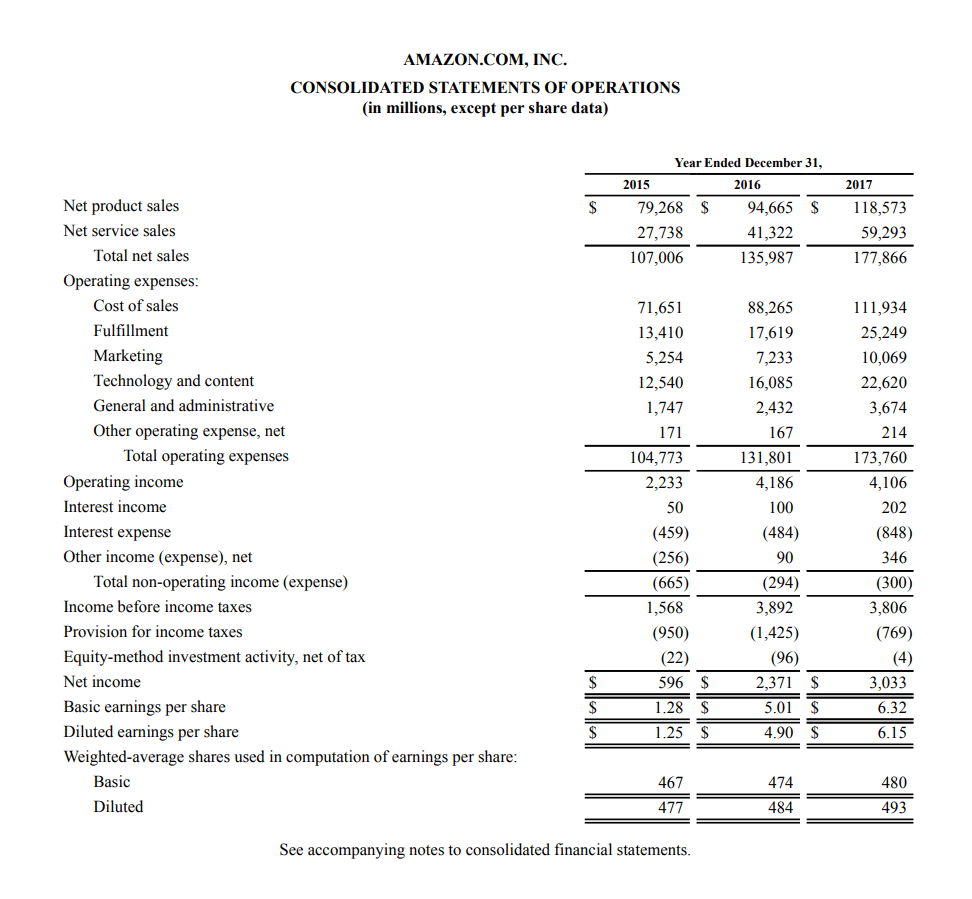

Here is a real example of a income statement from Amazon, for the years ended December 31, 2015 – 2017.

These individual subheads can be further broken down into different categories. For instance, expenses are composed of employee expenses, marketing expenses, administration expenses, financial expenses, among other things.

However, it is important to understand that an income statement talks primarily about the company’s performance over a reported period (usually the accounting year). It does not give information about the performance of the company over the years.

That’s where the second component of the financial statements, the balance sheet comes in.

Balance Sheet

According to Investopedia, the balance sheet is defined as the statement which “provides an overview of a company's assets, liabilities, and stockholders' equity as a snapshot in time. The date at the top of the balance sheet tells you when the snapshot was taken, which is generally the end of the fiscal year.”

To further elucidate, a balance sheet gives users information pertaining to:

- The overall net worth of the company,

- How much debt it has,

- How much it owns as on the day of preparation of the balance sheet, and

- Any material information (for instance, if an asset was sold a day after the balance sheet was prepared, but before it is presented in the General Meeting of shareholders). Such differences will also be presented in the form of notes.

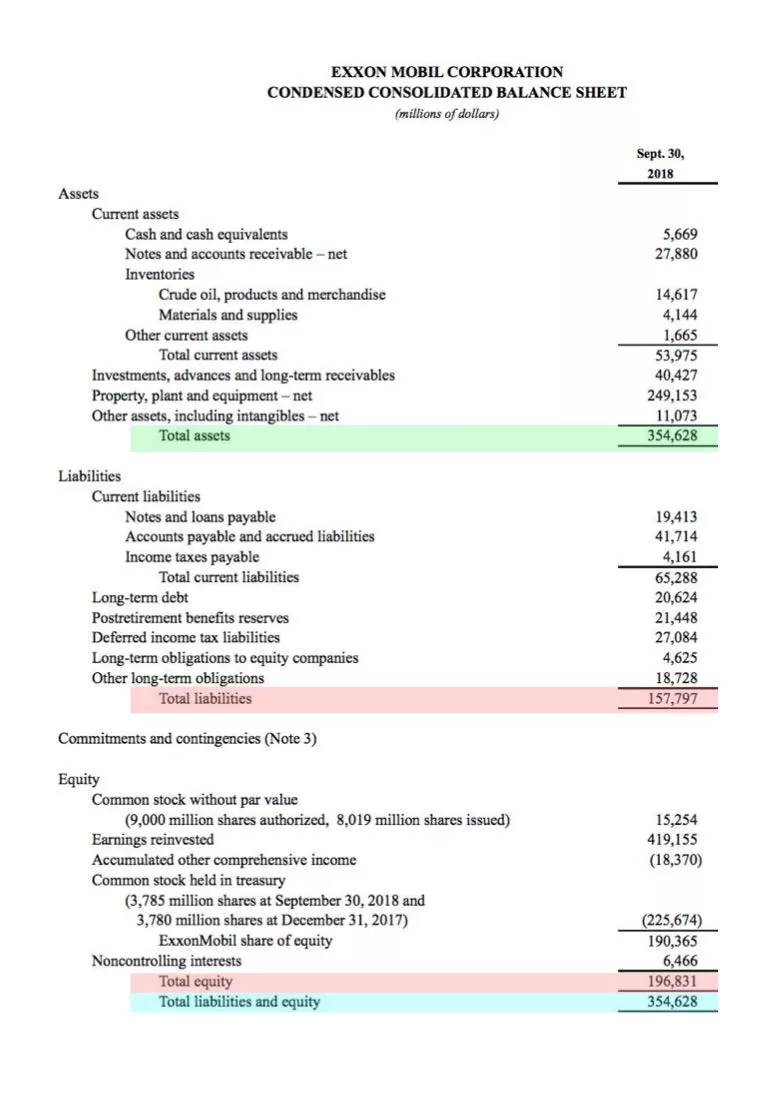

Let’s look at Exxon’s Balance sheet as on September 2018 to understand the different components further:

As you can see, the items in the balance sheet are broadly categorized into the following:

Assets

Current Assets

Cash and cash equivalents: Highly liquid assets, includes Treasury bills and certificates of deposit, which can be easily converted into cash

Accounts receivables: Money owed to the company by its customers.

Inventory: Includes Stock in trade, along with goods which are work in progress and spare tools

Fixed Assets

Land and Building

Plant and Machinery

Office Furniture

Liabilities

Debt: Money borrowed from different sources

Wages payable

Dividends payable

Accounts Payable: Money owed by the company to its vendors - not to be confused with debt.

Shareholders' Equity

Shareholders' equity can be best defined as the ownership stake of the company’s shareholders and is calculated by subtracting the total assets with the liabilities. We have an in-depth article explaining shareholder’s equity if you want to read up more.

Cash Flow Statements

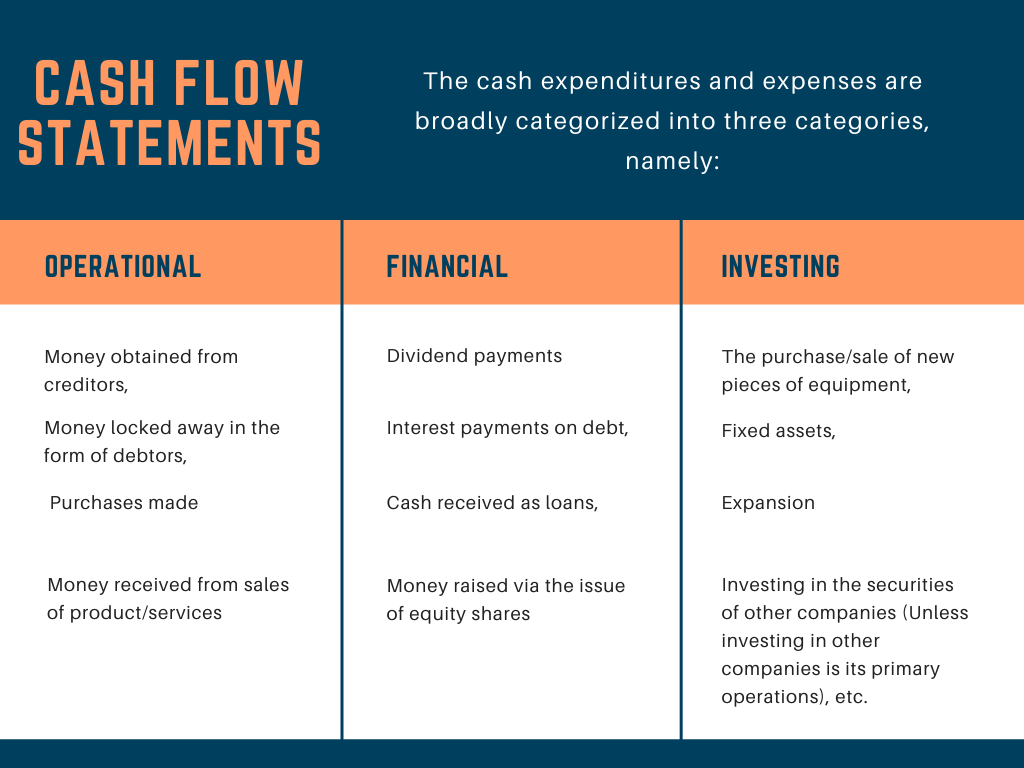

Cash flow statements play an important role in explaining how your business has utilized the cash resources available over the fiscal year. The cash expenditures and expenses are broadly categorized into three categories, namely:

- Operational

- Financial and

- Investing Activities.

Operational Activities

Operational Activities refer to cash expenses/Incomes arising from the normal course of business. This header pertains only to the business operations and does not take into account the inflows/outflows made in the form of obtaining debt, purchasing fixed assets, etc. Instead, it focuses on:

- Money obtained from creditors,

- Money locked away in the form of debtors,

- Purchases made,

- Money received from sales of product/services, etc.

Usually, the Net Cash inflow from operational activities can be ascertained by following 2 different methods - direct or indirect. More details on the comparison and cash flow statements, and tips for maintaining optimal cash flow can be found on our complete cash flow guide here.

Investing Activities

This covers cash inflow/outflow pertaining to activities regarding:

- The purchase/sale of new pieces of equipment,

- Fixed assets,

- expansion or even

- Investing in the securities of other companies (Unless investing in other companies is its primary operations), etc.

Financial Activities

Cash Income/ Expenditures made regarding making funds available for business’ growth, development, and day-to-day maintenance are categorized as financial activities. This includes:

- Dividend payments,

- Interest payments on debt,

- Cash received as loans, and even

- Money raised via the issue of equity shares

To Conclude

Financial Statements are a mandatory and crucial part of a business’ accounting process. It becomes incredibly easier with cloud tools like Deskera to automate the preparation of your financial statements and prevent compliance issues, without causing too much trouble for yourself as a business owner. With Deskera’s comprehensive all-in-one business plans, you’re sure to have all your bases covered. For more informative blogs and articles, make sure to subscribe to our newsletter!