The Internal Revenue Service (IRS) released the new Federal Income Tax Rates for the financial year (FY) 2022 on 10th November 2021. The upper Federal Income Tax Rate levels will reflect the most substantial year-over-year inflation since 1990.

For the 2021-'22 taxable year, there are seven tax brackets for most regular income. They are10%, 12%, 22%, 24%, 32%, 35%, and 37%. You can determine your Federal Income Tax Rates by knowing your filing status and taxable income.

Your Federal Income Tax Rates depend on whether you are single, married, filing jointly or separately, qualifying widow(er), or head of household. The general rule is that, as your pay scale advances, so will your Federal Income Tax Rates.

This article discusses the various federal income tax rates in relation to your tax filing status in the US and contains:

- What is Federal Income Tax (Rates) Bracket?

- Federal Income Tax Rate for Single Filers

- Federal Income Tax Rate For Married, And Filing Jointly

- Federal Income Tax Rate For Married, And Filing Separately

- Federal Income Tax Rate For Head of Household

- Federal Income Tax Rates—Tax Bracket Identification

- Conclusion

- How can Deskera Help You?

- Key Takeaways

What is Federal Income Tax (Rates) Bracket?

In the US, individuals and business entities are liable to pay tax depending on the federal income tax (rate) bracket that applies to their income. Low-income earners are taxed at lower federal income tax rates, whereas higher-income earners are taxable at higher federal income tax rates.

Thus the Federal income tax (rate) bracket is a range of incomes subject to a specific federal income tax rate. Tax brackets produce a progressive tax system, in which taxation rises progressively as an individual's income rises.

The federal Income taxes are payable in April 2022. You can also apply for an extension period to pay in October 2022. However, it is better to deliver within the stipulated period and avoid the penalty.

Continue reading to know the federal income tax rates for diverse filing statuses. Let us begin with single filers.

The federal income tax rate for the various tax bracket for single filers is as follows:

Federal Income Tax Rate for Single Filers

|

Federal Income Tax Rates |

Tax bracket |

Tax Liability |

|

10% |

$0 to $9,950 |

10% of taxable income |

|

12% |

$9,951 to $40,525 |

$995 and 12% of the income exceeding $9,950 |

|

22% |

$40,526 to $86,375 |

$4,664 and 22% of the income exceeding $40,525 |

|

24% |

$86,376 to $164,925 |

$14,751 and 24% of income exceeding $86,375 |

|

32% |

$164,926 to $209,425 |

$33,603 and 32% of income exceeding $164,925 |

|

35% |

$209,426 to $523,600 |

$47,843 and 35% of income exceeding$209,425 |

|

37% |

$523,601 or more |

$157,804.25 and 37% of income exceeding $523,600 |

The following Federal Income Tax Rates apply if the taxpayers are married, and filing jointly.

Federal Income Tax Rate For Married, And Filing Jointly

|

Federal Income Tax Rates |

Taxable income bracket |

Tax Liability |

|

10% |

$0 to $19,900 |

10% of taxable income |

|

12% |

$19,901 to $81,050 |

$1,990 and 12% of income exceeding $19,900 |

|

22% |

$81,051 to $172,750 |

$9,328 and 22% of income exceedingr $81,050 |

|

24% |

$172,751 to $329,850 |

$29,502 and 24% of income exceeding $172,750 |

|

32% |

$329,851 to $418,850 |

$67,206 and 32% of income exceeding $329,850 |

|

35% |

$418,851 to $628,300 |

$95,686 and 35% of income exceeding $418,850 |

|

37% |

$628,301 or more |

$168,993.50 and 37% of income exceeding $628,300 |

There is no express condition that the married couple must file their tax papers jointly. They can do so individually by following the below mentioned federal income tax rates:

Federal Income Tax Rate For Married, And Filing Separately

|

Federal Income Tax Rates |

Taxable income bracket |

Tax Liability |

|

10% |

$0 to $9,950 |

10% of taxable income |

|

12% |

$9,951 to $40,525 |

$995 and 12% of income exceeding $9,950 |

|

22% |

$40,526 to $86,375 |

$4,664 and 22% of income exceeding $40,525 |

|

24% |

$86,376 to $164,925 |

$14,751 and 24% of the income exceeding $86,375 |

|

32% |

$164,926 to $209,425 |

$33,603 and 32% of income exceeding $164,925 |

|

35% |

$209,426 to $314,150 |

$47,843 and 35% of income exceeding $209,425 |

|

37% |

$314,151 or more |

$84,496.75 and 37% of income exceeding $314,150 |

The Federal income tax rates for the head of household are applicable as follows:

Federal Income Tax Rate For Head of Household

|

Federal Income Tax Rates |

Taxable income bracket |

Tax Liability |

|

10% |

$0 to $14,200 |

10% of taxable income |

|

12% |

$14,201 to $54,200 |

$1,420 and 12% of income exceeding $14,200 |

|

22% |

$54,201 to $86,350 |

$6,220 and 22% of income exceeding $54,200 |

|

24% |

$86,351 to $164,900 |

$13,293 and 24% of income exceeding $86,350 |

|

32% |

$164,901 to $209,400 |

$32,145 and 32% of income exceeding $164,900 |

|

35% |

$209,401 to $523,600 |

$46,385 and 35% of income exceeding $209,400 |

|

37% |

$523,601 or more |

$156,355 and37% of income exceeding $523,600 |

Federal Income Tax Rates—Tax Bracket Identification

To know your tax bracket divide your taxable income into each applicable bracket. Federal income tax rates apply to each tax bracket and the tax bracket that applies to you also depends on your chosen filing status. Diverse federal income tax rates apply if you are a single filer, married filing jointly with your spouse, married filing separately, or head of household.

Your marginal tax bracket is the tax bracket in which your highest income falls. It is the highest tax bracket, and it applies to the highest portion of your income.

Conclusion

Federal income tax rates and tax brackets help to ascertain a taxpayer's federal income tax liability. Nevertheless, they differ from each other. The tax bracket is the taxable income range, while the federal income tax rate is applicable to the specific tax bracket to ascertain an individual's tax liability. The federal income tax rate is the taxpayer's tax rate to know the amount to pay as taxes. The federal income tax rates vary depending on the tax bracket of the federal income tax.

How can Deskera Help You?

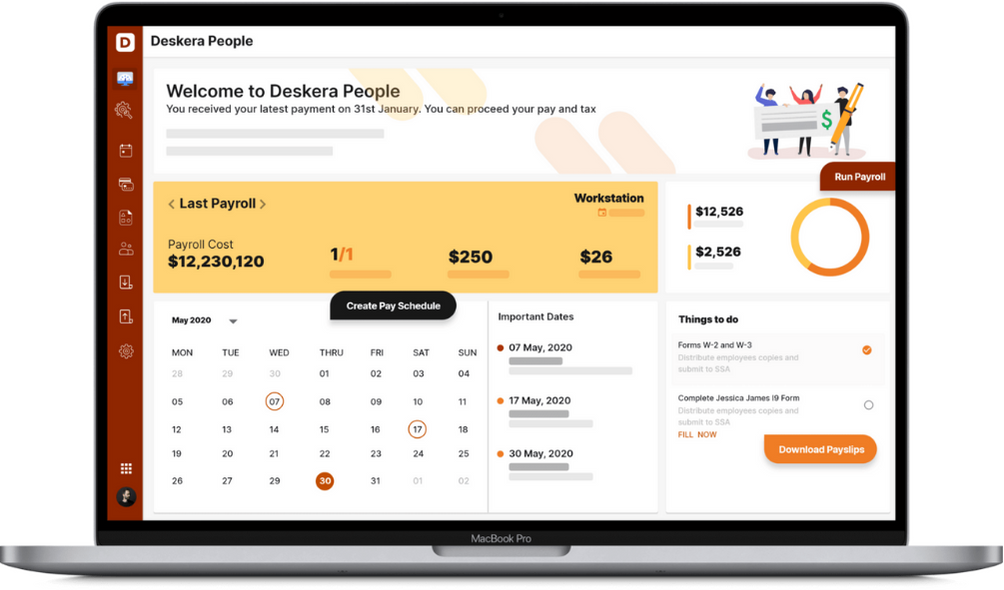

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- In the United States, there are now seven federal income tax brackets, with federal income tax rates ranging from 10% to 37%

- The federal income tax rate gradually accelerates, with lower brackets paying lower federal income tax rates and higher brackets paying higher federal income tax rates

- The upper bracket Federal Income Tax Rates in 2021-22 will rise to reflect the highest year-over-year inflation since 1990

- All assesses other than those in the lowest federal income tax bracket are liable to pay tax at multiple federal income tax rates as your income increases

Related Articles