EPF is a government-run savings scheme that helps employees save money for their retirement, and the scheme provides financial security to employees and their families.

However, it is essential to know the procedures and requirements for claiming the dues of a deceased EPF member to avoid any unnecessary delays or complications.

In this article, we will discuss in detail the purpose and process of filing Form 20 for EPF and its importance in ensuring a smooth transfer of assets to the nominee.

- What is Form 20 for EPF?

- Eligibility Criteria for Filing Form 20

- Who can file Form 20?

- What documents are required to file Form 20?

- Important Points While Filing Form 20

- How to Fill Form 20?

- Attestation of EPF Form 20

- Is there a deadline for filing Form 20?

- What are the benefits of filing Form 20?

- EPF Form 20 FAQs

- Conclusion

- How can Deskera Help You?

- Key Takeaways

- Related Articles

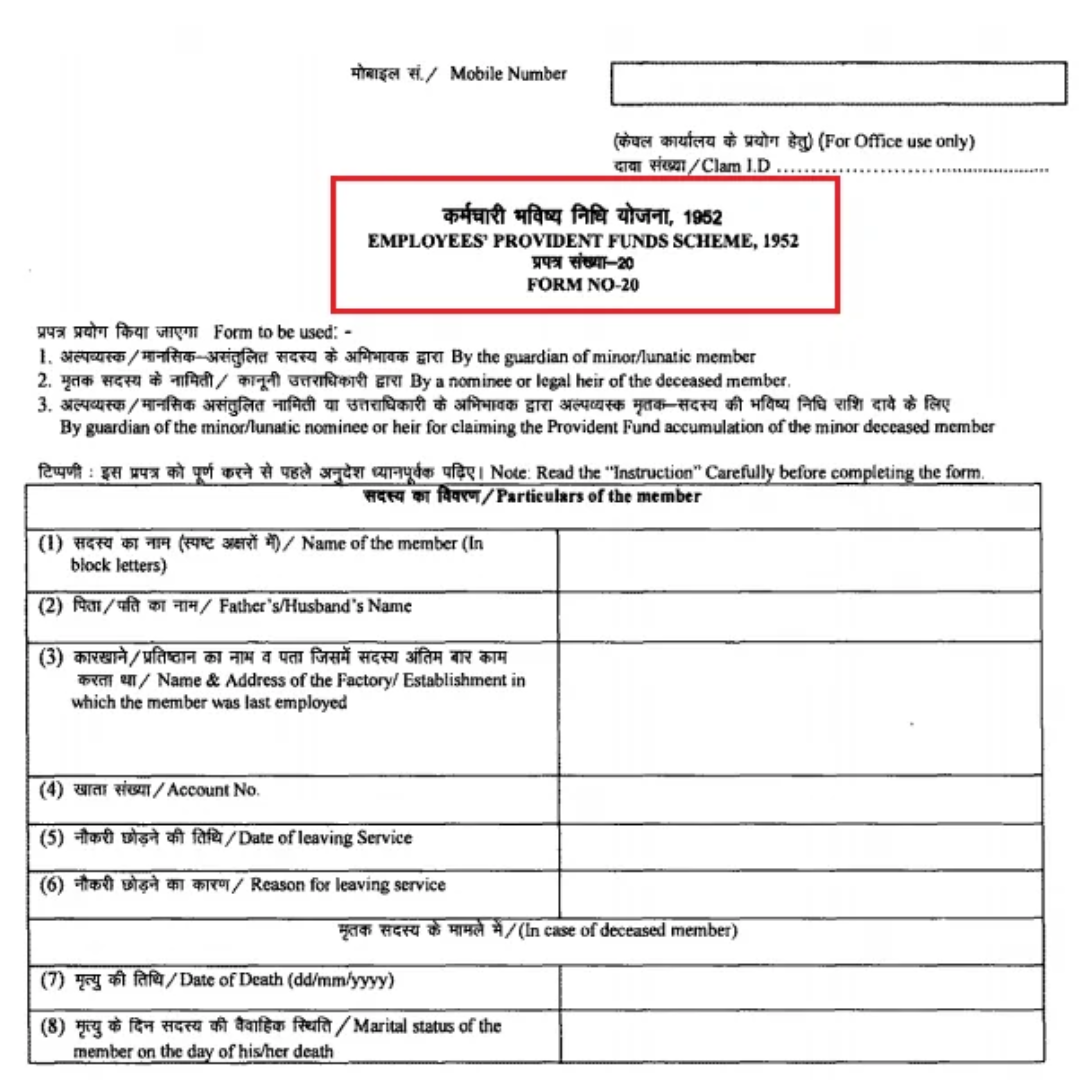

What is Form 20 for EPF?

Employees' Provident Fund (EPF) is a retirement benefits scheme in which the employee and his employer contribute during the service period and receive benefits when they retire at the age of 58 or before (in special cases).

There are times when a member is unable to provide service until retirement. In the event of a member's untimely death, the surviving family is entitled to up to Rs. 7 lakhs in insurance under the EDLI scheme and a monthly widow/child/orphan pension under the EPS scheme.

The family can also use the EPF Form 20 to request a provident fund withdrawal. This form can also be used to request withdrawal for a minor or a mentally ill member.

Eligibility Criteria for Filing Form 20

Any of the following claimants can complete the EPF Form 20:

- By the minor/lunatic member's guardian.

- By the deceased member's nominee or legal heir.

- By the minor's guardian/lunatic nominee or heir for claiming.

- the Provident Fund accumulation of the minor deceased member.

Who can File Form 20?

Form 20 can be filed by the nominee of the deceased EPF member. The nominee is the person chosen by the member to receive the benefits of the EPF in the event of their death. The nominee can be a family member or any other person chosen by the member.

If the member has not nominated anyone, then the legal heirs of the member can file Form 20 to claim the EPF benefits. In such cases, the legal heirs may have to provide additional documents such as a succession certificate or a legal heir certificate to prove their relationship with the member.

It is essential to note that the nominee or legal heirs should have the necessary documents such as the death certificate of the member, their own identity proof, and a copy of the member's EPF account statement to file Form 20. They should also ensure that the form is filled correctly, and all the required information and documents are attached to avoid any delays or rejection of the claim.

What Documents are Required to File Form 20?

The following documents will be required for filing Form 20:

- After the death of a member, the nominee/surviving family members or their guardian/legal heirs may apply for a death certificate.

- If the application is forwarded by a guardian other than the natural guardian of the minor member/nominee/family member/legal heir, a guardianship certificate will be issued by a competent court of law to them.

- Cancelled cheque so that the payment could be sent to the claimant's account via ECS.

- EPF Form 5 IF is used to claim benefits from the Employees' Deposit Linked Insurance Scheme (EDLI) if a member dies while on the job.

- EPF Form 10D is used to claim pension benefits such as widow's pension, children's pension, and orphan's pension.

- EPF Form 10C for pension withdrawal if the member died after the age of 58 and had not completed 10 years of service as of the date of death.

Important Points While Filing Form 20

Mention your mobile phone number to receive SMS alerts at various stages of approval.

- Fill out the form in BLOCK LETTERS with all of your information.

- Submit the bank account's cancelled cheque to have the funds transferred to your account.

- The address should be complete and include the PIN Code.

How to Fill EPF Form 20?

An applicant (member's family member/heir/nominee/guardian) can fill out the EPF Form 20 offline and submit it to the EPF Commissioner's office via the employer, along with the required documents. The applicant must fill out the following fields on the EPF Form 20 with care:

Mobile Number: Mention the applicant's phone number to receive SMS alerts on the status of the EPF withdrawal.

Particulars of the Member

- Name of the Member

- Name of Father/Husband (in case of married women)

- Name and address of the establishment where the member was most recently employed

- Account Number for EPF

- Date of Departure from the Service.

- Reason for Leaving the Service (In the case of a deceased member, mention "Death").

- Date of Death (dd/mm/yyyy)

- Marital status of the member on the day of his/her death

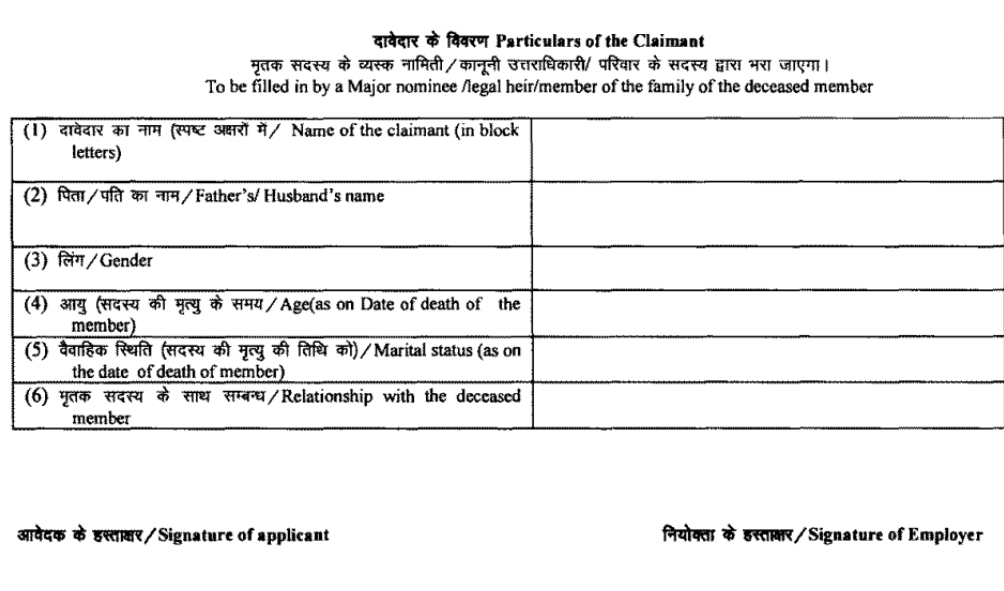

Particulars of the Claimant

- Claimant's name

- Father’s/Husband’s Name

- Gender

- Age (as on the date of death of the member)

- Marital Status (As on the date of death of the member)

- Relationship with the deceased member

Section to be filled by the Guardian/Manager of Minor/Lunatic Member

or

Guardian of Lunatic/Minor Nominee(s)/Legal Heir (s)/Family member (s) of the Deceased Member

- The claimant's name

- Name of the father/husband

- Claimant's Full Postal Address Relationship with the minor/deceased member (in block letters)

- Remittance Method

- Using a Postal Money Order

- Account payees' cheques/electronic transfers are sent to S.B. A/C (Scheduled Bank/PO)

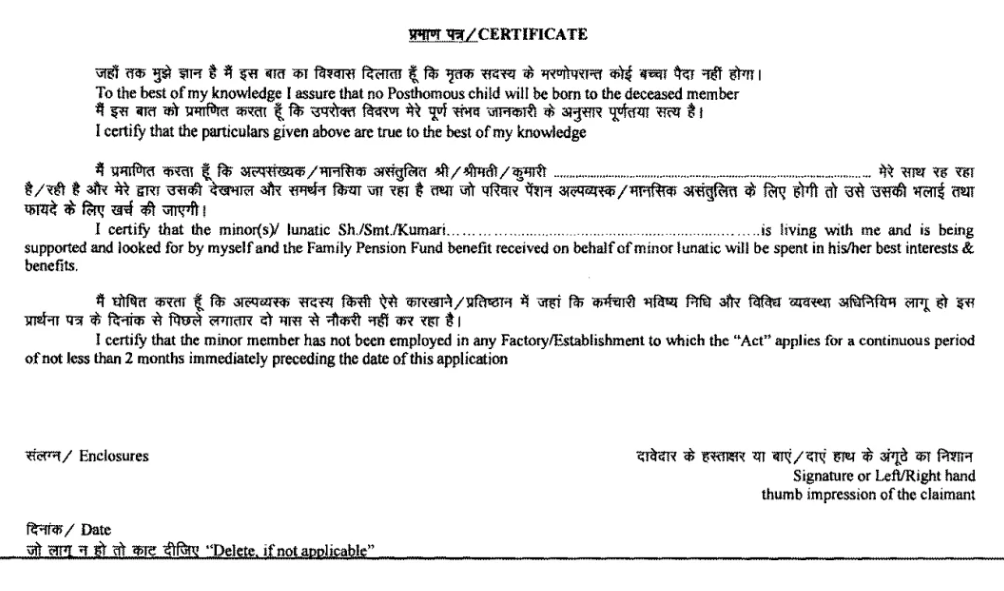

Certification by the claimant

Advance Stamped Receipt

Only to be provided if funds are disbursed via check and bank account]. This confirms receipt of EPF funds.

Attestation of EPF Form 20

EPF Form 20 must be submitted to the EPFO by the employer with whom the member was most recently employed. Each page of the form must be signed by both the employer and the claimant.

If the establishment is no longer open, the form must be duly verified and attested by any of the following signatories:

- Magistrate

- Gazetted Officer

- Post or Sub-Post Master

- Chairman or Secretary or Member of the Municipal or District Local Board/Member of Parliament/Legislative Assembly/Member of Central Board of Trustees

- Regional Committee of Employees’ Provident Fund (EPF)

- Manager of the Bank in which the Saving Bank Account is maintained

- Head of any recognized educational institution

- President of Village Union

- President of the Village Panchayat where there is no Union Board

Is There a Deadline for Filing Form 20?

The form should be filed as soon as possible after the death of the member. It is advisable to file the form at the earliest possible to avoid any unnecessary delays in the processing of the claim.

If the nominee fails to file Form 20 within the specified time limit, the EPF authorities may reject the claim for the dues. In such cases, the nominee may have to seek legal help or approach the EPF appellate authority to get the claim processed.

Therefore, it is essential to file Form 20 as soon as possible after the death of the member to ensure timely payment of the dues and avoid any complications or delays. The nominee should also ensure that they provide all the required documents and information correctly to avoid any rejection or delay in processing the claim.

What are the Benefits of Filing Form 20?

The benefits of filing Form 20 for the nominee of a deceased EPF member include:

- Claiming the dues of the member: The primary benefit of filing Form 20 is to claim the dues of the EPF member. These dues include the accumulated EPF balance, gratuity, and pension benefits, if any.

- Transfer of assets: Filing Form 20 is a necessary step in transferring the assets of the deceased EPF member to their nominee. By filing the form and providing the required documents, the nominee can ensure that the assets are transferred smoothly.

- Financial security: The EPF scheme is designed to provide financial security to the employees and their families. By filing Form 20, the nominee can access the funds and benefits that the deceased member had accumulated during their lifetime.

- Ease of the process: Filing Form 20 can help streamline the process of claiming the dues and transfer of assets. It can help avoid any unnecessary delays or complications that may arise if the form is not filed correctly or on time.

- Timely payment: By filing Form 20, the nominee can ensure that the payment is made in a timely manner, and they receive the benefits entitled to them as soon as possible.

EPF Form 20 FAQs

Here are some frequently asked questions (FAQs) about EPF Form 20 with their answers:

Q: What is EPF Form 20?

A: EPF Form 20 is a form that needs to be filled by the nominee or legal heir of a deceased employee to claim the benefits of the Employee Provident Fund (EPF) after the death of the employee.

Q: Who can fill EPF Form 20?

A: The nominee or legal heir of the deceased employee can fill EPF Form 20.

Q: What is the time limit for submitting EPF Form 20?

A: There is no time limit for submitting EPF Form 20, but it is recommended to submit it as soon as possible to avoid any delay in the claim process.

Q: How can EPF Form 20 be submitted?

A: EPF Form 20 can be submitted physically by visiting the nearest EPFO office or online through the EPFO portal.

Q: How long does it take to process the EPF claim after submitting EPF Form 20?

A: EPF claim processing time may vary based on the completeness of the submitted documents and the verification process. However, it generally takes around 10-15 days to process the claim.

Q: Can the claim amount be transferred to any bank account?

A: The claim amount can be transferred only to the bank account of the nominee or legal heir.

Q: Can the nominee or legal heir withdraw the entire EPF balance?

A: Yes, the nominee or legal heir can withdraw the entire EPF balance of the deceased employee.

Q: What happens if there is more than one nominee for the EPF account?

A: In case there is more than one nominee, the claim amount will be divided equally among all the nominees, unless a specific percentage share is mentioned in the EPF Form 2 (nomination form).

Q: When Do We Need to Submit Form 20 PF?

A: When an EPF member dies, an EPF Form 20 is submitted to the EPFO Commissioner's office. The form is filled out by the nominee, legal heir, or family member of the deceased EPF member. Thus, if you are a nominee for any EPF member and he or she dies, you must submit EPF form 20.

Conclusion

In conclusion, filing Form 20 is a crucial step in claiming the dues of a deceased EPF member. As a nominee, it is your responsibility to ensure that you follow the correct procedures and submit all the necessary documents to avoid any unnecessary delays or complications.

By filing Form 20, you can help facilitate a smooth transfer of assets and ensure that you receive the benefits entitled to you as the nominee. It is also important to note that timely filing of Form 20 can help expedite the payment process, and any delay in filing may lead to a prolonged wait for the payment.

We hope this article has provided you with a comprehensive understanding of the purpose and process of filing Form 20 for EPF, and we encourage you to seek professional advice if you have any doubts or queries.

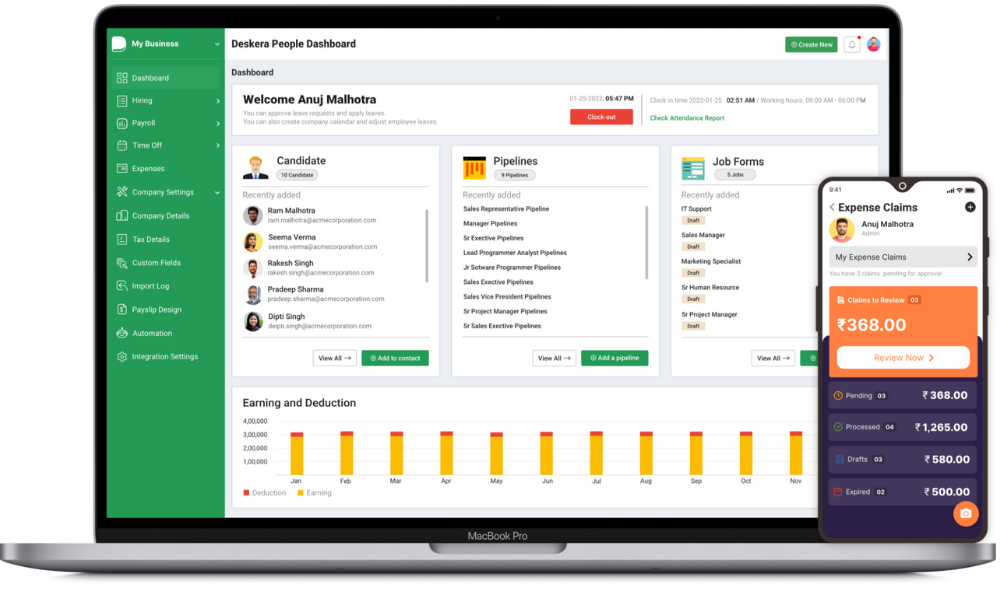

How can Deskera Help You?

Deskera People is human resources software that assists companies in managing employee data and tracking performance. It assists organizations in managing employee attendance, payroll, benefits, recruitment, and other HR functions. It also provides analytics and reporting to help you make better decisions.

Deskera's modules are appropriate for companies of all sizes, from small start-ups to large corporations. It provides businesses with a simple, unified platform for more effective and efficient management of their operations.

Deskera Books is a software that automates accounting and invoice generation.

Deskera CRM excels at customer relationship management.

Deskera ERP provides exceptional enterprise resource planning at a low cost.

Deskera MRP, among other things, for assisting manufacturers in optimizing their administrative tasks!

Key Takeaways

- Employees' Provident Fund (EPF) is a retirement benefits scheme in which the employee and his employer contribute during the service period and receive benefits when they retire at the age of 58 or before (in special cases).

- There are times when a member is unable to provide service until retirement. In the event of a member's untimely death, the surviving family is entitled to up to Rs. 7 lakhs in insurance under the EDLI scheme and a monthly widow/child/orphan pension under the EPS scheme.

- The family can also use the EPF Form 20 to request a provident fund withdrawal. This form can also be used to request withdrawal for a minor or a mentally ill member.

- The nominee or legal heir of the deceased employee can fill EPF Form 20.

- EPF Form 20 can be submitted physically by visiting the nearest EPFO office or online through the EPFO portal.

- EPF claim processing time may vary based on the completeness of the submitted documents and the verification process. However, it generally takes around 10-15 days to process the claim.

- The claim amount can be transferred only to the bank account of the nominee or legal heir.

- In case there is more than one nominee, the claim amount will be divided equally among all the nominees, unless a specific percentage share is mentioned in the EPF Form 2 (nomination form).

- When an EPF member dies, an EPF Form 20 is submitted to the EPFO Commissioner's office. The form is filled out by the nominee, legal heir, or family member of the deceased EPF member. Thus, if you are a nominee for any EPF member and he or she dies, you must submit EPF form 20.

Related Articles