Whenever you join a new company, you come across common terms such as PF or provident fund. Your in-hand salary is calculated after deducting your PF or EPF amount. It may sound confusing in the beginning but in reality, it is quite easy to understand.

Here is all that we shall cover on this page:

- What is an Employee's Provident Fund or EPF?

- What are the benefits of EPF contribution?

- How is the EPF interest rate calculated for monthly EPF contribution?

- EPFO Login

- What is UAN?

- EPFO Employee Login

- EPF Payment

- EPF Withdrawal or PF Withdrawal

- Key Takeaways

What is an Employee's Provident Fund or EPF?

Let us understand the meaning of PF or EPF in detail:

An employee’s provident fund or EPF is created through contributions made by an employee and employer. Under the EPF scheme, both the employer and the employee have to make contributions every month. The employee will receive this money at the time of retirement or if you discontinue working either temporarily or permanently due to any kind of disability.

What is the EPF Interest rate?

The EPF interest rate for the year 2020-21 is 8.5% as decided by the EPFO (Employee Provident Fund Organization) board. This interest rate is completely tax-free.

Here are some key points to understand the EPF interest rate:

- The EPF interest rate is the return on the investment made by an employee in their EPF account.

- The interest rate is announced every year for the previous financial year. For example, the interest rate for the financial year 2021-22 was declared in September 2021.

- The EPF interest rate is decided by the Employees' Provident Fund Organisation (EPFO) based on the earnings from the investments made by the EPFO.

- The EPF interest rate is calculated on the monthly balance of an employee's EPF account.

- The EPF interest rate is compounded annually, which means the interest earned in the previous year is added to the principal amount, and the interest for the next year is calculated on the new balance.

The EPF interest rate has fluctuated over the years. Here is a brief history of the EPF interest rate:

- From 1952 to 1959, the interest rate was 3%.

- From 1959 to 1963, the interest rate was 3.5%.

- From 1963 to 1964, the interest rate was 3.75%.

- From 1964 to 1965, the interest rate was 4%.

- From 1965 to 1974, the interest rate was 4.5%.

- From 1974 to 1975, the interest rate was 5%.

- From 1975 to 1976, the interest rate was 5.5%.

- From 1976 to 1986, the interest rate was 8.5%.

- From 1986 to 2000, the interest rate fluctuated between 8.5% to 12%.

- From 2000 to 2020, the interest rate fluctuated between 8.25% to 8.65%.

- For the financial year 2021-22, the interest rate was 8.5%.

What are the benefits of EPF contribution?

Here is a list of the benefits of EPF contribution:

Retirement Corpus

The primary aim of the EPF scheme is to build a retirement corpus. Do you know around 8.33% of the EPF contribution goes into the Employee Pension Scheme? It ensures a sense of security so that the employees can have a healthy retirement life.

Capital Growth

The interest rate which is decided by EPFO is earned on the monthly amount. It adds up over the year to build a big retirement sum. The interest rate acts as a pre-fixed constant which helps in making the amount bigger and bigger over the years.

Habit of Saving

Since it takes many years to build a sum, there is no extra pressure on the employees to save all at once. As the amount is not contributed in the lump sum, thus inculcates the habit of gradual savings.

Emergency

The EPF amount comes as a blessing in disguise in case of a financial crisis. According to the rules set by EPFO India, partial withdrawal is allowed in case of extreme financial hardships such as building a house, wedding expenses, opting for higher education, etc.

Tax-Free

One of the most important benefits of EPF contributions is that it is tax-free including the interest earned on it. It falls under the category of Exempt, Exempt, Exempt (EEE). No amount of tax is levied on the amount of money you invest, the interest you earn, or the amount of maturity. If you withdraw your investment before 5 years, you won’t be able to avail these tax benefits.

How is the EPF interest rate calculated for monthly EPF contribution?

The EPF interest rate for the year 2020-21 has been decided to be 8.5%. To do the calculation for every month, you need to divide the total percentage by 12. So, (8.5/12) equals 0.7083% of the interest rate every month.

Let’s take an example, the basic salary plus DA of Mr. A is Rs 20,000 for a month.

Basic Salary + DA= Rs 20,000

EPF employee contribution at 12% of 20,000= Rs 2,400

EPF employer contribution at 12% of 20,000=Rs 2,400

Employer’s contribution to EPS at 8.33% of basic salary+ DA= Rs 1660 (ceiling amount)

Employer’s contribution to EPF at (2400-1660) =Rs 740

Total EPF contribution of the employee and employer= Rs 2400+Rs 740=Rs 3140

Now the interest earned is at 8.50% per annum or 0.7083% per month

So, the monthly interest earned is at 0.7083% of Rs 3140= Rs 22.244

There are a few points to remember about the EPF interest rate:

- It is applicable every year from the start of the financial year from April 1 to the end of March 31. It gets reviewed every year by the EPFO.

- The interest is calculated per month, but the whole amount gets transferred at the end of the year on 31st March to the EPF amount.

- The amount that gets accumulated every year gets carry forward for each year. Thus, the amount transferred at the end of March is used to calculate the interest for April from thereon.

EPF for International Workers: Guidelines and Procedures

EPF, or Employees' Provident Fund, is a social security scheme established in India to provide financial security to employees. It is applicable to all organizations with 20 or more employees.

While EPF is primarily for Indian citizens, international workers in India can also benefit from it. Here are some guidelines and procedures for international workers to join and contribute to the EPF:

- Eligibility for international workers: Any foreign national working in India and receiving a salary of up to Rs 15,000 per month is eligible to join the EPF.

- EPF registration for international workers: To register for EPF, the international worker must have a Permanent Account Number (PAN), an Aadhaar card, and a bank account in India. The employer must then provide a registration letter to the EPFO office.

- Contribution to EPF: Both the employee and employer must contribute 12% of the employee's basic salary, dearness allowance, and retention allowance to the EPF. The employee can also contribute more than 12% if they wish.

- Withdrawal of EPF: If the international worker leaves India, they can withdraw their EPF after a waiting period of 2 months. If the worker is returning to their home country permanently, they can withdraw their EPF immediately.

- Tax implications of EPF: The EPF contribution is tax-deductible under Section 80C of the Indian Income Tax Act. However, if the international worker withdraws their EPF before completing 5 years of service, the amount withdrawn is taxable.

- Portability of EPF: If the international worker changes jobs in India, they can transfer their EPF account to the new employer. If the worker leaves India, they can withdraw their EPF or keep the account active and continue contributing to it.

What is the Dormant or Inoperative EPF Amount?

If the EPF account doesn’t receive any kind of contribution for over three years, it will convert into an inoperative EPF account. In case, the employee hasn’t yet retired, the interest will get added to inoperative EPF accounts. However, in the case of retired employees, there is no added interest in EPF accounts.

EPF Registration

Employee: If you are an employee, you needn’t do much in case of EPF registration. This process will happen according to the will of the employer.

Employer: If you are an employer, you have to meet some kind of eligibility criteria in order to do EPF registration. The company should be a registered company and should have at least 20 people. It should involve in activities under Schedule 1 of the EPF Act. Once this is done, you need some documents to move the process ahead. The documents include:

- Proprietorship enterprises-You will need to submit the applicant’s name, PAN, ID proof, etc.

- Society-In case you want to register your society, you will have to submit a copy of the registration certificate of your society along with a copy of the rules and objectives of the society. Also, you will need a Memorandum of Association (MOA), By-Laws, PAN, address proof, phone number of the president, and members.

- Partnership Firm-If you have a partnership firm, you will require a certificate of registration and a copy of the partnership deed. Not only this, but you also require a PAN, ID proof of all partners-passport or Voter ID, and all partners’ address proofs.

- LLP/Company-You will require a copy of the certificate of incorporation, ID proof of directors, DSC of directors, MOA, and Articles of Association (AOA).

There are some other common documents that are also required for EPF application. Let’s take a look:

- Income tax documents

- Partition deed,

- First sales invoice

- Salary details of all employees

- Copy of the balance sheet.

What is the procedure for EPF registration?

Let’s take a look at some of the steps required for EPF registration:

- Firstly, you need to visit the online portal known as Employees’ Provident Fund Organisation, India.

- The home screen will appear and you will see multiple options. After seeing the ‘Establishment Registration’ option, click on it.

- Once you click on it, a new page called the “Shram Suvidha” portal will open up. It will ask you to either log in or sign-up.

- Before clicking on the sign-up option, make sure you download the instruction manual. You need to download it from the top tab and read it.

- Once this is done, click on sign-up and a new page will open.

- You are now required to enter your details such as name, email address, phone number and verify the captcha. Click on the sign-up button after this.

- The new page that opens will give an option called, “Registration for EPFO-ESIC”. Once you click on it, the next page will give you an option called “Apply for New Registration”.

- Once you click on it, a new page will open which will give you two options. The first one is, “Employees’ State Insurance Act, 1948”. While the second one is, “Employees’ Provident Fund and Miscellaneous Provision Act, 1952”.

- You can check both the options and then click on the ‘Submit’ button.

- Once you submit, a new page will open where you have to fill in the details such as establishment Details, eContacts, details of workers, contact persons, identifiers, employment details, activities, branches, and attachments.

- Fill in these details –all the mandatory details will be marked by an asterisk. Once you fill in everything, click on the “submit” button to register.

- Following this, you should complete the Digital Signature Certificate (DSC). This is the final step of EPF registration.

- Once the DSC registration is complete, Shram Suvidha portal will send you an email depicting that your registration is complete and confirmed.

EPFO Login

Every EPF account holder can access his/her EPF account number online on the EPFO portal. Functions like withdrawal, KYC update, and checking EPF balance can be performed. Universal Account Number or UAN can be used to login to the portal.

- To log in to the EPFO portal, employees and employers need to have a Universal Account Number (UAN) and a password.

- The UAN is a unique 12-digit number assigned to every member of the EPF scheme. It helps in linking all the PF accounts of a member throughout their employment.

- The EPFO Login portal enables employees to check their PF balance, download their PF passbook, transfer funds between PF accounts, and update their personal and employment details.

- Employers can use the EPFO Login portal to submit monthly PF contributions and other necessary documents, view the monthly PF contribution reports, and track the claim status of their employees.

- EPFO Login also provides a facility to generate an e-Passbook, which is a soft copy of the PF passbook. It contains all the transaction details of a member’s PF account, including contributions made by the employer and employee, interest earned, and withdrawals made.

- To ensure the security of the EPFO Login portal, members are advised to keep their login credentials confidential and change their password periodically.

- In case of any issues or errors while logging in, members can use the “Forgot Password” option or contact the EPFO Helpdesk for assistance.

What is UAN?

Universal Account Number is a 12-digit number that is allocated to each member by EPFO. When you change your job, the UAN number remains the same, and only the member ID changes. Once this is done, the new ID will get linked to UAN. You will get your UAN number through your employer. In case, you don’t get the UAN number you can login to the UAN portal with your member ID and find out the UAN.

EPF UAN Activation

EPF UAN Activation is a very important step because without actually getting the UAN activated, UAN is of no use. For completing the EPF UAN Activation process, you will need to know details like your UAN, Member ID, PAN, etc.

The steps for EPF UAN activation are:

- Firstly, you need to visit the EPFO Member e-SEWA portal. Once you do that, click on the “Activate UAN” option.

- On the next page, you need to fill in your UAN details, Member ID, Aadhar Number, PAN, E-mail id, other details and crack the captcha.

- Once this is done, click on the “Get Authorization Pin” button. You will then receive a PIN on your registered UAN mobile number.

- On the next page, you can check the “I Agree” box and then, enter the OTP pin you received. Click on the “Validate OTP and Activate UAN” box finally.

- After this, you will get a UAN password on your registered mobile number. You can use this password and your UAN to login into the EPFO portal from here onwards.

EPFO Employee Login

To login as an EPFO employee, you need to know UAN and the password. Once you login you can update your KYC, check EPF Claim status, file for EPF withdrawal, etc. The steps are:

- Open the EPFO website. When the home screen appears, click on the “Our Services” option. From the drop-down list that appears, click on the “For Employees” option.

- A new screen appears and you will see an option called “Services”. Under that option click on the “Member UAN/Online Service” option.

- This will redirect you to the Member e-SEWA portal. Here, you can log in using your UAN, password, and captcha.

- This will open the EPFO Employee page for you. Now, you can update your KYC, check EPF Claim status, file for EPF withdrawal, etc.

EPFO Employer Login

For the EPFO employer login, the steps are:

- Open the EPFO website. When the home screen appears, click on the “Our Services” option. From the drop-down list that appears, click on the “For Employer” option.

- A new screen appears and you will see an option called “Services”. Under that option click on the “Online ECR/Challan Submission/OTCP” option.

- This will redirect you to the “EPF Unified Portal for Employers”. Here, you can log in into the “Employer’s sign-in” and not the “Establishment sign-in” option. You will see the “Employer’s sign-in” below the “Establishment sign-in” option.

- Log in using your username, and password. This is the same username you get once you register your establishment.

- This will take you to the EPFO Employer page and you can approve KYCs, EPF withdrawals, etc.

EPF Payment

The employer can make the EPF payment on the EPFO portal online. Despite the fact that every month, both the employee and the employer make the 12% contribution, it is the duty of the employer to submit the EPF payment to the account. EPF payment can be made in two ways – either through the EPFO portal as mentioned above or through the bank’s website. Currently, there are 10 banks that have tie-ups with EPFO. Let’s take a look:

- SBI

- PNB

- HDFC Bank

- ICICI Bank

- Axis Bank

- Allahabad Bank

- Bank of Baroda

- Kotak Mahindra Bank

- Union Bank of India

- Indian Bank

What are the steps required to complete the EPF Payment?

- You need to go to the EPFO portal and log in using your Electronic Challan cum Return (ECR) credentials.

- Once you get logged in, check whether the details like establishment ID, Member name, etc. are correct.

- Open the dropdown list and click on the “Payment” option.

- Pick the “ECR Upload” option after that.

- Pick “Wage Month”, “Salary Disbursal Rate”, “Rate of contribution” and upload the ECR text file. The uploaded ECR file will then get validated on the predefined conditions.

- If you meet all the criteria, a page showing the message “File Validation Successful” will open up.

- In case, the file does not get validated, an error message will pop up. It will ask you to change the ECR text file in the required format. Upload it again after making the required corrections.

- After the validation, a TRRN will appear. Check on the “Verify” option on the page and move ahead.

- The next step is to generate the ECR summary sheet by clicking on the “Prepare Challan” option.

- Enter the Admin/Inspection charges and click on ‘Generate Challan’.

- Once you verify the Challan amount, click on the “Finalize” button. Click on “Pay” against the relevant TRRN.

- Choose the payment mode as ‘online’. Then, a drop-down will open from which you can select the bank from which you wish to pay. Now you will be asked to make a payment on the bank’s internet login page through net banking.

- Your transaction is complete here. You will be getting your Transaction Id and E-payment slip-on a successful EPF payment.

- Your transaction status will then be updated on the EPFO page.

- You will receive a confirmation of the payment made against the TRRN number provided by EPFO.

EPF Withdrawal or PF Withdrawal

Under certain circumstances, EPF withdrawal or PF Withdrawal can be done partially or completely. Since EPF is a retirement-oriented scheme, it’s advised to not withdraw the amount for minor issues. However, it is important to be able to distinguish between major and minor reasons. Some of the main reasons you can cite while filing for a partial/complete EPF withdrawal are:

- Wedding commitment

- Higher education

- Building a house

- Medical emergency

- Unemployment (for over two months)

- Retirement of the employee

- Permanent relocation to another country

- Complete physical or mental retirement

- Death of the employee

EPF Withdrawal Online

The process of online EPF withdrawal is simple. It is advisable to not withdraw the PF amount partially or fully before 5 years of the start of the EPF account because of many reasons. However, if you still need to withdraw EPF amount online, let’s take a look at the process:

- Open the EPFO website. When the home screen appears, click on the “Our Services” option. From the drop-down list that appears, click on the “For Employees” option.

- A new screen appears and you will see an option called “Services”. Under that option click on the “Member UAN/Online Service” option.

- This will redirect you to the Member e-SEWA portal. Here, you can log in using your UAN, password, and captcha.

- On the screen that opens, check the top tab. Click on the “Manage” option and check on the “KYC” option.

- Scroll down to the bottom of the new webpage that opened and find the “Digitally Approved KYC” section. Check that all your KYC details are correct.

- Once you are sure that all your KYC details are accurate and you can click on the “Online Service” option on the top tab.

- From the drop-down that appears, click on the “Form 31,19&10C” option. The new page will have an automatic generated form. You will then have to fill in the last 4 digits of your registered bank account number. Click on “Verify” after that.

- Once the bank verification is done, a “Certificate of Undertaking” will show up. Press “Yes” to proceed. After that, click on the “Proceed for Online Claim” option.

- A new screen will open which will have sections like “date of joining”, “I want to apply for”, “Purpose for which advance is required”, “Amount of Advance required in Rs”.

- Check the “PF ADVANCE Form-31” option in the “I want to apply for” tab. Also, you need to fill in the reason for your withdrawal in the “Purpose for which advance is required” tab.

- Fill in the amount of advance required and the address. Once you fill in all these details, you can click on the submit your application.

- Once this is done, you will have to submit a few documents. The type of documents asked will depend on the nature/purpose of your EPF withdrawal.

- After all the processes are done and the employer approves of your EPF claim, the withdrawal amount will be deposited in your registered bank account.

- In the end, you will receive an SMS notification on your registered mobile number. This is the final step of the process.

What happens when you withdraw your EPF amount before 5 years?

If you withdraw your EPF amount before 5 years, you will receive no tax benefits. Your EPF amount will become part of your taxable income. However, you won’t have to pay any tax if the amount falls below Rs 50,000 but if the amount is more than this, the amount will be eligible for a tax deduction of 10%.

In case, you want to avoid paying this amount, you can fill the form 15G or 15H while filing your income tax returns. In this case, you won’t be able to avail of the tax benefits that Section 80C of the Income Tax offers. The interest will be taxable the same as the interest earned from any other source.

The one and only exemption that you can get in this case is if the withdrawal is made due to a medical emergency. You won’t have to pay any tax in such situations.

How Can Deskera Help You

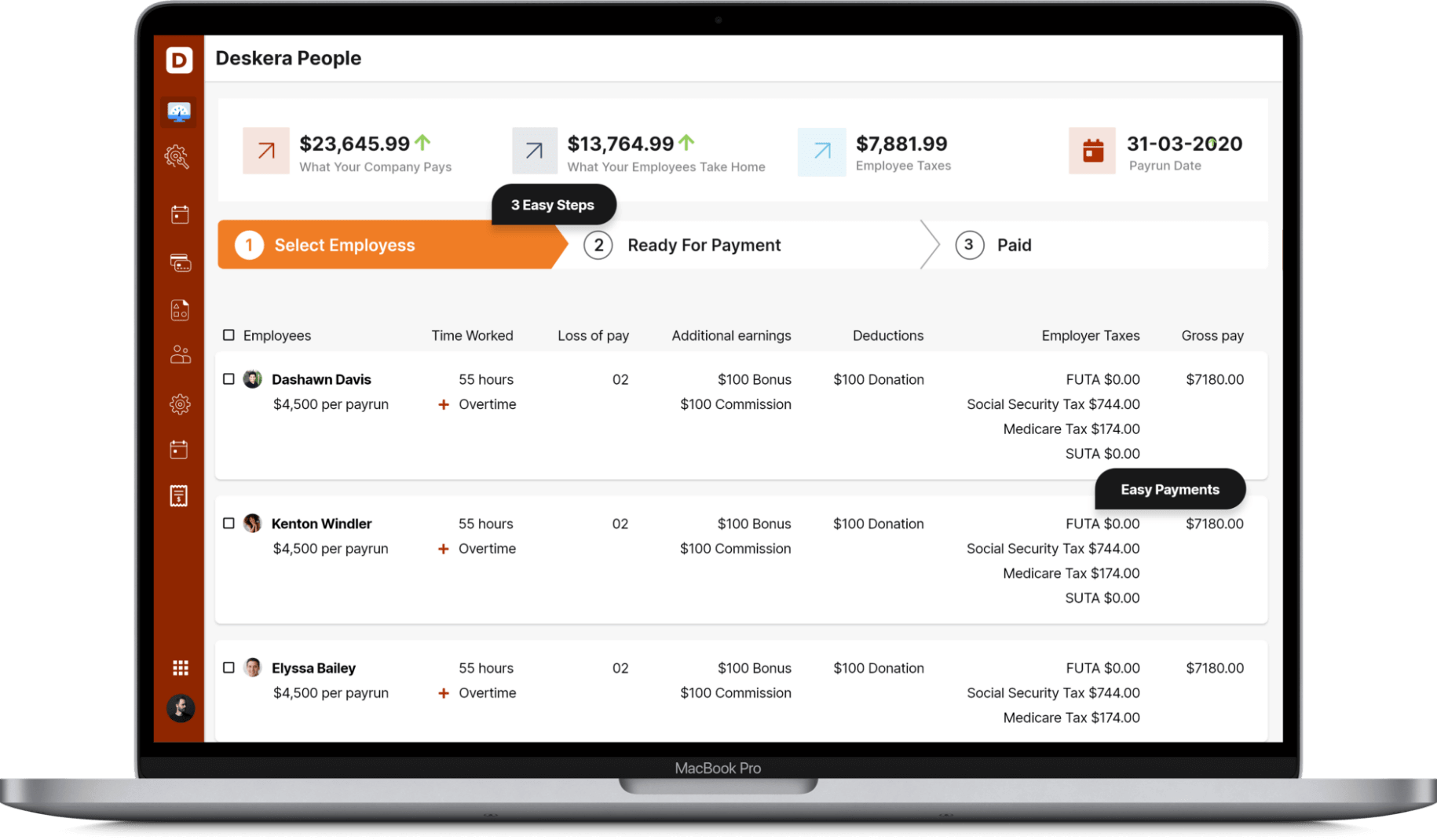

Deskera HRMS is all in one; it has many functions that will come in handy. To start with, you have excellent payroll software that will ease out the payroll process of your company. And the best part of the Deskera HRMS is you can do it in just three steps. Simply add employees to the system, select the amount to be paid, and pay them off.

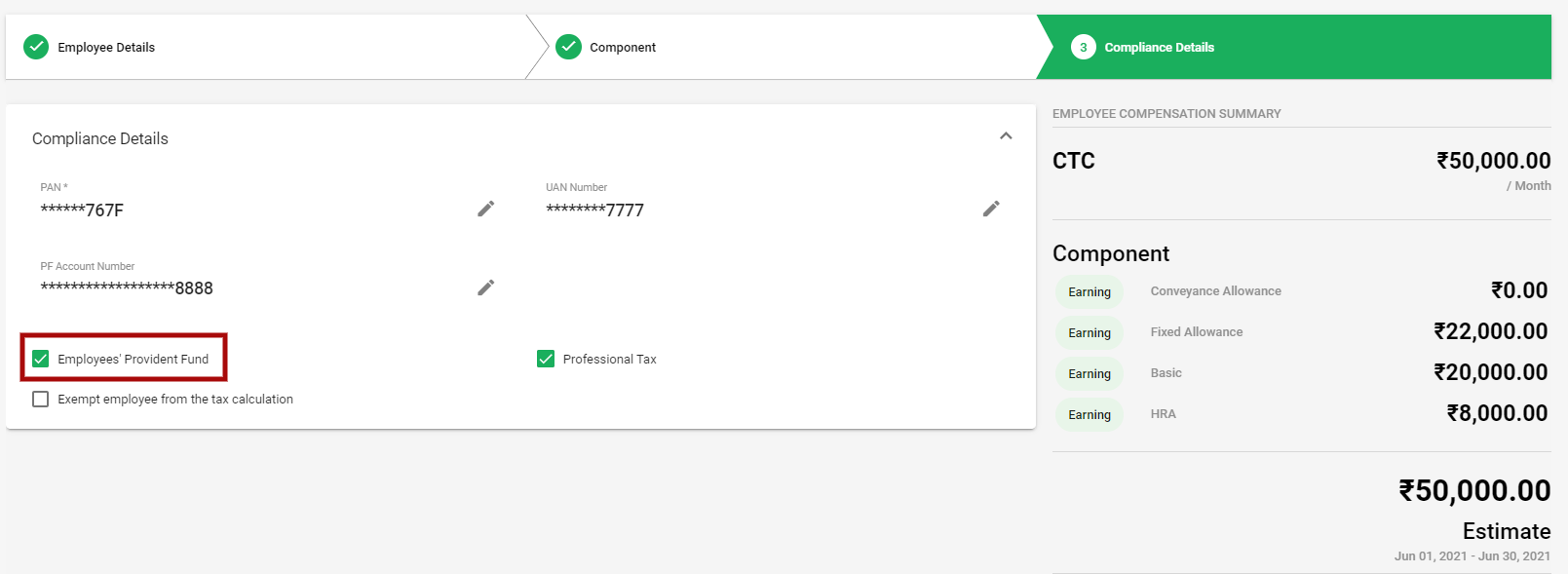

You can generate payroll and payslips in minutes using Deskera People. You can also file and manage your taxes using Deskera People. Deskera is an online cloud platform that can helps you organize your business, your employees and with handling your tax filings. Apart from helping you process your monthly payruns, Deskera People also handles your employees’ Income Tax saving investments.

A 15-day free trial will enable you to become familiar with the enterprise features. Deskera People provides you with an amazing HRMS system that helps you manage your employees from end to end. From managing payroll, employee onboarding, leave and attendance management, deskera also helps you with salary management. Using Deskera People, you can file your Income Tax or IT declaration and Proof of Investment(POI) using the platform.

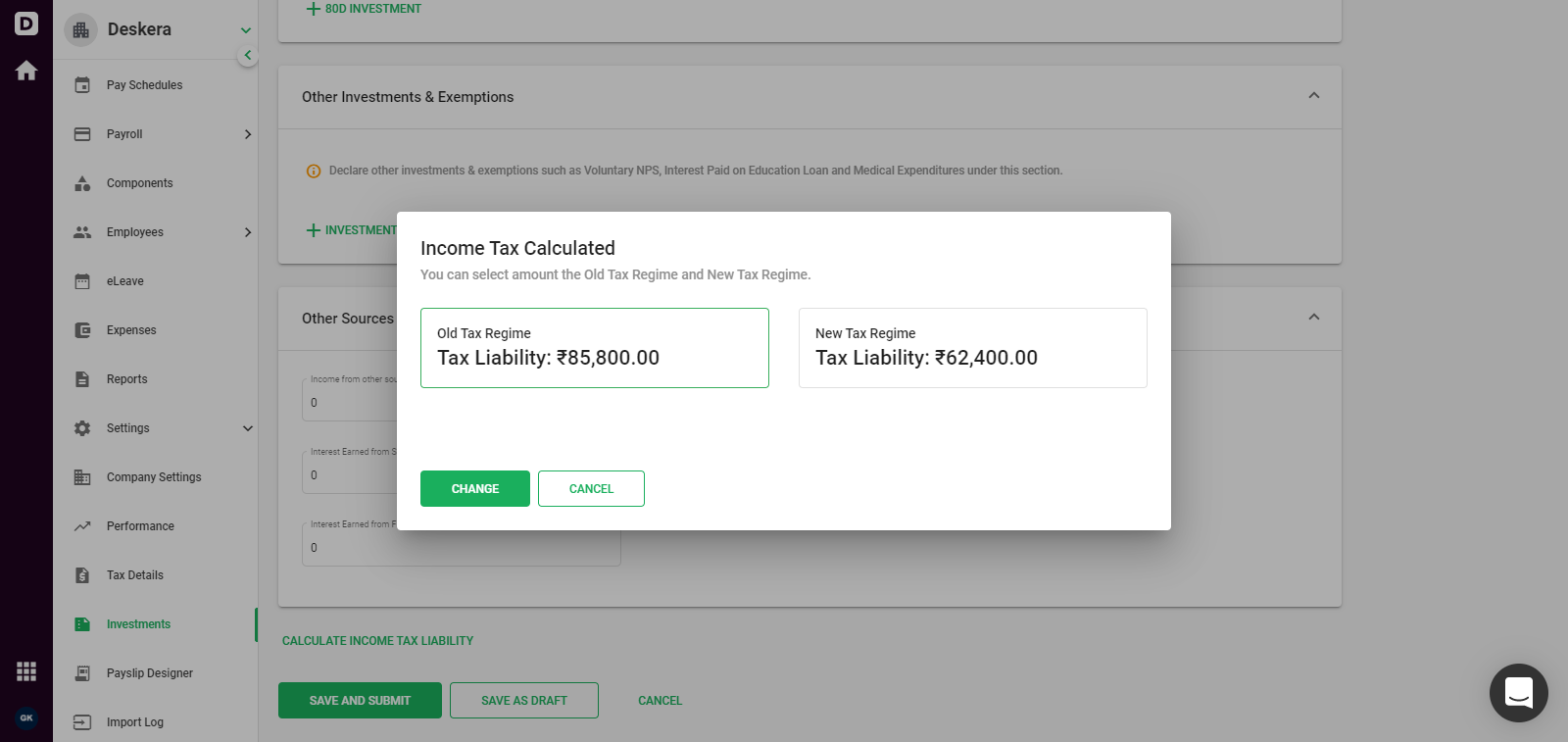

Deskera People simplifies the process of filing an ITR. Your organization's needs can be met with a customized plan designed by Deskera. Easy-to-use Deskera's tax software can help you file your taxes in no time. Business owners with any type of tax filing requirement can rely on the system. Employees can declare their proposed investments and anticipated expenses through the IT declaration.

Employees can declare the investments that they have made and submit proofs for the same, and Deskera People will auto - calculate the Income Tax based on the type and amount of each investment. The main incentive for employees’ to declare their investments is that it reduces their net taxable income, thereby decreasing the amount they need to pay as Income Tax.

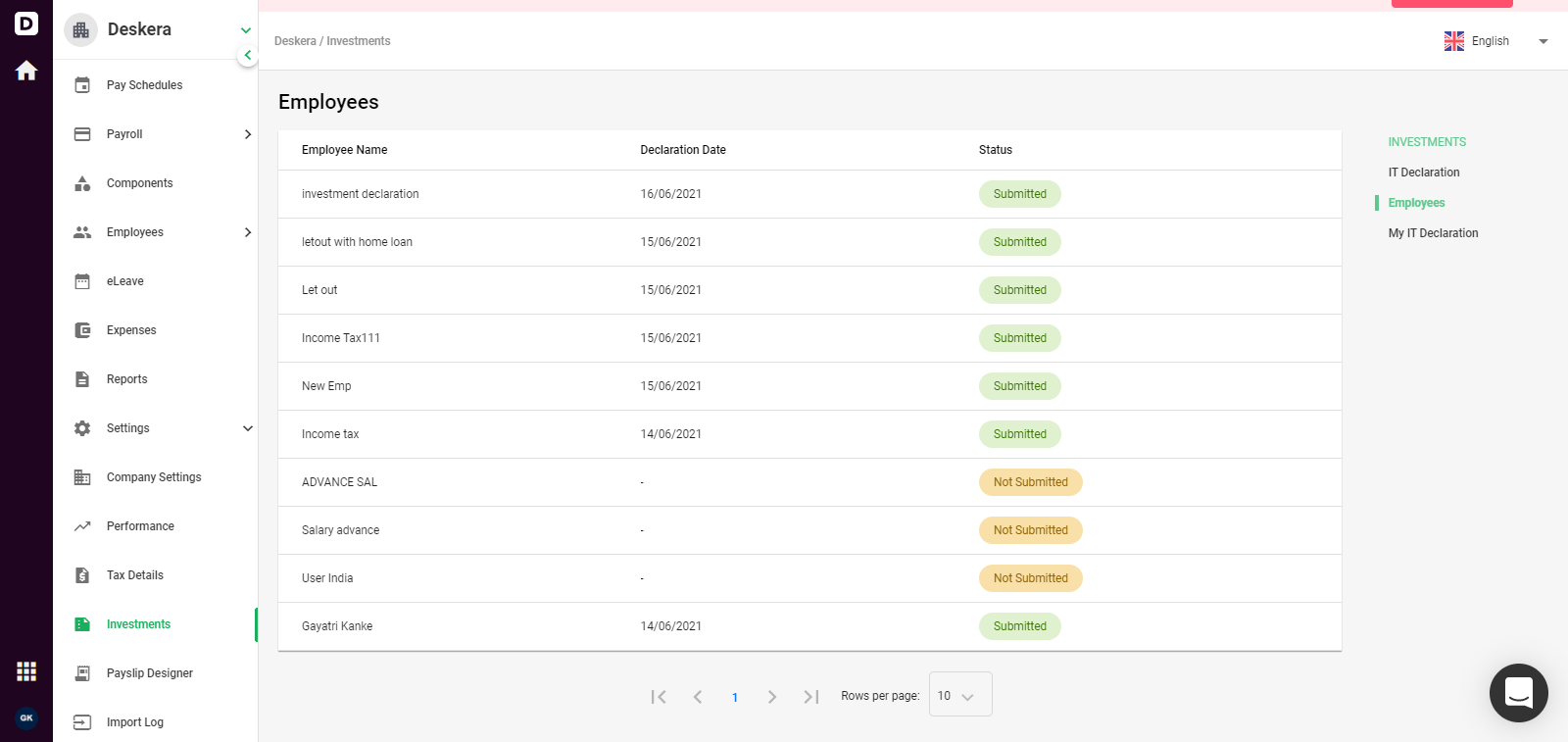

Once the IT Declarations are submitted by all the employees, the employers can view the status of these submission. Other than payroll management, Employee Provident Fund (EPF) and EPS contribution are also calculated in Deskera People. With Deskera People, you can accurately and automatically calculate the EPF and EPS contribution for both employee and employer.

All you need to do is access one dashboard, and you have all your employee information aligned together. The People Dashboard depicts all the pertinent information like the cost of the previous pay run and estimates of the upcoming one.

It also illustrates the year-to-date cost in a graphical interface. The calendar embedded in the Dashboard helps you identify the upcoming pay run dates for you to take action.

With Deskera, you can also add and deduct salary components easily without much hassle. Simply set up employee bonuses, voluntary deductions, taxes, and so on. Deskera also develops extensive reports on your payroll, taxations, and all you need to know about your company. As a result, you are always prepared for any inspections taking place or if you have to go through any specific information.

Conclusion

Employee Provident Fund (EPF) is an essential savings tool for employees in India, helping them to build a financial cushion for retirement. The scheme is administered by the Employee Provident Fund Organisation (EPFO), and contributions are made by both employers and employees.

The EPF scheme offers a host of benefits, including guaranteed returns on investment, tax benefits, and social security in the form of insurance and pension schemes. The scheme is also a valuable tool for building long-term wealth, with compound interest adding significant value over time.

The EPF scheme is structured to encourage long-term savings, with contributions made over the course of an employee's working life. These contributions are invested in a variety of instruments, including government securities, corporate bonds, and equities, with the aim of providing stable and long-term returns.

Key Takeaways

- An employee’s provident fund or EPF is created through contributions made by an employee and employer.

- The EPF interest rate for the year 2020-21 is 8.5% as decided by the EPFO.

- There are various benefits of EPF contribution that have been discussed in the article.

- In this article, we have discussed how to calculate the EPF interest rate.

- If the EPF account doesn’t receive any kind of contribution for over three years, it will convert into an inoperative EPF account.

- The procedure of EPF registration has been discussed in the article.

- UAN or Universal Account Number is a 12-digit number that is allocated to each member by EPFO.

- The process of UAN activation has been discussed in the article.

- The steps for EPFO employee login have been discussed in the article.

- The steps for EPFO employer login have been discussed in the article.

- The steps for completing EPF payment have been discussed in the article.

- The article talks about the steps to withdraw EPF payment online.

- If you withdraw your EPF amount before 5 years, you will receive no tax benefits. Your EPF amount will become part of your taxable income.

- Deskera is a top-notch platform that can help you in online invoicing, accounting, inventory management, HR & Payroll, and the list goes on.

Related Articles