Employer and employee contributions are used to fund the ESI Scheme. The employer's contribution is 4.75 percent of the earnings paid to employees. Employees are required to contribute 1.75 percent of their gross compensation.

The Employees' State Insurance Act contains several parts that give medical benefits and insurance to employees who work in factories that are registered with the ESI Corporation. As the start of a formal social security scheme in India, this is an intriguing prospect for both employees and lawyers.

The features of the Act will be discussed in this article, as well as how it operates to aid employees in times of need. Following are the topics covered:

• Application and scope of the Act

• Benefits

• Sections included in the Act

What is ESI?

The Employees' State Insurance Act, 1948, is a social security plan offered by the Indian government. Employees are covered under the plan if they become disabled or die as a result of work-related injuries, illnesses, or maternity leave. Employees must enroll in the plan in order to receive medical treatment and other benefits. The financial aid provided by the scheme may be used to compensate employees for lost wages due to illness.

This is a self-financing program in which employees and employers contribute a certain percentage of their wages to the scheme on a monthly basis.

Application and scope of the Act

The Employees' State Insurance Act (ESI) of 1948 provides financial support and assistance to the working class in times of medical difficulty, such as:

• Parental Leave

• Disturbances (mental or physical).

• Disability.

• Death.

It is a self-funded project that acts as a form of social security program to protect the working class from financial hardships caused by the medical conditions mentioned above.

The Act applies to non-seasonal factories employing 10 or more people under Section 2(12).

The Scheme has been extended to stores, hotels, restaurants, theatres including preview theatres, road-motor-transport operations, and newspaper establishments that employ 10* or more people under Section 1(5) of the Act.

The Scheme has also been extended to private medical and educational institutions employing 10* or more people in specified States/UTs under section 1(5) of the Act.

In Maharashtra and Chandigarh, however, the bar for establishment coverage remains at 20 employees. The current monthly pay ceiling for coverage under the Act is Rs.21,000 (as of January 1, 2017).

ESI applies to any entity that employs ten or more people, such as non-manufacturing stores, hotels, and restaurants, cinemas, road motor vehicle establishments, newspaper establishments, and private educational and medical institutes.

The ESI Scheme is now operational in 526 districts throughout 34 states and union territories, including 346 complete districts, 95 district headquarters, and 85 districts. The plan is in place in the centers. Arunachal Pradesh and Lakshadweep have yet to adopt the plan.

Benefits

Employees are entitled to benefits under Section 46 of the ESI Act as social security in the event of injury while on the job. There are six different sorts of advantages available:

• Medical benefit.

• Sickness benefit

• Maternity benefit

• Dependents’ benefits.

• Disability benefits

• Additional benefits.

Medical Benefits

These benefits are guaranteed to employees as soon as they are hired, and they also apply to their family members. This benefit pays for any treatment costs incurred by the employee as a result of medical difficulties.

From the first day of insurable employment, an insured person and his family receive full medical treatment. There is no limit on how much an insured person or a family member can spend on treatment. On payment of a nominal annual premium of Rs.120/-, medical care is also provided to retired and permanently disabled covered persons and their spouses.

Sickness Benefits

Section 46(1)(a) of the ESI Act allows covered employees to receive periodic payments in the event of sickness, as long as the medical condition is validated by an authorized medical practitioner.

The compensation is roughly 70% of their salaries, with a maximum of 91 days of compensation each year. The employee must have worked for a minimum of 78 days over a 6-month term of employment to be eligible for the benefit.

o Extended Sickness Benefit (ESB): In the case of 34 malignant and long-term conditions, SB can be extended for up to two years at an enhanced rate of 80% of salaries.

o Enhanced Sickness Benefit: Insured persons undergoing sterilisation for 7 days/14 days for male and female workers receive an Enhanced Sickness Benefit equal to their full earnings.

Benefits of Maternity

An insured woman can receive periodical payments under Section 46(1)(b) of the ESI Act if any of the following scenarios occur:

• confinement (labour that leads to birth or birth after 26 weeks);

• pregnancy-related illness

• childbirth complications

The benefit is payable for three months, with a one-month extension available if needed. In the year preceding the pregnancy, a minimum of 70 days of employment must be completed.

Dependents’ Benefits

Section 46(1)(d) provides for recurrent compensation (typically provided monthly) to the dependants/family members of someone who dies while working, with the cause of death being an employment injury or occupational hazard. Compensation is usually 90% of the employee's salary.

Disability Benefits

In the event that an employee is disabled as a result of an injury sustained while on the job. The disability may be transitory or permanent in nature. The disablement benefit, unlike the other benefits, does not require a minimum work contribution, albeit eligibility will be evaluated by the Medical Board.

This decision has an impact on the amount of compensation awarded, if any, with the average percentage of wages awarded being about 90%.

TDB (temporary disablement benefit): From the first day of insurable employment, regardless of whether or not any contributions have been paid, in the event of an employment injury. For as long as the disability lasts, a 90 percent of wage Temporary Disablement Benefit is paid.

PDB (permanent disability benefit): The benefit is provided in monthly installments at a rate of 90% of wage, depending on the level of loss of earning capacity as determined by a Medical Board.

Other Benefits

Other benefits relate to non-essential benefits that employees can receive in addition to the five primary perks. The following are some examples:

• Funeral Expenses: The eldest surviving member of an employee's family gets compensated Rs. 10,000 to execute his dying rites.

• Vocational Rehabilitation: This benefit is for disabled workers who are undergoing rehabilitation.

• Old age medical care: This benefit is accessible to retired employees or those who have left their jobs due to an injury, with a general compensation of Rs. 120 per month.

• Confinement Expenses: An insured woman or an I.P. in respect of his wife if confinement occurs in a location where requisite medical facilities are not accessible under the ESI Scheme.

• Physical Rehabilitation: In the event of a physical disability caused by an occupational harm.

• Rajiv Gandhi Shramik Kalyan Yojana: This unemployment allowance plan began on April 1, 2005. An insured person who becomes unemployed after three years of coverage due to factory/establishment closure, retrenchment, or permanent invalidity is entitled to the following benefits: o Unemployment Allowance equal to 50% of wage for a maximum of two years.

Medical care from ESI Hospitals/Dispensaries for self and family throughout the time IP is receiving jobless benefits.

Vocational Training is provided to upgrade skills - ESIC pays for the fees and travel allowance.

• Incentives for firms in the private sector to hire people with disabilities on a regular basis:

o For Physically Disabled Persons, the minimum wage ceiling for ESIC benefits is Rs 25,000/-.

o The Central Government pays the employers' contribution for three years.

Contribution

• Because the E.S.I. Scheme is contributory in character, all employees in the factories or enterprises to which the Act applies must be insured in accordance with the Act's provisions. In the case of an employee, the contribution payable to the Corporation will be made up of an employer contribution and an employee contribution at a certain rate. The rates are updated on a regular basis.

• The employee contribution rate (as of 1.1.97) is 1.75 percent of wages, whereas the employer contribution rate is 4.75 percent of wages paid/payable in respect of employees in each wage period. For the first 24 months in newly adopted areas, the contribution rate is 1% of employee wages and 3% of employer wages (w.e.f. 06.10.2016) Employees who earn a daily average wage of up to Rs.137/- are excused from contributing. Employers, on the other hand, will contribute their fair part in the case of these employees.

Collection of Contribution

• An employer is responsible for paying his contribution for each employee and deducting employee contributions from wages bills, and must pay these contributions to the Corporation at the above stipulated rates within 15 days of the last day of the calendar month in which the contributions are due. The Corporation has authorized specified State Bank of India and other institutions to accept payments on its behalf.

Contribution Period and Benefit Period

• There are two six-month contribution periods and two six-month benefit periods, as shown below.

Contribution period Corresponding Cash Benefit period

In the first case, the Principal employer must contribute.

• The primary employer has to collectively pay the contribution, both his own and that of his employees, regardless of whether they are directly employed under him or are working through an immediate employer.

• If a directly employed employee fails to pay his contributions, the employer can only recover that contribution by deducting the employee's wages.

• The primary employer bears all payment to the Corporation transfer costs, both his own and those of his employees, regardless of whether they are directly employed under him or working through an immediate employer.

Contribution reimbursement from the immediate employer

The principal employer has the right to collect the payment made on behalf of an indirect employee from the immediate employer as a debt owing to him in the case of an employee who is indirectly employed under the principal employer via an immediate employer.

Before paying his dues, the immediate employer must also prepare a list of all the employees under him and submit it to the primary employer.

Contribution payment provisions in general

In the event that an employee's wage falls below the Central Government's stipulated wage range, the employee is not accountable for his contribution and it is not payable.

Method of payment of contributions

The Act's payment regulations have been specified under the following conditions:

• The type and timing of the contribution.

• Payment involving the application of stamps or other adhesives to books of accounts or other documents.

• The contribution evidence that reaches the Corporation must be dated.

• The various entries in the books of accounts, as well as the insured persons' information.

• Replacing papers that have been misplaced, damaged, or disfigured.

Sections included in the Act

Section 1. Short title, extent, commencement and application.

Section 2. Definitions.

Section 2A. Registration of factories and establishments.

Section 3. Establishment of Employees' State Insurance Corporation.

Section 4. Constitution of Corporation.

Section 5. Term of office of members of the Corporation.

Section 6. Eligibility for re-appointment or re-election.

Section 7. Authentication of orders, decisions, etc.

Section 8. Constitution of Standing Committee.

Section 9. Term of office of members of Standing Committee.

Section 10. Medical Benefit Council.

Section 11. Resignation of membership.

Section 12. Cessation of membership.

Section 13. Disqualification.

Section 14. Filling of vacancies.

Section 15. Fees and allowances.

Section 16. Appointment of a Director General and a Financial Commissioner.

Section 17. Staff.

Section 18. Powers of the Standing Committee.

Section 19. Corporation's power to promote measures for health, etc., of insured persons.

Section 20. Meetings of Corporation, Standing Committee and Medical Benefit Council.

Section 21. Supersession of the Corporation and Standing Committee.

Section 22. Duties of Medical Benefit Council.

Section 23. Duties of Director General and the Financial Commissioner.

Section 24. Acts of Corporation, etc., not invalid by reason of defect in constitution, etc.

Section 25. Regional Boards, Local Committees, Regional and Local Medical Benefit Councils.

Section 26. Employees' State Insurance Fund.

Section 27. [Omitted.].

Section 28. Purposes for which the Fund may be expended.

Section 28 A. Administrative expenses.

Section 29. Holding of property, etc.

Section 30. Vesting of the property in the Corporation.

Section 31. [Omitted.].

Section 32. Budget estimates.

Section 33. Accounts.

Section 34. Audit.

Section 35. Annual report.

Section 36. Budget, audited accounts and the annual report to be placed before Parliament.

Section 37. Valuation of assets and liabilities.

Section 38. All employees to be insured.

Section 39. Contributions.

Section 40. Principal employer to pay contributions in the first instance.

Section 41. Recovery of contribution from immediate employer.

Section 42. General provisions as to payment of contribution.

Section 43. Method of payment of contributions.

Section 44. Employers to furnish returns and maintain registers in certain cases.

Section 45. Social Security Officers, their functions and duties.

Section 45A. Determination of contributions in certain cases.

Section 45AA. Appellate authority.

Section 45B. Recovery of contributions.

Section 45C. Issue of certificate to the Recovery Officer.

Section 45D. Recovery officer to whom certificate is to be forwarded.

Section 45E. Validity of certificate and amendment thereof.

Section 45F. Stay of proceedings under certificate and amendment or withdrawal thereof.

Section 45G. Other modes of recovery.

Section 45H. Application of certain provisions of the Income-tax Act.

Section 45-I. Definitions.

Section 46. Benefits.

Section 47. [Omitted.].

Section 48. [Omitted.].

Section 49. Sickness benefit.

Section 50. Maternity benefit.

Section 51. Disablement benefit.

Section 51A. Presumption as to accident arising in course of employment.

Section 51B. Accidents happening while acting in breach of regulations, etc.

Section 51C. Accidents happening while travelling in employer's transport.

Section 51D. Accidents happening while meeting emergency.

Section 51E. Accidents happening while commuting to the place of work and vice versa.

Section 52. Dependant's benefit.

Section 52A. Occupational disease.

Section 53. Bar against receiving or recovery of compensation or damages under any other law.

Section 54. Determination of question of disablement.

Section 54A. References to medical boards and appeals to medical appeal tribunals and Employees' Insurance Courts.

Section 55. Review of decisions by medical board or medical appeal tribunal.

Section 55A. Review of dependant's benefit.

Section 56. Medical benefit.

Section 57. Scale of medical benefit.

Section 58. Provision of medical treatment by State Government.

Section 59. Establishment and maintenance of hospitals, etc., by Corporation.

Section 59A. Provision of medical benefit by the Corporation in lieu of State Government.

Section 59B. Medical and para-medical education.

Section 60. Benefit not assignable or attachable.

Section 61. Bar of benefits under other enactments.

Section 62. Persons not to commute cash benefits.

Section 63. Persons not entitled to receive benefit in certain cases.

Section 64. Recipients of sickness or disablement benefit to observe conditions.

Section 65. Benefits not to be combined.

Section 66. [Omitted.].

Section 67. [Omitted.].

Section 68. Corporation's rights where a principal employer fails or neglects to pay any contribution.

Section 69. Liability of owner or occupier of factories, etc., for excessive sickness benefit.

Section 70. Repayment of benefit improperly received.

Section 71. Benefit payable up to and including day of death.

Section 72. Employer not to reduce wages, etc.

Section 73. Employer not to dismiss or punish employee during period of sickness, etc.

Section 73A. Definitions.

Section 73B. Power to frame Schemes.

Section 73C. Collection of user charges.

Section 73D. Scheme for other beneficiaries.

Section 73E. Power to amend Scheme.

Section 73F. Laying of Scheme framed under this Chapter.

Section 74. Constitution of Employees' Insurance Court.

Section 75. Matters to be decided by Employees' Insurance Court.

Section 76. Institution of proceedings, etc.

Section 77. Commencement of proceedings.

Section 78. Powers of Employees' Insurance Court.

Section 79. Appearance by legal practitioners, etc.

Section 80. [Omitted.].

Section 81. Reference to High Court.

Section 82. Appeal.

Section 83. Stay of payment pending appeal.

Section 84. Punishment for false statement.

Section 85. Punishment for failure to pay contributions, etc.

Section 85A. Enhanced punishment in certain cases after previous conviction.

Section 85B. Power to recover damages.

Section 85C. Power of Court to make orders.

Section 86. Prosecutions.

Section 86A. Offences by companies.

Section 87. Exemption of a factory or establishment or class of factories or establishments.

Section 88. Exemption of persons or class of persons.

Section 89. Corporation to make representation.

Section 90. Exemption of factories or establishments belonging to Government or any local authority.

Section 91. Exemption from one or more provisions of the Act.

Section 91A. Exemptions to be either prospective or retrospective.

Section 91AA. Central Government to be appropriate Government.

Section 91B. Misuse of benefits.

Section 91C. Writing off of losses.

Section 92. Power of Central Government to give directions.

Section 93. Corporation officers and servants to be public servants.

Section 93A. Liability in case of transfer of establishment.

Section 94. Contributions, etc., due to Corporation to have priority over other debts.

Section 94A. Delegation of powers.

Section 95. Power of Central Government to make rules.

Section 96. Power of State Government to make rules.

Section 97. Power of Corporation to make regulations.

Section 98. Omitted.

Section 99. Medical care for the families of insured persons.

Section 99A. Power to remove difficulties.

Section 100. Repeals and savings.

Medical Benefit Council

The Medical Benefit Council is an advisory council that advises on medical benefit management under the ESI plan.

• The Director-General of ESIC, who serves as Chairman.

• As co-Chairman, the Director-General of Health Services.

• ESIC's Medical Commissioner.

• Each state has one member appointed by the state government.

• Employers are represented by three members, while employees are represented by three members.

• Three members, one of them is a woman from the medical field.

Members of the Medical Benefit Council's tenure

The members of the Medical Benefit Council listed below have been appointed for a four-year term:

• ESIC's Director-General as Chairman.

• As co-Chairman, the Director-General of Health Services.

• ESIC's Medical Commissioner; and one member nominated by each state's government.

Resignation of membership

A member of the Corporation's resignation is complete when a written notice of resignation is delivered to the Central Government, and his seat will become empty upon acceptance of his resignation.

Cessation of Membership

If a member of the ESIC misses three consecutive meetings, he or she will be removed from his or her relevant body (Corporation, Standing Committee, or Medical Council). However, under the guidelines established by the Central Government, the same member can be restored by the concerned authority.

Any employer, employee, or medical representative who, in the judgment of the Central Government, fails to represent their qualification will lose their ESIC membership.

Disqualification

• If a qualified judge declares him to be of unsound mind, he can be disqualified as an ESIC member.

• If he is an unpaid insolvent;

• If he has ever been convicted of a crime involving moral turpitude.

Allowances and fees

The fees that members of the ESIC must pay for their services can be paid at any moment at the discretion of the Central Government. There is no set timeline in place.

Penalties

Punishments

All of the penalties for default stated in the ESI Act are covered under Sections 84, 85, and 85A.

• False Statement: Any individual caught raising the payment or benefit to avoid payment by himself is suspected of lying. Punishable by up to six months in prison and/or a fine of not more than Rs. 2000. Insured people who are convicted of this will be denied monetary benefits.

• Failure to pay contribution: Failure to pay the contribution, as well as improperly deducting earnings or benefits, unfairly punishing an employee, obstructing inspector's responsibilities, and so on, can result in a sentence of up to three years in prison and a fine of up to Rs. 10,000.

• Subsequent Punishment: If a person is found guilty of the same offence twice, he will be sentenced to a maximum of two years in prison and a fine of Rs. 5000 for each subsequent offence.

Power of Court to make orders

It also provides measures for enforcing judicial orders, in addition to the court's ability to recover damages. If the defaulting employer fails to satisfy the Court's payment deadlines, the employer will be considered to have committed a new offence, punishable by imprisonment and/or fines.

Damages-recovery authority

If an employer fails to pay contributions due in any way, whether on his own or on behalf of his employees, the Corporation has the right to recoup the deficiency through a penalty.

This contribution recovery will not take place, however, until the person in charge has been given a reasonable opportunity to be heard about the failure to pay the contribution.

Prosecution

Section 86 of the ESI Act states that any prosecution must first acquire the approval of the Insurance Commissioner or another authorized authority, such as the Corporation's Director-General. Under the ESI Act, no court lower than a First Class Magistrate can try an offence, and no court will take cognizance of any offence reported under the Act.

Offences by companies

Taking cues from the concept of a commercial entity, where each firm is treated as an individual, i.e., it is a separate legal entity that can sue or be sued in a court of law.

As a result, when a corporation is accused of committing a crime, all of its managerial personnel who were in charge of the company at the time will be tried alongside the company and found guilty of the same crime. They will face the consequences as a result.

Exemptions

Sections 87, 88, 90, 91, and 91A of the Internal Revenue Code specify the conditions under which certain benefit exclusions may be granted.

The suitable government (appropriate here meaning the government exercising more authority, in closer vicinity) can exempt the following from the benefits of the ESI Act (if they were already receiving those benefits) by a notification in the Official Gazette:

• Factory/establishment or a class of factories/establishments.

• Persons or classes of persons.

• Government-owned factories or establishments.

• Any of the aforementioned from a specific Act provision.

• Any of the above could be excused in the future for a set amount of time.

Wage Limit

Employees with a monthly income of less than Rs.21,000 are eligible for the scheme's benefits. To summarize, employees who work for companies or establishments with 10 or more employees and monthly earnings of up to Rs.21,000 are eligible for health benefits under the ESI Act.

In the case of daily average wages of Rs.137, there are exceptions to the rule. They are not required to contribute from their earnings to the scheme. For such people, just the employer's payment is paid.

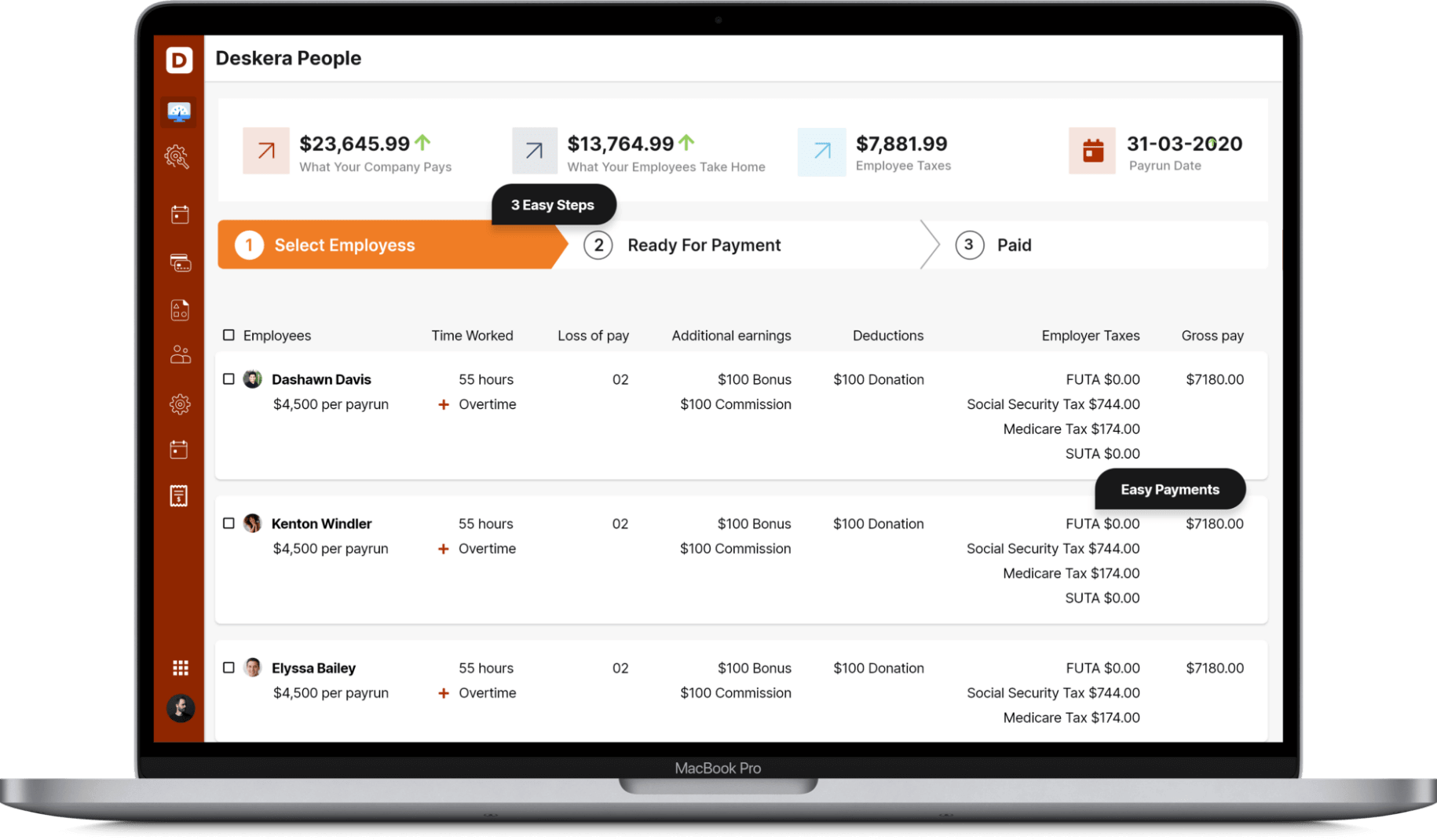

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key takeaways

- The ESI Act is a necessary utility for a working-class employee in India, as it benefits them while also benefiting sectors outside of the working class.

- Apart from providing medical benefits to employees, the Employees' State Insurance Act also regulates many other indirect aspects of effectively managing the Corporation established by the Act, such as sales proceedings, account management, and power separation among its many officers.

- Employees' State Insurance Corporation (ESIC) is a government agency in charge of administering the Employees' State Insurance (ESI) program. Employees and their families are provided with medical and financial help under the scheme.

- The minimum number of employees required to subscribe for ESI scheme varies with states, such as Maharashtra, Meghalaya, Mizoram, Nagaland, Goa, Chandigarh, and Assam-20; Jharkhand, Haryana, Karnataka, Rajasthan, Tripura, West Bengal, Andhra Pradesh, and Delhi-10.

Related articles