Multiple strains of the highly mutant Covid virus have had a large impact on businesses of all sectors. As we slowly learn to live with the virus with appropriate precautions and administration of vaccine doses, there are still some businesses that remain affected by it.

The pandemic continues to present unanticipated challenges to small businesses as they await the return of visitors and proper income. The federal government of the United States of America has stepped forward to assist the impacted employers and initiated the Employee Retention Credit (ERC) under the CARES act.

What is Employee Retention Credit?

The Employee Retention Credit or ERC is a response developed by the American government to help employers. It was created under the Coronavirus Act, Relief and Economic Security Act (CARES) by Congress in the USA to motivate employers to keep workers on payroll and wages in when the unexpected disease began.

The employee retention credit calculation is done to help the employer understand the total amount needed for business relief which ensured they gave qualified wages to the employees. In short, it is a fully refunded tax credit that employers can claim if they were forced to shut down operations. The Consolidated Appropriations Act (CAA) expanded the ERC act in December 2020 and it was ended retrospectively for most businessmen in September 2021. Let us understand this in more detail.

How was ERC implemented?

At the initial stage, the employee retention credit calculation was given as 50 per cent for qualified employee wages but later got restricted to 10,000 dollars for just a single employee. So, each employee was granted 5000 dollars as wages from March 2020 to December 2021.

It was later updated to 70% of the qualified salary of the salary in 2021 and hence, each qualified worker was to get 10,000 dollars per quarter. The credit applied to all the employers who had under 100 and 500 employees for a time being in 2020 and 2021 with a different set of rules for each.

Eligibility Criteria for the Employers

For an employer in the US, he was first expected to understand the eligibility criteria before finalizing the employee retention credit calculation spreadsheet. According to the Infrastructure Investment and Jobs Act, an employer with a recovery startup business was considered eligible for taking advantage of the credit.

After the enactment of the American Rescue Plan Act, even institutions such as hospitals, colleges, universities and 501-c organisations qualify for the credit retention policy. To qualify for it, the interested individual must fulfil the following 2 conditions

- During peak Covid-19 times, the employer’s business or trade was partially suspended. He had to reduce the working hours as per the government’s order. The credit was given only for the suspended time in the quarter and not the entire quarter.

- The employer saw a significant decline in business and gross receipts.

The rules were slightly modified in the year 2021 for the first and second quarters. Hence, its eligibility criteria can be understood from the following flowchart.

What are Qualifying Wages?

The credit was given to the employer based on the number of employees he had in his organization in 2019. For instance, if the businessman had more than 100 employees in 2020, then only the workers who the employer decided to retain but could not continue work due to government regulations were eligible to get employee retention credit.

If the business had 100 or less than 100 workers, then wages for all employees - whether they are working or not could be claimed by the employer. In 2021, the federal government has increased this threshold to 500.

It meant if the business owner had 500 or more employees working at his firm, he could claim employee retention credit calculation for those workers who could not provide services due to stringent regulations of the government. In case, the number was less than 500, then the claim for all employees could be filed to IRS.

How the Employee Retention Credit Calculation is done by the U.S federal government?

The government has revised employee retention credit multiple times and hence, getting through its terms and conditions can look complex for any employer. To simplify your worries, you need to understand the eligibility criteria, step-by-step on basis of which the federal government decides who can get the credit. These steps included -

- Identify Single Employer: IRS identified the controlled entities in affiliation with a larger company or other sister companies that had less gross receipts as a single employer

- Check Eligibility of Business: The ERC then determined the eligibility of the business and if its sales went down by 50% in 2019 or if it needed to suspend operations because your suppliers’ business got stopped abruptly

- Point the Time period: The employer then had to pinpoint the time when the company was eligible to get credit. He needed to exactly tell which quarter was the period where he was most affected.

- Determine Qualification of Wages for Tax credit: Irrespective of whether he was a small or big employer, he had to classify and determine which wages of employees were eligible for credit. In this calculation, qualifying wages was considered to be a point of discussion by the auditors and was seen as a major challenge by most employers.

- Get the right calculations: The employer needed to give accurate employee retention credit calculations for both the years, 2020 and 2021. In the year 2020, 50% of qualifying wages was given to every employee whereas it was 70% in 2021.

- Comparison of relief: The employer then needed to compare the relief he had got from ERC and PPP programs, and then select the best possible option.

- Optimization with other tax credits to prevent overlap: The qualifying wages used for ERC had not to be used for other tax credits such as payroll tax deduction, R&D tax credit in 2020 and 2021.

- Review and finalize the documentation: The employer has reviewed and checked each step of his documentation done for employee retention credit calculation before submitting it to the IRS agent.

The Employee Retention Credit came to an end retroactively for most employers on 30 September 2021. Additionally, it was applicable only for small employers. He could get all answers to the FAQs on the government site.Furthermore, he could request advance payment by filling form 7200 until 31 January 2022.

How to Claim the ERC calculation?

The employer could claim the ERC calculation from IRS, the eligible employers needed to report the company’s total qualified wages as well as health insurance costs for each quarter on their quarterly employment tax returns. Most employers had to give these details on form 941 to IRC. While filing this form, the employers were permitted to retain some amount as employment taxes or in form of deposits or other ways. The detailed information for this is given on the IRS website.

Conclusion

The government of America had made provision for sustainable living for employers facing income crises after the sudden onset of a pandemic by giving employee retention credit. Using this employee retention credit calculation, the employer needed to provide the appropriate amount to the IRS agent and he could include it to get tax benefits for the specific year.

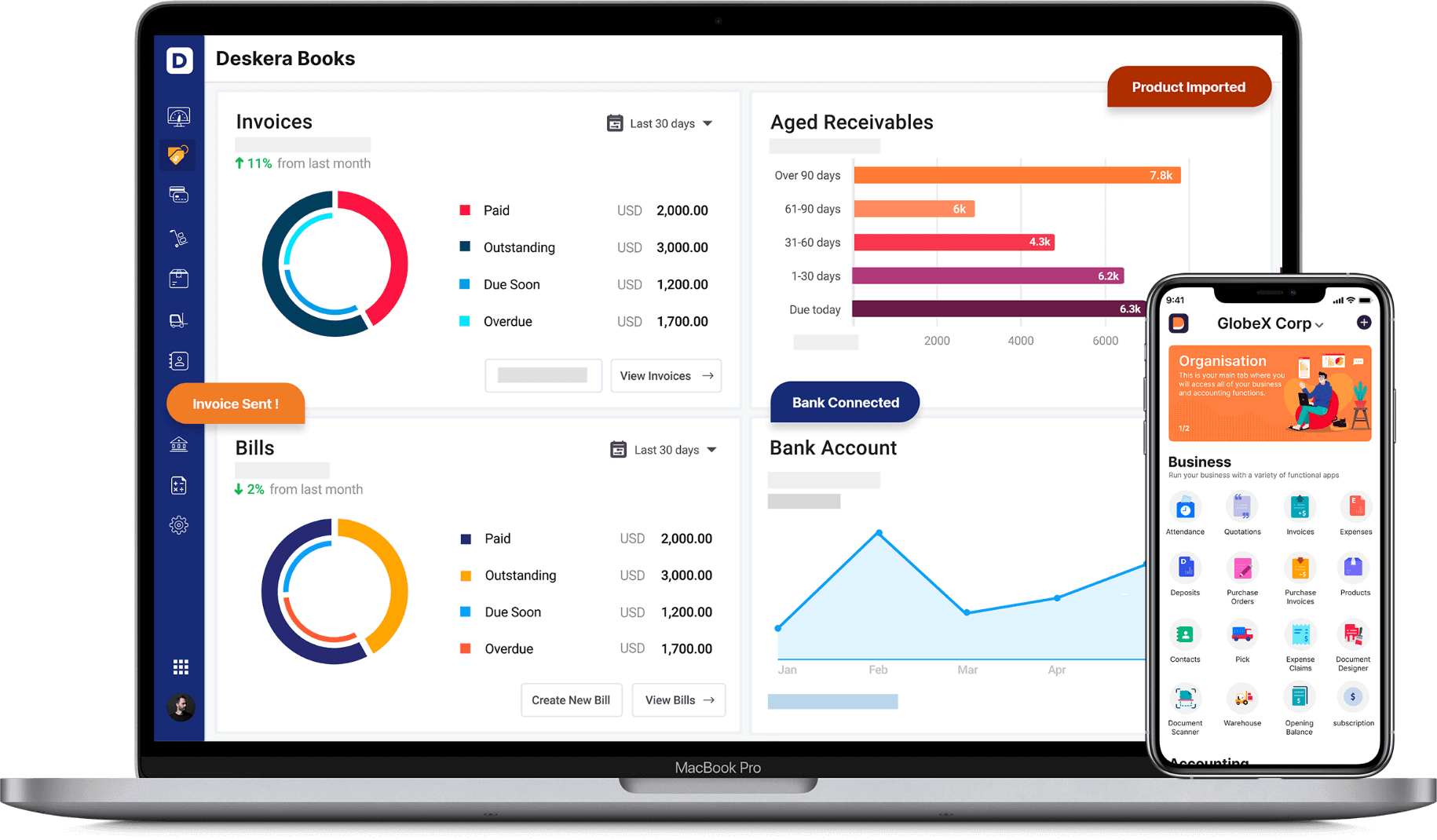

How Deskera can help you with Accounting

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Learn about the exceptional and all-in-one software here:

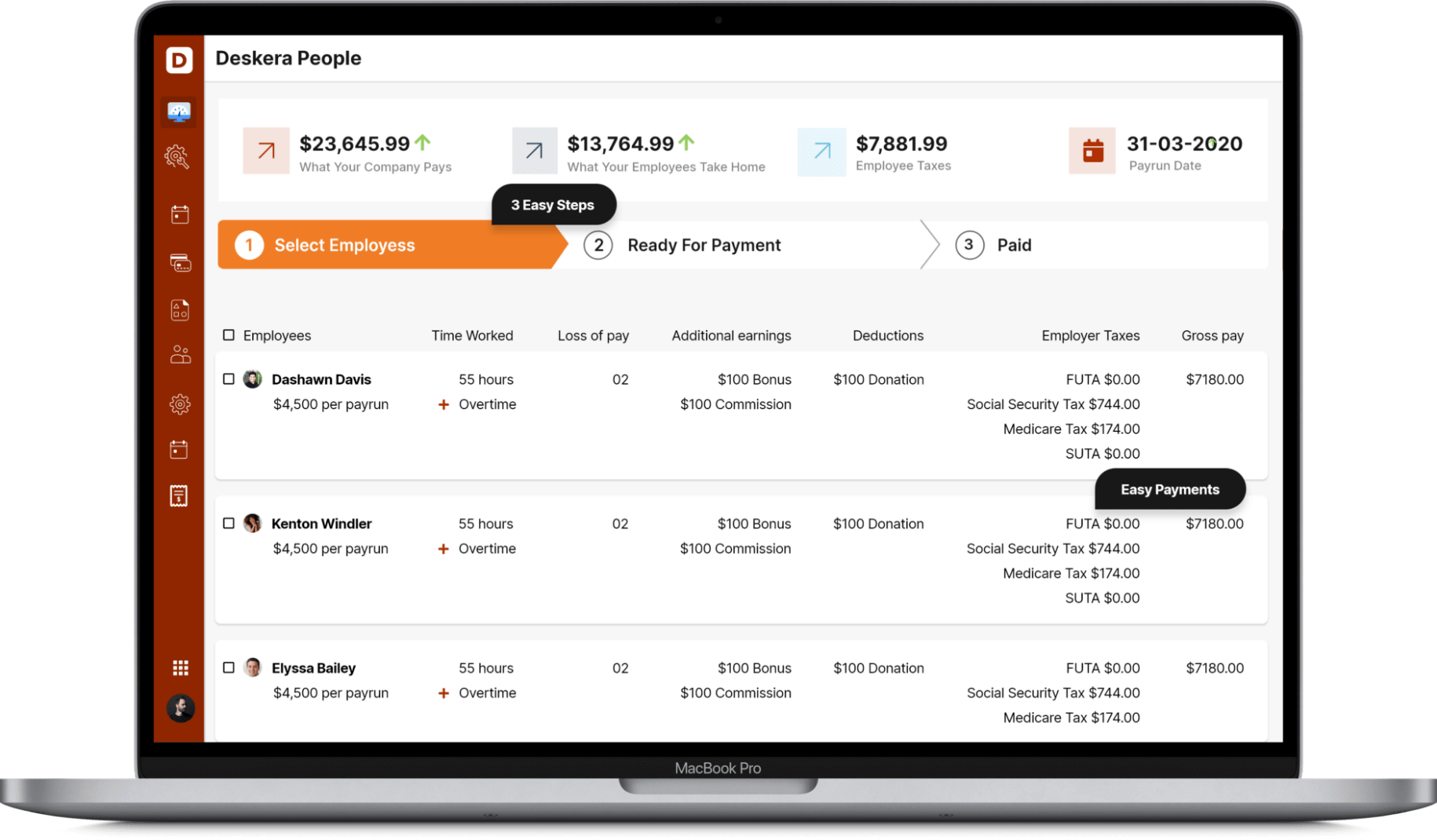

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more.

Key Takeaways

- The unanticipated Covid19 pandemic had a disastrous effect on employers, professionals and their families, thereby leaving some of them without a fixed source of income. To address this major financial issue, the US government started an employee retention credit policy for employers.

- The employers could claim qualifying wages for the employees who had to leave the work profile due to stringent regulations from the government and a dip in gross income. He could claim 50% per individual in 2020.

- The ERC norms were modified in 2021 and an employer could claim 70% for each employee per month on his monthly salary. The employer had to do an accurate employee retention credit calculation, make a report and submit it to the IRC agent.

- In 2020, the credit was given to employers who had 100 or fewer employees who had to give up work due to the circumstances and drop in employer’s income. The ERC was revised for 2021 and the permissible number of workers was raised to 500. Furthermore, the credit became applicable only for small business owners.

- The employer had to submit an employee retention credit calculation report to the IRS agent with full details to guarantee qualifying wages for each individual and also get some income tax benefits for that concerned financial year.

Related Articles