As a small business owner or a startup owner, you have a diverse set of issues to work with. Budget is a predominant concern for most companies, besides hiring the brightest talent. These early-stage speed breakers may weaken the business integrity and hinder employee engagement. After all, talent acquisition is one of the most critical points on your business strategy list.

Moreover, at the onset of your business, you certainly need funds and yet, offer the best incentives to your employees in order to induce motivation. So, you may wonder about the options you have at hand to accomplish it.

Offering stock options has been gaining momentum when arriving at a good employee equity strategy. And why not! There are myriad benefits that come along.

We shall be learning more about employee equity and many other topics, including the following:

- What is employee equity?

- Steps to offer employee equity

- More about stocks

- Distribution of Common Stock

- Common Stock Valuation

- More about Vests and Cliffs

- Types of Equity Compensation

What is Employee Equity?

In many companies, equity is a part of the overall compensation package. Equity represents a portion of ownership of the company, and employees can be incentivized to stay and work hard by offering equity to them.

Employees receive equity in the form of non-cash compensation called Employee equity. There are various kinds of equity that you can offer as an employer. It is also a brilliant way to reward the best performers of your company and keep them engaged and motivated for better productivity in the future.

Employees may receive stock options, restricted stock, and performance shares as equity compensation. They all aim to represent a company employee's ownership interest.

Through equity compensation, employees can gain a share of the company's profits. It may motivate them to stay back. Equity compensation can sometimes come with a salary that is in the below-market range.

Employee equity can encourage employees to invest in the future of your company. As an employer, you can set the ground for giving equity when you have hired your first set of employees; also, it is essential to learn about the types of stocks you will be offering.

Steps to Offer Employee Equity

It is imperative we learn about employee equity before offering it. In this section, we get to learn about the steps you would need to take to offer employee equity in a well-organized manner.

- Hire a sharp end crew

- Examine your equity alternatives and evaluate them by comparing them to those of your competitors

- Choose the equity option you'll provide. Create a vesting schedule and terms that work for you

- Decide on an expiration date

- Determine whether or not employees will be able to execute their stock options early

- Your terms should be included in your employee handbook

More about Stocks

While learning about employee equity, we must walk through the two kinds of stocks:

- Preferred Stock

- Common Stock

Preferred Stock

In addition to voting on certain corporate governance matters and choosing board members, the preferred stock carries diverse other rights with it. Preferred stock is typically sold to investors. In the case of exits, its liquidation preference is high as it is paid out first, ahead of everyone else.

Common Stock

Common Stocks are for employees and do not generally offer any significant rights. This makes them less valuable or preferable. Moreover, it also does not provide any liquidation preference.

When the company is a private firm, the common stock does not offer much value, but when it becomes public, the preferred stock is converted to common stock. As a result, there is a single type of stock available for everyone to buy or sell on the public stock exchange.

Distribution of Common Stock

There are two ways in which you can offer the common stocks to your employees:

- Stock Options

- Restricted Stocks

Stock Options

Stock options give the employees the right to buy shares of the company’s stock at a predecided cost. This predecided price is also known as Exercise Price.

The employees receive an increased or vested right to transfer or sell the options. Although the option usually carries an expiry date, it still encourages the employees to stay back longer with the company.

The employees with stock options should not be confused with the stockholders. The stockholders have more rights than the employees who have stock options. Therefore, the tax liabilities and payables will turn out to be different in both cases. It is recommended that employees who have received options must check out the tax rules that apply to them.

While stock options are more popular with startup companies (as far as equity for employees is concerned), you must still know about the other options available to you. Learning about both aspects offers a clearer perspective to make better decisions.

Common Stock Valuation

Common stock valuation is done through the 409A valuation technique. Let’s quickly learn about it in the following paragraph.

What is the 409A process?

Speaking of common stock, we must know that it requires a process - 409A Valuation for determining its price. This process is essential, especially when you are a startup offering employee equity. Before establishing your company's value, you cannot offer equity to your employees. Therefore, 409A valuation plays an important part.

While public companies have the market to establish the price of the stock, private firms have to rely on third-party assessments like the 409A valuation technique to determine FMV or fair market value of the common stock of your companies.

Coming back to Common stock valuation, the exercise price is the price the employees have to pay in order to own the stock. The exercise price for each employee option grant is the fair market value (FMV) of the Common Stock on the date the board approves the budget.

Stock options can become exceedingly lucrative because the exercise price of an employee's option grant is set. When the value of your startup climbs, so does the value of the stock. There could be chances and possibilities that the set exercise price will represent a significant saving when employees exercise their options.

The options provided at any other or later stage will have a different exercise price, as approved by the board.

More about Vests and Cliffs

Companies offer stock options to employees by breaking them into sets of installments. Eventually, the stock will be owned or vested by the employees. However, Here is where we must learn about Vesting and Cliffs.

Vesting

In simple terms, vesting translates to ownership; the things fully vested imply the individual wholly owns them. When the employees obtain the rights to exercise their stocks, the process is called vesting.

It involves a vesting schedule that specifies when an employee acquires the rights to the options. When an employee's stock vests, he or she obtains the right to exercise the shares. A vesting schedule specifies when an employee acquires the rights to the options. Linear vesting is most commonly used. It involves the same amount of stock vesting at the same time every month, quarter, or year.

Cliffs

A cliff can be termed as a highlight or threshold of stock vesting. The initial component of the stock vests at a certain point, known as the cliff. Until the cliff arrives, the employee does not obtain the rights to the options.

Types of Equity Compensation

We have already discussed the stock options and the related aspects such as vesting and cliffs. Let’s move on to learning about the other types of employee equity.

Restricted Stock

In the case of the restricted stock, the vesting period must be completed. After a certain length of time, vesting can be accomplished completely at once. Vesting can also be done in any combination that the company's management deems appropriate. For example, vesting equally throughout a predetermined amount of years. RSUs are comparable but they constitute the company's pledge to pay equity according to a vesting schedule.

Performance Shares

As the name suggests, performance shares are only given out if specific criteria are met. These could include meeting targets or a return on equity (ROE). The performance analysis is done for long durations spanning a couple of years or more.

Non-qualified Stock Options (NSOs) and Incentive Stock Options (ISOs)

Non-qualified stock options (NSO) and incentive stock options are two more types of equity remuneration (ISOs).

ISOs: Only employees have access to ISOs. The non-employee persons like the directors or consultants cannot avail it. These options offer specific tax benefits.

NSOs: In the case of non-qualified stock options, the employers are not required to declare when they obtain non-qualified stock options or when they become exercisable.

How can Deskera Help You?

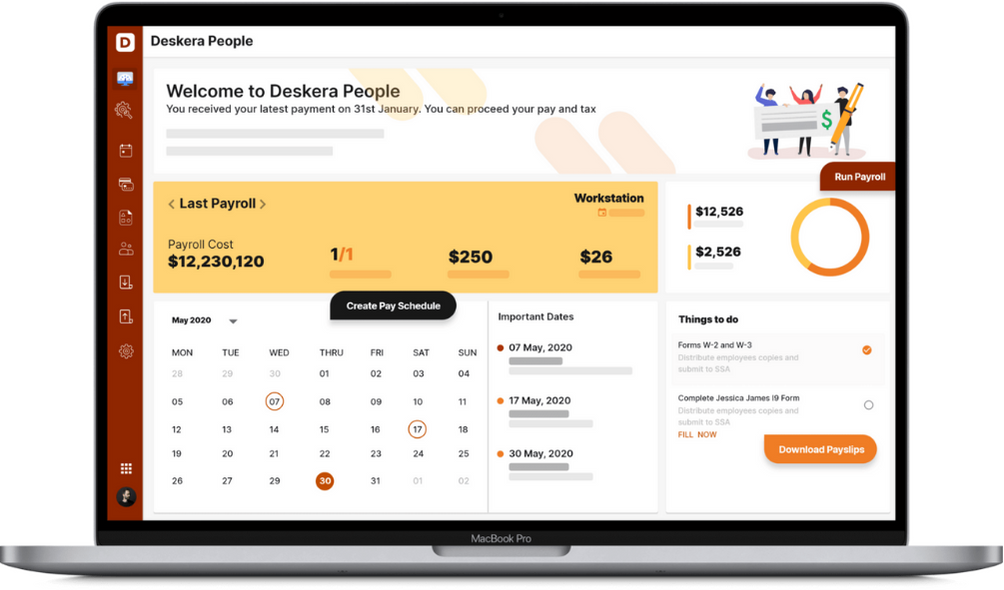

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

Here are the key takeaways:

- Offering stock options has been gaining momentum when arriving at a good employee equity strategy

- Employees receive equity in the form of non-cash compensation called Employee equity

- It is also a brilliant way to reward the best performers of your company and keep them engaged and motivated for better productivity in the future

- Employees may receive stock options, restricted stock, and performance shares as equity compensation

- Through equity compensation, employees can gain a share of the company's profits

- While learning about employee equity, we must walk through the two kinds of stocks: Preferred Stock and Common Stock

- Preferred stock is typically sold to investors and in addition to voting on certain corporate governance matters and choosing board members, it carries diverse other rights with it

- Common Stocks are for employees and do not generally offer any significant rights

- When the company is a private firm, the common stock does not offer much value, but when it becomes public, the preferred stock is converted to common stock

- There are two ways in which you can offer the common stocks to your employees: Stock Options and Restricted Stocks

- Stock options give the employees the right to buy shares of the company’s stock at a predecided cost

- Common stock valuation is done through the 409A valuation technique

- Common stock valuation is accomplished through a process called 409A valuation

- Before establishing your company's value, you cannot offer equity to your employees. Therefore, 409A valuation plays an important part

- The exercise price for each employee option grant is the fair market value (FMV) of the Common Stock on the date the board approves the budget

- Stock options can become exceedingly lucrative because the exercise price of an employee's option grant is set

- In simple terms, vesting translates to ownership; the things fully vested imply the individual wholly owns them

- A cliff can be termed as a highlight or threshold of stock vesting

- Non-qualified Stock Options (NSOs) and Incentive Stock Options (ISOs), Restricted stocks, and performance shares are the common types of employee equity you can offer

Related Articles