Understanding, determining, and applying EBITDA plays a crucial role in establishing the value of your business. This article will establish what EBITDA is and what it means for your business. We will be covering everything from breaking down the definition and formulas of EBITDA, to outlining why it is an essential term in the process of valuing and selling a business.

Earnings before interest, tax, depreciation, and amortization (EBITDA) measure a small business's operating performance and focuses on profitability. It is essentially a way of evaluating a small business's performance without factor in financing decisions, accounting decisions, or tax environments. It is seen as a proxy for cash flow from the entire business operation.

You can also calculate EBITDA by taking a business's net income and adding back interest, taxes, depreciation, and amortization. But more about that later. Let us take a look at what we are going to cover in this guide broadly.

- What does EBITDA stand for

- Why is EBITDA important and how it is calculated

- What are the benefits and drawbacks of EBITDA

- What are the different EBITDA ratios

- How is EBITDA different from other measures

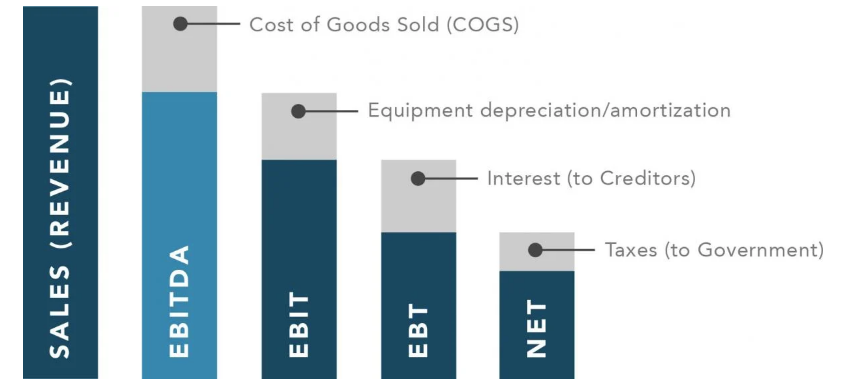

The EBITDA metric variation of operating income (EBIT) excludes non-operating expenses and certain non-cash expenses. The purpose of the deduction is to remove the factors that business owners have discretion over, such as debt financing, capital structure, depreciation methods, and taxes. EBITDA can be used to showcase a firm's financial performance without accounting for its capital structure.

Investors and creditors often use EBITDA as a coverage ratio to compare businesses with certain amounts of debt or large investments in fixed assets. This measurement excludes the accounting effects of non-operating expenses like interest and paper expenses like depreciation. Adding these expenses back into net income allows us to analyze and compare the businesses' actual operating cash flows.

To calculate your business's EBITDA, you will want to review a recent income statement for the time-frame you would like to analyze. You would also need a cash flow statement for the same period of time to find out the depreciation and amortization amount(D&A).

While reviewing the income statement, or profit-loss statement, locate your operating profit. The operating profit shows revenue minus the Cost of Goods Sold (COGS) and operating expenses. Unlike the net income, or the "bottom line" of the P&L statement, it does not consider tax or interest expenses. It does, however, include depreciation and amortization. So we will need to add these back into calculate EBITDA.

Turn to your cash flow statement, find depreciation and amortization and add those values into the EBITDA calculator.

The final dollar amount will be your company's EBITDA. For EBITDA to be a meaningful metric for your business, you will want to calculate it regularly and monitor any changes. You may compare your own EBITDA to that of other businesses in your industry to see how your erations are stacking up.

What Does EBITDA Stand For?

The meaning of EBITDA's acronym is broken down to the following:

E – Earnings

B – Before

I – Interest

T – Taxes

D – Depreciation

A – Amortization

Other Key terms - Interest, Taxes, Depreciation and Amortization:

- Earnings (Net Income) – Net Income is also known as earnings, it really means net profit. It is the bottom line profit for the company found at the bottom of the income statement.

- Interest – the cost to a business caused by interest rates in third party platforms such as loans provided by a bank. Interest expense is different among companies and across industries. This expense is found in the non-operating expense section also.

- Taxes – are the expenses to a business caused by tax rates imposed by their city, state, and country. Tax expense changes from year-to-year and business to business. Tax often depends on the industry, location, and size of the company. Tax is usually found in the non-operating expenses section of the income statement.

- Depreciation is a non-cash cost referring to the gradual reduction in a business's asset value.

- Amortization – is a non-cash expense related to the cost of intangible (non-balance sheet) assets over time.

Depreciation and amortization (D&A) is the investment that loses value over time. Depreciation means tangible fixed assets like equipment, vehicles, or a building. Amortization means intangible assets like patents.

In both cases, non-cash expenses show the deteriorating value of these assets. For example, in the case of a transport truck, a business owner may expect it to be on the road for five years. So every month until the end of its useful life, the vehicle's resale value will go down.

The same goes for intangible assets. While a patent does not deteriorate before our very eyes, it does lose value as its expiration date nears.

Determining depreciation expenses and amortization expenses is exceptionally subjective. When business owners purchase equipment, they decide on a useful life and the value they can expect when the equipment wears out over time.

Because of their subjective nature, they are removed from consideration in the EBITDA metric.

With interest, tax, depreciation, and amortization expenses rolled into net income, business owners and parties interested in acquiring a business can easily compare businesses.

Hence, in its simplest definition, EBITDA is a measure of a company's financial performance. It acts as an alternative to other metrics like revenue, earnings, or net income. EBITDA reflects the operating profitability of a business, which can effectively be compared between companies by owners, buyers, and investors.

EBIT Vs. EBITDA: What Are the Differences?

EBIT (Earnings Before Interest and Tax) presents an earning value without the impact of interest and tax rates only.

EBITDA goes further by identifying and removing the expenses related to depreciation and amortization.

Both the terms are useful to refer to when building up a picture of a company's value, breaking down the business expenses and the relative impact they have on its worth.

Variations of EBITDA worth knowing are as follows:

- EBIAT - Earnings Before Interest After Taxes

- EBID - Earnings Before Interest and Depreciation

- EBIDA - Earnings Before Interest, Depreciation and Amortization

- EBITDAX - Earnings Before Interest, Tax, Depreciation, Amortization and Exploration

- EBITDAR - Earnings Before Interest, Tax, Depreciation, Amortization and Restructuring/Rent Costs

- EBITDARM - Earnings Before Interest, Tax, Depreciation, Amortization, Rent and Management Fees

All of the above calculations are useful in the process of discovering the value of a business. This is why they are regularly applied by prospective buyers and investors to compare companies.

EBITDA = NET PROFIT + INTEREST + TAXES + DEPRECIATION + AMORTIZATION

EBITDA = OPERATING INCOME + DEPRECIATION + AMORTIZATION

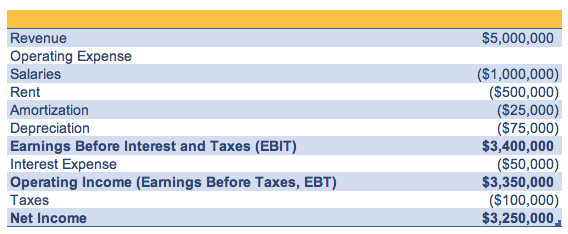

Calculating EBIT above,

Earnings Before Interest and Taxes (EBIT) - $3,400,000

Interest Expense - ($50,000)

Operating Income (Earnings Before Taxes, EBT) - $3,350,000

Taxes - ($100,000)

Net Income - $3,250,000

To calculate EBITDA, find the line items for:

- Operating Income, or EBT ($3,350,000)

- Interest Expense ($50,000)

- Depreciation ($75,000) and

- Amortization ($25,000)

Putting the numbers into the EBITDA formula:

EBITDA = EBT + INTEREST + DEPRECIATION + AMORTIZATION

$3,500,000 = $3,350,000 + $50,000 + $75,000 + $25,000

In this example, the firm's EBITDA (i.e. earnings before subtracting non-cash depreciation and amortization expenses, interest expenses, and taxes) comes out to $500,000.

Alternate Formula to Find EBITDA

EBITDA = NET PROFIT + INTEREST + TAXES + DEPRECIATION + AMORTIZATION

To find EBITDA using this formula – and the income statement above – find the line items for:

- Net Income ($250,000)

- Interest ($50,000)

- Taxes ($100,000)

- Depreciation ($75,000), and

- Amortization ($25,000)

$3,500,000 = $3,250,000 + $50,000 + $100,000 + $75,000 + $25,000

The Formula for EBITDA Margin

The EBITDA margin takes the profitability formula and turns it into a financial ratio used to compare all different sized companies. The EBITDA margin formula divides the earnings before taxes, interest, depreciation, and amortization equation by the total revenues of your business– thus, calculating the earnings left over, after all, operating expenses (removing interest, taxes, dep, and amort) paid as a percentage of total revenue.

EBITDA Margin = EBITDA / Total Revenue

Using figures from our example Income Statement for Company XYZ above, the EBITDA Margin would be:

$500,000 / $2,000,000 = 25% (EBITA Margin)

The margin tells you that Company XYZ could turn 25% of its revenue into cash profit during the year.

The basic earnings formula is also used to compute the enterprise multiple of your business. The EBITDA multiple ratios are measured by dividing the enterprise value (EV) by the earnings before ITDA to calculate how low or high a company is valued compared with its metrics. For example, a high ratio would indicate a company might be currently overvalued based on its earnings.

What is the EBITDA Coverage Ratio?

The EBITDA coverage ratio measures a company's ability to pay off liabilities such as debts and lease payments. It is a solvency ratio, meaning that it compares EBITDA and lease payments to the total debt payments and lease payments.

EBITDA Coverage Ratio Formula

EBITDA Coverage Ratio = (EBITDA + Lease Payments) / (Interest Payments + Principal Payments + Lease Payments)

Applying this formula to your business, if the result is one or greater, indicates prospective buyers or investors that your company is in a better position to pay off any debts, liabilities, and obligations. Hence, EBITDA has a variety of ways; it can indicate an organization's performance.

What is Adjusted EBITDA?

The differences between EBITDA and adjusted EBITDA is small but essential to know. Basically, adjusted EBITDA normalizes this value based on a company's incomes and expenses.

These values can differ between companies. This makes it difficult for analysts and buyers to determine if the business is more appealing than another.

By standardizing income and cash flows and eliminating any abnormalities (redundant assets, bonuses to owners, rent paid above market value, etc.), it is easier for people to simultaneously compare multiple businesses, regardless of differences in industry location.

Adjusted EBITDA is just using the standard EBITDA formulas above, but before that, we can go a step further by subtracting the cost of the different one-time, non-recurring and irregular expenses that do not have a bearing on the day-to-day running of your company.

What's Removed in Adjusted EBITDA?

The list of the balance sheet features excluded when calculating the adjusted EBITDA:

- Non-operating income

- Unrealized gains or losses

- Non-cash expenses

- One-time gains or losses

- Share-based compensation

- Litigation expenses

- Special donations

- Above-market owners' compensation

- Goodwill impairments

- Asset write-downs

- Foreign exchange gains or losses

Why is EBITDA Important?

How to calculate and apply EBITDA is essential for small business owners for two key reasons:

- Getting a clear picture of your company's worth.

- Demonstrating to buyers and investors its value.

As discussed before, EBITDA helps you and other small business owners analyze and compare profitability between companies, businesses and industries. It removes the effects of financing, government or accounting decisions. Hence, it provides a clearer indication of your earnings and value.

Above all, EBITDA's importance is the standout formula and language applied by professional buyers, private equity investors and more when discussing the business value and its worth.

EBITDA is used as a proxy for cash flow. EBITDA can help provide you with an estimated valuation range for your small business overall using other metrics called the EBITDA multiple.

What is the EBITDA Multiple?

To work out the EBITDA multiple, you first need to know your Enterprise Value (EV). EV is calculated by adding up the following in your organization:

- Market capitalization

- Value of debt

- Minority interest

- Preferred shares

A firm’s enterprise value is equal to its equity value (or market capitalization) plus its debt (or financial commitments) less any cash (debt less cash is referred to as net debt). Enterprise Value is the numerator in the EV/EBITDA formula/ratio.

The enterprise value, which can also be known as firm value or asset value, is the total value of the business's assets, excluding cash.

When the equity, debt, and cash are known, then you can calculate enterprise value as follows:

EV = (Share price x Number of shares) + total debt – cash.

Then, subtract your cash and cash equivalents (bank accounts, marketable securities, treasury bills, etc.). Then, we use this formula:

EBITDA Multiple = Enterprise Value / EBITDA

The Enterprise Value (EV) / EBITDA Multiple Calculation

The EV/EBITDA - multiple ratios indicate to analysts, professionals and financial advisors whether your company is either overvalued or undervalued.

If the ratio is high, your company might be overvalued, whereas a low ratio indicates it's undervalued. The benefit to the EBITDA multiple is that it takes company debt into account, which other multiple ratios don't take it into account.

Net Income vs. EBITDA

EBITDA is defined as an indicator of a company's ability to make a continuous profit, net income outlines a company's total earnings.

This difference means net income is used to determine the value of earnings per share of a business. EBITDA is used rather than its overall earning potential.

EBITDA = Net Income + Taxes + Interest + Depreciation + Amortization

Net Income = Revenue – Business Expenses

How to Increase EBITDA

When presenting your business's EBITDA and other financials for the purpose of exiting the business, you, as a business owner, should aim to present data stretching back 3-6 years.

This data will demonstrate your business's development over time, reassuring buyers that your growth potential is consistent year on year.

The more accurate the data is, the lower the risk associated with your company from prospective buyers and investors. Once you have determined your company's EBITDA, you can aim to increase its value before placing it on the market. This may be calculated by recasting your financials.

What is Recasting Your EBITDA Value?

Recasting is where an expert examines your financials to reinsert any one-off earnings or expenses. Recasting is defined as the amending and re-releasing of previously released earning statements with specific intent.

This reexamination paints a more accurate picture for potential buyers of your company's value. This must not be confused with manipulating your statements.

Recast is done to increase the EBITDA of your company and present a more accurate picture of its worth. These include:

- Revenue/expenses from disproportionate assets – for example, if you annually rent a house for a company retreat, this expense will not be considered by the buyer.

- Owner salaries/bonuses – these will likely be greater than other employees, a new owner mostly will not follow the same costs.

- One-time fees – if the money is spent on a legal dispute or a one-time marketing campaign, these are ongoing costs a buyer will not take on.

- Non-arms-length revenue/expenses – these are transactions when your firm pays more or less than market rates. This can be the rent etc.

- Repairs/maintenance – sometimes, private business owners will categorize capital expenses like repairs to minimize taxes but can hurt its valuation down the road by decreasing your historical EBITDA.

These above areas can be looked into to increase and improve your EBITDA value.

What Are the Benefits and Drawbacks of EBITDA in Business Valuations

EBITDA presents significant benefits for business owners, analysts and acquirers in offering a fair calculation of a company's worth and potential. It is important to take note that it is a metric that can be exploited. If misused, it can lead to negative consequences down the road.

Benefits of EBITDA

- It's commonly used – EBITDA is very commonly used by many investors, groups and notably buyers. It is a language most are very familiar with, meaning they can use it to compare business valuations.

- It eliminates unhelpful variables – by removing interest rates, tax rates, depreciation, and amortization unique for different businesses. This provides a better illustration of a company's operating performance.

- It's easy to calculate – formulas in EBITDA are simple to determine as long as your financial numbers are correct. This makes it easy to understand all sides of the negotiations.

- It's reliable – since it enables investors to fully focus on your business's baseline profitability, EBITDA is a more reliable indicator of its financial soundness.

Drawbacks of EBITDA

EBITDA's strength is that the firm focuses on profitability by excluding capital expenditure; however, some have viewed this as a potential weakness.

Taking out expenditure can allow companies to subvert any issues or problem areas within their financial statements. Because of the nature of the formula and the information it discounts, it can overshadow some risks in a business's overall performance.

However, EBITDA does not fall under Generally Accepted Accounting Principles (GAAP). This means that companies can interpret the formula and its components in multiple ways. This allows them the flexibility to help them hide red flags that prospective buyers could later pick up during due diligence.

- Ignores Costs of Assets - unlike free cash flow, EBITDA ignores the cost of assets. It assumes that profit is a function of sales and operations alone.

- Ignores Working Capital - leaves out the cash required to fund working capital and the replacement of old equipment.

- Varying Starting Points - different companies use different earnings figures as the starting point for EBITDA. Hence, EBITDA is susceptible to the earnings accounting games found on the income statement.

- Obscures Company Valuation - EBITDA can make a company look worth less than it really is. When investors or buyers look at stock price multiples of EBITDA rather than bottom-line earnings, they produce lower multiples.

What is the Debt to EBITDA Ratio?

This ratio measures a business's ability to pay off its debts. The Debt to EBITDA ratio is calculated by dividing a company's liabilities by its EBITDA value. The lower the ratio, the more likely a business will be able to pay any obligations. A higher value means it could be hard to clear their debts and is a bad indication for buyers.

What is the EBITDA to Sales Ratio?

This is calculated by dividing EBITDA by your business's sales. The EBITDA to sales ratio is used by buyers and analysts to determine a business's profitability by comparing its revenue to its earnings. It is useful in comparing similar-sized businesses.

What is the EBITDA to Fixed Charges Ratio?

The EBITDA to fixed charges ratio tells us a business's ability to pay off its fixed charges and debts.

What Is the Difference Between My EBITDA Margin and My Profit Margin?

Net Profit Margin = (Revenue – Cost of Goods Sold – Operating Expenses – Other Expenses – Interest – Taxes) / Revenue x 100

Net Profit Margin is an indication of how much profit each dollar of sales generates. EBITDA differs from this by accounting for all expenses generated by production and daily operations but adding back depreciation and amortization costs.

What Is the Difference Between And EBITDA and Cashflow?

Free cash flow and EBITDA are two ways of assessing the value and profit of your company. EBITDA demonstrates a business's earning potential after removing essential expenses like interest, tax, depreciation and amortization.

Free flow cash takes a firm's earnings and adjusts it by adding in depreciation and amortization, then reducing working capital changes and expenditures. Both techniques are used to determine business value.

Key Takeaways

- EBITDA - Earnings before interest, taxes, depreciation, and amortization, and its margins reflect a company's short-term efficiency.

- EBITDA is useful when comparing companies with different capital investment, debt, and tax profiles.

- EBITDA is only a single indicator. To develop a full picture of any given business's health can not be just decided by EBITDA.

Related Articles